Vetted by HousingWire | Our editors independently review the products we recommend. When you buy through our links, we may earn a commission.

Real estate is a vibrant, dynamic and competitive industry. From the thrill of a sale to the pursuit of new leads, it keeps you on your toes. That said, it can also be incredibly isolating, and it can be hard to stay motivated. As a way to deal with this, many agents and brokers seek out professional mentorship as a means to gain insight and level up their performance. Across the country, the best real estate coaches serve as valuable mentors who can help agents and brokers achieve the success they deserve.

“It’s really hard for independent business owners to get unbiased advice from themselves,” says Kyle Scott, President of SERHANT. Ventures. “So they need unbiased experts to work with that will help them grow their business — someone who has been there, who has done it, and who is able to see their business from both the 35,000-foot view and down in the weeds.”

A quick internet search will prove that real estate coaching programs are plentiful. Whether you’re looking to expand your team or client network or figure out how to delegate work so you can focus on the tasks you do best, a real estate coaching program could be a valuable launchpad. But when it comes to choosing the right one for your unique needs, there’s a lot to consider. Here, we highlight some of the best real estate coaches in the industry and their programs.

An unbiased view is worth millions. Often, we turn to our closest friends and family for guidance. Unfortunately, they’re usually not familiar with the ins and outs of the real estate industry and can’t provide you with the relevant feedback you need. As a result, many independent contractors rely on themselves, which generally doesn’t work either.

You can’t advise yourself, you’re too close to it. A coach works best for someone who is actually looking to grow their business, someone who is looking to put in the time and the energy to make a difference in achieving more income this year.

Hire a coach if you want to start taking your business to the next level for any reason — you want to make more money, have more freedom with your time, or stop riding the ins and outs of the commission cycle.

President of SERHANT. Ventures

1. Sell It Like Serhant

Key Facts

Grown throughout the pandemic, the Sell It Like Serhant program has been carefully adapted to the current market. It follows a weekly and bi-weekly platform featuring one-on-one virtual coaching from Serhant’s proprietary video platform. After a half-hour or hour-long group meeting every week or every other week, participants follow actionable steps to help them grow their business. Thus far, more than 22,000 enrollees in 128 countries have been through the Sell It Like Serhant program.

What We Love

Serhant offers daily office hours so participants can pop into virtual sessions to ask questions or get expert advice between their regularly scheduled sessions. A community platform also allows participants to pass referrals to each other. Thus far, it seems to have worked: To date, participating agents have closed over $250 million of referral deals.

Pricing

There are different membership tiers, depending on the level of guidance you need. The introductory Real Estate Core Course starts at $497. Prices are higher for a more specific course or one with 1:1 coaching.

Who’s it Best For?

If you’re looking to build a memorable personal brand, SERHANT. is the way to go. “The number one differentiator about our program is we understand that as a real estate agent, you have one job: to generate leads,” says SERHANT. Ventures President Kyle Scott. “Our number one focus is helping you build a clear, compelling, memorable personal brand and put your lead generation on autopilot. So that way, you can do what you do best, which is build relationships and close deals.”

Visit Sell It Like Serhant

2. Tom Ferry International

Key Facts

For good reason, Ferry International refers to itself as the real estate industry’s leading coaching and training company. Focused on Ferry’s “8 Levels of Performance,” the programs are a staple of real estate coaching. Their new group coaching sessions cover various aspects of real estate sales.

Prospecting Bootcamp is a 14-hour program comprised of seven two-hour group coaching sessions, and includes a peer-to-peer collaboration space. It involves independent work pulled from training videos and downloadable resources.

Recruitment Roadmap consists of hour-long sessions each week for ten weeks. Completed over Zoom and through the Tom Ferry video platform, each group coaching program offers a high level of specialization.

Finally, their Fast Track program offers 12 interactive group coaching sessions designed to help new agents build the necessary skills to succeed — like mastering listing presentations and handling objections.

What we love

If you’re looking for the gold standard of real estate coaching, Tom Ferry has the goods to back up the bravado. Because of their many years in the biz, Tom Ferry has a huge base of coaches, which means there are plenty of options to find the program best suited for your specific needs.

Pricing

Tom Ferry’s Prospecting Bootcamp and Fast Track coaching programs cost $999 but can be broken down into three monthly payments. The Recruitment Roadmap group coaching costs $1,499 but can be split into three monthly payments of $500. Consider their free coaching consultation if you want to dip your toes in the water. Check out their customer reviews, where several coaching program alums rave about the program.

Who’s it Best For?

If you thrive in a group setting that allows you to feed off the energy of others, Tom Ferry might be right for you. Their group coaching programs are new and more affordable alternatives to often costly 1:1 coaching fees.

Visit Tom Ferry

3. Tim and Julie Harris

Key Facts

The dynamic duo of real estate coaching, Tim and Julie Harris are a major name in the industry. Under their business, Harris Real Estate Coaching, their programs are divided into three tiers: Premier, Premier Plus, and VIP, all of which rely on a user-friendly online platform.

Pricing

Premier platform costs $197 per month, but a 30-day free trial is available. Premier Plus costs $599 per month, while VIP costs $999 per month. Of course, their wildly successful podcast is a great free resource to tap into, as well as Tim and Julie’s many written contributions to HousingWire.

Who’s it Best For?

If you’re constantly on the go, the ability to access the course from any device is a major asset.

4. Candy Miles-Crocker

Key Facts

Newbies are welcome at Candy Miles Crocker’s program. Known as the “Real Life Realtor,” she’s the brain behind Real Life Real Estate Training. With a variety of courses in her offerings, including a plethora of self-paced online courses, Miles-Crocker gives new agents a leg-up on the rest.

What we love

Miles-Crocker is still an active agent, working with clients to close deals. Her 20+ years of experience practicing in Washington, D.C., Virginia and Maryland have helped her build “systems, strategies and scripts” that she shares with her coaching clients.

Pricing

The CORE Essentials Blueprint program retails for $1,597. Smaller, more specific courses, such as The Buyer Presentation, are priced at $347. While all pricing isn’t listed on her website, Miles-Crocker also offers a free course that includes her 6-point system for growth.

Who’s it Best For?

Miles-Crocker’s courses could be beneficial if you are new to agent life or looking to get your business reorganized. She even has one specifically for your first 30 days as a real estate agent.

5. Ashley Harwood

Key Facts

Boston-based Ashley Harwood inspires introverts with her convincing, heartfelt and high-touch approach to practicing real estate. Her very human, very relatable Move Over Extroverts coaching approach is the perfect antidote for cheerleader-style coaches that urge you to door-knock, chase down divorce leads or become a social media superstar.

What we love

Harwood is a licensed agent coaching agents week-in and week-out at no less than three Keller-Williams offices in the great Boston metro. We love her humanity, inspiring videos, and her latest enterpise — The Quiet Success Club. Inspired by Susan Cain’s New York Times bestseller Quiet, about the power of introverts, Harwood brings together a community of like-minded real estate agents wanting a more client-centric approach to succeeding as an agent.

Pricing

Join The Quiet Success Club for $45 per month (paid monthly) or get two months free when you pay for an annual subscription (for $450). The club is currently offering founding member pricing for $25 per month or $250, but it’s a limited-time offer available only under April 30, 2024. Or get a lifetime membership to Harwood’s suite of courses, called IntrovertU, for a one-time cost of $997.

Who’s it Best For?

Introverts, of course! While you may not count yourself as one, if you read Susan Cain’s book, you may unearth your more introverted traits — like recharging your battery by being alone. Ok, even if you don’t bask in solitude, Harwood promises a calming community where agents can be themselves, be seen, and where they don’t have to be the loudest voice in her mastermind group, purposefully (and quietly) designed to teach successful lead generation and other strategies.

6. Levi Lascsak

If you’re looking to improve your social media game, Levi Lascsak is the YouTube master. The author of Passive Prospecting specializes in helping real estate professionals embrace the video platform, and he does so in jam-packed, 2-day virtual events. Discover how he earned over $4 million in gross commission income as a new agent.

What we love

Lascsak’s social media marketing skills are top-of-the-line. While he may not be part of the traditional world of real estate coaching, Lascak’s ability to relate to younger audiences is an asset that Millennial and Gen Z agents might appreciate.

