What’s The Best Recession-Resistant Investment?

The economy is booming right now. Few would argue with this fact.

But there are storm clouds on the horizon.

You can close your eyes and try to ignore the future, but that won’t change what’s coming.

What’s coming?

I don’t know. My crystal ball is broken. (Ha ha ha. But this over-used quotation is quite true. Warren Buffett and Howard Marks affirm this.)

Here’s what I do know.

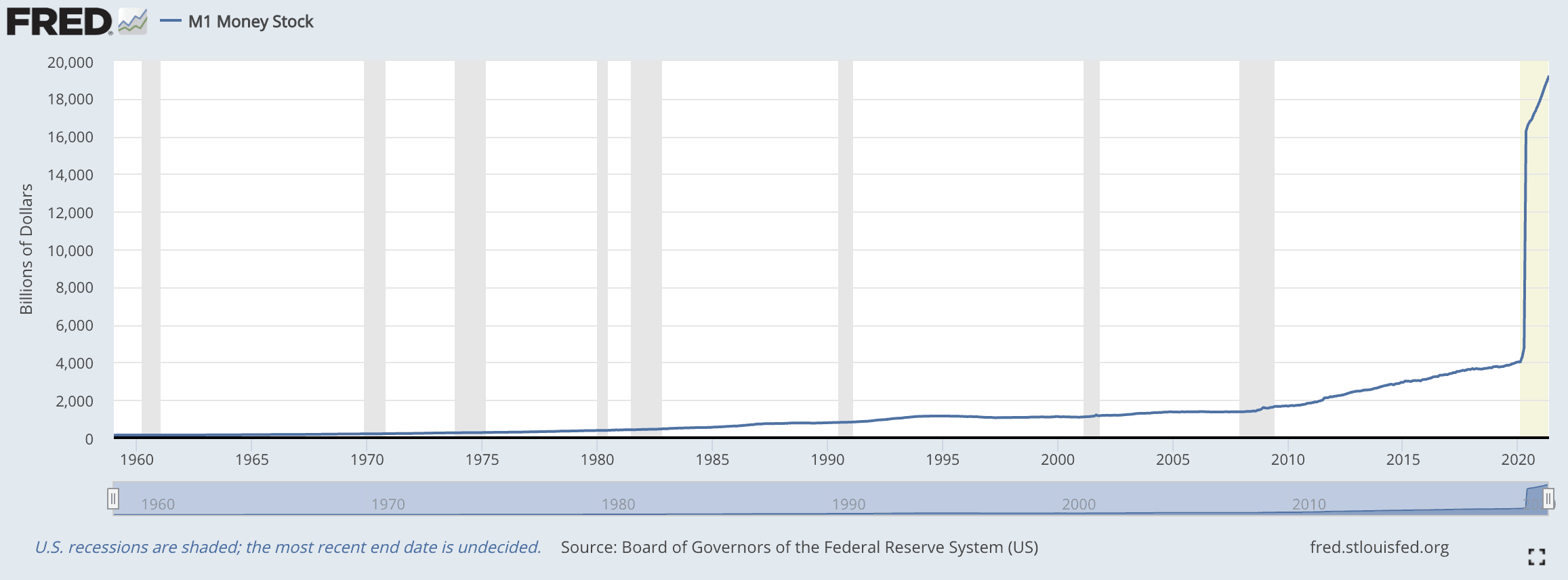

The Fed is printing cash like there’s no tomorrow. (I hope that’s not literal.) See the chart from the St. Louis Fed below.

