In 2021, United Wholesale Mortgage (UWM) CEO Mat Ishbia set a three-year goal to make UWM the No. 1 lender in the country. Ishbia, who started running his father’s mortgage firm in 2013 and has since grown it into the country’s No. 2 lender, isn’t satisfied with second place, behind Rocket Mortgage.

“I don’t have on my board my goal is to be the No. 2 overall lender, it’s to be No. 1 and we’re going to do that,” Ishbia told HousingWire in 2021.

After two golden years in the mortgage market during the pandemic period, refis have dried up and the industry has since pivoted toward a purchase market. Ishbia is confident his firm can benefit from this trend by cutting prices for brokers and bringing more retail loan officers to its wholesale channel, whose market share currently stands at around 20%.

Following the firm’s pledge to beat the top 20 lenders’ pricing by one basis point in May, UWM took another aggressive step towards pricing in June. Dubbed the ‘Game On’ pricing initiative, UWM slashed prices across all loans by 50 to 100 basis points, wreaking havoc on competitors with already compressed margins.

“I’m not really focused on the margins for this quarter,” Ishbia told investors in UWM’s second-quarter earnings call. “It’s an investment for the long term, strategically building the broker channel.” With gain on sale margins expected to be at around 30 to 60 bps in the third quarter, there’s no question UWM is losing money, analysts said.

“There is no magic bucket of money,” said Brian Hale, founder and CEO at Mortgage Advisory Partners. “He’s trying to drive more volume to speed those costs across and to say to his brokers that we’re in the fight with you.”

For a company that has more than $900 million in cash and $3.2 billion in equity as of the second quarter, plus technology that can close loans faster than most competitors, aggressive pricing is a “multibillion dollar decision investment,” as Ishibia put it. That aggressive strategy means other lenders focused on the wholesale channel or reducing servicing portfolios are finding themselves in a bind. Smaller players that have limited access to liquidity may be forced to downsize or get consolidated.

“He (Ishbia) wants to win at all costs,” said Kevin Heal, senior analyst at Argus Research. “They (UWM) have enough capital to withstand, whereas others that didn’t raise capital or didn’t go public might not necessarily have cash on hand or capital to sustain in this new match.”

Multibillion dollar investment

It’s been about two months since UWM rolled out its new pricing strategy and Ishibia says he is already seeing the impact on the market.

“With Game On, it’s making them (retail loan officers) take an extra look at the broker channel,” Ishbia told analysts in its second-quarter earnings. “We believe the broker channel will grow to 33% over the next five years. However, with strategic initiatives like Game On, we think that number could reach 40% or higher.”

In the second quarter, the lender’s $215.4 million net income was buoyed by a more than $26 million increase in the fair value of mortgage servicing rights (MSRs) and UWM’s cash and cash equivalents rose 6% to $958.7 million from the previous quarter.

The lender’s total MSR portfolio was valued at $3.7 billion as of June 30, up from $2.7 billion a year earlier, according to SEC filings. That’s after selling off MSRs tied to $72.7 billion in loans over the first six months of 2022 — for total proceeds of $871.7 million, including $216.2 million posted in the second quarter.

Kevin Barker, managing director at Piper Sandler, says UWM has access to liquidity via borrowing and selling MSRs, and the lender is not too levered with net debt to equity being 1.7 times.

“You could run that up to 3 or 4 before it starts to become a real concern. His tangible net worth ratio (a proxy of how much equity you have relative to your total assets) is just under 30%. Anything below 15% you start to question it,” said Barker.

During the refi heyday, UWM beefed up its employee count to 9,000 in the second quarter of 2021 but has consistently cut down their headcount, losing a total of 2,000 employees over 12 months, according to the firm’s 10-Q report. Expenses in the second quarter dropped 5% to $348 million led by a cut in salaries and commission.

But there is no question Ishbia is losing money on the gambit, Barker added. “With the gain-on-sale margin of 99 bps, when you cut 50 bps off of that, you’re in negative territory pretty quick.”

UWM’s total production expenses were $247 million or 86 bps on the $29.9 billion in originations for the second quarter, a report published from Wedbush Securities estimated.

“With a gain on sale margin of 99 bps this quarter, they are making a GAPP profit, but if you think about the cash flow, they are burning cash,” said Jay McCanless, senior vice president at Wedbush.

UWM’s loan production income of $296.5 million includes $412.7 million of non-cash MSR capitalization. When mortgage servicing rights are sold, UWM’s current loan production income in cash terms would be -$117 million ($296.5 million-$412.7 million), according to Wedbush’s report.

“They made money on a GAAP basis this quarter. We think they’re going to lose money on a GAAP basis next quarter because of how low they’re taking the gain on sale margin,” said McCanless.

Ishbia didn’t set a timeline for how long UWM will run with the Game On pricing initiative and the big question among analysts is how much of the market share gain is going to end up being permanent when the lender ends its price cuts.

“He’s using price to increase market share. What we don’t know is whether market share could stay when prices go back up,” said Barker.

Not all about pricing

Broker Hussam Saada of Precision Mortgage closed about 60% of mortgages with UWM after the firm rolled out its new pricing initiative. On a monthly basis, he closed about $3 million in volume with his previous top lenders including Flagstar and Homepoint. With UWM cutting rates and its technology enabling fast closings, Saada’s business with the Michigan lender grew about three-fold since ‘Game On.’

He now sees other wholesale lenders quickly catching up to compete in the game. For one, Homepoint is offering a 75 bps pricing bonus for conforming conventional loans at no additional costs to borrowers, although it’s limited to a specified number of ZIP codes in 20 states.

“At the beginning, UWM was more than 0.25% to 0.375% better in rates than my top lenders, but other wholesale lenders are getting aggressive to compete with UWM,” Saada said. “When one company gets aggressive with pricing, everyone else has to catch up.”

On Aug. 25, UWM was paying brokers 101.025 bps per loan excluding loan officer compensation, at a 5.25% mortgage rate for a single family, $400,000 purchase price with a 20% downpayment and a 720 credit score, according to pricing data on Loansifter. Provident Funding Associates Wholesale had the best price for brokers that day, offering 101.25 bps, meaning the lender was paying 22.5 more bps per loan to brokers than UWM.

Rocket Pro TPO trailed UWM by offering 100.718 bps per closed loan. Homepoint ranked fourth at 100.465bps and Flagstar followed, paying brokers 100.095 bps per closed loan that day. (Some brokers might have better pricing based on volume provided to each wholesaler.)

But for brokers, price isn’t the only determining factor when comparing rates for the borrower. On top of competitive rates, getting approved for a mortgage has to be an easy and quick closing process for the customer, said Kevin Leibowitz, CEO of brokerage Grayton Mortgage.

“There are two things I need to mitigate: process and price,” said Leibowitz. “I need to use somebody that has a process I like. If I’m going to offer a loan in a competitive environment and they are doing a good job with the process, I might as well offer a lender with the lowest rate that doesn’t require the borrower to pay for points and pays my commission.”

For instance, UWM’s underwriting system Bolt, which the lender says enables brokers to underwrite a loan in 15 minutes, was one of the top reasons brokers gave for choosing the lender. Using artificial intelligence, Bolt allows brokers to do a pre-underwrite, which an underwriter looks at within four hours or so, according to Hussam.

“I can get you (borrower) a conditional loan approved in 20 minutes. If it wants the loans ‘clear to close,’ borrowers would need to have to wait for their closer to get the package out. With UWM, you as the loan officer, you as the attorney or title company, can do your own closing package in 10 minutes. It’s smoother for the client,” Hussam said.

“What’s the end game?”

UWM is actively courting more brokers and retail LOs to the wholesale channel. In this highly competitive environment, how are other lenders countering that strategy?

Home Point Capital, the parent company of wholesale lender Homepoint, is one of the most affected by the price war triggered by its rival UWM. The pure play wholesale lender reported a $44 million loss in the second quarter from an $11.9 million profit in the previous quarter. To improve liquidity, it chose to reduce its servicing portfolio, completing a sale of single-family mortgage loans worth $257.3 million in the first quarter.

