David:

This is the BiggerPockets Podcast, show 666. In basketball, we had this concept called a four point swing. So imagine that you’re on a fast break, you got a wide open layup. You miss it. The other team gets the rebound, they throw the ball the other side, and then they get an open layup. It’s not that they score two points. It’s that you lost two points and they score two points equally, a four point swing. That’s like the worst thing that can happen. The same is true if you don’t house hack. Not only are you not raising rents on your tenants, but you are having them raised on you. That doubles the impact of the power of real estate, but it’s working against you. When you own the asset, you’re getting the four point swing in your favor. Hey, everyone, this is David Green, your host of the BiggerPockets Real Estate Podcast, here today with a Seeing Green episode.

If you haven’t heard one of these before, on these episodes we take questions from you, the BiggerPockets community, and have me answer them with my experience with investing in real estate. I try to teach, I try to share, and I try to give advice to the people who are submitting questions so that they could grow their wealth in real estate, similar to how I was able to do for myself and get out of that job you hate and into a life you love. Today’s show’s pretty awesome. I bring some clarity to house hacking in an expensive market. This is a question that comes up all the time. People don’t quite understand the right way to house hack or how it could be so powerful. I get to kind of expand on that point and give some really good advice to one of our listeners who is in Sacramento, California, and having a hard time finding a deal that works.

We talk about what to consider when you are an agent and you are also trying to wholesale or wholetail a deal, the right way to get into that. And then we talk about scaling using DSCR products. So DSCR products are loans that take into account the income from the property, very much like commercial property is evaluated, not the income of the borrower. And I come up with kind of an entire plan for a firefighter who’s trying to scale their portfolio, but concerned about pre-payment penalties. All that and more on today’s show.

Before we get into it, today’s quick tip is we’re nearing the end of September, which means right around the corner is October. And October, from a realtor’s perspective, is when the market starts to slow. We find less buyers are active in the market during the winter months, especially during the holidays. Let’s say you’ve been sitting on the fence. Let’s say you want to buy a primary residence, but you’re tired of being outbid because every house gets so much attention. Now is the time that I would recommend you reach out to your agent and you put a search together and you start looking again.

There are going to be a lot less buyers for every existing house than there was before, which means you have less competition, which means if you’re buying, that’s good for you. If you’re selling, you may want to wait until springtime when there’s more buyers that are looking and you’re more likely to get multiple offers, unless you need the equity now so you can go reinvest it into the slower market.

As an investor myself, I totally take advantages of seasonal fluctuations. I do not think that that’s urban legend. I’ve seen from my experience it’s very true. I often tell the David Green Team clients, “If you want to get top dollar, let’s wait till spring. If you want to get the best deal possible, let start looking for you in the wintertime.” And I increase my own buying during the wintertime. And if I’m going to sell, I try to wait till spring. So just wanted to pass that along to you so you could take advantage as well. Okay. Let’s get to our first video.

Jessica:

Hello. My name’s Jessica and I live in Dayton, Ohio. I’m a relatively new listener, but I love the Seeing Green episodes the most. So, David, I’m really hoping you can help me with this question. We are looking to get into the real estate investment market. Both work full time. Our home has really appreciated, and so we took out a home equity fixed loan for about $53,000 in hopes that we could then have money to put down towards a rental property. We’re finding that a lot of the homes that are within our price range, which we’re trying to stay as close to $100,000 as possible, which in this market, in the Dayton area, isn’t unheard of, but it’s definitely difficult.

Our realtor mentioned that another client she’s been working with recently started Airbnb their property as a long-term extended stay Airbnb. She said they had a lot of success renting it out to families who are looking to move, but who haven’t secured a new home yet and need a place to live for a couple of months. Or, the other thing that is really, really popular around here, we have several large healthcare organizations in the area and they’re growing. They’re massively growing. So that’s booming. My thought too is what stops us from using a long-term, turning it into an extended stay short-term rental? I haven’t heard you guys talk a lot about that. I don’t know what your guys’ thoughts are. It seems that the profit is a lot easier to get a property to cash flow in today’s market using that strategy. And so I just was curious what your thoughts were on that.

David:

All right. Thank you, Jessica, for that question. Also, please give your dog a high five or a high paw for me. We saw a little cameo there in the back, very cute. Wanted to get into show business, I see, and it worked. Also, thanks for saying the Seeing Green is your favorite of the BiggerPockets Podcast. I appreciate that. Mostly because I’m hearing your Seeing Green.

All right, let’s get into your question. I like it. You’re talking about I think what you call them more extended stay short-term rentals. There’s all kinds of names. I typically refer to them as mid-term rentals. If you’ve never heard of these before, basically mid-term rentals is something to have on your radar because I think that this is sort of the next wave, the next common trend. There’s always a trend in real estate that people do really well with, this is the next one.

I’ve got 13 units that I’m working on rehabbing right now to bring online. And when that happens, I will have more information for you guys about how to run them efficiently, how to run them productively. I’ll be able to bring all the education that I can. If I talked about it right now, the problem is I would be speculating. I’d be telling you what I think works and what I’m planning on happening, but I don’t have the data yet to support it. I don’t like to talk until I know for sure, it’s just my personality, so keep an eye on that.

The reason mid-term rentals have sort of become popular and are becoming popular is because many areas are outlying short-term rentals. And when they say you can’t do short-term rentals, they’re typically putting a limit on how long someone can stay in the place as the minimum amount of time. They’ll say they got to be there 30 days or more. You can’t rent your unit out for less than 30 days. This is the case in many parts of Hawaii, where I own real estate, where Brandon lives. And then other municipalities are sort of adopting this because the neighbors don’t like these people coming in for two days and throwing big parties and kind of bringing a bad name on short-term rentals.

Because there’s moratoriums put in place and laws being changed that force someone to stay in a rental for 30 days or more, you’re seeing a lot of people that are owning real estate are getting into catering to people that would stay somewhere for that long. And who is that going to be? Traveling professionals like nurses or corporate executives, people that are maybe moving near a hospital, because they have a sick family member that’s going to be there for a long period of time and they want to be close by, somebody taking a temp job sometimes. Maybe someone who’s moving to an area, but isn’t sure if they want to buy or if they want to rent. Sometimes you take a job somewhere and you don’t know if you want to buy a house. Well, you don’t want to pay the expensive rate of a short-term rental, you don’t want to live in a hotel.

So you’ve got these medium-term rentals, which is what I’m calling. I’ve also heard them called long shorts, extended stay short-term rentals was the phrase that you came up with there. And that’s what we’re doing is they’re furnished just like a short-term rental. They operate just like a short-term rental, but you don’t charge as much because you’re not renting them out nightly. And they’re a little bit less work. On the spectrum of tons of work versus very little work, tons of work tends to have higher profit margins. Maybe I’d look at short-term rentals are the very, very end where you get the most profit but the most work.

Long-term rentals or traditional rentals are on the other side, the least amount of work and the least profit. And mid-term are right there in the middle. I’d like to be able to tell you more about it. I don’t know for sure. I’m anticipating it’s going to be very good. I’ve got three properties that are all in California that I currently bought. And two of them are BRRRRs and one of them is not. But I still had to do a rehab to basically get the houses ready to be in really good shape so that I can rent them out to traveling professionals.

I think in areas like California, that allow ADUs… We have a lot in California where you were not allowed to restrict homeowner’s ability to have an ADU. Cities can’t say you can’t build an ADU. We’re actually allowed to have up to three: a regular house, an ADU and a junior ADU. Of course there’s permitting and code requirements you have to follow, but this is a great market for something like that because you can turn one property into three different units and rent them out to traveling professionals and get much more rent than traditional rentals.

