Dave:

Hey, everyone. Welcome to On the Market. I’m Dave Meyer, your host, and I am here with two BiggerPockets and investing legends. We’ve got Henry Washington who’s here a lot. Henry, how’s it going?

Henry:

What’s up, buddy? Glad to be here.

Dave:

Thank you. Thank you for being here. And we also are bringing back, I think you are our first two-time guest, J Scott. What’s going on, J?

J:

I am doing great and I am thrilled to be your first two-time guest. I can’t wait. And hopefully, I’ll be your first three-time and four-time and five-time also.

Henry:

Whoo. Whoo.

Dave:

All right. Wow, I like it. Yeah. I mean, I think your episode about investing in a recession might be one of our best, if not our best episode of all time. So if you haven’t listened to that already, you should check that out. J has written a book about recession, investing in all sorts of market cycles, particularly useful in this type of economic environment. But J, can you tell people why you’re here joining us today?

J:

Yeah. I’m here today because you wanted me to be here because you and I are getting ready to release a book, our next book for BiggerPockets, and you were too ashamed to self-promote and announce it yourself. So you brought me on to announce it so you wouldn’t have to look bad.

Dave:

That’s exactly right.

J:

So we’re here to talk about a lot of… Or I’m here to talk about a lot of things, but would definitely want to mention that you and I, Dave, are releasing a book called Real Estate by the Numbers. It’s coming out in a couple days, I think October 13th, from BiggerPockets. It’s now available for pre-order. And basically, it’s all about how we can better think like investors. So how we can think more strategically, how we can employ investing concepts that really successful investors use, all the math that goes on behind the scenes that we need to underwrite deals, and how we should be thinking about investing from the most basic level, like underwriting deals, to how we should be thinking about structuring our business and structuring our portfolio basically to be a more successful, more profitable investor.

Dave:

That’s perfectly right, and thank you for taking the responsibility of the shameless plug. We got to do it, but I do want to mention that it is available for pre-order for two more days. And if you do pre-order it, there are benefits. J and I are both giving away coaching calls. We’re going to be hosting a webinar that you can attend. It’s a live Q&A. There’s a couple other benefits. And you can use a discount code, DAVE, to get 10% off. Or J, I think, do you have a code also?

J:

Yeah, JSCOTT.

Dave:

Okay, or you could either use the code Dave, D-A-V-E, or J-S-C-O-T-T, JSCOTT for 10% off. So you should check that out. So it’s a great book. I think you should read it. I think Henry actually even wrote a little blurb about how much he loved the book on it.

Henry:

Yes. You know what’s funny is if I were to direct somebody, if somebody came to me and said, “Hey, Henry, I really need to know about what are the best rules of thumb or financial equations, or how do I get really good with numbers? Who do you know at BiggerPockets that could help me with that?” My 1000% answer would’ve been like, “Oh, you got to talk to Dave and J Scott. Talk to those two people. Those are the ones who can really break down the numbers for you.” And so the fact that you actually wrote a book called Real Estate by the Numbers, it’s almost like, it’s like a meme. Like, “Of course, Dave and J Scott wrote a book Real Estate by the Numbers. That is 1000% who they are.” So I think people should take advantage of that because you want people to speak on the things that they are passionate about and that they know the best. And if I know anything about the two of you, it’s that you’re passionate about data, the numbers, and real estate. So that’s super exciting.

Dave:

Well, thank you, Henry.

J:

Thank you, Henry. I don’t want to spend the whole episode talking about the book. There are so many more important things to talk about, but I do want to point out that Dave and I, we worked for several years on this book. This is my fifth and by far the hardest book that I’ve ever worked on. And no way I would’ve accomplished it at all, let alone it be as good as it is without Dave. So we put a lot of time and effort and blood, sweat, and tears into this one. But at the end of the day, I am more excited about this book launch than any of the other four that I did because I really think this book is going to help more investors over the next 10, 20, 50 years than anything we’ve ever written.

Dave:

All right. Well, we will get into the meat of this episode because we want to hear about what J is doing with investing. But I am also excited because I now have physical proof to all my teachers and guidance counselors who said I’d never graduate college or do anything with my life, that I have done something with my life. So there.

J:

I like how he says he has physical proof and he just holds up an invisible…

Dave:

Yeah, it doesn’t even exist. I’m just holding up nothing. But in a couple of weeks, I will. This is what they meant, J, when they said I’d never amount to anything.