As of June 30, the servicing portfolio totaled $90.5 billion in unpaid principal balance, down 11% quarter over quarter. While the company was cash-flow positive, reporting $135.8 million in cash and cash equivalents in the second quarter, the company cut its dividend to preserve liquidity. It also bought back $50 million of senior debt in the open market to reduce leverage in the second quarter, a report from Wedbush said.

Home Point Capital’s CEO Willie Newman in a second-quarter earnings call acknowledged the firm may get smaller with the “volume opportunity” on a macro basis “relatively limited,” but said Homepoint won’t engage in a price war.

Instead, the lender plans on expanding its product mix, in line with other firms’ pivot to diversify product offerings, including Rocket’s solar loans and home equity loans.

“Whether it’s our enhanced portfolio of adjustable-rate mortgage (ARM) and jumbo products, or more innovative solutions like Homepoint Cash Compete and Homepoint New Build, we’re giving consumers, real estate agents and home builders more reasons to work with our broker partners,” said Phil Shoemaker, president of originations at Homepoint.

Homepoint Cash Compete helps buyers close an all-cash bid and the Homepoint New Build program connects builders with construction financing.

And though it may not want to engage in an all-out price war, Homepoint is strategic about pricing for certain segments, as its recent 75 basis point pricing bonus demonstrates.

Amid UWM’s aggressive pricing, nonbank heavyweight loanDepot exited the wholesale channel after reporting a $224 million loss in the second quarter. With cash and cash equivalents rising 72% to $955 million in the second quarter from the previous one, it plans on rolling out its home equity line of credit (HELOC) product later this year while maintaining joint ventures with homebuilders and depositories.

Rithm Capital, parent company of New Residential Investment, which acquired Caliber in August 2021, posted a $3 million loss partially due to a decline in residential mortgage originations. While its origination volume dropped 29% to $19.1 billion in the second quarter and cash holding declined 9.6% to $1.5 billion from the previous quarter, the firm said it’s focused on “consistent pricing.”

“We monitor our competition, we evaluate their movements but we’re focused on discipline and consistent pricing,” said Jeff Gravelle, chief production officer at Caliber. “We have a wide range of products we offer in non agency, specifically our ‘Smart Series’ which is our non-QM program. This gives NewRez, Caliber plenty to add to our broker customers.”

The firm plans to roll out new products and features in non-QM in the coming weeks and focus on affordable housing lending, said Gravelle.

As Wedbush analysts said in a report in June, it will likely take a quarter or two before excess capacity from public mortgage companies is flushed out of the system Looking at lenders’ financials, the silver lining for some of these firms is that they have access to liquidity via cash or selling MSRs.

The mortgage landscape isn’t expected to get any better in the third quarter as mortgage rates remain elevated and lenders lay off employees to reduce expenses. Smaller lenders that don’t have access to liquidity are caught in a difficult spot.

“You probably will see some small lenders driven out from the market or some consolidation or get bought by a private equity company,” said Heal.

The analyst said that while UWM has enough cash and capital to fund their own loans, smaller lenders relying on warehouse loans are getting squeezed. “As rates rise, those warehouse financing costs go up.”

However, smaller-sized wholesale lenders who carved out a niche by targeting a different audience than UWM are better positioned to weather the storm.

“A smart wholesaler won’t try to out UWM,” said Paul Blaylock, CEO at retail lender LoanFlight Lending. “What they’ll try to do is find a corner of a market where UWM doesn’t compete, can’t compete or won’t compete.”

Pennsylvania lender Spring EQ Wholesale Lending, a wholesale lender that offers home equity loans and 30-year fixed-rate mortgages for second lien loans, is an example of a lender that found its niche four years ago. Because the lender doesn’t offer first lien mortgages, it is immune to UWM’s aggressive pricing, the firm said.

Spring EQ sees competition coming as rates stay high and available home equity is at historic levels. Without disclosing its origination volume, the lender said it added 54 operations team members over the past 90 days to “accommodate growth.”

“We are not competing with UWM,” said Paul Saurbier, senior vice president at Spring EQ. “If someone wants a $1.2 million mortgage, a mortgage broker can do an $800,000 agency loan with UWM and then they can do a simultaneous second one with us to make up the difference,” he said.

For consumers, the rate for a jumbo loan is higher than a conventional loan and guidelines tend to be more stringent, so breaking the loan gives borrowers a better blend of rates.

“Customers get better terms on the first mortgage not going jumbo and we can help facilitate that. It’s a simultaneous closing for a second lien mortgage for the client where they sign the UWM loan and sign a loan with us, called a piggyback loan.”

Other lenders including Provident Funding, Cardinal Financial Wholesale and AmeriSave Mortgage Corporation were not available for interviews on their strategies to navigate, pricing and their prospects for the third quarter.

Time will tell how well UWM will maintain its market share once the lender raises prices again. Another major question that remains unanswered is how UWM’s ambition to increase its market share will affect consumers in the long term.

“He (Ishbia) wants a monopoly,” said Blaylock. “So the question is, is that good or bad for the consumers in the long term? If a wholesaler has monopoly in the short term, during that battle it’s probably good. Long term, nine times out of 10, it’s bad.”

“Once he (Ishbia) has price control, he probably has a fiduciary duty to shareholders to take advantage of that. Brokers have to decide whether that is healthy in the long term. What’s the end game? Who pays for this?”

The post The strategy behind UWM’s multibillion dollar investment appeared first on HousingWire.

Source link

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

Why home-price growth is still up 18% year over year

On Tuesday, the S&P CoreLogic Case Shiller Index reported that national home prices grew 18% year over year. While the growth rate is cooling monthly, we are still in a savagely unhhealthy housing market trying to get national inventory levels back to pre-COVID-19 levels.

From the index:

I know it seems strange, but existing home sales are falling, and the monthly supply of new homes is at 10.9 months even if the last existing home sales report showed home price growth of near 11% year over year.

There is a simple explanation for this, but you’re going to have to believe that supply and demand economics still work and that the credit profiles of homeowners matter more than people think. This means all those men and women since 2012 who have been saying its housing 2008 all over again on their YouTube, Twitter, Facebook and other social media outlets simply don’t have the proper training to talk about housing economics. I have documented the history of these housing price crash addicts for a decade now.

Housing inventory issue with no booming demand

My observation post-2020 is that many people have never read the total housing inventory data because we still have people who say active listings aren’t low or that it’s fake news. I understand why anti-Central Bank people say this because they want to blame everything on the Federal Reserve and say it’s just been booming demand.

However, we haven’t had a credit sales boom like the one we saw from 2002-2005. Nor can we ever have a credit sales boom again with lending standards back to normal. Case in point, purchase application data is already below 2008 levels today.

Total Inventory had been growing from 2001-2005; total listings data in 2005 was at the higher historical range of 2.5 million listings. We broke to all-time lows post-2020, continuing the trend of lower inventory. Today, we stand at 1,310,000 active listings.

NAR Total Listing Data:

If we cut the timeline to the last time inventory grew, which was 2014, you can see this downtrend in inventory, unlike 2001-2005, when inventory grew from 2 million to 2.5 million. Inventory has been falling for years but people ignored the trend because some were always talking about the housing bubble 2.0 crash, especially from 2012-2019.

Then we can see a vicious break to all-time lows in 2020 when we didn’t have a seasonal push in inventory, and even today, with the weakness in home sales, we aren’t back to the range I believe would be ok, between 1.52-1.93 million. I don’t need to see total active listing get back to the historical range of 2-2.5 million to take the savagely unhealthy theme off, but I do need us to get into a range between 1.52-1.93 million, like I have talked about for some time now.

New listings are declining now

One of the issues with existing home inventory has been that, for the most part, a traditional seller is usually a buyer of a home. I am not talking about investors; I am talking about primary resident homeowners. Some sell to rent, of course. However, traditionally speaking, they buy a home.

