Looking at the housing market in the years 2020-2024, one risk i identified early on was that home prices could accelerate more in this period than we saw in the previous expansion if inventory channels broke to all-time lows.

I talked about having a 23% price-growth model for the housing market in the years 2020-2024 as a critical marker of balanced growth versus overheating, especially as inventory had been falling for years right into our critical demographic patch. Slow and steady always wins, but sometimes fate deals you a bad hand, and not much can be done when the marketplace overrides anyone’s desire for balance.

Over the last two and a half years of U.S. housing, one thing that will make the record books is that it wasn’t housing deflation we needed to worry about, but housing inflation on both ends: home prices and rents.

After 2021 ended and my price-growth model was broken after only two years and we started 2022 at all-time lows in inventory, I labeled the U.S. housing market as savagely unhealthy. This problem is much different than the housing credit bubble of 2002-2005. Back then, we had higher sales, higher inventory, and less price growth, but we had a massive credit bubble. Today we have fewer sales, few listings, and much hotter home-price growth.

When I talked about needing higher rates in February of 2021, it was based on the fact that we didn’t have a credit bubble, so the demand is legit. However, this also means that demand has limits. The reality was that global bond yields were still low, and getting the U.S. 10-year yield above 1.94% was going to be problematic. As inventory fell again, bidding wars became the norm, and home prices escalated.

By October of 2021, it was apparent that inventory had no chance of showing any year-over-year growth, and we were heading to an even worse home-price growth inflation story in 2022 unless rates rose. January and February data looked so bad that I threw in the towel and said nothing else matters at this stage — we need rates to rise to try to cool this market down.

Mortgage rates of 4%-5% weren’t doing the amount of demand destruction I thought they would. I was anticipating four-week moving average year-over-year declines of 18%-22%, but we were seeing high single-digit and lower double-digit declines. Mortgage rates closer to 6% for sure are driving bigger year-over-year decline data. Still, I never got the four-week moving average decline of 18%-22% trend that I was looking for and it’s now past the traditional seasonality time for this data line.

On Wednesday, the purchase application data was down 4% week to week, 18% year over year, and the four-week moving average decline is now down 17.25%. I will assume that the growth in ARM loans this year prevented the 18%-22% year-over-year decline trends I was looking for earlier in the year.

By October of this year, the year-over-year comps will be much harder, so we can expect bigger declines if the trend stays the same.

However, mortgage rates getting to 6.25% indeed have picked up the pace on the year-over-year declines percentage wise in the purchase application data. Still, here are just a few examples of why we needed rates to rise. (This is not normal, folks. You don’t see percentage declines like this with year-over-year price growth in June.)

- Las Vegas some sales were down 24% year over year as median sales price was up 21% year over year.

- Orange County, California attached homes in June, sales were down 27.2%, and prices up 17.8%.

Redfin:

Realtor.com:

Now just imagine how hot home prices would be if mortgage rates didn’t rise past 6% this year and we didn’t take the big hit to affordability? The housing market always sees better demand once the 10-year breaks under 2% and we have sub-4% rates.

In the middle of the drama of higher rates, my bigger fear is actually if rates go down again. Home sellers and builders had too much pricing power, pushing prices to the extreme. My five-year growth price model got smashed in two years, and things worsened in 2022 before rates rose.

Remember, we all want a balanced housing market; it’s a good thing, not bad. So the goal for me lately is to see total inventory get back to 2019 levels. That will be positive, and we are working our way there, we just need more time because the housing market of 2022 is not the forced credit selling housing market of 2008. I don’t need the housing market to have 2012, 2014, orr 2016 inventory levels to be balanced — I just need 2019 inventory data, which is between 1.52-1.93 million homes, using the NAR data.

NAR: Total Inventory

Realtor.com and others have data lines that use other inventory metrics. However, they all trend the same way.

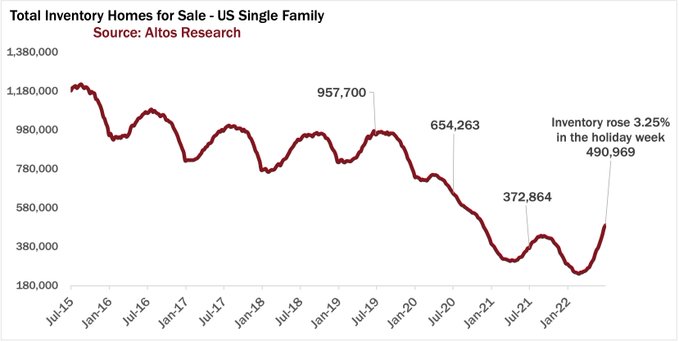

From Altos Research:

I recently did a podcast with Mike Simonsen from Altos Research on this topic.

As the economic cycle shows more recessionary data lines, traditionally, the bond market and mortgage rates head down together.

