The change didn’t happen instantaneously. She had to completely start anew and work towards her goals which at one point meant working 60 hours a week for a year to get pre-approved for a loan. Her drive and persistence allowed her to close on 4 units with hopes of closing on more single-family homes in the future. We touch on topics like creating value, breaking from the “traditional” path, self-managing a house hack, finding a mentor, and being a young investor.

Ashley:

This is Real Estate Rookie episode 131.

Rachel:

How bad do you want it? I wanted it so bad. Every time I would lay in bed, I’d think, “Should I go into work today?”, but then I’ll think, “I just need to bear it out for a little bit more.” To think that it’s building my retirement, I will look back on these years and not regret it.

Ashley:

My name is Ashley Kehr. I am here with my co-host, Tony Robinson. Tony, what’s going on? What do you want to banter about today before the episode?

Tony:

I like the little life updates we’ve been doing. That’s been a fun little addition. So, I’m trying to think what’s going on in my personal life or something that’s cool. My son came… So, he’s in eighth grade. He came home the other day and told us that not one, but two girls had written love letters to him confessing their adoration of our son. So, we’re at that phase of the parents and life now.

Ashley:

Oh, my gosh. He shared that with you, guys?

Tony:

Yeah, yeah, he let us know.

Ashley:

That’s so sweet! I hope my boys tell me too, show me their little love notes they get.

Tony:

So, we’re just trying to brace ourselves that we’re now at that phase of parenting. So, yeah, it was so funny. Sarah and I, my wife, we were separate on Friday. I was at home, she was out running errands. We both separately bought books on raising teenagers. I bought two books on my Kindle. She just happened to stop by Barnes and Noble to pick up a book on it too. So, the joy of raising children.

Ashley:

Oh, my gosh. That’s so funny. Yeah. Well, I can’t wait to have you learn everything and then just tell me what to do when my boys are teenagers. This is actually really nice. I do like it when we give a little life update, because whenever me and you actually do talk and we do talk a lot, it’s always like, “What should I do in my business? Where are you taking your business?” All business and real estate talk usually. Yeah, so I just took my boys to Fort Lauderdale. Actually, we just got back the other day. We did a little mini weekend vacation I was speaking at, one of Steve Rosenberg’s events.

Ashley:

My mom came with me, and it was great. It was awesome. My mom got to meet the Steve Rosenberg, who has been my mentor for a long time. That was probably the worst dinner I’ve ever had in my life and it was like my worst nightmare coming true, because the conversation went like this. So, Steve said to my mom, “So start from the beginning, what was Ashley like?” My mom goes, “Well, she started talking around two and she wouldn’t stop talking.” He’s like, “That sounds about right. Keep going.” From there, they went through my dating history, everything.

Tony:

The whole backstory of Ashley. Just making fun along the way.

Ashley:

We have three other people joined our table who are coming to attend and see the event. I’m like, “Yeah. So, this is my mom and this is me. Join the story.” Yeah, it was fun.

Tony:

But that’s where real friendships are forged, over the dinner table and hearing the embarrassing stories of what it was like growing up.

Ashley:

Yeah. Well, today, we have somebody who is not very grown up today on the show, 20 years old. You guys will not believe her story.

Tony:

Yeah, just really phenomenal. So, we have Rachel on the show today. People make so many excuses as to why they can’t get started. I think Rachel’s proof along with so many of our other guests as to why your age isn’t a restriction. Your background isn’t a restriction, your occupation. There’s nothing that’s holding you back from becoming a real estate investor. I think Rachel is just such a great example of that again today.

Ashley:

Before we bring Rachel on to the show, make sure you guys check us out on the Real Estate Rookie YouTube and you can check me out on Instagram. Slide into my DMs, @wealthfromrentals. The same with Tony, @tonyjrobinson. Share your stories with us. Towards the end of the show, you’ll catch the rookie rockstar and we would love to feature you guys. So, send us a DM, slide in there, and tell us about your win, your success for that week. We’d love to hear it.

Ashley:

Rachel, welcome to the show. Thank you so much for joining us. Can we start off with you telling us a little bit about yourself and how you got started in real estate?

Rachel:

Oh, my gosh. Where to start? So, I have been homeschooled from K to 12. I just grew up in the country. My mom, she’s a Korean mom. She’s a stereotypical tiger mom, always just very honest about getting good grades. You got to get a safe job, a high paying job, and to study hard every single day, which is what we did. As homeschooled kids, you got to learn to be self-motivated. That’s when I decided, I was like, “I’m going to be a doctor. I love health. I love holistic healing. I’m going to get a degree, go to med school, and get a nice well-paying job that is also very fulfilling.” And then I went to college at 16 after taking the ACT.

Ashley:

Wow, that’s awesome.

Tony:

Yeah, congratulations.

Rachel:

Thank you. Everyone says, “You must be super smart.” Well, I think that the public school does a huge disservice to their students. As a homeschool kid, I was able to see how working on yourself and working at your own pace can really help you get ahead. Yeah, I went to college and I told everyone, “Hey, anyone could do it.”

Tony:

That is amazing. Ashley, what were you doing at 16?

Ashley:

Doing nothing. I just sat in my Pontiac Bonneville at age 16.

Tony:

Sorry, Rachel. So, you go to college at 16. What happens from there?

Rachel:

Yeah, so I ran track in college. I had a lot of fun, so much fun at college. I love those years. Room and board, you lived in the dorm, you went to the cafeteria, you went to practice. It was just such a simple life. I was a bio major obviously because medicine, you got to be science. And then I got into an accelerated program with KCU, which is an osteopathic school here in Kansas City. I was on a three-year course. At my third year, I was getting ready to attend med school. I’ve always thought about real estate. It’s been at the back of my mind.

Rachel:

And then when I was working to save up for med school, I worked at a warehouse job where it’s such a mindless job. So, you could listen to podcasts and ebooks, YouTube videos. So, I just thought, “Okay, I might as well capitalize all this free time, where I was actually making money and just listen to real estate podcasts.” So, I started off listening to The Real Estate Radio Guys and then to BiggerPockets Rookie. That was such a ray of hope in my life, just hearing these regular people becoming financially free through real estate. And then once I started getting that idea that I could do it, I started actually thinking about not going to med school.

Rachel:

Also, there’s a whole another reason why, because I believe that the medical system in America is very corrupt. If you are to be your own boss and actually care for your clients in the way that you want to, you have to open a private practice. Otherwise, you’ll be bossed around by the big hospitals and whatnot, but anyways. I decided to just get into real estate full time. After a lot of prayer and self-reflection, I thought, “Okay, this is something I really want to do. What if later down the road, I look back and realize that this is something that I really wanted to do but I never took the plunge?”

Rachel:

So, I decided to get my license and become an investor basically. Yeah, that’s where I started. I’ve always thought about real estate in the back of my mind, especially since I listened to Graham Stephan. He’s a realtor/YouTuber, but yeah, that’s where I got my idea, from you guys basically. BiggerPockets is such a treasure chest of information. Yeah.

Ashley:

We love BiggerPockets just as much too.

Rachel:

Yeah, I love BiggerPockets.

Ashley:

Okay, so did you stop going to school then?

Rachel:

Yes, yes.

Ashley:

Okay. So, let’s talk about that right there. You were on this path to go to med school for a very long time since how old? Was it even 16 or even before that? You knew you wanted to go to med school.

Rachel:

Listen, it was way before. I’ve always been a fan of natural health, natural cures. There was this huge, thick book. It’s called like natural cures or something. I would read that every single day. You know how you bring your phone to the bath and when you take your dump? I brought that huge book because we didn’t have phones. I got my first phone when I was 16. So, I would just read health books 24/7. I was obsessed with health. I still love health. I think that natural cures are the way to health, but I’ve moved on from that and I’m absolutely obsessed with real estate. Yeah, I have an obsessive personality.

Tony:

Sorry, really quick. Can we just also set the table? Rachel, how old are you as of today or in today’s recording?

Rachel:

I’m 20.

Tony:

That’s amazing.

Ashley:

Yeah.