Pricing

The live, 2-day events are available at a discount for $47. But as you can expect, he’s got endless information available for free on YouTube.

Who’s it best for?

If you’re a digital native looking to pack a bunch of education into a short period, a Lascsak course is particularly beneficial.

7. Jess Lenouvel

Key Facts

Promising to help agents scale from six to seven figures, The Listings Lab founder Jess Lenouvel is the author of More Money, Less Hustle. A strong example of a coach with a significant understanding of social media, Lenouvel hosts vibrant live events that hype up the audience and prepare them to take their career to the next level.

What we Love

Lenouvel emphasizes the significant power of mindset to achieve one’s goals. She understands how quickly the market shifts and emphasizes staying on top of trends to succeed.

Lenouvel’s live events focus on messaging. For those looking to solidify their brand and develop a clear, concise message, her events might be what you need.

8. Buffini & Company

Key Facts

Another giant of the real estate coaching industry, Buffini & Company is one of the largest coaching and training companies in the United States. They have two major coaching programs: The Leadership Coaching program includes three monthly coaching calls, free admission to a 2-day conference, and curriculums and training led by Brian Buffini. There are also bi-monthly coaching sessions and a monthly web series with a live Q&A.

Buffini & Company also performs a REALstrengths profile — an in-depth personality assessment. In the One2One Coaching program, there are two coaching calls per month, a monthly marketing kit, the REALStrengths profile, and as with the SERHANT. program, Buffini features the Buffini Referral Network, allowing participants to send and receive referrals with other agents.

What We Love

Buffini coaches aren’t independent contractors. Instead, they’re full-time employees who go through intense training. Thus far, they’ve conducted 1.7 million coaching calls and more than one million hours of coaching.

Pricing

The Leadership Coaching program costs $1,499 a month. Private coaching, referred to as One2One Coaching, costs $549 per month. Two tiers of Referral Maker courses are available from $45 to $149 each per month.

Who’s it Best For?

Team spirit is the name of the game for Buffini’s Leadership Coaching program. If you’re a team leader looking to improve your coaching skills and assist your team in leveling up, the Leadership Coaching program might be right for you. If you want a more personalized path as a solo agent, the One2One Coaching program may be a better fit.

9. Vanda Martin

Key Facts

A popular name in the real estate coaching industry, Vanda Martin’s VIP Coaching Program follows three components: coaching, content, and community. Martin doesn’t shy away from mistakes – instead, she emphasizes avoiding indecision that puts you behind the pack.

What we love

Positive vibes are plentiful in Martin’s world, and her energy is tangible. Just check out her Instagram videos.

Pricing

Martin’s pricing isn’t listed.

Who’s it best for?

If you’re looking for a female leader who emphasizes loving your job and building habits that will take you to a greater level of success, Martin’s ability to convey those feelings is clear. Just check out the endless testimonials on her website.

9. Tat Londono

Key Facts

Tatiana Londono is the founder and CEO of Londono Realty Group Inc. The author of Real Estate Unfiltered, she offers a variety of programming that ranges from free templates to intensive coaching sessions. The Millionaire Realtor Membership provides weekly input from Londono, while the intensive Millionaire Real Estate Agent Coaching Program focuses on building 12-month objectives using a custom success action plan. It uses live programming and workshops with Londono herself, as well as an exclusive online community and referral network for members.

What we love

Londono’s keen sense of social media and her posts are a masterclass in how to boost your engagement on platforms like TikTok and Instagram. Don’t miss her takes on Taylor Swift’s real estate portfolio.

Londono’s programs specifically target agents who are looking to scale their business. If you’re struggling with lead generation or want to increase the number of views you’re racking up on social media, Londono is a valuable source within the industry.

10. Steve Shull

Key Facts

Steve Shull’s Performance Coaching focuses on using consistent execution to achieve your goals. With options ranging from 1:1 private coaching to small group coaching for 10 to 20 agents, the groups have 30-minute Zoom calls three times a day, but the number of sessions you choose to attend is up to you. Several self-directed courses are also available on the website, focusing on topics ranging from mindset to time blocking.

What we love

If you’re not positive you want to make the investment, Performance Coaching allows a 14-day free trial of daily accountability calls.

Pricing

Small group coaching costs $6,000 a year, and while 1:1 coaching prices aren’t listed online, you should prepare for a hefty price tag.

Who’s it Best For?

If you have a specific area you’re looking to improve upon, Performance Coaching offers coaches with unique areas of expertise, ranging from CRMs to business strategy. Tailoring your program to your greatest areas of weakness can help you become a more well-rounded agent.

11. Aaron Novello

Key Facts

Aaron Novello of Elite Real Estate Coaching has several programs tailor-made for agents looking to hone their craft. A Masterclass in Systems works to teach agents how to scale their real estate business, organize their team, and use programming like Follow Up Boss to manage their business.

The Role Play Mastermind is for agents looking to prepare themselves for tough discussions by working with a role-play partner for 15 to 30 minutes, five days a week. The group coaching option includes a variety of scripts Novello used to close on homes, as well as mindset guides, skill sheets, and expert guidance from experts in the field.

What we love

Novello’s exclusive accountability group allows active members and former coaching clients to share everything from guidance to motivation. If you’re looking to save money, Novello also has a free podcast available on YouTube.

If you struggle with having difficult conversations and are looking for solid templates to guide you, Novello’s Role Play Mastermind is a solid investment. The group coaching option emphasizes taking the educational portion and putting it into practice in the real world rather than just watching videos.

12. Krista Mashore Coaching

Key Facts

Filled with energy and known for popping up in the press, Krista Mashore is the mind behind Unstoppable Agent, her 3-day mastery class. It includes over 15 hours of coaching, group workshops, breakout sessions, and skill-building workshops to provide you with the skills to implement digital marketing successfully into your real estate business.

What we love

A positive attitude counts for a lot, and Mashore’s personality is a key component of the success of her course.

Pricing

Mashore’s accessibility is another one of her program’s best assets. Her 3-day class is currently priced at $47, but pricing occasionally varies.

Who’s it best for?

If you crave energy and enthusiasm, Krista Mashore has the goods. She’s also an expert on working in today’s low-inventory market, which is ideal for someone struggling with the current housing shortage. But she’s also got a good sense of humor, which shines through in her social media presence.

The full picture: The best real estate coaches for 2024

Hiring a top real estate coach goes far beyond just expanding your skills. While growing and educating yourself as you navigate your career is essential, hiring a coach is all about seeking to achieve more. Whether you’re looking to boost lead generation, build a solid personal brand, or make more commission income, having the input of a seasoned expert is a priceless step in the right direction. As you can see through the endless reviews and testimonials on coaches’ websites, agents who want to scale their business and take their profits to a higher level often seek the outside guidance of a coach. While the cost of hiring someone may be significant, the return on investment is equally as monumental.

Real estate coaching programs vary in price significantly. Most cost over $500 per month, with others charging several thousand dollars per month. “Oftentimes, it is the case that you get what you pay for,” said Kyle Scott, President of SERHANT. Ventures.

However, prices can also vary depending on the specific niche of real estate coaching you’re focusing on. The more specificity you’re seeking, the higher the financial investment. Of course, self-led courses are likely to cost much less.

Does your career feel stalled right now? Are you ready to take your career to the next level, but you’re not sure where to start? In a down market, you can channel your time and energy into actively improving your business skills so that you’ll be sufficiently prepared for when the market changes.

“When things pick up again, you’re ready to capture the climbing market,” says Scott. “If that’s the case, then the best time to embrace coaching is now. At the same time, a thriving market presents agents with new challenges, ranging from having to turn away business or being unable to service your existing business in a way you’re proud of,” Scott noted. “In that type of market, a real estate coach can help you determine what kind of junior agent or assistant would serve you best. How do I figure out how to manage my business in a way that I can keep up with the volume?”

https://frankbuysphilly.com/wp-content/uploads/2024/03/Ashley-Harwood_headshot-1-e1710369631720.png7991200Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2024-03-13 23:35:482024-03-13 23:35:48The best real estate coaching programs for 2024

The presiding judge in the bankruptcy case involving Reverse Mortgage Investment Trust (RMIT) — the parent company of former leading reverse mortgage lender Reverse Mortgage Funding (RMF) — has approved a request to transfer the company’s bankruptcy status to Chapter 7 from its current Chapter 11 status. This is according to court documents reviewed by RMD.