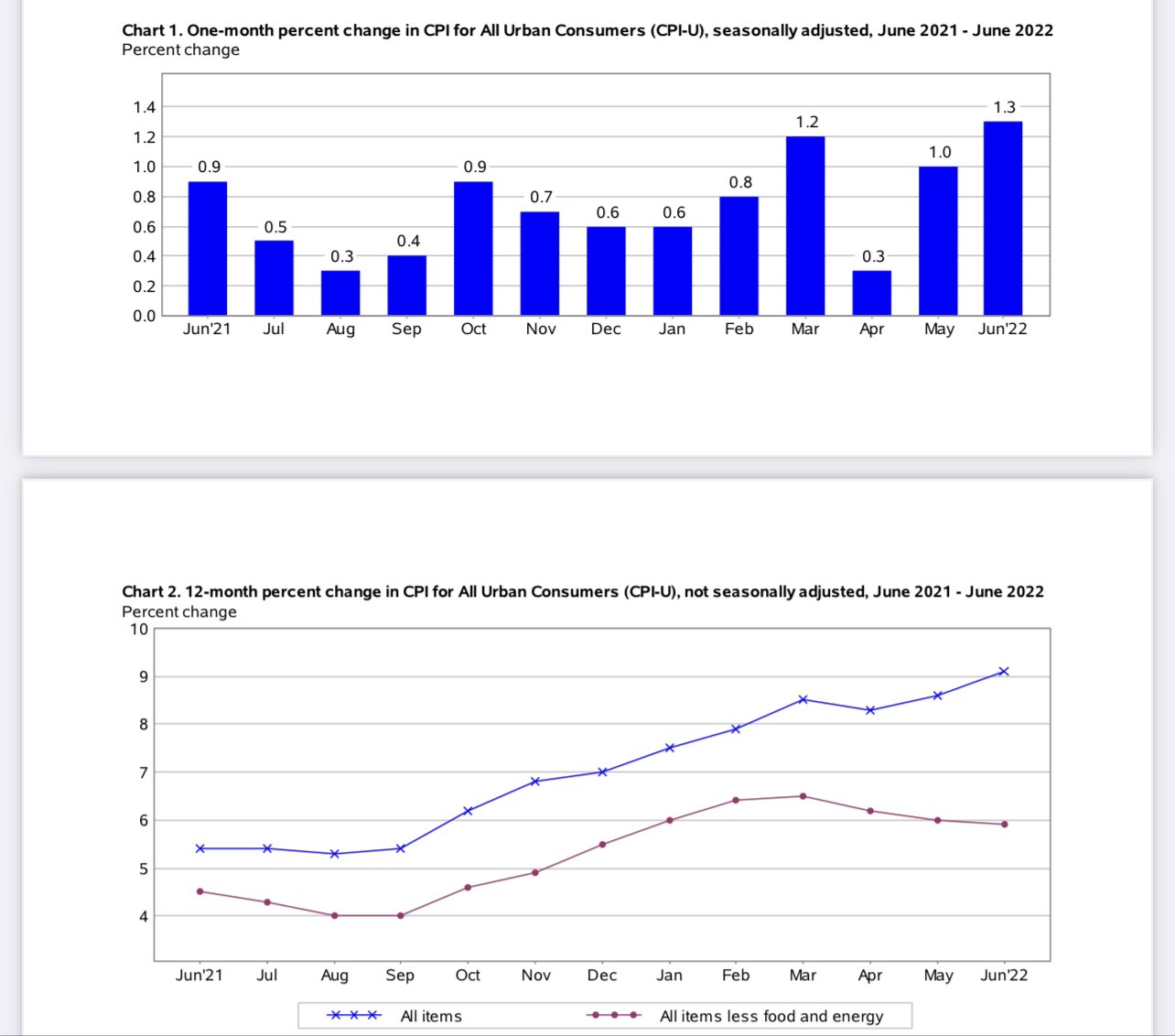

On Wednesday we had another hot CPI print, and the 10-year yield is trading at 2.93%. This isn’t even the high we had back in 2018 when inflation growth was cooler. Many people believe mortgage rates should be higher today if they were tracking the growth rate of inflation, meaning bond yields should be much higher, too. However, since 2021, bond yields haven’t followed the growth rate of inflation.

From BLS:

The downside of higher rates

Housing construction will slow

Keeping in line with my summer of 2020 premise that for the market to change, it needs a 10-year yield above 1.94% and with duration to impact sales negatively. The new home sales sector will slow down like it always does. Even in March of this year, when the data wasn’t terrible, the industry was at risk.

Just last month, I raised my fifth recession red flag, knowing that the builders were at the point of pulling back on construction and focusing on selling what homes they had left and dealing with cancelation rates rising. My one argument here is that if we need 3%-4% mortgage rates for the builders to build at the expense of home prices increasing 15%-20% a year, it’s not a good trade off.

Jobs and incomes will be lost.

As we all know, we have many companies in the real estate and mortgage sector that are laying off people. It isn’t just the companies that boomed due to COVID-19, so we have real-life material damage to households. Also, with fewer transactions happening, less transfer of commission will occur in housing.

Getting closer to a recession

With the fifth recession red flag raised due to higher mortgage rates, we are getting closer and closer to a total recession in the U.S., which in part means more Americans are losing their jobs and lives being turned upside down. With higher rates, inflation, and no employment, it is a stressful time for any household, especially those with children.

To wrap up, I labeled this market savagely unhealthy earlier this year because I knew what this data would look like. Home prices are growing even with higher rates, so we aren’t benefiting from falling home prices, even though sales are dropping. This has happened before when rates rose, sales fall, and price growth would cool down but not go negative.

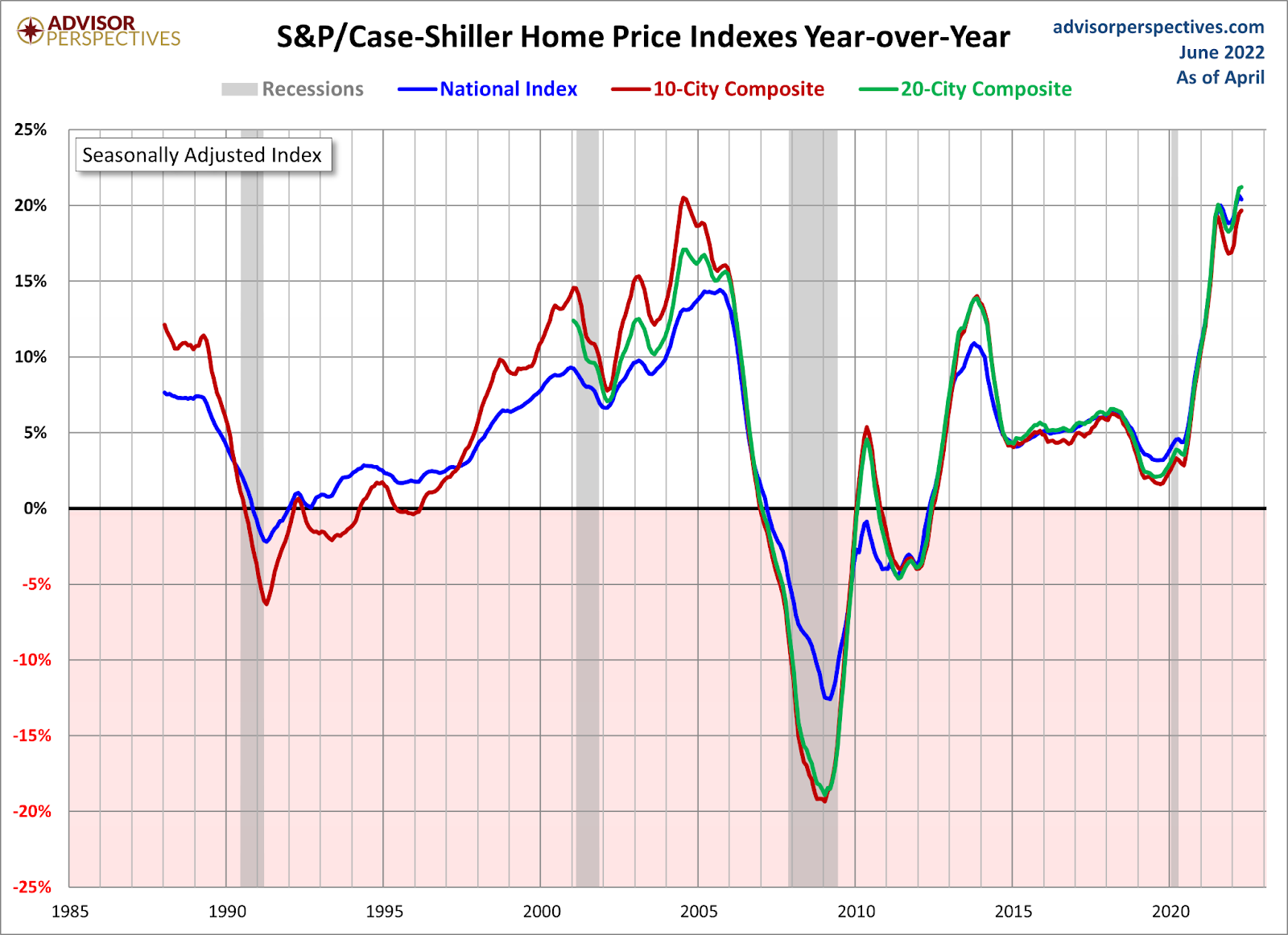

However, it’s a different ball game here in 2020-2024. The S&P CoreLogic Case Shiller Home Price Index, while it lags, still shows 20% plus year-over-year growth. In the past, with higher rates, the growth rate would cool down toward single digits. Clearly, we aren’t there yet, but we should be getting there in time with the rising inventory.

Hopefully, this explains why I am part of “team higher rates” and why I believe a balanced housing market is the best. Higher rates are working; it just takes more time to get us back to 2019 levels of inventory.

The post With home sales down, why are home prices still up? appeared first on HousingWire.