Rachel:

Listen, I’m blessed.

Tony:

Yeah, I think you might be the youngest person that we’ve interviewed. I remember, we interviewed a couple of college students, but I think they were older than 21. I don’t think anyone that we’ve had on the show has been younger than… I don’t know. Ashley, am I wrong?

Ashley:

Yeah, I don’t know. It might have been someone that was 20, but yeah.

Rachel:

That’s really cool. Yeah.

Tony:

Definitely right up there. So, kudos to you.

Ashley:

Producer, can you fact check this? Can we fill this in?

Rachel:

I can’t even buy margarita yet.

Ashley:

But you can buy a property.

Rachel:

Oh, yeah.

Ashley:

That’s what’s important.

Rachel:

That’s what matters.

Ashley:

Who cares about a margarita when you could buy a property?

Rachel:

Exactly.

Ashley:

Okay, so what about that mindset shift? You’ve spent almost a large majority of your life focused on this track. What was that like for you to be able to make that shift? You’ve spent so much money already on college. You did all this stuff to reach this one goal. Now, you’ve made a complete pivot. Not to say that that was all a waste, but it’s not exactly necessary for you to need to become a real estate investor. How did you become okay with that? Because I went to school for accounting. I mean, I used that, I guess, in real estate. So, it has been beneficial, but I don’t know how you would be using health, I guess, and medicine in real estate investing.

Rachel:

Well, so the mindset shift, I would say definitely, was a huge shift. The year of 2020 was the best year of my life in terms of, I feel like I’ve changed so much. I feel like I’ve come closer to God. Faith is a huge part of my life. Also, I gained the knowledge and the understanding that money comes easily. You don’t have to work your tail off. You don’t have to spend thousands of dollars on a college education to make money. We live in a capitalist society right now. You gain money proportionally to how much you contribute to the lives of others.

Rachel:

Obviously, doctors contributes so much. They’ve gone through college. They’ve gone through med school. They save lives, but so do real estate investors. If you’re an investor, you’re providing housing. You’re providing something valuable to people. I just realized that entrepreneurialism is not about clocking in and out and trading your time for money. It’s about just building bigger value for people around you.

Rachel:

That just really was just such a mind blowing thing for me, because I’m sure this is common in the Asian culture more than in the Western culture, but we think that you got to take the safe road towards wealth. Get a job, get a good education, be smart, be book smart, and do your work well, instead of finding new ways to build wealth. That’s the mindset shift that I went through after listening to all these successful people on your podcast, all these other podcasts, and ebooks that I’ve listened to.

Ashley:

Rachel, the thing that I thought of and what stood out to me is when you were talking just about your story and what you were passionate about, and that was natural health. And then you decided to shift to real estate. I think real estate is going to be a better vehicle and a better tool for you to actually make an impact fulfilling your passion.

Ashley:

If you decided to go the medical route, yes, you’d be making money and you’d be in the profession to try and make an impact, but I think that you are building this foundation through real estate that you’re going to free up a lot more of your time. You’re going to have a lot of resources, and you’re going to have a lot of money to actually make a bigger impact than if you would have went to medical school. I’m already so excited. You’re only 20 and I can’t wait to have you back on the show in even just 5 years-

Rachel:

Oh, my gosh. Yes, I would love to be back.

Ashley:

… to see what’s happening, what’s going on. We’ll probably see you on the news first or something, giving a lecture.

Rachel:

Well, listen, this is such a blessing. It’s come as a surprise. I just put that post out there and Mindy commented on the post. She was like, “Eric, did you see this?” I was like, “Did you see what?” Yeah, I’m just so happy to be here.

Tony:

It’s because you’re taking action. I think that’s a really strong underlying message for everyone that’s listening that it doesn’t matter your age. It doesn’t matter your background. It doesn’t matter where you’re coming from. It doesn’t matter what you’ve been through. As long as you consistently take the right action towards your goal, you’re going to make progress. I also want to highlight something that you said, Rachel, because I thought it was really, really insightful, but you said, “Entrepreneurship is about building bigger value for the people around you.”

Tony:

I thought that was such a smart way of defining what it means to be an entrepreneur, where your value as an entrepreneur isn’t about how much time you put in, but it’s about the amount of value that you give to other people. When you frame it that way, I think it makes the jump of becoming an entrepreneur a little less scary if you’re confident in your ability to provide that value to other people. So, dropping bombs seven, eight minutes into the conversation, but I want to make sure that we highlighted that. But it makes me think of one other question. So, hopefully, you can answer this for us.

Tony:

Early on, you talked a little bit about the family pressures of following that traditional path. There are societal pressures of following that traditional path of getting a W-2 job and getting a higher earning W-2 job. Sometimes there’s internal pressures to do that as well. You just feel like you need to do that. How did you overcome those feelings of pressure, those sensations of trying to follow along that path to break out on your own? Because, again, you’re 20 years old, which I think is really, really brave of you at that age to have that realization, but there are many people who are in their mid-20s or late 20s or 30s or 40s or 50s that are listening, that haven’t been able to escape from that pressure. So, I want to know how you did it at your age.

Rachel:

Well, okay. So, have you ever worked at a job where there was just an old way of doing things? When you’d ask, “Why are we doing things this way?”, they’d be like, “Well, it’s just the way we’ve always done it.” That would be the most frustrating thing I would ever hear. If you just put in a little bit of creativity and your own work, your own sweat and work into finding a better way to do something, your results are magnified. You can see an exponential increase in productivity when you actually put in the work and put in creativity to fulfilling a goal.

Rachel:

So, I thought about going down the old path of completing all my education and getting a safe job that literally everyone else could do. And then I thought about, “What if I applied myself to my business and then I could literally start building value for people right now, instead of going down the old path?” That’s why I had the confidence to be able to get started, because I’ve seen so many times in my past where people will do things the old, inefficient way that just everyone does and then say, “Oh, I’m on the path to something safe, into something very promising.”

Rachel:

But I want to do something where I could start providing value now. Yeah, I’m an impatient person. I like to get things done now and when they need to be gotten done. I think that procrastination and not sticking to your gut in terms of what you think you’re passionate about, it can fester. It leaves you in a state of regret. Later on, down the road, when I’m on my deathbed, I want to look back and say, “Wow, I’m so glad I tried that,” instead of, “Dang it. I should have tried that.”

Ashley:

Rachel, we’re only 10 minutes in. I feel like you have said so much and provided everybody with so much value already. Let’s talk about your deals though. What does your portfolio look like right now?

Rachel:

I have four units right now. So, that four-plex was my first investment. Yeah, I’m just so excited to get into my next investment, which I’m planning on house hacking my next investment and then purchasing single family homes and doing the burst strategy on those. So, that’s my plan for my next couple of investments.

Ashley:

Awesome. Let’s go through this. Did you buy this four-unit after you decided to quit school or was this before?

Rachel:

No, no. I’ve been going back and forth about whether or not to quit school. I was like, “Okay, God, just take it all. It’s all you. Give me clarity.” That same day, I had the clarity to tell the staff at KCU that “Hey, I’m not coming, just so you know. Take me off the list and bring in the next person that you have on the list.” So, after I gained that clarity, I was like, “Okay, Rachel, you literally told them medicine is not in your future. You have to buy a house now.”

Rachel:

So, I was like, “Okay, three and a half down, FHA, what could go wrong? If I just buy a house, even if it burns down, say I put down 10 grand on a house, what could go wrong? I tried it out.” So, I started going MLS eye shopping. So, I would go on Zillow, and I would just look through all these multi-families every single darn day. I had a notebook full of analysis where I put down the cash-on-cash return, down payment.

Ashley:

Okay, let’s stop and talk about that right there because that is so important. You were practicing?

Rachel:

Yes.

Ashley:

How do you get super good at analyzing deals? You practice, practice, practice.

Rachel:

Yes, analyze a deal.

Ashley:

Yeah. So, talk about this notebook more.

