Tech-focused real estate brokerage Radius, flush with $14 million in venture capital raised this past April, has launched a mortgage lending arm in California that it plans to roll out to additional markets sometime next year.

The new venture, a mortgage brokerage operation, is focused on the California market to start, where Radius already has a strong presence. The firm, based in San Francisco, plans to refine and demonstrate “proof of concept” for the new mortgage brokerage through the first quarter of 2023, according to Sam Kasle, Radius’ chief revenue officer, before expanding to additional states.

Kasle also confirmed that Radius has its eyes on eventually launching a mortgage banking unit, which would allow the firm to underwrite and offer its own loan products as well as keep more of the profits in-house. Mortgage brokerages, by contrast, serve as intermediaries between lenders and borrowers and work with multiple lenders, or mortgage banks, and are typically paid by the lenders after loans close.

“We work with eight or nine different lenders to make sure that we have a full product suite to provide to the end buyer [homebuyer via the new mortgage brokerage], whether they’re looking for jumbo loans or VA [Veterans Affairs] loans or bridge loans,” Kasle said. “We work with a number of different lenders, including the top ones like UWM [United Wholesale Mortgage] and loanDepot, but we also work with some boutique lenders to make sure that we have a full suite [of loan products] to meet our buyers’ [agents’ and their customers’] needs across the board.”

Radius is setting up the infrastructure and testing the viability of its new mortgage brokerage arm in California first, including the workflows, product flows, marketing and the general playbook. Kasle said “when the sun comes back out” on the now-dour economy, hopefully sometime in 2023, then Radius “will be prepped to take advantage of that.”

Kasle added that “it’s a pretty good bet” that the next states that will be the focus of the mortgage brokerage’s future expansion are Florida, Texas and Washington, “which are very attractive markets.”

The new mortgage brokerage is set up as a separate operation from Radius’ real estate brokerage, Kasle stressed, “so with the corporate structure, there is a clear delineation.” The mortgage brokerage services also will be presented to agents — both part of Radius’ network and beyond — as just one option among others, Kasle explained. He added that Radius will remain in compliance with the Real Estate Settlement Procedures Act (RESPA), which governs mortgage settlement procedures and costs as well as referral fees and prohibits kickbacks.

“If we [Radius’ mortgage brokerage] are presented through one of our brokerage agents to the end user [the homebuyer], we are presented along with a number of other options to make sure that the end user is making a fully informed decision about all their opportunities,” Kasle added.

Radius is a full service, fee-based brokerage that enables real estate professionals to keep 100% of their commissions while providing agents and their teams with the services and resources needed to grow their business. The brokerage focuses on serving real estate professionals by offering them access to integrated technology, including a web-based dashboard and services that include mentorship; legal and compliance support; recruiting help; financial services; vetted business leads; customer-relationship management; and marketing resources. The goal is to build and amplify the affiliated agents’ own brands, Kasle explained.

Fee-based membership and access to Radius services is open to both agents and brokerage teams. In addition, Radius also operates an 85,000-member social network, with features that are like those of other social media platforms — including, in Radius’ case, offering real estate agents access to a robust referral-exchange network.

Radius currently has some 300 fee-paying member agents, according to Kasle, including 34 teams, across the seven states where it is currently licensed to operate — California, Colorado, Georgia, Oregon, Texas, Florida and Washington.

Radius, along with announcing the new mortgage brokerage, also said it plans to expand its real estate brokerage operations to more states by year’s end — although it did not reveal which states are on the firm’s planning whiteboard. Kasle said Radius helped real estate professionals and their teams close some $400 million in sales in the first quarter of 2022. In addition, the company claims its social network has helped participating agents generate $25 billion in referral commissions over the last three years.

Kasle said Radius brought in $2.2 million in 2021. Expansion will come in iterations, he said.

“First we want to prove that we can pull this off [the mortgage brokerage] in California and that it makes sense from an operational regulatory and financial basis, and also that were providing the right products and services to our clients and our clients’ clients [homebuyers],” Kasle said. “If all things go well, then we would start looking into how to keep more of the of the revenue and moving from being just a [mortgage] broker to being correspondent lender or even an originator.”

Kasle said any move toward establishing a mortgage banking operation, however, is likely two or three years down the road at this point. He added that by launching a mortgage banking operation and underwriting its own loans, Radius would be able to offer “even better, more innovative financing solutions and also keep more of the profits.”

Radius’ new mortgage brokerage arm will be headed by Michael Bardales, director of mortgage and a 20-year veteran of California lending. Silvia Grace Davis, a 17-year real estate veteran and top lending officer in the state, will serve as senior lending manager.

Radius, funded in 2015, is backed by an impressive group of investors and is fresh off raising $14 million in Series A venture capital funding that will help propel the firm’s expansion plans. Among its investors are Trulia founder and former CEO Peter Flint; Roofstock founder and CEO Gary Beasley; former Zillow CEO and co-founder Spencer Rascoff; Crosscut Ventures, led by co-founder and Managing Director Bret Brewe; and Sierra Ventures, led by Managing Director Tim Guleri.

“We’re following the tried-and-true VC [venture capital] path,” Kasle said. That path – if successful – normally results in an eventual sale of a company or a public offering of stock.

“Our internal goals are looking to what is needed to raise a Round B [venture capital investment],” Kasle said. “But because of the current [economic] macro-environment, we have looked at everything top to bottom at the company with a fine-tooth comb and are now only leaning into what’s essential.

“We have battened down the hatches to a certain extent, while continuing to grow, and are really setting our sights on a Round B [fundraising effort] next year.”

Kasle recognizes that Radius is going against the grain to an extent in planning a mortgage-brokerage expansion during a down-cycle in the housing market — marked by rising rates and declining mortgage originations, especially refinancing. He stressed, however, that “you don’t get to choose the weather,” referring to business operations and the current economic climate.

Radius does have a full tank of gas due to its venture capital backing and says it is positioning itself to take advantage of the market conditions — as opposed to being confined by them.

“We’re continuing to hire full-time staff, in both the [real estate] brokerage and the mortgage [arm],” Kasle said, adding that Radius currently employs about 80 people. “We’re pursuing more thoughtful growth, rather than all guns blazing at once.

“For Radius, the markets we’re focused on [for future product expansions] are in Washington, California, Florida, and in Texas. If there is a pullback [of the economy, a recession], that pullback is going to hit those areas less than then it could potentially hit others, which will give us a clear path to growing through a downturn.”

The real estate industry is “highly fractionalized,” Kasle added, so if a Radius were to achieve “10% penetration into 20 major metros,” it would easily become “a multi-billion company.”

