15% ROI”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2021\/05\/large_Extra_large_logo-1.jpg”,”imageAlt”:””,”title”:”SFR, MF & New Builds!”,”body”:”Invest in the best markets to maximize Cash Flow, Appreciation & Equity with a team of professional investors!”,”linkURL”:”https:\/\/renttoretirement.com\/”,”linkTitle”:”Contact us to learn more!”,”id”:”60b8f8de7b0c5″,”impressionCount”:”236873″,”dailyImpressionCount”:”797″,”impressionLimit”:”350000″,”dailyImpressionLimit”:”1040″},{“sponsor”:”Azibo”,”description”:”Smart landlords use Azibo”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2021\/11\/Logo-512×512-1.png”,”imageAlt”:””,”title”:”One-stop-shop for landlords”,”body”:”Rent collection, banking, bill pay and access to competitive loans and insurance – all free for landlords.”,”linkURL”:”https:\/\/www.azibo.com\/biggerpockets\/?utm_source=biggerpockets&utm_campaign=biggerpock ets&utm_medium=affiliate&utm_content=blog”,”linkTitle”:”Get started, it\u2019s free”,”id”:”618d372984d4f”,”impressionCount”:”291960″,”dailyImpressionCount”:”513″,”impressionLimit”:”300000″,”dailyImpressionLimit”:0},{“sponsor”:”The Entrust Group”,”description”:”Self-Directed IRAs”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2021\/11\/TEG-Logo-512×512-1.png”,”imageAlt”:””,”title”:”Spring Into investing”,”body”:”Using your retirement funds. Get your step-by-step guide and learn how to use an old 401(k) or existing IRA to invest in real estate.\r\n”,”linkURL”:”https:\/\/www.theentrustgroup.com\/real-estate-ira-report-bp-awareness-lp?utm_campaign=5%20Steps%20to%20Investing%20in%20Real%20Estate%20with%20a%20SDIRA%20Report&utm_source=Bigger_Pockets&utm_medium=April_2022_Blog_Ads”,”linkTitle”:”Get Your Free Download”,”id”:”61952968628d5″,”impressionCount”:”425948″,”dailyImpressionCount”:”481″,”impressionLimit”:”600000″,”dailyImpressionLimit”:0},{“sponsor”:”Guaranteed Rate”,”description”:”One-Stop Mortgage Lender”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/01\/927596_CB_BiggerPockets-January-2022-Assets-512×512-1.png”,”imageAlt”:””,”title”:”$1,440 Mortgage Savings*”,”body”:”Whether you\u2019re buying new or cash-out refinancing to upscale the old \u2013 get started today and we\u2019ll help you save!\r\n\r\n”,”linkURL”:”https:\/\/www.rate.com\/biggerpockets?adtrk=|display|corporatebenefits|biggerpockets|july2022_blog||||||||||&utm_source=corporatebenefits&utm_medium=display&utm_campaign=biggerpockets&utm_content=july2022-blog “,”linkTitle”:”Buy or Cash-Out Refi”,”id”:”61ccd6a886805″,”impressionCount”:”122791″,”dailyImpressionCount”:”535″,”impressionLimit”:”200000″,”dailyImpressionLimit”:”2222″},{“sponsor”:”BAM Capital”,”description”:”Multifamily Syndicator\r\n\r\n”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/02\/Bigger-Pockets-Forum-Ad-Logo-512×512-2.png”,”imageAlt”:””,”title”:”$100M FUND III NOW OPEN”,”body”:”Earn truly passive income with known assets in an award-winning market. Confidently targeting 2.0x-2.5x MOIC.\r\n\r\n\r\n”,”linkURL”:”https:\/\/capital.thebamcompanies.com\/offerings\/?utm_source=bigger-pockets&utm_medium=paid-ad&utm_campaign=bigger-pockets-blog-feb-2022&utm_content=fund-iii-now-open”,”linkTitle”:”Learn more”,”id”:”621d250b8f6bd”,”impressionCount”:”141195″,”dailyImpressionCount”:”404″,”impressionLimit”:”150000″,”dailyImpressionLimit”:”2500″},{“sponsor”:”Walker & Dunlop”,”description”:” Apartment lending. Simplified.”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/03\/WDStacked512.jpg”,”imageAlt”:””,”title”:”Multifamily Property Financing”,”body”:”Are you leaving money on the table? Get the Insider\u0027s Guide.”,”linkURL”:”https:\/\/explore.walkerdunlop.com\/sbl-financing-guide-bp-blog-ad”,”linkTitle”:”Download Now.”,”id”:”6232000fc6ed3″,”impressionCount”:”139799″,”dailyImpressionCount”:”374″,”impressionLimit”:”200000″,”dailyImpressionLimit”:”6500″},{“sponsor”:”SimpliSafe Home Security”,”description”:”Trusted by 4M+ Americans”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/03\/SS-Logo-.png”,”imageAlt”:””,”title”:”Security that saves you $”,”body”:”24\/7 protection against break-ins, floods, and fires. SimpliSafe users may even save up to 15%\r\non home insurance.”,”linkURL”:”https:\/\/simplisafe.com\/pockets?utm_medium=podcast&utm_source=biggerpockets&utm_campa ign=2022_blogpost”,”linkTitle”:”Protect your asset today!”,”id”:”624347af8d01a”,”impressionCount”:”111471″,”dailyImpressionCount”:”420″,”impressionLimit”:”200000″,”dailyImpressionLimit”:”2222″},{“sponsor”:”Delta Build Services, Inc.”,”description”:”New Construction in SWFL!”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/04\/Image-4-14-22-at-11.59-AM.jpg”,”imageAlt”:””,”title”:”Build To Rent”,”body”:”Tired of the Money Pits and aging \u201cturnkey\u201d properties? Invest with confidence, Build To\r\nRent is the way to go!”,”linkURL”:”https:\/\/deltabuildservicesinc.com\/floor-plans-elevations”,”linkTitle”:”Look at our floor plans!”,”id”:”6258570a45e3e”,”impressionCount”:”103760″,”dailyImpressionCount”:”437″,”impressionLimit”:”160000″,”dailyImpressionLimit”:”2163″},{“sponsor”:”RentRedi”,”description”:”Choose The Right Tenant”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/05\/rentredi-logo-512×512-1.png”,”imageAlt”:””,”title”:”Best App for Rentals”,”body”:”Protect your rental property investment. Find & screen tenants: get full credit, criminal, and eviction reports.”,”linkURL”:”http:\/\/www.rentredi.com\/?utm_source=biggerpockets&utm_medium=paid&utm_campaign=BP_Blog.05.02.22&utm_content=button&utm_term=findtenants”,”linkTitle”:”Get Started Today!”,”id”:”62740e9d48a85″,”impressionCount”:”84472″,”dailyImpressionCount”:”264″,”impressionLimit”:”150000″,”dailyImpressionLimit”:”5556″},{“sponsor”:”Guaranteed