The move allows the RMIT estate to sell off its remaining assets to satisfy creditor claims. It can also provide an additional mechanism for resolving disputes while reducing the administrative costs the estate would need to continue paying under Chapter 11.

Granting the conversion

In the original request, the RMIT plan administrator explained that conversion to Chapter 7 was being sought to preserve the value of the estate’s remaining assets and ease the overall liquidation process.

“The Plan Administrator hopes that by converting this case, instead of seeking dismissal or simply resigning, that the estate will be able to preserve value of any potential recovery from the TCB dispute or other litigation for the benefit of all unsecured creditors,” the January filing explained. “Absent conversion and the installation of a chapter 7 trustee, this value could be significantly eroded, if not entirely eliminated.”

Presiding Judge Mary Walrath of the U.S. Bankruptcy Court for the District of Delaware found that the request was “due and sufficient under the circumstances.” The conversion will be effective anywhere from five to 10 business days after the entry of the March 12 order, according to the court filing.

In a separate order, Walrath gave permission to the plan administrator to “abandon and destroy any records to be destroyed which she, in her sole discretion and business judgment, deems to be no longer necessary to the administration of the plan,” pursuant to the bankruptcy code.

TCB/Ginnie Mae dispute

When presenting the motion to convert the case to Chapter 7, an attorney for the plan administrator reiterated that this was partially due to a dispute currently playing out between Ginnie Mae and Texas Capital Bank (TCB), the debtor-in-possession lender to RMF.

After the bank filed its lawsuit, the court in that case set deadlines well into 2025, making the situation more challenging for the plan administrator in the bankruptcy case to resolve in a timely manner. The attorney for the RMIT estate told Walrath that the case is clearly “not going to be resolved anytime soon.”

“As a result, the court previously entered an order turning over the unencumbered assets to TCB. The plan administrator has worked diligently to try and resolve as much of the issues as possible before we needed to come to your honor, but […] that day is here.”

The attorney reiterated that the estate has run out of money, and that it requires conversion to Chapter 7, which will mean liquidating any remaining assets to wind the company down.

Need for conversion

In the January filing, the plan administrator explained that a conversion to Chapter 7 would be in the best interest of all stakeholders.

“While it is unclear at this juncture how the TCB dispute will conclude, there remains the possibility of future distributions being available to creditors. If the Chapter 11 Cases were to be dismissed, all creditors, including TCB, could lose the opportunity to receive funds from the estate,” the filing read.

The creditors themselves would also “be in a better position if the Chapter 11 case converted to one under Chapter 7 which would remain and be preserved as a vessel that can resolve any remaining disputed unsecured claims, and distribute funds to all creditors, if TCB is successful in the TCB dispute and thereafter returns funds to the estate,” according to the January filing.

Guild Mortgage released its fourth-quarter and full year 2023 earnings report this week, showing that it narrowed its focus on purchase originations and increased its market share on the forward lending side, but it still sustained a loss.

After its acquisition last year of Cherry Creek Mortgage, Guild increased its involvement in the reverse mortgage industry due to Cherry Creek’s well-developed reverse lending apparatus. In the new earnings report, the company now lists reverse mortgages it holds for investment, which totaled $315.9 million, representing loans it has elected not to sell on the secondary market.

Guild’s in-house retail reverse mortgage originations reached $49.8 million in volume in 2023, while its wholesale reverse origination volume was $36.8 million for the year.

The company also reported an $8.2 million gain on the reverse mortgages it is holding for investment, as well as income related to Home Equity Conversion Mortgage (HECM)-backed Securities (HMBS), according to the earnings report.

Through its Cherry Creek acquisition, Guild became a top 10 reverse mortgage lender in 2023, according to a tabulation by Reverse Market Insight (RMI). The two companies each had a high enough volume last year to effectively earn two separate slots on RMI’s leaderboard, holding the No. 8 and No. 9 positions.

Guild could move up further in 2024, considering that the sixth largest lender of 2023 — Austin-based Open Mortgage — announced its exit from the reverse mortgage business late last year due to lower origination volumes combined with lower pull-through rates, according to CEO Scott Gordon.

When combining the raw loan volume of both Cherry Creek and Guild based on RMI’s 2023 top 10 leaderboard, the company produced 1,136 HECM endorsements in 2023. If that figure was credited solely to Guild, then the company would have emerged as the sixth largest lender in the industry, just behind Fairway Independent Mortgage Corp.

https://frankbuysphilly.com/wp-content/uploads/2024/03/inventory-remains-low-e1693560716851.jpeg6991200Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2024-03-13 21:32:502024-03-13 21:32:50Guild earnings show more reverse mortgage activity after Cherry Creek acquisition

The CPI report came out Tuesday, and the headline number showed a 12-month inflation of 3.2%. The running average of CPI going back to 1914 has been 3.3%. So, what should we take away from this number, seeing that market participants are still worried about 1970s inflation and some don’t want to see any rate cuts this year?

Fed presidents and others have cited the fear of 1970s-style entrenched inflation as a reason they hiked rates so fast and are being careful as they consider rate cuts. However, is the 1970s reference a valid one? After today’s inflation report, is this even a possibility with the current economic conditions?

The deflation question is an easy no: the history of deflationary collapses post-WWII is non existent. This is an issue from the 1800s. As long as people are working and the economy is expanding, it is rare to see deflation in the CPI numbers.

But what about the 1970s inflation that led to 18% mortgage rates in the early 1980s? For this to happen, we would need to see a few big key variables which aren’t happening currently.

Today’s CPI report

From BLS: The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in February on a seasonally adjusted basis, after rising 0.3 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.

The year-over-year core inflation data have been slowing down on all the inflation reports; CPI, PPI, and PCE have slowed from the COVID-19 peak. The core PCE inflation data that the Fed focuses on is at 2.8% yearly, which is a far cry from the 1970’s 10%.

In today’s CPI print, core inflation today is running at 3.76%. How is this possible when the stock market has recovered, the labor market is intact, and the economy is growing above trend? We were told inflation couldn’t possibly cool down with all those three variables happening. Well, it did!

Remember that in the 21st century, it was difficult even to keep core PCE inflation above 2%. The global pandemic created supply shortages, an extra boost in demand for goods over services, and a massive burst in inflation. Like all pandemics, disinflation follows the pandemic inflation boost as supply chains improve.

Can the 1970’s inflation return?

So, how do we get the 1970s inflation growth rate with an economy currently outperforming? This is a damn good question! One of my running jokes over the last year has been that we have people saying we are in a recession but that we can’t cut rates because the economy is too strong. Both of those things can’t be true ot the same time, so you need to pick one. You can say that the tight labor market that pushed up wages is cooling off. Here’s my latest article on the jobs report, which shows the labor market isn’t tight anymore and wage growth is cooling down.

Why is this key? If the labor market cools, wage growth slows down, making it challenging for rent inflation to grow much faster. If 44.4% of CPI is shelter, you need a booming housing market again to push rents higher than what we saw at the peak of the global pandemic. Good luck on this by the way.

The 1970s saw wage growth, labor force growth, and a lack of housing, facilitating the housing boom and rent inflation. That’s not happening now; if anything, rent inflation is artificially too high.

Also, we have a lot of supply coming online in the five-unit sector, which will keep rent growth cool for apartments and less for single-family homes. One crazy idea that can boost inflation is if the government forces investors to sell their homes, kicking out renters and limiting the supply of rented homes. That is an evident supply argument because fewer single-family homes to rent would boost inflation. However, I don’t see this happening. What about the government giving tax breaks to investors to sell their homes? It’s not good for politicians to make investors more money while families are booted out of their single-family rental units.

What about a supply shock?

To get anything that looks like the 1970s inflation today, we would need to see a supply shock and one that lasts a long time. We had an oil shock back in the 1970s which would amount to oil prices today — adjusted for inflation — of about $450/barrel. Instead oil is $78/barrel today.

