The June housing starts data beat estimates with positive revisions, however, this doesn’t change the housing market recession call that I made last month. Knowing that the housing cycle was at risk back in March of this year when the 10-year yield broke above 1.94%, I was mindful of when I was going to raise the fifth recession red flag. That happened in June after the May housing starts data came out.

The headline numbers on today’s housing starts data looks OK, but the reality is different. That reality can be seen more clearly by looking at the homebuilder’s sentiment index, which collapsed yesterday.

I believe the builder’s survey data is the best in America when tied to economic expansions and recessions. Its quality is good because it’s driven by profit rather than ideological takes, which distinguishes it from other surveys. The smart thing to do is go with the builder sentiment trend until it reverses, and most likely, we will need to see lower mortgage rates for that to happen.

Looking at the housing starts report, the numbers came in slightly better than anticipated, driven by multifamily construction. Also, the previous reports were revised higher. If mortgage rates were still below 4%, we would be discussing this report differently, but they aren’t, so the context of my discussion is more forward-looking with the recession red flag raised last month.

From Census: Building Permits: Privately‐owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,685,000. This is 0.6 percent below the revised May rate of 1,695,000, but is 1.4 percent above the June 2021 rate of 1,661,000. Single‐family authorizations in June were at a rate of 967,000; this is 8.0 percent below the revised May figure of 1,051,000. Authorizations of units in buildings with five units or more were at a rate of 666,000 in June.

The housing permit data doesn’t look terrible. Still, it’s backward-looking and the growth in multifamily construction, which we desperately need to cool down rental inflation, has recently been positive. This is a plus for rental supply, however, single-family construction is about to cool down in response to higher rates.

Housing Starts: Privately‐owned housing starts in June were at a seasonally adjusted annual rate of 1,559,000. This is 2.0 percent (±9.0 percent)* below the revised May estimate of 1,591,000 and is 6.3 percent (±10.2 percent)* below the June 2021 rate of 1,664,000. Single‐family housing starts in June were at a rate of 982,000; this is 8.1 percent (±12.2 percent)* below the revised May figure of 1,068,000. The June rate for units in buildings with five units or more was 568,000.

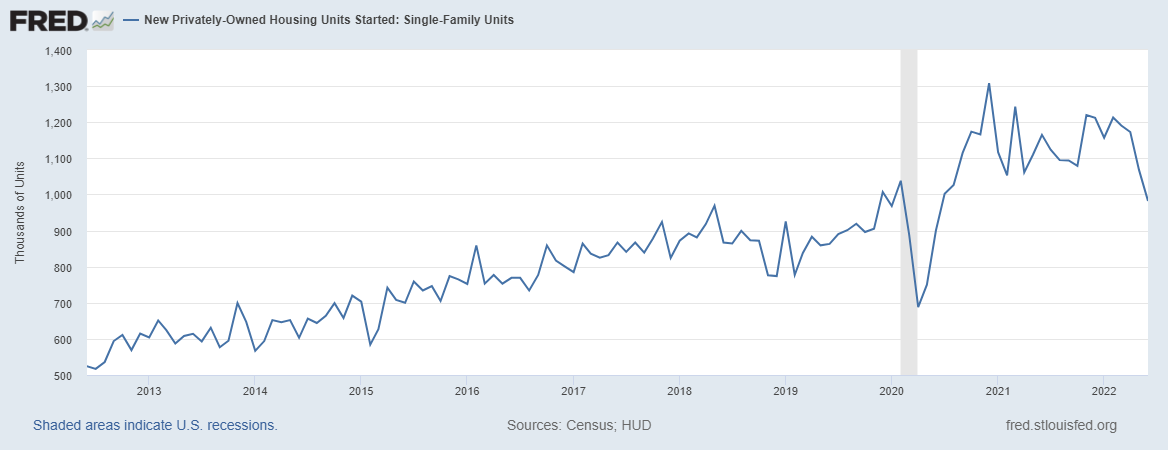

There’s a similar trend with the housing starts data: it doesn’t look terrible, but it’s also backward-looking. As you can see below, we never got back to the peak of the housing bubble years when single-family starts growth was driven by credit demand, which wasn’t sustainable.

Since new home sales are still historically low and rental demand is still in place, we aren’t having the collapse in this data line as we did in 2006. However, it will get weaker in the upcoming months. With demand falling, the need for construction labor to build single-family homes will be an economic risk.

Housing Completions: Privately‐owned housing completions in June were at a seasonally adjusted annual rate of 1,365,000. This is 4.6 percent (±11.7 percent)* below the revised May estimate of 1,431,000, but is 4.6 percent (±13.4 percent)* above the June 2021 rate of 1,305,000. Single‐family housing completions in June were at a rate of 996,000; this is 4.1 percent (±11.1 percent)* below the revised May rate of 1,039,000. The June rate for units in buildings with five units or more was 366,000.

The housing completion data has been the most frustrating data line we have dealt with for years. Some buyers had to wait forever before they could lock in their rate, meaning they didn’t qualify for their homes as rates moved up so fast. This was a risk to the homebuilders as cancelation rates started to increase and you can understand why their mood changed as rates went higher.

New home sales are coming up next week, and the one key thing to remember here is that new home sales are currently low by historical standards. We never saw the credit sales boom as we did from 2002-2005, so the builders themselves are in a better position to manage their future. We won’t see a sales decline in scale terms as we had from 2005-2008 since we simply have never had that type of sales and credit demand. We are already below the 2000 recession levels and back to 1996 levels today.

This is also similar to the purchase application data, since we never had a credit boom in housing as we saw from 2002-2005. This data line is already below 2008 levels currently. As you can see, the entire housing marketplace is much different from what we experienced in 2008.

To recap, the housing starts report wasn’t terrible, but it’s backward-looking. The slowdown in single-family construction is noticeable now that mortgage rates have risen. If mortgage rates fall, we might have a different conversation, but not yet, with the 10-year yield at 2.99%. Look for the builders to offer incentives for their products to ensure they sell their houses.

I’m looking for single-family starts to slow down as demand for new homes stays soft. However, the more interesting aspect will be what happens with multifamily construction because the demand for rent has been solid. Higher mortgage rates will keep more renters in place, and rental deflation collapses aren’t the norm as most people are always working and needing shelter.

However, we can all agree that the housing market materially changed in March once the 10-year yield broke over 1.94% with duration. Higher rates are just one variable here, but the real issue with housing has always been the massive home-price gains we have seen since 2020, especially in the new home sales sector.

The Bureau of Labor Statistics has released the latest Consumer Price Index. Despite any chatter that may have predicted otherwise, inflation is still at a 40-year high and a 1.3% increase from the month before. Though inflation impacts everyone one way or the other, its effect on the housing market keeps getting more interesting, especially since it’s not fully visible through the statistics.

After all, when the price of gas is so high that people can’t make it to their kids’ doctor’s appointments without taking out loans and food prices are 24% higher in school cafeterias, nothing could be worse than rent prices increasing for some of these families, unless you count now people having to give up their pets, too.

And, as we know, landlords have to keep up, so increasing rent is what’s going to happen anyway. In some cities, these increases are over 10%. Even those who may be in a position to get out of their leases and make a home purchase—as the housing market may finally start to show signs of cooling—interest rate hikes may keep them in their rentals longer.

What Does the Latest CPI Data Tell Us?

The price increases we’re seeing is broad. Over the last 12 months, gas is up 11.2%, food is up 10.4%, shelter increased 5.6%, and energy as a whole increased by a whopping 41.6%.

In total, prices are up 9.1% since last June.

Though we did get a bit of a reprieve from gas prices in mid-June and the Fed continued to raise rates to fight inflation, the bottom line hasn’t changed. Unfortunately, the average person’s ability to afford basic necessities continues to get worse.