Rachel:

Oh, my gosh. So, like I told you, I came from a background of homeschooling. So, I knew the power of writing something down every single day, because we would go through textbooks, so much material, and we’d have to memorize a lot. So, we write down a lot. And then Brandon always says, “The reason why people say they can’t find a deal is because they’re not analyzing the deals.” So, I thought, “Okay, Brandon is right. I have to start analyzing deals every single day.” So that’s what I did. Even it’s a multifamily, I analyze mostly multi-families, because house hacking is something I want to do. I wasn’t really a fan of renting out three bedrooms. So, I thought, “Okay, a duplex or triplex comes on the market, I will analyze it that night.”

Rachel:

So, I wrote down the cost to get rent ready. If it was ugly, I just assumed. I’m not a contractor. So, I just came up with a number. I put down the down payment, which would be 3.5%. I put down the interest rate at the time. I put down taxes and estimated insurance. I just wrote down my estimated cash flow, estimated cash-on-cash return, an estimated ROI. So, I’ll look at all these different deals and get a feel of which zip codes and which cities had better returns. And then I noticed that the worst neighborhoods had a lot better returns on paper, but I wasn’t sold. I knew about how appreciation was very important and how buying in a good neighborhood for your first investment, especially if you’re going to live in it, is also important.

Ashley:

Rachel, how did you get pre-approved? Were you working at this time in your warehouse job?

Rachel:

Yes. Okay, that’s a whole another story in and of itself. So, I started talking to lenders. It started off as just me eye shopping and then I would see these multi-families coming on the market. I would wonder, “I really want this property. I don’t know how to get it, but there has to be a way.” So, I realized that you have to get a pre-approval letter to submit an offer on a house. So, I talked to so many different lenders and got different quotes on closing costs, interest rates. And then I finally got a pre-approval letter, but yeah, I was working a W-2 job at the time. I was working, like I said, at a warehouse at Amazon. So, many times I’ve wanted to quit that job because it is Amazon. I’m not sure if you’ve heard the rumors, but yeah, you’re literally a machine. So, I worked as a machine.

Ashley:

I’ve seen the memes.

Rachel:

Oh, my gosh. Yeah. So, I knew that conventional lenders don’t like to lend on people who recently quit their job. So, I just stuck with that job for the longest time. I chatted with a lender and I told them my goals. I told them the price point that I wanted to buy at, which is around $400,000, because I wanted a four-plex in a nice area. They’re like, “Well, your income doesn’t cut it. You earn $15 an hour. You can’t buy this house.”

Rachel:

And then I told her, “Well, hey, I work a lot of overtime. What can I do?” They said, “Well, if you have one year of overtime income, we can include that.” So, I worked 60 hours a week for one whole year, didn’t take a break. And then I came back to my lender. I was like, “Hey, I’m here, 60 hours a week.” I gave him the records and everything. He’s like, “Okay, you’re pre-approved.”

Ashley:

So, you waited a whole year.

Tony:

We got to pause on that, right? Yeah, that’s an insane amount of dedication from you, Rachel. I think that’s the part that when people hear, “She’s 20 years old, she bought a four-plex.” They hear the shiny thing at the end, but they don’t see all the hard work that happened in the middle. How many people are willing to raise their hand and say, “I’m going to work 60 hours a week at a very labor intensive job to help me get to my goal of buying my first real estate investment property?”

Tony:

Ashley, it almost reminds me of Heather Blankenship, right? We had her back on the podcast. I can’t remember which episode but she was sleeping in the shop or a RV park the first couple of months just trying to get it all set up. Right now, she’s super successful, multi-millionaire, but it’s the hustle in between that gets overlooked so often. So, whenever I hear that, we got to stop, we got to pause. We got to give you some praise, Rachel, for being the person to be willing to grind it out like that.

Rachel:

Oh, my gosh. Yeah, it was a lot of work, but looking back, I was very happy. I was very happy knowing that I was building something. I think that’s what differentiates successful people from people who don’t end up succeeding is just, “How bad do you want it?” I wanted it so bad. Every time I would lay in bed, I’d think, “Should I go into work today? Should I not?” Because you don’t really have to sign up for overtime to just come in and work, but then I’ll think, “Oh, my gosh. I just need to bear it out for a little bit more.” To think that it’s building my retirement, I will look back on these years and not regret it.

Rachel:

So, I thought, “Oh, I have to get out of bed and work.” It’s a no brainer. If later on, this will pay for my future, for my family, and it’ll build generational wealth, it’s such a no brainer to just get your butt out of bed. Once you start driving to work, listening to good music, you’re living the life. Every day is such a blessing that you get to work. I think that during the pandemic, a lot of us weren’t able to work and I thought, “Okay, Rachel, you have a car. You’re blessed to be able to go to work. So, just go to work and appreciate it.” That’s what got me through those grueling months.

Ashley:

That gratitude, showing gratitude, I think, is so important and just waking up every morning. Even just naming off one or two things that you are grateful for can really help you start your day. I think a lot of people tied to success do express their gratitude all the time and I think there’s a big correlation. So, you guys, put a little journal next to your bed and write in there every morning three things you’re grateful for as you wake up, or a lot of people even do it at night too, where they write it before bed and just having that positive energy before you go to sleep.

Rachel:

Man, it makes you such a different person. I love that, what you just said. Gratitude, it really makes you a different person.

Ashley:

Okay, so what happens next, finding this deal? You’ve gotten pre-approved. Did you hook up with a real estate agent? What happens next?

Rachel:

Oh, yes. So, I was honestly just calling the listing agents of all these properties. I didn’t think about getting an agent because I didn’t really know how that worked. So, I called the listing agents. The funny thing is, when I saw a really good deal, it would get off the market instantly. So, I talked to these agents. I was like, “Hey, if you find a multifamily that hasn’t hit the market yet, call me up. You won’t have to deal with listing it. You won’t have to deal with talking to other agents. I will be your go-to buyer.” They’re like, “Oh, yeah, okay.” So yeah, I knew that I had to offer them something to show that I’m a qualified buyer and that they will benefit from coming to me.

Rachel:

So, I said, “Hey, if you get a 6% in your listing agreement, who knows? You might be able to keep that whole thing,” because sometimes they’ll end up cutting it to save the seller money. But I said, “If you found the buyer, you might end up with 6%.” So, they’re like, “Okay, okay, okay.” And then none of that really got back to me, except this one guy. He is a multifamily expert. When he heard what I was trying to do, by then, I was also licensed, which you might have some questions about. I just got licensed. And then I was also looking for homes, but being licensed doesn’t mean you know exactly what you’re doing. So, I was just licensed, going eye shopping.

Rachel:

And then I told him, “Hey, I’m a realtor and an investor. If you find me an off-market deal, you can make it all. I’m not going to ask for any commission.” He was like, “Wait, what are you trying to do? Are you an investor?” I said, “Yeah, a little bit of both.” And then he said, “Oh, come to my office sometime and I’ll teach you the game.” So, Steven, this is the guy who I called, he is literally the most personable realtor that I’ve ever met. He doesn’t even call himself a realtor, because he deals with people. He thinks that he is there in the service industry, which we as realtors are, but sometimes it can become such a cutthroat game where they’re just like, “Do you have a pre-approval letter? Call me when you do.”

Rachel:

He really cared about me. He said, “I will find you an investment, just come to my office. Let’s chat about this.” So, I went to his office. That became the start of a long friendship, which I’m still friends with him to this day. I visit his office often. He mostly sells apartments, but he’s very well-connected in the area. He got me hooked up with an off-market deal, which is how I got this property.

Tony:

So, a couple of things to point out with your story here, Rachel. First is that we often talk about the importance of relationships in the world of real estate investing and your relationship lead to experience, right? Because this person passed some experience on to you. They put you up on game from what they said, right? The second thing is you found a deal through this relationship and you found friendship. We talk so often that real estate investing is all about your ability to create and maintain meaningful relationships with other people. So, I think you lived that saying out so well.

Tony:

But the second point and this is a question for you too, but I know one of the things that comes to Ash and I pretty often is, “How do I get a mentor? I want someone to take me under their wing and show me the steps that needs to be done.” It’s hard, right? People that are typically successful are successful, because they don’t have a lot of time to share with a bunch of random people. But you were able to break through that and find someone who was willing to, again, take you under their wing and walk you through. What do you feel that you did or what some maybe advice you can give to rookies that are listening to put themselves in a similar situation to align themselves with the mentor?