Now, before I get into the details I can’t share, because I don’t know yet, I do want to bring this up as a point to be aware of. I would anticipate that you knew that short-term rentals weren’t going to last because the neighbors complain. If you were paying attention, you would have anticipated, like I did, that medium term rentals would be the next phase. My guess here, and I don’t know this, this is me trying to put on my crystal ball, which looks a lot like my head, is that you’re going to start to see a lot of tenants that start complaining that there are no places left that are affordable to rent. Because all of the real estate investors that we’re using existing inventory that they own to rent to traditional rentals, long-term, many of them have moved into short-term and now you’re going to see them getting into medium term, which means of the rentals that were out there, there’s less supply for long-term tenants and they’re going to start complaining.

When that happens, you typically see politicians pass laws either at the federal state or local levels that restrict your ability to use rentals maybe as a medium-term or short-term. So again, there is no quick answer to real estate. You always have to be adapting. You need to be listening to podcasts like this and staying ahead of the information curve so you don’t get stuck with an asset that you can’t use the way you intended.

I would expect some backlash from the tenant pool that had been renters for a long time as they see their ability to find places to rent is diminishing and the rents are going up on those significantly, because the supply is restrained. So to sum up what I just said, I think the future is mid-term rentals. I think after that, you’re going to see laws that are passed that force landlords to rent their places out as long-term rentals. And that if we don’t build some more freaking houses in some of the busiest areas, this is going to constantly come back to make investors look bad. And it looks like you had a follow-up to your original question that I missed. So we’re going to air it now, and I will reply.

Jessica:

The other thought that I have, that I wanted to throw by you guys and see what you thought, we have several friends who are also interested in getting into the game. Accumulatively, we could probably put money down on a very nice or multi-home property and do a long-term rental that way. And we have friends who have a little bit more experience than we do, who are interested in partnering, but honestly… And it sounds great. We’re very interested. We trust these guys. They have more experience, so we would love to learn from them. I don’t know where to start with the partnership.

What kinds of things should a person be considering when partnering on a real estate investment? I guess I’m just curious, is there a contract template or how have you guys done that in the past to make everybody feel secure in the plan? You guys talk a lot about partnering and so I know you have these answers. I think it’s one of those things that when you’re a newbie, you have no idea where to start. But when you’ve done it a few times, you don’t realize the little details that the newbies are wondering. I’d love to know your thoughts. We can’t wait to hear what you think about these things. Thank you so much.

David:

When it comes to partnerships, first off let me say everybody at BiggerPockets, all the different hosts and personalities and advisors, we all have a different perspective on this. And a lot of that comes down to different personalities, different business goals, different perspectives. There is no right or wrong answer. There is a right or wrong answer for you. Now this may come as a surprise, even though I do talk about partnerships, I tend to err towards not being in favor of them. In fact, I have people that reach out to me about partnerships and it just always seems to go wrong whenever I take that road. I recently did one with someone that I didn’t know and something came up right after the partnership that caused me to question how much I can trust this person, but I’ve already got the money and the deal. I don’t really love that.

Other times I’ve partnered with somebody and they’ve wanted… They’re fascinated by real estate. They have a million questions and I’m more like, “I want less time put. That deal’s already done. Let it sit. Let’s look at the next one.” So we have different goals. If I do partner, there’s a couple rules of thumb. The deal has to be big enough that it makes sense. I’m typically only going to partner on very expensive residential real estate or multi-family real estate. I don’t want to partner on a smaller deal because instead of the work getting cut in half, you just have to do all the work twice, as both sides want a say and some control over how things go down and it’s not worth my time if it’s not a big deal.

Or, the deal has to be something I’m getting in and out of, I would definitely partner on a flip. I would definitely partner on if it was like a big deal and a BRRRR where I thought I could go in, get my money out and be okay. Those are some of the qualifications that I would say I have when I’m going to partner with somebody else. The right reason to do it is because you have complimentary skill sets. Somebody’s great at finding deals, someone’s great at managing deals. Somebody has construction contacts, the other person has management experience.

The wrong reason is for emotional ones. You don’t want to partner with someone just because you’re afraid to do it on your own. I know what you asked for was tactical stuff to make sure you’re doing in a partnership. What I’m going to say is you’re probably better off, if this isn’t a very big deal, to do it on your own without the partner, because I haven’t had the person yet who came back and said, “This deal I did with a partner went well.” I’ve always heard it didn’t go well and then they’re not partnering on future deals. The only exception is if you are going to partner in a company, and that company is going to own several properties, and this is someone you’ve known for a long time and you trust.

In that case, the tactical advice I’ll give you is spell out in the operating agreement exactly who will be responsibility for which parts of the managing it. Talk with that person about how long they’re okay having their money and their equity in this partnership. Some people are letting it ride for 40 years, other people want to get that money in and out in six months or two years, and you will have conflict with your partner if you’re not on the same page as far as the time horizon of the velocity of that money, how soon you want to see it returned to you.

Thank you for reaching out. This is also a really good question to put in the forums and see what different people on BiggerPockets have to say about partnerships that they’ve had that went well or went poorly. Last pieces of advice that I will give you, take all the questions that you’re asking me right now, put them in a Google document and sit down with your partner and say, “Here’s what my questions are. How do you think we should handle each of these things?” And then see how many things you’re on the same page with the partner. It’s way better to ask more questions than less.

And then finally you can search BiggerPockets for partnerships. We’ve done episodes with Rob and I talking about the house that we bought in Scottsdale together. Tony and Ashley on the Rookie Podcast have done several episodes on partnerships. There’s much more available to you than I could possibly answer on an episode like this. If you go to BiggerPockets and search both the forums and the podcast for partnerships, let us know what you find.

All right, our next question comes from Tommy C. in Georgia. Tommy says, “I’m a real estate broker in Georgia and an investor. My favorite people to represent our other investors. I’ve grown my business like crazy over the last five years. I did 27 million last year and over 160 transactions. The first quarter, I’m already at 63 transactions and 8 million in sales. My question is, how do I grow a team of agents that want to work with investors to help me serve more clients? What should I look for in those agents? Currently I’m struggling to get to everyone. I don’t want let anyone down, but there’s not enough time in the day. Any thoughts? Thanks.”

Well, Tommy, a very similar problem to what I have run into, is you have a whole bunch of people that want your help, because there’s not very many people that understand how to help clients build wealth of real estate. There’s tons of agents that will help you find a cute kitchen or be near the school district that you want. There’s not many that understand the way that money is built within real estate. Once you get good at that, you start to find that there are more clients coming your way than you have time in the day, which is definitely the case because you look like you’re doing awesome.

The problem is the reason all those clients are coming to you is because there’s not many people that could do what you do, which is the irony in your inability to grow because you can’t find agents that can help those people because there’s not as many people they can do what you can do. I’ve had several different ways I’ve tried to approach this problem. They’ve all been serviceable. None have been amazing. One way is I’ve tried to train agents how to do what I do. The problem with that is you’ll often spend a ton of your time and energy training the agents instead of helping the clients, and then those agents either won’t get it figured out or they will get the information and leave. This happens all the time.

Another one is that they will understand the information, but they won’t have the same work ethic or integrity that you do. They will know how to run the numbers, they’ll know how to find the houses, but they treat the clients like a transaction. You’re just a number I’m here to get you in and out the clients don’t like how that feels, you lose your future business. The reality is it is very difficult to grow real estate sales team. One of the hardest things that there is to grow, and that’s because the people that you’re hiring tend to have different motivations. They just want to get paid more. They want someone to teach them. They want someone to hold their hand. They want someone to help them grow. Then you have, which is you want them to treat your clients as if it’s their own.