J:

It was all a dream.

Dave:

All right. Well, let’s take a quick break, but then we are going to talk to J all about his investing and what he’s doing in this very confusing economy, and we will be right back.

Speaker 4:

(singing)

Dave:

Okay. So J, tell us about your read of the economy. And what are you doing in your investing business right now to adjust to these very confusing market conditions?

J:

Yeah, I wish I had a better answer than what I’m about to give, but I think right now is very much… I’m not stopping investing. There’s no reason to ever stop investing if the right deals are coming along, but I’m certainly being a little bit more introspective, and sitting on the sidelines a little bit and waiting to see where things go probably not for too much longer. I think we’ll have a good bit more clarity in the next month or two. So everybody knows that we’re experiencing some high inflation and that’s leading the Federal Reserve to raise interest rates to slow down that inflation, which is leading to higher mortgage rates. And now, debt is more expensive. It’s harder to get a loan, or it’s not hard to get a loan, but it’s harder to get a cheap loan to buy your real estate.

And so nobody really has any idea of how high interest rates are going to go. And so we’re in an uncertain time right now. But what I will say is that even though some other asset classes, I mean, the stock market has struggled a little bit recently and crypto is down like 80%, and other asset classes that I look at are down a good bit, real estate has stayed pretty strong. Now, certainly there’s a few markets around the country that things got so hot over the last couple years, places like Seattle, San Francisco, Boise, Idaho, New York City, where things are starting to slow down a little bit and we’re seeing prices actually decrease in a few markets. But for the most part, in most markets… And I know it’s going to be a couple weeks before this episode’s released, hopefully nothing’s happened in those two weeks that make this statement look idiotic. But for the most part, most markets have been pretty resilient.

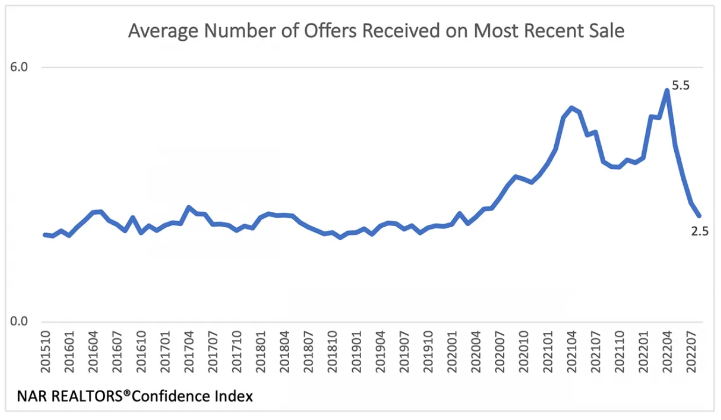

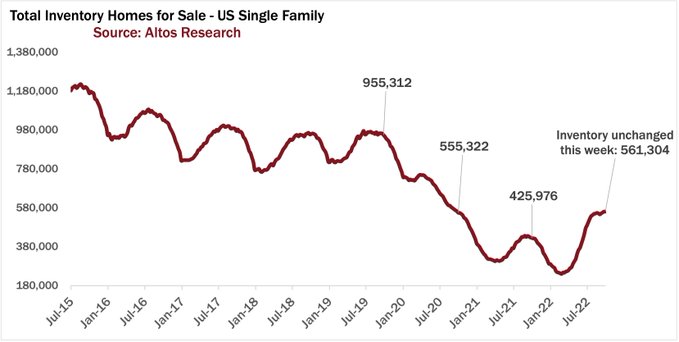

And so what we’re seeing is there aren’t a lot of sales. Sellers aren’t really lowering their prices and buyers aren’t necessarily willing to come up to the high prices right now. So what we’re seeing is a drop off in sales. We’re seeing increased inventory in a lot of these markets and we’re seeing lower transaction volume, but the nice thing is we’re not seeing desperate sellers. We’re not seeing a real… I mean, foreclosures are up a good bit percentage wise, but they were so low that even the big jump percentage wise doesn’t translate to big numbers. So foreclosures are still relatively low. Lots of people locked in long-term, really low fixed-rate debt a couple years ago. So I don’t see right now a whole lot of desperate sellers, which means prices are going to stay relatively strong.