In Other News

Additionally, while not in the CPI report, the Euro is continuing to lose its value against the U.S. dollar, with one of the factors being the Fed raising interest rates, along with the Russian invasion of Ukraine. Whether this is a chicken-or-egg situation is beside the point. This may be great for summer travelers, but not so fast. Airlines have been taking a major hit since the pandemic began with a 9+ billion dollar loss and staffing issues to boot. Consequently, with gas up as well, airline tickets are the most expensive they’ve been in years.

Despite this, Americans are still planning vacations, as noted in a recent short-term rental report on BiggerPockets.

The Housing Market Is Still Wild, But Cooling

Alongside this report, the housing market has seen some changes over the last few weeks, but whether this is good or bad depends on whom you ask. Even though there are indicators that prices are starting to cool down, it’s still a war for homebuyers.

Supply constraints continued to be plagued by construction costs, leaving many developers on the sidelines. As of April, the cost of building materials had gone up 19% year-over-year, according to NAHB, and it’s likely to continue increasing. Combine that with gas prices and a global supply chain that’s remained in limbo, building projects may start to get pushed back, and those in the midst of a project could be putting off the completion date. May saw housing starts of privately owned units decrease from 1.8M to 1.5M.

While sifting through the news has been confusing, and it seems like there’s not much positivity on the horizon, as long as your tenants are still paying rent, you’re still doing okay.

While housing prices are high in every market, some markets still have decent opportunities. As an investor, you should do some research and check out these top 10 markets in the U.S. to invest in now.

Be on the lookout for the next GDP report on July 28. If growth was negative in Q2, the U.S. will be in a technical recession. We’ll be covering what you need to know here on BiggerPockets.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

https://frankbuysphilly.com/wp-content/uploads/2022/07/June-2022-CPI-report-1024x680.jpg6801024Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2022-07-19 03:21:382022-07-19 03:21:38Inflation Up 9.1% Since Last Year

Servicers’ forbearance portfolio volume trended downward in June but declined at a much slower pace than earlier this year, according to the Mortgage Bankers Association (MBA).

The total number of loans in forbearance decreased by 4 basis points to 0.81% of servicers’ portfolio volume in June from May, per data from the MBA. The rate has steadily declined this year, dropping below 1% in April, with fewer than half a million borrowers remaining with an active plan as of June.

The largest decline in June came from portfolio loans and private-label securities (PLS), which dropped 18 bps to 1.69% of the servicers’ total portfolio volume. Fannie Mae and Freddie Mac loans in forbearance decreased 4 bps to 0.35%. Ginnie Mae loans in forbearance rose 1 bps to 1.26% in June from May.

“Borrowers continue to exit forbearance, but at a much slower pace than six or nine months ago,” said Marina Walsh, vice president of industry analysis at the trade group. “New forbearance requests are still trickling in, as permitted under the CARES Act, resulting in very little movement in the overall percentage of loans in forbearance.”

At the end of June, 405,000 homeowners were in forbearance plans.

Exits represented 0.18% of servicing portfolio volume in June and total forbearance requests represented 0.11%. The survey showed 29.8% of total loans were in the initial plan stage last month and 57.6% were in a forbearance extension. The remaining 12.6% represented re-entries.

Between navigating a post-pandemic world, rate hikes and the threat of a recession, mortgage lenders across the country are managing a volatile housing market. Learn how updating your mortgage technology stack can help you get ahead in today’s unpredictable lending environment.

Presented by: Polly

The mortgage forbearance rate on a declining trend is positive news after the economic impacts of the pandemic hit borrowers hard. But there are some early indicators of borrower stress resulting from high inflation and rising interest rates, added Walsh.

“For example, overall servicing portfolio performance dropped by 14 bps to 95.7% current in June, and the performance of post-forbearance workouts declined by 140 bps to 81.3%,” Walsh said. “It is worth monitoring post-forbearance workouts for all borrowers, and particularly for borrowers with government loans, who are typically the most vulnerable to economic slowdowns.”

From June 2020 to June 2022, MBA data revealed that 29.4% of exits resulted in a loan deferral or partial claim, while almost 19% of borrowers continued to pay during the forbearance period. However, about 17% were borrowers who did not make their monthly payments and did not have a loss mitigation plan.

The survey also shows loans serviced, not delinquent or in foreclosure, dropped to 95.7% in June, from 95.9% in May at a time of high inflation and volatility in mortgage rates.

The real estate and title markets are dealing with lower volumes right now, which means increased competition and pressure for businesses to stay profitable. However, it’s also a good time to invest in digital transformation. HousingWire recently spoke with Michael Valdes, president and founder of Axis Technical Group, about investing in automation technologies as a way to prepare for the next boom cycle.

HousingWire: Why is now a good time to invest in new automation technologies for real estate and title?

Michael Valdes: It is well known that the real estate industry is cyclical with periods of “feast or famine.” We just finished a big feast. Recent Fed actions and concerns over a possible recession have put the brakes on transaction volume. This will create challenges for some companies. Focus has shifted to cost containment.

Interestingly, a contrarian perspective might be a better option. This is especially the case if your long-term strategy is growth. Now is an ideal time to invest in automation systems and digital workflows. To start, time and resources are more readily available. New systems are easier to test, implement and optimize with lower transaction volume. And the opportunity cost of losing new business is much lower.

Those with the insight to do this type of investment now will be in a far stronger position to take advantage of the next boom cycle. Higher transaction volume will then be better managed. New efficiency gains can defer or even avoid potential future resource constraints. Combined, these factors can have a really big impact on future profit potential for firms with this insight.

HW: What are the benefits of these automation strategies?

MV: A comprehensive automation strategy offers many advantages. This is especially the case when an industry is in a digital transformation, such as what we are all experiencing in the real estate and title insurance industries. We saw a lot of change over the past two years. Many of these changes will remain.

As successful companies such as Google and Apple have shown us, everyone wins when a complex process is simplified or automated. Employees are better utilized by spending their time where judgment is needed. An automation strategy can not only streamline repetitive processes to save time and money, but it can also unlock new business scalability options to respond faster to change. Automation can ease the visibility of business transactions and provide new insights for process improvement. When combined, these factors can have a dramatic impact on employee productivity and morale, and customer satisfaction.

HW:What automation options exist?

MV: Many parts of a business can be automated. Any repetitive or higher volume actions that are performed are an ideal candidate for automation. Examples include customer inquiries, qualification and review processes, and any other process involved in data acquisition.

A common theme is that the “inputs” for a process need to be digitized. For example, the title insurance industry still relies on paper-based documents and manual review processes. To effectively automate this process, systems will need to be implemented that can more effectively perform document management and data extraction to acceptable levels. The transition may need to be gradual to provide sufficient time to be part of your automation strategy. The important thing is to start planning now.

HW: How is Axis Technical Group poised to help decision-makers set up a more data-driven, automated infrastructure?

MV: Technology plays a critical role in driving innovation. Artificial intelligence and machine learning are two great examples. These technologies are now unlocking superior automation performance.

Specifically, data extraction processes can be “learned” quickly whereby the intelligence gathered by AI-driven algorithms can collect data with greater accuracy and context. This innovative approach extracts unstructured data with context – intelligence that can be used to accelerate the performance of any automated business process.

Axis Technical Group has built an AI-driven data extraction engine specifically tailored to the title insurance industry. This solution, available as a managed service, can deliver superior performance and play a critical role in a company’s overall automation strategy. Our professional services team has successfully implemented this new solution at several locations. The results continue to surprise our clients, which has created many new opportunities for other performance and scalability improvement programs.

https://frankbuysphilly.com/wp-content/uploads/2021/04/April-Magazine-RON-New.jpeg6751200Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2022-07-18 17:52:242022-07-18 17:52:24Is now a good time to invest in real estate automation technologies?

new jobs hiring, housing jobs, recruiting for mortgage industry

Based on the headlines, one might assume the mortgage business is a complete disaster. Origination volume is down about 50% from last year, thousands of layoffs are reported each week, and gloomy prognosticators say recession will make for a long winter. Some mortgage companies will merge to stay afloat, and many others will go under.