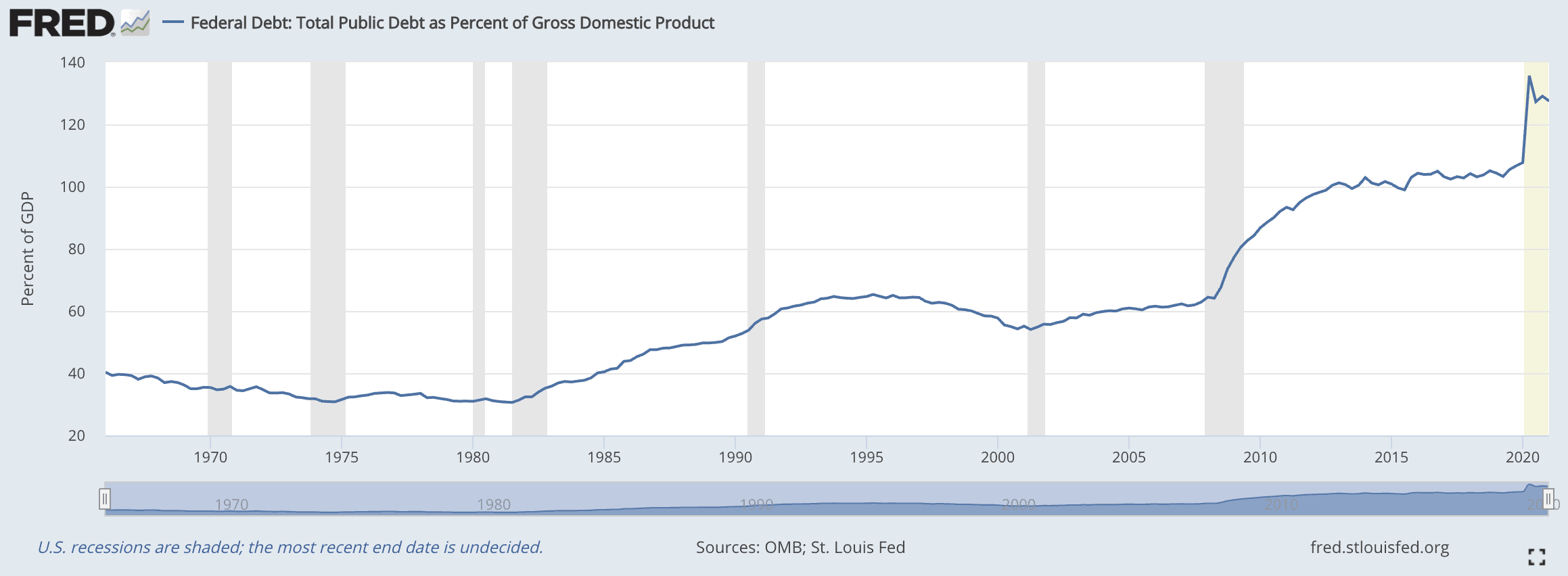

Inflation just skyrocketed to about 2.5 times the Fed’s targeted rate in May 2020. And U.S. debt as a percentage of GDP (Gross Domestic Product) is two to four times its historical levels. (See chart below. Levels from 1966 to the end of 2007 ranged from about 30% to about 65%. The Q1 2021 level is over 127%.)

Let’s drill down on just this last fact. According to my astute friend and podcaster Jason Hartman, we are in big trouble. Hartman reminds us that the government has not only the debt-to-GDP problem but also a massive albatross of unfunded liabilities (like social security, Medicare, military protection, and other programs) totaling many times our current debt.

Hartman says there are only six ways for our government to get out of this hole.

- Default. Break its promises. Highly unpopular and very unlikely.

- Raise taxes. Nope. They cannot raise taxes enough to get out of this mess.

- Yard sale. The U.S. sells off its assets to foreign countries to raise capital. (Who would love to get their hands on our international ports?)

- Steal. Start a war. Take over other countries or at least their assets. Napoleon did it, and perhaps we should, too. Or not.

- Innovate. Tech innovations in energy, biotech, and nanotech pull us out of the mire.

- Inflate. Devalue our dollar by printing more of it. This is almost certainly the “best” way out.

Check out the M1 money supply chart above again. It’s been said that approximately 30% of all U.S. money ever printed was produced since COVID-19 hit. This is one of the greatest aspects of real estate investing, so I hope you’ll check that out.

But the economic and political turmoil in the United States can’t be inflated away by monetary policy alone. The problems are way too complex at this point.

More on investing during a recession from BiggerPockets

What’s an investor to do?

Check out this infographic I found at Visual Capitalist. This article discusses how investors can hedge against portfolio volatility.

Though it is generally aimed at financial planners and those who utilize them, I love how all three volatile-resistant categories describe real estate. At least the type of real estate my team invests in. Check it out.

Real estate in general, and certain commercial real estate specifically…

- Has a low correlation to the market

- Is defensive or non-cyclical

- Generates cash flow

Let’s talk about each of these in a little detail.

Low correlation to the market

Who’s up for a little quiz?

Question: What happens to my investment portfolio value when Elon Musk tweets a sad-face emoji?

Answer: It could crash and burn, if I am steeped in cryptocurrency.

But what happens to my real estate portfolio?

Zero. Zip. Nada.

My real estate consists of real assets with real cash flow. It is unconcerned about any celebrity’s tweets or any other opinions.