There is no easy way around this, and this is why most of the advice that I give to the investors and the buyers is quit expecting your agent to be able to do everything you need them to do. You almost have to train your agent. If the people that you work with know how to run numbers, know how to figure out the ARV and they can just tell the agent what they need and the agent could go and gets it, that’s typically the best situation for all parties involved. I wish I had an easy answer to give you, but I’m in the same boat. We constantly hire agents train them and then they leave. Or it was harder to make money than what they thought they were going to make.

Now I’m in California where one, even if we have the information, people trying to buy the best houses that are getting tons of competition, get out bid. It’s very frustrating. I think in Georgia, where your price-to-rent ratio is a little more solid, finding cash flowing deals is probably a little bit easier for you. In fact, I like your model so much I’m actually going across the country, I just got back from traveling for 30 days, and meeting with different agents to try to find David Green Team expansion agents in the markets that cash flow strong, so when people come to me and want to buy investment property, I can say, “Boom, I’ve already got this person that I’ve trained.” It might be worth you and I having a talk at some point in the future.

But that’s really the challenge that you’re having, is that we have to figure out a way to serve our clients. That’s the ultimate goal. And doing that is something you’ve done well, that’s why you’ve grown the brokerage so big. Finding the people that are going to have the same level of care that you do is very challenging. So, my ultimate or my last response for you would be probably focus a little bit less on the knowledge they already have and focus on the integrity of the person that you’re hiring. You can always teach them the knowledge, but you can’t change their character. And focus on hiring agents that also own property.

It’s part of why you work so well with investors, is you are an investor. You understand when you’re looking at the deal what you would be doing for yourself, so you know how to help the clients. If you find agents that also own real estate, they are much more likely to be looking at that opportunity for the client from the lens that they would be looking at it themselves. And we always do better when we’re thinking about what benefits us than when we’re thinking about what benefits other people. If you can get those interests aligned, that will help. Thank you for your question. Let us know how that goes.

All right. We’ve had some great questions so far and I want to thank everyone for submitting them. Please take a minute to make sure to like, comment and subscribe to the YouTube channel if you’re listening to us on YouTube. I got all dressed up for you guys today. What do you think about the clothes that I’m wearing on today’s show? Here are some comments from our previous episodes I’d like to share with you.

Matheus Chaves says, “Thank you, David Green. I listen every day to your podcast.” Well, first off, thank you for thinking it’s my podcast, but I’m really just a humble servant of the podcast itself. “I’m finally going to get myself into real estate and this was the show that gave me the final push.” Okay, that makes me feel good. I’m very glad to hear that I helped you get over that hump. Have very low expectations for your first deal, slightly lower expectations on your second deal. By your third deal, you can expect to be doing pretty good. And by the fourth, fifth and sixth deal, you’ll probably be good at it. That’s the best piece of advice I could give you.

Next comment comes from Rea Vera. “I love the long answers. Love David with and without the others, the entire show with all of his personalities is incredible.” Well thank you for that. I’ve often wondered if I need to keep my answers shorter or if I should go on the longer stream of consciousness so you guys can kind of understand the logic behind why I give the answer. Glad to hear that you like it when I take a little bit more time and effort to answer the questions.

Tim Kauflin says, “What happened to the green background? How am I supposed to know that this is really Seeing Green?” Funny you say that, Tim, sometimes I forget to change the light that’s behind my head because I am so excited to start sharing information with all of our audience. Today’s shows was one of those shows. And because I saw this comment, I went back and rerecorded everything with the green light instead of the blue. That’s one of the telltale signs that it’s a Seeing Green episode. A few other telltale signs you can know, it says Seeing Green in the title, there’s no other podcast host with me, and it’s me playing videos and listening to them and commenting on those videos. If you don’t see the green light, or you’re listening to this on iTunes or Spotify or Stitcher and you don’t see the background, you can still feel assured that you’re listening to the Seeing Green episode if it fits any of those qualifications. And lastly, if you’re seeing me, you’re already seeing Green, so it doesn’t matter what color the light is.

Angelo comments, “Thank you for reading my question, Dave, very much appreciated. Even missing fine detail, like we all do, your points come across crystal clear, great skill that you have. I like the longer form answers, the creative ideas on how to approach all of the questions people have. You take time to answer, give examples and provide analogies.” Well, thank you for that, Angelo. I’m glad that you like it. Make sure you subscribe to this channel so you get notified when we put out future Seeing Green episodes.

And our last comment comes from Karl Hackman. “I love your content and the way you break it down so anyone can understand. Would love if you would show your book collection, favorite book.” So bit of an Easter egg there. I’ve got my book collection right here. However, they’re too blurry for you to actually read, because I’m doing that cool thing that YouTubers do where we’re in focus but what is behind us is not. So you can’t really see what those books are. However, if you want to actually submit a question on Seeing Green and say, “David, what are some of your favorite books that are behind you?” Maybe I’ll take a minute and make a segment where I pull those books out and show them to the camera so you can all see what some of my favorite books are.

All right, are these questions and are these comments resonating with you? Do you have situations that are similar and you’d like me to answer? I need to know. Tell me in the comments. Tell me what type of stuff you’d like us to cover, what we can change to make the show better, what you didn’t like about or what your favorite parts are. Or, just say something really funny, because I read them and so does the staff at BiggerPockets, and we love to see what you guys are thinking. The comments section is the best way to get your point of view across, so please go there and leave comments and hopefully we read one of them in a future show.

All right, let’s get to our next question from Shaun Nichols.

Shaun:

Hey David, thank you so much for taking this question. Essentially, my question boils down to what tips tricks or pitfalls do I need to watch out for when wholetailing or essentially working as an iBuyer? I’m a real estate agent and investor in the Columbia, South Carolina markets. And I actually work with an investor who runs an iBuyer program. And essentially what we do is I go in as his local rep and make an offer on a property, 100% of market value, no repairs, no showings, all that good stuff, for like a 12% fee plus the 6% realtor fee. Or, we give them the option, “Hey, you can either sell it to my investor, or I can put it on the market for you at just a 6% fee and he’s willing to do it for any property under $1 million.”

Essentially I’m wanting to do the same thing. I’m wanting to be able to go in and tell a client or a potential client, “Hey, I’m willing to buy your house at 100% of market value, as is, for a 12% fee. Or, I’ll list your property for a 6% fee,” and give them both options to see whatever works for them. If they do decide to sell the property to me, I’m just planning on putting it right back on the market for the exact same price that they sold it to me for.

What things do I need to be watching out for with this? Obviously it’s going to take a lot of cash, a lot of capital, to be able to do something like this, especially if you’re planning on buying the house in cash. But I’d love your opinion on things I need to watch out for. Obviously, I don’t want to be like Zillow and go in and offer what this estimate is and go broke. So any advice or feedback you can provide me, I’d really appreciate it. Thanks. Talk to you soon.

David:

All right. Thank you, Sean. A few things that you are indeed going to need to look out for. The first is you’re blurring the line pretty significantly here between the fiduciary duty of a licensed real estate agent and the non-fiduciary duty of buying a house for yourself. I would have a long and well thought out conversation with your broker to find out what forms they would need you to get signed, to where it was disclosed to the person when you’re acting in the capacity of an agent and when you’re buying it for yourself. One angry family member could get you in a lot of hot water with a lawsuit when you buy grandma’s house for what ends up being a discount and they feel like you could have sold it for more on the open market. And even though you explained this to them, in your opinion, they thought that as a licensed real estate agent you were telling them that the iBuyer option was her best option.

This can happen. This is one of the reasons that wholesaling is, in some ways, considered to be illegal in a lot of different markets. It’s especially troublesome the person’s a licensed agent. Now, I understand how frustrating this is, because as a licensed agent, there’s a bazillion hoops that they make you jump through. And then as a wholesaler, it’s the Wild West, you could do whatever you want. Personally, I think that there needs to be some legislation passed to bring some clarity on this because it’s not fair that people who play the game fairly and go get their real estate license have so much more restrictions, so much more regulation and so much more exposure to being sued than the person who doesn’t have their license, isn’t representing the client is just going there to buy the house for themselves.