Rate”,”description”:”One-Stop Mortgage Lender”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/06\/GR-512×512-1.png”,”imageAlt”:””,”title”:”$1,440 Mortgage Savings”,”body”:”Whether you\u2019re buying new or cash-out refinancing to upscale the old \u2013 get started today and we\u2019ll help you save!”,”linkURL”:”https:\/\/www.rate.com\/biggerpockets?adtrk=|display|corporatebenefits|biggerpockets|july2022_blog||||||||||&utm_source=corporatebenefits&utm_medium=display&utm_campaign=biggerpockets&utm_content=july2022-blog%20%20%20″,”linkTitle”:”Buy or Cash-Out Refi”,”id”:”62ba1bfaae3fd”,”impressionCount”:”40998″,”dailyImpressionCount”:”277″,”impressionLimit”:”70000″,”dailyImpressionLimit”:”761″},{“sponsor”:”Avail”,”description”:”#1 Tool for Landlords”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/06\/512×512-Logo.png”,”imageAlt”:””,”title”:”Hassle-Free Landlording”,”body”:”One tool for all your rental management needs — find & screen tenants, sign leases, collect rent, and more.”,”linkURL”:”https:\/\/www.avail.co\/?ref=biggerpockets&source=biggerpockets&utm_medium=blog+forum+ad&utm_campaign=homepage&utm_channel=sponsorship&utm_content=biggerpockets+forum+ad+fy23+1h”,”linkTitle”:”Start for FREE Today”,”id”:”62bc8a7c568d3″,”impressionCount”:”44019″,”dailyImpressionCount”:”311″,”impressionLimit”:”200000″,”dailyImpressionLimit”:”1087″},{“sponsor”:”Steadily”,”description”:”Easy landlord insurance”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/06\/facebook-business-page-picture.png”,”imageAlt”:””,”title”:”Rated 4.8 Out of 5 Stars”,”body”:”Quotes online in minutes. Single-family, fix n\u2019 flips, short-term rentals, and more. Great prices and discounts.”,”linkURL”:”http:\/\/www.steadily.com\/?utm_source=blog&utm_medium=ad&utm_campaign=biggerpockets “,”linkTitle”:”Get a Quote”,”id”:”62bdc3f8a48b4″,”impressionCount”:”46679″,”dailyImpressionCount”:”298″,”impressionLimit”:”200000″,”dailyImpressionLimit”:”1627″},{“sponsor”:”MoFin Lending”,”description”:”Direct Hard Money Lender”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/06\/mf-logo@05x.png”,”imageAlt”:””,”title”:”Flip, Rehab & Rental Loans”,”body”:”Fast funding for your next flip, BRRRR, or rental with MoFin! Close quickly, low rates\/fees,\r\nsimple process!”,”linkURL”:”https:\/\/mofinloans.com\/scenario-builder?utm_source=biggerpockets&utm_medium=cpc&utm_campaign=bp_blog_july2022″,”linkTitle”:”Get a Quote-EASILY!”,”id”:”62be4cadcfe65″,”impressionCount”:”51955″,”dailyImpressionCount”:”336″,”impressionLimit”:”100000″,”dailyImpressionLimit”:”3334″},{“sponsor”:”REI Nation”,”description”:”Premier Turnkey Investing”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/07\/REI-Nation-Updated-Logo.png”,”imageAlt”:””,”title”:”Fearful of Today\u2019s Market?”,”body”:”Don\u2019t be! REI Nation is your experienced partner to weather today\u2019s economic conditions and come out on top.”,”linkURL”:”https:\/\/hubs.ly\/Q01gKqxt0 “,”linkTitle”:”Get to know us”,”id”:”62d04e6b05177″,”impressionCount”:”40451″,”dailyImpressionCount”:”348″,”impressionLimit”:”195000″,”dailyImpressionLimit”:”6360″},{“sponsor”:”Zen Business”,”description”:”Start your own real estate business”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/07\/512×512-1-300×300-1.png”,”imageAlt”:””,”title”:”Form Your Real Estate LLC or Fast Business Formation”,”body”:”Form an LLC with us, then run your real estate business on our platform. BiggerPockets members get a discount. “,”linkURL”:”https:\/\/www.zenbusiness.com\/p\/biggerpockets\/?utm_campaign=partner-paid&utm_source=biggerpockets&utm_medium=partner&utm_content=podcast”,”linkTitle”:”Form your LLC now”,”id”:”62e2b26eee2e2″,”impressionCount”:”26521″,”dailyImpressionCount”:”349″,”impressionLimit”:”80000″,”dailyImpressionLimit”:”2581″},{“sponsor”:”Marko Rubel “,”description”:”New Investor Program”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/07\/DisplayAds_Kit_BiggerPockets_MR.png”,”imageAlt”:””,”title”:”Funding Problem\u2014Solved!”,”body”:”Get houses as low as 1% down, below-market interest rates, no bank hassles. Available on county-by-county basis.\r\n”,”linkURL”:”https:\/\/kit.realestatemoney.com\/start-bp\/?utm_medium=blog&utm_source=bigger-pockets&utm_campaign=kit”,”linkTitle”:”Check House Availability”,”id”:”62e32b6ebdfc7″,”impressionCount”:”25888″,”dailyImpressionCount”:”366″,”impressionLimit”:”200000″,”dailyImpressionLimit”:0},{“sponsor”:”Xome”,”description”:”Search & buy real estate”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/08\/BiggerPocket_Logo_512x512.png”,”imageAlt”:””,”title”:”Real estate made simple.”,”body”:”Now, you can search, bid, and buy property all in one place\u2014whether you\u2019re a seasoned\r\npro or just starting out.”,”linkURL”:”https:\/\/www.xome.com?utm_medium=referral&utm_source=BiggerPockets&utm_campaign=B P&utm_term=Blog&utm_content=Sept22″,”linkTitle”:”Discover Xome\u00ae”,”id”:”62fe80a3f1190″,”impressionCount”:”7415″,”dailyImpressionCount”:”593″,”impressionLimit”:”50000″,”dailyImpressionLimit”:”1667″},{“sponsor”:”Follow Up Boss”,”description”:”Real estate CRM”,”imageURL”:”https:\/\/www.biggerpockets.com\/blog\/wp-content\/uploads\/2022\/08\/FUB-Logo-512×512-transparent-bg.png”,”imageAlt”:””,”title”:”#1 CRM for top producers”,”body”:”Organize your leads & contacts, find opportunities, and automate follow up. Track everything and coach smarter!”,”linkURL”:”https:\/\/pages.followupboss.com\/bigger-pockets\/%20″,”linkTitle”:”30-Day Free Trial”,”id”:”630953c691886″,”impressionCount”:”6961″,”dailyImpressionCount”:”608″,”impressionLimit”:”150000″,”dailyImpressionLimit”:”1230″}])” class=”sm:grid sm:grid-cols-2 sm:gap-8 lg:block”>