Now, the downside is, as real estate investors, we don’t mind if prices drop because we just dollar cost average and buy more real estate, but what I expect over the next at least six to 12 months is that we’re going to see just a stagnating market. We’re going to see prices that don’t really go up, don’t really go down, we’re going to see sellers that aren’t really willing to budge off their prices because they don’t have to, we’re going to see buyers that aren’t really willing to come up to the seller’s prices just because they don’t know where things are going. And so I think it’s going to be a quiet six to 12 months, despite the fact that we could be facing a big recession in the economy and other parts of the economy could be getting much worse. So it’s interesting that we’re facing a lot of economic headwinds, but real estate could really just be boring for the next six to 12 months.

Henry:

Yeah, man, that’s super interesting. I share your perspective. I think things are just going to stay where they are. I don’t see much of a drop coming in prices in most markets. Like you said, some markets are going to see somewhat of a drop, but we’ve got this… What did Jamil call it? We’ve got this standoff happening in real estate until there’s some change that has an actual major effect. One thing you did mention that I want to ask you about is you did say that you’re not stopping investing, but also have been waiting on the sideline. And so can we define that for people? Because I think there’s a lot of investors out there who feel like they should be waiting on the sideline. And I think us as investors, when we say that, we’re really meaning like, “I may not be as actively aggressively searching for something to pour my money into, but I’ve still got my eyes out there. And if something comes along, we’re going to jump on it.” So what does that really mean to you?

J:

Well, here’s the big thing, I can stay active and we can all stay active in real estate without buying or selling anything. So I’m actually using this time to investigate some new asset classes. So there’s some asset classes that I think are likely to do well during a downturn. So over the next year or two or three. There are a couple asset classes that I’m starting to look at and we can talk about those. But just at a high level, I’m using this opportunity, one, like you said, I’m not stopping investing. I’m still looking for deals. I’m not finding as many deals. I’m not finding as many opportunities, but if a good deal comes along, I’m going to jump on it. But at the same time, I’m using this slow down to do research, to learn how to underwrite other asset classes, to build relationships with operators in other asset classes.

When I say other asset classes, I don’t mean outside of real estate. I mean instead of focusing on multifamily, which is what I’ve been focused on the last few years, I’m starting to investigate other commercial niches, and I’m still buying some single-family stuff. But I’m trying to see where the market is going, where the economy is going in the specific locations where I’m investing and seeing what opportunities might exist outside of the core asset class, again, for me, multifamily, that I’ve been in. And what I like to tell people, is that you don’t necessarily ever have to stop investing. You may have to move to a different location, or if you want to stay in the location, you may have to find a different niche, or different asset class, or different business model.

But if you’re good at being flexible and you’re good at pivoting… And this is why… And to go back to the fact that the book Dave and I wrote is so important, it’s really important that you’re able to evaluate deals in different ways. We all probably know how to underwrite if we flip houses. We all know the equation to evaluate a house flip. And if we hold a rental, a lot of us know the equations and the formulas for how to evaluate a single-family buy-and-hold. But the reality is every deal is going to be analyzed differently. Every asset class is going to be analyzed differently. And there are lots of different ways to look at deals and look at markets, and there are lots of different reasons we invest in real estate.

And so using this time to really educate yourself on how to look at deals from different perspectives, and how to maximize the returns on deals with other things other than maybe cash flow, or other than maybe just equity growth. There’s a lot of things that we can be learning and doing right now to really find these needles in a haystack, and to find other asset classes that might be more advantageous given where the market’s headed and where the market currently is. And so what I’m spending a lot of time doing is, one, I’m not stopping looking for deals, but I’m really trying to get familiar with other asset classes, and other business models, and other niches that I can leverage to really grow my portfolio in a market that’s about to change.

Dave:

J, can you remind everyone what your primary niche is currently? And then talk a little bit about some of the niches that you think are going to work short term, or maybe some of the niches and opportunities you are excited about on the longer term perspective as well.

J:

Yeah. So long term, I’m excited about everything. Honestly, I mean, we’ve talked about this before. Go back and listen to the last episode we did of this podcast that I was on. But the reality is that historically speaking, recessions don’t last that long. And so if the Fed started raising interest rates six months ago on average between the time the Fed starts raising interest rates and starts dropping interest rates, is about two years, just over two years. The longest it’s ever been is about three years. So if history is going to repeat itself, which it normally does, we can expect that in the next year and a half to two and a half years, we’re going to see interest rates starting to come down again. So if you’re a house flipper, if you’re a buy-and-hold investor, whatever you do, most likely in the next two to three years, it’s going to be a great time to do it again. The market’s going to have recovered and interest rates are going to come down. Everything’s going to be good.