But despite the worst business climate in over a decade, there are mortgage companies hiring workers and thinking opportunistically about the cycle.

Purchase-focused lenders that didn’t balloon in size to capture refinancing business during the boom, in particular, are looking to hire loan officers. And mortgage brokerages, which don’t have the burden of high overhead, are heavily recruiting retail LOs whose pipelines have thinned in recent months.

Though purchase volume across the industry is down from 2020 and 2021, it’s among the only source of business out there for lenders. And it’s still very much a relationship-driven business: borrowers want to speak to local loan officers when starting the process of getting a loan, which is why firms are hiring LOs, recruiters and mortgage lending executives said.

Even traditional depository lenders are keen to bring aboard LOs from coast to coast. A quick scan of job boards shows depositories such as U.S. Bank, Citi and Bank of America looking to expand the ranks of LOs.

WesBanco Bank, the second-largest bank headquartered in West Virginia, plans to hire at about a dozen loan originators in 20 major markets this year. Founded in 1870, the bank has about 65 LOs. It has patiently prepared for a downturn and didn’t layoff a single employee in the past two years, said Rick Trew, vice president and regional sales manager at WesBanco.

“We didn’t go out and hire everybody we possibly could,” Trew said. “We maintained our stability during the last several years, that’s what set us apart.”

With over 200 branches in West Virginia, Ohio, Pennsylvania Kentucky, Tennessee and Indiana, Trew said the bank is focused on purchase and the construction business.

Join us!

Recruiting battles for LOs remain fierce, mortgage executives and LOs told HousingWire. Though signing bonuses aren’t as generous as they were during the boom, many LOs making a move are receiving better compensation at their new firm. But it could take a few months to land, especially doing outbound recruiting.

“Our industry knows that the process of going into a marketplace trying to find experienced originators is a very competitive and somewhat of a lengthy process,” Paul Buege, CEO of Inlanta Mortgage, told HousingWire.

Several large mortgage brokerages see the market-wide volatility as a recruiting tool. Mike Kortas-led NEXA Mortgage, a high-volume brokerage, is looking to grow to 2,000 brokers by the end of the year, pitching what he called the best pricing in the industry and 100% splits.

And Anthony Casa-helmed UMortgage, headquartered in Philadelphia, is recruiting from large retail lenders across the country. He’s also bringing in brokers. Sean Grapevine, who led ATL Mortgage in Georgia, recently joined UMortgage. Casa plans to also hire for data, IT, operations and HR roles.

Smaller operations are also looking to fill their ranks, including Motto Mortgage and Grow Mortgage.

Motto, which added 60 franchises in 2022, is looking for seven business development consultants who will be tasked with selling franchises of Motto. Real estate firm RE/MAX acquired Motto Mortgage in 2016 to create a “one-stop-shop” in which homebuyers can work with both a real estate agent to find a home and a Motto Mortgage loan originator to secure financing.

“As rates have gone up and the refi volume have gone down, they (rates) pushed origination back to purchase money,” said Bob Butterfield, vice president of franchise sales at Motto Mortgage. “Purchase applications are where brokerages really shine in the first place.”

“The broker channel is growing so quickly [that] we can’t hire fast enough,” said Russell Petty, owner of Grow Mortgage, which has offices in the Carolinas, Florida and Indiana. Faster return times, often same-day underwriting approvals, and less overhead are all factors that drive lower rates and business to Grow, Petty said.

He plans to hire up to 20 brokers by the end of the year, including junior LOs.

wemlo,a platform connecting mortgage brokers and loan originators to a processing network, is looking to expand. The firm is looking to hire account executives to sell the firm’s processing software. Demand for wemlo is being driven by brokerages that don’t have in-house processors, Butterfield said. The number of brokerages submitting loans to wemlo for processing rose 74% in the second quarter of 2022 from the same period last year, the company said. Acquired by real estate firm RE/MAX and Motto Mortgage in 2020 after two firms struggled to hire experienced processors, wemlo added three account executives with experience at wholesale lenders this year.

“Interest rates have knocked out homebuyers but we still have more qualified buyers who saved up a lot of money and have been trying to get into the market,” Buege said. “As we see a cooling in the housing market, it’s almost bringing a balance back. We look at the market as the glass is half full.”

Tough time for operations staff

It’s a better job market for LOs than processors and underwriters as they are the “revenue generators,” said Mandy Garfield, head of talent acquisition at independent mortgage bank Norcom Mortgage, which is looking for LOs in multiple markets.

“During the heavy refi years, companies really bulked up with processors, underwriters and support staff,” Garfield said. “When the refis went away… [that] is why you are seeing a lot of these layoffs. In order for a company to grow, loan originators are the ones bringing in the loans and revenue to the mortgage company.”

It’s an extremely competitive job market for operations professionals. Over a dozen out-of-work operations workers told HousingWire they’ve applied to hundreds of jobs, and rarely receive more than a few interviews for positions they’re highly qualified for.

“We had more than 300 people apply for a loan originator assistant position in 24 hours so we had to close that posting,” Garfield said.

Janille Dimaguipo knows that first-hand. She has nearly a decade’s worth of experience as a funder, processor and underwriter. She was laid off from her underwriting job by Change Home Mortgage in May 2022

“I knew it was a bad job market but I didn’t know it was this bad,” she said. “Layoffs are cyclical but I’m not used to there being nothing. This layoff season has been different for me. It’s scary. Some people have been out of work since January.”

Dimapuigo said she’s received few responses from the hundreds of jobs she’s applied to. But she isn’t deterred.

“The industry hasn’t beaten me down,” she said. “A lot of people don’t get into underwriting until later in life. I am a quick learner, I’ve worn a lot of hats, I’ve done a little bit of everything. I’m not too set in my own ways, I love learning and being in the industry.”

Here is a list of mortgage lenders and brokerages that are looking for LOs, account executives, processors and others. We will continue to update this list of firms Here is a list of mortgage lenders and brokerages that are looking for LOs, account executives, processors and others. We will continue to update this list of firms that are hiring, please share any other openings you see out there by emailing Connie Kim at connie@hwmedia.com.

*American Financial Network has open positions for LOs, sales managers and branch managers

*E Mortgage Capital is hiring LOs and account executives

*WesBanco Bank is seeking LOs and processors throughout its mid Atlantic markets, Tennessee, Indiana and Ohio

*PNC Bank is hiring LOs in the New York City region

*Cross Country Mortgage is hiring LOs in the New York City region

*Seacoast Bank is hiring LOs in Florida. The positions are remote but living in Florida and having self sourced business is a requirement

*Carrington Mortgage Services is hiring LOs who are remote

*Navy Federal is hiring an LO in Mayport, Florida.

*SecurityNational Mortgage Company is hiring LOs in Texas, Ohio, Florida, Virginia, Maryland

*Landmark Professional Mortgage is hiring LOs in Vancouver, Washington

*Griffin Funding is looking for LOs with non-QM experience

*Greater Nevada Mortgage is hiring LOs to fill its field and internal mortgage consultant positions in the Reno and Las Vegas areas in Nevada and Sacramento and Roseville areas in California. The firm is also seeking a regional sales manager in the Reno and Sparks area in Nevada.

*Geneva Financial is hiring LOs and branch managers

*Go Mortgage is hiring LOs

*Norcom Mortgage is hiring LOs and branch managers

*Liberty Home Mortgage is hiring LOs

*UW Mortgage is hiring a junior accountant, an office manager and VP of operations

*Logan Finance is hiring account executives and account managers with non-QM experiences, non-QM underwriters, scenario desk underwriters, loan set-up specialist

*Goldstar Financial is hiring LOs and managers in 39 states and Washington D.C.