One of the points of concern this year has been that when rates got toward 6%, this could potentially have new listings decline faster than normal because buying a home after selling might not be the best financial decision. Inventory is always seasonal, but the decline in new listings this year was not what I wanted to see. The decrease also happened when rates fell 1.25% from the recent highs of 6.25% back down to 5%. This is not encouraging news at all, in my view.

From Redfin

The recent decline in new listings has impacted the active listings to be negative now year to date. From Realtor.com:

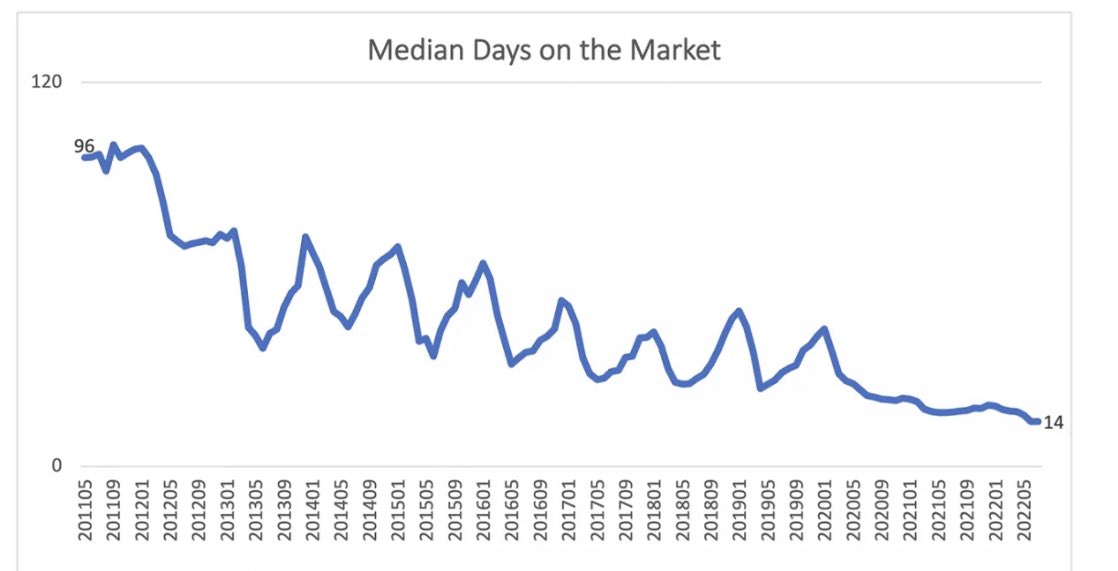

Even with demand weakness in recent months, days on market are still low.

This is the most frustrating aspect of housing and the inventory situation. Because total inventory data is still low historically, the days on the market are not growing, year over year, per the last two existing home sales reports. NAR has a very critical data line, which shows that 82% of the active listings are being sold within a month. This is a much higher percentage than what we saw pre-COVID-19. This is also the most recent data, so the decline in sales still hasn’t increased the total inventory levels high enough to get back to pre-COVID-19 levels.

From the NAR:

In the last existing home sales report, you can see the year-over-year decline on the days on market data.

In the early 1980s we had a significant sales decline from 4 million to 2 million, but we had more active listings then. In 2022, despite our robust sales declines, we are still seeing low days on the market because total active listings are still lower today than then.

Also, homeowners on paper look great with fixed long-term debt products and have positive cash flow, so owners need a valid reason to sell. The next job loss recession, when it happens, will have more foreclosures, short sales, and bankruptcies. However, not to the degree we saw from 2005-2008. The 2005 bankruptcy reform laws and the 2010 Qualified Mortgage laws, once passed, created an expansion that has produced the highest quality homeowners in our lifetime.

Note: Even with the savings rate percentage below pre-COVID-19 levels, we still have net excess savings of over 2 trillion dollars.

With housing tenure much longer post-2008, people’s wages have increased yearly, and their cash flow has improved with multiple refinancing since 2012.

Since we never had any exotic loan debt products in the system post-2010, you don’t see foreclosures and bankruptcies rising even as the expansion was moving along like what we saw in 2005, 2006, 2007 and 2008.

To wrap it up, inventory started the year at all-time lows, which is the most significant reason pricing is still firm even this late in the year. The growth rate of pricing above 20% wasn’t sustainable, and I and others are rooting for this madness to stop. However, there is a proper way to talk about and price cooling market other than saying 2008 every day of your life.

As I have stressed, people need to be patient with inventory growth and not run 2002-2011 credit sales to inventory models for this marketplace. It hasn’t worked since 2012 for a reason. Weakness in demand can create inventory, but it takes time because each new year we have new traditional listings.

Since we are so close to the fall, it’s time to look at housing with a 2023 outlook because seasonality will kick in soon. The growth rate of home prices is already cooling off, and the Case Shiller report lags that data, just like in October of 2020 when prices started to rise, but the data back then lagged the price growth.

I am all for price growth to fall and decline to get my price growth model back in line. As any analyst will tell you, you can’t just give up tracking data and throw up a random percent decline number and then hope that happens. Any good analyst will account for all the variables around the sector they follow. This is why I take the economic data one day at a time and stress that inventory growth needs more weakness and time.

I know the popular theme in 2021 was that we were going to see mass selling from homeowners who wanted to get out of their homes before prices crashed. This of course didn’t happen, but for me personally, something more problematic is happening right now. New listing data has fallen so much in the last seven weeks that it’s impacting the active listing data year to date, making it go slightly negative according to Realtor.com data. This isn’t what I wanted to see happen because it keeps the housing market stuck in a savagely unhealthy state.

The post Why home-price growth is still up 18% year over year appeared first on HousingWire.

Source link

Mountain West Financial steps back from wholesale lending

Add mortgage lender Mountain West Financial to the list of victims of the price war in the wholesale channel.

The Redlands, California-based company informed its broker network last week that it has “made the difficult decision to take a step back from wholesale lending,” according to a spokesperson.

Founded in 1990, Mountain will continue to serve retail and consumer direct clients throughout the Western United States. With 24 locations, it offers Federal Housing Administration (FHA), Veterans Affairs (VA), United States Department of Agriculture (USDA), conventional loans and down payment assistance programs.

According to the Scotsman Guide, the lender originated $2.75 billion in 2021, closing 9,991 loans. In total, wholesale comprises 35% of the total. The data shows that in the first half of 2022, the company reached $1.9 billion in total volume and wholesale was responsible for 39%.

Mountain’s spokesperson said the company will honor all loans in the pipeline that were submitted and locked by Aug. 26. However, all loans must be closed by Sept. 30. Reasons for the decision were not provided.

However, reduced origination volumes and a price war imposed by rival United Wholesale Mortgage (UWM), have caused several mortgage companies to exit the wholesale channel.

UWM pledged to beat the top 20 lenders’ pricing by one basis point in May. In June, the company took another aggressive step towards pricing with the ‘Game On’ pricing initiative, slashing prices across all loans by 50 to 100 basis points.

Homepoint followed its competitor by launching a new program to reduce prices for lower-income borrowers in August. The company is offering a 75-basis point pricing bonus for conforming conventional loans in specific zip codes in 20 states.

The initiatives are wreaking havoc on competitors with already compressed margins.

loanDepot, for example, shut down its wholesale division and non-delegated correspondent channel amid plummeting origination volumes and widening financial losses in the second quarter.

Celebrity Home Loans exited the wholesale channel to focus on retail lending, mainly affecting Cypress Mortgage Capital, the correspondent division for Celebrity that offered non-qualified mortgages, prime jumbos and reverse mortgages.

The post Mountain West Financial steps back from wholesale lending appeared first on HousingWire.

Source link

3 Mistakes to Avoid As An Airbnb Host

A $400 cleaning fee? (Soon to be $550.)

That was the exact thought my wife and I had as she booked a trip to upstate New York. There was definitely sticker shock to the final price compared to the daily rate initially shown on the listing. But after viewing the pictures and the reviews, my wife felt confident in booking the property even with the crazy cleaning fee, or so she thought.