But as the way it stands now, in many areas, you are able to do both. So talking to your broker to make sure you don’t get in trouble with the state or the governing board over your license would be the first thing that you should do. Having disclosures to fill out would be another thing for you to consider. Now the third piece would just be your personal exposure. If you’re going in and you’re paying fair market value for houses, like what the iBuyer person you work for is doing, or if you’re trying to get them at lower priced houses, but you don’t have cash, you actually have to think about you’re taking on some risk.

If you’re going to borrow money from a hard money lender, if you are going to borrow private money, if you’re going to take out a HELOC. Where’s this cash going to come from? Because if you try to refinance out of these houses that you buy, you’re only going to probably pull 75 to 80% of the value of the home out. That’s about the LTV that you’re going to get. If you use cash to buy the property for 100% of the appraise value, and then you go get a loan on it, you’re still going to be stuck with 20 to 25% of the money you borrowed from the hard money lender that you can’t get out when you go to refinance into conventional loan. Which means that you probably have to be buying them at 20 to 25% under market value to not run out of capital, which now puts you back in the tricky spot where you’re offering them significantly less to buy it yourself versus if you go sell it and put it on the market.

I don’t know for sure, and I can’t give you legal advice, but here’s what my gut is thinking if I was in your spot. I would find a different license person to refer business to when you find a person that wants to sell it and put it on the market and focus more on buying the houses that you want to buy yourself, than trying to do both and sort of remove yourself from that legal problem that you can run into when you’re trying to act in two different capacities. Thank you for your question and let us know how that goes.

And our next question comes from Tony Spencer. Tony asks about scaling using DSCR loans. If you haven’t heard of these DSCR, stands for Debt Service Coverage Ratio. And it’s a fancy way of saying a loan that is based off income that the property makes, not income that the borrower makes themselves. “Hello, David, I wanted to ask you a question about scaling a portfolio, specifically investing in short-term rentals. My understanding is that a DSCR loan has a five year prepay penalty.” I’ll say most of them do, Tony. A five year prepay penalty means if you refinance or sell that loan or pay it off in any way within five years, you typically are going to receive a penalty and money that you have to pay back to the lender because they gave you that loan expecting to receive interest on it for at least five years.

“Right now I’m BRRRRing an investment property with about 400,000 in equity once it’s done. My debt-to-income ratio is now maxed, so a DSCR loan for my first out-of-state short-term rental makes the most sense.” Like I said earlier, DSCR loans take into consideration the income from the property, not the income from the borrower. So if Tony’s debt-to-income ratio is maxed out and he can’t get a loan with his own income, he still can with the property’s income. “But then how do I buy the next few deals after that? I’m sure I can just save up the cash for another down payment, but that could easily take two to three years. Is it possible to do a HELOC on a DSCR property or do I just bite the bullet and pay the penalty once I’ve got the equity needed? I do have roughly 750,000 in equity in my primary residence, but my wife and I are really not comfortable pulling that out.”

“Another possibility I’ve considered is some type of partnership deal, but that is totally foreign to me. And that’s definitely not my preference. Side note, I’m basically working two jobs right now, a full-time 24-hour shifts as a firefighter, and remodeling an investment property on my days off. In addition to that, I’ve got a one-year-old and a three-year-old at home, but I still make sure to schedule time to listen to this podcast and interact with the BP community. That’s how much value represents me. It’s such an amazing platform and source of information.” Amazing. Well, Tony, thank you. And let me just give a shout out to your fire department. I don’t know the name of it, but if you guys are working with Tony and you listen to this, thank you for the service that you do. I hope all you firefighters out there are eating healthy food and getting workouts with weights and getting to sleep at work like us police officers never got to.

All right, now let’s get to your actual question here, how do you keep buying properties when there’s a pre-payment penalty and you have to use the DSCR loans? Well, the first thing I would say here is you can usually avoid the pre-payment penalty if you pay more upfront for the loan. So if you increase your closing costs, usually a couple points, you can have that prepayment penalty waived. If not, yeah, you might just have to pay it. When you go to refinance. It’s better than not getting a deal at all if your personal debt to income ratio is maxed out. Another thing you could do is use these DSCR loans while it paying down your own debt and increasing your income so that you can use your DTI to get a conventional loan when it’s clear, and use DSCR loans for whatever periods of time it’s not.

Is it possible to do a HELOC on a DSCR property? It’s possible to do a HELOC on any property. It doesn’t really matter what loan you get against the property, because the bank giving the HELOC is just concerned with the equity that you have in the property. They don’t care what type of loan you have in first position. A HELOC is a second position loan basically, that’s qualified based off of your ability to make the payment and the equity that is in the house, so they end up in second position to the first. In that case, your problem isn’t going to be because it’s a DSCR loan. Your problem is going to be because HELOCs are notoriously difficult to get on investment property. They are much easier to get on a primary residence, which is why it would make more sense for you to pull it out of your primary. But then you say that your wife and I are not really comfortable pulling it out.

Here’s my question to your wife and you, does it matter if you’re pulling the equity out of your primary residents versus the investment property? Are you planning on not making the payment for either one? If you’re a firefighter, I’m assuming that means that you can work overtime if you end up in some kind of financial jam and you have to pay back the loan that you took out. So if you’re going to take a HELOC on investment property, why wouldn’t you just take a HELOC on your primary residence? You’re going to get a better rate and it’ll be easier. In my mind, it doesn’t really make a difference which asset you take the HELOC out against, especially if you have so much equity in your primary.

Let’s go worst case scenario. Let’s say you take the HELOC on your primary and someone steals your money, you buy the worst deal ever, aliens come and take your house and fly away with it and you have no collateral. Something crazy happens. Well, you didn’t borrow against the whole 750,000 that you had in your primary. You probably didn’t need that much cash. So worst, worst, worst case scenario, you can’t work overtime and pay back that money over a longer period of time, you can’t afford the payment. You sell your house, because it still has a lot of equity. You pay off all the debt you have. You and your wife go house [inaudible 00:33:18], get a smaller house. Okay? That’s not ideal, but that’s not bad for a worse case scenario when you could be buying more real estate with the money that came from that, growing a portfolio that will pay your mortgage for you and your HELOC for you with the rental income that comes in.

I’d probably have the conversation about why are we afraid about taking a HELOC on our primary? See if you can get to the bottom of where those fears come from, and maybe look at that differently. And then yeah, you’re probably going to have to use DSCR loans until your DTI is changed. And that’s okay. If you got to pay a prepayment penalty, that’s okay. If you don’t want to pay the prepayment penalty, get the loan in the beginning and pay to not have it. You’re going to have to pay a little bit more upfront. Thanks for that question. And I hope work goes well and you stay safe out there, brother.

Next question comes from Chris Roberts in Chattanooga it’s funny. I was just in Chattanooga not too long ago flying out of their airport. “Hi, David. BP has become sort of therapy hour for me lately and I appreciate it. I’ve spent my life in the food industry and need to be doing something different. My wife and I bought a second home to fix up, got a HELOC on our primary residence to finance the rehab. And now I’m trying to figure out if we should sell the primary when we’re moved in, walk away after the HELOC is paid back with maybe 15,000, or keep it and rent it out. That’ll give me about 450 a month in cash flow, considering the HELOC payment in this equation and then the journey could start. I’m also a real estate agent here and love working on project homes. I’m just feeling a little lost in the direction to take with my life, but feel like BP could be a part of it. Thanks for all you offer. And Rob is awesome to, Chris.”