Source link

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

FAR president on the role home equity can play in supporting retirement strategies

The HousingWire award spotlight series highlights the individuals who have been recognized through our Editors’ Choice Awards. Nominations for HousingWire’s Vanguards are now open through Friday, July 22, 2022. Click here to nominate someone.

As home prices continue to rise, one growing point of interest for many homeowners are reverse mortgages, with older Americans sitting on a record $10 trillion in home equity, according to data from the National Reverse Mortgage Lenders Association.

“There’s no doubt that market volatility, inflation, and the impacts of high home price appreciation…have created headwinds for retirees and pre-retirees,” said Kristen Sieffert president at Finance of America Reverse. “Yet, with all the economic pressures facing older Americans this year, reverse continues to stand out as a really elegant solution for them. Market fluctuations and downturns often catch people’s attention, but they may not pay close attention to how much their home equity has grown during this time.”

Last year, Sieffert was nominated as a HousingWire Vanguard for her work in transforming FAR into one of the largest reverse mortgage lenders in the country, including the company’s shift to becoming a more complete provider of holistic retirement solutions. Each year, Vanguards recognize an elite group of housing execs who are making an unmistakable impact on the housing economy.

HousingWire reached out to Sieffert for an update on market conditions in the world of reverse and to learn more about the role leadership plays within FAR’s company culture.

HousingWire: Reverse Mortgage Daily has reported that Home Equity Conversion Mortgage (HECM) endorsements were at historic levels for much of the first half of 2022. What trends have you seen at FAR?

Kristen Sieffert: FAR saw a similar trend to start the year. Industry wide, reverse-to-reverse refinances were driving a lot of the incremental volume, with many borrowers benefiting from high home price appreciation and lower available rates. However, the market has shifted quite dramatically in the last couple of months. Rates rose quickly, and the benefits for those refinances are not nearly as strong as they were a few months ago. The interesting thing is that the demand is still really high, and coming from new origination borrowers, looking for ways to increase cash flow during this challenging time of market volatility. In speaking with potential and current customers, as well as many financial advisors, it’s clear that inflation, stock market pressures and overall affordability remain top concerns. With the ability to access large amounts of equity and lower or no monthly mortgage payments — key features of HECM as well as our proprietary HomeSafe and EquityAvail offerings — we anticipate our broad suite of offerings will continue to meet more peoples’ needs. Historically, during times of market volatility, reverse product options have been looked at more favorably, and we are seeing a similar trend occurring now.

HousingWire: How is the reverse mortgage market positioned as we head into 2H’22 and 2023?

Kristen Sieffert: There’s no doubt that market volatility, inflation and the impacts of high home price appreciation — which make it hard to downsize due to high prices and a lack of housing inventory — have created headwinds for retirees and pre-retirees. Living on a fixed income while facing these pressures is extremely challenging. Yet, with all the economic pressures facing older Americans this year, reverse continues to stand out as a really elegant solution for them. Market fluctuations and downturns often catch people’s attention, but they may not pay close attention to how much their home equity has grown during this time. Older Americans are sitting on a record $10 trillion in home equity. Higher expenses and monthly mortgage payments pose challenges for so many retirees who could benefit from tapping into their home equity. As a result, the market for reverse mortgages is both enormous and bursting with potential for innovative companies like FAR that are seeking to help more retirees find a solution that works best for them and their families.

The most interesting thing to point out with the potential for the reverse market, though, is its implications for the traditional side of mortgage lending. In these more difficult economic times, many traditional mortgage and lending originators will need to find new ways to generate customers, and reverse connects them with a huge population of unreached customers and a new loan product that may not have been part of their offerings in the past. With continued awareness and education about the benefits of tapping into home equity, I expect more homeowners and financial professionals will begin to understand the critical role home equity can play in supporting retirement strategies, and we may start to see more traditional lenders expand their practices to include reverse mortgages and other home equity loans as we head into the next year.

HousingWire: FAR recently earned 2022 Great Place to Work certification. What role does leadership play in building great work environments?

Kristen Sieffert: There’s no doubt that leadership makes or breaks a company culture. The actions the leadership team takes daily, the way we communicate and the priorities we set for ourselves inevitably percolate down into our teams and make a huge impact on the company as a whole. That fact provides us with a significant amount of responsibility and opportunity to build the best community we can. As the president of FAR, I see it as my daily mission to build a vibrant work environment that is purpose-driven and supportive of our talent, allowing our company to remain innovative and forward-looking on behalf of our customers.

I believe that putting our people at the center of our business and encouraging them to bring their whole selves to work is the key to a thriving environment. I am constantly asking myself and my teams what we can do better or differently to surprise and delight our team and customers, rethink the status quo, and build a future landscape of our own making that doesn’t exist today. As a leader, there is nothing more empowering or rewarding than sharing this vision with my teams and watching them take on new challenges on behalf of America’s retirees, and also for themselves.

HousingWire: What tactics or strategies have you deployed to attract and retain great people to the reverse mortgage business?

Kristen Sieffert: At FAR, we’re always striving to put people at the forefront of what we do. Employee growth, strong relationships, and meaningful work are the hallmarks of our “10 Star” company culture and enable us to build talented, compassionate teams across our business. In terms of individual strategies, we regularly find ways to recognize and mentor employees and open up opportunities for professional development. In fact, this past year, we formalized our FAR mentorship program to help employees reach their career goals by pairing the right mentor with the right mentee. We utilize regular employee surveys to track and monitor our progress and we seek out opportunities to highlight the company and individuals with industry awards and other recognitions that help attract and retain talent.

We recently expanded access to our annual President’s Retreat — a premier event that recognizes our top performers, offers employees the chance to build an interoffice community, elevate their leadership skillsets, and spearhead creative new solutions for FAR borrowers. What was previously a sales rally is now an event that employees from all parts of the company can be nominated for and are eligible to attend. We also love to call out star employees in monthly emails and spotlight their excellent work at our quarterly town halls.

Last, and something that has become one of my favorite traditions, is our annual word of the year. Each year we unveil a word that serves as the north star for our annual goals. It carries a significant meaning not only for what we can do together as a team within our business, but also for how our team can find new ways to thrive in their personal lives outside of work. Having this word allows our team to rally around common stories, and especially when the business is facing more challenging times — like the pandemic or the current market volatility — the word gives us a framework to connect deeply around a common theme that supports us in moving through the challenges united and with our heads held high. Together, these efforts culminate to create a strong company culture that supports our employees and delivers for our customers every day.

The post FAR president on the role home equity can play in supporting retirement strategies appeared first on HousingWire.

Source link

Auctions see high owner-occupancy rates for foreclosed homes

The Federal Housing Administration’s recently announced first look program for foreclosed property auctions is a welcome innovation that should help boost a trend that has been developing over the past decade: more foreclosed homes getting into the hands of owner-occupants and fewer getting into the portfolios of large-scale single family rental operators, often backed by Wall Street.

Some might be surprised to hear about this trend toward higher owner-occupancy rates for foreclosed homes. It is counter to a popular and politically potent narrative grounded in the aftermath of the Great Recession, when large institutional investors scooped up thousands of properties at foreclosure auction.

This narrative was once again repeated in the HousingWire article announcing the FHA first-look program: “Typically, FHA-insured foreclosed properties are snatched up by large investors and turned into rental properties.”

But proprietary data from Auction.com and public record data clearly show this oft-repeated narrative is yesterday’s news.