Recently, Airbnb has been getting a lot of bad press on social media because of its increasing fees, such as service and cleaning fees. The internet has recently been riddled with blog, Instagram, and TikTok posts of guests complaining about paying ridiculous cleaning fees. For the record, hosts cannot do anything about the service fees but have control over the cleaning fee.

In this article, I’m going to go over what you shouldn’t do as an Airbnb host.

1. Don’t Make Your Guest Clean

As my wife checked into the short-term rental, she was greeted with a list of items that had to be completed before checking out. This list went beyond the average tasks a guest is expected to do.

That brings me to my first point: your guest is not your cleaning crew. Imagine if you were staying in a hotel. It’s rare to strip beds and clean the sink before leaving. Airbnb is no different. It’s fine if towels are used, it’s fine if there are dishes left in the sink, and it’s fine if the place is left in somewhat of a mess—as long as nothing is damaged.

If you have people stay in your listing, they shouldn’t be expected to leave the place immaculate, especially since they are paying a cleaning fee. Isn’t that the whole point of the cleaning fee?

Another issue I see a lot: if you are charging a pet fee and allow pets, don’t complain if dog hair is all over your property when the guest leaves. That is the point of the pet fee.

To make my cleaning crew’s life easier, I purchased pet blankets that go on the couches. Once a quest checks out, those blankets are stripped and replaced with new ones, and the old ones are washed and reused.

We want our guests to relax during their stay. Whether they are traveling for work or vacation, we don’t want our guests to worry about anything during their stay. Imagine you’ve had a rough couple of months; you book a stay on Airbnb, go through the hassles of traveling, and once you check in, you are greeted with a huge laundry list of items you must do during your stay and before you check out. Wouldn’t you be annoyed?

Want to host an Airbnb of your own? Check out our short-term rental calculator here!

2. Provide Basic Amenities

As my wife settled into her Airbnb, she realized that there was barely any silverware and no paper towels. We assumed the lack of silverware was to minimize cleaning.

Now, I will point out that before Airbnb and VRBO, it was normal for guests checking into a short-term rental to bring their own silverware, towels, and sheets. Today, it’s different. Things like clean towels, sheets, and silverware are common (and expected) amenities.

My rule of thumb for kitchen items is two sets of bowls, glasses, plates, and silverware per guest. For example, if the property can sleep six people, there will be 12 bowls, 12 glasses, 12 plates, and 12 sets of silverware. I also provide salt, pepper, sugar, olive oil, and ground coffee. Things like paper towels and tissues are expected as well.

Amenities are one way you can set yourself apart from the rest of the properties in your area. Some other complimentary amenities you should include are:

Free breakfast, too. Hear me out. I like to leave out a serving tray with a small $7 waffle maker, pancake mix, and a spatula with syrup in the fridge. It’s one of the biggest things mentioned in all the positive reviews we get. It costs $3 for those pancake mixes, and the guests love it!

3. Do Not Communicate with the Guest Outside of the Platform

When my wife checked out of the property, she was surprised that the host texted her outside the Airbnb app to request another $150 because she and her group left the place “a mess.” If you’re keeping track, that’s now $550 in cleaning fees.

This property had only two bedrooms with a sleeper sofa. To put that into perspective, we host a luxury log cabin with five bedrooms that can sleep 14 people. It’s a 3,000-square-foot cabin with a large living room, kitchen, and dining room, and the cleaning fee for that property is $300. How could this small two-bedroom property cost $550 to clean?

Communicating with the guests outside of the platform is against the guidelines that online travel agencies like Airbnb and VRBO have. You can call if there is an emergency, but in this case, the host was making contact outside of the platform to request more money. They probably knew that it was against the guidelines. They would have requested it through the platform if they felt like it was the right thing to do.

Other Things to Consider

As a general rule of thumb, I always advise anyone trying to figure out if a cleaning fee is too high to refer to their daily rate. Your cleaning fee should not be higher than your nightly rate. So if your average nightly rate is $200, your cleaning fee should not be more than $200.

I do ask my guests to do some things. Just two, in fact. I ask them to strip the beds and take their trash to the bins next to the cabin. But here is the key, I don’t penalize them or get angry if they don’t do it.

Once you start hosting, you will quickly see that many guests will ask you a day or so before their checkout if there is anything they need to do before leaving. If they ask, I simply tell them to strip the beds and take the trash out.

Conclusion

In conclusion, let your guests enjoy their stay.

They shouldn’t be cleaning anything if they’re paying a cleaning fee. Charge a reasonable cleaning fee that doesn’t exceed your one-night average daily rate. Provide your guests with basic amenities like silverware, plates, and paper towels. It’s the norm for today’s short-term rentals.

Lastly, do not text your guests outside of the platform. That is the quickest way to lose your account. These issues were not particular to the one listing that my wife stayed at. I see it every day through guest complaints on social media and in articles. It’s a real problem and one of the reasons short-term rentals get a bad rap. It starts with the hosts. It falls on us to ensure we provide a comfortable experience to our guests during and after their visit. We’re in the hospitality business.

Find long-term wealth with short-term rentals

From analyzing potential properties to effectively managing your listings, this book is your one-stop resource for making a profit with short-term rentals! Whether you’re new to real estate investing or you want to add a new strategy to your growing portfolio, vacation rentals can be an extremely lucrative way to add an extra income stream—but only if you acquire and manage your properties correctly.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Source link

Opinion: Taming inflation requires making housing affordability a national priority

Inflation slowed more than expected in July, the result of a dip in gas and energy prices. But soaring housing costs continue to weigh heavily on family budgets. Rents and home purchase prices are up – 17% and 20% respectively – from last year. It seems as if every day there is yet another news story highlighting how so many families are suffering under crushing housing costs.

These costs make up one-third of the Consumer Price Index, meaning they account for a big part of the inflation dilemma. For a little perspective: The shelter component of the CPI increased 0.5% in July, rose 5.7% over the last year, and accounted for about 40% of the total increase in all items other than food and energy.

CPI changes also typically lag real-time changes in housing costs, so we can expect shelter to loom large in future CPI calculations even if rent growth may be slowing down, as some have suggested.

Classic supply and demand mismatch

At the root of high and rising housing costs is the severe shortage of affordable homes both for rent and sale. What we are witnessing is a classic supply-demand mismatch: there are simply not enough homes, particularly those that are affordable to low- and middle-income households. While estimates vary, most analysts agree we have underbuilt housing of all types by millions of homes over the past 20 years.

Economists are beginning to highlight the importance of increasing housing supply to help reduce inflation. As Mark Zandi, Chief Economist at Moody’s Analytics, explained to the Washington Post: “No matter what happens to pricing across most goods, inflation will remain high as long as the cost of housing continues to rise so quickly.” In a more recent tweet, Zandi adds: “Driving [strong rent growth] is a severe shortage of affordable homes, which has been long in the making, and won’t be resolved quickly.”

Jason Thomas, former economic advisor to President George W. Bush, concurs, saying that high inflation can be attributed to the country’s “structural shortfall” when it comes to housing. He notes, “You could really see core inflation down close to target by year end were it not for shelter, were [it] not for primary rents…. When you look at the data in terms of cumulative housing starts it looks to be somewhere between one-and-a-half and 4 million short of what is actually necessary.”

Closing the housing supply gap will not happen overnight because it has taken some time to get where we are today. The construction industry has yet to fully recover from the 2008 financial crisis when it lost a big segment of its skilled construction workforce. Pandemic-related supply chain snags have impacted the prices of key construction inputs like lumber, steel, and copper. Add to this mix significant regulatory compliance costs, as well as local zoning and land use requirements that restrict the type of housing that can be built, and we have a recipe for a constrained housing supply.

Rising interest rates

Ironically, rising interest rates, the result of the Federal Reserve’s tightening of monetary policy to combat inflation, are also affecting the homebuilding industry. Residential construction statistics from July 2022 show construction of single-family homes is the weakest since the onset of the pandemic and construction of multifamily dwellings has fallen as well.