And real estate resides in an inefficient marketplace. That alone scares off a lot of investors. But this is one of the reasons I love real estate investing!

Can you get a deal on Bitcoin? Can you find Apple stock on sale? How much are you able to improve the returns on your bond portfolio? Three questions with three now-familiar answers: Zero. Zip. Nada.

But real estate is entirely different. You can find deals. You can sniff out inefficiencies that create massive upside potential. The illustrations are too numerous to list here, and I’ve written about this a lot. Here are a few examples.

- I just got off the phone with my friend and BP member Alex Jarbo. Alex is a real estate agent and investor in Asheville, North Carolina. He explained how he generates cash-on-cash returns of well over 50% annually by building cabins to lease on Airbnb and VRBO. By designing and building these cabins, he can create even more profits than buying an existing cabin. (Though that would work too.) The inefficiencies of the real estate market allow him and his investors to make returns like this.

- My son can buy a piece of steep, landlocked mountain land and figure out multiple ways to turn a profit on it. These may include timber, billboards, cell towers, solar, carbon credits, and leases to hunters and farmers. And he can subdivide lots to owner finance for a profit. Some of these parcels sat on the market for years with no buyer.

- BP member AJ Osborne was on the BiggerPockets Podcast in the summer of 2018. He explained how he acquired an old Super Kmart, sold off the parking lot for apartments, cut the building in half, and turned it into a beautiful self-storage facility. While he was in a coma. He had about $2.5 million in cash plus about $5 million in debt in the project. He turned down an offer of $26 million for the property while it was still being leased up.

The inefficiency of real estate allowed for all these deals and many more.

And real estate’s value is not tied to the mood on Wall Street, a rumored war in the Middle East, or a CEO scandal. Real estate has a low correlation to Wall Street’s casinos.

Prepare for a market shift

Modify your investing tactics—not only to survive an economic downturn, but to also thrive! Take any recession in stride and never be intimidated by a market shift again with Recession-Proof Real Estate Investing.

Defensive or non-cyclical

Well, I guess it’s not all non-cyclical. But certain real estate assets are significantly defensive and counter-cyclical.

Think about long-term leases on Amazon sorting facilities or triple-net leases on CVS stores. Or 20-year cell tower leases.

Solar leases are often 40 years and may have a built-in escalation clause. Who’s up for a wind farm on their land?

My firm invests in assets that tend to be counter-cyclical, like mobile home parks and self-storage facilities.

Self-storage revenues typically rise in troubled times. The four D’s (divorce, death, downsizing, and dislocation) drive increased occupancy and profits. Tenants are quite sticky and don’t usually leave over rent hikes.

Mobile home parks have a similar stickiness to them. This is the only asset class I know of that has increasing demand and decreasing supply every year. And there is a real affordable housing crisis. In tough times, those who can’t pay their mobile home lot rent (typically a fraction of apartment rent) have few other options. They almost always pay their rent.

Generates cash flow

Real estate is typically not that liquid. But the tradeoff is a more stable and predictable cash flow stream.

Think about the definition of real wealth. Real wealth is owning assets that produce a cash flow stream. (Real estate does that so well.) I would say an income stream, but income is a financial concept. Income results in taxes, and real estate investors often avoid taxes for years on end. In some cases, forever.

Have you studied Robert Kiyosaki’s cash flow quadrant? He teaches investors to use money to make money (quadrant I). He also explains the estimated tax brackets for each quadrant:

- E = Employee: ~ 40%

- S = Self-employed: ~ 60%

- B = Business owner: ~ 20%

- I = Investor: ~ 0%

It’s a beautiful thing

I’ve been a serial entrepreneur for decades. Before that, I worked at Ford with an engineering degree and an MBA. I started or was involved in quite a few businesses before I discovered real estate.

Now that I’m on this track, I can’t imagine doing anything else. I only wish I would have started sooner, for more reasons than I can list here.

Howard Marks’s classic “Mastering the Market Cycle” convinced me there will always be ups and downs as long as humans are involved in the investment process. So, we live with a constant expectation that markets will eventually move against us. Our firm chooses asset classes accordingly.

Our favorite recession-resistant investments are self-storage, mobile home parks, RV parks, and senior and assisted living facilities. We also like a tiny chunk of real estate known as well-placed ATMs. But many other real estate classes (multifamily, single-family, and more) fall into these recession-resistant classifications, too.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com