Net owner-occupancy rates

Among nearly 135,000 properties foreclosed between 2016 and 2020 that sold to third-party buyers at foreclosure auction on the Auction.com platform, more than half (54%) are owner-occupied as of 2022, according to public record county tax assessor data from ATTOM Data Solutions. That compares to a 49% owner-occupancy rate for more than 190,000 properties that reverted back to lenders at foreclosure auction. Most of these reverted REOs are eventually sold via the Multiple Listing Service (MLS).

The data paints a similar picture specifically for foreclosed properties backed by FHA-insured loans, the subject of the recently announced first-look program. Over the same period (2016 to 2020), the net owner-occupancy rate for FHA foreclosures sold via auction was 57% compared to 50% for FHA foreclosures sold on the MLS.

The higher owner-occupancy rate for distressed properties sold at auction than those sold on the MLS is a surprising stat given that the MLS is much more broadly known to retail, owner-occupant buyers.

The role of renovators

A deeper dive into the data helps to explain this surprising result. While most distressed properties sold at foreclosure auction don’t go directly to owner-occupant buyers (the reasons for that have recently been well-explained by Urban Institute research), many end up with owner-occupant buyers by way of local investors who renovate distressed properties into a condition that is attractive and financeable — but still affordable — for owner-occupants.

Among more than 73,000 properties sold to third-party buyers at foreclosure auction between 2016 and 2020 and then subsequently resold into the retail market, 73% (more than 53,000) were sold to owner-occupant buyers, according to the public record data. That compares to a 58% owner-occupancy rate for more than 121,000 properties that resold on the retail market after reverting back to the lender at foreclosure auction during the same period.

It turns out local investors are also more efficient than banks and government agencies at renovating and reselling homes. The local investors resold their renovated homes to owner-occupants an average of 311 days after the foreclosure auction, about three months faster than the average 397 days it took to resell renovated REO homes.

Again, the trends are similar for foreclosed properties securing FHA-insured loans: a resale owner-occupancy rate of 74% among properties purchased at foreclosure auction by third-party buyers compared to a resale owner-occupancy rate of 56% among those that reverted to the lender at the foreclosure auction.

Among the FHA foreclosures, local investors resold their renovated homes an average of 287 days after the foreclosure auction, nearly five months faster than the 431 days on average to resell renovated REOs.

I buy local

But what about the foreclosed properties that don’t end up in the hands of owner-occupants? Are those going to “large investors” building single family rental empires, as claimed by the popular narrative?

Once again, the data clearly points to this narrative being outdated.

Nearly 100% of Auction.com buyers in 2021 (99%) purchased 10 or fewer properties during the year, and 79% purchased just one property. The 99% of buyers accounted for 89% of all properties purchased during the year.

Furthermore, 83% of all purchases on the auction site in 2021 were made by buyers who lived within 100 miles of the property purchased, while 63% were by buyers who lived within 25 miles. The median distance between buyers and properties purchased was just 17 miles.

This data paints a much different picture of the typical foreclosure auction buyer than that painted by the popular narrative. These are not multi-state institutional investors purchasing hundreds of properties a year at foreclosure auction. These are local investors buying a few properties in communities where they live and work.

Bye-bye bulk buyers

The popular narrative about foreclosure auction buyers is grounded in truth; it’s just truth from more than a decade ago. Public record data looking at the total foreclosure sales market demonstrates this. In 2009, at the peak of the Great Recession’s foreclosure crisis, more than half (52%) of all foreclosure sales were sold to entities who purchased at least 10 properties in a calendar year, according to data from ATTOM Data Solutions.

But that share has gradually shrunk over the last 12 years. In 2020 and 2021, only 11% of total market foreclosure sales went to entities who purchased at least 10 properties in a calendar year.

Broader buyer spectrum

The 11% of 10-plus property buyers in the total market is likely higher than the 1% on Auction.com for a couple reasons. First, site’s data is only looking at the number of properties purchased on the platform while the public record data is looking at total properties purchased.

Secondly, properties sold through the auction platform are more visible and accessible to a broad spectrum of buyers than are properties sold through the traditional foreclosure sale model. In that model, the only marketing of foreclosure auctions is through notices in a local newspaper or legal publication.

This technology-enabled transparency is creating equal opportunity for more buyers, including smaller-volume local investors who can now better compete against the large-volume institutional investors.

Daren Blomquist is vice president of market economics at auction.com.

The post Auctions see high owner-occupancy rates for foreclosed homes appeared first on HousingWire.

Source link

With home sales down, why are home prices still up?

Looking at the housing market in the years 2020-2024, one risk i identified early on was that home prices could accelerate more in this period than we saw in the previous expansion if inventory channels broke to all-time lows.

I talked about having a 23% price-growth model for the housing market in the years 2020-2024 as a critical marker of balanced growth versus overheating, especially as inventory had been falling for years right into our critical demographic patch. Slow and steady always wins, but sometimes fate deals you a bad hand, and not much can be done when the marketplace overrides anyone’s desire for balance.

Over the last two and a half years of U.S. housing, one thing that will make the record books is that it wasn’t housing deflation we needed to worry about, but housing inflation on both ends: home prices and rents.

After 2021 ended and my price-growth model was broken after only two years and we started 2022 at all-time lows in inventory, I labeled the U.S. housing market as savagely unhealthy. This problem is much different than the housing credit bubble of 2002-2005. Back then, we had higher sales, higher inventory, and less price growth, but we had a massive credit bubble. Today we have fewer sales, few listings, and much hotter home-price growth.

When I talked about needing higher rates in February of 2021, it was based on the fact that we didn’t have a credit bubble, so the demand is legit. However, this also means that demand has limits. The reality was that global bond yields were still low, and getting the U.S. 10-year yield above 1.94% was going to be problematic. As inventory fell again, bidding wars became the norm, and home prices escalated.

By October of 2021, it was apparent that inventory had no chance of showing any year-over-year growth, and we were heading to an even worse home-price growth inflation story in 2022 unless rates rose. January and February data looked so bad that I threw in the towel and said nothing else matters at this stage — we need rates to rise to try to cool this market down.

Mortgage rates of 4%-5% weren’t doing the amount of demand destruction I thought they would. I was anticipating four-week moving average year-over-year declines of 18%-22%, but we were seeing high single-digit and lower double-digit declines. Mortgage rates closer to 6% for sure are driving bigger year-over-year decline data. Still, I never got the four-week moving average decline of 18%-22% trend that I was looking for and it’s now past the traditional seasonality time for this data line.

On Wednesday, the purchase application data was down 4% week to week, 18% year over year, and the four-week moving average decline is now down 17.25%. I will assume that the growth in ARM loans this year prevented the 18%-22% year-over-year decline trends I was looking for earlier in the year.

By October of this year, the year-over-year comps will be much harder, so we can expect bigger declines if the trend stays the same.

However, mortgage rates getting to 6.25% indeed have picked up the pace on the year-over-year declines percentage wise in the purchase application data. Still, here are just a few examples of why we needed rates to rise. (This is not normal, folks. You don’t see percentage declines like this with year-over-year price growth in June.)

Redfin:

Realtor.com:

Now just imagine how hot home prices would be if mortgage rates didn’t rise past 6% this year and we didn’t take the big hit to affordability? The housing market always sees better demand once the 10-year breaks under 2% and we have sub-4% rates.

In the middle of the drama of higher rates, my bigger fear is actually if rates go down again. Home sellers and builders had too much pricing power, pushing prices to the extreme. My five-year growth price model got smashed in two years, and things worsened in 2022 before rates rose.