*WMB is hiring LOs and account executives in California, Florida and Washington

*Lending3 is hiring LOs, branch and account executives

*Inlanta Mortgage is hiring LOs and branch managers in the Midwest

*Nexa Mortgage is hiring remote LOs across the US (call Joe Stunzi at 404-867-8991)

*Weichert Financial Services is hiring LOs in New New Jersey, Pennsylvania, Virginia, Maryland & DC. It’s also seeking originators for the company’s call center

*First State Bank of the Southeast is hiring senior LOs in Kentucky and Tennessee

Undoubtedly, active real estate investors have heard about raising private money for real estate projects. Blogs, podcasts, books, and other media share tactics to successfully find this capital and have it fund your real estate investments using other people’s money (OPM).

This magical pool of private capital is much like a secret society with no storefronts, no advertising, and no easy way to search for these lucrative sources of OPM to help you fund your next project. However, what isn’t discussed as often is how to “be the bank” as a private money lender, an often-overlooked source of passive income in real estate. You might be surprised by how easily private money lending can fit into your investing goals and lifestyle.

Most assume private money lending is a niche market reserved for retirement plans and older retired people with millions in loose change. However, private money lending—the act of being the “other” person in other people’s money—is actually a diversification strategy employed by experienced and novice real estate investors alike. There are a few scenarios we commonly see for active investors who are also private lenders, all of which fit nicely into an existing real estate portfolio.

Lend Private Money Instead of Flipping Yourself

The first scenario we will cover is flipping. This flashy HGTV style of investing often involves a lot of time and capital to acquire and renovate a property. As the market changes or possible life events require an active flipper to pause for a period of time, flippers often utilize private money lending to earn some interest income while they take a break between projects.

This capital, which otherwise might sit in a low-interest savings account, is instead used to help fund another investor’s flip project. Flipping will always be an active income source, but why not take a break and earn some passive cash flow by becoming a lender on a project instead? Similarly, an active investor may use a retirement account to fund other investor projects since they cannot lend the money to themselves. Borrowers pay interest to your future self in that case!

As an active flipper grows, they may choose to “graduate” from such a time-consuming activity as flipping altogether and pursue more passive income routes. Private money lending can be one of those strategies! The lack of strict time commitments attracts these maturing active flippers as they search for more relaxed cashflow approaches. As an active flipper, you might be under very tight deadlines, dealing with contractors at the job site, difficulty getting materials, or even finding more problems with the project than initially thought.

A phone call can come in anytime with a potential (and sometimes literal) fire to be put out. In private money lending, rarely is there an emergency moment that must be addressed immediately. This allows an active investor to regain the one asset no one can buy more of: time. When active investors start transitioning to private lending, they still underwrite the project the way they would if they were to purchase the flip themselves. The bonus this time is that they get to sit back and watch the interest income stream in monthly without the hassle of dealing with project budgets, sub-contractors, and supply chain issues.

Lending Money Instead of Managing Rental Properties

Investors who typically use the BRRRR method to acquire and stabilize buy and hold investments are increasingly concerned about how rising interest rates might affect their ability to refinance and maintain cash flow, much less get most or all of their capital back out of the deal. Instead of rolling the dice in a fluctuating market, rental property owners may choose to lend out their capital to other active investors while they wait and see what interest rates will do in the long term. Rising interest rates are good for lenders, and private money lenders are no different!

Don’t think the benefits are just for the active and scaling investor. Landlords who aren’t interested in growing their portfolios can choose to unlock the equity in their investment properties. You can do this through cash-out refinances or a home equity line of credit (HELOC), arbitraging the funds into private money loans and earning a spread on the interest. In other words, if a HELOC is worth $100,000 at a variable interest rate of around 5%, and then you lend those funds out to an investor at 10%, you will earn the difference between these two rates. In this case, 5%.

Landlords approaching retirement age and making plans for their families may also turn to private lending to continue cash flow from real estate without having heirs take on the burden of rental units. If market conditions make selling these rentals attractive, landlords may choose to transition that capital into private money lending to keep the income stream they acquired through rental units. Some landlords may own properties in multiple states and want to downsize to make managing the portfolio easier with fewer vendors needed and less complication with income taxes. These opportunities to pivot make a great segway into private money lending!

Private Lending Can Be a Strong Starting Alternative to Wholesaling

While this is a more sophisticated approach to private money lending using “borrowed” capital, private lending isn’t just for experienced investors. In fact, private lending can be a preferred entry point into real estate for many investors gun shy on the idea of wholesaling. All too often, wholesaling is touted as the best and fastest way to get into real estate with little to no money.

While that may be true for some of the brave souls out there willing to undertake all the actions needed in this multi-disciplined sector of real estate, the fact is that many newbies are often discouraged by how many skills and competencies they must learn to truly be successful in wholesaling. In addition, similar to active flipping, wholesaling requires a near-constant connection with your cell phone as motivated sellers don’t generally make appointments ahead of time to discuss a deal.

Cold calling, door knocking, and negotiating with reluctant sellers can be overwhelming and lead some new investors to seek other entry points into real estate investing. Armed with a “small” amount of cash—perhaps not enough to truly start a flip on their own—investors act as the bank for other investors so they can earn interest income and learn how to underwrite deals along the way.

The Benefits of Learning About Private Lending

Having covered who may consider private lending, there are also numerous benefits to learning more about private lending and incorporating this passive income opportunity into your real estate investment strategy. First, the lender gets to set the rules. The lender can choose how much to charge in interest rates (within state and federal regulations) and the terms and conditions of the loan. Private lenders can walk into any deal knowing ahead of time what they will be making, which likely isn’t possible with other methods of investing in real estate. Many private lenders choose short-term loans offering CD-like liquidity without the ultra-low interest rates currently offered on those types of depository investments. Each time the capital is turned over, it is another opportunity to earn origination points and any associated fees with the loan.

Additionally, the underwriting associated with being the creditor, or lender, on an investment project is similar to the due diligence of the active investor. For novice real estate investors, this is a relatively safe way to learn the ropes while a lot of the heavy lifting is done by your more experienced borrower. Experienced investors looking to get into more passive investing strategies are already familiar with underwriting projects, so the transition from flipper or landlord to lender is smooth.

Private money lending is also a team sport. Active investors may be used to “going it alone,” often shouldering the responsibility entirely for the progression of the project. On the other hand, the lender has multiple professionals to help advise and protect the capital in the loan.

Private money lenders have legal help in drawing up documents for the loan, a title representative to do a title search and assure clear title, a hazard insurance broker to help review insurance quotes from the borrower, and even other private lenders in their network to help balance out their risks and rewards in the loan. If a private lender builds a solid virtual team, many simply become the reviewer of information instead of the collector, which is even better.

Perhaps one of the best benefits of private money lending is that it can be done anywhere at any time. A business in a backpack, if you will.

This isn’t just financial freedom but more of a lifestyle choice. Those seeking more time back in their busy lives but want to make their money work for them in real estate-backed private money lending while living their best life. Most people pursue real estate investing for financial freedom, but most of the time, what they are really seeking is time freedom or even geographical freedom. Their “why” often revolves around wanting to do what they want, where they want, not necessarily having $10,000 per month coming in as income. For those who value time freedom over anything else, building a private lending practice from anywhere in the world is easy!

Even if you don’t feel private money lending is a path you want to explore, learning more about how it’s done safely and securely, from the lender’s point of view, can help you raise private capital. Private lenders will want to work with borrowers concerned with and know how to mitigate the risks associated with being the creditor on the loan. The more acumen you can display to potential private debt partners and share how you can protect their investment through safe and secure lending practices, the more confident the lender will be in working with you.

Armed with the knowledge of how to do private lending, you can share your real estate knowledge with others in your network, potentially making some your own private lender!

https://frankbuysphilly.com/wp-content/uploads/2022/07/private-money-lending-1024x680.jpg6801024Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2022-07-16 03:14:262022-07-16 03:14:26Private Money Lending is a Perfect Alternative to Active Investing. Here’s Why

In today’s fast-paced real estate market, results and creative problem solving are the name of the game, which are two keys areas that Nick Bailey, president and CEO of RE/MAX, is more than skilled at. This is why HousingWire is honored to include Bailey in the list of speakers for HW Annual 2022.