“And the way we have set up our strategy, it can facilitate that level of growth,” he concluded.

The post Real estate brokerage Radius unveils mortgage-lending arm appeared first on HousingWire.

Source link

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

Banking agencies get deluge of feedback on CRA proposal

Stakeholders on all sides of the issues sounded off on the proposed changes to the federal redlining statute in comments to the banking agencies marshaling the changes.

Some of the nearly 360 comments came in late on Thursday, a day before the deadline imposed by the Office of the Comptroller of the Currency, the Federal Reserve and the Federal Deposit Insurance Corporation. Those agencies oversee banks, and are tasked with ensuring banks do not redline, by enforcing the Community Reinvestment Act.

In the days before the deadline, trade associations preparing their comments were still “deep in the weeds,” scrambling to get their members to agree on details big and small.

In theory, agencies have to read the comments and respond publicly, especially to issues raised by multiple commenters. The agencies don’t have to heed criticisms, however.

Much of the feedback that trade associations, fair housing groups and community advocacy groups submitted had common threads. Numerous organizations criticized the agencies for not proposing to grade banks based on data about their minority lending.

The nearly 50-year old statute curiously never included language about race, although it was intended to address redlining. The National Community Reinvestment Coalition has argued that putting race in the implementation of the law would not violate the constitution.

“But regulators are wary of going anywhere near that line,” said Jesse Van Tol, CEO of NCRC.

“Above all, we are extremely disappointed to see the lack of the explicit consideration of lending by race in a lender’s CRA rating,” wrote the St. Louis Equal Housing and Community Reinvestment Alliance.

Some think that the proposed rule already addresses concerns that including race more explicitly would draw a legal challenge. The National Housing Conference, a trade association that represents mortgage lenders, was one of the few industry stakeholders that suggested the banking agencies push the boundaries a bit more.

“NHC recommends that the CRA regulation develop a process for collecting and reporting baseline data on investment and lending to people of all races,” wrote David Dworkin, the National Housing Confeence’s CEO. “This same data reporting should be used in assessing performance and establishing performance context in CRA evaluations as well.”

While the regulators did not propose using data on race in community reinvestment exams, the banking agencies floated the idea of giving community development credit for special purpose credit programs. Among commenters, there was broad support for that idea, including from the Urban Institute, fair housing groups, and numerous trade associations, including the Mortgage Bankers Association and the Housing Policy Council.

In its letter, the MBA said it was supportive of the banking agencies giving credit for special purpose credit programs.

The Housing Policy Council, which represents large bank and nonbank mortgage lenders and servicers, recommended that the agencies consider special purpose credit programs “favorably” in community reinvestment exams.

“Such a specific positive reference to SPCPs in the rule would likely encourage more banks to utilize SPCPs – a result that would benefit more LMI borrowers and neighborhoods,” wrote Ed DeMarco, president of the Housing Policy Council. Doing so would dovetail with other efforts by regulators to encourage mortgage lenders to make targeted lending programs.

The Housing Policy Council also suggested some tweaks to how CRA credit is given for loan purchases from Ginnie Mae pools, to avoid discouraging lender participation in programs backed by those securities. The trade association recommended that the banking agencies allow a loan purchased from a Ginnie Mae pool to qualify as a loan to a low- or moderate-income borrower, as long as the borrower was low- or moderate-income at the time of origination.

The MBA also recommended the banking agencies weigh retail and community development tests equally in CRA exams, rather than the proposed weights of 60% and 40%, respectively.

Multiple commenters, including HPC and MBA, asked the banking agencies to allow more time to adjust to the revisions. The proposal would give banks a year to implement the changes.

Comments received by the agencies were not limited to those representing banks who, in theory, must pass CRA exams in order to be allowed by the regulators to grow larger. (That rarely, if ever, happens.)

Those representing nonbanks also took the opportunity to weigh in, amid the proliferation of CRA-like requirements for nonbanks at the state level. The expansion of those regulations stems, in part, from support from top Federal Reserve officials.

In 2021, Fed Chair Jerome Powell said he supported subjecting nonbanks to CRA requirements, saying, “Like activities should have like regulation.”

The Community Home Lenders Association, which represents small and mid-size nonbank mortgage lenders, in its letter to the banking agencies, said that CRA requirements for nonbanks were “inappropriate.”

The CHLA pointed out that most loans that nonbanks make are backed by federal agencies, and subject to their underwriting guidelines, loan pricing and upfront fees for borrowers. Nonbanks make up the greater share of Federal Housing Administration mortgages, which are the mortgage of choice for first-time homebuyers and borrowers of color.

The trade group also argued that nonbanks, which are not subject to the federal CRA, continue to outperform banks when it comes to minority borrowing. Their letter cites findings from the Urban Institute, that for nonbank originations, median credit scores are consistently lower, and median debt-to-income ratios are consistently higher than those of banks.

But the Urban Institute also found that, whether subject to the CRA or not, mortgage lenders overall are not keeping up with even current levels of homeownership in majority-minority areas.

In its letter to the banking agencies, the Urban Institute found that predominantly minority neighborhoods have a 10% homeownership share, but receive only 8.1% of mortgages and 5.9% of bank loans.

“In all cases, overall lending is lower than the current homeowner share, and nonbanks consistently outperform banks,” the Urban Institute wrote.

The post Banking agencies get deluge of feedback on CRA proposal appeared first on HousingWire.

Source link

Sixth recession red flag raised, despite strong jobs report

What a crazy day for my economic model! On the same day, the Bureau of Labor Statistics (BLS) revealed that we’ve recovered all the jobs lost to COVID-19 and I am raising my sixth recession red flag.