All right, Chris, I think I can actually make this question very simple for you. You took out of HELOC on your primary. You used that to buy the second house you’re fixing up and now you’re trying to figure out, should you pay off the HELOC or should you sell your home and use the proceeds to pay it off and walk away with about $15,000? The question that you got to ask yourself is would you rather have your house you have now, or would you rather have $15,000 in cash? Now when I say the house you have now, what I’m referring to is the house with the HELOC against it. When you consider keeping the house, it looks like you’re saying that you could rent it out for $450 a month extra, that’s the cash flow you’re going to make after your primary mortgage is paid and your HELOC is paid. So now the question becomes even more simple. Would I rather have $450 a month or would I rather have $15,000 in the bank?

Let’s do a little calculation to see what kind of a return 450 is on 15,000. We’re going to take 450 times 12, which is 5,400 divide that by 15,000 and that’s a 36% return on that money. Do you think you can sell that house, take 15 grand and get more than a 36% return on the money? Probably not. Makes it pretty clear that you need to keep that house as a rental property, rent it out and go buy a different house to live in. I especially like that idea because now you get to use an FHA loan or a primary residence loan, somewhere between three and a half to 5% down, to get your next house, which means you don’t need a ton of capital to do it. And that house could become your next rental property after you’re done living there. You are in a great position. You shouldn’t feel bad at all. Well done my friend, keep going.

JD:

Hi David. My question is about the three or 5% down. You’ve mentioned several times that your suggestion is to take great funding, put three or 5% down, house hack, and then just rinse and repeat that. My question lies in the fact that I live in California. I live in Sacramento and properties are quite expensive out here, like 400,000 easy. I hate where I live, so it doesn’t do me any good to buy something super cheap just to end up in a crummy neighborhood like where I’m currently living. I’m looking to purchase something in a nicer neighborhood. You’re 500,000, 600,000. If I want to house hack or create a situation where I can generate some income, then it’s definitely going to be in the higher price point.

I don’t understand how I can make this work according to your suggestion, because putting three or 5% down makes the mortgage unpayable. Can you give an example or give some specifics on how I can make this work in my California market? That would be awesome. Thank you.”

David:

All right. Thank you, JD. Now I understand that you actually had a little bit of trouble getting acknowledgement for the video submission that you put in here. I can see that you are very eager to make some progress, so a few words of suggestion for you. One, if you ever have a question like this, that you feel is very urgent and you need answered, please consider in addition to spinning it to us here at biggerpockets.com/David, go to the BiggerPockets forums and ask it there. Also, I have an agent on my team. He’s been interviewed on the BiggerPockets, money show. He’s been on the BiggerPockets YouTube general, Kyle Rankie, he and Brandon Turner are my two best friends. He works in the Sacramento market. You should reach out to him. He would be happy to help you with this question because we know that market very well.

Now I’m really glad you asked this question because it gives me each chance to clarify a few things for you. You said that it’s very difficult to find a property that will generate income as a house hack when you’re only putting three and a half to 5% down. That is right. It’s notoriously difficult, almost impossible most of the time. Here’s where I think you got confused. House hacking is not meant to generate income. House hacking is meant to save money that you were spending on rent. It’s not something that you should be approaching thinking, “How much money am I going to make?” It’s something you should be approaching with the idea of how much money can I save.

So for instance, if rent in Sacramento where you’re living is $2,500 a month and we can get you a house hack that after your tenant pays you rent, you’re only paying 500 a month or a thousand a month, you’re actually saving 1500 to $2000 a month. Now you’re not making anything because you’re still coming out of pocket somewhere between 500 to 1000, but that is significantly less than what your rent would be. Now you may say, “Well, I’m living in a house. I’m not paying rent.” That’s true, but you have a mortgage still. If you’re able to move out of the one you’re in, if you own it, rent it to someone else, break even or make some cash flow on that and then drop the payment that you are making of maybe 2,500 a month or 3000 a month, down to the 500 to $1000 a month that you’re coming out of pocket to house hack, you’re saving money and you’re adding an additional property to your portfolio.

Now I’m really glad that you submitted this question and we selected it specifically because I need to highlight I’m always telling people to house hack. But the assumption is I should be able to live in a property which takes up one of the units that would normally be rented, put very little money down, three and a half to 5% instead of 20%, and still have it cash flow. And this is why house hackers get so frustrated. In some markets that might work. If you’re in the South, if you’re in the Midwest, if you’re in a place with very low price-to-rent ratios and it’s a fourplex or a triplex, you might be able to house hack and still make a little bit of money. But if you’re in expensive market like California, Sacramento, Northern California, the value is not that you’re making money every month. The value is that you’re owning real estate that’s going to go up in value. The rents are going to be going up in value. The price of the asset’s going to be going up in value. And most importantly, the rent that your landlord is charging you isn’t happening anymore because when you’re renting, your rents go up every year.

Just like when you own the home and you get to increase the rents every year, when you don’t own the home, the rents get increased on you. In basketball, we had this concept called a four point swing. Imagine that you’re on a fast break, you’ve got a wide open layup. You miss it. The other team gets the rebound, the throw the ball the other side and then they get an open layup. It’s not that they scored two points, it’s that you lost four points and they scored two points, equaling a four point swing. That’s like the worst thing that can happen.

The same is true of you don’t house hack, not only are you not raising rents on your tenants, but you’re having them raised on you. That doubles the impact of the power of real estate but it’s working against you. When you own the asset, you’re getting the four point swing in your favor. You’re getting to increase the rents every year and you’re not having them increased on you at the same time that the value of your asset is going up over time, and you’re adding another home to your portfolio. What I’m getting at here is house hacking is incredibly powerful, but it doesn’t work if you’re trying to force it to cash flow. Don’t just think about making money every month, think about the money you’re saving and doing this.

And the last piece of advice I’ll give, if you go make $500 in cash flow investing out of state somewhere else, that’s going to be taxed. Let’s say you get to keep 350 out of that $500. Okay? If you save $500 in rent, it’s not taxed. You’re actually keeping the full 500. So you’re only taxed on money you earn, you’re not taxed on money you save. And this is why I constantly tell people that are trying to build wealth, “Start with what you’re spending. Start by spending less. Start by decreasing the amount of money you spend all the time, because you’re not getting taxed on what you save. It has a bigger impact.” Okay?

If you want to actually make 500 bucks, maybe you have to earn 700 because you are only going to keep a percentage of it. So saving 500 in rent is the equivalent of making $700 in an out-of-state market, which is very difficult to do. Hope that helps answer your question. Thank you for your patience and working with this and get on those BiggerPockets, forums and ask more questions there. All right. I am very glad we got another episode of Seeing Green on the books.

I went pretty quickly here, but that let me bring more value to you by answering more questions. Hope you guys enjoyed this. And I hope that if you’d like to be considered to be on this show, please go to BiggerPockets.com/David and submit your question. Also, if you’re not following us on YouTube, please do that there where you can like, comment and subscribe and we can see what you have to say about the show.

If you’d like to follow me on social media, I’m @DavidGreen24. You can find me there. But your best chance of getting ahold of me is to submit a question here through BiggerPockets and hopefully be on the podcast yourself. Thanks again for giving me your attention and for coming here to get your information about wealth building through real estate. I appreciate that I am the one that gets to lead you through this journey. Thank you for your support and we’ll catch you on the next episode.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

Opinion: Here’s the latest data on what Realtors are witnessing in the housing market

The real estate market has shifted, and we are in a new housing paradigm. Mortgage interest rates have risen quickly in the past few months further eroding affordability. However, there are a number of attention-grabbing headlines, which unfortunately only compare today’s housing market to the very recent history of the last two years. It is always good to know where we are with the real estate market, but it is essential to keep all data in historical perspective.