Attendees can find Bailey on the stage Tuesday morning, October 4th. He will be sharing his insights on staying ahead of the curve during the “From Disruption to Partnership: The Amazon of Real Estate” panel. The question, “can anyone truly disrupt real estate?” may finally be answered.

Bailey began his career in real estate as a teenager when he purchased his first investment property. The joy of that experience propelled him to earn his real estate license at the age of 21, and there was no stopping him from there. Bailey has held a long tenure with RE/MAX, working in positions from regional manager and vice president all the way to his current position as president and CEO. Outside of RE/MAX, he has also held senior positions at Century 21 and Zillow.

Bailey has been named one of the top 25 most influential leaders in the industry, and it is no surprise as to why. In all of his leadership positions, he has led multi-million dollar marketing initiatives, attracted impressive talent, innovated in the industry and built long-term, successful relationships.

HW Annual will be held in Scottsdale, Arizona this year and feature housing leaders from all corners of the industry including real estate, mortgage and closings. Hear from today’s top leaders and experts and enjoy networking events with like-minded professionals. Join us at HW Annual for the content, connections and technology you need to win in this environment. Register here

This week’s HW+ member spotlight features Brian Gubernick, chief real estate officer at Homeward. He has more than 15 years of industry experience, holding multiple positions in the industry including being an investor, team owner/leader, brokerage operating partner, coach and trainer and corporate executive.

Below, Gubernick answers questions about the housing industry:

HousingWire: What is your current favorite HW+ article and why?

Brian Gubernick: While I do not think I have a favorite article, I definitely have a favorite section right now…and that’s “Mortgage”! I’ve been in the residential real estate business for over 15 years, but most of my experience has been on the agent and brokerage side of things.

In order to be more effective in my role at Homeward, I’ve had to deepen my understanding of mortgage. This includes developing a stronger knowledge about mortgage products, origination, compliance and regulatory matters, how loan officers operate day to day and mortgage sales. HW+ has been a major resource in getting my knowledge base to where it needs to be!

HousingWire: What is the weirdest job you’ve ever had?

Brian Gubernick: When I was in my 20s I decided I wanted to be an entrepreneur. Prior to getting my real estate license and starting my sales team, I actually owned and operated a tanning salon! I randomly learned of a salon for sale and figured “that sounds interesting…I can build that business.”

And so, I bought the salon (on terms of course, because I certainly did not have the money to buy a business at that time), renamed it “Desert Bronze Tanning,” created a logo and slapped it on the door and went to work! It actually turned out to be a half-decent investment for me.

HousingWire: What is the best piece of advice you’ve ever received?

Brian Gubernick: This is a difficult one as I’ve received a lot of great advice over the years from some very wise individuals. But the advice that I think about on a daily basis came from my friend and mentor, Gary (Keller) – “Align your actions around one true north vision for your life, spend your days living up to the reputation you want to be known for and surround yourself with people who want what you want.”

HousingWire: What has been your biggest learning opportunity?

Brian Gubernick: No question, the greatest learning opportunity I’ve experienced was the 2007-2008 housing market crash. As a novice real estate investor at the time, the market downturn completely wiped me out. As a result, I had to “relaunch” my business career. The failure and all that I learned from that experience shaped me to be the business person I am today.

HousingWire: What’s one thing that people aren’t paying attention to that you think they should be paying attention to?

Brian Gubernick: People are aware of this, but I believe it needs an even greater focus — how unaffordable it has become for the average family to purchase a home. NAR recently shared that there are nearly 30% more homes available for sale compared to earlier in the year but that buyers need to earn at least $125,000 to afford to buy most of these additional homes.

Given that the average family income is less than $70,000 this is nothing short of a crisis. We’ve all seen the stats — the average net worth of a homeowner is 40x greater than that of a renter. We need to get more well-deserving people into homeownership, and this is a major focus for our team at Homeward this year and beyond.

HousingWire: What keeps you up at night and why?

Brian Gubernick: Lots of things are keeping me up at this moment! But the issue that seems to take up space in my mind, and has for several years now, is the threat that I believe Realtors are under as it pertains to our role in the industry.

There are just so many companies that have the objective of displacing the Realtor altogether. “Disrupters” that believe that wedging their way between the Realtor and his or her database is what is best for buyers and sellers. I fundamentally disagree with this and think that a compassionate, well-educated, professional fiduciary (a Realtor) best serves the buyer/seller and the housing space, at large.

Wells Fargo‘s second-quarter earnings reflect the broader challenges mortgage lenders face in such a turbulent market – in just six months, a rapid rise in mortgage rates has eroded consumer demand, shocked capital markets and forced mass industry layoffs. And those fundamental challenges are not going away anytime soon.

The third-biggest U.S. mortgage lender by volume on Friday reported a decline in originations, a decrease in gain-on-sale margins and lower revenues from the re-securitization of loans purchased from securitization pools. The lone bright spot was higher mortgage servicing income.

Wells Fargo originated $34.1 billion in mortgages between April and June, down 10% quarter-over-quarter and 36% year-over-year. Refinancing originations fell to just 28% of total production in the second quarter, down from 56% in the first quarter.

Wells Fargo’s retail channel volume fell to $19.6 billion in Q2 2022, down 19% quarter-over-quarter and 47% year-over-year. Correspondent channel origination volume came in at $14.5 billion, up 5% compared to the previous quarter but down 36% compared to the same period in 2021.

The bank’s home lending business revenues reached $972 million, declining 35% compared to the prior quarter and 53% compared to the same period of 2021. The higher rate environment and a more competitive landscape were responsible for the dip, executives at the bank said Friday.

The mortgage banking noninterest income came in at $287 million in Q2 2022, a decrease from $693 million in the previous quarter and $1.3 billion in the same period of 2021.

“Noninterest income declined as higher interest rates and weaker financial markets reduced our venture capital, mortgage banking, investment banking, and brokerage advisory results,” Charlie Schar, the bank’s CEO, said in a news release.

Wells Fargo’s mortgage servicing rights – carrying value (period-end)– increased 8%, from $8.5 billion in Q1 2022 to $9.2 billion in Q2 2022. Compared with Q2 2021, when it was $6.7 billion, it increased 36%. The net servicing income declined 34% quarter-over-quarter to $77 million but was up 201% year-over-year.

According to Schar, the bank is reassessing what makes sense in mortgage lending – in the servicing business, the primary focus should be on serving its customer base.

On the origination side, he said Wells Fargo is not interested in being “extraordinarily large.” Instead, it is focused on products that will provide solid returns over the cycles, “given all the complexities and requirements that banks have that not necessarily everyone else has.”

“If you just look at how much we originated historically versus you know what we’re originating today, it’ll naturally just come down over time,” Schar told analysts.

Wells Fargo is the second top-10 mortgage originator to report its second quarter earnings. JPMorgan Chase, the second-largest depository mortgage lender, reported double-digit declines in originations, margins compressions and revenue.

“The mortgage market is expected to remain challenging in the near term,” Mike Santomassimo, Wells Fargo’s chief financial officer, said Friday. “We are making adjustments to reduce expenses in response to lower origination volumes, and we expect these adjustments will continue over the next couple of quarters.”

Wells Fargo will lay off 125 employees in its home lending division in Iowa by the end of August, according to Worker Adjustment and Retraining Notification (WARN) notices submitted to the Iowa Workforce Development. The bank eliminated 72 mortgage jobs in Iowa across earlier layoffs.

Mortgages and home lending divisions are now under Kleber Santos, chief executive officer of consumer lending. Santos will replace Mike Weinbach.

Wells Fargo’s stock was trading at $41.33 as of 10:45 PM EST Friday, up 6.70% from the previous day.

