This is one of the most-asked questions we receive. When you’re starting as a rookie real estate investor, every strategy seems like a good one. You may hear a guest on the Real Estate Rookie show talk about wholesaling or flipping or short-term rentals. Before long, you’re already planning your next exciting purchase even if you had another one already in the works. This “shiny object syndrome” is common when getting started, and while it’s good to know about many different investing strategies, changing yours too often can lead you well off the path to financial freedom.

Here are some suggestions if you’re torn between strategies and need to up your analysis game:

If you want Ashley and Tony to answer a real estate question, you can post in the Real Estate Rookie Facebook Group! Or, call us at the Rookie Request Line (1-888-5-ROOKIE).

Ashley:

This is Real Estate Rookie episode 192. My name is Ashley Kehr and I am here with my co-host Tony Robinson.

Tony:

And welcome to the Real Estate Rookie Podcast, where every week, twice a week, we bring you the inspiration information and education you need to kickstart your real estate investing career. And I’m here with my lovely co-host, Ashley Kehr. What’s going on Ash? What’s new on the east coast these days?

Ashley:

Well, just a little update on my dead knee. I had surgery again on Tuesday, so two days ago where they had to go in and clean out all the scar tissue from my MCL. And yeah, so back into PT, I spend six months of physical therapy. I am best friends with my physical therapist, probably the person I talk to [inaudible 00:00:51].

Tony:

Knows all your deep dark secrets now.

Ashley:

Yeah. He’s also really starting to open up to me too. I heard about his sunburn and everything, so. But yeah, so I’ve just been the last couple days, just yesterday, just pretty much zoned out on pain pills and hung out. And today I held off on doing a pain pill, so that I could be a full body of mind. So, if I’m crying by the time we get to the end of our recording, that’s why.

Tony:

That’s why. All right. Well, hopefully your fingers crossed you’re at the end of this journey and you can get back to normal Ashley riding on bulls and hula hooping and all the stuff you did before your knee injury.

Ashley:

Yeah, if you guys last year at the BiggerPockets Conference, me and Tony got pretty wild out there, hula hooping, riding bulls, or maybe just me. But San Diego 2022 is where the BiggerPockets Conference is going to be held. So, makes sure you guys go to BiggerPockets.com/events and check it out and we’ll see you guys there. So, what’s new Tony?

Tony:

Yeah, we just got back from Cabo San Lucas actually. So, I know this episode comes out in June, but we just got past Memorial weekend. So, my wife Sarah and I it’s been like a busy, busy first half of the year for us and we just felt like we need a little bit of time. We’re not doing any work, we’re not doing anything. So, we got away. We went back to Cabo, which is where we got married and we stayed at that same hotel. We had dinner at the venue we got married at. So, it was cool to take some time and just kind of not think about work, but then literally as soon as we get back, on the drive home, the work starts again. We’re in the middle of raising money for our first hotel purchase.

And we’ve just learned a lot through that process. So, talking with all our investors and giving all the information that they need and figuring out all the stuff for the attorneys and the accountants and all that stuff. So, lots of lessons learned. So, I’ll be excited once we’re done with this to maybe do another reply where we can like break down all the stuff we learned going through this process because there’s definitely more to this than just buying like a regular single family house.

Ashley:

Yeah, that would be a great rookie reply to do, even if you’re not even close to doing a syndication deal, as a rookie just kind of figuring out if that’s something you’re interested in maybe in the future too. Be great to hear about that deal.

Tony:

Yeah, for sure. And just last thing before we move on like you said, even if you’re not focused on doing that right now, if your goal at some point is to scale, having at least a baseline understanding of syndications and how they work, I think will be something that you’ll want to start educating yourself on sooner rather than later. One of the very first books I read on real estate investing was about apartment syndication. Before I read all the books about flipping and house act and all these other stuff, it was apartment syndication because I knew we wanted to scale. So, there’s definitely some value.

Ashley:

Okay. So, let’s get to today’s question. This one is actually pulled out of the Real Estate Rookie Facebook group. So, if you have not joined that, make sure you guys join the group and answer all of the questions because if moderators will not let you in unless you agree to the rules and the conditions of being part of the group. So, this week’s question is from Natalie Ann and it’s a two parter. So, the first question is how did you narrow your focus to determine your strategy? I’m all over the place with purchasing a buy and hold and I’m also intrigued by doing a flip and having short term rentals. Tony, you want to start with that question?

Tony:

Yeah. So, Natalie super understandable position to be in. I think a lot of folks as they’re looking to get started in real estate investing, there’s this shiny object syndrome where you see someone having success in this niche, someone else killing in this other niche, and someone making tons of money in this other niche, you’re just like, man, I want to try it all. But I think one of the best decisions you can make as a new real estate investor is to specialize in one type of investing first. Now your question of how do you do that? There’s a couple things that or three things we’re going to look at, it’s your time, your desire, and your ability. So, if you look at those three things that should help kind of point you in the right direction. So, first is time. Some of these asset classes or types of investing are more time intensive than others, right? Like flipping houses and short term rentals are probably more work than a traditional long term rental.

So, think about the time availability that you have. So, time. Next is ability. So, what skill do you have and what type of investing does that skillset lend themselves to you? Do you know how to hang drywall and install countertops and do all that stuff? Then maybe flipping is a great place for you to start. Are you great on the phone and you can sell anything to anyone? Then maybe you start off as a wholesaler. Maybe you’re great at interior design and creating really cool experiences, so short term rentals might be good for you. So, think about where you naturally are skilled at and which one of those types of investing best relates to that. And then the second is your desire, right? So, we talked time, ability, and desires the last piece. So, even if you’re the world’s greatest salesperson, if you hate sales, then maybe wholesaling isn’t for you. So, you want to see where do those three things of time, desire, and ability all kind of intersect and that should help point you in the right direction.

Ashley:

Yeah, I think the biggest takeaway there is what are the resources available to you? Remember this is not a hobby. Yeah, you want to be passionate about what you are doing, but this isn’t a hobby where you’re just going to pick what you love. It’s also what resources do you have available to you that are going to make you successful? So, when I started, I started with buy and hold long term rentals because I was a property manager for long term rentals. I worked for an investor who did long term rentals. I knew what to do. I had access to his resources.

So, look around just like Tony said, maybe if you are into construction, you know how to rehab a property. Maybe BRRRR or flipping is meant for you if you can do those projects yourself or you can easily manage one of those projects. So, I think sit down and actually write out of a list. What are the resources you have available to you and then how do they apply to each strategy? And then also look at, okay, so maybe it’s close between two, which one are you passionate about? Which one do you get more excited about? And after I built my strong foundation of buying properties, I was very lost as to like, okay, where do I want to go now? Shiny object syndrome everywhere. I went to different conferences from self storage to mask your minds on commercial real estate and just like all over the place, not knowing exactly what I wanted to focus on.

And then I was talking to somebody about the different niches and what I was thinking of. And when I talked about campgrounds, they told me I just lit up. Like that was what I was passionate about, but I had gotten that strong foundation built of something that I could accomplish, those long term buying hold rentals, then I went off and really and pursuing what excites me, what I’m interested in. So, I think take it with a grain of salt. And even if you’re not going to do the thing you’re most passionate about and have fun with and love right off the bat, that’s okay. Find what you’re going to be most successful at first and build that foundation so that you can go off and play with what other type of real estate you want to.

Tony:

Yeah. Ashley, you bring up such a good point about building that foundation. And for us, when we started investing in short term rentals, we literally told ourselves or I told myself this, that I want to focus on this one asset class for the next five years because I want to become an expert in this one thing. And similar to you in terms of building that foundation because when you go really narrow and deep on one type of investing, the success you have I think compounds because all of your energy, all of your attention, all of your focus is on this one thing and getting really, really good at that one thing. So, people always ask me Tony, how did you scale so fast, and this that, and the other, and you’ve got this big portfolio short-term rentals in a relatively short period of time.

And it’s because that was the only thing that we were focused on, right? So, from the time that I woke up until the time that I went to sleep, the only thing that I was thinking about when it came to work was building our short term mental business. And when you have that kind of laser focus, it allows you to scale and grow a lot more quickly. So again, shiny object syndrome. I know it’s a real thing, but try and have that discipline to pick one thing and just go all and in at it.