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

Legacy Home Loans launches SPCP for Black borrowers

Ben Slayton’s Legacy Home Loans, the largest Black-led mortgage banking firm in the country, has launched a special purpose credit program for prospective Black borrowers in six cities across the country.

The SPCP, called “closing the gap,” permits a 1% down payment with a free appraisal, free home warranty program, free homebuying counseling and financial assistance with closing costs. The SPCP loan program will be piloted in Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia. Borrowers must presently reside in a census tract of the six cities that has 51% or more Black population.

The loan program uses credit guidelines based on factors such as timely rent, utility bill, phone, and auto insurance payments. The underwriting guidelines are based on the borrower’s income with a minimum credit core of 620.

“There may be others coming out with similar SPCP loan programs, but don’t be fooled, Legacy Home Loans is where you are celebrated not just tolerated,” said Slayton, who was the first Black Realtor to be licensed in the U.S., and has worked in the mortgage industry for over 50 years.

Only recently have mortgage lenders felt comfortable moving forward with special purpose credit programs. In December, the Department of Housing and Urban Development released guidance that SPCPs would not violate the Fair Housing Act, which has long discouraged creditors from developing programs.

A few months later, seven federal agencies — including the the Federal Reserve, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the Department of Housing and Urban Development, the Department of Justice and the Federal Housing Finance Agency — released a statement encouraging lenders to develop SPCPs.

In a press statement, Legacy noted the 30% homeownership gap between Blacks and whites.

In June, the FHFA unveiled equitable housing finance plans for Fannie Mae and Freddie Mac, which establish a framework for the government-sponsored enterprises to close the racial homeownership gap.

The post Legacy Home Loans launches SPCP for Black borrowers appeared first on HousingWire.

Source link

Homepoint has shed about 75% of its workforce in a year

Following the latest round of layoffs, Homepoint has shrunk its workforce from about 4,000 workers in summer of 2021 to about 1,000 in fall of 2022.

The wholesale lender last week laid off 913 employees, according to a review of Worker Adjustment and Retraining Notification notices filed in Arizona, Florida, Michigan and Texas. Over the last year it has also sold off large chunks of the business – including servicing to ServiceMac and delegated correspondent to Planet Home Lending – which accounts for several thousand workers transitioning to new firms.

The company’s headcount is down about 40% from pre-pandemic levels of about 1,500, a Homepoint official said. It’s down about three-quarters from summer of 2021, when the Ann Arbor, Michigan-headquartered lender had about 4,000 workers overall.

Most of the employees laid off last week worked remotely, and separations will begin on Nov. 1. Eliminated positions include post-closing auditors, underwriters, loan coordinators, and document review specialists.

The workforce reduction is forecast to save more than $100 million annually for the lender, whose parent company Home Point Capital reported losses of more than $44 million in the second quarter of 2022.

Amid the shrinking loan origination environment caused by high mortgage rates, Homepoint has also been hit hard by an aggressive pricing initiative triggered by United Wholesale Mortgage.

With UWM cutting prices between 50 to 100 basis points across all loans since the end of June, Home Point Capital CEO Willie Newman acknowledged that “competitor actions have added to the challenges of a down origination cycle resulting in historical lows in market level margins,” in its most recent earnings call.