The good news

While these facts should give us pause, the good news is there are many policy options that can be tapped now to increase housing supply and improve housing affordability.

At the local level, city governments can:

At the state level, officials can:

Federal policymakers, in turn, should:

The affordable housing crisis is a national problem requiring a national response, one that is not limited just to Washington, DC, state capitals, or city halls. Fortunately, solutions abound – some big, some small, but all meaningful.

Dennis C. Shea is the executive director of the J. Ronald Terwilliger Center for Housing Policy at the Bipartisan Policy Center.

The post Opinion: Taming inflation requires making housing affordability a national priority appeared first on HousingWire.

Source link

The strategy behind UWM’s multibillion dollar investment

In 2021, United Wholesale Mortgage (UWM) CEO Mat Ishbia set a three-year goal to make UWM the No. 1 lender in the country. Ishbia, who started running his father’s mortgage firm in 2013 and has since grown it into the country’s No. 2 lender, isn’t satisfied with second place, behind Rocket Mortgage.

“I don’t have on my board my goal is to be the No. 2 overall lender, it’s to be No. 1 and we’re going to do that,” Ishbia told HousingWire in 2021.

After two golden years in the mortgage market during the pandemic period, refis have dried up and the industry has since pivoted toward a purchase market. Ishbia is confident his firm can benefit from this trend by cutting prices for brokers and bringing more retail loan officers to its wholesale channel, whose market share currently stands at around 20%.

Following the firm’s pledge to beat the top 20 lenders’ pricing by one basis point in May, UWM took another aggressive step towards pricing in June. Dubbed the ‘Game On’ pricing initiative, UWM slashed prices across all loans by 50 to 100 basis points, wreaking havoc on competitors with already compressed margins.

“I’m not really focused on the margins for this quarter,” Ishbia told investors in UWM’s second-quarter earnings call. “It’s an investment for the long term, strategically building the broker channel.” With gain on sale margins expected to be at around 30 to 60 bps in the third quarter, there’s no question UWM is losing money, analysts said.

“There is no magic bucket of money,” said Brian Hale, founder and CEO at Mortgage Advisory Partners. “He’s trying to drive more volume to speed those costs across and to say to his brokers that we’re in the fight with you.”

For a company that has more than $900 million in cash and $3.2 billion in equity as of the second quarter, plus technology that can close loans faster than most competitors, aggressive pricing is a “multibillion dollar decision investment,” as Ishibia put it. That aggressive strategy means other lenders focused on the wholesale channel or reducing servicing portfolios are finding themselves in a bind. Smaller players that have limited access to liquidity may be forced to downsize or get consolidated.

“He (Ishbia) wants to win at all costs,” said Kevin Heal, senior analyst at Argus Research. “They (UWM) have enough capital to withstand, whereas others that didn’t raise capital or didn’t go public might not necessarily have cash on hand or capital to sustain in this new match.”

Multibillion dollar investment

It’s been about two months since UWM rolled out its new pricing strategy and Ishibia says he is already seeing the impact on the market.

“With Game On, it’s making them (retail loan officers) take an extra look at the broker channel,” Ishbia told analysts in its second-quarter earnings. “We believe the broker channel will grow to 33% over the next five years. However, with strategic initiatives like Game On, we think that number could reach 40% or higher.”

In the second quarter, the lender’s $215.4 million net income was buoyed by a more than $26 million increase in the fair value of mortgage servicing rights (MSRs) and UWM’s cash and cash equivalents rose 6% to $958.7 million from the previous quarter.

The lender’s total MSR portfolio was valued at $3.7 billion as of June 30, up from $2.7 billion a year earlier, according to SEC filings. That’s after selling off MSRs tied to $72.7 billion in loans over the first six months of 2022 — for total proceeds of $871.7 million, including $216.2 million posted in the second quarter.

Kevin Barker, managing director at Piper Sandler, says UWM has access to liquidity via borrowing and selling MSRs, and the lender is not too levered with net debt to equity being 1.7 times.

“You could run that up to 3 or 4 before it starts to become a real concern. His tangible net worth ratio (a proxy of how much equity you have relative to your total assets) is just under 30%. Anything below 15% you start to question it,” said Barker.

During the refi heyday, UWM beefed up its employee count to 9,000 in the second quarter of 2021 but has consistently cut down their headcount, losing a total of 2,000 employees over 12 months, according to the firm’s 10-Q report. Expenses in the second quarter dropped 5% to $348 million led by a cut in salaries and commission.

But there is no question Ishbia is losing money on the gambit, Barker added. “With the gain-on-sale margin of 99 bps, when you cut 50 bps off of that, you’re in negative territory pretty quick.”

UWM’s total production expenses were $247 million or 86 bps on the $29.9 billion in originations for the second quarter, a report published from Wedbush Securities estimated.

“With a gain on sale margin of 99 bps this quarter, they are making a GAPP profit, but if you think about the cash flow, they are burning cash,” said Jay McCanless, senior vice president at Wedbush.

UWM’s loan production income of $296.5 million includes $412.7 million of non-cash MSR capitalization. When mortgage servicing rights are sold, UWM’s current loan production income in cash terms would be -$117 million ($296.5 million-$412.7 million), according to Wedbush’s report.

“They made money on a GAAP basis this quarter. We think they’re going to lose money on a GAAP basis next quarter because of how low they’re taking the gain on sale margin,” said McCanless.

Ishbia didn’t set a timeline for how long UWM will run with the Game On pricing initiative and the big question among analysts is how much of the market share gain is going to end up being permanent when the lender ends its price cuts.

“He’s using price to increase market share. What we don’t know is whether market share could stay when prices go back up,” said Barker.

Not all about pricing

Broker Hussam Saada of Precision Mortgage closed about 60% of mortgages with UWM after the firm rolled out its new pricing initiative. On a monthly basis, he closed about $3 million in volume with his previous top lenders including Flagstar and Homepoint. With UWM cutting rates and its technology enabling fast closings, Saada’s business with the Michigan lender grew about three-fold since ‘Game On.’

He now sees other wholesale lenders quickly catching up to compete in the game. For one, Homepoint is offering a 75 bps pricing bonus for conforming conventional loans at no additional costs to borrowers, although it’s limited to a specified number of ZIP codes in 20 states.

“At the beginning, UWM was more than 0.25% to 0.375% better in rates than my top lenders, but other wholesale lenders are getting aggressive to compete with UWM,” Saada said. “When one company gets aggressive with pricing, everyone else has to catch up.”

On Aug. 25, UWM was paying brokers 101.025 bps per loan excluding loan officer compensation, at a 5.25% mortgage rate for a single family, $400,000 purchase price with a 20% downpayment and a 720 credit score, according to pricing data on Loansifter. Provident Funding Associates Wholesale had the best price for brokers that day, offering 101.25 bps, meaning the lender was paying 22.5 more bps per loan to brokers than UWM.

Rocket Pro TPO trailed UWM by offering 100.718 bps per closed loan. Homepoint ranked fourth at 100.465bps and Flagstar followed, paying brokers 100.095 bps per closed loan that day. (Some brokers might have better pricing based on volume provided to each wholesaler.)

But for brokers, price isn’t the only determining factor when comparing rates for the borrower. On top of competitive rates, getting approved for a mortgage has to be an easy and quick closing process for the customer, said Kevin Leibowitz, CEO of brokerage Grayton Mortgage.

“There are two things I need to mitigate: process and price,” said Leibowitz. “I need to use somebody that has a process I like. If I’m going to offer a loan in a competitive environment and they are doing a good job with the process, I might as well offer a lender with the lowest rate that doesn’t require the borrower to pay for points and pays my commission.”

For instance, UWM’s underwriting system Bolt, which the lender says enables brokers to underwrite a loan in 15 minutes, was one of the top reasons brokers gave for choosing the lender. Using artificial intelligence, Bolt allows brokers to do a pre-underwrite, which an underwriter looks at within four hours or so, according to Hussam.