Palo Alto, California-based fintech Point, which offers home-equity investment (HEI) contracts to homeowners, is expanding its services into Nevada and Ohio.

With the expansion, Point’s HEI contracts are now available in 18 states and the District of Columbia, according to the company.

“Nevada homeowners are sitting on more than $150 billion in tappable home equity, and Ohio homeowners have more than $330 billion,” said Eddie Lim, CEO and co-founder of Point. “The vast majority of homeowners in both states have tappable equity and are sitting on an incredible amount of wealth in their homes.

Point’s HEI contracts provide homeowners with cash upfront in exchange for a contract providing Point with a slice of the homeowner’s equity. That share, via Point’s home equity investment contracts (HEIs), is typically around 10% or so.

“As an HEI is equity financing, it doesn’t add a monthly payment to a homeowner’s expenses,” Point’s announcement of its market expansion states. “Homeowners can access up to $500,000 and have the flexibility to buy their equity back at any time within the 30-year term with no penalty.

“…To qualify, the home needs to be valued at least $155,000 and the homeowner must retain at least 20 percent of the equity after Point’s investment.“

Point, which claims on its website to “have served over 5,000 homeowners,” has set the financing pillars in place to help propel its growth and take advantage of market conditions. Last year, Point and specialty finance and real estate investment firm Redwood Trust — which holds an investment stake in Point — completed a first-of-its- kind securitization deal backed by HEI contracts.

The private-label securities transaction closed in late September 2021 and represents a new liquidity channel to help fund future HEI pacts. The offering involved issuing $146 million in securities through a conduit dubbed Point Securitization Trust 2021-1.

In addition, earlier this year, Point announced that it had raised $115 million through a Series C fundraising round led by venture capital firm WestCap. The capital will be used to accelerate Point’s growth in the expanding home-equity market, according to the company’s co-founder and CEO Eddie Lim.

Point said that it plans to use the funding to augment its product line as well as its market footprint — with a goal of being in a total of 28 markets by early 2023.

Point also has raised about $54 million in venture capital through three previous funding rounds, according to Crunchbase. The venture capital investment is in addition to $1 billion in separate capital commitments from investors that Point has lined up to help fund its HEI contracts.

Point is not alone in chasing opportunity in the home-equity market. One of its main competitors in the space, for example, San Francisco-based Unison, also is aggressively extending its market reach. Unison, through its platform, offers homeowners the opportunity to tap their home equity without taking out a loan — via a home-equity investment product that it calls a residential equity agreement (REA).

Unison announced earlier this week that it was expanding its services to Nebraska, following the opening of an office in Omaha earlier this year. Unison, as of June 30, boasts having in force $6.1 billion in equity-sharing agreements with some 9,000 homeowners across 29 states and the District of Columbia

Earlier this year, Unison bolstered its liquidity options by completing a $443 million private-label offering backed by shared home-equity loans — with plans to pursue future securitizations as well.

The growth in the home-equity market, and its attractiveness to companies like Point and Unison, is being driven by fast-rising home prices. Single-family home prices grew at an annualized rate of 19.4 percent in the second quarter of this year, according to Fannie Mae’s most recent Home Price Index report. The Federal Reserve now estimates home equity nationwide is now valued at nearly $28 trillion.

“CoreLogic analysis shows U.S. homeowners with mortgages (roughly 62% of all properties) have seen their equity increase by a total of over $3.8 trillion since the first quarter of 2021, a gain of 32.2% year over year,” states the property-information and analysis company in its first-quarter 2022 Homeowner Equity Insights report. “[Through] the first quarter of 2022, the average homeowner gained approximately $64,000 in equity during the past year.”

Point CEO Lim said, however, that home equity isn’t always easily accessible to help homeowners with “life’s needs or to achieve a dream.”

“And with mortgage rates on the rise, refinancing is a less attractive way to leverage home equity,” he said. “A Point HEI is a great option for homeowners who are ‘house rich but cash poor.’”

https://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.png00Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2022-07-14 21:25:492022-07-14 21:25:49Shared-equity firm Point expands into two more states

The housing market recession continues, despite starts data

The June housing starts data beat estimates with positive revisions, however, this doesn’t change the housing market recession call that I made last month. Knowing that the housing cycle was at risk back in March of this year when the 10-year yield broke above 1.94%, I was mindful of when I was going to raise the fifth recession red flag. That happened in June after the May housing starts data came out.

The headline numbers on today’s housing starts data looks OK, but the reality is different. That reality can be seen more clearly by looking at the homebuilder’s sentiment index, which collapsed yesterday.

I believe the builder’s survey data is the best in America when tied to economic expansions and recessions. Its quality is good because it’s driven by profit rather than ideological takes, which distinguishes it from other surveys. The smart thing to do is go with the builder sentiment trend until it reverses, and most likely, we will need to see lower mortgage rates for that to happen.

From the National Association of Home Builders:

Looking at the housing starts report, the numbers came in slightly better than anticipated, driven by multifamily construction. Also, the previous reports were revised higher. If mortgage rates were still below 4%, we would be discussing this report differently, but they aren’t, so the context of my discussion is more forward-looking with the recession red flag raised last month.

From Census: Building Permits: Privately‐owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,685,000. This is 0.6 percent below the revised May rate of 1,695,000, but is 1.4 percent above the June 2021 rate of 1,661,000. Single‐family authorizations in June were at a rate of 967,000; this is 8.0 percent below the revised May figure of 1,051,000. Authorizations of units in buildings with five units or more were at a rate of 666,000 in June.

The housing permit data doesn’t look terrible. Still, it’s backward-looking and the growth in multifamily construction, which we desperately need to cool down rental inflation, has recently been positive. This is a plus for rental supply, however, single-family construction is about to cool down in response to higher rates.

Housing Starts: Privately‐owned housing starts in June were at a seasonally adjusted annual rate of 1,559,000. This is 2.0 percent (±9.0 percent)* below the revised May estimate of 1,591,000 and is 6.3 percent (±10.2 percent)* below the June 2021 rate of 1,664,000. Single‐family housing starts in June were at a rate of 982,000; this is 8.1 percent (±12.2 percent)* below the revised May figure of 1,068,000. The June rate for units in buildings with five units or more was 568,000.

There’s a similar trend with the housing starts data: it doesn’t look terrible, but it’s also backward-looking. As you can see below, we never got back to the peak of the housing bubble years when single-family starts growth was driven by credit demand, which wasn’t sustainable.

Since new home sales are still historically low and rental demand is still in place, we aren’t having the collapse in this data line as we did in 2006. However, it will get weaker in the upcoming months. With demand falling, the need for construction labor to build single-family homes will be an economic risk.

Housing Completions: Privately‐owned housing completions in June were at a seasonally adjusted annual rate of 1,365,000. This is 4.6 percent (±11.7 percent)* below the revised May estimate of 1,431,000, but is 4.6 percent (±13.4 percent)* above the June 2021 rate of 1,305,000. Single‐family housing completions in June were at a rate of 996,000; this is 4.1 percent (±11.1 percent)* below the revised May rate of 1,039,000. The June rate for units in buildings with five units or more was 366,000.

The housing completion data has been the most frustrating data line we have dealt with for years. Some buyers had to wait forever before they could lock in their rate, meaning they didn’t qualify for their homes as rates moved up so fast. This was a risk to the homebuilders as cancelation rates started to increase and you can understand why their mood changed as rates went higher.

New home sales are coming up next week, and the one key thing to remember here is that new home sales are currently low by historical standards. We never saw the credit sales boom as we did from 2002-2005, so the builders themselves are in a better position to manage their future. We won’t see a sales decline in scale terms as we had from 2005-2008 since we simply have never had that type of sales and credit demand. We are already below the 2000 recession levels and back to 1996 levels today.

This is also similar to the purchase application data, since we never had a credit boom in housing as we saw from 2002-2005. This data line is already below 2008 levels currently. As you can see, the entire housing marketplace is much different from what we experienced in 2008.