Ashley:

So, the second question that Natalie had was how did you get good at analyzing deals? Practice, practice, practice, making mistakes. My first property I ever purchased, I forgot to include snow plowing. I live in Buffalo, New York, obviously the driveway needs to be snow plowed. And I forgot to add that in. And yeah, it didn’t kill the deal. It didn’t kill our cash flow, but it still wasn’t what I had projected it to be. And I had taken on a partner with that deal, so just from gaining experience from practicing analyzing deals and also looking at other people’s deals. So, looking at how they are analyzing it. So, joining Zoom calls, webinars where people go through and show you how they are analyzing deals, you’ll pick up so many tips and tricks and also just the biggest thing I can say is don’t fudge the numbers, verify, verify, verify.

So, if you want super accurate numbers and you have no idea what the insurance expense is going to be on a property because you’ve never bought in that market before, go to an insurance agent and ask them to estimate it. It is free. You don’t have to pay anything to have that done. So, verify as much information as you can to become really good at analyzing deals, then it will just be okay, I know this type of house in this area, the insurance per year is about $800 a month. So, I can use that as my number knowing it may be a little less or a little more than that, but that’s the average cost. So, definitely the experience is a good way to get good at analyzing deals.

Tony:

Yeah, and they say repetition is a mother of skill and I think that applies to analyzing deals completely. But I also think Natalie, that once you answer the first part of your question about which type of investment do you want to focus on, then getting good at analyzing becomes a lot easier. But if you’re trying to analyze multiple flips and then multiple long term, multiple short term, this wholesale deal, now you’re spread really thin on building that repetition. But if you answer question number one and say, “Hey, I’m going to do flips and that’s going to be the thing that I do.” Then you can say, “okay, every property that I look at, now I’m getting that repetition in of analyzing a deal as a flip.”

And once you’ve had that decision, it almost becomes like second nature. When I first started investing and we were buying in Shreveport, I knew the zip codes that I was looking at like the back of my hand, right? We were looking at 71104 and 71105. Then I could tell you what was a good price for properties in each of those zip codes, what they could rent for. When you really narrow in, it becomes easier to get better at analyzing those deals.

Ashley:

Yeah, you get a lot quicker once the things you can zoom through them, analyzing them, or even just looking at the property and be like, yeah, I know that this isn’t going to work for me. Even if I offer a $100,000 below asking price.

Tony:

Like Ashley, I’m sure you could in your neighborhoods where you invest, you probably wouldn’t even really have to analyze a deal per se right now to know whether or not you want to put an offer. And you could see, okay, I know like.. I mean, right? Like, am I right? Or do you like-

Ashley:

No, you’re exactly right. I’m going to look at a property tonight where someone texted it to you this morning and I was driving and I was going through my just thinking about it and I analyzed it in my head, be like, okay, this is what I think the rehab would be, this is what we-

Tony:

Totally, and same for us. We’re in Joshua Tree, like I can look at a listing and pretty much ballpark what we’re going to profit on that property as well. So, Natalie just the repetition is where you get really good at analyzing deals. And then I think the last thing is don’t be afraid to if you have other investors in your network, share your analysis with them as well, right? Or even posting in the Real Estate Rookie Facebook group. But I think if you can get some feedback from other investors that maybe gone down that path and like say that you’re a new investor in Buffalo, you post in the group and you don’t have snow plowing, there is one of your expenses. Ashley, one of the other experienced investors can point that out for you. So, repetition but then also trying to get some feedback from folks that have done it once or twice before.

Ashley:

Okay. Well, thank you guys so much for joining us for this week’s Rookie Reply. I’m Ashley at Wealth From Rentals and he’s Tony at Tony J Robinson on Instagram. And we’ll be back on Wednesday with a guest. See you guys next time.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

5 Ways a Rental Property Makes Money

If you’re anything like me, you grew up believing rental properties were inherently profitable. Within that belief, you likely didn’t know how they made money, just that they did.

Well, in this article, you can learn precisely how rental properties make money. Overall, they make money in five different ways.

Cash Flow

Cash flow is what’s left over from the rental income after all expenses are paid. Cash flow may also be referred to as “net income” (as compared to “gross income” which is the income before expenses are taken out).

Cash flow can be positive or negative. Positive cash flow means there’s excess income after the expenses are paid, and that income gets to go right into your pocket as profit. Negative cash flow means the costs have exceeded the income, and you now have to pay out of pocket to cover those.

You can calculate your cash flow on a monthly or yearly basis. Decide which you want to look at, total up your expenses for that period, and subtract that expense total from the rental income total. What’s left is your cash flow.

A nice thing about positive cash flow is that it can act as a tremendous buffer against shifting real estate market dynamics. For example, suppose the real estate market crashes and the value of your property decreases. As long as you’re still collecting cash flow from the property, you can wait until the market corrects and the value of your property goes back to where it was.

In that situation, you wouldn’t even know we were experiencing a recession since you’d still make the same amount of money from the property each month.

Compare this to a negative cash flow situation and the market tanks. You may get stuck in a position that forces you to offload the property at a loss because you can’t afford to maintain it through the recession.

While not the highest profit center of all, cash flow can serve as a critical foundation for successful rental property investing.

Appreciation

Probably the most popular form of profit when people think of rental properties, appreciation has been a consistent performer over time and one of the biggest players in what makes people so wealthy from real estate.

Appreciation is when the value of a property increases due to various factors.

The three main causes of appreciation are:

Improving a property

Rehabbing a property will create appreciation because that rehab has now increased the property’s value. In most cases, the increase in the value of the property will be more than what the investor had to pay to complete the rehab.

For example, let’s say you buy a $100,000 property and put $30,000 into a rehab. With all of the improvements, the property is worth $150,000. You only put in $130,000 ($100,000 plus the $30,000 rehab), but now the property is worth $150,000. There’s an extra $20,000 in free money thanks to the appreciation generated by the rehab.

This kind of appreciation is called forced appreciation.

Location

The location you bought the property in will also be a primary driver of appreciation. If the demand for housing in the area—the broader market or the specific neighborhood—rises, so will property values. Demand may rise due to general market growth, or it may be because you bought in an area that got intentionally gentrified, which could force quicker and more dramatic appreciation.

In addition to improvements and demand increasing the value of a property, an investor may likely also experience appreciation in the market value of rental income. Rents inevitably increase over time due to several factors, but what causes appreciation to the value of a property will usually trigger appreciation in rental values as well. When the rents increase, your cash flow will increase proportionately.

While appreciation is one of the highest profit centers of a rental property, it’s also speculative. It’s never a guarantee that the reason you believe a property will appreciate will pan out as you assume it will. You should always consider contingency plans on how you expect a property to profit should the appreciation strategy fold.

The other consideration to remember is that rental properties are long-term investments, and often true appreciation potential is experienced over the long-term rather than the short-term.

Building Equity Through Mortgage Payoff

One of the coolest things about owning a rental property is that your tenants’ rent check is most likely covering your mortgage payment! Hopefully, it’s covering more than that, but if it’s at least covering your mortgage payment, it means that you aren’t the one paying down your mortgage—they are.

Here’s an example: You buy a $100,000 rental property with 20% down. That means you paid $20,000 upfront and the remaining $80,000 is the balance on the loan, in addition to interest payments.

Over 30 years, the mortgage balance is paid down every month through the income you receive from your tenants. At the end of those 30 years, $80,000 has been paid off and you now own the property free and clear. The $80,000 isn’t immediately liquid because it’s in the form of equity, but it’s your money, and you can either keep it as equity or pull it out of the property and use it however you wish.

The bottom line is that you turned $20,000 into $80,000, plus any appreciation that’s most likely occurred over 30 years.

Tax Benefits

*Disclaimer: I’m not a tax expert. You should consult your CPA for all tax matters involving your real estate investments.

Rental properties are among the most advantageous investments within the IRS tax code. Essentially, rental property income can wind up being tax-free income when filed correctly.