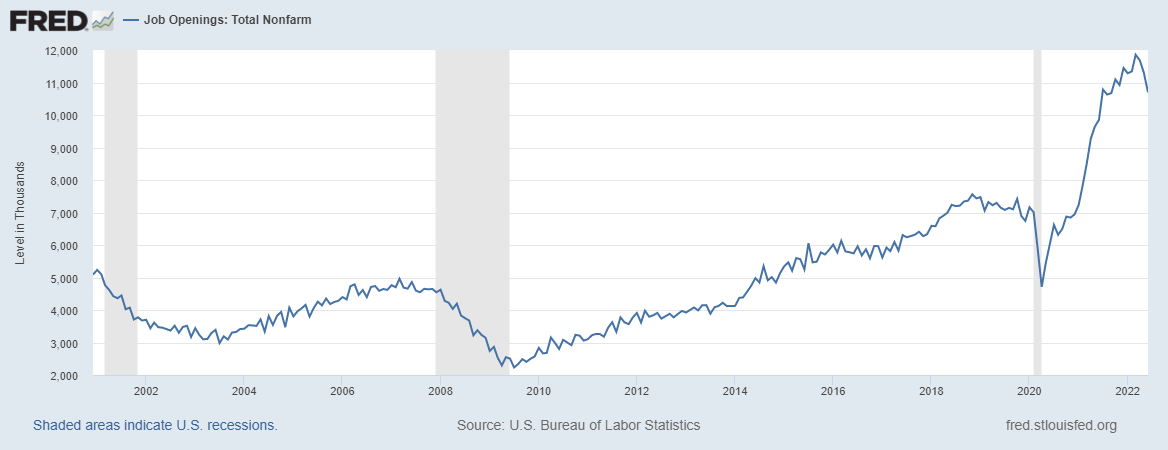

When I wrote the America is back recovery model on April 7, 2020, and then retired it on Dec. 9, 2020, I knew one data line would lag the most: jobs! I have talked about how job openings would move toward 10 million and that we should get all the jobs we lost to COVID-19 back by September 2022. Well, I was off by two months: Today, the BLS reported that 528,000 jobs were created with positive revisions of 28,000, which gave us just enough to pass the February 2020 levels.

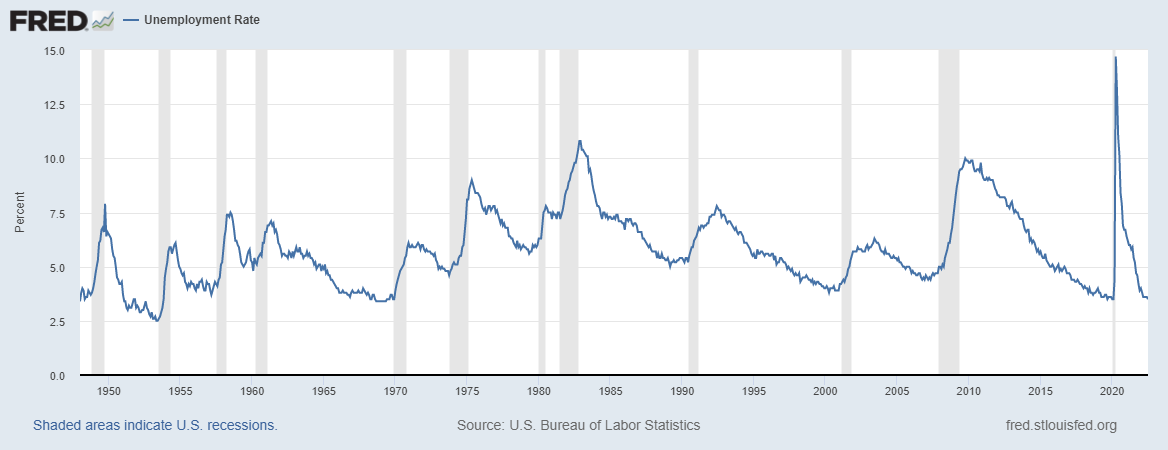

From BLS: Total nonfarm payroll employment rose by 528,000 in July, and the unemployment rate edged down to 3.5 percent, the U.S. Bureau of Labor Statistics reported today. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, and health care. Both total nonfarm employment and the unemployment rate have returned to their February 2020 pre-pandemic levels.

Feb 2020: 152,504,000

July 2022: 152,536,000

The big job numbers we have seen recently are tied to the decline in the job openings data, which lags also, but we do see a decrease in this data line as it appears for now that the job openings data has peaked in this cycle. It recently went from 11.3 million to 10.7 million, and the recent peak was near 11.9 million.

We have seen increases in jobless claims and slighter increases in continuing claims. However, nothing too drastic yet. Again, at this stage of the economic cycle you should focus on the rate of change data.

A tighter labor market is a good thing; this means people with less educational backgrounds can get employed since we have many jobs that don’t require a college education. The unemployment rate did tick up for those with less than a high school diploma in this report.

Here is a breakdown of the unemployment rate and educational attainment for those 25 years and older:

—Less than a high school diploma: 5.9%.

—High school graduate and no college: 3.6%

—Some college or associate degree: 2.8%

—Bachelor’s degree and higher: 2.0%

Below is a breakdown of the jobs created. Every sector created jobs; even the government created jobs. All this was just working our way back from the losses to COVID-19, which I knew would take a bit longer than some people would have thought with the economic data we had in 2021.

Now that we have regained all the jobs lost to COVID-19, what is next?

Hopefully, people know that we weren’t in a recession in the first six months of the year. When you’re in a recession, you don’t create jobs, have positive industrial production data, or positive consumer data in GDP. We had some funky trade and inventory data that tilted the GDP negatively, but the traditional data lines that go negative in a recession are just not there yet.

Even so, because some of the more current data is trending negatively, I am raising my sixth recession red flag today. Allow me to present my case.

Recession red flag watch

Where are we in the economic cycle? I’ve already raised five of my six recession red flags, but until they are all up, I don’t use the word recession.

Let’s review those red flags in order, as my model is based on an economic progression model:

1. The unemployment rate falls down to a level where we start to talk about Federal Reserve rate hikes because the economy doesn’t need as much stimulus for employment gains. For this recovery, the unemployment rate getting to 4% is the level where I raised my first recession red flag. This just means that the recovery is more mature than the earlier stages of the unemployment rate falling. Today it’s currently at 3.5%.

2. The Federal Reserve starts to raise rates. The Federal Reserve started Its rate hike process this year, to start fighting inflation and has been more aggressive recently. This shows that the expansion is longer and that the Federal Reserve is in a mood to tighten policy rather than make it more accommodative.

3. The inverted yield curve. This is more of a market-driven bond yield red flag. I had been on an inverted yield curve watch since Thanksgiving of 2021. This is when the two-year yield and 10-year yield slap high fives and say hi to each other. It’s another progression red flag, reflecting that we are in a more mature stage of the economy. Traditionally you see an inverted yield curve before every recession.

4. Find the overheating economic sector where demand can’t be sustained. Once that demand comes back to normal, people will be laid off. We see this in the durable goods data. A few companies are laying people off or putting into place a hiring freeze.

5. New home sales, housing starts, and permits fall into a recession. Once mortgage rates rise, the new home sales sector does get hit harder than the existing home sales market. The homebuilder confidence index is falling noticeably, and while we never had the housing build-up in credit and sales that we saw in 2005, the builders will slow housing production down with higher rates. I raised my fifth recession red flag in June.