Here is my model for 1970s inflation returning. We would have to have war around the world: China going to war with Tawain, Russia using oil and wheat as a weapon of choice against western economies and Iran continuing to have their pirates attack ships in the Red sea. This would force headline inflation to rise, and as long as it sticks, wage growth would have to compensate, leading to core inflation rising with it.

This model assumes the variables above would happen for a long time, forcing U.S. companies to compensate their workers for the higher cost of living. However, you get my point here: we would need a supply shock the size of Godzilla. The economy and the stock market are doing fine, but inflation doesn’t look like in the 1970s because the supply markets are returning to normal.

Can the 1970s inflation return and bring double-digit mortgage rates heading toward 18%? In theory, yes. In reality, no. Unless you get a massive supply shock, it’s hard to get inflation that high again and sustain itself.

For a long time, people said we couldn’t bring the inflation growth rate down if the economy expanded. Some people said we needed high levels of unemployment for many years to bring down inflation. Well, the unemployment rate is under 4% and the inflation growth rate is much closer to what we saw in the last decade than the inflation growth rates of the late 1970s. So, take those disco pants and give them to the Salvation Army. It’s a new world, and we must leave that period behind us.

A little over a month after formally relaunching homebuyer refunds under its Sign & Save program, Redfin announced that Sign & Save is now available to clients nationwide.

In an announcement on Tuesday, the brokerage noted that it had expanded the program to more than a dozen additional markets, including Chicago, Los Angeles, Philadelphia, San Diego and San Francisco. The program is now available to Redfin clients across the country, except in states such as Arkansas, Iowa, Kansas, Mississippi, Missouri, Oklahoma, Oregon and Tennessee, where commission refunds are prohibited by law.

First piloted in a handful of markets in September 2023 and formally launched in early February, the Sign & Save program provides buyers who sign up to work with a Redfin agent before their second home tour — and who purchase a property with that agent within 180 days of signing the agreement — a refund of 0.25% to 0.5% of the purchase price of the house. The buyer will receive the refund at closing.

With Sign & Save, at the end of a buyer’s first home tour, the Redfin agent will ask them to sign a buyer agency agreement, which creates a formal working relationship between Redfin and the buyer. Clients who sign the agreement before going on a second home tour with the Redfin agent will get a refund when they close on their new home.

The Sign & Save refund starts at 0.25% of the purchase price, but it rises to 0.5% for luxury homebuyers who purchase a home through Redfin’s Premier service.

“With Sign & Save, Redfin is giving consumers a better deal in real estate,” Jason Aleem, Redfin’s senior vice president of real estate operations, said in a statement. “This program rewards customers who commit to working with a Redfin agent early in the process, which is helping drive more sales for our agents.

“Not only are we putting money back in our customers’ pocket, we’re also educating them about how real estate commissions work and how Redfin can help them win. This is good for our customers, our agents and our growth as a brokerage, which is why we’re expanding it everywhere we can.”

In July 2022, Redfin moved to eliminate the commission refund it offered to buyers in 22 markets. During the firm’s Q2 2022 earnings call, CEO Glenn Kelman said the brokerage was hoping to fully eliminate the refund as early as January 2023.

But in the wake of the jury verdict in the Sitzer/Burnettcommission lawsuit, many real estate industry professionals are concerned about homebuyers’ ability to afford representation if the practice of cooperative compensation is banned, as the Department of Justice has recently expressed as its desired policy outcome.

https://frankbuysphilly.com/wp-content/uploads/2024/03/Redfin2.jpg6751200Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2024-03-12 18:53:222024-03-12 18:53:22Redfin’s relaunched homebuyer refund program now available nationwide

In anticipation of Tuesday’s inflation reading, mortgage rates eased compared to last week.

HousingWire’s Mortgage Rate Center showed the average 30-year fixed rate for conventional loans at 7.08% on Tuesday, down from 7.17% one week earlier. At the same time one year ago, the 30-year fixed rate averaged 6.83%. Meanwhile, the 15-year fixed rate averaged 6.46% on Tuesday, down from 6.5% one week earlier.

The relief in borrowing costs, however, may be short-lived as Tuesday’s strong inflation data is likely to reverse this trend. Consumer prices in February were up 3.2% from a year earlier, according to data released by the U.S. Bureau of Labor Statistics.

“The growth rate of inflation has fallen a lot, and the Fed is going to cut rates three times this year,” HousingWire lead analyst Logan Mohtashami said. “This makes bearish American citizens mad because people who don’t want rate cuts or want the Fed to hike rates want to see the Fed create a recession. You can understand their anger with the economy still in expansion mode.”

As long as the economy is expanding, rates will stay elevated. Only a pivot by the Fed or a softening of labor data could change the status quo, Mohtashami added.

Housing inventory

For-sale inventory has been rising for two years despite elevated mortgage rates. Inventory is now 21% higher than the same time last year. Mike Simonsen, founder and president of Altos Research, wrote on Monday that the available inventory of homes on the market will continue to climb until mortgage rates start to decline.

According to Simonsen, the Fed’s eventual commitment to cut rates, along with cooling inflation and job markets, are giving homeowners reasons to sell.

In the week ending March 8, there were just over 500,000 single-family homes on the market in the U.S, up 0.5% from the previous week and up 21% from one year ago. Additionally, there were 100,000 more single-family homes on the market than there were in March 2023.

“Unless mortgage rates fall from here, then by July, we could have 40% more homes on the market than a year ago,” Simonsen wrote.

Disparities in inventory levels have surfaced at a regional level, with Gulf Coast markets witnessing a resurgence in supply levels that have surpassed pre-pandemic benchmarks. Northeastern and Midwestern markets, meanwhile, have been slower to emerge from pandemic-induced troughs.

The available inventory of unsold homes on the market was 59,000 last week, 15% higher than it was a year earlier.

The Consumer Price Index rose again in February, undermining confidence that inflation is sustainably moving back to the 2% target.

Consumer prices in February were up 3.2% from a year earlier and up from 3.1% in January, according to data released by the Bureau of Labor Statistics on Tuesday. On a monthly basis, the index increased by 0.4% in February after rising 0.3% in January. Ideally, economists expect nothing more than monthly increases of 0.1% to 0.2%.

Today’s inflation reading is unlikely to affect next week’s Federal Open Market Committee meeting, during which no rate cuts are expected.

Core inflation, the Fed’s preferred inflation gauge, fell to 3.8% annually, down from 3.9% in January. The Fed’s target for core inflation remains 2%.

The index for shelter and gasoline accounted for 60% of the monthly increase in the index for all items in February. The monthly increase in shelter inflation eased down to 0.4% in February, from 0.6% in January. Shelter posted a 5.7% increase over the year, according to Realtor.com chief economist Danielle Hale.

Will the economy achieve a soft landing?

During his semiannual monetary policy testimony last week, the Federal Reserve Chair Jerome Powell reiterated that the central bank won’t be applying any cuts to benchmark interest rates until it’s sure that inflation is under control.

In anticipation of the CPI data release, mortgage rates have eased back a little from recent highs. Today’s inflation reading is likely to reverse this trend. HousingWire’s Mortgage Rate Center is showing the average 30-year fixed rate for conventional loans at 7.08% on Tuesday, down from 7.17% one week earlier.

In January, the U.S. median rent continued to decline year-over-year for the sixth month in a row, according to Realtor.com’s January rental report.

“Improvement in asking rent is a necessary precursor for falling shelter rent and should lead to declining shelter inflation later in 2024,” Hale said in a statement. “In the meanwhile, federal, state, and local government efforts to address the still widening housing shortage are essential.”

In January 2023, the BLS refined the weighting method for owners’ equivalent rent (OER) in the CPI. Unit-level weights for OER are now adjusted to account for structure-type: the proportion of owned homes that are single-family detached compared with non-detached housing units (such as townhouses and condos). The new method better reflects rental markets across the nation, but it may introduce monthly variability in the unit-level weights.

After a winter slump, the real estate market is starting to look a little brighter in time for spring. More homes are entering the market, and buyers are starting to consider buying again after staying on the sidelines, according to the latest numbers from Redfin.