That’s longer term. From a shorter term perspective, the next 6, 12, 18 months, what I like about real estate is that there’s a segment of real estate called commercial real estate where values of properties are based on the income those properties produce. So if I go and buy a single-family home… I live in a house right now. The house that I live in, the value of that house is going to be impacted by the value of all the other houses around me. So if somebody goes to sell… If I go to sell my house right now, I’m going to look at what my neighbor sold his house for last month, or what the guy down the street sold his house for three weeks ago, or whatever. I’m going to find other houses that are similar to mine, what we call comparables or comps. And whatever they’re selling for, that’s probably what my house is worth.

In the commercial real estate world, and when I say commercial, I mean anything that you use that generates income that’s bigger. So multifamily, or self-storage, or mobile home parks, or office space, whatever it is, the value of that real estate isn’t based on what the building next door sold for, or what the complex across the street sold for. The value of that building, or the value of that real estate is based on the income it’s producing. And if it makes more income next year than it did this year, the value is probably going to go up. And so the reason I really like commercial real estate right now is because even though values may drop on a comp basis, even though single-family values may go down or stagnate over the next 6, 12, 18 months, in the commercial space, as long as rents are going up, we’re going to see values going up for the most part. Now, there’s another component there, but for the most part, if rents are going up, values tend to go up.

And so the question we need to ask ourselves is, “What are those asset classes where we expect income to go up?” So multifamily, that’s the niche that I’m in. I own a bunch of apartment complexes and what we’ve seen over the last couple of years is this trend away from home ownership and this trend towards renting. More people are renting, wages are going up, people are moving to certain population centers. So if you’re in the right market with good population growth and good wage growth and good employment growth, you’re going to see that rents are going up. And so I really like multifamily in a lot of these markets because I know that rents are going to go up, which means values in my properties are going to go up. And so any asset classes where you think income is going to go up over the next couple years, that’s a good place to be.

Historically, during recessions, people move from bigger houses to smaller houses, but they don’t like to sell their stuff. What do they do with their stuff? They put it in storage. So historically, self-storage is counter-cyclical to the broader economy. If the broader economy is doing worse, self-storage is doing really well because people need a place to put their stuff when they downsize. So I really like self-storage right now. Mobile home parks, mobile home parks tend to do pretty well during a recession because it’s the lowest common denominator for housing. And so a lot of people that have to move out of their house or out of their apartment, a lot of them will look for a mobile home. And so typically, mobile homes do pretty well during recessions.

Other asset classes that I like right now are industrial and warehouse. So we’re seeing this shift away from in-person retail. People aren’t walking into stores and malls as much anymore. This isn’t a revelation. Everybody knows this. They’re ordering off of Amazon, or they’re ordering off of other online retailers, and these retailers need to be able to ship in 24 or 48 hours. And so they’re opening warehouses all around the country to make basically their fulfillment and delivery systems more efficient. So lots of big companies like Amazon are buying warehouses all over the country, as well as smaller online retailers doing the same thing. And so what we’re seeing is demand for these light industrial warehouse lots and warehouses has been going through the roof. And so I really like that because I think that trend is going to continue.

Now, there are other asset classes in commercial where I think income is likely to go down; office space. So we saw a ton of office space open up after COVID, simply because everybody was working from home. And a lot of companies have recognized that this work-from-home thing is actually working okay for them. Not saying everybody. Some companies are starting to tell their employees to come back to work, but for a lot of companies, they’ve recognized that this work-from-home movement is a great way to save costs for the company. And so they have all this office space that they may have leased for a year or two years or three years or five years, but at some point, that lease is going to come due over the next couple years and they’re not going to renew. And the landlord, whoever’s holding the building, is going to have trouble leasing this office space. So office space, I have a feeling, is going to be one of those asset classes that’s going to start to contract over the next year or the next couple years.