Rachel:

So, I hear that a lot. Everyone’s like, “I really want to find a mentor.” Honestly, I don’t like the word mentor, because it sounds like someone is pouring information into your life and you’re just taking it in. But I never really wanted to get a mentor because I wanted to. I always want to be value wherever I step. So, I didn’t want to be someone’s burden. And then when I talked to people, I realized that if I really want to find a mentor or a friend who’s going to help me, I’ve got to approach every single situation with something first. I told this guy, “Hey, you’re going to make both sides of the commission. I will work with you on future deals. Let’s create a partnership.”

Rachel:

So, I didn’t really ask him, “Hey, will you teach me the game or will you teach me this? Will you teach me that? Will you bring me deals to solely me?” I just said, “Hey, I would love to work with you sometime.” And then that really opens up people to the idea of working with you. He’s just a very generous hearted person. So, he invited me to his office. He taught me all he knew. Not everyone’s going to do that, but if you approach every single situation with a service first mentality, you’re going to find someone who would love to work with you or love to teach you.

Rachel:

Because at that point in your life, where you get to the point where you’ve had so much success, you want to pour into others, but that’s also the point where you can smell people who are just trying to get something from you. If you just come into every situation with, “I want to serve. I want to help,” the successful people will see that and they’ll be like, “Okay, this is someone I want to invest in,” because people are created to build legacies. Everyone wants to help. Old people are so generous, they love helping, but they also don’t want to help the selfish Gen Z who just wants to take something from you.

Ashley:

Okay. Well, Rachel, my next question was actually going to be, “Do you think that more people are interested in you and interested in helping you because you are so young trying to do this, or do you think that they take you less serious because you are younger?”

Rachel:

Well, that’s a good question. Well, I would say that they’re intrigued and they just assume that I’m a little bit older. Their first reaction is like, “Oh, are you buying the house?”, but then they’re like, “Oh, she must be older. She just has a young face.” So, I don’t really tell people my age until they ask, which I’m like, “Yeah, I’m 20.” Obviously, they probably think that I’m a super-rich person, but then I say, “Oh, yeah, I work in a warehouse.” They’re like, “Oh…” It’s confusing for some people.

Rachel:

But then I think once they see that I’m really ready to hustle, that helps them take me more seriously, because with my background, you wouldn’t really expect a warehouse worker to start investing in real estate, but it gives you a level of credibility to show that you started from really nothing to get where you are and people can take you seriously.

Ashley:

Yeah, I think you have an opportunity, an advantage that you’re starting so young and you are young and you are serious that like you said, that people are intrigued by you. I think that you will be able to receive a lot more help and guidance from people or even be able to get more mentors, because you are younger and you are starting.

Rachel:

I think it’s a real blessing. I don’t think it’s a problem at all.

Ashley:

That’s great. One thing I want to point out to everyone listening is that if you do feel like people aren’t taking you serious, that’s probably more in your own mind than it actually is. Rachel, I’ve loved your mindset, this whole thing. You are so wise.

Rachel:

Oh, my gosh. Thank you.

Ashley:

I know that you do not have that problem. Yeah. Okay, so what happens next with the mindset or not in the mindset?

Tony:

What’s your mindset here?

Ashley:

The property. Where does your mind go?

Rachel:

Yeah, my mind. Yeah, the property is a really nice property. It is very turnkey, but I still bought it under market value. It needs some work, which I’m fine with. It’s cool if it needs some work. I just put in some repairs in two of the units. Actually, do you have the details of the property or would you like me to give you the details?

Tony:

Yeah, let’s hear the details.

Rachel:

Okay, it’s a four-plex in Lee’s Summit, Missouri. So, Lee’s Summit is the Overland Park of Missouri. So, Overland Park, Kansas is a very upscale neighborhood. Lee’s Summit is considered the Overland Park in Missouri. The good thing about it, the reason why I love this market is because the property values haven’t appreciated to extreme levels yet. So, it’s still appreciating and the property values are not overblown. That is such a plus. Two of the units have three bed, one and a half on opposite sides. Two of the units in the middle have two bed one and a half bath. They all have garages, which is great, no basement, stone slab, concrete foundation. They all have great tenants.

Rachel:

I know them personally, which made it harder to raise the rent, so I didn’t raise the rents as much, but I love them. They’re just so awesome. I know some people will say that’s not a great way to start a business. You got to be a business minded person. You got to raise the rents as much as you can. But once their leases ran up, I told them, “Hey, I’m going to be raising rents, because market rents are way above what you guys are at.”

Rachel:

I told them, “I won’t raise it that much,” which I didn’t, because they had been living here for a while. I get why some investors would want to raise into market rents, but you got to understand that these people… Their income is suited for that level of rental expenses. If you raise it to a certain amount that they can’t handle, they had to move all their stuff out. So, I mean, that’s just not something that I want to be a part of. So, I just said, “Just raise it just by 50 bucks.”

Ashley:

There’s that trade-off too as to, “Do you raise the rent and risk having a turnover and having to fill that vacancy, or do you just raise it a little bit and keep those long-term tenants in there, too?” So, when you did your analysis, though, are you cash flowing? Is the property making money for you at what you are charging?

Rachel:

It would actually break even with me living in it, but when once I move out… Actually, once I raised rents, the cash flow’s a little bit. So, once I move out, I’ll probably rent this unit for 1,300 bucks. So, I’ll be cash flowing, if I did my math correctly, about 300 bucks or so, 300 minimum per door.

Ashley:

So how much are you paying towards everything for you to live there?

Rachel:

Okay, let’s talk numbers. So, I’m paying $2,800 for the mortgage payment and insurance all in, $2,800. One of the units rents right now for $1,050. The other unit rents for $1,050. Those are the two three-beds. The two-bed rents for $915. That covers my mortgage and more. So, by the time I move out, I’ll rent this one out. Of course, I’ll need to do some updates on it, which the kitchen is very outdated.

Rachel:

So, I just got some contractors to give me a quote today. They’ll send in the quote by the end of the week, and we’ll get that updated and ready to go. Yeah, I think it’s a good return for an appreciating market, because some people buy properties here that literally don’t cash flow, because the lease on it is that good. The lease is hot. The school districts are 8 to 10. Yeah, it’s just really a nice area. So, I think I thought a great deal.

Tony:

It sounds like you got a killer deal, Rachel. I mean, look, you’re living rent free, right? You’re living totally no money out of pocket to cover your own living expenses, which for anyone at any age is an impressive feat. So, you’re building equity in your property by allowing your tenants to pay down your rent. You’re living for free and would you say is a really nice area of the state that you live in.

Tony:

It’s a win-win-win across the board. You’ve done your tenants a favor by allowing them to stay in this nice part of town without pricing them out. Now, one of the questions that jumps out to me, Rachel, is a lot of people, I think, hesitate becoming a landlord because of having to deal with tenants. So, are you self-managing this property? If so, how has that experience been for you? Can you maybe share any advice on how to effectively house hack and manage that property at the same time?

Rachel:

Oh, my gosh. That’s such a good question, because that was my biggest question when I was first getting into house hacking. I was like, “I will be living next to my tenant. I don’t know.” Yeah, that’s definitely scary. That’s the biggest thing that the people I talked to about house hacking, they’re like, “Well, what do you do with your tenant?” You collect rent. That’s just the simple answer, but yeah, I was very afraid. And then I was like, “Should I just contact a property management company and have them deal with my tenants?” But I realized, “Okay, it’s not scary. People aren’t scary. If you were in their shoes, what would you want?”

Rachel:

If I was in their shoes, I wouldn’t care if a new owner came in and just collected rent in the place of the property manager. Tenants don’t care. Unless it’s a super dramatic person, they really don’t care. As long as you’re very upfront and honest with what you’re doing, it’s actually the start of a great relationship. I run into them. I have conversations with them. They’re great people. Yeah, I mean, they’re just mature adults. It’s not that deep. Obviously, managing the maintenance can be a headache, which I’m just now getting into the flow of, because finding good contractors is not the easiest job. But once you do find them, you have them in your back pocket, you can call them up whenever.