Today, I am raising the last recession red flag, which considers the Leading Economic Index (LEI). This week I presented my six recession red flag model to the Committee For Economic Development of The Conference Board (CED) — the committee that created the leading economic index. “Since its inception in 1942, CED has addressed national priorities to promote sustained economic growth and development to benefit all Americans. CED’s work in those first few years led to great policy accomplishments. One is the Marshall Plan, the economic development program that helped rebuild Europe and maintain peace, the Bretton Woods Agreement that established the new global financial system, and the World Bank and International Monetary Fund.”

6. Leading economic index declines four to six months before a recession. Historically, the LEI fades into every recession, outside a one-time huge economic shock like COVID-19. To raise this flag I needed four to six months of decline, which we saw recently. However, knowing the components of this data line, I know this data line has legs to keep going lower.

As you can see, the LEI doesn’t have a good history of reversing course when the downtrend is in place. We have had times in the mid-1990s when we saw a slowdown but didn’t get a recession.

With that in mind, how might this reverse? Well, the two easy answers are this:

1. Rates fall to get the housing sector back in line.

2. Growth rate of inflation falls, the Fed stops hiking rates and reverses course, as they did in 2018.

Most Americans are working, and job openings are still high enough that people can find work if they need to. However, if you’re asking me how we could see a reversal after all six flags are up, this is it.

So how do I square raising the last recession red flag when we had such a strong job report today? Well, the model isn’t designed to work during a recession. It’s intended to show the progression of an expansion into a recession. As you can see below, this data line fell in 2006, and we were still creating jobs in 2006 and 2007.

During the housing bubble, we had a clear over-investment, and that was in the housing market, so the recession red flag model was evident before the recession. Only three of my recession red flags were up before the COVID-19 crisis; in fact, we were still in expansionary mode if COVID-19 hadn’t occurred.

I can’t describe it any other way: things have been crazy since April 2020. All of us that track economic data have had to adjust to the highest velocity of data movement in our lifetime and have had to make COVID-19 adjustments all the time.

At some point in the future, things will get back to normal. I’ve presented you with my data lines to show we weren’t in a recession the first six months of the year, but the economic data is getting softer and softer. I will be looking for weaker data lines getting to the point where we actually see real recessionary data, which means jobs are being lost monthly, production data falls and companies make adjustments to their business model with greater force.

I’ll take each data point one day at a time and try to make sense of it. Remember, economics done right should be very boring, and always, be the detective, not the troll.

The post Sixth recession red flag raised, despite strong jobs report appeared first on HousingWire.

Source link

Black Knight reports slowing organic growth

Ahead of a potential merger with rival Intercontinental Exchange Inc., mortgage tech giant Black Knight reported slimmer profits in the second quarter and slowing organic growth.

The company’s profit dropped nearly 90% from the previous quarter’s $364.6 million due to a gain on the investment in credit report services company Dun & Bradstreet Holdings, according to the earnings report released Thursday. The firm’s net earnings rose 1.5% from $39.7 million from the same period in 2021.

Black Knight’s revenue in the second quarter climbed to $394.5 million, a 9% increase from the same period in 2021. But organic revenue growth slowed down to 7% from April to June, in line with the firm’s expectations of a downturn in the mortgage industry. Black Knight CFO Kirk projected late last year that organic growth would likely fall between 7% and 8% in 2022 as lower mortgage origination volume chills demand for the company’s data and analytics products..

Revenue for software solutions came in at $339.4 million, which was 86% of the total revenue in the second quarter. Operating margin for that segment declined slightly to 45.6% from 2021’s second quarter of 46.4%. The remaining revenue of $55.1 million came from data and analytics, with an operating margin of 24.9% compared to 30.6% in the same period in 2021.

“Our core performance in the second quarter was consistent with our expectations and highlights the ongoing strength and resilience of our business as we continued to expand and extend our relationships with existing clients through cross-sell and contract renewals, win new clients and deliver innovative new solutions,” said Anthony Jabbour, executive chairman of Black Knight.

Black Knight is preparing to be acquired by Intercontinental Exchange Inc. (ICE), assuming regulators don’t stand in their way. In May, ICE said it entered into a definitive agreement to acquire Black Knight for $13.1 billion, which valued Black Knight at $85 per share.

The obstacles to a digital mortgage are changing – Here’s what lenders need to know

HousingWire recently spoke with Armando Falcon, CEO of Falcon Capital Advisors, about the continued growth of digital mortgage solutions such as eClosings and what lenders can do to implement eMortgages into their business models.

Presented by: Falcon Capital Advisors

Two challenges quickly emerged following the announcement of the deal between the two giant suppliers of mortgage loan origination software – whether ICE could convince regulators that the acquisition of Black Knight will not harm competition in the mortgage tech solutions market and whether ICE could get approval from Black Knight’s shareholders.

According to a 10-Q filing with the SEC on Thursday, ICE said the transaction is expected to close in the first half of 2023 following the receipt of regulatory approvals and the satisfaction of customary closing conditions.

On July 22, ICE filed an amended proxy statement/ prospectus with the SEC, which is under review by the commission. According to the filing, the board of directors of Black Knight and ICE unanimously approved an agreement for ICE’s acquisition of Black Knight.

“ICE is expected to issue about 22.2 million shares of ICE common stock in the aggregate in the merger,” the filing said.

Because of the proposed transaction Black Knight said it suspended providing forward-looking guidance and would not host a conference call related to its second quarter earnings release.

Black Knight’s stock which was trading at $65.32 around 1 p.m. on Thursday, up from the previous close of $64.17

The post Black Knight reports slowing organic growth appeared first on HousingWire.

Source link

Freedom Mortgage agrees to sell RoundPoint Mortgage Servicing

Two years after acquiring RoundPoint Mortgage Servicing, Freedom Mortgage Corp. has inked a deal to sell the nonbank mortgage servicer to Matrix Financial Services Corp., another leading mortgage servicer and a wholly owned subsidiary of real estate investment trust Two Harbors Investment Corp.

The acquisition is an all-stock deal, with Matrix agreeing to pay a preliminary price equal to the tangible net book value of RoundPoint, plus a $10.5 million premium. Matrix also has agreed to begin using RoundPoint as a servicer prior to the deal’s closing date “and expects to begin transferring loans to RoundPoint in the fourth quarter of this year,” the Two Harbors announcement of the acquisition states.

“Upon closing, all servicing licenses and capabilities will remain with RoundPoint, and RoundPoint will become a wholly owned subsidiary of Matrix,” the deal announcement states.