Remember, we all want a balanced housing market; it’s a good thing, not bad. So the goal for me lately is to see total inventory get back to 2019 levels. That will be positive, and we are working our way there, we just need more time because the housing market of 2022 is not the forced credit selling housing market of 2008. I don’t need the housing market to have 2012, 2014, orr 2016 inventory levels to be balanced — I just need 2019 inventory data, which is between 1.52-1.93 million homes, using the NAR data.

NAR: Total Inventory

Realtor.com and others have data lines that use other inventory metrics. However, they all trend the same way.

From Altos Research:

I recently did a podcast with Mike Simonsen from Altos Research on this topic.

As the economic cycle shows more recessionary data lines, traditionally, the bond market and mortgage rates head down together.

On Wednesday we had another hot CPI print, and the 10-year yield is trading at 2.93%. This isn’t even the high we had back in 2018 when inflation growth was cooler. Many people believe mortgage rates should be higher today if they were tracking the growth rate of inflation, meaning bond yields should be much higher, too. However, since 2021, bond yields haven’t followed the growth rate of inflation.

From BLS:

The downside of higher rates

Housing construction will slow

Keeping in line with my summer of 2020 premise that for the market to change, it needs a 10-year yield above 1.94% and with duration to impact sales negatively. The new home sales sector will slow down like it always does. Even in March of this year, when the data wasn’t terrible, the industry was at risk.

Just last month, I raised my fifth recession red flag, knowing that the builders were at the point of pulling back on construction and focusing on selling what homes they had left and dealing with cancelation rates rising. My one argument here is that if we need 3%-4% mortgage rates for the builders to build at the expense of home prices increasing 15%-20% a year, it’s not a good trade off.

Jobs and incomes will be lost.

As we all know, we have many companies in the real estate and mortgage sector that are laying off people. It isn’t just the companies that boomed due to COVID-19, so we have real-life material damage to households. Also, with fewer transactions happening, less transfer of commission will occur in housing.

Getting closer to a recession

With the fifth recession red flag raised due to higher mortgage rates, we are getting closer and closer to a total recession in the U.S., which in part means more Americans are losing their jobs and lives being turned upside down. With higher rates, inflation, and no employment, it is a stressful time for any household, especially those with children.

To wrap up, I labeled this market savagely unhealthy earlier this year because I knew what this data would look like. Home prices are growing even with higher rates, so we aren’t benefiting from falling home prices, even though sales are dropping. This has happened before when rates rose, sales fall, and price growth would cool down but not go negative.

However, it’s a different ball game here in 2020-2024. The S&P CoreLogic Case Shiller Home Price Index, while it lags, still shows 20% plus year-over-year growth. In the past, with higher rates, the growth rate would cool down toward single digits. Clearly, we aren’t there yet, but we should be getting there in time with the rising inventory.

Hopefully, this explains why I am part of “team higher rates” and why I believe a balanced housing market is the best. Higher rates are working; it just takes more time to get us back to 2019 levels of inventory.

The post With home sales down, why are home prices still up? appeared first on HousingWire.

Source link

Spencer Rascoff to headline at HW Annual October 3-5

One of the largest barriers to homeownership is affordability and access. Former Zillow CEO, Spencer Rascoff, has recognized that obstacle and uses his business and real estate insight to tear it down. That is why HousingWire is thrilled to have Rascoff as a headline speaker at HW Annual October 3 – 5th 2022.

On Wednesday morning, Rascoff’s 20-plus years of experience will shine on the HW Annual stage. As a top business leader, he is set to tackle the next challenge, tapping into his experience as an entrepreneur and company leader at some of the biggest names in housing to leave attendees with his expert perspective on the future of housing.

Rascoff was co-founder and CEO of Zillow until his departure in 2014. Since then, he has dug further into the entrepreneur and investment world. He is the co-founder and board chair of Pacaso, a company that helps homebuyers purchase their second home. He also merged his company Supernova with Offerpad, a leading real estate company. He recently invested in Arrived Homes, a Seattle-based real estate company investing in single-family rental properties. Rascoff lives and breathes a lucrative mix of technology finance, and real estate, three inextricably linked sectors.

Outside of his time in the board room, Rascoff is the host of “Office Hours,” a podcast featuring candid conversations between prominent executives on leadership, diversity equity and inclusion and startups. Some of his most recent guests include Stephen Adler, mayor of the booming real estate city Austin, TX and Ryan Serhant, founder of real estate brokerage SERHANT. He is also the author of the NYT Bestseller, “Zillow Talk: Rewriting the Rules of Real Estate.”

HW Annual will be held in Scottsdale, Arizona this year and feature housing leaders from all corners of the industry including real estate, mortgage and closings. Hear from today’s top marketing leaders and women of influence award winners, plus enjoy networking events with like-minded professionals. Join us at HW Annual for the content, connections and technology you need to win in this environment. Register here.

The post Spencer Rascoff to headline at HW Annual October 3-5 appeared first on HousingWire.

Source link

Michael Bright: Where residential mortgage-backed securities can take sustainable investing

ESG investing — that is “environmental, social and governance” money management — goes by many monikers. Some call it “sustainable investing,” others “impact investing.” The United Nations, which coined the term two decades ago in the wake of the Enron and Exxon Valdez scandals, sometimes refers to it as “inclusive investing.” All these phrases imply that capitalism can consider factors outside of quarterly earnings when making investment decisions.

Others are less sanguine about the movement. Unfettered free market advocates view it as misguided. Elon Musk has used his Twitter megaphone to call ESG “the devil incarnate.” Recently, the Financial Times, while pointing out that the term “ESG” was mentioned in almost 20% of corporate earnings calls last year, simultaneously said ESG’s ambiguity has set it up for a “reckoning.”

Rhetoric aside, here are some facts

The Securities and Exchange Commission has begun the process of developing mandated disclosure regimes for funds that consider ESG factors in their marketing material. Millennial and Gen Z investors have been voting with their wallets, demanding that ESG-like items are incorporated into investment decisions. The market has seen a major increase in corporate board focus on the issue, as well as investment funds offering ESG products.

Consider how much the estimates of dollar-based ESG assets range — from tens of trillions to nearly a hundred trillion — depending on the source. This massive variation demonstrates the current market’s inability to successfully quantify (or even define) what exactly we mean by those three magic letters.

Where is ESG investing going next?

What does ESG’s growth and current ubiquity mean for residential MBS markets?

When thinking about ESG in RMBS, right now there are three considerations that can help the mortgage market properly capitalize on the momentum behind the ESG movement. If done responsibly, ESG and RMBS should coexist in a positive, self-reinforcing, meaningful way, and one that establishes the residential mortgage market as a best practices leader in the movement overall.

To get there, first, Residential Mortgage-Backed Security (RMBS) issuers, investors, and rating agencies should avoid trying to boil the ocean. The E, S and G components are all very different, and at times unwieldy. Sometimes these factors are in outright tension with one another. Is affordable housing construction that requires trees to be torn down a social good, or not? Care needs to be taken so that the market doesn’t bite off more than it can chew.

The RMBS market should break ESG factors down and analyze them one at a time. Environmental (E) metrics are currently the most advanced. RMBS issuers and investors analyze not only environment hazard risks, like homes being in flood or wildfire zones, but also collateral features that have a positive environmental impact like solar panels. Data like the percentage of loans in a pool with LEED or Energy Star certifications, for example, are also good places to continue building a market.