Rachel:

So, self-managing is not too big of an issue, especially since I have automatic payments in apartments.com. They just enroll for automatic payments. I told them, “Hey, property’s going under new management. I’m managing the property.” At first, they’re a little bit confused. They’re like, “Oh, are you the property manager?” I said, “Well, yes, I am, but I’m also the owner.”

Rachel:

So, I decided to come forward with a relationship, completely straightforward and honest. So, that gave me confidence, because I’m hiding nothing from them. They’re very honest with me. I’m very honest with them, and we have a great relationship going on. So, it’s nothing to be scared about. For all those people out there, potential house hackers, do not be scared of managing your own units. It is not scary. Yeah, it’s just dealing with people.

Ashley:

We had somebody on the show not too long ago, or actually, I think it was actually a long time ago, maybe even a year ago. But they had said how when they had bought their first property, they got that first maintenance call. It was just like stress and this weight on their shoulders. They’re like, “Oh, my gosh. There’s a problem.” They called somebody to get a fix. And then afterwards, they realized, “Wait, that was 10 minutes of my life and I made 500 bucks this month from this tenant, cash flow that much.” $500 for 10 minutes of my time-

Rachel:

That’s a good cash flow.

Ashley:

This isn’t actually that big of a deal. I always remember that, because that even made an impact on me is that sometimes you think something can be so overwhelming and so stressful, but really, you’re getting paid for that time and it took 10 minutes to resolve that situation. Yes, especially the first couple times, taking those calls from tenants or maintenance requests, you might feel flustered. Oh, my gosh. I want my tenants to be happy. I want the property to be doing well. Oh, my gosh. What do I do? And then it finally becomes common. Complaints [inaudible 00:43:11].

Rachel:

Oh, my gosh. I remember my first maintenance call was the garage door was rattling a lot. I had a heart attack. When I heard that, I was like, “My house. Oh, no.” I was so scared. But then once I got that fixed, it was just like, “This is nothing.” Well, obviously, for anyone’s first, it’s going to be scary. But once you get over that hump, it’s just like, “Ah, this isn’t bad.” Especially if you have in your mind the fact that you’re providing housing for someone, it’s a blessing to provide housing. It’s nothing to be scared about.

Tony:

It’s a win-win-win for everybody involved. I think your first house hack, Rachel, hopefully inspires a lot of people. Just to recap the numbers, right? You’ve got total rents coming in of $3,015. Your principal interest tax and insurance is $2,800. So, you’re already cash flowing right now. And then like you said, once you move out and move on to that next house hack, those numbers go up even more. So, kudos to you. Congratulations to you for crushing on this very first deal.

Rachel:

Yeah, I didn’t think my first deal would be great. I thought it would just be an okay deal.

Tony:

But you proved yourself wrong.

Rachel:

Yeah. I feel so blessed every single day, but I just want people out there who’s listening to this, you don’t have to have an amazing home run first deal. You could be the dumbest person in the world and just buy real estate and win in the end, because property values always go up. That said, don’t buy a $16,000 house in a terrible dumpy neighborhood. Don’t do that. As long as you don’t do that and buy real estate, you’ll be good. Well, of course, there are some ifs to that statement, but real estate is not scary.

Ashley:

One if is the property that Tony has for sale in Louisiana, if anybody would like to buy now.

Tony:

Yeah, at Shreveport, Louisiana.

Ashley:

Maybe if you just hold onto it for 20 years.

Tony:

Yeah, I’ll hold it for 20 years. I would just do mortgage payment on it. Jesus. So, that deal has been haunting my mind for months now, but let’s talk about better mindset things. I want to get into your psyche, Rachel. I want to see what makes Rachel tick. So, let’s move on to our mindset segment. So, we’ve talked a lot about mindset already, but I’m curious, Rachel, you seems like you’ve learned a lot in your journey with this first four-unit deal that you’ve house hacked. If you go back to Rachel before you close in that first deal, what were some of the misconceptions you had about becoming a real estate investor, some things you thought were necessaries and things you thought were true that turned out to be false?

Rachel:

Yeah, so one of the biggest misconceptions I had was property management, it’s going to be so hard. I have to have a huge software or something. I have to have a whole team to be able to manage my properties. Well, if you have a huge portfolio, that is necessary. But starting out, I’d always recommend newbies to self-manage their properties for at least a couple months, just get a feel of it. It’s not scary at all.

Rachel:

That’s one of my biggest misconceptions is that talking to the tenants would be scary. I thought it would be so intimidating, because I thought they’d ask me for favors, for so many different questions, but no, people aren’t like that. They’re not going to be bothering you all the time. They just want to live a good life and have quality housing, which hopefully you’re providing. As long as you approach each interaction with, “Okay, how can I serve this person to help them get the best experience of my property?’, there’s nothing to be scared about.

Ashley:

Yeah, providing that great customer service and also keeping in communication too. So, even for maintenance, one of the biggest things I’ve learned over the years is even if you can’t solve the issue or the problem right away, keep in communication with your tenants as to what’s the update, what’s happening. I think that really does make a big difference that you stay. Keep up that communication.

Rachel:

Yeah, I just want to highlight one more misconception. I think this is very important. I thought that when you buy a house, I thought it was a huge, huge risk. It’s not like buying a stock. It’s not like putting money into a stock that could literally disappear the next day. When you put a down payment on a house, you can earn that back in whatever job you’re doing. It’s sitting in your house. That’s literally equity in your house. So, it’s not like making an investment is where you’re burning that cash. You can recoup that investment if you sell the house. So, to anyone out there who’s just so scared about buying real estate, it is not scary, because you can always sell. It’s not like it’s gone.

Tony:

Coming to you live from Rachel, who was only 20 years old and bought a house. So, if she can get over that fear, that obstacle, so can you guys. So, Rachel, I want to take us to the Rookie Request Line. You guys can give us a call at 1-888-5-ROOKIE and leave us a voicemail. Tony and I actually get these voicemails emailed right to us. So, if you send it at 3:00 in the morning, I will probably be away working on high clarity, my future, my business. No, I’m just kidding. I will listen to your voicemail, but we may pick it to be played on the show. So, here is today’s question.

Zach:

Hello, fellow investors. This is Zach. I’m from Connecticut. Right now, I’m looking at house hacking a smaller multifamily. Now, my big thing is, is I would like to get this done within this first year. I want to jump in and get my feet wet, but I don’t necessarily have the funds. Now, looking at partnerships, I do have people with money in my life, but I’m not sure how to negotiate with them and give them the deal.

Zach:

I know I would be benefiting by house hacking, AKA living rent free, and maybe having a little bit of cash flow. I guess my question is more or less, how could you negotiate? Is there any tips on making sure my partner is happy in this deal? Because I would be living there so I’m benefiting by living in a place rent free and he’s the one who’s maybe giving me 50% of the down payment. I am just looking for advice on ways to better it for both sides. Thank you.

Ashley:

Rachel, what would be your advice for Zach?

Rachel:

Okay. So, just right off the bat, hearing him say down payment, I’m assuming he’s getting a loan on it, which is great. If he’s qualified for a loan, that means he has a W-2 job. If he has people in his life, who can lend him that money, great. But I would always recommend save up and then invest that 3.5% FHA loan. If you just decide to buckle down and say, “Okay, these next three months, I’m going to save up as much as I can for a down payment and use that along with my already saved up funds,” you could probably get a down payment for a decent house.

Rachel:

But if that’s still not possible, yeah, go to your closest family member and tell them what you’re trying to do. Maybe send them some of the Rookie podcasts. You can’t explain everything in one conversation. So, send them podcast to listen to on their free time and say, “Hey, this is what I want to do.” Don’t just tell them right off the bat, “Hey, I’m going to buy a house, lend me some money.” No, you got to explain to them what you want to do. And then once they see your vision, they see that you’re absolutely driven, and you will absolutely pay them back, they’ll be much more likely to lend you the money. Like I said, if it’s an FHA loan, 3.5% shouldn’t be too much.