“I can get you (borrower) a conditional loan approved in 20 minutes. If it wants the loans ‘clear to close,’ borrowers would need to have to wait for their closer to get the package out. With UWM, you as the loan officer, you as the attorney or title company, can do your own closing package in 10 minutes. It’s smoother for the client,” Hussam said.

“What’s the end game?”

UWM is actively courting more brokers and retail LOs to the wholesale channel. In this highly competitive environment, how are other lenders countering that strategy?

Home Point Capital, the parent company of wholesale lender Homepoint, is one of the most affected by the price war triggered by its rival UWM. The pure play wholesale lender reported a $44 million loss in the second quarter from an $11.9 million profit in the previous quarter. To improve liquidity, it chose to reduce its servicing portfolio, completing a sale of single-family mortgage loans worth $257.3 million in the first quarter.

As of June 30, the servicing portfolio totaled $90.5 billion in unpaid principal balance, down 11% quarter over quarter. While the company was cash-flow positive, reporting $135.8 million in cash and cash equivalents in the second quarter, the company cut its dividend to preserve liquidity. It also bought back $50 million of senior debt in the open market to reduce leverage in the second quarter, a report from Wedbush said.

Home Point Capital’s CEO Willie Newman in a second-quarter earnings call acknowledged the firm may get smaller with the “volume opportunity” on a macro basis “relatively limited,” but said Homepoint won’t engage in a price war.

Instead, the lender plans on expanding its product mix, in line with other firms’ pivot to diversify product offerings, including Rocket’s solar loans and home equity loans.

“Whether it’s our enhanced portfolio of adjustable-rate mortgage (ARM) and jumbo products, or more innovative solutions like Homepoint Cash Compete and Homepoint New Build, we’re giving consumers, real estate agents and home builders more reasons to work with our broker partners,” said Phil Shoemaker, president of originations at Homepoint.

Homepoint Cash Compete helps buyers close an all-cash bid and the Homepoint New Build program connects builders with construction financing.

And though it may not want to engage in an all-out price war, Homepoint is strategic about pricing for certain segments, as its recent 75 basis point pricing bonus demonstrates.

Amid UWM’s aggressive pricing, nonbank heavyweight loanDepot exited the wholesale channel after reporting a $224 million loss in the second quarter. With cash and cash equivalents rising 72% to $955 million in the second quarter from the previous one, it plans on rolling out its home equity line of credit (HELOC) product later this year while maintaining joint ventures with homebuilders and depositories.

Rithm Capital, parent company of New Residential Investment, which acquired Caliber in August 2021, posted a $3 million loss partially due to a decline in residential mortgage originations. While its origination volume dropped 29% to $19.1 billion in the second quarter and cash holding declined 9.6% to $1.5 billion from the previous quarter, the firm said it’s focused on “consistent pricing.”

“We monitor our competition, we evaluate their movements but we’re focused on discipline and consistent pricing,” said Jeff Gravelle, chief production officer at Caliber. “We have a wide range of products we offer in non agency, specifically our ‘Smart Series’ which is our non-QM program. This gives NewRez, Caliber plenty to add to our broker customers.”

The firm plans to roll out new products and features in non-QM in the coming weeks and focus on affordable housing lending, said Gravelle.

As Wedbush analysts said in a report in June, it will likely take a quarter or two before excess capacity from public mortgage companies is flushed out of the system Looking at lenders’ financials, the silver lining for some of these firms is that they have access to liquidity via cash or selling MSRs.

The mortgage landscape isn’t expected to get any better in the third quarter as mortgage rates remain elevated and lenders lay off employees to reduce expenses. Smaller lenders that don’t have access to liquidity are caught in a difficult spot.

“You probably will see some small lenders driven out from the market or some consolidation or get bought by a private equity company,” said Heal.

The analyst said that while UWM has enough cash and capital to fund their own loans, smaller lenders relying on warehouse loans are getting squeezed. “As rates rise, those warehouse financing costs go up.”

However, smaller-sized wholesale lenders who carved out a niche by targeting a different audience than UWM are better positioned to weather the storm.

“A smart wholesaler won’t try to out UWM,” said Paul Blaylock, CEO at retail lender LoanFlight Lending. “What they’ll try to do is find a corner of a market where UWM doesn’t compete, can’t compete or won’t compete.”

Pennsylvania lender Spring EQ Wholesale Lending, a wholesale lender that offers home equity loans and 30-year fixed-rate mortgages for second lien loans, is an example of a lender that found its niche four years ago. Because the lender doesn’t offer first lien mortgages, it is immune to UWM’s aggressive pricing, the firm said.

Spring EQ sees competition coming as rates stay high and available home equity is at historic levels. Without disclosing its origination volume, the lender said it added 54 operations team members over the past 90 days to “accommodate growth.”

“We are not competing with UWM,” said Paul Saurbier, senior vice president at Spring EQ. “If someone wants a $1.2 million mortgage, a mortgage broker can do an $800,000 agency loan with UWM and then they can do a simultaneous second one with us to make up the difference,” he said.

For consumers, the rate for a jumbo loan is higher than a conventional loan and guidelines tend to be more stringent, so breaking the loan gives borrowers a better blend of rates.

“Customers get better terms on the first mortgage not going jumbo and we can help facilitate that. It’s a simultaneous closing for a second lien mortgage for the client where they sign the UWM loan and sign a loan with us, called a piggyback loan.”

Other lenders including Provident Funding, Cardinal Financial Wholesale and AmeriSave Mortgage Corporation were not available for interviews on their strategies to navigate, pricing and their prospects for the third quarter.

Time will tell how well UWM will maintain its market share once the lender raises prices again. Another major question that remains unanswered is how UWM’s ambition to increase its market share will affect consumers in the long term.

“He (Ishbia) wants a monopoly,” said Blaylock. “So the question is, is that good or bad for the consumers in the long term? If a wholesaler has monopoly in the short term, during that battle it’s probably good. Long term, nine times out of 10, it’s bad.”

“Once he (Ishbia) has price control, he probably has a fiduciary duty to shareholders to take advantage of that. Brokers have to decide whether that is healthy in the long term. What’s the end game? Who pays for this?”

The post The strategy behind UWM’s multibillion dollar investment appeared first on HousingWire.

Source link

Is the Global Economy About to Collapse? Inside China’s Real Estate Crisis

Sponsored

Source link

Does Powell’s tough talk mean another 75 bps rate hike?

Restoring price stability will cause some pain now, but will forestall the greater pain of higher inflation, Federal Reserve Chairman Jerome Powell said in a speech on Friday.

Powell, speaking at an economic policy symposium in Jackson Hole, Wyoming, made it clear that the Federal Open Market Committee (FOMC) would continue to be tightly focused on bringing inflation back down to its 2% goal. Although he didn’t specify how high the FOMC might raise the federal funds rate at their September meeting, markets reacted to the comments by falling sharply on Friday morning.

Powell noted that inflation was still running “well above 2%” and that although July’s numbers were better, “a single month’s improvement falls far short of what the Committee will need to see before we are confident that inflation is moving down.”

The Fed raised the federal funds rate by 75 bps in both June and July, driving mortgage rates sharply higher to more than 6% in a short period. The big question is whether we should expect a repeat in September.

“July’s increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook. At some point, as the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases.”

HousingWire Lead Analyst Logan Mohtashami said that while housing isn’t the main focus of the Fed’s actions, it wants to fight back against the housing market’s perception that the Fed will cut rates next year as the market gets weaker.

“I think the Federal Reserve is frustrated that total housing inventory is not back to 2019 levels, even though mortgage rates have gone as high as 6%. They are frustrated and the fact that new home listings are now declining can’t be encouraging to them,” Mohtashami said. “Powell’s comments reaffirm their stance that they will hike rates and keep them high while looking to see what happens next.”

Powell’s short remarks emphasized the Fed’s responsibility to achieve price stability, calling it “the bedrock of our economy.”