For the four weeks ending March 3, new listings were up 13%, the biggest increase in three years. That uptick helped bring the total number of homes for sale up 1.7%, marking the first time in eight months that supply has increased. Meanwhile, asking prices had their smallest increase in two months, with around 5.5% of home sellers dropping their asking price.

With spring on the way, there’s also been a jump in interest in housing, with touring activity up 23% from the start of the year. Mortgage purchase applications were also up 11% for the week ending March 3.

Still, these numbers haven’t yet boosted housing sales, with pending sales down 6% year over year. Some of that may be due to the continued rise in mortgage rates, which pushed the median monthly housing payment to $2,694, according to Redfin.

Metro Areas With the Biggest Growth and Listings

Of course, not all metro areas are seeing the same number of new listings. In Texas and Florida, for example, there has been a large year-over-year increase, with Forth Worth, Texas, seeing the largest uptick in listings at 27% and Fort Lauderdale, Florida, not far behind at 25.4%. With many more homebuyers moving to Florida in recent months, this could be welcoming news for buyers.

Metros With Biggest Year-Over-Year Increase In New Listings

Metros With Biggest Year-Over-Year Decline in New Listings

Fort Worth, TX (27%)

Atlanta (-5.9%)

Fort Lauderdale, FL (25.4%)

Newark, NJ (-2.1%)

Houston (24.4%)

Chicago (-0.4%)

Jacksonville, FL (24.1%)

Miami (24.1%)

Still, the uptick in new listings hasn’t yet translated to a large increase in pending sales, as mortgage rates still remain elevated. But pending sales did increase in eight metro areas, including Austin, Texas.

Metros With Biggest Year-Over-Year Increase in Pending Sales

Metros With Biggest Year-Over-Year Decline in Pending Sales

Cincinnati (9.2%)

San Antonio, TX (-23.8%)

Milwaukee (6%)

Warren, MI (-15.7%)

Pittsburgh (5%)

New Brunswick, NJ (-15.6%)

Minneapolis (5%)

Atlanta (-15.1%)

Austin, TX (4.6%)

Nassau County, NY (-14.1%)

San Francisco (2.8%)

Seattle (0.7%)

Cleveland (0.2%)

Homebuyers are still under pressure from rising interest rates. The median monthly mortgage payment was up 6.9% compared to a year ago. While mortgage rates have dipped slightly since the fall, they still remain elevated, with the current average for a 30-year fixed rate mortgage at 6.88% as of March 7.

Even with a slight increase in supply, it’s still a seller’s market, with the median sale price up 5.3% year over year, according to Redfin. And even while some sellers have dropped their listing price, many sell for the final list price or even more—24% of homes in February sold for above the final list price.

What the Numbers Tell Us About Current Real Estate Trends

Although the increase in new listings is welcome news for the supply crunch in the housing market right now, the U.S. still has a serious housing shortage. Despite a surge in new construction, a Realtor.com analysis found that the market is missing around 7.2 million homes as a result of underbuilding.

That shortage of supply isn’t helping prices come down. Still, while housing prices remain high, some real estate experts say the market is looking promising for buyers.

Chen Zhao, a Redfin economic researcher, said in a press release that prices are likely to come down as mortgage rates decline, adding: “Buyers who can afford today’s mortgage rates may have better luck finding a home now than they have in the past several months, and they also may be less likely to face competition because inventory is improving.”

The Bottom Line

With the increase in new listings, investors looking to buy this spring are likely to have more choices than they did a year ago. Still, there are other uncertainties in the real estate market, and buyers seem to be still waiting to find out if prices (and mortgage rates) will continue to decline.

While there may be opportunities in some metro areas, sellers still have the upper hand. But it remains to be seen if we’ll see a spring surge in sales.

Make Easier and Smarter Financing Decisions

Deciding how to finance a property is one of the biggest pain points for real estate investors like you. The wrong decision may ruin your deal.

Download our What Mortgage is Best for Me worksheet to learn how different mortgage rates impact your deal and discover which loan products make the most sense for your unique position.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

https://frankbuysphilly.com/wp-content/uploads/2024/03/home-for-sale-1-1024x517.jpg5171024Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2024-03-11 02:29:312024-03-11 02:29:31More Homes Are for Sale but the Market Remains at a Standstill—When Will Demand Come Back?

Everyone was waiting to see if this week’s jobs report would send mortgage rates higher, which is what happened last month. Instead, the 10-year yield had a muted response after the headline number beat estimates, but we have negative job revisions from previous months. The Federal Reserve’s fear of wage growth spiraling out of control hasn’t materialized for over two years now and the unemployment rate ticked up to 3.9%. For now, we can say the labor market isn’t tight anymore, but it’s also not breaking.

The key labor data line in this expansion is the weekly jobless claims report. Jobless claims show an expanding economy that has not lost jobs yet. We will only be in a recession once jobless claims exceed 323,000 on a four-week moving average.

From the Fed: In the week ended March 2, initial claims for unemployment insurance benefits were flat, at 217,000. The four-week moving average declined slightly by 750, to 212,250

Below is an explanation of how we got here with the labor market, which all started during COVID-19.

1. I wrote the COVID-19 recovery model on April 7, 2020, and retired it on Dec. 9, 2020. By that time, the upfront recovery phase was done, and I needed to model out when we would get the jobs lost back.

2. Early in the labor market recovery, when we saw weaker job reports, I doubled and tripled down on my assertion that job openings would get to 10 million in this recovery. Job openings rose as high as to 12 million and are currently over 9 million. Even with the massive miss on a job report in May 2021, I didn’t waver.

Currently, the jobs openings, quit percentage and hires data are below pre-COVID-19 levels, which means the labor market isn’t as tight as it once was, and this is why the employment cost index has been slowing data to move along the quits percentage.

3. I wrote that we should get back all the jobs lost to COVID-19 by September of 2022. At the time this would be a speedy labor market recovery, and it happened on schedule, too

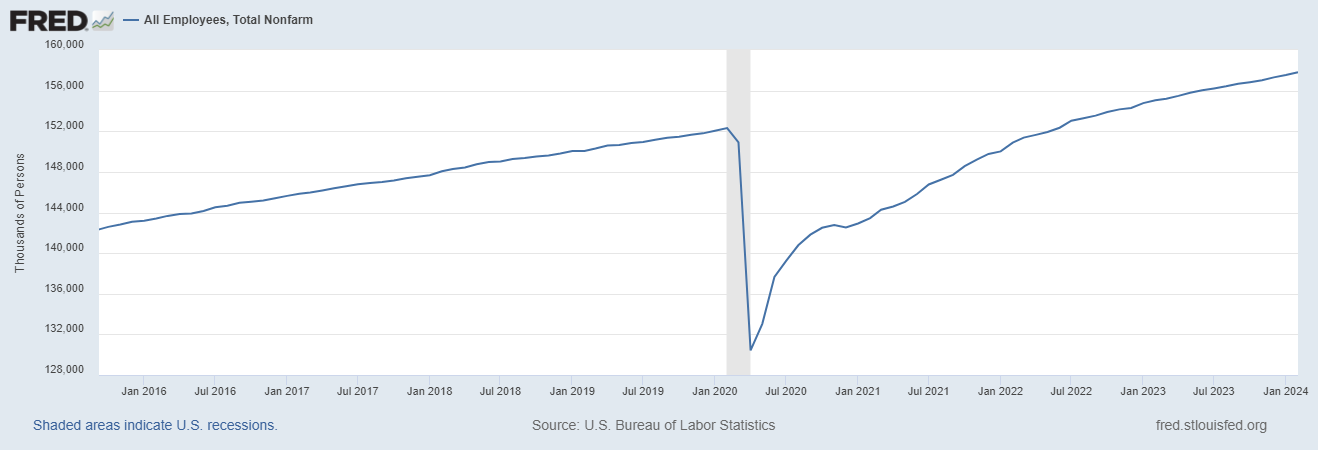

Total employment data 4. This is the key one for right now: If COVID-19 hadn’t happened, we would have between 157 million and 159 million jobs today, which would have been in line with the job growth rate in February 2020. Today, we are at 157,808,000. This is important because job growth should be cooling down now. We are more in line with where the labor market should be when averaging 140K-165K monthly. So for now, the fact that we aren’t trending between 140K-165K means we still have a bit more recovery kick left before we get down to those levels.