“We are not afraid to get smaller as an organization,” Willie said, indicating further cost reductions and liquidity actions.

Home Point Financial ranked 15th on Inside Mortgage Finance’s list of top purchase mortgage lenders in the first six months of 2022. The lender originated $12.2 billion in volume as of June 2022, down 18.5% year-to-date.

The post Homepoint has shed about 75% of its workforce in a year appeared first on HousingWire.

Source link

Private-label MBS market facing strong headwinds

The pace of mortgage-backed securities (MBS) issuance in the nonagency market slowed considerably in July and August as rising interest rates and Federal Reserve MBS-purchase policy have combined to dampen the momentum exhibited in the private-label space in 2021 and over the first half of this year.

In July and August of this year, there was a total of 25 residential mortgage-backed securities (RMBS) deals secured by mortgage pools valued at $8.3 billion, according to nonagency RMBS offerings, both prime and nonprime, tracked by the Kroll Bond Rating Agency (KBRA). That’s less than half the volume of private-label securitizations tracked by KBRA over the same two-month period in 2021, when there was a total of 44 RMBS transactions backed by loan pools valued at $19.4 billion.

The nonagency share of the MBS market just prior to the housing market crash some 15 years ago exceeded 50% — with the balance being MBS issued by Fannie Mae, Freddie Mac and Ginnie Mae, or agency issuance. By 2012, in the wake of the global financial crisis, private-label MBS market share had shrunk to 1.83%.

The nonagency share of the market has been rising slowly since then, reaching 4.32% in 2021, according to recent analysis by the Urban Institute’s Housing Finance Policy Center. Last year “was the largest year of nonagency securitization since 2008,” the Urban Institute’s report continues.

That trend accelerated over the first half of this year, with the nonagency share reaching 6.52%. The frenetic pace of growth in nonagency issuance has since slowed, however, due to a variety of market pressures — chief among them the contraction of mortgage originations in the face of fast-rising interest rates.

“In August 2021, the 30-year fixed-rate mortgage rate stood at approximately 2.75%,” a recent KBRA report on the nonagency RMBS market states. “Less than one year later, in June 2022, the rate reached 5.8% ….

“In late July 2022, mortgage application rates had fallen for the fourth consecutive week, pushing the MBS mortgage application to its lowest level since February 2000.”

Despite these headwinds, year to date through August of this year, overall issuance volume in the nonagency MBS space is still up slightly over the same period in 2021.

KBRA’s data, based on the deals it tracks, shows a total of 141 RMBS offerings came to market through August of this year backed by mortgage pools valued at $63.1 billion. That compares to 135 RMBS offerings backed by loans valued at $57.1 billion over the same period in 2021.

Declining mortgage originations in the face of rising rates is not the only impediment to nonagency MBS issuance going forward, however. The Federal Reserve’s pullback from the MBS-purchase market — as it pursues a policy of quantitative tightening to fight inflation — also is creating pricing pressures for MBS issuers, compounding pressures sparked by volatile rates.

The [Federal Open Market Committee] intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested …,” the Board of Governors of the Federal Reserve said in a recent statement explaining its policy.

The Fed capped monthly MBS runoff of its $2.7 trillion MBS portfolio over the past three months at $17.5 billion. That cap doubled starting in September, meaning the central bank going forward will now allow up to $35 billion per month in MBS to roll off its balance sheet as the securities mature.

“The additional MBS supply the central bank will allow to roll off from its portfolio and hit the market this month [September] is estimated between $20 and $25 billion,” states an analysis by financial advisory firm Mortgage Capital Trading. “This [rate of runoff] will necessitate private investors to absorb about $250 billion in additional supply per year over the next decade.

“Mortgage spreads widened toward the end of August [an indicator of an increased perception of risk] as a result of investors beginning to take the Fed seriously. Should the Fed decide to speed up the process and begin to actively sell mortgages off its balance sheet (again, not likely), it will be the [MBS] production coupons from the past few years that will bear the brunt of it.”

The Fed’s pullback from the MBS market and the additional MBS supply now available for sale, primarily agency MBS, creates pricing pressures for MBS issuers generally. In addition, in a rising rate environment such as the one we are experiencing, MBS pricing is subject to something known as “negative convexity” — which is the tendency for MBS prices to decrease at an increasing rate as interest rates rise.

The 30-year fixed mortgage rate averaged 5.89% this week, up from 5.66% the prior week, according to the most recent Freddie Mac Primary Mortgage Market Survey (PMMS).

“Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation,” said Freddie Mac Chief Economist Sam Khater, reacting to the release of this week’s PMMS survey results.

Interest rate stability offers the best environment for MBS performance. That stability, so far this year, has been elusive.

KBRA’s RMBS report notes that hard times in the mortgage industry, such as the existing environment, will require mortgage originators to adapt or face the prospect of failure.

“Industry headlines have trumpeted layoffs at large bank originators like JPMorgan Chase, Flagstar, and Wells Fargo, as well as many more nonbanks,” the KBRA report states. “Some companies have shut down entirely, such as Sprout Mortgage, or filed for bankruptcy protection, as is the case for First Guaranty Mortgage Corporation.

“As has been the case over the past 30 years, lenders will continue to fail for various reasons, particularly in challenging economic environments and when they are dependent on external funding.”

Still, unlike the lax underwriting environment that accompanied the housing-industry crash earlier in the century, KBRA said the mortgages that are being originated today are vastly superior in credit quality overall, which bodes well long-term for the health of the mortgage-securitization market as well — once some market stability is achieved and investor confidence is bolstered.

“Originators’ legal and reputational liabilities have increased, as have pre-securitization loan-quality verification procedures,” the KBRA report stresses. “In KBRA’s view, while lender failures will continue, the RMBS market has many features that reduce the correlation between lender failure and future loan performance.”