While that may not sound like profit in your pocket right away, think about how much you end up paying in taxes on your normal income. If you’re in the 33% tax bracket, you could pay $33,000 in taxes on a $100,000 income.

What if you were able to keep that $33,000? Isn’t that a hefty amount of money? The tax benefits aren’t exactly black and white, but they should at least give you a perspective on how substantial the profits from these benefits can be.

The primary way rental properties generate tax breaks is through write-offs. When you write off an expense, it decreases your taxable income, decreasing how much you owe in taxes. If you have sufficient write-offs to decrease your taxable income enough, you could bring your tax liability way down or even zero it out.

The write-offs for rental properties come from two primary sources:

With the expense and depreciation write-offs reducing your taxable income, you stand to receive a notable amount of money taken off your tax liability each year, which in turn equates to profit in your pocket.

Hedging Against Inflation

Inflation, possibly one of the most hated words in the English language, tends to strain our lives in myriad ways. But is inflation always bad? When it comes to rental properties, inflation is actually a good thing. The more inflation, the more profitable your rental property may be.

Inflation causes the dollar to become worth less than it used to be. Assume you get a fixed-rate mortgage today on your $100,000 rental property. While $100,000 is worth $100,000 today, what if $100,000 is only worth the equivalent of today’s $70,000 at some point in the future when the dollar’s value goes down? That’s how inflation works.

As mentioned earlier, rent increases are caused by a lot of different factors, and one of those additional factors is inflation. When a tenant’s rent payment increases due to inflation, your fixed-rate mortgage payment doesn’t change, resulting in even more cash flow.

As with appreciation, inflation helps with both the overall equity in your property and the tangible cash flow hitting your pocket.

Applying the Five Profit Centers

It’s exciting to know how rental properties can make money, especially since the profit comes from five different directions. Having owned my rental properties for 10-12 years, I can personally vouch for all five profit centers. I vaguely understood them when I started investing, but it wasn’t until I owned my properties for a substantial amount of time that I could see how lucrative each profit center is.

One of the best things you can do as an investor is to understand each of these profit centers and apply the knowledge to your analysis when looking at prospective rental properties.

There are two keys that you should know when beginning to analyze the profit potential of a rental property:

No two rental properties will make money in the same way at the same rate. In most cases, there is a risk versus reward trade-off. Mismanagement of a rental property can cause even the best property to not see a profit. But when you take the time to understand these dynamics and how rental properties make money and apply that to your buying decisions, you stand a much higher chance of experiencing noticeable profit from the properties you invest in.

If you’ve owned rental properties for a significant amount of time, what has your experience been in seeing returns from these five profit centers?

Find financial freedom through rentals

If you’re considering using rental properties to build wealth, this book is a must-read. With nearly 400 pages of in-depth advice for building wealth through rental properties, The Book on Rental Property Investing imparts the practical and exciting strategies that investors use to build cash flow and wealth.

Source link

New Residential to internalize management, change name to Rithm Capital

New Residential Investment Corp. announced on Friday that it has decided to internalize the company’s management, a step that the real estate investment trust estimates will reduce its costs and potentially attract more institutional investors to its stock.

The company is also changing its name to Rithm Capital, reflecting the diversification of its businesses as more than just a mortgage real estate investment trust. Last year, the company closed the acquisition of Caliber Home Loans and Genesis Capital LLC.

New Residential will start trading on the NYSE as “RITM” on or about August 1, 2022.

Despite the changes in the management agreement, Michael Nierenberg will continue to be the chairman of the board, chief executive officer, and president. In addition, the company will retain key personnel across functions such as investments, finance and accounting, legal, tax, and treasury.

New Residential entered into a management agreement with an affiliate of Fortress Investment Group in 2015, resulting in annual net operating expenses of $101 million for the company to be externally managed, subject to oversight by the board of directors.

The company, however, decided to be managed internally, agreeing to pay a termination fee of $400 million by December 15, 2022, of which $200 million has already been funded.

The internalization will replace the management fee with compensation, benefits, and general and administrative expenses. The company claims that this change is expected to leverage infrastructure across businesses and reduce costs.

“We view this transaction as a way to drive value for shareholders with expected cost savings, incremental synergies and ability to leverage employees across the NRZ ecosystem,” Nierenberg said in a statement.

NRZ estimates the internalization will result in approximately $60 million to $65 million in cost savings. Another benefit is it potentially expands institutional ownership by attracting investors who avoid externally managed structures.

“Our strategy has not changed – we will continue to focus on opportunities across the financial services landscape,” Nierenberg said. “We have changed dramatically since our inception, from an owner of MSR assets to a company with complementary operating companies and a unique portfolio of investments.”

The company’s first-quarter earnings repeat the logic of rising interest rates lowering origination profits but increasing servicing gains, as reported by its peers. The real estate investment trust reported a $690 million net income, a 267% increase from the previous quarter. The main contribution came from the servicing portfolio.

The post New Residential to internalize management, change name to Rithm Capital appeared first on HousingWire.

Source link

Mortgage stocks are getting battered – what happens next?

In a one-week period between June 10 and June 17, 11 publicly traded mortgage companies lost a collective $6.14 billion in market capitalization. As investors fled the space, their valuations declined 17.4% to $29 billion in aggregate, according to a HousingWire analysis of stock data.

And it’s unclear when – or if – they’ll recover from the sell-off.

The companies include Finance of America Companies, Flagstar Bancorp, Guild Holdings Company, Home Point Capital, loanDepot, Mr. Cooper Group, New Residential Investment Corp., Ocwen Financial Corporation, Pennymac Financial Services, Rocket Companies, and UWM Holdings Corporation.

“People are reluctant to invest in the mortgage space at the moment because it’s unclear how long the downturn is going to last,” Bose George, mortgage finance analyst at Keefe, Bruyette & Woods (KBW), said. “You don’t know how much money these companies will lose and what their book values will look like once this is done.”

The bear stock market began on Friday, June 10 when the U.S. Consumer Price Index showed an 8.6% increase year-over-year in May, 30 basis points above the consensus estimates and the highest mark in four decades.

Consequently, the Federal Reserve raised the federal funds rate by 75 basis points on Wednesday, a hike not seen since 1994. Chairman Jerome Powell also signaled the possibility of raising an additional 75 bps at the Fed’s next meeting in July.

Investors last week scrambled to sell riskier assets amid growing fears that the Fed will send the U.S. economy into a recession this year. In a note published Monday, a team of Goldman Sachs economists increased their outlook for a U.S. recession, citing concerns that the Fed will act aggressively to control inflation, even if economic activity weakens. The Goldman Sachs economists now see a 30% probability of entering a recession over the next year, versus 15% previously, and a 25% probability of entering a recession in the second year if it is avoided in 2022.

All the turbulence in the markets pushed purchase mortgage rates up 55 bps over the last week, the largest one-week increase since 1987, to 5.78%, according to the Freddie Mac PMMS. Other indexes showed rates north of 6% last week. Well-qualified buyers in the non-qualified mortgage space were locking rates in double-digits, several LOs told HousingWire.

“In terms of the mortgage originators, refis are already largely gone, so the question is whether this rate move is enough to slow purchase more meaningfully. It’s a little early to tell,” George said. “We are pretty negative on the industry, and we have not recommended taking any of these names.”

Who was hit harder?

Investors are fleeing from mortgage companies that are struggling to generate cash – meaning those not delivering profits. They are also punishing the classes of 2020 and 2021, a group of lenders that went public at high valuations, often on the strength of lower mortgage rates and refi euphoria.

Nonbank heavyweight loanDepot suffered the biggest decline in valuation during the one-week period. The company lost 37.7% in market capitalization to $538 million on Friday, HousingWire’s analysis found. The stock debuted in 2021 at $14 a share and closed on Friday at just $1.52 a share.

The Orange County-based lender, founded by Anthony Hsieh, reported a net loss of $91.3 million in the first quarter due to a steep decline in origination volume and expense reductions that did not keep up with the rapidly changing environment. Company executives said they don’t expect to have a profitable fiscal year, citing pressures on margins and lower market volume.