Ashley:

Yeah, I actually did something similar to what you’re asking, Zach, with my sister. When she graduated college, we actually purchased a house together where she needed money for the down payment. What we did was she went and got the FHA mortgage, and I gifted her. We wrote a gift letter that I was gifting her the money for the down payment and the closing cost for the property. In this gift, the letter, it states that she does not have to pay me back for this money and the loan will accept that. So, what we did was she got the mortgage in her name and then we became 50/50 owners of the property. So, we are 50/50 on the deed. The mortgage is only in her name, so it doesn’t affect my debt to income at all. I gave her the funds for the down payment, closing costs.

Ashley:

So, the benefit to me is I got into an expensive property for a low amount of money, because if I went to go buy an investment property and wanted to use as little of my own cash, I would have to put 20% down or pay cash for it. So, that was an advantage to me. It’s in an appreciating area. So, this is a long term benefit for me. My sister is living in one unit. She’s renting out the other. The benefit to her is that she’s only paying $45 a month to live there. That’s what her costs are.

Ashley:

Yeah, so great benefit to her, great long term benefit to me. If she eventually moves out, we split the cash flow from that when the other unit is rented. And then if we end up selling the property, I get 50% of the equity that’s left in the property after selling it. So, that is definitely one way you can structure it. When you are trying to approach somebody to be your partner, make sure that you’re approaching it as it’s an opportunity for them, not just that you need them and you need the money. Make it an opportunity for them. So, yeah.

Tony:

Yeah. Can I add one thing to that too, Ash? This question comes up a lot about, “What’s the best way to structure a partnership, or how do we make sure that it’s fair?” The honest answer is that there’s no one size fits all for partnerships. What’s a good partnership deal to me may be different than what’s a good partnership deal to Rachel or to Ashley. All that matters at the end of the day is that all parties involved are happy with what the agreement is. If it means that, Zach, you go out and you buy this property and maybe you don’t put up any of the capital and then any cash flow that is left over goes to the partner, then so be it.

Tony:

If you put up maybe a little bit of the capital, they put up the other half, but you’re responsible for all the repairs and the maintenance, then there’s a difference. You can set it up in any way, shape, or form that you want. So, there is no right or wrong answer on partnership structures as long as at the end of the day, you’re happy with what you’re signing up for. So, I just wanted to clarify that because I know that question comes up a lot.

Rachel:

Exactly. Yeah. Another thing to highlight about that, you mentioned that you gifted her the money. I’m pretty sure most down payment programs require you to give the money with no evidence of having to pay it back. If you want to provide value while you’re requesting assistance, I guess you could say, “I owe you a royalty of what rents come in,” instead of like, “Okay, I have to pay this back,” because some people don’t want to be part way partnerships and deals. So, that works for Ashley because she’s a real estate investor. But for other people, just come up with a deal that works for them. Yeah, I just think what you did with your sister is so smart. That’s so awesome.

Tony:

Yeah, it’s a win-win for everybody, right? Love those ways in real estate investing. All right. So, I want to highlight our rookie rockstar before we get out of here today. So, for all the rookies that are listening, be sure to get active in the Real Estate Rookie Facebook group, get active on the BiggerPockets forums, shout out to Ashley and I, give us a shout out on Instagram, let us know what you’re doing. She’s @wealthfromrentals. I’m @tonyjrobinson. As we find a lot of those good stories, we’ll be sure to share them here on the podcast.

Tony:

But today’s rookie rockstar is Kade. Kade and his wife just finished their first live-in flip and get this. They bought the property for $140,000 with 0% down. The rehab was $42,000 and they sold it for $292,000. So, Kade, major congratulations to you and your wife. If you haven’t already, submit an application to get you on the Rookie show, because I’m sure everybody’s heads are spinning, saying, “Kade, how did you get a 0% down loan on a property?” So, congratulations to you both. Excited to see you guys win some more going into the new year here.

Ashley:

Well, Rachel, thank you so much for joining us today. Can you tell everyone where they can find out some more information about you and possibly reach out to you?

Rachel:

Oh, my gosh, yes. Thank you for asking. I love people who have questions, because I just love being able to tell about my experiences. Yeah, Rachel Morrow. I’m on Facebook, Rachel Morrow, like tomorrow but no T-O, Rachel Morrow. EXP Realty because that’s the brokerage I work with. It’s easiest to find me on Facebook and Instagram. On Instagram, I’m @rachdoesrealestate. So, R-A-C-H, doesrealestate, because I do real estate. Yeah, that’s where you can find out more about me. Ask any questions you have about house hacking. I love to answer them all, or even about investing in general. I’m also a realtor here in the Kansas City area. I occasionally come across off-market deals. So, if you’re looking to buy a house, hit me up. Yeah, I’m excited to hear from our listeners.

Ashley:

Well, Rachel, thank you so much. We love talking with you and appreciated all of the value that you provided to us and our listeners today. We will be back on Saturday with a rookie reply. I’m Ashley, @wealthfromrentals, and he’s Tony, @tonyjrobinson. Have a great week, guys.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

Opinion: Pass the Neighborhood Homes Investment Act

A shortage of affordable starter homes is thwarting aspiring first-time homebuyers and fueling inflation in home prices. At the same time, many urban and rural communities are struggling for stability and vitality. It’s a fact: the homeownership gap between Black and white households is wider now than when the Fair Housing Act was passed in 1968.

The Neighborhood Homes Investment Act (Neighborhood Homes) would begin addressing these challenges by developing or renovating 125,000 affordable homes in economically distressed communities. The House has included it in its revised Build Back Better bill. The Senate should keep or expand it in its version too. The support is clear. This initiative has won backing from 72 bipartisan sponsors in the House and Senate, the White House and stakeholders ranging from civil rights groups and nonprofits to financial institutions and real estate trade associations.

Neighborhood Homes is a practical solution for communities in which the cost of renovating or building a home exceeds its market value after the work is complete. This cost gap all-too-often prevents the renovation of affordable houses that need a great deal of work. The cost gap also thwarts construction and development of modest homes, limiting the availability of affordable homes for first-time and first-generation homebuyers.

The new and renovated housing resulting from Neighborhood Homes would support the revitalization of neighborhoods across the country, fighting blight and vacancy. This will, in turn, bolster state and local tax revenue and lead to improved municipal services. Meanwhile, many rural communities will be able to more effectively keep or attract growing businesses with more desirable homes for their workforce.

Neighborhood Homes creates a tax credit that covers the gap between the cost of construction and a home’s sale price. It is targeted to census tracts with lower home prices and income levels. This interactive map shows where Neighborhood Homes could be used.

Homeowners will secure mortgages to finance their homes which can then be used as comparable sales for financing of nearby homes. Over time, this approach will help stabilize real estate markets previously dominated by distressed sales.

There is also an important racial justice aspect to Neighborhood Homes. According to the Urban Institute, the gap between white and Black homeownership rates is wider today than it was when redlining was legal — 42% of Black families are homeowners vs. 72% of white families. This disparity in the homeownership rate fuels the racial wealth gap.

According to the Federal Reserve, the median wealth of white families is $188,200 while the median wealth of Black families is $24,100. This is both a cause and an effect of disparities in homeownership rates. Ignoring this problem slows the economic growth of the country. Research shows that the nation’s GDP could grow by $5 trillion over the next five years if gaps in wages, education, housing, and investment are eliminated. Neighborhood Homes is part of a concerted strategy that will benefit the entire nation.

In 2015, Rocket Mortgage partnered with the Detroit Land Bank Authority on Rehabbed & Ready, a program similar to Neighborhood Homes, in Detroit, Michigan. A University of Michigan Study released earlier this year showed that the program is working. It found that median sale prices grew an additional 11.5% per year in Rehabbed & Ready neighborhoods during the program’s first three years (2016-2018) compared to neighborhoods without the intervention – stabilizing home values in the four target neighborhoods.