The post Private-label MBS market facing strong headwinds appeared first on HousingWire.

Source link

Banking trade group “strongly” opposes nonbank membership in FHLB system

An influential banking trade group this week argued that the Federal Housing Finance Administration (FHFA) should not permit nonbank lenders and real estate investment trusts to become members of the $1 trillion Federal Home Loan Bank system.

In a statement issued Tuesday, Rebecca Romero Rainey, president of the Independent Community Bankers of America, said the FHLBs must “remain a strong, stable and reliable source of funding for community banks, including many agricultural lenders.”

The FHFA is conducting a comprehensive review of the 90-year-old FHLB system – currently composed of 11 regional FHL banks and about 6,800 member institutions – beginning in the fall. The FHL banks distribute money from global bond markets to members that include thousands of commercial lenders, thrifts, credit unions and insurers across the U.S. Member institutions are able to borrow money cheaply and can pass savings on to members.

The ICBA said it “strongly” opposes any efforts to “compromise” the system’s regional and cooperative structure, permit non-depository banks access to FHLB programs or services, or consolidate the system without the “grassroots leadership” of its member-owners.

The FHFA, which regulates the FHLB system as well as Fannie Mae and Freddie Mac, said it is specifically interested in receiving feedback in six key areas: The FHLBanks’ general mission and purpose in a changing marketplace; FHLBank organization, operational efficiency, and effectiveness; FHLBanks’ role in promoting affordable, sustainable, equitable, and resilient housing and community investment; Addressing the unique needs of rural and financially vulnerable communities; Member products, services, and collateral requirements; and Membership eligibility and requirements.

While the ICBA and the American Banking Association have spoken out against nonbanks gaining access to the FHLB system, other influential trade groups have sought a different outcome, arguing that the FHLB system is archaic, primarily channels government subsidies to large banks and doesn’t serve the housing market optimally.

The Mortgage Bankers Association notably has pushed for inclusion of nonbanks and real estate investment trusts. In a letter to then-FHFA Director Mark Calabria in 2020, the trade group said an expansion should “better reflect the diverse providers of single-family and multifamily housing finance throughout the country.”

Opening up membership to nonbanks and real estate investment trusts would require legislation and would likely take years.

The post Banking trade group “strongly” opposes nonbank membership in FHLB system appeared first on HousingWire.

Source link

Americans are deeply pessimistic about the housing market

Home prices have started to drop, but the decline has not been significant enough to brighten pessimism about the housing market.

Fannie Mae’s Home Purchase Sentiment Index (HPSI), which tracks the housing market and consumer confidence to sell or buy a home, dropped by 0.8 points in August to 62, marking its sixth consecutive decline. The government-sponsored enterprise attributed high home prices and mortgage rates to the decline, particularly weighing on home-selling sentiment. Year over year, the index is down 13.7 points.

On the seller side, 35% said it was a bad time to sell, rising from 27% in July. About 59% said it’s a good time to sell, dropping from the previous month’s 67%.

“The share of consumers expecting home prices to go down over the next year increased substantially in August. Accompanying this, HPSI respondents reported a significant decrease in home-selling sentiment,” said Doug Duncan, Fannie Mae’s senior vice president and chief economist.

Following a slow down in home price appreciation, prices slipped 0.77% in July from June, marking the largest single-month decline in the housing market since January 2011, according to Black Knight. About 85% of major housing markets, mainly in the West Coast, saw prices pull back from their peak levels, and more price corrections are expected across the U.S.

“We also observed a large decline in consumers reporting high home prices as the primary reason for it being a good time to sell a home, suggesting that expectations of slowing or declining home prices have begun to negatively affect selling sentiment,” Duncan said.

On the other hand, lower home prices would be welcome news for potential first-time homebuyers, who are disproportionately affected by high home prices and high mortgage rates.

Overall, 22% of respondents said it was a good time to buy a home in August, up from 17% a month prior, but 73% said it was a bad time to buy, down from 76% in July.

Consumers were not optimistic about mortgage rates. About 11% of respondents said that mortgage rates will go down in the next 12 months while 61% stated that mortgage rates will go up.

Mortgage rates have been on a rising trend in recent weeks ahead of another potential rate hike by the Federal Reserve later this month. Purchase mortgage rates rose to an average of 5.89% this week.

“With home prices expected to moderate over the forecast horizon and economic uncertainty heightened, both homebuyers and home-sellers may be incentivized to remain on the sidelines – homebuyers anticipating home price declines and potential home-sellers not keen to give up their lower, fixed mortgage rate – contributing to a further cooling in home sales through the end of the year,” Duncan said.

Goldman Sachs, in a paper titled “The Housing Downturn: Further to Fall,” forecasted that new and existing home sales are going to fall 22% and 17% respectively this year. Next year, the investment predicted new and existing home sales will drop another 8% and 14%.

The post Americans are deeply pessimistic about the housing market appeared first on HousingWire.

Source link

Here are 92 of the Most Affordable Housing Markets in the World—Turns Out the U.S. Has Most of Them

Sponsored

Source link

The risk of zero-down loans while the Fed talks recession

Bank of America recently announced a loan for lower-income households that doesn’t require homebuyers to come up with a downpayment or closing costs, and doesn’t base the loan on a minimum FICO score. People’s first reaction was to wonder if this was 2008 all over again. Are we really doing those types of loans and promoting homeownership again without understanding the risks?

Well, it isn’t 2008, but this type of loan does have risk — and it’s the risk that is traditional among all late economic cycle lending in America when the loan requires low or no downpayment. For sure, this Bank of America loan doesn’t have the exotic loan debt structures that caused so much pain during the housing crash years, but it’s good to understand what could happen.