Among the six mortgage companies that went public during the Good Times – besides loanDepot – Rocket (-19.4%), UWM (-16.4%), Home Point Capital (-8.7%), and Guild (-5.35%) also experienced sizable losses in their valuations over the last week. Notably, FoA, with a decline of 9.55%, closed at $1.80 a share on Friday, joining loanDepot in the $1 club.

– besides loanDepot – Rocket (-19.4%), UWM (-16.4%), Home Point Capital (-8.7%), and Guild (-5.35%) also experienced sizable losses in their valuations over the last week. Notably, FoA, with a decline of 9.55%, closed at $1.80 a share on Friday, joining loanDepot in the $1 club.

The remaining companies also had declines in their valuations due to the havoc in the financial markets: New Residential (-20.4%), Ocwen (-14.4%), Pennymac (-11.3%), Mr. Cooper (-9.85%), and Flagstar (-6.3%).

The turmoil in the markets caused the Wedbush Securities’s team of analysts to cut estimates for several mortgage companies.

“Mortgage rates have spiked to near 6% levels, after hovering ~3% for the last couple of years, at an unprecedented pace, rapidly evaporating the rate & term refinance market,” Jay McCanless, Brian Violino, and Henry Coffey said in the report.

“While purchase volumes remain fairly strong from a historical perspective, purchase rate locks are starting to see some pressure and total volume projections from the big three (Fannie, Freddie, and the MBA) for 2022 and 2023 have continuously moved lower throughout the year.”

Wedbush reduced Flagstar’s price target from $50 to $48, maintaining its neutral rating. For UWM, which also has a neutral recommendation, the analysts reduced the price target from $5 to $4.

Pennymac’s price target dropped from $65 to $55, with an outperform rating; the Wedbush analysts expect the total return to outperform relative to the median projected by analysts over the next 6-12 months.

Wedbush has an outperform rating for Guild (price target $12), Home Point ($5.50), and Mr. Cooper Group ($60). The analysts also have a neutral target for Rocket, with the price target at $7.

The worst since 2008?

A number of industry observers said the mortgage market is facing its worst downturn since the financial crisis in 2008.

On June 10, the day the inflation data came out, the mortgage-backed securities (MBS) market went “no-bid,” according to longtime mortgage broker Louis Barnes. Investors asked for higher premiums to invest in these assets amid a flight to quality caused by the expectation of higher U.S. Treasury rates.

“It’s a tough time in the market right now because you don’t know what rates to offer borrowers,” Kevin Heal, senior analyst and fixed income strategist at Argus Research, said.

He added: “From the mortgage side, there are still securitizations happening – the worry is if you’re issuing a security at 5.5%, but it could be the next day, you walk in, and then you’re underwater.”

Heal expects that the gain-on-sale margin will decrease dramatically for mortgage originators over the coming quarters just because of the volatility and the fact that lenders will have to sell loans in the secondary market with lower gains.

He estimates margins in the retail channel could go down to 2% on average, compared to 3% in the previous quarters.

However, there is no reason for panic: analysts agree originators are in a better position than in the past because they cashed in during the refi boom of 2020 and 2021.

Only three in the group of 11 companies had a reduction in the cash position in the first quarter of 2022, compared to the Q4 2021, among them Home Point, Mr. Cooper and Flagstar. Some socked away tremendous gains from the boom – Rocket has more than $2.3 billion in cash, and New Residential has more than $1.6 billion. Finance of America had a 60.6% increase in the cash position quarter-over-quarter, and Pennymac’s cash position rose 44% during the same period. Many of those companies also bought back stock that investors were shedding.

Lenders have already started to reduce costs, protecting what’s left of their diminishing margins. The Wedbush analysts said in their report that, although most mortgage companies have begun to trim back their workforces to account for an excess capacity issue, “it will likely take a quarter or two before excess capacity is flushed out of the system.”

In addition, with originations going down, some lenders can also boost their earnings by taking advantage of the strong demand for their servicing portfolios. Mortgage servicing rights (MSRs) values tend to increase as mortgage rates rise, and borrowers are less likely to refinance or prepay their loans.

“There’s a long-term trend reflected on many days, including Friday, in the mortgage industry towards higher rates, less refinance, and seemingly downward pressure on the purchase money market,” said Henry Coffey, a mortgage and housing analyst at Wedbush. “In this context, we expect the servicing portfolio to be bringing more profits to mortgage companies in the coming quarters.”

The post Mortgage stocks are getting battered – what happens next? appeared first on HousingWire.

Source link

Opinion: Title insurance is vital to protecting the American dream

As someone who spent a career in the title insurance industry – both as a builder of a title business and leader of the industry’s trade group, — I am proud of the role we play in helping to protect what most Americans consider the biggest purchase of their lives.

Title insurance is imperative for lenders to ensure the borrower has ownership rights to a property, but it doesn’t just protect against problems affecting title. It plays an essential role in the economics of homeownership, ensuring that credit reaches those who need it and providing safeguards to those who lend it. The capital markets depend on the due diligence, transparency, and protection our industry provides to do its job.

In fact, our industry is so important that throughout the COVID-19 pandemic, title insurance professionals were deemed essential by the federal government. Their hard work kept a major part of the economy running during a challenging time when purchasing a home meant more than ever.

During this same time, our industry helped consumers take advantage of low interest rates to refinance mortgages. In a refinancing, homeowners obtain a new loan and lenders require a new title search and a title insurance policy on that loan to protect their investment. Professionals conduct the search and examine documents, with title companies regularly providing a discount, or “reissue rate” on a refinance.

Discounts also may be available if using the same lender that issued the original loan. And because the home’s ownership remains unchanged, a homeowners’ title insurance “Owner’s Policy” is valid through refinance.

Why is a title search necessary for refinancing? In short, even if someone recently refinanced, problems could have arisen that the lender must know about before approving a new loan. For instance, a homeowner may have incurred a lien from a contractor who claims they weren’t paid. Or a homeowner might have a judgment on their house due to unpaid taxes, homeowner association dues, or child support. The borrower also may have encumbered the property with loans that were not disclosed when applying for refinancing.

There are other issues that can arise between origination and refinancing:

Real estate is a $3 trillion industry in the United States. There has been a great deal of innovation around purchasing homes, making credit available, and closing real estate transactions. This innovation is positive for consumers. However, sometimes innovators can misrepresent products or sow confusion. They point to low claims ratios as evidence that title insurance is unnecessary. Not only is this not true, but it is a fundamental misunderstanding of what title professionals do and how our underwriting protects this work.

Low claims ratios are a testament to the work our agents do to eliminate items prior to closing. It is this work that keeps the cost of our insurance low and protects the homeowner and lender from problems that would arise if not for the work we do in advance of closing — problems that could be detrimental to the homeowner’s credit and the lender’s investment.

While this is clear to active industry participants, it may not seem intuitive to homeowners who are purchasing or refinancing for the first time. That is why we take pains to explain the process. Through the American Land Title Association and state associations, the industry continues to develop new tools to help consumers understand the role title insurance plays in the closing, the benefits of title insurance and how to shop for title insurance. The best resource for consumers is ALTA’s comprehensive home closing website, homeclosing101.org.

The work title professionals do every day is critical to protecting the American dream. And the work our industry does to make the closing process faster and easier is a critical part of the overall economy. All participants in this economy should engage in good faith conversations — with facts and data — to improve our industry’s offerings.

As the economy and housing market begins to slow, we must avoid the temptation to move away from well-regulated products that are a key part of protecting lenders and homeowners. The last housing crisis proved that strong underwriting standards are critical, especially during market downturns. But it is never the right time to take new and unknown risks that ultimately will increase the cost and be a detriment to consumers and lenders.

Mary O’Donnell is CEO of Westcor Land Title Insurance Co. and a past president of the American Land Title Association.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Mary O’Donnell at modonnell@wltic.com

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com

The post Opinion: Title insurance is vital to protecting the American dream appeared first on HousingWire.

Source link

A record year for real estate brokerage firms

The 2021 real estate market was one for the ages: record low interest rates and housing inventory gave way to record high home prices and sales. Capitalizing on these market factors, brokerage firms in the 2022 RealTrends 500 brokerage rankings broke records in market share, closed transaction sides (there must be inventory somewhere!) and sales volume.