Retail. So retail tends to not do well during recessions. People don’t go out and shop as much. Certain types of retail do well. If you own an anchor store like a grocery store or the big store on the corner of the shopping center, that might do well. But in general, retail and strip malls and mall space isn’t going to do well during a recession. So I’m staying away from retail. So this is basically what I mean by there are going to be opportunities out there, but you really have to understand how the market works, you have to understand how the economy works, and you have to understand how the two work together, how the economy impacts the real estate market in certain asset classes. And so I’m starting to do research on those asset classes that I think are likely to do well over the next couple years, as well as starting to build relationships with other operators who are working in those asset classes so that I can either learn from them, I can partner with them, I can invest with them, whatever it is.

Henry:

That’s super interesting because we have taken some time this year to do almost exactly the same thing. And so I purchased my first commercial office complex this year, and also we’re looking at a trailer park. And so all that to say, not to toot my own horn, but I’m agreeing with the point that you’re making, is that there are other niches and there are niches that are going to be better suited to the economic conditions. It’s an echo to what you said in the beginning. There’s always room to be an investor. It’s just about what you invest in, what price points you enter at, and then what your return on that investment is.

A good deal, is a good deal, is a deal. And we say a good deal is based on what you’re getting it for in that current market condition. And so you can get a good deal in any market condition. So I love that you’re looking into those things. And I hope that encourages some people to think, not necessarily outside the box, but just be smart about, in sports, we call it take what the defense is giving you. And so you look around at your environment, at what the defense or what the country or what the economic status is giving you, and then you look for the opportunities there. So that’s awesome.

J:

Yeah. And another thing to keep in mind, I think one of the reasons I like real estate right now, I love real estate right now, is because I think the long-term growth trends are astronomical. One of the big concerns that the Federal Reserve has now, for anybody that’s listened to some of the recent press conferences or read some of the things that Jerome Powell, Federal Reserve has released over the last couple months, is this concern for housing. And they’re not concerned about housing because they want us real estate investors to continue to do well and make money. They don’t care about that. They’re concerned about housing because they know that if we don’t continue to create more housing, that we’re going to have affordability problems, that we’re going to have a housing crisis where people can’t afford to live. Basically, the Fed is telling us, “We need housing to do well because we need builders to keep building, and we need people to keep providing housing for all the people that can’t afford a place to live or a place to buy.”

And so I have a feeling, and not just a feeling, but the data supports this as well, that there’s going to be a whole lot of housing, millions of units literally somewhere in the three to five million units that are needed over the next five years to support all of the people that are looking for housing, and all of the people that can’t necessarily afford to buy and are looking for rental housing. And so if you’re a landlord, if you’re a developer, if you’re a multifamily investor, this is going to be a fantastic place to be over the next five or 10 years. So what I would suggest to anybody is if you’re flipping houses right now, start investigating how to buy single-family rentals because there’s going to be a great opportunity and it’s going to be a very powerful asset class over the next few years. If you’re already buying single-family rentals, start looking into multifamily and looking into going bigger. Because again, it’s not that difficult to do bigger in the residential space. And so start thinking about how you can scale up your business.

If you’re in multifamily or if you’re a single-family landlord, start thinking about development because there’s probably going to be some good opportunities. I’m not saying this month or even this year, but over the next several years, there could be some great opportunities for you to be doing either ground-up development or infill development, which means basically buying a house, knocking it down and rebuilding it. And so learning these new skills now while everything’s slowed down and boring is going to be a great way for you to be making a lot of money come two years from now or three years from now or five years from now.

I see too many real estate investors that are so focused on what they’re doing day in and day out that they’re not thinking about, “How am I going to be able to make a lot of money two or three or five years down the road?” Well, now is the time. If you’re not doing a lot of deals, now is the time to be reading, and learning, and studying, and building relationships that you can leverage a couple years down the road when the market’s really going to need more rental housing.

Dave:

I love that, J. It’s such a good synopsis of the long-term prospects for real estate investing. There’s just a supply shortage in the market. There’s going to be so many ways to profit from that over the next couple years. And not just profit from it, but provide housing for people that need it. You are providing value to society and you could benefit from it personally too. To me, I agree. That gets me super excited about real estate investing over the next couple years.

A couple of the asset classes you talk about, to me, at least when I was getting started, felt a little daunting, retail. Henry, you’re just buying office spaces. What would you say to people who are ready to get into the market now, or maybe they’re in one of those markets that have already settled down or maybe is going to keep growing over the next few years? Do you think now is a good… Would you caution people away from single-family rentals right now if they can find good deals? Or do you still think those are possible to be profitable in the next year or so?