The percentage of homes in Rehabbed & Ready neighborhoods purchased with a mortgage grew an additional 5.6% per year over the three-year treatment period — eventually reaching 42.2%, or nearly double the entire city’s 21.6% average — creating much-needed comparable sales.

At the national level, the Black Homeownership Collaborative, a diverse coalition of organizations committed to creating 3 million net new Black homeowners by 2030, has developed a 7-Point Plan to reach this goal. The Neighborhood Homes tax credit is a critical element of that strategy. In 63% of the Neighborhood Homes-eligible census tracts, people of color are the majority of residents.

Neighborhood Homes will create jobs, narrow the racial wealth gap and reduce blight in America’s communities. Congress needs to pass it now.

Bob Walters is President of Rocket Mortgage, “Buzz” Roberts is President and CEO of the National Association of Affordable Housing Lenders, and Lisa Rice is President and CEO of the National Fair Housing Alliance.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the authors of this story:

Bob Walters at policy@rocketmortgage.com, Buzz Roberts at broberts@naahl.org, Lisa Rice at Lisa.Rice@nationalfairhousing.org

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com

The post Opinion: Pass the Neighborhood Homes Investment Act appeared first on HousingWire.

Source link

Inside the Realogy-Blackstone iBuying venture

Realogy says it is real serious about its two-year-old iBuying division, RealSure.

“Our RealSure investment will step up meaningfully in Q4 as we continue to scale, launch this new product, expand our direct-to-consumer marketing and substantially build out the business and the team even more under Katie’s leadership,” Realogy CEO Ryan Schneider said on the company’s earnings call earlier this month.

The new product is RealSure Buy, which – similar to the emerging world of “power buyers” – assists potential homebuyers make a cash offer, but it will not launch until sometime in 2022.

The Katie is Katie Finnegan, who was chief customer and ecommerce officer at Rite Aid, before she was named RealSure CEO in October. Finnegan previously spent five years at Walmart, including a stint as vice president of strategy and mergers and acquisitions.

Finnegan runs an outfit for which Home Partners of America holds a significant, undisclosed stake. Chicago-based Home Partners is a corporate landlord that gives tenants an option to eventually buy their home. Blackstone Group agreed to buy Home Partners for $6 billion in June. The Wall Street Journal reported that Home Partners owns over 17,000 homes in the U.S. and that about 20% of Home Partners renters eventually purchase their home.

The Realogy/Blackstone foray comes at a pivotal, if not existential, moment for iBuying, which lets people sell their home for cash instead of listing it on the market with a real estate agent.

After pouring billions of dollars into iBuying, Zillow announced its exit from the sector this month. The main remaining iBuyers – Opendoor and Offerpad – are growing fast but report net losses.

The Realogy/Blackstone partnership also raises questions about whether iBuying is directly leading to fewer owner-occupied homes – at a time when real estate faces an inventory crisis – and more homes owned by investors. As part of its wind down, Zillow is actively looking for corporate landlords to buy its properties, and reportedly has sold 2,000 homes to New York City investment firm Pretium Partners.

A study released last week by the corporate landlord lobby disputes a major connection between iBuying and its members. National Rental Home Council “member companies acquired fewer than 4,000 homes through September 30 using iBuying services,” the study reads, “an amount less than .08% of the 5,195,000 total homes purchased by all buyers in the United States during that time.”

RealSure, meanwhile, is…maybe growing fast? In a video interview with HousingWire, Finnegan gave a pitch for why RealSure might succeed where others have not, but was short on specifics including what, exactly, Realogy is investing in the venture.

Realogy is the biggest brokerage in the country by sales volume, per RealTrends figures. In other words, it has a lot of real estate agents who might not be happy about alternatives to listing your home with a real estate agent! But, as Finnegan explained, RealSure does seek to work with agents.

Here is an edited version of that conversation with Finnegan, who conducted the session with her pet in the background at a dog-friendly New Jersey hotel:

HousingWire: You have a background working at Walmart and Rite Aid, but not a background in brokerage. How can your prior experiences assist in your current position?

Katie Finnegan: Walmart was such an amazing experience, where I really understood what scale and impact meant. Walmart is just this next level step change, where 160 million Americans go into a Walmart store every week. And so, when I left Walmart, I thought, ‘What can I do next that going to give me the same amount of impact?’ And I don’t think it’s going to be in retail, right? Because that is the culmination of scale. And, so, I actually looked around industries that I felt I could add value from a consumer lens perspective. Where I felt that probably the consumer experience hadn’t been disrupted, and I could bring learnings from other industries.

And, so, the three that came to mind for me at that time were health care, education, and real estate. And, so, when I got into this – It was like, wow, that’s one of the three, that’s amazing.

Also, having two very large real estate titans backing this gives you confidence that you’re going to get to that massive scale in one of the largest asset classes that exist.

HW: Is RealSure similar in corporate structure to a joint venture? Is it 50% owned by Realogy, 50% owned by Home Partners of America?

KF: The structure has not been disclosed at this time. But they are both deeply involved and deeply invested in the success of RealSure. And you heard it firsthand from Ryan Schneider at the Realogy earnings how it’s one of the top strategic priorities of Realogy. Obviously, Home Partners doesn’t have public earnings calls, and you can’t hear it from them, but you could assume a similar tone.

HW: Any specifics you can give about how much money Realogy is putting into Real Sure, or any kinds of goals in terms of homes sold?

KF: We’re not quoting consumer metrics. But what I will say is that qualitatively the RealSure team have really spent a ton of time figuring out the financial model, the economics, and the customer value proposition. Homebuying is a very complex transaction with a lot of zeros attached to it, right, so you want to be very precise.

And that was impetus for hiring for me, for hiring a CEO. This summer, they said, ‘Okay, now’s the time to make this a massive strategic focus of ours.’

HW: Zillow just wound down its iBuying. Even if you mostly chalk that up to issues specific to Zillow, Opendoor and Offerpad have lost money doing it. Why will RealSure be different?

KF: I mean, there’s like, put this in air quotes, kind of a venture way to look at things where it’s like, ‘Oh, if you build it, they will come to you.’ And, I will say, that’s not the perspective that this team has taken.

And that’s why they’ve been a little bit ‘go slow to go fast,’ right? The last two years were focused on figuring out and building it.

Differentiating from some of the others you mentioned is twofold.

One is an extremely profitable lease-to-buy program. So, there is a program that has been created by Home Partners – which was why Blackstone acquired them – that has found a way to take homes and make a profit out of them. So, we have a way to actually offload those homes quite profitability.

Second, is their predictive analytics and data modeling function. The core competency of Home Partners and Blackstone has been that they need to understand the market opportunity for an individual home with so much precision, because if they’re off by 10 basis points at billions of dollars that becomes a lot of money. And that allows us to really understand what to bid on homes in a way that is extremely scalable and profitable.

HW: Given Blackstone’s history as a landlord renting single-family homes and Home Partners’ business model, when RealSure buys a home will it be an option to lease the home out, instead of immediately trying to resell like other iBuyers?

KF: It’s not super black and white as to where the home goes and how we do it, right? Because we have all the options that we’re pricing in, but that is one of the options for sure.

HW: If you want to use RealSure to sell your house, how does it work?

KF: We’ll price the home and say, ‘Listen, we can give you this, obviously, you don’t have to then stage it, and you have the certainty of selling it.’ And the fees are different because you’re not listing.

However, you can also list it simultaneously for 45 days and see what the best offer is, right?

But it allows you to know that a sale is guaranteed, you’re going to get X dollars in the bank, and you can make family decisions. A lot of times, these families are just sitting in limbo, not sure when they can make decisions. This allows you to effectively do both options simultaneously and make the decision that makes the most sense for you.

HW: How many homes has RealSure bought so far? How many has it resold?

KF: To be honest, I don’t even know that number off the top of my head. I would say it’s insignificant for what it’s going to be in the next 90 days.

HW: In terms of how Realogy’s agents work with RealSure – How does that work?

KF: It depends on your preference. So you’ll come in and say, ‘I want cash for my home,’ and we’ll say, ‘Okay, we’ll give you $250,000 for your home.’ And then we’ll say, ‘But if you want to list it, we can help you do that, too, right?’