FromBLS:Total nonfarm payroll employment rose by 275,000 in February, and the unemployment rate increased to 3.9 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in health care, in government, in food services and drinking places, in social assistance, and in transportation and warehousing.

Here are the jobs that were created and lost in the previous month:

In this jobs report, the unemployment rate for education levels looks like this:

Less than a high school diploma:6.1%

High school graduate and no college: 4.2%

Some college or associate degree: 3.1%

Bachelor’s degree or higher:2.2%

Today’s report has continued the trend of the labor data beating my expectations, only because I am looking for the jobs data to slow down to a level of 140K-165K, which hasn’t happened yet. I wouldn’t categorize the labor market as being tight anymore because of the quits ratio and the hires data in the job openings report. This also shows itself in the employment cost index as well. These are key data lines for the Fed and the reason we are going to see three rate cuts this year.

In remarks made Thursday to the Senate Banking Committee this week, Federal Reserve Chair Jerome Powell said he expects some U.S. banks to fail in the coming months because of declining values and defaults in their commercial real estate loan portfolios.

According to reporting by multiple outlets, including The Hill, Powell indicated that the risk is tied to small and midsized banks, and there is no systemic risk to the banking sector posed by the potential collapse of major institutions.

“We have identified the banks that have high commercial real estate concentrations, particularly office and retail and other [property types] that have been affected a lot,” Powell said. “This is a problem that we’ll be working on for years more, I’m sure. There will be bank failures, but not the big banks.”

Powell’s remarks came about a month after U.S. Treasury Secretary Janet Yellen expressed similar concerns to the Senate Banking Committee. Yellen told lawmakers that bank regulators are working to address risks tied to rising vacancy rates and lower valuations for office buildings in major cities.

These stressors are tied to the post-pandemic increase in remote work, as well as higher interest rates that have made it difficult to refinance commercial real estate debt.

“I hope and believe that this will not end up being a systemic risk to the banking system,” Yellen said in February. “The exposure of the largest banks is quite low, but there may be smaller banks that are stressed by these developments.”

Although commercial mortgage debt is propelling these concerns, the possibility of failure for a federally insured bank has implications for the residential mortgage sector. According to the Federal Deposit Insurance Corp. (FDIC), banks held $2.78 trillion in residential mortgage debt as of first-quarter 2023.

Community banks — commonly defined as those with less than $10 billion in assets — accounted for nearly $477 billion (or 17%) of the total debt. And the FDIC reported that home loans are the largest lending segment by dollar volume at more than 40% of community banks.

New York Community Bancorp (NYCB) is one institution that is facing a “confidence crisis” related to commercial real estate, primarily multifamily loans. NYCB, one of the largest U.S. residential mortgage servicers, received an equity investment of $1 billion earlier this month that is designed to strength the bank’s balance sheet.

In the wake of last year’s failures of First Republic Bank, Silicon Valley Bank and Signature Bank, smaller U.S. banks moved away from commercial real estate lending. Data from MSCI Real Assets showed that after originating a record-high 34.2% of all commercial mortgages in Q1 2023, regional and local banks trimmed their share of originations to 25.1% in Q2 2023. The latter figure represented a 53% year-over-year decline.

Still, small banks are more exposed to commercial mortgage debt than larger banks. Federal Reserve data from September 2023 showed that commercial real estate accounted for an average of 44% of the portfolios at small banks, compared to 13% at the country’s 25 largest banks.

Funding a potential bailout could be another concern for banks. When the FDIC rescued Silicon Valley Bank and Signature Bank in March 2023, the price tag was $22 billion. The regulator recouped $16 billion of that through a special assessment on more than 100 of its institutions.

https://frankbuysphilly.com/wp-content/uploads/2024/03/fedhq_wikimediacommons.jpg5681024Frank Buys Phillyhttps://frankbuysphilly.com/wp-content/uploads/2017/10/Bo-Final-Logo.pngFrank Buys Philly2024-03-08 23:19:082024-03-08 23:19:08‘There will be bank failures,’ Fed chief tells lawmakers

The best real estate coaching programs for 2024

Vetted by HousingWire | Our editors independently review the products we recommend. When you buy through our links, we may earn a commission.

Real estate is a vibrant, dynamic and competitive industry. From the thrill of a sale to the pursuit of new leads, it keeps you on your toes. That said, it can also be incredibly isolating, and it can be hard to stay motivated. As a way to deal with this, many agents and brokers seek out professional mentorship as a means to gain insight and level up their performance. Across the country, the best real estate coaches serve as valuable mentors who can help agents and brokers achieve the success they deserve.

“It’s really hard for independent business owners to get unbiased advice from themselves,” says Kyle Scott, President of SERHANT. Ventures. “So they need unbiased experts to work with that will help them grow their business — someone who has been there, who has done it, and who is able to see their business from both the 35,000-foot view and down in the weeds.”

A quick internet search will prove that real estate coaching programs are plentiful. Whether you’re looking to expand your team or client network or figure out how to delegate work so you can focus on the tasks you do best, a real estate coaching program could be a valuable launchpad. But when it comes to choosing the right one for your unique needs, there’s a lot to consider. Here, we highlight some of the best real estate coaches in the industry and their programs.

Summary

Who can benefit most from real estate coaching?

An unbiased view is worth millions. Often, we turn to our closest friends and family for guidance. Unfortunately, they’re usually not familiar with the ins and outs of the real estate industry and can’t provide you with the relevant feedback you need. As a result, many independent contractors rely on themselves, which generally doesn’t work either.

You can’t advise yourself, you’re too close to it. A coach works best for someone who is actually looking to grow their business, someone who is looking to put in the time and the energy to make a difference in achieving more income this year.

Hire a coach if you want to start taking your business to the next level for any reason — you want to make more money, have more freedom with your time, or stop riding the ins and outs of the commission cycle.

President of SERHANT. Ventures

1. Sell It Like Serhant

Key Facts

Grown throughout the pandemic, the Sell It Like Serhant program has been carefully adapted to the current market. It follows a weekly and bi-weekly platform featuring one-on-one virtual coaching from Serhant’s proprietary video platform. After a half-hour or hour-long group meeting every week or every other week, participants follow actionable steps to help them grow their business. Thus far, more than 22,000 enrollees in 128 countries have been through the Sell It Like Serhant program.

What We Love

Serhant offers daily office hours so participants can pop into virtual sessions to ask questions or get expert advice between their regularly scheduled sessions. A community platform also allows participants to pass referrals to each other. Thus far, it seems to have worked: To date, participating agents have closed over $250 million of referral deals.

Pricing

There are different membership tiers, depending on the level of guidance you need. The introductory Real Estate Core Course starts at $497. Prices are higher for a more specific course or one with 1:1 coaching.

Who’s it Best For?

If you’re looking to build a memorable personal brand, SERHANT. is the way to go. “The number one differentiator about our program is we understand that as a real estate agent, you have one job: to generate leads,” says SERHANT. Ventures President Kyle Scott. “Our number one focus is helping you build a clear, compelling, memorable personal brand and put your lead generation on autopilot. So that way, you can do what you do best, which is build relationships and close deals.”

Visit Sell It Like Serhant

2. Tom Ferry International

Key Facts

For good reason, Ferry International refers to itself as the real estate industry’s leading coaching and training company. Focused on Ferry’s “8 Levels of Performance,” the programs are a staple of real estate coaching. Their new group coaching sessions cover various aspects of real estate sales.

Prospecting Bootcamp is a 14-hour program comprised of seven two-hour group coaching sessions, and includes a peer-to-peer collaboration space. It involves independent work pulled from training videos and downloadable resources.

Recruitment Roadmap consists of hour-long sessions each week for ten weeks. Completed over Zoom and through the Tom Ferry video platform, each group coaching program offers a high level of specialization.

Finally, their Fast Track program offers 12 interactive group coaching sessions designed to help new agents build the necessary skills to succeed — like mastering listing presentations and handling objections.