The monthly Realtors Confidence Index helps to dispel many of the myths and cut through the noise of what is currently happening in the market. The National Association of Realtors Research Group has produced the index since 2008, at a time of turmoil in the real estate market. It is a monthly pulse on what is happening in the market from the perspective of Realtors who are active in the field. Questions have evolved and shifted overtime, but it is a steady resource of what is happening on the ground.

As reported in the latest NAR Existing-Home Sales, inventory still remains in tight supply, which means homes are still moving at a fast past despite the recent rise in rates and home prices. The median days on market is just 16 days — a slight increase from the record low seen in the last two months of 14 days. In comparison, in 2011, homes took 96 days to sell.

Notably, the market has contracted as fewer buyers can afford to purchase in today’s market with the rise in interest rates and the continual rise in home prices. However, in many areas of the country it does remain a seller’s market. For every home that was listed, there were 2.5 offers. This is down from the frenzied market from April of this year when every home that was listed had 5.5 offers. Historically 2.5 offers represents a competitive housing market, edging towards a balanced market.

One way to understand the competitiveness of the market is to look at buyers who are waiving contingencies. While this data series is shorter, it does reflect a slight ease that mirrors the number of offers for every home. There had been nearly one-third of buyers who waived an inspection or appraisal contingency, but the last month it fell to just over 20% for both.

Another measure the housing market, is whether a Realtor had a client who had a distressed sale in the last month. Due to the consistent rise in home prices, homeowners typically do have equity in their home distressed sales are not common today. In 2008, 49% of Realtors had a client with a distressed sale, today it is only 1%. Another reason why distressed sales are likely low, is that lending standards remain tight. It is difficult to obtain a mortgage today. A housing borrower must have a higher credit score, significant savings, and higher incomes to qualify for a mortgage and compete in today’s housing market.

Last month, we saw a shift in who is purchasing homes. There is a reduction in the share of all-cash buyers, who may be waiving the home appraisal, and a reduction in vacation and investment purchases. All cash buyers now stand at 24%. The last high among all-cash buyers was seen at 35% in 2014.

The share of non-primary residence buyers is now at 16% from a high of 22% in January 2022. In January of 2022, there may have been buyers who were looking to purchase vacation homes as travel remained suppressed at that time. Investors may have been attracted to the market as they saw rents increase for tenants. Others may have viewed the property for both purposes: a vacation home that could be rented as a short-term vacation rental when not in personal use.

Unfortunately, the share of first-time buyers remains suppressed at just 29% last month. While it is not the high seen during the First-time Home Buyer Tax Credit in 2010, it is also not the historical norm of 40% seen in the annual Profile of Home Buyers and Sellers report. Notably, during the timeframe of the First-time Home Buyer Tax Credit, there was significantly more inventory than seen today.

To read more on the monthly Realtors Confidence Index, check out the full report the same day Existing-Home Sales is released.

Want to learn more about what to expect when it comes to the future of the housing market? This article offers a preview of our upcoming HousingWire Annual Housing Market Super Session that will feature an all-star panel of housing experts. Join us in Scottsdale, Arizona Oct. 3-5 to attend this super session that is designed to help attendees understand macroeconomic data and housing trends for the next year and beyond. To register for HW Annual, go here.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author responsible for this story:

Jessica Lautz at JLautz@nar.realtor

To contact the editor responsible for this story:

Brena Nath at brena@hwmedia.com

The post Opinion: Here’s the latest data on what Realtors are witnessing in the housing market appeared first on HousingWire.

Source link

Top tips for mortgage professionals using TikTok

Social media app TikTok is expected to reach 1.8 billion users by the end of 2022 – will you be one of them? Many mortgage professionals are turning to the platform as a way to connect with prospective borrowers and educate them on mortgage, as well as market themselves.

We spoke to UMortgage Branch Manager Arielle Best, known as the VA Loan Lady on TikTok, about the platform and how best to utilize it as a mortgage loan originator. Best joined TikTok in 2020 and today has 61.3k followers and 524.8k likes on the platform. She’s part of UMortgage’s “Lender Avengers” team, along with Rebecca Richardson (The Mortgage Mentor) and Nate Fain (The Mortgage Creator).

“We’re on [TikTok] mostly to educate and provide information, it’s not necessarily a sales platform,” Best said. “We’re on there to provide accurate information, and if people want to use us, that’s awesome.”

Using TikTok

Best’s top three tips for loan officers using TikTok are to be your genuine self, keep it short and sweet, and “just do the video.”

“Even if the first one sucks, you can only get better,” she said. “You can look at it and say, ‘How can I make this video better?’”

She said one mistake she sees a lot of loan officers new to TikTok make is talking to the camera rather than through the camera to their audience.

“Be your true self,” she said. “Act like you’re talking to friends when you’re explaining something, as if your best friend came to your house to ask you mortgage advice – talk to your phone like that.”

According to Best, her biggest learning curves upon joining TikTok were learning how to use the app’s features and understanding what the algorithm was looking for when putting out content.

“Putting out information – useful information – wasn’t gaining traction unless you made it less than 10 seconds, put catchy music behind it and put the words on the screen,” she said. “The biggest thing with TikTok is understanding how viewers want to consume the information, even if that information is something that’s important, getting it to where they’re going to see it.”

She said the app’s algorithm is looking for “small bites of information that are useful, digestible and understandable, and in as short a time as you can provide it.”

She also recommended learning how to organize your TikTok by using the playlists feature. Best has playlists for her Q&A Wednesday series, satire videos and true stories, among other types of videos. Playlists make it easier for your followers to binge your content and absorb all the information.

When it comes to deciding what to make videos about, Best says she looks toward her commenters.

“I always will go to my comment section, because those are the people that are looking for answers, are the ones asking questions,” she said. “I let them decide what I’m going to talk about.”

“That’s another great thing about TikTok that I love – one person can ask me a question that is useful to so many people, and I’ll reply to that with the answer,” she said. “Then so many more people have that knowledge and information now that didn’t and wouldn’t have known where to find it, because the average borrower is not going to go dig through the chapter of a handbook to find information for their loan circumstance.”

Best also recommends making videos on important news updates borrowers need to know about.

Building a brand

In terms of building a brand, Best says it’s crucial to know your market and to combine your passion with what you’re already doing. As the VA Loan Lady, she specializes in VA loans because she’s passionate about helping veterans.

“Build your brand around the things that you love to do, and then your brand comes to you a little more naturally,” she said.

The best way to grow your audience is to post routinely, and be sure to cover controversial and often misrepresented topics by providing accurate information, she said.

Return on investment

Best said she spends less than 10 hours a week on her TikTok.

“I’ll spend probably an hour today just replying to videos, and then editing and posting and kind of batch-dumping videos,” she said.

What kind of ROI does she see for her time on the app? In April she had 400 people fill out inquiries and applications from TikTok. She posted a video in July that had more than 1 million views, and said that about 530 people reached out afterward.

“It wasn’t all applications, but we had inquiries up above 500 for one video,” she said. “If I were to average, it’s no less than at least 150 to 200 either inquiries or applications a month.”

Ultimately, Best said, the key to TikTok is to remember that your audience consists of real people you’re connecting with, rather than people you’re trying to pitch or sell yourself to.

“You are there to educate and inform them of their options for financing,” she said. “Don’t sell yourself, be yourself.”

Interested in seeing how other professionals use TikTok? Check out these mortgage and real estate accounts you should be following!

The post Top tips for mortgage professionals using TikTok appeared first on HousingWire.

Source link

Angel Oak Mortgage shakes up leadership

Non-QM real estate investment trust Angel Oak Mortgage Inc. on Wednesday announced the departure of CEO Robert Williams. The company appointed Sreeni Prabhu, a managing partner at affiliate Angel Oak Capital Advisors, as the new president and CEO.