“Without price stability, the economy does not work for anyone. In particular, without price stability, we will not achieve a sustained period of strong labor market conditions that benefit all,” Powell said.

“Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain,” Powell said.

The Fed Chair said that public expectations of continued higher inflation can become a self-fulfilling prophecy. “During the 1970s, as inflation climbed, the anticipation of high inflation became entrenched in the economic decision-making of households and businesses. The more inflation rose, the more people came to expect it to remain high, and they built that belief into wage and pricing decisions.”

Powell ended the speech by noting the Fed’s resolve. “We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.”

The post Does Powell’s tough talk mean another 75 bps rate hike? appeared first on HousingWire.

Source link

Blend releases new home equity software solution

Mortgage tech firm Blend launched a software solution for home equity products amid a mad dash from lenders into the space.

Instant Home Equity, an automated end-to-end digital home equity product for lenders, integrates income, identity verification, title, decision and property appraisal to save time and costs, Blend said in a release this week.

Lenders using Blend’s home equity product can offer personalized home equity loans and then close in a few days as opposed to multiple weeks it takes through legacy home equity processes, according to the firm.

“With the purchase and refi origination markets way down, having a home equity product right now is an important counter cyclical business line for lenders, especially in light of record home equity levels and demand (exacerbated by secular trends like increased work from home),” Blend’s spokesperson said.

Despite downturns in the mortgage origination market, Americans’ tappable home equity surged to a historic-high of $27.8 trillion in the first quarter, according to the Federal Reserve Bank of St. Louis. Nonbank lenders that are seeking more volume are jumping into home equity lending, which has been dominated by depository banks for years.

On a home equity loan, the lender disburses a lump sum upfront to the borrower, who then pays the loan back in fixed-rate installments.

Lenders have also been expanding to home equity line of credit (HELOC) products, which allows homeowners to access their equity without refinancing their primary mortgage. A HELOC is a revolving line of credit that allows borrowers to withdraw as needed, with a variable interest rate.

Rocket, the nation’s largest mortgage lender, expanded its product portfolio to home equity loans earlier this month. While maintaining at least 10% equity in the home, homeowners can access between $45,000 and $350,000 of their home’s equity in a 10- or 20-year, fixed-rate loan.

Guaranteed Rate, UWM, loanDepot and New Residential Investment Corp. are companies that have either rolled out or plan to launch HELOC products.

Blend reported a $478 million loss in the second quarter, after posting a $73.5 million loss in the previous quarter. In its recent earnings call, the firm said it will prioritize product lines that deliver a return on investment in a short time period while reviewing cost structure related to contracts with vendors.

The post Blend releases new home equity software solution appeared first on HousingWire.

Source link

Will new products stop the bleeding for mortgage lenders?

Homepoint is in a tough spot.

Like its peers, the wholesale lender’s origination volume has plunged over the past year due to a dearth of refinancings and a sluggish purchase market. But there’s another threat that Homepoint executives must worry about – United Wholesale Mortgage (UWM), the top dog in wholesale, has embarked on a strategy of heavy price cutting, forcing Homepoint and others to limbo to compete for business. That has contributed to UWM’s competitors taking losses on loans when they can least afford it.

Homepoint’s financial statements tell the story. Origination volume declined 63.5% year over year to $9.3 billion in the second quarter, and the lender took a $44 million loss overall. Among 11 publicly traded nonbank mortgage lenders, the loss represented the third-worst financial performance in the second quarter, according to a HousingWire analysis.

Homepoint has been aggressive in its attempts to stop the bleeding. In the last year it has reorganized operations nationwide; sold non-core operations, including its correspondent business; transitioned its in-house servicing platform to ServiceMac; sold mortgage servicing rights when possible; and cut prices by 75 basis points to low-income borrowers. In total, Homepoint said the cost reductions made in the second quarter alone should result in $31 million in savings on an annualized basis.

But the reality is Homepoint – like some of its peers – is going to lose market share as it attempts to right the ship.

“Our bias right now is towards more margins and less volume – that said, obviously, the volume opportunity on a macro basis is relatively limited,” Willie Newman, Home Point Capital CEO and president, told analysts during a second quarter conference call. “We’re not afraid to get smaller as an organization.”

Beyond cost-cutting, the wholesale lender is looking to diversify its product mix to capture business it previously wouldn’t have even competed for. “We believe that in the purchase market, products are going to become more and more important,” said Phil Shoemaker, Homepoint’s president of originations.

Homepoint is hardly alone. During the second-quarter earnings season, executives from publicly traded mortgage lenders detailed their forays into jumbo loans, non-qualified mortgages, reverse mortgages, home equity products and even personal loans.

Analysts, mortgage executives and loan officers said that diversifying the portfolio is a smart strategy for mortgage originators. But due to the inherent challenges in distribution and adoption, they don’t expect these products will be enough to overcome larger market challenges and win in a purchase market – at least in the short term.

“For some smaller originators, it could kind of move the needle,” said Bose George, mortgage finance analyst at Keefe, Bruyette & Woods (KBW). “But I don’t think it can be meaningful for the big companies just because these other markets are smaller than the traditional mortgage market.”

Just a little less vanilla

The obvious starting place for nonbank lenders looking to capture volume is in jumbo lending, executives and analysts said. Home prices have remained stubbornly high, and there’s tens of billions of dollars in homes for sale beyond the conventional loan limits set by Fannie Mae and Freddie Mac.

Jumbo loan volume increased 3.1% in the second quarter from the first quarter to $135 billion, according to Inside Mortgage Finance estimates. Mortgage executives project that number to remain steady or even tick up in the third quarter.

“We’ve been focused on rounding out our jumbo offering, given what’s happened with home price appreciation, which is something that’s here to stay,” Shoemaker said. “Even though home price appreciation may feel like a bubble, it truly is an imbalance between supply and demand.”

Lenders are making a play with jumbo adjustable-rate mortgages (ARM), a product that has made a comeback after falling out of favor due to their role in the housing crash of 2008 and a decade-plus of fixed-rate mortgages under 5%.

In July, UWM rolled out an ARM product for jumbo loans with seven- or 10-year ARM and rate/term and cash-out refi for a maximum loan amount of as much as $3 million.

The company also launched temporary rate buydowns, which allows borrowers to receive lower mortgage rates at the beginning of their loan terms by using seller concessions as part of the payment. It comes at a time in which the housing market favors buyers and seller concessions become more frequent.

The new products complement UWM’s “Game On” initiative, a cut-rate pricing strategy devised to grow market share with purchase buyers.

“The investment we make today will have exponential benefits in 2023, 2024 and 2025 and beyond,” UWM CEO and Chairman Mat Ishbia said during an earnings call. “And we continue to capture more market share and not only position ourselves to win, but dominate the future. And we feel great about the decisions we made. As I said before, we control the margins.”

He added: “We’re watching it (Game On initiative) as it goes. And we’re going to continue to do it because it’s much cheaper than acquiring someone.”

Risky business

On another front, wholesale lenders have flirted with adding a bevy of mortgage (non-QM) products this year.

The segment, which includes self-employed borrowers and those who work in the gig economy, was expected to take off with accelerating home prices and higher interest rates pushing borrowers outside the Fannie Mae and Freddie Mac credit boxes.

Homepoint told HousingWire in March that it was considering including bank statement and investor cash flow loans in its portfolio. UWM in March also launched a bank statement product for self-employed borrowers and loans for real estate investors.

But non-QM is a fairly dangerous space right now. With surging rates, lenders are struggling to sell in the secondary market legacy lower-rate loans originated months ago, as investors are seeking higher yields. This liquidity problem caused the implosion of non-QM lenders First Guaranty Mortgage Corp. and Sprout Mortgage. Others are backing off the product, such as Impac Mortgage Holdings.

Homepoint has decided to pause on entering the non-QM fray. “Based on our ongoing assessment of the non-QM market opportunity, coupled with the unpredictable liquidity for the product, we chose to focus our development resources on more relevant partnerships programs like Homepoint Cash Compete,” said a spokesperson for the company. “We’re thankful that we have not jumped into non-QM so quickly, and for the foreseeable future, we still don’t have any imminent plans to enter this space.”