The top four — Realogy Brokerage Group (RBG), HomeServices of America, Compass and eXp Realty — now have 20% market share in the U.S. “These four brokerage companies did just over $20 billion in residential gross commission revenue,” said RealTrends Senior Advisor Steve Murray. “In the 2021 rankings (based on 2020 data), these same firms closed just over $14 billion, so the increase was 43% in one year among just these four firms.”

Some of this growth was due to the increase in the value of the homes sold, but, according to Murray, “A large part was growth through both acquisitions and organic means. I don’t recall seeing this kind of one-year growth ever.”

A shake up at the top

RealTrends released its 2022 RealTrends 500 (RT500) brokerage rankings and for the first time since the late 1990s, Realogy Brokerage Group or HomeServices of America were not in the top spot by sales volume. Relative newcomer Compass snuck by Realogy to claim No. 1.

All firms in the 2022 RT500 did approximately 40.6% of all brokerage-controlled sales in the country, up from 38% in the 2021 rankings, with 35.9% of all Realtors. Agents with RT500 firms had an average of 7.9 transactions per agent. The average number of agents per RT500 firm was 1,138, up from 1,025 last year.

RealTrends has been the undisputed leader in the ranking of real estate brokerage firms, agents and teams. Third-party verification is mandatory to confirm the validity of transaction sides and sales volume submitted by the firms.

Due to RealTrends and RTC Consulting’s large valuation and M&A practice, “we have access to hundreds of brokerage financial statements every year,” said Murray. “Because of those financial statements, we are at an advantage to determine the accuracy of the numbers submitted to us, which serves as an additional layer of verification in the process we use.”

Leaderboard by transaction sides

Since 2018, Berkshire Hathaway behemoth HomeServices of America has taken the No. 1 by transaction sides with more than 388,000 sides. Each real estate transaction has two sides: a buying side and a selling side. Before 2018, NRT, now Realogy Brokerage Group, maintained that top spot. Now, Realogy Brokerage Group, composed of company-owned offices of Coldwell Banker, Corcoran and Sotheby’s International firms, is No. 2 with more than 376,000 transaction sides.

Neither of these numbers takes into account the many franchises of either brand. Cloud-based brokerage eXp Realty continued its meteoric rise in the No. 3 spot by transaction sides with more than 355,000 transaction sides. Led by founder and CEO Glenn Sanford, the company hopes to add former Keller Williams CEO Mark Willis to its leadership team pending litigation with Keller Williams.

Willis played a key role in the massive growth of Keller Williams between 2005-2014, when the company grew from 700 agents to 140,000 agents worldwide. Compass took the No. 4 spot by transaction sides.

Shake up in sales volume leader

Perhaps the biggest news of all is that 10-year-old, self-proclaimed real estate technology brokerage Compass snuck past Realogy Brokerage Group to take the No. 1 spot by sales volume with $251 billion in sales in 2021, ending an almost 20-year run of RBG in that spot. Realogy was a close second with $246 billion.

Compass rose quickly to the top by acquiring agents and teams rather than brokerage firms, which was the primary way to grow quickly for many firms. “When today’s Realogy Brokerage Group (formerly NRT) bought Coldwell Banker in 1996, they soon rose to No. 1 for many years. They got there largely through that major acquisition,” said Murray. “Compass got there largely through key acquisitions of top-producing real estate agents and teams, which was a different way to grow.” Compass also had a few key brokerage acquisitions, including Pacific Union International Realty in 2018.

While still focused on recruiting, Compass CEO Robert Reffkin suggested in his February 2021 earnings call that Compass is not giving agents the compensation packages it has in the past, stating 62% of agents who recently came to Compass are receiving a less favorable split compared to their brokerage.

Also, fewer agents are “getting equity,” Reffkin said. Instead, Reffkin will be focused on innovation to improve per-agent productivity. The third-largest firm by sales volume is HomeServices of America, with $199 billion, followed by eXp Realty at $132 billion.

Low-fee or low-cost brokerage firms gaining traction

Of the top 25 RealTrends 500 brokerage firms by transaction sides, eight firms, or 32% of the top 25 firms, are considered low-fee or low-cost firms. Low-cost or low-fee firms charge a flat fee to the agents, or have higher splits to the agents, than traditional firms. By far the biggest of these is eXp Realty at No. 3 by transaction sides, followed by Redfin (6), HomeSmart (7), United Real Estate (8), Fathom Realty (10), West USA Realty (17), My Home Group (24) and Samson Properties (25).

The new Billionaire’s Club players The Billionaire’s Club consists of the top U.S. real estate brokerage firms that closed at least one billion dollars’ worth of real estate in 2021, according to data from the 2022 RealTrends 500 brokerage rankings. Not only does this rarified group include more firms than ever before — 435, versus 347 last year — but this year’s rankings also feature many firms on the list for the first time.

Among the 88 new firms with the highest representation on The Billionaire’s Club, 46 are Keller Williams companies, 13 are with RE/MAX, six Coldwell Banker and three HomeSmart. Steven Barks, president and COO, Worth Clark Realty, a 100% commission model based in Missouri and in The Billionaire’s Club for the first time, said, “Last year was a stress test in expansion.” Both his firm’s transaction and agent count grew by 39%. “We learned a lot about the expansion process by entering two new states and opening nine new major markets last year,” he reveals.

Looking ahead, Barks predicts that inventory and closed sales will continue to trend down or stay relatively flat this year, making agent productivity a key metric to watch. Mauricio Umansky, CEO, The Agency, a Beverly Hills-based brokerage that submitted to the RealTrends 500 rankings for the first time, explains how his company expanded its global network while still maintaining its boutique, luxury approach.

The Agency expanded to more than 50 offices (including 11 new franchises opening in 2021), with just over 1,000 agents total. “My dream is to create a global company that still operates as a boutique,” he explains.

Explosive growth

“Probably the single biggest factor behind this jump [in Billionaire’s Club members] is the price increase in housing,” says Murray. “The median price of a home jumped 22-25% in two years. We’ve never seen that before.” Beyond the strong market, Murray describes a wave of consolidation that began two years ago. “Suddenly, the larger firms — and those striving to be larger — got larger faster than ever before,” he says.

He attributes this primarily to the major brokerages being more tech-savvy, using Zoom and Microsoft Teams to communicate with their agents to keep relationships personal and strong. These bigger firms also used their more advanced technology suites to rapidly complete virtual transactions, and — in the case of Keller Williams — recruit and train agents. Basically, “the brokerages with the better tech platforms performed better,” he explains.

While the larger firms got stronger, the middle of the market shrank. “More agents are gravitating toward firms that are either big and very strong or have a niche specialty,” summarizes Murray. Interestingly, some of the firms new to the list are in smaller markets.

For instance, “from 2019 through the end of 2021, business increased by about 230% for Four Seasons Sotheby’s in Vermont and New Hampshire,” notes Murray. Brokers in the Poconos in Pennsylvania and in Portland, Maine also saw record sales. “People have been coming out of big cities with money to buy a second home or they just packed up and moved,” he says.

Find the 2022 RealTrends 500 brokerage rankings and more analysis of insights from the report at RealTrends.com.

This article was first featured in the June HousingWire Magazine issue. To read the full issue, go here.

The post A record year for real estate brokerage firms appeared first on HousingWire.

Source link

The savagely unhealthy housing market is now a nightmare

The housing nightmare continues. The National Association of Realtors (NAR) reported that existing home sales for April came in at 5.41 million, down 3.4% from the previous month and 8.6% from last year. But, the savagely unhealthy data line was that home prices are up 14.8%.

Now that we are almost in July, we can safely say the premise that once mortgage rates hit 4%, the mass panic selling of American homeowners who need to get out at all costs, driving total inventory up in the millions, hasn’t happened. In truth, that was always a terrible premise.

My nightmare scenario, on the other hand, has happened and this is bad news for everyone. Total housing inventory has collapsed to all-time lows since 2020 and because this happened during the years 2020-2024, it created forced bidding and drove prices well above my 23% five-year home-price growth model in just two years.