J:

Well, let me start with the first part of that first. Yeah, people are definitely scared of these bigger asset classes. I know that when I started, I used to think that people that owned apartment complexes were special people. It wasn’t people like you and me. I grew up living in an apartment complex, probably literally one of the largest department complexes in the country. It was something like 1600 units. And so my idea of an apartment complex is, “You’ve got this multi-billion-dollar company that buys these things and that’s who owns apartment complexes.”

And what I’ve realized over the last couple years is, “No, there are a lot of mom and pop investors like me and you and Henry and other people who are buying up apartment complexes or buying office space or buying retail space.” We’re not talking about necessarily having to go in and buy a billion-dollar shopping mall or having to go to New York and buy a skyscraper for office space. Henry, tell us a little bit about the office space you built or that you bought, and break it down for us in a way that makes it sound like it’s really not that daunting. I imagine it probably wasn’t once you broke it down.

Henry:

Yeah, no, the way I approached it is the way I’d probably advise someone who’s new to commercial real estate investing. I had a general interest in wanting to understand it better. And so the way I went about doing that was obviously on my own research, but I put intention around networking with people who already do it and are good at it. And so I was able to then create a friendship with someone who thrives in this space, and then we started looking for deals together. And then as deals would come across, we would analyze them, and then we would make… Just like in residential real estate, we would analyze the deal, we would figure out what we think the value is based on the income that it’s making, and then we would figure out what we think the value could be based on the income that it would be making if everything was at market rates and in good condition, and then we made our offer.

And when we made our offer, the financing worked almost the same as how it does when I buy my residential properties. The only difference was the evaluation was based on the money it brings in. And so we put the deal under contract, we went and looked at the property, we did an inspection on the property, it had an appraisal. And then we bought the property, we then met with the tenants, and we either are renewing leases at market rates or we are going to bring in new tenants at market rates. The only major differences between this deal and what I do in the residential space was these new leases are going to be on triple-net leases, which is not something we can get in residential, but it’s super sweet if we could. And then the evaluation and the value of it is based on the income that it brings in. Those are really the only two things that were different.

And so as I got into doing it, first of all, I partnered with somebody who’s an expert. So that way, when I do my analysis and when I looked at something, I could be looking at it through the wrong lens because I’ve never done it before. So I had that sounding board to bounce things off of. And then so I partnered with somebody, I brought value to the table, and then I learned along the way and I’m still learning. And what I’ve learned was that it’s not much different than the process I’ve been doing with residential minus a few things, but the values are higher and the income is higher. And so that’s what I would tell people. It’s daunting until you surround yourself with people who are doing it and then it just seems like the thing to do.

J:

Yeah. And I think you hit a couple really important things there. And Dave, I have not forgotten your main question and I will come back to it.

Dave:

Go on. You could ignore me. Don’t worry about that. Henry’s got more interesting things to say anyway.

J:

Yeah, but the way he described it is the same way you would describe buying a single-family rental. Basically, you have to find the deal, and then you have to underwrite the deal or analyze the deal and figure out, “Do the numbers work?” And then you have to figure out how to make the money part, the financing part work, and then you have to manage it on the back end. And so at the end of the day, these are the same steps we take, whether you’re buying a hundred-thousand-dollar single-family house or a hundred-million-dollar skyscraper. And so I just want people to start thinking from the perspective of yeah, the nuts and bolts change.

You need to learn how to underwrite different types of deals. Finding these deals are going to be completely different than finding single-family deals. And structuring the loans and the money you put in is going to be different. And then managing it on the back end is going to be different, but it’s the same four steps. It’s finding, underwriting, capital stacks or financing it, and then managing it. And so really, I would encourage everybody out there, don’t not think big. If you want to be doing single-family, that’s fantastic. I did single-family for 10 years. I love single-family, but don’t stay in single-family just because you’re scared to move out of it. If you want to stay in it, great, but don’t think you can’t do other things.