What we love

If you’re looking for the gold standard of real estate coaching, Tom Ferry has the goods to back up the bravado. Because of their many years in the biz, Tom Ferry has a huge base of coaches, which means there are plenty of options to find the program best suited for your specific needs.

Pricing

Tom Ferry’s Prospecting Bootcamp and Fast Track coaching programs cost $999 but can be broken down into three monthly payments. The Recruitment Roadmap group coaching costs $1,499 but can be split into three monthly payments of $500. Consider their free coaching consultation if you want to dip your toes in the water. Check out their customer reviews, where several coaching program alums rave about the program.

Who’s it Best For?

If you thrive in a group setting that allows you to feed off the energy of others, Tom Ferry might be right for you. Their group coaching programs are new and more affordable alternatives to often costly 1:1 coaching fees.

Visit Tom Ferry

3. Tim and Julie Harris

Key Facts

The dynamic duo of real estate coaching, Tim and Julie Harris are a major name in the industry. Under their business, Harris Real Estate Coaching, their programs are divided into three tiers: Premier, Premier Plus, and VIP, all of which rely on a user-friendly online platform.

Pricing

Premier platform costs $197 per month, but a 30-day free trial is available. Premier Plus costs $599 per month, while VIP costs $999 per month. Of course, their wildly successful podcast is a great free resource to tap into, as well as Tim and Julie’s many written contributions to HousingWire.

Who’s it Best For?

If you’re constantly on the go, the ability to access the course from any device is a major asset.

4. Candy Miles-Crocker

Key Facts

Newbies are welcome at Candy Miles Crocker’s program. Known as the “Real Life Realtor,” she’s the brain behind Real Life Real Estate Training. With a variety of courses in her offerings, including a plethora of self-paced online courses, Miles-Crocker gives new agents a leg-up on the rest.

What we love

Miles-Crocker is still an active agent, working with clients to close deals. Her 20+ years of experience practicing in Washington, D.C., Virginia and Maryland have helped her build “systems, strategies and scripts” that she shares with her coaching clients.

Pricing

The CORE Essentials Blueprint program retails for $1,597. Smaller, more specific courses, such as The Buyer Presentation, are priced at $347. While all pricing isn’t listed on her website, Miles-Crocker also offers a free course that includes her 6-point system for growth.

Who’s it Best For?

Miles-Crocker’s courses could be beneficial if you are new to agent life or looking to get your business reorganized. She even has one specifically for your first 30 days as a real estate agent.

5. Ashley Harwood

Key Facts

Boston-based Ashley Harwood inspires introverts with her convincing, heartfelt and high-touch approach to practicing real estate. Her very human, very relatable Move Over Extroverts coaching approach is the perfect antidote for cheerleader-style coaches that urge you to door-knock, chase down divorce leads or become a social media superstar.

What we love

Harwood is a licensed agent coaching agents week-in and week-out at no less than three Keller-Williams offices in the great Boston metro. We love her humanity, inspiring videos, and her latest enterpise — The Quiet Success Club. Inspired by Susan Cain’s New York Times bestseller Quiet, about the power of introverts, Harwood brings together a community of like-minded real estate agents wanting a more client-centric approach to succeeding as an agent.

Pricing

Join The Quiet Success Club for $45 per month (paid monthly) or get two months free when you pay for an annual subscription (for $450). The club is currently offering founding member pricing for $25 per month or $250, but it’s a limited-time offer available only under April 30, 2024. Or get a lifetime membership to Harwood’s suite of courses, called IntrovertU, for a one-time cost of $997.

Who’s it Best For?

Introverts, of course! While you may not count yourself as one, if you read Susan Cain’s book, you may unearth your more introverted traits — like recharging your battery by being alone. Ok, even if you don’t bask in solitude, Harwood promises a calming community where agents can be themselves, be seen, and where they don’t have to be the loudest voice in her mastermind group, purposefully (and quietly) designed to teach successful lead generation and other strategies.

6. Levi Lascsak

RMF parent obtains Chapter 7 bankruptcy status

The presiding judge in the bankruptcy case involving Reverse Mortgage Investment Trust (RMIT) — the parent company of former leading reverse mortgage lender Reverse Mortgage Funding (RMF) — has approved a request to transfer the company’s bankruptcy status to Chapter 7 from its current Chapter 11 status. This is according to court documents reviewed by RMD.

The move allows the RMIT estate to sell off its remaining assets to satisfy creditor claims. It can also provide an additional mechanism for resolving disputes while reducing the administrative costs the estate would need to continue paying under Chapter 11.

Granting the conversion

In the original request, the RMIT plan administrator explained that conversion to Chapter 7 was being sought to preserve the value of the estate’s remaining assets and ease the overall liquidation process.

“The Plan Administrator hopes that by converting this case, instead of seeking dismissal or simply resigning, that the estate will be able to preserve value of any potential recovery from the TCB dispute or other litigation for the benefit of all unsecured creditors,” the January filing explained. “Absent conversion and the installation of a chapter 7 trustee, this value could be significantly eroded, if not entirely eliminated.”

Presiding Judge Mary Walrath of the U.S. Bankruptcy Court for the District of Delaware found that the request was “due and sufficient under the circumstances.” The conversion will be effective anywhere from five to 10 business days after the entry of the March 12 order, according to the court filing.

In a separate order, Walrath gave permission to the plan administrator to “abandon and destroy any records to be destroyed which she, in her sole discretion and business judgment, deems to be no longer necessary to the administration of the plan,” pursuant to the bankruptcy code.

TCB/Ginnie Mae dispute

When presenting the motion to convert the case to Chapter 7, an attorney for the plan administrator reiterated that this was partially due to a dispute currently playing out between Ginnie Mae and Texas Capital Bank (TCB), the debtor-in-possession lender to RMF.

After the bank filed its lawsuit, the court in that case set deadlines well into 2025, making the situation more challenging for the plan administrator in the bankruptcy case to resolve in a timely manner. The attorney for the RMIT estate told Walrath that the case is clearly “not going to be resolved anytime soon.”

“As a result, the court previously entered an order turning over the unencumbered assets to TCB. The plan administrator has worked diligently to try and resolve as much of the issues as possible before we needed to come to your honor, but […] that day is here.”

The attorney reiterated that the estate has run out of money, and that it requires conversion to Chapter 7, which will mean liquidating any remaining assets to wind the company down.

Need for conversion

In the January filing, the plan administrator explained that a conversion to Chapter 7 would be in the best interest of all stakeholders.

“While it is unclear at this juncture how the TCB dispute will conclude, there remains the possibility of future distributions being available to creditors. If the Chapter 11 Cases were to be dismissed, all creditors, including TCB, could lose the opportunity to receive funds from the estate,” the filing read.

The creditors themselves would also “be in a better position if the Chapter 11 case converted to one under Chapter 7 which would remain and be preserved as a vessel that can resolve any remaining disputed unsecured claims, and distribute funds to all creditors, if TCB is successful in the TCB dispute and thereafter returns funds to the estate,” according to the January filing.

Source link

Guild earnings show more reverse mortgage activity after Cherry Creek acquisition

Guild Mortgage released its fourth-quarter and full year 2023 earnings report this week, showing that it narrowed its focus on purchase originations and increased its market share on the forward lending side, but it still sustained a loss.

After its acquisition last year of Cherry Creek Mortgage, Guild increased its involvement in the reverse mortgage industry due to Cherry Creek’s well-developed reverse lending apparatus. In the new earnings report, the company now lists reverse mortgages it holds for investment, which totaled $315.9 million, representing loans it has elected not to sell on the secondary market.

Guild’s in-house retail reverse mortgage originations reached $49.8 million in volume in 2023, while its wholesale reverse origination volume was $36.8 million for the year.

The company also reported an $8.2 million gain on the reverse mortgages it is holding for investment, as well as income related to Home Equity Conversion Mortgage (HECM)-backed Securities (HMBS), according to the earnings report.

Through its Cherry Creek acquisition, Guild became a top 10 reverse mortgage lender in 2023, according to a tabulation by Reverse Market Insight (RMI). The two companies each had a high enough volume last year to effectively earn two separate slots on RMI’s leaderboard, holding the No. 8 and No. 9 positions.