The acquisition is slated to close in 2023, subject to customary closing conditions and regulatory approvals. Once finalized, the acquisition of RoundPoint is expected to provide Two Harbors with annual annual pre-tax earnings of about $20 million, according to Two Harbors. It also will provide greater control over the Two Harbors’ existing mortgage servicing rights (MSR) portfolio via self-servicing as well as long-term opportunities to expand RoundPoint’s existing operations and ability to pursue additional business.

“Our acquisition of RoundPoint [founded in 2007] marks an evolution in our MSR strategy, which will deliver long-term financial and strategic benefits to Two Harbors,” Bill Greenberg, Two Harbors’ president, CEO and chief investment officer said. “The operational efficiencies and revenue opportunities it presents will add value for shareholders while deepening our involvement in the industry.”

Freedom Mortgage purchased RoundPoint in 2020, which at the time serviced and subserviced some $75 billion in mortgages based on unpaid principal balance (UPB) — most of those agency loans. The acquisition increased Freedom’s combined owned and subserviced MSR portfolio to $310 billion, Freedom Mortgage announced at the time.

As of the end of June, according to mortgage-analytics firm Recursion, Freedom Mortgage ranked as the sixth largest servicer of all-agency loans, with a 4.6% market share and a $380.2 billion MSR portfolio based on the UPB of loans serviced. Matrix Financial Services Corp., ranked 10th, with a 2.7% market share and a $221.1 billion MSR portfolio based on the UPB of agency loans serviced as of the end of the second quarter.

The entire all-agency MSR market, based on the total UPB of loans serviced, is worth some $8.2 trillion.

The deal with Matrix resulted in Roundpoint closing some sales operations and laying off employees. The company is closing an office in Long Island, according to a Worker Adjustment and Retraining Notification (WARN) notice filed with the New York State Department of Labor.

According to the notice, the business will be permanently closing, affecting 71 employees, with the separations beginning on October 27, or the 14 days commencing on that date. Zenobia Littlejohn, vice president of human resources, said in the notice the reason for dislocation is “economic.”

Flavia Furlan Nunes contributed reporting to this story.

The post Freedom Mortgage agrees to sell RoundPoint Mortgage Servicing appeared first on HousingWire.

Source link

Real estate brokerage Radius unveils mortgage-lending arm

Tech-focused real estate brokerage Radius, flush with $14 million in venture capital raised this past April, has launched a mortgage lending arm in California that it plans to roll out to additional markets sometime next year.

The new venture, a mortgage brokerage operation, is focused on the California market to start, where Radius already has a strong presence. The firm, based in San Francisco, plans to refine and demonstrate “proof of concept” for the new mortgage brokerage through the first quarter of 2023, according to Sam Kasle, Radius’ chief revenue officer, before expanding to additional states.

Kasle also confirmed that Radius has its eyes on eventually launching a mortgage banking unit, which would allow the firm to underwrite and offer its own loan products as well as keep more of the profits in-house. Mortgage brokerages, by contrast, serve as intermediaries between lenders and borrowers and work with multiple lenders, or mortgage banks, and are typically paid by the lenders after loans close.

“We work with eight or nine different lenders to make sure that we have a full product suite to provide to the end buyer [homebuyer via the new mortgage brokerage], whether they’re looking for jumbo loans or VA [Veterans Affairs] loans or bridge loans,” Kasle said. “We work with a number of different lenders, including the top ones like UWM [United Wholesale Mortgage] and loanDepot, but we also work with some boutique lenders to make sure that we have a full suite [of loan products] to meet our buyers’ [agents’ and their customers’] needs across the board.”

Radius is setting up the infrastructure and testing the viability of its new mortgage brokerage arm in California first, including the workflows, product flows, marketing and the general playbook. Kasle said “when the sun comes back out” on the now-dour economy, hopefully sometime in 2023, then Radius “will be prepped to take advantage of that.”

Kasle added that “it’s a pretty good bet” that the next states that will be the focus of the mortgage brokerage’s future expansion are Florida, Texas and Washington, “which are very attractive markets.”

The new mortgage brokerage is set up as a separate operation from Radius’ real estate brokerage, Kasle stressed, “so with the corporate structure, there is a clear delineation.” The mortgage brokerage services also will be presented to agents — both part of Radius’ network and beyond — as just one option among others, Kasle explained. He added that Radius will remain in compliance with the Real Estate Settlement Procedures Act (RESPA), which governs mortgage settlement procedures and costs as well as referral fees and prohibits kickbacks.

“If we [Radius’ mortgage brokerage] are presented through one of our brokerage agents to the end user [the homebuyer], we are presented along with a number of other options to make sure that the end user is making a fully informed decision about all their opportunities,” Kasle added.

Radius is a full service, fee-based brokerage that enables real estate professionals to keep 100% of their commissions while providing agents and their teams with the services and resources needed to grow their business. The brokerage focuses on serving real estate professionals by offering them access to integrated technology, including a web-based dashboard and services that include mentorship; legal and compliance support; recruiting help; financial services; vetted business leads; customer-relationship management; and marketing resources. The goal is to build and amplify the affiliated agents’ own brands, Kasle explained.

Fee-based membership and access to Radius services is open to both agents and brokerage teams. In addition, Radius also operates an 85,000-member social network, with features that are like those of other social media platforms — including, in Radius’ case, offering real estate agents access to a robust referral-exchange network.

Radius currently has some 300 fee-paying member agents, according to Kasle, including 34 teams, across the seven states where it is currently licensed to operate — California, Colorado, Georgia, Oregon, Texas, Florida and Washington.

Radius, along with announcing the new mortgage brokerage, also said it plans to expand its real estate brokerage operations to more states by year’s end — although it did not reveal which states are on the firm’s planning whiteboard. Kasle said Radius helped real estate professionals and their teams close some $400 million in sales in the first quarter of 2022. In addition, the company claims its social network has helped participating agents generate $25 billion in referral commissions over the last three years.

Kasle said Radius brought in $2.2 million in 2021. Expansion will come in iterations, he said.

“First we want to prove that we can pull this off [the mortgage brokerage] in California and that it makes sense from an operational regulatory and financial basis, and also that were providing the right products and services to our clients and our clients’ clients [homebuyers],” Kasle said. “If all things go well, then we would start looking into how to keep more of the of the revenue and moving from being just a [mortgage] broker to being correspondent lender or even an originator.”