To recap, the housing starts report wasn’t terrible, but it’s backward-looking. The slowdown in single-family construction is noticeable now that mortgage rates have risen. If mortgage rates fall, we might have a different conversation, but not yet, with the 10-year yield at 2.99%. Look for the builders to offer incentives for their products to ensure they sell their houses.

I’m looking for single-family starts to slow down as demand for new homes stays soft. However, the more interesting aspect will be what happens with multifamily construction because the demand for rent has been solid. Higher mortgage rates will keep more renters in place, and rental deflation collapses aren’t the norm as most people are always working and needing shelter.

However, we can all agree that the housing market materially changed in March once the 10-year yield broke over 1.94% with duration. Higher rates are just one variable here, but the real issue with housing has always been the massive home-price gains we have seen since 2020, especially in the new home sales sector.

One might even say this housing market is still savagely unhealthy.

The post The housing market recession continues, despite starts data appeared first on HousingWire.

Source link

Inflation Up 9.1% Since Last Year

The Bureau of Labor Statistics has released the latest Consumer Price Index. Despite any chatter that may have predicted otherwise, inflation is still at a 40-year high and a 1.3% increase from the month before. Though inflation impacts everyone one way or the other, its effect on the housing market keeps getting more interesting, especially since it’s not fully visible through the statistics.

After all, when the price of gas is so high that people can’t make it to their kids’ doctor’s appointments without taking out loans and food prices are 24% higher in school cafeterias, nothing could be worse than rent prices increasing for some of these families, unless you count now people having to give up their pets, too.

And, as we know, landlords have to keep up, so increasing rent is what’s going to happen anyway. In some cities, these increases are over 10%. Even those who may be in a position to get out of their leases and make a home purchase—as the housing market may finally start to show signs of cooling—interest rate hikes may keep them in their rentals longer.

What Does the Latest CPI Data Tell Us?

The price increases we’re seeing is broad. Over the last 12 months, gas is up 11.2%, food is up 10.4%, shelter increased 5.6%, and energy as a whole increased by a whopping 41.6%.

In total, prices are up 9.1% since last June.

Though we did get a bit of a reprieve from gas prices in mid-June and the Fed continued to raise rates to fight inflation, the bottom line hasn’t changed. Unfortunately, the average person’s ability to afford basic necessities continues to get worse.

In Other News

Additionally, while not in the CPI report, the Euro is continuing to lose its value against the U.S. dollar, with one of the factors being the Fed raising interest rates, along with the Russian invasion of Ukraine. Whether this is a chicken-or-egg situation is beside the point. This may be great for summer travelers, but not so fast. Airlines have been taking a major hit since the pandemic began with a 9+ billion dollar loss and staffing issues to boot. Consequently, with gas up as well, airline tickets are the most expensive they’ve been in years.

Despite this, Americans are still planning vacations, as noted in a recent short-term rental report on BiggerPockets.

The Housing Market Is Still Wild, But Cooling

Alongside this report, the housing market has seen some changes over the last few weeks, but whether this is good or bad depends on whom you ask. Even though there are indicators that prices are starting to cool down, it’s still a war for homebuyers.

Supply constraints continued to be plagued by construction costs, leaving many developers on the sidelines. As of April, the cost of building materials had gone up 19% year-over-year, according to NAHB, and it’s likely to continue increasing. Combine that with gas prices and a global supply chain that’s remained in limbo, building projects may start to get pushed back, and those in the midst of a project could be putting off the completion date. May saw housing starts of privately owned units decrease from 1.8M to 1.5M.

Investors: What Should You Do Now?

While sifting through the news has been confusing, and it seems like there’s not much positivity on the horizon, as long as your tenants are still paying rent, you’re still doing okay.

While housing prices are high in every market, some markets still have decent opportunities. As an investor, you should do some research and check out these top 10 markets in the U.S. to invest in now.

Be on the lookout for the next GDP report on July 28. If growth was negative in Q2, the U.S. will be in a technical recession. We’ll be covering what you need to know here on BiggerPockets.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

Source link

Mortgage forbearance rate declines marginally in June

Servicers’ forbearance portfolio volume trended downward in June but declined at a much slower pace than earlier this year, according to the Mortgage Bankers Association (MBA).

The total number of loans in forbearance decreased by 4 basis points to 0.81% of servicers’ portfolio volume in June from May, per data from the MBA. The rate has steadily declined this year, dropping below 1% in April, with fewer than half a million borrowers remaining with an active plan as of June.

The largest decline in June came from portfolio loans and private-label securities (PLS), which dropped 18 bps to 1.69% of the servicers’ total portfolio volume. Fannie Mae and Freddie Mac loans in forbearance decreased 4 bps to 0.35%. Ginnie Mae loans in forbearance rose 1 bps to 1.26% in June from May.

“Borrowers continue to exit forbearance, but at a much slower pace than six or nine months ago,” said Marina Walsh, vice president of industry analysis at the trade group. “New forbearance requests are still trickling in, as permitted under the CARES Act, resulting in very little movement in the overall percentage of loans in forbearance.”

At the end of June, 405,000 homeowners were in forbearance plans.

Exits represented 0.18% of servicing portfolio volume in June and total forbearance requests represented 0.11%. The survey showed 29.8% of total loans were in the initial plan stage last month and 57.6% were in a forbearance extension. The remaining 12.6% represented re-entries.

What lenders should know about today’s economic climate

Between navigating a post-pandemic world, rate hikes and the threat of a recession, mortgage lenders across the country are managing a volatile housing market. Learn how updating your mortgage technology stack can help you get ahead in today’s unpredictable lending environment.

Presented by: Polly

The mortgage forbearance rate on a declining trend is positive news after the economic impacts of the pandemic hit borrowers hard. But there are some early indicators of borrower stress resulting from high inflation and rising interest rates, added Walsh.

“For example, overall servicing portfolio performance dropped by 14 bps to 95.7% current in June, and the performance of post-forbearance workouts declined by 140 bps to 81.3%,” Walsh said. “It is worth monitoring post-forbearance workouts for all borrowers, and particularly for borrowers with government loans, who are typically the most vulnerable to economic slowdowns.”

From June 2020 to June 2022, MBA data revealed that 29.4% of exits resulted in a loan deferral or partial claim, while almost 19% of borrowers continued to pay during the forbearance period. However, about 17% were borrowers who did not make their monthly payments and did not have a loss mitigation plan.

The survey also shows loans serviced, not delinquent or in foreclosure, dropped to 95.7% in June, from 95.9% in May at a time of high inflation and volatility in mortgage rates.

The post Mortgage forbearance rate declines marginally in June appeared first on HousingWire.

Source link

Is now a good time to invest in real estate automation technologies?

The real estate and title markets are dealing with lower volumes right now, which means increased competition and pressure for businesses to stay profitable. However, it’s also a good time to invest in digital transformation. HousingWire recently spoke with Michael Valdes, president and founder of Axis Technical Group, about investing in automation technologies as a way to prepare for the next boom cycle.

HousingWire: Why is now a good time to invest in new automation technologies for real estate and title?

Michael Valdes: It is well known that the real estate industry is cyclical with periods of “feast or famine.” We just finished a big feast. Recent Fed actions and concerns over a possible recession have put the brakes on transaction volume. This will create challenges for some companies. Focus has shifted to cost containment.

Interestingly, a contrarian perspective might be a better option. This is especially the case if your long-term strategy is growth. Now is an ideal time to invest in automation systems and digital workflows. To start, time and resources are more readily available. New systems are easier to test, implement and optimize with lower transaction volume. And the opportunity cost of losing new business is much lower.

Those with the insight to do this type of investment now will be in a far stronger position to take advantage of the next boom cycle. Higher transaction volume will then be better managed. New efficiency gains can defer or even avoid potential future resource constraints. Combined, these factors can have a really big impact on future profit potential for firms with this insight.