So, then we’ll assign you an agent. And most or all of the agents assigned are in the RealSure program and sort of selected for this, right? So, they’re very well versed. We’re going to continue to optimize the matching program and make sure the personalities fit. Because as I’m sure you know, an agent is very much a personal relationship. So, making sure that maybe a working mom has a working mom as agent.

HW: Opendoor has gone to charging consumers a flat 5% fee for all home purchases they make. What is the fee RealSure charges consumers?

KF: It’s similar. I actually don’t know if it’s the same in every market. It’s very standard to what the usual fee is for a broker.

HW: Let’s close with the Zillow question. Here’s a company with seemingly all the resources and brand visibility in the world, and they gambled on IBuying and lost. What assurances can you give that RealSure will not suffer a similar fate when it tries to scale up its iBuying operation?

KF: With Home Partners and Blackstone, the tires have been kicked and pressure tested. And, so to me, it just shows the importance of really the approach the team has taken with “go slow before you go fast” and taking two years to really work through it. So then when we scale up, we’re very confident in our approach and what that means for our balance sheet.

The post Inside the Realogy-Blackstone iBuying venture appeared first on HousingWire.

Source link

Existing home sales now outperforming

The National Association of Realtors‘ existing home sales report for October came in at a solid beat of estimates at 6.34 million. This number is above my trend sales peak of 6.2 million and that means we have had back-to-back existing home sales prints of over 6.2 million. Early in the year, I had discussed that if existing home sales stay in a range between 5.84 million and 6.2 million, that would mean it’s a good year for housing demand.

A big part of my work since the end of 2020 is explaining to people that housing data was going to moderate because the make-up demand from COVID created a surge in sales that is very abnormal. This meant that I had anticipated home sales to fall to a more reasonable range. However, the key was to not overreact to that moderation and say that housing was crashing. This was very common in the previous expansion when any weaker data line trend was interpreted by some people as a housing crash.

As I wrote in my blog in 2020: “The rule of thumb I am using for 2021 is that existing home sales if they’re doing good, should be trending between 5,840,000-6,200,000. This, to me, would be considered a good year for housing.”

I had anticipated a few prints under 5.84 million and so far we have only gotten one print this year below that level. This means with only two more reports left so far in 2021 every single existing home sales print has been higher than the total closing level of 5.64 million in 2020. Not bad considering the low inventory and all that unhealthy home price growth we have seen since the start of 2020.

If home sales moderate from these levels, that would be perfectly normal to me because clearly now the existing home sales market is outperforming my expectations with these last two sale prints. So much for the 2021 forbearance crash bros — the second half of 2021 housing crash YouTube fanatics. Mother demographics and low mortgage rates can crush a lot of American bear’s hearts as they did in 2020 and 2021.

The main reason why housing has done better in the years 2020 and 2021 is that we just got a boost in demand from the most significant housing demographic patch ever in history, as ages 27-33 are the biggest group ever. Then when you add move-up, move-down, cash, and investor buyers together, we should be able to always have total home sales — both new and existing — at 6.2 million or higher. This is something that couldn’t happen in the years 2008-2019. We are well above my 6.2 million total sales numbers and that means both years have been a noticeable beat in my eyes.

For every positive, there is a risk of a negative and we have seen that risk play out in home-price growth. My single biggest concern for the years 2020-2024 was that home-price growth could overheat and we have seen that take place, which is why I keep on saying this is the most unhealthy housing market post-2010. Not because of a credit housing bubble boom but because days on market are still too low, creating a bidding war frenzy that doesn’t do anyone any good.

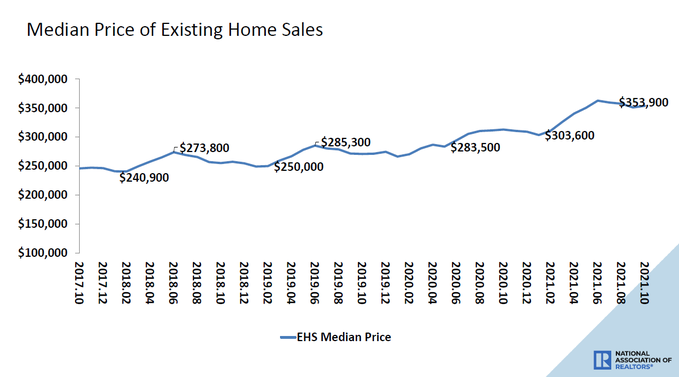

From NAR: The median existing-home price for all housing types in October was $353,900, up 13.1% from October 2020 ($313,000), as prices climbed in each region.

One data set I like to keep an eye on regarding progress for what I want to see in the B&B housing market (boring and balanced) is for days on market to grow. Now we have some good news, the days on market grew one day from the last month’s report, from 17 to 18 days. I know it might not sound like much, but still, progress is progress. I would love to see days on market get to 30 days, so we still have a ways to go for that to happen.

NAR: In October, first-time buyers were responsible for 29% of sales; Individual investors purchased 17% of homes; All-cash sales accounted for 24% of transactions; Distressed sales represented less than 1% of sales; Properties typically remained on the market for 18 days.

Another theme of mine earlier this year was to expect negative year-over-year data in the MBA purchase applications in the second half of 2021. This is only due to the high comps that we had in the second half of 2020 — all due to the make-up demand from COVID-19. I saw a lot of rookie housing bears try to push this as a reason for housing to fall hard in the second half of 2021. This is a terrible rookie mistake made by people who lack the experience of tracking housing data properly. So, the negative year-over-year data in home sales should not be a shock anymore.

NAR: Sales fell 5.8% from a year ago (6.73 million in October 2020).

There has been a lot of hype that this entire housing market is driven by investors. Dear lord, this Micky Mouse act happens often, but the real driver of housing is mortgage buyers. When mortgage buyers fade — and they will at some point if mortgage rates go higher — so will home sales. We don’t have a Wall Street moat around housing. The MBA purchase application data had been firming up since 11 weeks ago and nobody really cared to notice.

It’s sexier to say that investors are driving home prices higher instead of all those pesky mortgage buyers, which is by far the biggest portion of housing demand. It just doesn’t sell well to say that millennial mortgage buyers are driving home prices to all-time highs. Yellow journalism, gloom-and-doom clickbait sites, and ideological extreme left and right-wing takes get a lot of play, but that doesn’t mean they are right.

Since the summer of 2020, I had have said housing will slow but it needs mortgage rates above 3.75%, which means the 10-year yield has to get over 1.94%. My 2021 forecast didn’t have that reality in play. In fact, the AB recovery model range of 1.33%-1.60% held its ground for a portion of 2021. Everything remarkably looks right with the bond market for me. As I write this article, the 10-year yield is at 1.60%. Priceless, isn’t it?

For the rest of the year, I am really watching one thing: I would love to see inventory hold up better than it did last winter. I do not want to see Inventory collapse like it did last year and start the spring of 2022 at those levels. So, that is my focus for the last two reports and the weekly tracking of inventory.

All in all, I would say existing home sales, for now, are outperforming and if sales levels hold above 6.2 million I will be very impressed. If sales trends come down a bit in the next few months, that would fall in line with my sales trend levels. However, the main story for 2021 is that home sales demand is going to end higher than it did in 2020 led by American mortgage home buyers.

The post Existing home sales now outperforming appeared first on HousingWire.

Source link

Find Money, Partners, & Deals Using The “D.A.D System”

We often hear entrepreneurs talk about how they want to “be the best” in their field. It’s the same with many real estate investors. They want to be the best wholesaler, flipper, short-term rental host, or landlord. But, does “being the best” really matter much to your customer if they can’t tell the difference between you and your competition? Probably not.

Mike Michalowicz, author of Profit First, is on the show today to discuss his new book, Get Different, and why so many entrepreneurs and real estate investors have marketing all wrong. If you’ve ever tried direct mail, cold calling, or door knocking, you know the sting of quick rejection from a potential seller. Why do they reject so quickly? Because you sound just like every other real estate marketer trying to get to them.