Now that mortgage rates have risen, demand is getting hit, while we are still showing 14.8% home-price growth data. YIKES!

NAR Research: The median existing-home price for all housing types in May was $407,600, up 14.8% from May 2021 ($355,000), as prices increased in all regions. This marks 123 consecutive months of year-over-year increases, the longest-running streak on record.

Since the summer of 2020, I have truly believed that once the 10-year yield broke over 1.94% — which means 4% plus mortgage rates — the housing narrative would change. Home prices have escalated out of control since then, creating more rate move impact damage than it would have traditionally.

Whenever rates rise, we see it impact demand, and mortgage rates are at 6% and no longer at 3%. This is real demand destruction; prices and rates are a double whammy and why I have stressed we need to get inventory higher as soon as possible. The only way this happens is higher rates.

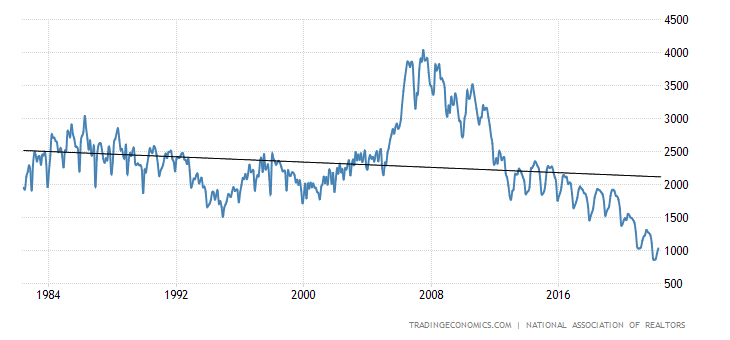

Since March of this year, housing demand has been falling more and more, but inventory is still below the 2010, 2013, 2016, and 2019 levels, which is a nightmare. Because housing is shelter, people don’t sell their homes to be homeless; it’s where they live. When you’re trying to sell your home, naturally, you’re a homebuyer too.

Rates have risen at the fastest pace ever, which makes houses more expensive, so in theory, some homebuyers can’t move. Home sellers with high equity aren’t as sensitive to higher rates because they bring a more significant down payment. Inventory skyrocketing back toward historical norms of 2 million to 2.5 million, which I would find to be the best thing ever for housing, is not happening this year.

NAR Total Inventory Data Back To 1982:

Getting to that historical inventory level will take more time. I have stressed that housing doesn’t move like the stock market. Homeowners are in a better financial position than stock traders, which is why the idea of mass panic selling doesn’t reflect housing reality. You don’t get a margin call at noon and are forced to sell your house in seconds. A real estate investor, on the other hand, doesn’t have that type of shelter relationship with a home, that a homeowner does.

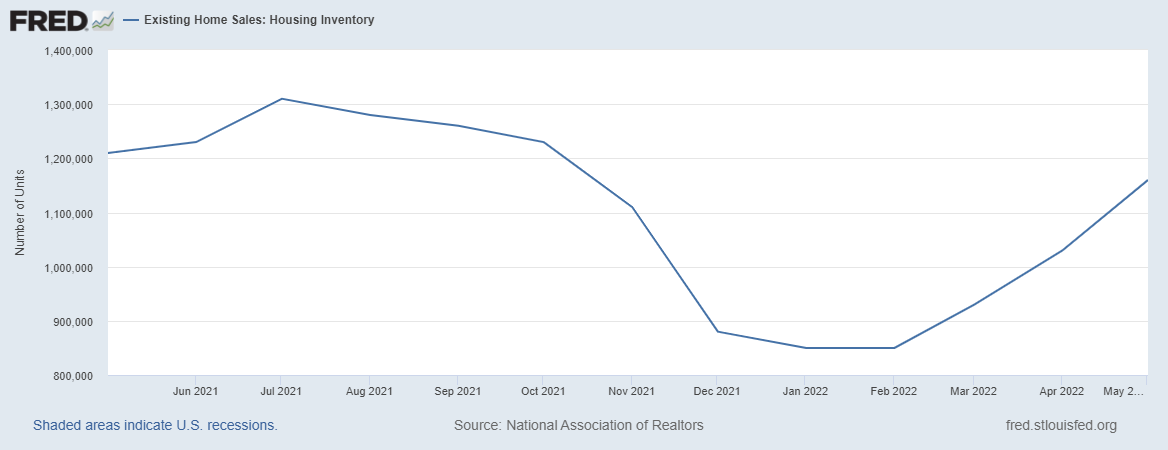

The goal is simple: We need total housing inventory to reach a range of 1.52-1.93 million to return to normal. Currently, we are at 1.16 million. Weakness in demand, time and the massive hit to affordability will get us there, but not at the speed people promoted last October.

Remember, inventory is very seasonal, and in the next few months, the seasonal inventory will fade, but before that happens we should still break over the previous year’s high. We should all be rooting for more inventory to end this madness.

Regarding the monthly supply for housing, we want this to get above four months as soon as possible. This would be a more traditional level for the housing market; we are making some progress here but not where we want to be yet.

NAR Monthly Supply Data Before This report

As a nice jump in monthly supply, we see the seasonal push in inventory tied to sales falling, which means the months of supply should increase. This is the best part of today’s existing home report.

NAR Research: Total housing inventory registered at the end of May was 1.16 units, an increase of 12.6% from April and a 4.1% decline from May 2021. Unsold inventory sits at a 2.6-month supply at the current sales pace, up from 2.2 months in April and 2.5 months in May 2021.

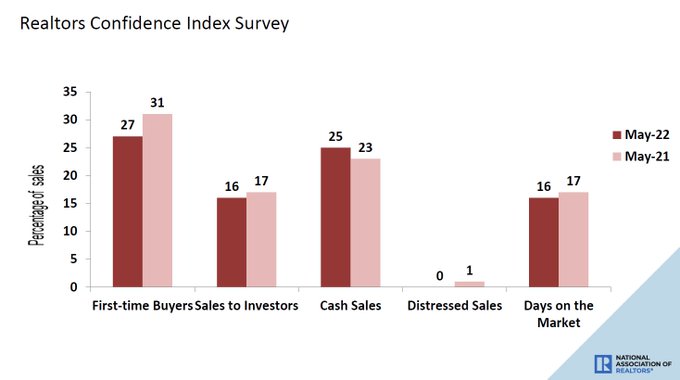

Additional bad news from the report is the data for days on the market. The frustrating data line during this savagely unhealthy housing market has been days on the market stubbornly staying at the teenager level. We want this to go much higher to get back to anything normal.

We recently paid a severe price on the home-price growth nationally, and as long as this data line is still at a teenager level, we will not gain the balance in the housing market we need. We need home prices to fall by 17% to return to the peak growth model for the years 2020-2024 — just to have a regular market.

NAR Research: First-time buyers were responsible for 27% of sales in May; Individual investors purchased 16% of homes; All-cash sales accounted for 25% of transactions; Distressed sales represented less than 1% of sales; Properties typically remained on the market for 16 days.

Regarding sales trends, this data line still lags the reality of the rising rate environment, so we have a lot more room to go lower in sales. When mortgage rates were between 4%-5%, it looked more like a traditional downturn in sales with higher rates, adjusting to the massive price gains since 2020.

However, at 6% plus mortgage rates, we are seeing some real demand destruction as the most significant homebuyer in America, mortgage buyers, get hit with a double whammy.

While the purchase application data four-week moving average trend hasn’t gotten to levels that I thought I would see with mortgage rates this high, which was between 18%-22% year-over-year declines, we are picking up the pace now, and that four-week average is down 16.75% year over year. Remember that starting in October this year, the comps will be much harder to work with, so year-over-year declines of 25% to 35% are in play then.

The savagely unhealthy housing market continues until we can get inventory levels to cool down pricing and hopefully reverse some of the extensive material home price damage in America post-2020. If you want more of a guide on knowing when we will see a material change in that discussion, I wrote this article recently to go over what you should be tracking. A good rule of thumb to consider is inventory between 1.52 – 1 .93 million and over four months of supply, and then we are back to a normal marketplace.