Kasle said any move toward establishing a mortgage banking operation, however, is likely two or three years down the road at this point. He added that by launching a mortgage banking operation and underwriting its own loans, Radius would be able to offer “even better, more innovative financing solutions and also keep more of the profits.”

Radius’ new mortgage brokerage arm will be headed by Michael Bardales, director of mortgage and a 20-year veteran of California lending. Silvia Grace Davis, a 17-year real estate veteran and top lending officer in the state, will serve as senior lending manager.

Radius, funded in 2015, is backed by an impressive group of investors and is fresh off raising $14 million in Series A venture capital funding that will help propel the firm’s expansion plans. Among its investors are Trulia founder and former CEO Peter Flint; Roofstock founder and CEO Gary Beasley; former Zillow CEO and co-founder Spencer Rascoff; Crosscut Ventures, led by co-founder and Managing Director Bret Brewe; and Sierra Ventures, led by Managing Director Tim Guleri.

“We’re following the tried-and-true VC [venture capital] path,” Kasle said. That path – if successful – normally results in an eventual sale of a company or a public offering of stock.

“Our internal goals are looking to what is needed to raise a Round B [venture capital investment],” Kasle said. “But because of the current [economic] macro-environment, we have looked at everything top to bottom at the company with a fine-tooth comb and are now only leaning into what’s essential.

“We have battened down the hatches to a certain extent, while continuing to grow, and are really setting our sights on a Round B [fundraising effort] next year.”

Kasle recognizes that Radius is going against the grain to an extent in planning a mortgage-brokerage expansion during a down-cycle in the housing market — marked by rising rates and declining mortgage originations, especially refinancing. He stressed, however, that “you don’t get to choose the weather,” referring to business operations and the current economic climate.

Radius does have a full tank of gas due to its venture capital backing and says it is positioning itself to take advantage of the market conditions — as opposed to being confined by them.

“We’re continuing to hire full-time staff, in both the [real estate] brokerage and the mortgage [arm],” Kasle said, adding that Radius currently employs about 80 people. “We’re pursuing more thoughtful growth, rather than all guns blazing at once.

“For Radius, the markets we’re focused on [for future product expansions] are in Washington, California, Florida, and in Texas. If there is a pullback [of the economy, a recession], that pullback is going to hit those areas less than then it could potentially hit others, which will give us a clear path to growing through a downturn.”

The real estate industry is “highly fractionalized,” Kasle added, so if a Radius were to achieve “10% penetration into 20 major metros,” it would easily become “a multi-billion company.”

“And the way we have set up our strategy, it can facilitate that level of growth,” he concluded.

The post Real estate brokerage Radius unveils mortgage-lending arm appeared first on HousingWire.

Source link

Class Valuation acquires AMC AppraisalTek

National appraisal management company Class Valuation is extending its reach, with the acquisition of yet another appraisal management company.

The AMC today announced the acquisition of AppraisalTek, a Chandler, Arizona-based AMC, for an undisclosed sum. Class Valuation said it would bring on AppraisalTek’s 75 full-time employees.

AppraisalTek was founded in 2003 by Robert Oglesby. According to a Class Valuation press release, AppraisalTek operates in all 50 states, as well as the District of Columbia, and has a “significant staff appraiser impression” in Arizona.

The acquisition is Class Valuation’s fifth in recent years.

In 2018, Class Valuation, then Class Appraisal, acquired reverse-mortgage focused AMC Landmark Network. The following year, it acquired AMC Janus Valuation & Compliance.

In 2021, operating as Class Valuation, the company acquired Pendo Management, and in February, it added Metro-West. At the time, Class Valuation claimed Metro-West was the “largest independent residential appraisal firm in the country,” and had appraisers in 80 U.S. metros.

Sponsored Video

It’s not clear how large Class Valuation is after this latest acquisition. Class Valuation did not return a request to comment.

The fragmented and decentralized appraisal management company sector is ripe for consolidation, amid increased regulatory pressures on appraisers and potentially disruptive technological changes.

Earlier this year, Arcapita, a Bahraini investment firm acquired a stake in Nationwide Property and Appraisal Services for an undisclosed price, giving them access to its 15,000 licensed appraisers. Arcapita said at the time that with “appraisals being a regulatory requirement for mortgages for new home purchases, refinancing, and foreclosures, the $7.5 billion real estate appraisal services market has cumulatively grown by 32% since 2008.”

AMCs, potentially even more so than firms who do business with the government-sponsored enterprises, are heavily influenced by changes to conventional appraisal standards.

One such change is the growing acceptance by the GSEs and the VA of desktop appraisals and hybrid, or bifurcated, appraisals. Hybrid appraisals rely on third-party data collection, while desktop appraisals require photos and a floor plan. Both are alternatives to the traditional appraisal, and potentially reduce the amount of time an appraiser spends driving to and performing an on-site inspection.

Expected savings on appraisals — as well as faster turnaround times and a relief valve for spiking appraiser demand and a declining workforce — has some AMCs salivating.

But not all say that desktop appraisals should immediately usher in lower fees, including Oglesby, the CEO of AppraisalTek, now absorbed into Class Valuation.

In a public LinkedIn post earlier this year, Oglesby said, of desktop appraisals, that the industry should “not expect lower fees.”

Ogleby said in an interview that he believes fees will ultimately come down as acceptance of desktop appraisals becomes more widespread. He said he has seen greater adoption of desktop appraisals by appraisers than when the option was first announced, although lower appraisal volume has left appraisers have fewer choices.

The model of “boutique” AMCs like AppraisalTek are under pressure to bear the cost of adopting new technology, Oglesby said. That technology is not just expected to eventually reduce costs, he added, but could also mitigate appraisal bias.

“The tech involved in those modernized products prevents human to human interaction,” Oglesby said. “The downside to that is that we know there are credible techniques and good practices, and those human interviews are important, because the elements that effect value can vary greatly.”

The post Class Valuation acquires AMC AppraisalTek appeared first on HousingWire.

Source link

Can lower mortgage rates stop the housing recession?

To say that mortgage rates have been on a wild Mr. Toad’s ride in 2022 is an understatement. In less than a year, we went from 2.78% on the 30-year fixed to as high as 6.28%, then recently got as low as 5% — only to have another move higher this week to 5.30%. People thought the mortgage rate drama in 2013-2014 was a lot when rates went from 3.5% to 4.5%. However, as we all know, after 2020, things are just more intense.

The question is, can lower mortgage rates save the housing market from its recent downtrend? To understand this, we need to look back into the past to realize how different this period is from what we had to deal with in the previous expansion when rates rose and then fell.