The residential MBS market can also build from some of the infrastructure that already exists for the “S” – social – component of ESG. Ginnie MBS, for example, could be included in funds that focus on social impact, as they typically pool mortgages to borrowers with little credit history or needing down payment assistance. Same with “first-time homebuyer” flagged mortgages.

Where the market can get a bit more forward leaning would be with ideas such as a first-generation homebuyer flag, a measure of the proximity of affordable housing to public transportation, or whether new affordable housing will help a community meet its suggested/required affordable housing level.

Other ideas include more disclosure to investors around borrowers who received down payment assistance or are below a certain Area Median Income (AMI). These are all data elements that could be collected at origination and passed along to investors, and they fit nicely within the scope of how the market already operates today. The market should begin requesting these types of data flags from issuers and begin collecting and disseminating the needed data to ESG-focused investors.

Market participants must remember that, as fiduciaries, asset managers must tether all decisions to returns unless an investment mandate specifies otherwise. Certainly, ESG factors that analyze the sustainability of an asset do impact the fundamental value of securities. But for mortgages, the market can also be looking at ways to enhance pricing on MBS that offer both ESG components and improved, or at least more predictable, yield. Think, for example, of the reduced convexity of low balance loans.

Building out disclosure around low balance pools – reporting on whether they constitute underserved markets, low-to-moderate income (LMI) borrowers, neighborhoods that had historically been redlined, etc. – while also showing that the reduced refinance elasticity benefits investors and lowers rates to borrowers is a perfect place for RMBS to grab hold of already established practices and enhance them with ESG investing in mind. For a market already sophisticated in taking borrower factors into account for prepayment speeds and credit risk, looking at places where more details about homeowners can help both convexity risk and enhance underserved access to credit is an obvious win.

Next, RMBS market participants must understand that disclosures are going to be the key to success. The RMBS industry needs to work together to develop ESG disclosures that are as consistent and transparent as possible. One thing the recent raids at Deutsche Bank or fines against BNY demonstrate is that authorities are actively policing any accusations of “greenwashing,” ensuring ESG claims don’t get ahead of reality (see my previous comment on the market’s failure to consistently measure ESG assets). Sound data disclosure standards are the solution.

ESG investing means a lot of things to a lot of people. Maybe it’s the way eight billion people can share a planet and enjoy equitable and sustainable long-term growth. Maybe some of it is too amorphous to last. But considering how investments impact our world in the long-term is a very worthwhile goal, and one that many RMBS investors are seeking.

For the RMBS market to embrace the opportunity in front of it, building from what we already do well and staying laser-focused on transparency and data disclosure are the most important ingredients right now.

The post Michael Bright: Where residential mortgage-backed securities can take sustainable investing appeared first on HousingWire.

Source link

PLS deals backed by jumbo loans plummeted in June

June was a rough month for jumbo-mortgage securitizations, with only two private-label offerings brought to market valued at roughly $821 million.

The two jumbo-loan deals that did make it out of the gate last month were issued by Rocket Mortgage and J.P. Morgan Chase via the Rocket Mortgage Trust and J.P. Morgan Mortgage Trust conduits. The Rocket prime jumbo deal was backed by mortgages valued at $337.9 million and the J.P. Morgan deal was collateralized by jumbo mortgages valued at $483.4 million.

Prior to June, Rocket had sponsored three other prime jumbo securitizations backed by mortgages valued at about $1.9 billion. The most recent of the three was in April, with the other two in January and February, according to deals tracked by Kroll Bond Rating Agency (KBRA). Through June of this year, then, Rocket has sponsored a total of four private-label securitizations secured by prime jumbo loans valued at slightly north of $2.2 billion.

J.P. Morgan has been far more active this year, with nine prime-jumbo offerings through the end of June valued at $7.8 billion — two involving high loan-to-value prime jumbo-loan pools. But like Rocket, the lender has seen its private-label securitization activity fall off sharply in the past few months, with only one prime jumbo deal offered in May and one in June.

Across both the Rocket and J.P. Morgan jumbo offerings, a noticeable trend is the wide spread between current mortgage rates and the weighted average coupon (or interest rate) for the loan pools backing the securitization deals. That average coupon has been creeping up as the year moves forward for securitization deals sponsored by both lenders, according to bond-rating reports for each, but it is being outpaced by fast-rising market rates — propelled by the Federal Reserve’s monetary tightening policies in its battle against inflation.

A huge volume of loans was originated at much lower interest rates last year during the height of the refi boom, and many of those loans were still winding their way through the securitization pipeline in 2022, given most loans have several months of seasoning before being securitized. That has created a distortion in execution and pricing in the secondary mortgage market.

For Rocket, according to KBRA’s bond-rating reports, the average coupon on its jumbo offerings has risen from 3.02% to 3.91% between its first jumbo transaction in January to its most recent deal in June. For J.P. Morgan, according to a bond-rating report from Fitch Ratings, the average weighted coupon for the jumbo loan pools in its offerings has increased from 3.3% in April — prior comparable data was unavailable in the report — to 3.8% in its most recent offering in June.

In both cases, the most recent coupon figures fall well short of current market rates for 30-year fixed mortgages. That pattern has escalated since the start of the year, when interest rates started to shoot up dramatically.

For the final week of June, the rate for a 30-year fixed mortgage was in the 5.7% range. Even with big drop in rates in the first week of July — the sharpest decline since 2008, to 5.3% for a 30-year fixed rate mortgage, according to Freddie Mac — the spread remains wide between the average coupons of the Rocket and J.P. Morgan jumbo offerings and current market rates.

The average contract interest rate for 30-year fixed-rate jumbo mortgages (balances greater than $647,200) is even a tad lower than the prevailing market rate of 5.3% — coming in at 5.25 percent for the week ending July 8, according to the Mortgage Bankers Association’s weekly mortgage applications survey.

Digital mortgage exchange and aggregator MAXEX reported in its recently released June market update that the overall reduction in mortgage originations, “due to higher rates, increased rate volatility and widening spreads continued to impact the demand for RMBS [residential mortgage-backed securities] in June.”

“Just two [jumbo-securitization] deals priced in June, compared to three in May,” the MAXEX report states. “June’s issuance was more than $500 million below May’s numbers and more than $1.5 billion lower than April’s issuance.”

That slowdown in the private-label securitization volume compared with the start of the year is not isolated to prime jumbo deals, either, according to data from KBRA.

Year to date through June 2022, KBRA’s deal-tracking data shows that 111 prime and nonprime securitization deals hit the market backed by loan pools valued in total at some $52.8 billion. Last year, over the same time frame, 97 PLS transactions were recorded backed by mortgage pools valued at $39.6 billion.

Of note, however, is that the bulk of the prime and nonprime PLS deal volume in 2022 so far is from the first quarter of this year — 67 deals valued at $33.9 billion. Volume dropped off considerably in the second quarter, as rates continued to rise, to 44 deals valued at $18.9 billion, according to KBRA data,

“The market for securitizations has all but dried up, with just two prime jumbo RMBS issuances and one agency-eligible investor issuance printing for June,” MAXEX reported. “To put it into perspective, RMBS issuance in June 2022 [based on MAXEX’s deal tracking] totaled less than $900 million, versus the June 2021 total of nearly $5 billion.”

The post PLS deals backed by jumbo loans plummeted in June appeared first on HousingWire.

Source link

Mortgage application volume dips 1.7% led by decline in purchase mortgages

Demand for mortgages declined for the second consecutive week, led by a dip in purchase mortgage applications — despite rates on a downward trend.