First, to explain my logic here, I need to express what I believe housing is: “Housing is the cost of shelter to your capacity to own the debt. It’s not an investment.”

Part of our housing dilemma is this: How can you make something affordable when you promote it as someone’s best investment? Since many people think of housing as a wealth creator — and we want more Americans to have more wealth — then the government needs to make sure demand stays high enough for that wealth product to grow.

The entire system has to be designed to inflate the price over time. This is what we do in America. The housing market is very subsidized for demand to grow and whenever the economy gets weaker, rates fall and that impacts the housing market in a disproportionate way.

When mortgage rates fall, the majority of homebuyers (including homeowners who need to sell to buy another home) are mostly employed, so lower rates greatly benefit them, and housing demand increases. This can lead to home prices getting out of control, especially when total inventory gets to all-time lows. That is what has happened here in the U.S. We finally paid the price — pun intended — of not having enough product, with massive home price gains from 2020-2022.

The National Association of Realtors’ total Inventory data shows that historically we have between 2 to 2.5 million homes for sale, but in 2022 we got as low as 870,000 in total inventory. I always like to add that active listings were higher in the 1980s — and we have a lot more people now. So when you add move-up buyers, move-down buyers, first-time homebuyers, cash buyers and investors together, this can get out of hand.

We can see a clear deviation in home-price growth starting in 2020, when we broke to all-time lows in inventory. So if it seems like I was panicking about home-price growth and desperately wanted the inventory to grow, you can see my logic. By the summer and fall of 2020, I was basically into “danger, danger, Will Robinson” mode as inventory channels broke at the worst time possible for our country.

Now, we are talking about a housing reset, and the Federal Reserve is hiking rates with a tone that even implies they realize they can create a job loss recession! I just want emphasize this: the Federal Reserve is actively saying households are going to feel pain and some are making statements that they might not cut rates during a recession if inflation is high.

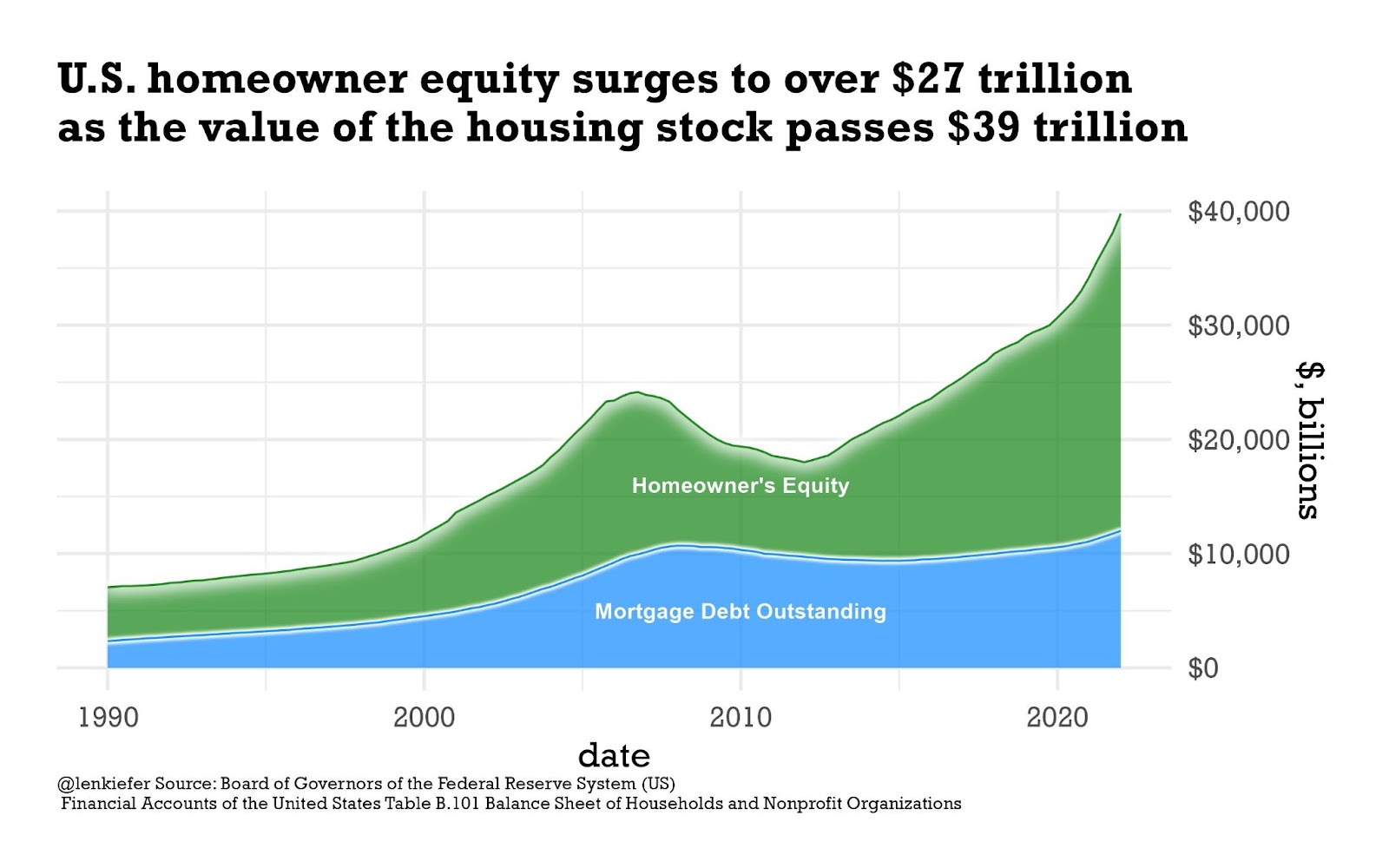

For the traditional homeowner who bought a home many years ago and has seen their nested equity position explode higher, this isn’t much of an issue. If they lost their job, they have a lot of equity in their home, and most likely their financials have gotten better over time.