The leadership shakeup comes after two consecutive quarters of financial losses. Angel Oak Mortgage Inc., which went public last year, disclosed a net loss of $52.1 million in the second quarter and $43.5 million in the first quarter.

Prabhu will remain a managing partner and the chief investment officer at Angel Oak Capital Advisors and Williams will serve in an advisory role during the transition, the company said Wednesday in a statement.

“I have worked side-by-side with Sreeni for more than 14 years, and believe his investment and operational experience, leadership, and strategic vision will help drive the company’s success in the years to come,” Michael Fierman, chairman of the company’s board of directors, said in a statement.

“After the successful completion of the company’s initial public offering in 2021 and its first full year as a public company, the board believes that now is the right time to make this leadership transition,” Fierman added. “We want to acknowledge Robert’s hard work and contributions to our growth and successful launch of the company as a publicly-traded REIT, and we wish him well in the future.”

In an 8K report filed with the Securities and Exchange Commission, Angel Oak said Williams, who previously worked at New Residential and Fortress, was terminated without cause.

Prior to co-founding Angel Oak Capital, Prabhu was chief investment officer of the investment portfolio at Washington Mutual Bank in Seattle, where he managed a $25 billion portfolio. He said Angel Oak Mortgage Inc. was “fully committed to growing the company through execution of our consistent strategy of underwriting and managing credit risk, judiciously utilizing the securitization market, and prudent leverage.”

Angel Oak Mortgage Solutions, a separate company within the Angel Oak family, this week announced layoffs affecting 75 staffers.

The post Angel Oak Mortgage shakes up leadership appeared first on HousingWire.

Source link

3 Ways to Boost Short-Term Rental Bookings Any Time of Year

Sponsored

Source link

HW+ Member Spotlight: Tammy Richards

This week’s HW+ member spotlight features Tammy Richards, CEO at LendArch. She has held leadership positions at Bank of America and Caliber Home Loans, and most recently served as chief operating officer at loanDepot.

Below, Richards answers questions about the housing industry:

HousingWire: What is your current favorite HW+ article and why?

Tammy Richards: I love the research and data. It’s not only a factual synopsis but also gives a clear perspective and interpretative view of how the data paves way into a trend. Its crisp, articulate and always insightful

HW Media: With HousingWire Annual right around the corner, which session are you looking forward to this year and why?

Tammy Richards: I am so looking forward to the Woman of Influence Forum, an interesting line up of women leaders and topics that are so relevant and current for today and tomorrow. I am so happy that it touches upon topics of mentorship, work life balance, leadership and peer environments. Way to go HousingWire for introducing this segment of discussion, it was much needed.

HW Media: What are you fast thoughts on the following:

Tammy Richards:

HW Media: What are 2-3 trends that you’re closely following?

Tammy Richards: AI, crypto and microservices.

HW Media: What keeps you up at night and why?

Tammy Richards: Inflation, interest rates, my friends losing their jobs due to volume, and world events/Ukraine.

HW Media: What do you think will be the big themes for the housing market in 2022-23?

Tammy Richards: The birth and acceptance of microservices. As we have invested the last two decades in creating and customizing our assembly lines and over engineered an engine that needs to upgrade.

Being bogged down by antiquated lending processes puts mortgage companies at risk of being overrun by competitors who have adopted new digital technologies to speed up the approval process for homebuyers.

Microservices architecture led products that integrate well with your current digital roadmap in a non-intrusive manner but yield the best results. This would result in optimized business functionality. Improved productivity, better resiliency, increased scalability (an issue our industry has been yearning for).

HW Media: What’s one thing that people aren’t paying attention to that you think they should be paying attention to?

Tammy Richards: Technology being seen as a problem when it can be the solution. I do empathize with the lending community as they are left with an abundance of technology choices to pick from.

Before anyone gets into choice from the abundance of technologies that are available, it’s very important to see what the objectives of this are. Is it to create more flexible capacity, trying to manage risk and compliance, boost customer centricity or increase agility? Or is it all the above?

This is an opportune moment to embark on this journey of digitization, optimize a tech stack and reboot your operating process to have a perfect assembly line when the volume floodgates open. The time is now, the clock is ticking, don’t act fast — act now.

Join HW+ members at this year’s HousingWire Annual by going here to register. Richards will be speaking at the Vanguard Forum on Oct. 4, sharing her ups and downs in her career during the CEO playbooks session.

To become an HW+ member, click here.

To view past issues of our HW+ exclusive HousingWire Magazine, go here.

The post HW+ Member Spotlight: Tammy Richards appeared first on HousingWire.

Source link

Opinion: Forgiving student loan debt boosts homeownership

Last month, President Joe Biden announced the federal government would forgive hundreds of billions of dollars of student loans. I believe this initiative is one of the most consequential administrative actions for housing in a generation. It could make homeownership accessible for millions of new homebuyers.

The student loan debt forgiveness decision has provoked a broad range of reactions. Some thought the forgiveness was too much, a betrayal of all of those who paid for college or repaid their loans. Those who called for all student debt to be forgiven thought it was too little. A few were in the middle, saying the president got it right.

According to a study conducted by the National Association of Realtors, “nearly half of student loan debt-holders say debt is delaying them from buying a home because they can’t save for a down payment (47 percent) and don’t think they qualify for a mortgage (45 percent).” And student loan forgiveness targeted to Pell Grant recipients will significantly impact borrowers of color.

The impact of student loan debt and homeownership is clear. In a study published in the Journal of Labor Economics in 2020, researchers from the Federal Reserve Board of Governors estimated that “a $1,000 increase in student loan debt lowers the homeownership rate by about 1.8 percentage points for public 4-year college-goers during their mid-20s, equivalent to an average delay of about 4 months in attaining homeownership.”

It is also important to remember that most people benefiting from student loan forgiveness are not graduates of four-year colleges or advanced degree programs. According to the U.S. Department of Education, 581 million student-debt holders have associate degrees, and another 389 million have certificates of completion, compared to 33.6 million undergraduates and 14.1 million with advanced degrees.

According to the U.S. Department of Education, graduates of for-profit barber and cosmetology schools make up eight of the ten schools nationwide with the highest student loan default rates. The reason for this is simple: incomes derived from these careers are rarely likely to be capable of servicing the debt necessary to become accredited.

Finally, before criticizing as deadbeats students who have their loans forgiven or suggesting they got something the rest of us did not, it would be good to ask if one’s job, or the job of a friend or family member, benefited from a Paycheck Protection Program (PPP) loan.

The Trump administration created this program and enacted it with strong, bipartisan Congressional support. As a result, over 10 million PPP loans were forgiven, more than $740 billion to date, including two taken by the National Housing Conference. With nearly 90 million jobs saved by PPP, I hope we can all agree it was worth it.

Some have expressed reasonable concerns that the program could inflate housing prices. This risk should not be dismissed, but can be significantly mitigated by the production of more starter homes. This market has largely disappeared. Proposals like the Neighborhood Homes Investment Act would create more starter homes by closing the appraisal gap in communities where home prices are so low they can’t appraise at the cost of construction or rehabilitation.

We must also make a real effort to fight local opposition to exclusionary zoning designed to keep single-family neighborhoods racially and economically segregated. Exclusionary housing regulations are the last bastion of bipartisanship in America. We see them as much in blue communities as red ones.

The National Housing Conference did not advocate for student loan forgiveness. Given the opportunity, it isn’t how we would allocate $400 million – more than twice the funding for housing passed by the House in the Build Back Better legislation. But there is no question that the student loan forgiveness decision will significantly impact housing, particularly for low- and moderate-income first-time homebuyers and cash-strapped renters.