The market composite index, a measure of mortgage loan application volume, decreased 1.7% for the week ending July 8, according to the Mortgage Bankers Association (MBA). The refinance index rose 2% from a week earlier and the purchase index dropped 4%.

“Purchase applications for both conventional and government loans continue to be weaker due to the combination of much higher mortgage rates and the worsening economic outlook,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Freddie Mac PMMS showed purchase mortgage rates dropped 40 basis points to 5.3% last week. Rates during the previous two weeks dropped by half a percent but were still well above the 30-year purchase rate of 2.9% from the same period in 2021.

The trade group estimates the average contract 30-year fixed-rate mortgage for conforming loans ($647,200 or less) remained at 5.74%, unchanged from the previous week. Jumbo mortgage loans (greater than $647,200) dipped to 5.25% from 5.28%.

After reaching a record average purchase loan size of $460,000 in March 2022, the figure declined to $415,000 last week led by the potential moderation of home price growth and weaker purchase activity at the upper end of the market, Kan added.

The refi share of total applications rose to 30.8% last week, largely due to an uptick in conventional and Federal Housing Administration (FHA) refinances. The overall refi index remained 5% below the average level reported in June, according to the MBA.

“With the 30-year fixed rate 265 basis points higher than a year ago, refinance applications are expected to remain depressed,” said Kan.

In a separate projection made by the MBA in June, of the $2.4 trillion origination volume forecast for 2022, about $730 billion is expected to come from refis. About $2.3 trillion, more than 40% of the $4 trillion origination volume, came from refis in 2021.

The FHA share of total applications decreased to 11.7% from the previous week’s 12%. The United States Department of Agriculture (USDA) share also declined to 0.5% from the week prior’s 0.6%. The Veterans Affairs (VA) share of total applications slightly rose to 11.2% from 11.1%.

The share of adjustable-rate mortgages (ARM) applications also rose, accounting for 9.6%. According to the MBA, the average interest rate for a 5/1 ARM increased to 4.71% from 4.62% a week prior.

The survey, conducted weekly since 1990, covers 75% of all U.S. retail residential mortgage applications.

The post Mortgage application volume dips 1.7% led by decline in purchase mortgages appeared first on HousingWire.

Source link

Why Rental Properties Are Still a Good Investment When Interest Rates Rise

One of the most valuable tools rental property investors have in the U.S. is the 30-year fixed-rate mortgage. Surprisingly, this style of mortgage is very much an outlier compared to what’s typically offered in other countries. Most countries tend to offer adjustable, variable, flexible, or renegotiable rate mortgages, all of which pose an inherent risk with the potential of an unexpected interest rate hike during ownership of the property.

Not only are fixed-rate mortgages excellent for letting investors skip those unexpected rate hikes down the road, but there have been notable periods where the interest rates on these mortgages have been remarkably low, making the cost of borrowing money almost trivial.

But what happens when those interest rates increase, potentially to levels we aren’t used to seeing? Suddenly monthly mortgage payments are noticeably higher, which hits our cash flow returns. Does it mean it’s time to slow down or stop investing in rental properties? How do you counter higher interest rates on your mortgage to stay profitable with your rental property?

The best way to decide this is by understanding how rental properties make money, the factors you can control in a rental property and its profits, and knowing what to look for in a prospective rental property to help set you up for the greatest chance of successful returns, despite a higher mortgage payment.

Rental Properties are Long-Term Investments

One of the biggest things you should remember with rental properties is that they are, in fact, long-term investments. Sure, some people may see a quick equity profit through improvements or value-adds, and some may land deals with significant cash flow from the start. Still, as a general rule, you must remember that rental properties see the most profit over the long haul.

Often when we analyze a rental property’s finances, we only see the cash flow number that’s right in front of us. It’s easy to forget that the projected cash flow is simply what’s projected today. That number doesn’t account for rent increases over time (while keeping a fixed mortgage payment), appreciation, demand, and inflation. All of those factors will continuously change, hopefully for the better.

How a Rental Property Makes Money

Before learning about real estate investing, you may have known that rental properties can be very profitable but not necessarily understand exactly how they can be so profitable.

The five ways that rental properties can make money are:

When you understand the details of each of these profit centers, you will not only become savvier about the power of holding a rental property for the long-term instead of the short-term, but you’ll also begin to realize that the expense of an interest rate that’s a couple of points higher than what you’re used to likely doesn’t hold a candle to the profit potential over the lifetime of the rental property.

You may already be saying, “But those other profit centers are speculative, and cash flow is still important, and the higher mortgage expense increases my risk by lowering my cash flow.” Yes, and that can very well be true. But what you want to do in this situation is two things:

When you understand how rental properties make money, you can begin to wear the investor hat rather than the consumer hat. It’s the consumer hat that causes people to think that increased interest rates are deal-breakers, whereas people who truly understand how rental properties profit will not only learn to see how to look past the interest rates but also give them perspectives on how to compensate for it.

Rent Increases

As already pointed out, a rental property’s projected cash flow is based on today’s rents, not tomorrow’s. Rents increase for two reasons: appreciation and inflation.

Guess what doesn’t increase over time and is not affected by appreciation or inflation? Your mortgage payment when you have a fixed-rate mortgage.

This means your cash flow spread will continue to grow over the life of your rental property as you continue to increase rents.

Your expenses, such as property tax and insurance, may increase over time, but they’re unlikely to increase at a rate anywhere near what rents will increase. Overall, you’ll see that rents will continue to pull farther and farther away from your fixed-rate mortgage expense, and your profits should continue to grow exponentially.

Forcing Profit Increases and Lowering Expenses

While I’ve been emphasizing the long-term, there are proactive things you can do to create more equity faster. Let’s go over them.

Improving the property

The more desirable your property, the more value it will generate and the more demand it will drive. While many profit centers will kick in on their own over time and increase the property’s value and rents, you can also do things to your property to increase desirability and force those profit increases more quickly.

The most basic way of improving a property is by rehabbing it. When you upgrade a property, making it nicer and more attractive, you not only increase the overall value of that property, but you can also ask for higher rents. You’re merely speeding along those profits past what the higher interest rate is costing you.

Refinancing your mortgage

Don’t forget that you may not be tied to that higher interest rate forever. Mortgage interest rates fluctuate, just as property and rents do. If the interest rate drops lower than what you originally signed up for, you can refinance the property at that lower interest rate. Of course, it’s not a guarantee the rates will drop, but if they ever do, you can make that move and increase your cash flow.

Picking the right location

If you’ll notice, this isn’t the first time the location of a rental property has been brought up. As mentioned before about buying in a path of demand to ensure appreciation potential, you can also make even more strategic moves when you learn how to analyze neighborhoods and identify areas with an extremely high chance of appreciation. Forces like gentrification, population growth, and job growth can increase values.

Of course, banking specifically on gentrification, as with any appreciation, is speculation. You not only want to learn how to identify areas that may experience gentrification, but you also should have a contingency plan in case gentrification doesn’t occur. You wouldn’t want all your eggs in one profit center basket if that basket were to tip over. But if you buy at the right time (which often means you have to move quickly and not spend forever hesitating, or you may lose the deal), gentrification can certainly force more profits.

Going Up Against Inflation

While inflation impacts most areas of our lives negatively, the one place it can help is with rental properties. Your fixed-rate mortgage expense stays the same for the loan term, despite what happens to the dollar’s value. You pay back the loan in yesterday’s dollars, not tomorrow’s.