This is a plus of homeownership, a fixed long-term debt cost while their wages rise every year. As you can see below, we haven’t had the mortgage credit boom like we saw during the housing bubble years. So, not only do we have 40% plus of homes with no mortgage, the nested equity homeowners have now is almost unfair. Remember, the system is designed to keep home prices inflated.

I always stress how crucial it was to have the 2005 bankruptcy reform laws and the 2010 qualified mortgage laws, which together have allowed homeowners to have the best financial profiles in our country’s history. When we look at the credit data over the past 10 years, it looks nothing like the stress we saw from 2003-2008, which was an economic expansion and jobs being created before the job loss recession in 2008.

Homeowners buy a home, have a fixed payment, and over the life of the loan, as their wages grow, their cash flow gets better.

FICO scores look a lot better now than in the run up to the great financial crisis. So you can see the benefit of having a fixed payment shelter cost, while your wages rise. We don’t have any more 100% loans that have significant recast rate risk, so that the total payment of the home can force someone to sell, even if two people are working full time and haven’t lost their jobs. We have a much better housing ecosystem now for sure.

With that all said, the concern I have with Bank of America’s no-down loan will be the concern I always have with late-cycle lending in any economic expansion. If we are going to provide 100% financing with no closing costs and the Federal Reserve is talking about the need for a recession, then I believe we need to make sure people realize the risk of this type of loan. I have to make this statement because all six of my recession flags are up.

Suppose all parties understand the risk of the Bank of America 100% loan and other low downpayment loans at the same time the Federal Reserve is trying to increase the unemployment rate. In that case, nobody can be blamed for the product — whether they are the ones offering the loan or the ones taking it.

In theory, you should never lose your home unless you lose a job or you experience a financial emergency. Your home is where you raise your family and that mortgage payment you make each month should make you sleep easy every night.

However, no matter how sound the loan is, we can’t close our eyes to the economic cycle risk, especially when we have Federal Reserve officials talking about the need to have unemployment rates going up to help combat inflation.

The post The risk of zero-down loans while the Fed talks recession appeared first on HousingWire.

Source link

Latest Duty to Serve plans are an improvement, affordable housing coalition says

A coalition of 21 affordable housing groups on Wednesday said Fannie Mae and Freddie Mac made important improvements to their plans to offer housing financing in underserved markets, but still have a ways to go.

The Underserved Mortgage Markets Coalition, which includes the Center for Community Progress, the National Housing Conference, the National Council of State Housing Agencies, the National Community Stabilization Trust and the Lincoln Institute of Land Policy, on Wednesday released its scorecard on the government-sponsored enterprises’ 2022-2024 “Duty to Serve” plans, which were produced on April 27 after the prior plans were rejected by Sandra Thompson, the FHFA director.

The federal regulation requires that the GSEs prioritize and improve affordable housing opportunities related to manufactured housing, affordable housing preservation and rural housing.

“The scorecard recognizes significant improvement in the latest plans compared with the versions released a year earlier,” the UMMC, which is spearheaded by the Lincoln Institute, said in a statement Wednesday. “However, the scorecard finds that Fannie Mae and Freddie Mac failed to fully implement a majority of the improvements recommended in the Blueprint for Impactful Duty to Serve Plans, which the UMMC released January 20.”

In October 2021, affordable housing groups heavily criticized the GSEs for seeking to eliminate programs to purchase chattel loans and for reducing loan targets for manufactured housing, affordable housing preservation and rural housing.

Affordable housing advocates in particular have sought a stronger commitment from the GSEs on manufactured housing. On that front, the scorecard presents a mixed grade for the enterprises.

“Neither Fannie Mae nor Freddie Mac is substantially increasing its commitment to help manufactured housing homeowners obtain real property loans,” the UMMC said in its scorecard, noting that Fannie Mae is targeting the purchase of 9,500 real property loans for manufactured housing by 2024 and Freddie Mac is targeting between 6,300 and 7,500. Those targets fall short of prior years. Fannie Mae’s 2021 target was 12,650 loans, and Freddie Mac’s 2021 target was 8,200 loans.

Freddie Mac, however, agreed to a pilot program to purchase between 1,500 and 2,500 manufactured homes not titled as real property, better known as chattel loans, which make up 42% of the manufactured housing market. Those loans tend to have fewer consumer protections than mortgages and higher interest rates. Fannie Mae has not yet committed to buying chattel loans, which the coalition encouraged.

The scorecard for rural housing finance was also mixed. Fannie Mae met the UMMC’s recommendation of 13 loans related to Section 515 property investment, a key financing program for rental housing in rural areas. Freddie Mac projects to make four transactions by 2024, below the UMMC’s recommendation of 13.

“The USDA anticipates 183 Section 515 properties will exit the program between 2022- 2024,” the UMMC said. “Fannie Mae’s significant loan purchase will substantially preserve affordability for rural renters. Freddie Mac’s lower targets will do much less to mitigate the loss of affordable housing.”

Neither of the GSEs adopted the UMMC’s recommendation to target 10% of their loan purchase to low- and moderate-income families in areas with high energy cost burdens.

However, both made some improvements related to single-family affordable housing preservation targets, notably in loan purchases for shared equity homes.

“Fannie Mae will increase loan purchases for borrowers of shared equity homes by 100% above its baseline by 2024 and is working to update its Selling Guide to promote standardization,” the UMMC said. Freddie Mac also updated its selling guide and is looking at ways to increase lender participation.