David Dworkin is President and CEO of the National Housing Conference.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

David Dworkin at davidmdworkin@nhc.org

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com

The post Opinion: Forgiving student loan debt boosts homeownership appeared first on HousingWire.

Source link

MAXEX seeks to capitalize on expanding non-QM market

MAXEX, a major mortgage trading and aggregating platform, has unveiled a series of new programs designed to serve originators and loan buyers in the growing non-QM lending market.

The increasing demand for non-QM loans (more broadly defined as nonprime) has run up against market volatility, as mortgage rates have doubled since late last year. That has left “originators scrambling for liquidity in this growing market segment,” MAXEX’s announcement of the new non-QM initiative states.

MAXEX is an Atlanta-based fintech company that is backed by leading private-equity and capital-markets investors, including J.P. Morgan Chase. To address the non-QM challenges, MAXEX says it will work to expand liquidity in the sector as follows:

• Improving daily-flow trading by establishing guidelines and daily pricing for individual whole loans.

• Facilitating forward-trading agreements, which allow platform users to sell loan pools at a future date with pre-negotiated terms and pricing.’

• Enabling bulk trading, which allows platform users to sell closed loan pools to one or more buyers in a single transaction.

In May, MAXEX expanded its reach into one part of the nonprime market by launching a flexible DSCR [debt-service coverage ratio] loan-purchasing program designed to serve real estate investors, such as rental-property owners.

“These new programs will expand our reach with bank-statement and other alternative-documentation loans, interest-only, etc., and are in addition to our DSCR program we launched in May of this year,” said MAXEX’s head of marketing, Andy Payment. “MAXEX’s goal is to continue to increase standardization and efficiency across the non-agency market, which includes jumbo, non-QM and more, thereby increasing liquidity and helping to meet the needs of creditworthy but underserved borrowers.”

Non-QM/nonprime mortgages include loans that cannot command a government, or “agency,” stamp through Fannie Mae or Freddie Mac. The pool of borrowers in this space includes real estate investors, property flippers, foreign nationals, business owners, gig workers and the self-employed, as well as a smaller group of homebuyers facing credit challenges, such as past bankruptcies.

“Access to reliable liquidity is critical to the growth of non-QM lending, which serves the growing number of gig economy workers, business owners and other underserved creditworthy borrowers with nontraditional income documentation,” said Brennan Walters, chief revenue officer at MAXEX. “The growth of this fragmented market requires standardization to meet the long term needs of the consumer and the industry, [and] MAXEX is committed to providing that, just as we have for jumbo loans.”

The lenders originating in the non-QM space — technically a more narrowly defined category within the nonprime sector — make use of alternative-income or nontraditional income documentation, such as bank statements or assets, because borrowers cannot rely on conventional payroll records or otherwise fall outside agency credit guidelines. Mortgages originated to purchase investment properties for business purposes, which involve loans that typically make use of DSCRs as income documentation, are exempt from qualified-mortgage rules — although they are generally considered part of the larger nonprime universe if they are not agency-eligible.

“The gig economy of the pandemic era invited more self-employed borrowers requiring alternative documentation into the fold — creditworthy but not fitting into the box of a conventional loan,” explains a recent MAXEX market report. “Investment property purchases have also been on the rise as those needing a business-purpose DSCR loan are typically less rate sensitive.

“… MAXEX is poised to put its sellers in a position to take advantage of this market with new non-QM programs, which will contribute more data to this report in the coming months to better track the trajectory of the market.”

MAXEX officials declined to offer an estimate of the expected loan volume the new non-QM loan-trading services will generate monthly or annually for the platform

“However, we currently have more than 320 originators approved to sell to MAXEX, and our goal is to improve liquidity for as many of them as possible — both through the non-QM programs we are offering now, and others we will add over the coming months,” Payment said.

As a sign of the popularity of non-QM/nonprime loans, through August of this year, according to the MAXEX market report, expanded-credit (nonprime) issuance in the residential mortgage-backed securities (RMBS) market was “greatly outperforming prime RMBS” based on deals tracked by the exchange.

“Year-to-date, 83 expanded-credit securitizations have priced versus just 29 prime jumbo issuances,” the MAXEX market report states. “The expanded-credit pools have a total volume of $32 billion while the prime deals have totaled just $18 billion.

“The higher coupons of the expanded-credit deals make them more attractive to investors versus the limited supply of higher-coupon prime pools. … The expanded-credit issuances also show the continued appetite for non-QM by both loan buyers and bond investors.”

The post MAXEX seeks to capitalize on expanding non-QM market appeared first on HousingWire.

Source link

New home sales are up 28% — but don’t believe the hype

New home sales came in as a massive beat of sales estimates, with a 28% month-to-month increase. And, out of the 461,000 new homes available for sale, only 49,000 have been completed and are available to be occupied. These are both crazy stats!

Monthly supply data fell — in normal times this would be looked at as a bullish report for housing. However, in this environment, with falling year-over-year purchase application data, this report isn’t as bullish as it seems.

The explanation has a lot to do with the fact that new home sales are already very low, so these month-to-month reports can look wild. We had a period this summer when mortgage rates moved from 6.25% back down to 5% and some of the new home sales activity picked up. In general, however, these data lines are just very volatile and prone to revisions. In fact, we had this happen with new home sales in May, only for the data to revert back to the trend of declining sales.

The Census Bureau reported that sales of new single-family houses in August were at a seasonally adjusted annual rate of 685,000. This is 28% above the revised July rate of 532,000, but 0.1% below the August 2021 estimate of 686,000.

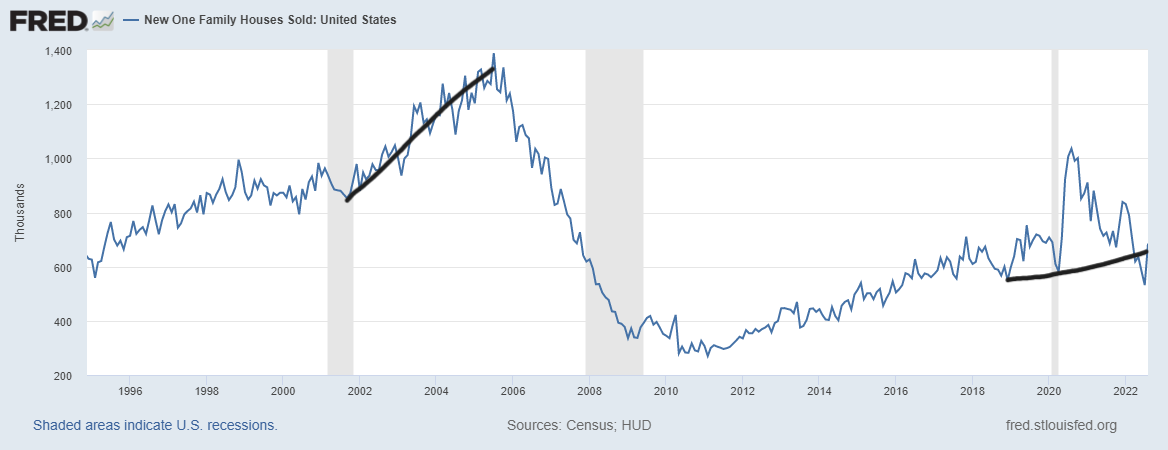

As you can see below, new home sales were historically low and as I’ve said before, we aren’t working from the peak 1.4 million level we saw in 2005. In fact, new home sales are below the recession level of 2000 and back to 1996 levels already. So, when we have a month where demand picks up, it can move the needle in a big way.

Now, revisions are always key and the revisions in this report were positive. So the data can be very extreme in this environment, especially in a brief period of time when rates fell and some deals were able to close. For that reason, I wouldn’t read too much into the revisions.

However, it does show that the builders are in a much better spot to deal with their massive supply, compared to the 2005-2008 period.