Look at inflation as compared to the interest rate of the mortgage. Many experts argue that the mortgage interest you pay over the term of a 30-year fixed mortgage is less than the expense of paying for the same property in cash with today’s dollars because of inflation.

When the inflation rate is higher than the interest rate on your mortgage, your profits will continue to outrun the expense of that mortgage.

Keys to Remember

It would be easy to read this article and believe that if you hang onto a rental property for a long time, it will be very profitable because no matter what your expenses are today, everything will catch up and shift into a profit.

That isn’t going to be true for all properties. Not all rental properties will be profitable, and many factors can challenge the various profit centers. It’s especially important to remember that speculation doesn’t always pan out, and you should avoid speculation more often than not.

The intention of this article isn’t to mislead you into thinking that any property will make for a profitable property, but it’s instead to show you how to look at and analyze potential rental properties with the understanding that a higher interest rate won’t eat as much of your income up as you think.

It’s also important to be educated. For instance, what you believe is a high-interest rate may be “normal.” We’ve gotten used to seeing historically low-interest rates. We’ve been spoiled, and it misleads us into thinking that we can only be profitable if we have stupidly low-interest rates on our mortgages.

Lastly, if the interest rate continues to stress you, consider putting more money down on the loan so your payment will be decreased. Plus, you may even land a slightly lower interest rate as you increase your down payment.

If you’ve invested during periods of higher interest rates, what’s the most creative financing structure you’ve used on your rental properties with those rates, and how did it turn out 10 or 20 years down the road of owning your property? Let us know in the comments!

Build a stable financial foundation

Are you tied to a nine-to-five workweek? Would you like to “retire” from wage-paying work within ten years? Are you in your 20s or 30s and would like to be financially free?The sort of free that ensures you spend the best part of your day and week, and the best years of your life, doing what you want?

Source link

Mortgage credit availability falls 0.3% in June

Lenders continued to tighten credit standards in June as higher mortgage rates slowed refinance and purchase activity.

The monthly Mortgage Credit Availability Index (MCAI) fell by 0.3% in June, according to the Mortgage Bankers Association. A decline of the index, benchmarked to 100 in March 2012, indicates lending standards are tightening, while an increase suggests loosening credit.

Credit availability was mixed by loan type. The conventional MCAI rose 1.2% while the government MCAI dipped by 1.7%. Of the component indices of the conventional MCAI, the jumbo MCAI increased by 1.4% and the conforming MCAI climbed by 0.6%.

“Mortgage credit availability decreased slightly in June, as significantly higher mortgage rates compared to a year ago slowed refinance and purchase activity and impacted the overall mortgage credit landscape,” said Joel Kan, associate vice president of economic and industry forecasting at the MBA.

Purchase mortgage rates, measured by the Freddie Mac PMMS Index, were at 5.3% last week. While rates are on a downward trend due to concerns about a potential recession, they remain well above last year’s 2.9% 30-year purchase rate.

Borrowers’ demand for mortgage loans fell last week driven by a 7.7% decline in refi applications and a 4.3% dip in purchase applications from the previous week, according to the MBA.

Although there was reduced supply of lower credit score and high loan-to-value (LTV) rate-term refinance programs, the decline was offset by increased offerings for conventional adjustable rate mortgage (ARM) and high balance loans, Kan said.

In a market with a shortage of inventory and soaring rates, an increasing number of homebuyers have been opting for ARMs this year, which carry lower rates for an initial period of fixed interest and amortize over a 30-year term. Application volume for ARMs hit a 14-year high in May, making up nearly 11% of all mortgage applications. Last week, it consisted of 9.5% of all mortgage applications.

“With higher rates and elevated home prices, more prospective buyers are applying for ARMs, but activity remains below historical averages,” Kan said.

The post Mortgage credit availability falls 0.3% in June appeared first on HousingWire.

Source link

Shared-equity fintech Unison expands Midwest operations

San Francisco-based Unison is extending its reach in the heartland by expanding its shared-equity loan program to homeowners in Nebraska.

The move follows the opening of an office in Omaha earlier this year and reaching the milestone as of June 30 of having in force $6.1 billion in equity-sharing agreements with some 9,000 homeowners across 29 states and the District of Columbia.

“With our recent office expansion to Nebraska, this was the next logical step for us,” said Unison founder and CEO Thomas Sponholtz. “Due to the current market conditions, many consumers are seeking affordable housing options, and we are thrilled we can now offer greater origination capabilities in Nebraska.

“With this announcement, we are expanding the number of consumers we can partner with to offer an option that doesn’t require interest or monthly payments.”

Unison currently operates in states bordering Nebraska to the south, including Kansas and Missouri and Colorado. Its operations also extend to the three West Coast states; the Southwest, other than Texas; and most states east of the Mississippi River. It does not yet have operations in most deep South states, other than Florida, nor in most of the Midwest states west of the Mississippi River, other than Minnesota and Missouri — and now Nebraska.

Earlier this year, Unison also completed a $443 million private-label offering backed by shared home-equity loans — with plans to pursue future securitizations as well. The company, through its fintech platform, offers homeowners the opportunity to tap their home equity without taking out a loan — via Unison’s shared home-equity product called a residential equity agreement (REA).

Prioritizing home equity solutions in a rising rate environment

The 2022 housing market has been underscored by interest rate spikes and refi decline and lenders are working hard to adjust to new borrower trends. HousingWire recently spoke with Barry Coffin, managing director of home equity title/close at ServiceLink, about the ways lenders can capitalize on these trends by revving up their home equity solutions.

Presented by: ServiceLink

“Home prices have been increasing rapidly over the past year, creating a record $24 trillion of wealth,” Unison said in announcing the securitization transaction. “… This transaction offers the opportunity for investors to access residential real estate equity and increases liquidity for homeowners across the country looking to monetize the equity in one of their most valuable assets — their homes.”

Unison, through an REA contract, advances the homeowner a portion of the equity in the property in exchange for a lien position and a share of the home’s future appreciation. Unison also shares some of the downside if the property loses value over the course of the contract.

“Our presence in Nebraska has continued to grow since our office opening earlier this year,” added Unison President Ryan Downs, who is leading the Omaha office. “We are seeing greater interest in our solution and are thrilled to have boots on the ground where we can service our clients in person and remotely as well as tap Nebraska’s financial services and technology talent pool.”

As part of a Unison’s REA product, the company will invest up to 17.5% of a home’s value after a 2.5% risk-adjustment haircut on the value of the property. The company and homeowner then share in any appreciation, or depreciation, of the home’s value over the course of the contract.

The homeowner has up to 30 years to pay off the initial investment, plus Unison’s appreciation cut, through a sale or refinancing of the home — or through a contract buyout after three-year lock-in period. As part of the REA, Unison’s share of the home’s appreciation can range from 20% to 70%, depending on size of the equity investment advanced.

“We’re sitting in an equity position side by side with the homeowner,” said Matthew O’Hara, head of portfolio management and research at Unison Investment Management, which is under the Unison umbrella. “So, if the price goes up, the homeowner benefits, and we benefit as well.

“If the price goes down, the homeowners are losing some of their equity, but we are also losing equity in our position at the same time.”

O’Hara added that Unison’s move into the private-label securitization market supports the company’s expansion efforts because it is an optimal way to decrease its cost of financing while also creating more liquidity for originating shared home-equity contracts — with the goal of lowering REI costs for homeowners.

The post Shared-equity fintech Unison expands Midwest operations appeared first on HousingWire.

Source link