Higher rates and sales data

We can see that when rates rise, sales trends are traditionally lower. We saw this in 2013-2014 and 2018-2019. We know the impact in 2022, working from the highest bar in recent history.

The most significant difference now from what we saw in the previous expansion is that mortgage rates never got above 5% in the previous expansion. However, more importantly, we didn’t have the massive home-price growth in such a short time. It does make an enormous difference now that home prices grew above 40% in just 2.5 years.

This is why I focused my readers on the years 2020-2024, because if home prices only grew by 23% over five years, we would be ok. However, that got smashed in just two years, and prices are still rising in 2022. It’s savage man, truly savage with the mortgage rate rise. Yes, rates bursting toward more than 6% is a big deal in such a short time, but the fact that we had massive home-price growth in such a short time (and in the same timeframe) is even more critical.

While I truly believe that the growth rate of pricing is now cooling down, 2022 hasn’t had the luxury of falling prices to offset higher rates. So we can’t reference this period of time with rates falling as we did the previous expansion due to the massive increase in home prices and the bigger mortgage rate move. In 2018, sales trends fell from 5.72 million to the lows of January 2019 at 4.98 million. This year we have seen sales fall from 6.5 million to 5.12 million, and they are still falling.

Housing acts better when rates are below 4%

In the past, demand improved when mortgage rates were heading toward 4% and then below. Obviously, we are nowhere close to those levels today, barely touching 5% recently to only go higher in the last 24 hours.

Again, I stress that the massive home-price growth is different this time. However, with that said, considering the sales decline trends and that we have seen better-than-average wage growth, housing demand should act much better if rates head toward 4% and below.

I stress that higher and lower mortgage rates impact the market, but it needs time to filter their way into the economy. When I talk about the duration, this means rates have to be lower for a more extended period. People don’t throw their stuff down and buy a home in a second; purchasing a home is planned for a year. Rates would need to stay lower for longer into the next calender year to make a big difference.

Millions and millions of people buy homes every year. They have to move as well, so a traditional seller is a buyer most of the time when it’s a primary resident owner. Sometimes when rates go higher too quickly, some sellers can’t move, this takes a sale off the data line, but if rates fall quickly, they might feel much better about the process.

The downside of rates moving up so quickly is that some sellers pull the plug until rates are better. We see some of this in the active listing data as new listings are declining. Lower rates may pull some of these listings forward as people feel more comfortable with rates down; time will tell.

From Realtor.com

From Redfin:

Of course, a 1% move lower in rates matters, but keep in context where we are coming from and how much home-price growth we have had in just 2.5 years. This isn’t like the previous expansion where home prices were working from the housing bubble crash and affordability was much better back then.

When to know when lower rates are working?

The best data line to see this take place is purchase application data, which is very forward-looking as the fastest data line we have in housing. Let’s take a look at the data today.

Purchase application data was positive week to week by 1% and down 16% year over year. The 4-week moving average is down negative 17.75% on a year-over-year basis.

This is one data line that has surprised me to a degree. I had anticipated this data to be much weaker earlier in the year. However, I concluded that 4%-5% mortgage rates didn’t do the damage I thought they would do. But, 5%-6% did, as I was looking for 18%-22% year-over-year declines on a four-week moving average earlier in the year. So, this makes me believe that if rates can get into a range of 4.125%-4.50% with some duration; the housing data should improve on the trend it has been at when rates are headed toward 6%. Again, we aren’t there on rates yet.

The builders would love rates to get back to these levels so they can be sure to sell some of the homes they’re finishing up on the construction side. Now assuming rates do get this low; what would the purchase application data look like? Keep it simple, the year-over-year declines will be less and less, and then when things are improving, we should see year-over-year growth in this index.

A few things about purchase apps: the comps for this data line will be much more challenging starting in October of this year. Last year’s purchase application data made a solid run toward the end of the year, which led existing home sales to reach 6.5 million. Next year we will have much easier comps to work with, so we need to keep that in mind. However, to keep things simple, the rate of change in the purchase applications data should improve yearly.

To wrap this up, lower mortgage rates should be looked at as a stabilizer first, but for them to change the market, we will need much lower rates for a more extended period. Also, we have to consider that rates moving from 3% to 6% is historical, and if rates fall, we have to look at housing data working from an extreme rise in rates that happened quickly. However, sales levels should fall if purchase application data shows negative year-over-year prints on a double-digit basis.

Since home prices haven’t lost this year, you can see why I used talked about this as a savagely unhealthy housing market. The total cost of housing had risen in a fashion that isn’t comparable to what we saw in the previous expansion when rates went up and down due to the massive increase in home prices. Also, we have to know that we aren’t working from a high level of inventory data as well. Traditionally, total inventory ranges between 2 to 2.5 million. We are currently at 1.26 million.

NAR total inventory data

We shall see how the economic data looks for the rest of the year and if the traditional bond and mortgage rate market works as it has since 1982, then mortgage rates will head lower over time. However, as of now, it’s not low enough to change the dynamics of the U.S. housing market.

The post Can lower mortgage rates stop the housing recession? appeared first on HousingWire.

Source link

Is home equity, now at $11.5 trillion, at its peak?

Home equity climbed to a historic high of $11.5 trillion in the second quarter, but it could be nearing its peak as major equity-rich markets on the West Coast begin to show signs of decline.

Tappable equity, the amount available for homeowners to access while retaining at least 20% equity in their homes, rose again for the 10th consecutive time, according to Black Knight. It rose $500 billion from the previous quarter and $2.3 trillion from the same period in 2021. Black Knight calculates homeowner equity levels by leveraging loan-level mortgage performance data and its home price index.

While homeowners saw home equity rise, the pace of growth slowed, especially on the West Coast.

“Equity growth slowed, however, as home price appreciation began to moderate, with some of the hottest markets even posting equity declines amid rising interest rates and affordability concerns,” said Andy Walden, vice president of enterprise research and strategy at Black Knight.

A total of 11 of the nation’s 50 most equity-rich markets posted declines in the second quarter, according to Black Knight. All of the markets were in the West Coast including eight in California. The Golden State saw a decline of $155 billion in tappable equity posting $3.5 trillion from April to June.

San Jose, California saw the strongest pull back in tappable equity which fell 12% by $55 billion. Tappable equity in Seattle, Washington fell by $38 billion (-10%), San Francisco, California declined by $42 billion (-5%) and Los Angeles, California dipped by $36 billion (-3%).

At the end of second quarter, the average U.S. homeowner had $216,900 in tappable equity, up 5% by $9,700 from the previous quarter and an increase of 25% by $43,400 from the same time in 2021.