Just imagine how much more damage we would have had this year if mortgage rates hadn’t risen. I, for one, am in total agreement with Fed Chairmen Powell: we need a housing reset because nothing good happens with such savagely unhealthy home-price growth.

The post The savagely unhealthy housing market is now a nightmare appeared first on HousingWire.

Source link

How to Choose Your Real Estate Investment Strategy

This week’s question comes from Natalie on the Real Estate Rookie Facebook Group. Natalie is asking: How did you narrow your focus to determine your strategy? And how do you get good at analyzing real estate deals?

This is one of the most-asked questions we receive. When you’re starting as a rookie real estate investor, every strategy seems like a good one. You may hear a guest on the Real Estate Rookie show talk about wholesaling or flipping or short-term rentals. Before long, you’re already planning your next exciting purchase even if you had another one already in the works. This “shiny object syndrome” is common when getting started, and while it’s good to know about many different investing strategies, changing yours too often can lead you well off the path to financial freedom.

Here are some suggestions if you’re torn between strategies and need to up your analysis game:

If you want Ashley and Tony to answer a real estate question, you can post in the Real Estate Rookie Facebook Group! Or, call us at the Rookie Request Line (1-888-5-ROOKIE).

Ashley:

This is Real Estate Rookie episode 192. My name is Ashley Kehr and I am here with my co-host Tony Robinson.

Tony:

And welcome to the Real Estate Rookie Podcast, where every week, twice a week, we bring you the inspiration information and education you need to kickstart your real estate investing career. And I’m here with my lovely co-host, Ashley Kehr. What’s going on Ash? What’s new on the east coast these days?

Ashley:

Well, just a little update on my dead knee. I had surgery again on Tuesday, so two days ago where they had to go in and clean out all the scar tissue from my MCL. And yeah, so back into PT, I spend six months of physical therapy. I am best friends with my physical therapist, probably the person I talk to [inaudible 00:00:51].

Tony:

Knows all your deep dark secrets now.

Ashley:

Yeah. He’s also really starting to open up to me too. I heard about his sunburn and everything, so. But yeah, so I’ve just been the last couple days, just yesterday, just pretty much zoned out on pain pills and hung out. And today I held off on doing a pain pill, so that I could be a full body of mind. So, if I’m crying by the time we get to the end of our recording, that’s why.

Tony:

That’s why. All right. Well, hopefully your fingers crossed you’re at the end of this journey and you can get back to normal Ashley riding on bulls and hula hooping and all the stuff you did before your knee injury.

Ashley:

Yeah, if you guys last year at the BiggerPockets Conference, me and Tony got pretty wild out there, hula hooping, riding bulls, or maybe just me. But San Diego 2022 is where the BiggerPockets Conference is going to be held. So, makes sure you guys go to BiggerPockets.com/events and check it out and we’ll see you guys there. So, what’s new Tony?

Tony:

Yeah, we just got back from Cabo San Lucas actually. So, I know this episode comes out in June, but we just got past Memorial weekend. So, my wife Sarah and I it’s been like a busy, busy first half of the year for us and we just felt like we need a little bit of time. We’re not doing any work, we’re not doing anything. So, we got away. We went back to Cabo, which is where we got married and we stayed at that same hotel. We had dinner at the venue we got married at. So, it was cool to take some time and just kind of not think about work, but then literally as soon as we get back, on the drive home, the work starts again. We’re in the middle of raising money for our first hotel purchase.

And we’ve just learned a lot through that process. So, talking with all our investors and giving all the information that they need and figuring out all the stuff for the attorneys and the accountants and all that stuff. So, lots of lessons learned. So, I’ll be excited once we’re done with this to maybe do another reply where we can like break down all the stuff we learned going through this process because there’s definitely more to this than just buying like a regular single family house.

Ashley:

Yeah, that would be a great rookie reply to do, even if you’re not even close to doing a syndication deal, as a rookie just kind of figuring out if that’s something you’re interested in maybe in the future too. Be great to hear about that deal.

Tony:

Yeah, for sure. And just last thing before we move on like you said, even if you’re not focused on doing that right now, if your goal at some point is to scale, having at least a baseline understanding of syndications and how they work, I think will be something that you’ll want to start educating yourself on sooner rather than later. One of the very first books I read on real estate investing was about apartment syndication. Before I read all the books about flipping and house act and all these other stuff, it was apartment syndication because I knew we wanted to scale. So, there’s definitely some value.

Ashley:

Okay. So, let’s get to today’s question. This one is actually pulled out of the Real Estate Rookie Facebook group. So, if you have not joined that, make sure you guys join the group and answer all of the questions because if moderators will not let you in unless you agree to the rules and the conditions of being part of the group. So, this week’s question is from Natalie Ann and it’s a two parter. So, the first question is how did you narrow your focus to determine your strategy? I’m all over the place with purchasing a buy and hold and I’m also intrigued by doing a flip and having short term rentals. Tony, you want to start with that question?

Tony:

Yeah. So, Natalie super understandable position to be in. I think a lot of folks as they’re looking to get started in real estate investing, there’s this shiny object syndrome where you see someone having success in this niche, someone else killing in this other niche, and someone making tons of money in this other niche, you’re just like, man, I want to try it all. But I think one of the best decisions you can make as a new real estate investor is to specialize in one type of investing first. Now your question of how do you do that? There’s a couple things that or three things we’re going to look at, it’s your time, your desire, and your ability. So, if you look at those three things that should help kind of point you in the right direction. So, first is time. Some of these asset classes or types of investing are more time intensive than others, right? Like flipping houses and short term rentals are probably more work than a traditional long term rental.

So, think about the time availability that you have. So, time. Next is ability. So, what skill do you have and what type of investing does that skillset lend themselves to you? Do you know how to hang drywall and install countertops and do all that stuff? Then maybe flipping is a great place for you to start. Are you great on the phone and you can sell anything to anyone? Then maybe you start off as a wholesaler. Maybe you’re great at interior design and creating really cool experiences, so short term rentals might be good for you. So, think about where you naturally are skilled at and which one of those types of investing best relates to that. And then the second is your desire, right? So, we talked time, ability, and desires the last piece. So, even if you’re the world’s greatest salesperson, if you hate sales, then maybe wholesaling isn’t for you. So, you want to see where do those three things of time, desire, and ability all kind of intersect and that should help point you in the right direction.

Ashley:

Yeah, I think the biggest takeaway there is what are the resources available to you? Remember this is not a hobby. Yeah, you want to be passionate about what you are doing, but this isn’t a hobby where you’re just going to pick what you love. It’s also what resources do you have available to you that are going to make you successful? So, when I started, I started with buy and hold long term rentals because I was a property manager for long term rentals. I worked for an investor who did long term rentals. I knew what to do. I had access to his resources.

So, look around just like Tony said, maybe if you are into construction, you know how to rehab a property. Maybe BRRRR or flipping is meant for you if you can do those projects yourself or you can easily manage one of those projects. So, I think sit down and actually write out of a list. What are the resources you have available to you and then how do they apply to each strategy? And then also look at, okay, so maybe it’s close between two, which one are you passionate about? Which one do you get more excited about? And after I built my strong foundation of buying properties, I was very lost as to like, okay, where do I want to go now? Shiny object syndrome everywhere. I went to different conferences from self storage to mask your minds on commercial real estate and just like all over the place, not knowing exactly what I wanted to focus on.

And then I was talking to somebody about the different niches and what I was thinking of. And when I talked about campgrounds, they told me I just lit up. Like that was what I was passionate about, but I had gotten that strong foundation built of something that I could accomplish, those long term buying hold rentals, then I went off and really and pursuing what excites me, what I’m interested in. So, I think take it with a grain of salt. And even if you’re not going to do the thing you’re most passionate about and have fun with and love right off the bat, that’s okay. Find what you’re going to be most successful at first and build that foundation so that you can go off and play with what other type of real estate you want to.