HW: What are the benefits of these automation strategies?

MV: A comprehensive automation strategy offers many advantages. This is especially the case when an industry is in a digital transformation, such as what we are all experiencing in the real estate and title insurance industries. We saw a lot of change over the past two years. Many of these changes will remain.

As successful companies such as Google and Apple have shown us, everyone wins when a complex process is simplified or automated. Employees are better utilized by spending their time where judgment is needed. An automation strategy can not only streamline repetitive processes to save time and money, but it can also unlock new business scalability options to respond faster to change. Automation can ease the visibility of business transactions and provide new insights for process improvement. When combined, these factors can have a dramatic impact on employee productivity and morale, and customer satisfaction.

HW: What automation options exist?

MV: Many parts of a business can be automated. Any repetitive or higher volume actions that are performed are an ideal candidate for automation. Examples include customer inquiries, qualification and review processes, and any other process involved in data acquisition.

A common theme is that the “inputs” for a process need to be digitized. For example, the title insurance industry still relies on paper-based documents and manual review processes. To effectively automate this process, systems will need to be implemented that can more effectively perform document management and data extraction to acceptable levels. The transition may need to be gradual to provide sufficient time to be part of your automation strategy. The important thing is to start planning now.

HW: How is Axis Technical Group poised to help decision-makers set up a more data-driven, automated infrastructure?

MV: Technology plays a critical role in driving innovation. Artificial intelligence and machine learning are two great examples. These technologies are now unlocking superior automation performance.

Specifically, data extraction processes can be “learned” quickly whereby the intelligence gathered by AI-driven algorithms can collect data with greater accuracy and context. This innovative approach extracts unstructured data with context – intelligence that can be used to accelerate the performance of any automated business process.

Axis Technical Group has built an AI-driven data extraction engine specifically tailored to the title insurance industry. This solution, available as a managed service, can deliver superior performance and play a critical role in a company’s overall automation strategy. Our professional services team has successfully implemented this new solution at several locations. The results continue to surprise our clients, which has created many new opportunities for other performance and scalability improvement programs.

Learn more about this managed service offering at: https://axistechnical.com/services/axis-smart-data-extraction/.

The post Is now a good time to invest in real estate automation technologies? appeared first on HousingWire.

Source link

Despite headwinds, these mortgage companies are hiring

Based on the headlines, one might assume the mortgage business is a complete disaster. Origination volume is down about 50% from last year, thousands of layoffs are reported each week, and gloomy prognosticators say recession will make for a long winter. Some mortgage companies will merge to stay afloat, and many others will go under.

But despite the worst business climate in over a decade, there are mortgage companies hiring workers and thinking opportunistically about the cycle.

Purchase-focused lenders that didn’t balloon in size to capture refinancing business during the boom, in particular, are looking to hire loan officers. And mortgage brokerages, which don’t have the burden of high overhead, are heavily recruiting retail LOs whose pipelines have thinned in recent months.

Though purchase volume across the industry is down from 2020 and 2021, it’s among the only source of business out there for lenders. And it’s still very much a relationship-driven business: borrowers want to speak to local loan officers when starting the process of getting a loan, which is why firms are hiring LOs, recruiters and mortgage lending executives said.

Even traditional depository lenders are keen to bring aboard LOs from coast to coast. A quick scan of job boards shows depositories such as U.S. Bank, Citi and Bank of America looking to expand the ranks of LOs.

WesBanco Bank, the second-largest bank headquartered in West Virginia, plans to hire at about a dozen loan originators in 20 major markets this year. Founded in 1870, the bank has about 65 LOs. It has patiently prepared for a downturn and didn’t layoff a single employee in the past two years, said Rick Trew, vice president and regional sales manager at WesBanco.

“We didn’t go out and hire everybody we possibly could,” Trew said. “We maintained our stability during the last several years, that’s what set us apart.”

With over 200 branches in West Virginia, Ohio, Pennsylvania Kentucky, Tennessee and Indiana, Trew said the bank is focused on purchase and the construction business.

Join us!

Recruiting battles for LOs remain fierce, mortgage executives and LOs told HousingWire. Though signing bonuses aren’t as generous as they were during the boom, many LOs making a move are receiving better compensation at their new firm. But it could take a few months to land, especially doing outbound recruiting.

“Our industry knows that the process of going into a marketplace trying to find experienced originators is a very competitive and somewhat of a lengthy process,” Paul Buege, CEO of Inlanta Mortgage, told HousingWire.

Several large mortgage brokerages see the market-wide volatility as a recruiting tool. Mike Kortas-led NEXA Mortgage, a high-volume brokerage, is looking to grow to 2,000 brokers by the end of the year, pitching what he called the best pricing in the industry and 100% splits.

And Anthony Casa-helmed UMortgage, headquartered in Philadelphia, is recruiting from large retail lenders across the country. He’s also bringing in brokers. Sean Grapevine, who led ATL Mortgage in Georgia, recently joined UMortgage. Casa plans to also hire for data, IT, operations and HR roles.

Smaller operations are also looking to fill their ranks, including Motto Mortgage and Grow Mortgage.

Motto, which added 60 franchises in 2022, is looking for seven business development consultants who will be tasked with selling franchises of Motto. Real estate firm RE/MAX acquired Motto Mortgage in 2016 to create a “one-stop-shop” in which homebuyers can work with both a real estate agent to find a home and a Motto Mortgage loan originator to secure financing.

“As rates have gone up and the refi volume have gone down, they (rates) pushed origination back to purchase money,” said Bob Butterfield, vice president of franchise sales at Motto Mortgage. “Purchase applications are where brokerages really shine in the first place.”

“The broker channel is growing so quickly [that] we can’t hire fast enough,” said Russell Petty, owner of Grow Mortgage, which has offices in the Carolinas, Florida and Indiana. Faster return times, often same-day underwriting approvals, and less overhead are all factors that drive lower rates and business to Grow, Petty said.

He plans to hire up to 20 brokers by the end of the year, including junior LOs.

wemlo, a platform connecting mortgage brokers and loan originators to a processing network, is looking to expand. The firm is looking to hire account executives to sell the firm’s processing software. Demand for wemlo is being driven by brokerages that don’t have in-house processors, Butterfield said. The number of brokerages submitting loans to wemlo for processing rose 74% in the second quarter of 2022 from the same period last year, the company said. Acquired by real estate firm RE/MAX and Motto Mortgage in 2020 after two firms struggled to hire experienced processors, wemlo added three account executives with experience at wholesale lenders this year.

“Interest rates have knocked out homebuyers but we still have more qualified buyers who saved up a lot of money and have been trying to get into the market,” Buege said. “As we see a cooling in the housing market, it’s almost bringing a balance back. We look at the market as the glass is half full.”

Tough time for operations staff

It’s a better job market for LOs than processors and underwriters as they are the “revenue generators,” said Mandy Garfield, head of talent acquisition at independent mortgage bank Norcom Mortgage, which is looking for LOs in multiple markets.

“During the heavy refi years, companies really bulked up with processors, underwriters and support staff,” Garfield said. “When the refis went away… [that] is why you are seeing a lot of these layoffs. In order for a company to grow, loan originators are the ones bringing in the loans and revenue to the mortgage company.”

It’s an extremely competitive job market for operations professionals. Over a dozen out-of-work operations workers told HousingWire they’ve applied to hundreds of jobs, and rarely receive more than a few interviews for positions they’re highly qualified for.

“We had more than 300 people apply for a loan originator assistant position in 24 hours so we had to close that posting,” Garfield said.

Janille Dimaguipo knows that first-hand. She has nearly a decade’s worth of experience as a funder, processor and underwriter. She was laid off from her underwriting job by Change Home Mortgage in May 2022

“I knew it was a bad job market but I didn’t know it was this bad,” she said. “Layoffs are cyclical but I’m not used to there being nothing. This layoff season has been different for me. It’s scary. Some people have been out of work since January.”