Now, getting back to your original question, Dave, do I think single-family is still a good asset class to be in? Absolutely. Here’s the thing, there’s more single-family houses out there than any amount of commercial real estate in the country. So opportunity is obviously larger. And here’s the other thing, real estate in general, single-family real estate in general is one of the best hedges against inflation on the planet. And we’re all concerned about inflation. I think we’re not going to see 7, 8, 9, 10% inflation like we have the last few months. But I think there’s a really good chance that over the next five or 10 years, we see inflation a little bit higher than it’s been the last 10 years. Last 10 years, it’s been under 2%. Most likely over the next 10 years, it’s probably going to average two and a half, 3%.

And so what is real estate… Why is real estate good when you see a lot of inflation around you? Well, number one, if you look over the last hundred years, real estate in general, single-family real estate in general in most places tends to track inflation in terms of home values. So we like to think over the last couple years, home values are going up 5, 10, 15, 20% a year. That normally doesn’t happen. But if inflation’s at three or 4%, home values are likely to go up at least three or 4% per year. Secondarily, the best part of real estate is you can get loans against it. You can get the bank to give you money and they’ll give you money at this low interest rate.

These days, it might be 6, 7, 7.5%, but still, you can refi it in a couple years if rates go down, but the best thing is your mortgage payment never changes. In 20 years when your income is doubled because of inflation and everything, all the money you’re making has gone up because of inflation, that mortgage payment’s going to be exactly the same. I mean, I know people that got loans on real estate 20, 25 years ago. They’re almost done paying it off and their mortgage payment is like three, four, $500 a month because they locked in debt 30 years ago when everything was so cheap. And when I say three, four, $500 a month, that sounds like little, but back then, that was a lot of money because we didn’t have 20 years of inflation.

So yeah, I love single-family real estate and there’s never going to be a bad… As long as we see inflation… And we’ve had inflation pretty much throughout this country’s history. As long as we have inflation, single-family real estate’s going to be a great place to be. And so obviously, you need to know how to underwrite your deals, you need to know how to analyze your deals and look at the numbers. And right now, you might want to be a little bit more conservative than you have been in the past, and you want to be more cognizant of the location that you’re buying. Buy in places where populations are growing, people are moving, employers are coming in, laws tend to be landlord friendly. As long as you’re focused on those things, you’re not going to make a mistake buying real estate that you’re going to hold for the next 10 or 20 years.

Dave:

I love what both of you’re saying because you’re reinforcing the idea that if you learn the principles and concepts behind analyzing deals, it applies to single-family rentals, it applies to multifamily, it applies to trailer parks, self-storage, office space. It’s almost like if someone wrote a book that taught you how to analyze those deals and to learn all those formulas, that that would be super helpful. So that’s me giving you a shameless plug for J and my book. We have two of them now. We’ll give you one more shameless plug. We won’t do more than three.

J:

But here’s the thing, it’s not just about the numbers and the formulas. It’s understanding that for any deal you do, you have to ask the right questions. And Dave and I came up with this idea back when we started writing the book a few years ago, that instead of just throwing a bunch of formulas out there and saying, “Here, learn the math,” basically, we decide to write a book to teach you how to think about how to do these investments. And we wrote a book that starts… Every chapter starts with a bunch of questions, “Here’s the questions you need to be asking for these types of investments and here’s how to answer them.”

And so it doesn’t just teach you to fill in the blanks or put numbers in a spreadsheet. It teaches you how to ask the right questions and be thinking about investments because I have investing situations every day that come up where I don’t know what formula to use. I can’t just stick the numbers in a formula because I don’t know a formula. I give an example in the book where I had this house that I was selling a couple years ago, and I listed it for sale and I got two really quick offers. And the first offer was full price, full list price, cash, close in two weeks.

The second offer was from another investor who really wanted the property, but he didn’t have the money because he had another deal that was closing, and he told me he was closing seven months from now. And basically, he said, “I’ll pay you. I’ll close on the property. I’ll buy your property today, but I can’t pay you for seven months. You’ll have to wait seven months. And I paid cash so I could do that, I could hold the note, I could do what’s called seller financing.” And he said, “I’ll pay you in seven months. I’ll buy it now, but I’ll pay you in seven months.” And he said, “I’ll pay you more than list price.”

And so I needed to figure out how much more do I need to be selling this property for in seven months so that it’s a better deal for me than selling it for full list price today? And so once I knew the right question to ask, and that was the question I needed to ask, “How much is a property going to be worth in seven months to me? Or how much do I need to sell a property for in seven months for it to be worth it not to get the money for seven months?” And once I realized that’s the question to ask, well, then I can figure out what formula or what concepts to use to plug the numbers in and figure out that number was.