Tony:

Yeah. Ashley, you bring up such a good point about building that foundation. And for us, when we started investing in short term rentals, we literally told ourselves or I told myself this, that I want to focus on this one asset class for the next five years because I want to become an expert in this one thing. And similar to you in terms of building that foundation because when you go really narrow and deep on one type of investing, the success you have I think compounds because all of your energy, all of your attention, all of your focus is on this one thing and getting really, really good at that one thing. So, people always ask me Tony, how did you scale so fast, and this that, and the other, and you’ve got this big portfolio short-term rentals in a relatively short period of time.

And it’s because that was the only thing that we were focused on, right? So, from the time that I woke up until the time that I went to sleep, the only thing that I was thinking about when it came to work was building our short term mental business. And when you have that kind of laser focus, it allows you to scale and grow a lot more quickly. So again, shiny object syndrome. I know it’s a real thing, but try and have that discipline to pick one thing and just go all and in at it.

Ashley:

So, the second question that Natalie had was how did you get good at analyzing deals? Practice, practice, practice, making mistakes. My first property I ever purchased, I forgot to include snow plowing. I live in Buffalo, New York, obviously the driveway needs to be snow plowed. And I forgot to add that in. And yeah, it didn’t kill the deal. It didn’t kill our cash flow, but it still wasn’t what I had projected it to be. And I had taken on a partner with that deal, so just from gaining experience from practicing analyzing deals and also looking at other people’s deals. So, looking at how they are analyzing it. So, joining Zoom calls, webinars where people go through and show you how they are analyzing deals, you’ll pick up so many tips and tricks and also just the biggest thing I can say is don’t fudge the numbers, verify, verify, verify.

So, if you want super accurate numbers and you have no idea what the insurance expense is going to be on a property because you’ve never bought in that market before, go to an insurance agent and ask them to estimate it. It is free. You don’t have to pay anything to have that done. So, verify as much information as you can to become really good at analyzing deals, then it will just be okay, I know this type of house in this area, the insurance per year is about $800 a month. So, I can use that as my number knowing it may be a little less or a little more than that, but that’s the average cost. So, definitely the experience is a good way to get good at analyzing deals.

Tony:

Yeah, and they say repetition is a mother of skill and I think that applies to analyzing deals completely. But I also think Natalie, that once you answer the first part of your question about which type of investment do you want to focus on, then getting good at analyzing becomes a lot easier. But if you’re trying to analyze multiple flips and then multiple long term, multiple short term, this wholesale deal, now you’re spread really thin on building that repetition. But if you answer question number one and say, “Hey, I’m going to do flips and that’s going to be the thing that I do.” Then you can say, “okay, every property that I look at, now I’m getting that repetition in of analyzing a deal as a flip.”

And once you’ve had that decision, it almost becomes like second nature. When I first started investing and we were buying in Shreveport, I knew the zip codes that I was looking at like the back of my hand, right? We were looking at 71104 and 71105. Then I could tell you what was a good price for properties in each of those zip codes, what they could rent for. When you really narrow in, it becomes easier to get better at analyzing those deals.

Ashley:

Yeah, you get a lot quicker once the things you can zoom through them, analyzing them, or even just looking at the property and be like, yeah, I know that this isn’t going to work for me. Even if I offer a $100,000 below asking price.

Tony:

Like Ashley, I’m sure you could in your neighborhoods where you invest, you probably wouldn’t even really have to analyze a deal per se right now to know whether or not you want to put an offer. And you could see, okay, I know like.. I mean, right? Like, am I right? Or do you like-

Ashley:

No, you’re exactly right. I’m going to look at a property tonight where someone texted it to you this morning and I was driving and I was going through my just thinking about it and I analyzed it in my head, be like, okay, this is what I think the rehab would be, this is what we-

Tony:

Totally, and same for us. We’re in Joshua Tree, like I can look at a listing and pretty much ballpark what we’re going to profit on that property as well. So, Natalie just the repetition is where you get really good at analyzing deals. And then I think the last thing is don’t be afraid to if you have other investors in your network, share your analysis with them as well, right? Or even posting in the Real Estate Rookie Facebook group. But I think if you can get some feedback from other investors that maybe gone down that path and like say that you’re a new investor in Buffalo, you post in the group and you don’t have snow plowing, there is one of your expenses. Ashley, one of the other experienced investors can point that out for you. So, repetition but then also trying to get some feedback from folks that have done it once or twice before.

Ashley:

Okay. Well, thank you guys so much for joining us for this week’s Rookie Reply. I’m Ashley at Wealth From Rentals and he’s Tony at Tony J Robinson on Instagram. And we’ll be back on Wednesday with a guest. See you guys next time.

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Check out our sponsor page!

Source link

Notarize lays off 25% of its workforce

Venture-backed remote online notarization firm Notarize laid off 110 employees, roughly 25% of its workforce, CEO Pat Kinsel announced in a Twitter thread this week.

This is the second time the seven-year-old, Boston-based firm has instituted layoffs. In 2019, Notarize made cuts after financing fell through on a funding round.

“We are exceptionally proud of the team we’ve built and they are leaving through no fault of their own – they are truly the best of the best. I will forever be grateful for the chance to work with them,” Kinsel wrote on Twitter. “The decision was mine. I take very seriously the commitments we’ve made to regulators, legislators, & industries who changed laws and policies to unlock the digital future we’re creating. I believe, Sequoia Capital, that this is a ‘crucible moment’ & have made the decision to put Notarize on a path to profitability w/ our current capital so we can provide our service in perpetuity.”

Notarize has posted and is updating a list of “Notarize Alumni” who are now looking for work. Eliminated positions include a corporate onboarding manager, a solutions engineer, members of the closing operations, sales, and customer success teams, as well as several others.

With the onset of the COVID-19 pandemic increasing the need and demand for RON services, and nearly all states and counties across the country approved emergency legislation legalizing RON, Notarize rapidly expanded. A super-hot housing market helped.

In March 2021, Notarize announced it had raised $130 million in its Series D funding round, which was led by Canapi Ventures. The funding round valued Notarize at $760 million, triple its valuation at the time of its $35 million Series C funding round a year prior, at the start of the pandemic.

“Our regulatory victories and partnerships have put the company in a fundamentally different position over the past two years, and our strategy must evolve,” Kinsel wrote in a statement. “We can no longer delay in addressing these issues. Additionally, the state of the economy and world events is creating a lot of uncertainty and putting significant pressure on businesses everywhere. While many of these factors propel Notarize’s business, they also change the company’s access to future investment and force us to re-evaluate what we can invest in and pursue.”

The firm is offering laid off employees severance packages and support services as they search for new positions.

The post Notarize lays off 25% of its workforce appeared first on HousingWire.

Source link

Housing starts data raises 5th recession red flag

I’m raising my fifth recession red flag today based on the Census Bureau‘s May housing starts data. Housing starts showed a miss on the estimate but positive revisions. Housing starts came in at 1.549 million and housing permits came in at 1.695 million.

Housing completion data did grow to 1.465 million and more of the backlogged homes are finished. However, considering Wednesday’s builder confidence index and mortgage rates over 6%, it’s time to raise the fifth recession red flag, since the builders will have a tough time growing housing starts with rates this high.

The data from the NAHB/Wells Fargo builder’s survey is always crucial because it is forward-looking, and it takes the reality of today’s market into the equation. However, the most current one doesn’t account for the higher rates we have today.

From NAHB:

From Census: Housing Permits Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,695,000. This is 7.0 percent below the revised April rate of 1,823,000, but is 0.2 percent above the May 2021 rate of 1,691,000. Single‐family authorizations in May were at a rate of 1,048,000; this is 5.5 percent below the revised April figure of 1,109,000. Authorizations of units in buildings with five units or more were at a rate of 592,000 in May

Housing permits aren’t collapsing by any means, but the permits data is backward-looking. As rates rise, this will impact the builders more as they try to find buyers for current homes in cancellation. Then, they need to manage what they can or can’t sell.

From Census: Housing Starts Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,549,000. This is 14.4 percent (±8.9 percent) below the revised April estimate of 1,810,000 and is 3.5 percent (±10.7 percent)* below the May 2021 rate of 1,605,000. Single‐family housing starts in May were at a rate of 1,051,000; this is 9.2 percent (±11.0 percent)* below the revised April figure of 1,157,000. The May rate for units in buildings with five units or more was 469,000.