In a statement, the UMMC said it hopes that “both companies will work collaboratively to amend their DTS plans so that the UMMC can issue an updated DTS scorecard with higher scores.”

In response, Fannie Mae on Wednesday said it appreciates UMMC’s “continued interest in our DTS plan and the work we have underway to achieve our objectives. We look forward to our continued engagement with the UMMC members, other industry stakeholders, and our business partners to provide innovative solutions to expand access, explore options, and knock down barriers in these underserved markets across the country and help more families have an affordable place to call home.”

Freddie Mac responded: “Freddie Mac appreciates the input of stakeholders as we work toward the objectives set forth in our Duty to Serve plan. The plan builds on our first three-year initiative with ambitious but appropriate targets. We are continually evaluating what opportunities exist to do more in support of underserved markets.”

The post Latest Duty to Serve plans are an improvement, affordable housing coalition says appeared first on HousingWire.

Source link

UWM follows Rocket, hikes conforming loan limits

Fiercer competition in the wholesale channel spurred United Wholesale Mortgage (UWM) to increase the ceiling on conforming loans on Wednesday, ahead of the Federal Housing Finance Agency’s (FHFA) decision in November.

UWM’s move follows an announcement on Tuesday from competitor Rocket Pro TPO, which was first out of the gate this year in raising loan limits on agency-eligible properties to $715,000.

On Wednesday, UWM increased the conforming loan limit from $647,200 to $715,000 for a one-unit property, forecasting that the FHFA will increase the limit by at least 10% in 2023.

In Alaska and Hawaii, the ceiling on loans originated by UWM and purchased by Fannie Mae and Freddie Mac rose from $970,800 to $1.073 million.

UWM said it is focused on “giving mortgage brokers a competitive advantage.”

Last year, lenders didn’t raise conventional loan limits until Sept. 30, when rates were still in the low 3% range. However, this year, companies are under pressure to launch new initiatives to attract brokers and land more purchase businesses amid high mortgage rates.

UWM, for example, launched the Game On pricing initiative in June and entered the HELOC space in August. Meanwhile, Rocket Pro TPO also plans to diversify its product portfolio by offering home equity loans in mid-September.

The expectation is that other mortgage lenders increase loan limits ahead of the FHFA’s November announcement.

The Housing and Economic Recovery Act established a formula in 2008 that mandated that the ceiling could only rise after home prices returned to pre-recession levels. That condition was finally met in 2016 when the FHFA increased the conforming limits for the first time in a decade.

The post UWM follows Rocket, hikes conforming loan limits appeared first on HousingWire.

Source link

Freedom Mortgage conducts layoffs, sends jobs overseas: sources

Top 10 lender and servicer Freedom Mortgage has trimmed its workforce across multiple rounds of layoffs this year and continues to “offshore” some jobs, former employees tell HousingWire.

In response to falling origination volume, the New Jersey-based mortgage company has conducted at least four rounds of layoffs this year – in March, May and August, multiple sources told HousingWire. Eliminated positions included loan officers, closers, underwriters and client advocates, according to six former employees. (The former employees requested anonymity because they believe speaking publicly would jeopardize their future job prospects.)

Privately held Freedom Mortgage did not respond to requests for comment about the layoffs, which sources said primarily affected the wholesale division.

Freedom, like most top lenders and servicers, has long offshored a portion of its operations, hiring staff overseas to work mortgage files at lower costs. The lender has a contract with Moder, the business outsourcing arm of Archwell Holdings, sources said. Moder, founded in December 2020, has a presence in India and the Philippines and plans on opening an operation center in Central America this year, according to its website. Erik Anderson, president and CEO of Archwell did not immediately respond to a request for comment.

Multiple former employees said the cuts at Freedom led to loan closer and underwriter positions being transferred to India, with U.S.-based Freedom employees reviewing work done by international workers.

“The only thing that is needed from the American team is communication and a quick compliance overview that is being done by the outsourced staff,” a former U.S. employee said. “You’re handling a higher volume, because you’re not doing the actual work. You’re doing a quick scan, correcting errors, you’re being the communication piece.”

After the layoffs, organizational restructurings occurred. As part of those restructuring some supervisors were demoted to become team leads and closers, sources claimed.

“I changed team leads four times,” said a former junior underwriter who worked remotely. “They would do a round of layoffs and they would restructure how you did your job.”

Changes included client advocates (a sole contact point between the broker and underwriter) sharing an inbox set up to address mortgage brokers’ inquiries, to being assigned to individual brokers because there was a drop in business, former employees said.

“They were trying to do a more streamlined process but they said we didn’t have the volume that was more efficient,” a former employee said.

Freedom, led by Stan Middleman, claims on LinkedIn to have more than 10,000 employees. HousingWire wasn’t able to confirm if that figure included staff overseas.

Freedom ranked as the nation’s sixth largest lender by origination volume during the first half of 2022, but like its competitors is suffering from the impact of high mortgage rates. According to data from Inside Mortgage Finance, the lender originated $19 billion of loans in the first six months of this year, with $8.3 billion originated in the second quarter of this year. Loan origination volume dropped 74% in the second quarter compared to the same period last year.

Last month, Freedom sold RoundPoint Mortgage Servicing to mortgage servicer Matrix Financial Services Corp. and a wholly owned subsidiary of real estate investment trust Two Harbors Investment Corp. two years after Freedom acquired it.

The acquisition increased Freedom’s combined owned and subserviced mortgage servicing rights portfolio to $310 billion, Freedom announced at the time.

The deal with Matrix led Roundpoint to close some sales operations and lay off employees.

The post Freedom Mortgage conducts layoffs, sends jobs overseas: sources appeared first on HousingWire.

Source link