Guild could move up further in 2024, considering that the sixth largest lender of 2023 — Austin-based Open Mortgage — announced its exit from the reverse mortgage business late last year due to lower origination volumes combined with lower pull-through rates, according to CEO Scott Gordon.

When combining the raw loan volume of both Cherry Creek and Guild based on RMI’s 2023 top 10 leaderboard, the company produced 1,136 HECM endorsements in 2023. If that figure was credited solely to Guild, then the company would have emerged as the sixth largest lender in the industry, just behind Fairway Independent Mortgage Corp.

Guild also ended 2023 as the sixth largest HMBS issuer in the industry, according to a report from New View Advisors based on public Ginnie Mae data and proprietary private sources.

Source link

Are 1970s inflation and mortgage rates possible?

The CPI report came out Tuesday, and the headline number showed a 12-month inflation of 3.2%. The running average of CPI going back to 1914 has been 3.3%. So, what should we take away from this number, seeing that market participants are still worried about 1970s inflation and some don’t want to see any rate cuts this year?

Fed presidents and others have cited the fear of 1970s-style entrenched inflation as a reason they hiked rates so fast and are being careful as they consider rate cuts. However, is the 1970s reference a valid one? After today’s inflation report, is this even a possibility with the current economic conditions?

The deflation question is an easy no: the history of deflationary collapses post-WWII is non existent. This is an issue from the 1800s. As long as people are working and the economy is expanding, it is rare to see deflation in the CPI numbers.

But what about the 1970s inflation that led to 18% mortgage rates in the early 1980s? For this to happen, we would need to see a few big key variables which aren’t happening currently.

Today’s CPI report

From BLS: The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in February on a seasonally adjusted basis, after rising 0.3 percent in January, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment.

The year-over-year core inflation data have been slowing down on all the inflation reports; CPI, PPI, and PCE have slowed from the COVID-19 peak. The core PCE inflation data that the Fed focuses on is at 2.8% yearly, which is a far cry from the 1970’s 10%.

In today’s CPI print, core inflation today is running at 3.76%. How is this possible when the stock market has recovered, the labor market is intact, and the economy is growing above trend? We were told inflation couldn’t possibly cool down with all those three variables happening. Well, it did!

Remember that in the 21st century, it was difficult even to keep core PCE inflation above 2%. The global pandemic created supply shortages, an extra boost in demand for goods over services, and a massive burst in inflation. Like all pandemics, disinflation follows the pandemic inflation boost as supply chains improve.

Can the 1970’s inflation return?

So, how do we get the 1970s inflation growth rate with an economy currently outperforming? This is a damn good question! One of my running jokes over the last year has been that we have people saying we are in a recession but that we can’t cut rates because the economy is too strong. Both of those things can’t be true ot the same time, so you need to pick one. You can say that the tight labor market that pushed up wages is cooling off. Here’s my latest article on the jobs report, which shows the labor market isn’t tight anymore and wage growth is cooling down.

Why is this key? If the labor market cools, wage growth slows down, making it challenging for rent inflation to grow much faster. If 44.4% of CPI is shelter, you need a booming housing market again to push rents higher than what we saw at the peak of the global pandemic. Good luck on this by the way.

The 1970s saw wage growth, labor force growth, and a lack of housing, facilitating the housing boom and rent inflation. That’s not happening now; if anything, rent inflation is artificially too high.

Also, we have a lot of supply coming online in the five-unit sector, which will keep rent growth cool for apartments and less for single-family homes. One crazy idea that can boost inflation is if the government forces investors to sell their homes, kicking out renters and limiting the supply of rented homes. That is an evident supply argument because fewer single-family homes to rent would boost inflation. However, I don’t see this happening. What about the government giving tax breaks to investors to sell their homes? It’s not good for politicians to make investors more money while families are booted out of their single-family rental units.

What about a supply shock?

To get anything that looks like the 1970s inflation today, we would need to see a supply shock and one that lasts a long time. We had an oil shock back in the 1970s which would amount to oil prices today — adjusted for inflation — of about $450/barrel. Instead oil is $78/barrel today.

Here is my model for 1970s inflation returning. We would have to have war around the world: China going to war with Tawain, Russia using oil and wheat as a weapon of choice against western economies and Iran continuing to have their pirates attack ships in the Red sea. This would force headline inflation to rise, and as long as it sticks, wage growth would have to compensate, leading to core inflation rising with it.

This model assumes the variables above would happen for a long time, forcing U.S. companies to compensate their workers for the higher cost of living. However, you get my point here: we would need a supply shock the size of Godzilla. The economy and the stock market are doing fine, but inflation doesn’t look like in the 1970s because the supply markets are returning to normal.

Can the 1970s inflation return and bring double-digit mortgage rates heading toward 18%? In theory, yes. In reality, no. Unless you get a massive supply shock, it’s hard to get inflation that high again and sustain itself.

For a long time, people said we couldn’t bring the inflation growth rate down if the economy expanded. Some people said we needed high levels of unemployment for many years to bring down inflation. Well, the unemployment rate is under 4% and the inflation growth rate is much closer to what we saw in the last decade than the inflation growth rates of the late 1970s. So, take those disco pants and give them to the Salvation Army. It’s a new world, and we must leave that period behind us.

Source link

Redfin’s relaunched homebuyer refund program now available nationwide

A little over a month after formally relaunching homebuyer refunds under its Sign & Save program, Redfin announced that Sign & Save is now available to clients nationwide.

In an announcement on Tuesday, the brokerage noted that it had expanded the program to more than a dozen additional markets, including Chicago, Los Angeles, Philadelphia, San Diego and San Francisco. The program is now available to Redfin clients across the country, except in states such as Arkansas, Iowa, Kansas, Mississippi, Missouri, Oklahoma, Oregon and Tennessee, where commission refunds are prohibited by law.

First piloted in a handful of markets in September 2023 and formally launched in early February, the Sign & Save program provides buyers who sign up to work with a Redfin agent before their second home tour — and who purchase a property with that agent within 180 days of signing the agreement — a refund of 0.25% to 0.5% of the purchase price of the house. The buyer will receive the refund at closing.

With Sign & Save, at the end of a buyer’s first home tour, the Redfin agent will ask them to sign a buyer agency agreement, which creates a formal working relationship between Redfin and the buyer. Clients who sign the agreement before going on a second home tour with the Redfin agent will get a refund when they close on their new home.

The Sign & Save refund starts at 0.25% of the purchase price, but it rises to 0.5% for luxury homebuyers who purchase a home through Redfin’s Premier service.

“With Sign & Save, Redfin is giving consumers a better deal in real estate,” Jason Aleem, Redfin’s senior vice president of real estate operations, said in a statement. “This program rewards customers who commit to working with a Redfin agent early in the process, which is helping drive more sales for our agents.

“Not only are we putting money back in our customers’ pocket, we’re also educating them about how real estate commissions work and how Redfin can help them win. This is good for our customers, our agents and our growth as a brokerage, which is why we’re expanding it everywhere we can.”

In July 2022, Redfin moved to eliminate the commission refund it offered to buyers in 22 markets. During the firm’s Q2 2022 earnings call, CEO Glenn Kelman said the brokerage was hoping to fully eliminate the refund as early as January 2023.

But in the wake of the jury verdict in the Sitzer/Burnett commission lawsuit, many real estate industry professionals are concerned about homebuyers’ ability to afford representation if the practice of cooperative compensation is banned, as the Department of Justice has recently expressed as its desired policy outcome.

Source link

Mortgage rates cool off ahead of inflation reading

In anticipation of Tuesday’s inflation reading, mortgage rates eased compared to last week.

HousingWire’s Mortgage Rate Center showed the average 30-year fixed rate for conventional loans at 7.08% on Tuesday, down from 7.17% one week earlier. At the same time one year ago, the 30-year fixed rate averaged 6.83%. Meanwhile, the 15-year fixed rate averaged 6.46% on Tuesday, down from 6.5% one week earlier.

The relief in borrowing costs, however, may be short-lived as Tuesday’s strong inflation data is likely to reverse this trend. Consumer prices in February were up 3.2% from a year earlier, according to data released by the U.S. Bureau of Labor Statistics.