Tapping that equity

Some lenders have taken a more aggressive approach to diversifying their offerings, going beyond traditional mortgages and betting on products such as reverse mortgages, home equity loans, and home equity lines of credit (HELOC).

Surging house prices have made home equity products an obvious choice, given the value of homes used as collateral for such loans is rising. According to Black Knight, at the end of the second quarter 2022, the average U.S. homeowner had $216,900 in tappable equity, up 5% quarter over quarter and 25% year over year.

In a traditional home equity loan, the lender disburses a lump sum upfront to the borrower, who then pays the loan back in fixed-rate installments. Meanwhile, a HELOC is a revolving line of credit that allows borrowing as needed, with a variable interest rate.

According to data provider Curinos, home equity originations reached $65 billion in volume last year, relatively flat compared to 2020. However, the product’s volume was pacing at a 49% annual growth rate between January 2022 and June 2022, compared to the same period in 2021. The data is based on 30 consortium lenders, including 20 of the top home equity originators in the U.S.

HELOC originations alone increased 41% year over year in the second quarter to 291,736, according to a recent analysis by TransUnion.

In the spring, nonbank top-10 lenders loanDepot and the real estate investment trust New Residential Investment Corp. (recently rebranded as Rithm Capital) announced plans to launch HELOC products, and Rocket Mortgage and Guaranteed Rate have also moved forward with home equity products. Meanwhile, UWM entered the space in August with standalone and piggyback options.

At Spring EQ, a home equity lender that’s increasingly going toe-to-toe with nonbank mortgage lenders in the space, demand for home equity loans continues to grow as home prices and borrowers struggle financially due to inflation, said Saket Nigam, senior vice president of capital markets. The lender’s loan rates range from 6% to 13%.

Home equity products, however, will not be a panacea to mortgage lenders’ short-term problems. “Home equity isn’t going to be the answer to the traditional mortgage volume drop, but it’s a way to at least replace some of the lost value for mortgage companies,” said Nigam.

In the case of loanDepot, president and chief executive officer Frank Martell told analysts the HELOC product will have a “modest contribution” toward the company’s goal to get back to breakeven in 2022, as “we’re launching it later in the year.” Most of the effort comes from reducing costs – the lender plans to cut 5,000 jobs.

At Finance of America, reverse mortgages have been a bright spot on an otherwise unsightly balance sheet. In total, FoA funded $4.23 billion in the traditional mortgage business in the second quarter of 2022, down 17% quarter over quarter and 39% year over year. However, reverse volume reached $1.58 billion in Q2 2022, a 7% increase compared to Q1 2022 and 56% compared to Q2 2021. The volume is a record for five consecutive quarters.

FoA has been particularly active in selling reverse, investor loans and commercial loans, products that can have higher margins in comparison to the traditional mortgage.

“If you look historically at mortgages, you know how cyclical it is. It’s boom and bust. Specialty products will be a bit steadier in their contribution to earnings. What’s going to be volatile is traditional mortgages,” Patti Cook, FoA’s former CEO, told HousingWire before stepping down as CEO in late June.

The company’s executives in August said they expect that the home improvement product, launched in May 2021, will break even financially later this summer, becoming a “very effective customer acquisition channel at essentially zero cost,” according to Graham Fleming, president and interim CEO.

Regarding FoA’s next bet, Cook said: “I would bet we could come out with a personal loan in 2022,” she said.

Moving beyond mortgage

Despite the relative risk, mortgage companies increasingly launching unsecured personal loans, which have traditionally been the domain of depository lenders, and more recently, startups like SoFi.

In July, Chicago-based Guaranteed Rate announced it had rolled out its first personal loan product. Customers can apply for a personal loan in 10 minutes and receive funds between $4,000 and $50,000 within hours. Standard fixed rate loans range from 5.74% APR and 19.99% APR.

“Personal loans are a really smart way for customers to reduce the cost of high-interest credit card debt or to help finance unexpected purchases,” said Anand Cavale, executive vice president and head of unsecured lending product at Guaranteed Rate, in a statement.

The introduction of a personal loan reflects the company’s strategy to develop end-to-end digital solutions to serve customers across various financial products beyond mortgages. But the product could also be a good source of mortgage leads down the road.

Guaranteed Rate’s diversified strategy appears to follow the Rocket Companies roadmap. The Detroit giant now offers closed-end home equity loans, solar panels installation, title insurance, real estate brokerage, auto loans and credit cards.

Its executives would prefer that mortgage – a cyclical, often volatile business – be just one spoke in a financial services wheel.

The second quarter makes that clear enough: Rocket originated $34.5 billion in mortgages, down from the $53.8 billion volume produced in the first quarter. The company reported a $60 million profit in the second quarter, down from $1 billion just the previous quarter. Much of the talk during the second quarter earnings call involved the rest of the Rocket product constellation.

Rocket plans to win new clients via Rocket Money (formerly known as TrueBill), the app it acquired in December for $1.275 billion, which surpassed 2 million paying premium members in the second quarter.

Despite its diversification, Rocket, for now, is largely a mortgage company. Mortgage represented more than 85% of its net revenue in the second quarter.

“2022 is playing out worse than expected and the second half of the year will be clearly tougher than the first for mortgage companies,” a team of mortgage analysts at Wedbush Securities wrote in a report. “We are looking past this year and towards what this company (Rocket) is going to do with its four million-plus active customers (Truebill and Servicing) over time.”

Time and training

Executives also noted that during the refi boom in 2020 and 2021, it was difficult for mortgage lenders to capture loan officers’ attention to sell additional products because they were making gobs of money with refi applications and straightforward purchase loans.

“We spend a lot of effort on training internal loan officers and our brokers to educate about products,” Cook said.

Whether loan officers will embrace the new products or lenders will have sufficiently worked out the operational kinks in time remains unclear, especially with fewer processors, underwriters, funders and closers in place. It takes time.

“You can’t just throw something out there and expect people to just through osmosis to pick it up,” said Shoemaker.

The post Will new products stop the bleeding for mortgage lenders? appeared first on HousingWire.

Source link

Qualia launches an API to track title orders

Closing software provider Qualia has launched Qualia Application Programing Interface (API), according to an announcement on Wednesday.

Qualia says its API provides real estate businesses and PropTech companies the ability to automatically connect internal software tools, integrate with their commercial partners, and analyze their comprehensive performance data.

Through the API, companies using the platform can automatically place and track title orders, as well as access comprehensive order, accounting, and contact data on their files in order to build custom notifications and executive-level performance dashboards.

According to Qualia, platform users can use these capabilities to design custom client experiences, track performance, productivity and revenue, and pipeline across clients and settlement agency branches.

“Our mission at Qualia is to create a simple and secure journey to home ownership,” Nate Baker, the CEO of Qualia, said in a statement. “As part of that, we continue to develop technology that helps businesses engineer full end-to-end purchase and refinance experiences. The API makes it easy for businesses to expand without an expensive and timely investment in custom built technology.”

Real estate companies and professionals are all looking for ways to streamline the homebuyer experience and improve communication among the parties involved in the transaction. Qualia said its cloud-based platform is uniquely positioned to meet the various needs of real estate business as market conditions shift and the needs of industry professionals evolve.

“We think about Qualia as an extension of the Redfin ecosystem and that’s not possible without the Qualia API,” Mary Pappas, the principal product manager at Redfin, said in a statement. “With the Qualia API, we don’t have to spend tens of millions of dollars in R&D to build out ways to streamline our title & escrow experience. The Qualia platform makes it possible for us to package, market, and let our customers have a cohesive experience that would not otherwise be possible as a set of discrete services.”

Qualia is not the only closing software firm working on improving integration. Over the past few weeks, SoftPro has announced its integration with several title firms, most notably Doma.

The post Qualia launches an API to track title orders appeared first on HousingWire.

Source link