“With 73% of equity held by borrowers who have locked in first lien interest rates below 4%, borrowers may be reticent to access their equity via refinancing,” said Walden. “As a result, we expect to see more homeowners turning toward second lien home equity products.”

While home equity lending was dominated by depository banks for years, nonbank lenders are targeting the space as they seek volume in a downmarket.

Rocket Mortgage rolled out a home equity loan this week, which will give homeowners access to up to $350,000 of their home equity while maintaining at least 10% equity.

Last month, Guaranteed Rate introduced a digital home equity line of credit (HELOC), a revolving line of credit that allows borrowers to draw, for two-to-five years. loanDepot and New Residential Investment Corp. join the list of nonbank lenders that plan on launching HELOC products.

The post Is home equity, now at $11.5 trillion, at its peak? appeared first on HousingWire.

Source link

What An Economic Downturn Means for Real Estate Investments

There’s a lot of talk these days about economic cycles, particularly recessions. I’ve noticed that many people assume that with an economic downturn, real estate will get hit as hard as the broader economy and other asset classes.

The truth is, while real estate does sometimes get hurt during a downturn, there is much less correlation between real estate and the broader economy than most people believe.

In fact, during more than half of the previous 34 recessions, dating back over 150 years, real estate has either not been affected or hasn’t been affected nearly as severely as other asset classes like stocks.

Why Does Real Estate Not Get Impacted As Much?

A few reasons:

For these reasons, real estate often operates in a counter-cyclical fashion to the broader economy.

In fact, back in the late 19th century, an American economist named Henry George wrote about why our economy goes up and down in cycles (remember, this was before the Federal Reserve existed). And, unlike today’s economists who attribute cycles to inflation and interest rates, George believed land speculation was the driving force behind these cycles.

Here is George’s theory on how land speculation caused the boom/bust cycle we see in the economy:

First, we start with the fact that land has a fixed supply; we can’t make more of it. In economics, we refer to this as inelastic supply. When something has inelastic supply, if demand for that thing increases, so does the price. When the demand for land increases, the price of land increases.

Next, we assume that in most cases, developers purchase land to develop today and resell in the near future. The prices developers are willing to pay for raw land reflect what the developers can sell the property for in a year or two if they start developing now. But during an economic boom, investors (people like you and me) will start to buy land on speculation—in other words, not to develop now, but to hold in the hopes that the price will increase in the future. These speculative purchases push land prices beyond the point where developers can make a profit, so developers are forced to stop buying.

When developers stop buying, they stop building. And when they stop building, this causes an economic ripple throughout the economy, hurting industries such as construction, heavy equipment, and building material manufacturing. This results in an economic recession, especially in those industries.

Eventually, speculators realize that they won’t be able to make money on their land purchases, and they start selling off their inventory at reduced prices, spurring developers back into action. Developers start building again, manufacturers start selling again, and the whole cycle repeats.

See the image below for what this cycle looks like:

Over the past 160 years, this real estate cycle has been very consistent. It doesn’t occur as often as the general economic cycle we often talk about (the “business cycle”); instead, this cycle is on its own timetable. And, historically, it has occurred about every 18 years. With the exception of several decades after the Great Depression, this 18-year cycle has been remarkably consistent, producing downturns in the real estate market independent of the broader economic downturns we often talk about.

Final Thoughts

Personally, I believe that both the business cycle and the real estate cycle exist, and they are driven by different, though often interrelated, economic forces.

I would argue that in 2008, the severity of the Great Recession was exacerbated by the fact that the business and real estate cycles both hit a downturn simultaneously. The real estate market collapsed right on schedule, almost 18 years after the last major real estate downturn started in 1989, which saw a correction of over 25% in many markets. And we were about six years into the business cycle after the 2001 downturns, almost exactly the average length of time between business cycles over the past 150 years. So, while 2008 may not have been inevitable, for those of us who follow cycles, the timing wasn’t overly surprising.

While I’m certainly not going to claim that I have any reliable information about whether real estate will get hit during the upcoming recession, and if so, how badly. I would caution anyone from assuming that real estate will necessarily see a downturn as bad as the broader economy or other asset classes. Real estate could get hit, but if history is an indicator, it’s far from certain that we’re in for anything major.

In fact, if you believe in the history of cycles, you should probably be more worried about real estate in 2026, 18 years after the last major real estate crash, than 2022.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Source link

Rocket doubles down on solar

Rocket Loans will be offering loans to customers who are installing solar panels, the lender announced Tuesday. The news comes exactly one year after its parent Rocket Companies announced it would enter the green energy game in 2022.

Rocket Loans will provide financing to Rocket Solar customers who choose to have a solar electricity system installed, the company said. When a customer applies to buy a solar panel through Rocket Solar, an automated and individualized solar loan will be sent from Rocket Loans in less than 30 seconds, according to the firm.

“It seems to be the right time to be in the business,” said Joel Gurman, president of Rocket Solar. “There was legislation announced the other day that would essentially extend a tax credit for renewable energy and solar investment tax credit.”

Last week, Senate Democrats unveiled a budget reconciliation bill that includes $369 billion in energy security and climate spending over the next 10 years. The bill contains tax credits to spur clean energy production, consumer incentives for energy efficiency and funding for transmission development.

In announcing plans to enter the renewable energy market in August 2021, Rocket Mortgage rolled out a rate-and-term refinance product that allows borrowers to consolidate any solar panel with their mortgage for one interest rate. While the refinance was available to homeowners with Property Assessed Clean Energy (PACE) program loans and private loans, the loan issued by Rocket Loans is a solar loan for homeowners looking to finance the equipment itself, the company said.

“It allows people to lock in a payment today versus a majority of what they’ll be paying in their utility bill,” Gurman said. “We know that will continue to increase because it follows the inflationary path.”

Founded this year and operating in 16 states, Rocket Solar provides consulting, system design and offers solar panels to homeowners across the U.S. The company claims that Rocket Solar customers can save an average of $1,300 on their electric bill in the first year of their solar panel installment.

The move represents further diversification for Rocket Companies, which has branched out beyond mortgages into auto loans, home equity loans and personal loans over the last decade.

Inside Mortgage Finance reported that Rocket was the largest producing mortgage lender in the first half of this year. According to IMF, Rocket generated $37.5 billion in originations in the second quarter of 2022, down 30.5% from the previous quarter. The Michigan lender is scheduled to issue second-quarter earnings on Aug. 4. The company reported a $1 billion profit in the first quarter.

The post Rocket doubles down on solar appeared first on HousingWire.

Source link