And at the end of the day, this was a real deal I did. I went back to the guy. I figured out how much more I would need in seven months to make me actually get the same amount of money and then I bumped it up 10,000. I went to him and I said, “Here’s how much I need.” And he said, “Okay.” And I knew that I was actually getting a better deal waiting seven months for my money. And so again, that’s not something where I could just have said, “Okay, stick it into this formula and get an answer.” I need to understand the concepts behind, in this case, something called time value of money. If I wasn’t going to get my money for seven months, how much more do I need to get to make myself whole?

Dave:

Well, learning about the time value of money legitimately changed my life more than almost anything. Once you understand and can incorporate that concept into your everyday thinking, your spending, your investing, it’s really honestly life changing. Henry, I’m curious, are there any formulas, investing tricks, or concepts that you have come across in your career that have just opened your eyes that really changed your perspective on investing or money in general?

Henry:

Yeah, yeah. So for me, I’m mainly single and small multi. And so my whole business is based off of the 70% rule of thumb. For me, that’s my measuring stick to, “Is this even worth my time?” Because what it did was when I was first starting out, I would have to go look at every single house, and then you do the dance of, “Do they want retail? Do they not want retail?” And you waste a lot of time. Now, when you’re new, I actually encourage you to do that. The more houses you can walk into and evaluate and make offers on, the more experience you’re going to get. But as you close more deals, that time that you’re putting into that is better used on deals that are actually going to produce the income. And so I had to figure out a way to still evaluate property and scale, still make the amount of offers I need to make, but not have to physically go put myself inside of every property before I knew that.

And so I know everybody understands, or most people have a general understanding of what the 70% rule is, but understanding it and then putting it into practice in a way that’s going to benefit you financially are two different things. And so for me, everything gets run through that filter before I’ll even go put my time into looking at that property and making an offer. And I’m not saying that that rule is a hard and fast rule, but what I needed was something for me to say, “Hey, this is probably worth your time,” or, “This is less likely to be worth your time,” so that I could spend my time on the ones that fit better. And so for me, I evaluate everything through that lens. If I’m talking to a seller and I can get them to tell me what they want and it doesn’t seem like it’s going to fit at a 30% discount, then we don’t even waste the time. It directs the conversation that I have.

Dave:

Can you just quickly though explain to anyone who doesn’t know what the 70% rule of thumb is?

Henry:

Yeah, absolutely. So as an investor, if you’re going to make money on a property, typically either as a rental or make profit as a flip, it’s that you need to be buying a house at a 30% discount or buying it at 70% of its value minus the repairs that it’s going to take to fix that property. And when I started just running it through… And I mean, you get enough where you’re just running it through it in my head. But yeah, typically, if I’m talking to somebody and I know their house in that neighborhood is worth a hundred-thousand dollars, I get it, there’s no house worth a hundred thousand dollars. I can hear you all already.

But just for numbers’ sake, if I’m talking to somebody and I know that their house is probably worth a hundred-thousand dollars and they want 95 for it, then that’s a lead that is less important to me than one that’s worth a hundred and they’ve already said they’d entertain an offer of less than 70. And so it helps me prioritize where I’m going to go to first and then prioritize who I’m going to make offers to first.

Dave:

I love that. Yeah, it’s a great way. Yeah, just allows you… These kinds of rules of thumbs, these concepts allow you to scale your business a lot faster than you would when you’re running everything single deal through a calculator, treating every lead equally, spending a lot of time just in random houses. I felt really old when I bought a deal that I had been in twice. It had been in the market and sold and then I came back to it. And it’s because when I first started, I would go to every open house. I was like, “Whatever, whoever will show me a house, I will go,” but you quickly learn that that is not sustainable. Well, thank you both. We do have to start wrapping this up, but this has been super helpful. J, is there anything else you think our audience should know about investing in this current climate? Or any words of wisdom for people who are trying to get in right now?

Henry:

Yeah, I’m going to use… Anybody that’s listened to me speak more than two or three times has probably heard me say this, but for anybody out there that hasn’t heard it or that just needs the reinforcement, anybody out there that’s looking to get that first deal, I don’t believe there are any secrets in real estate. Go to BiggerPockets. It’s all out there. But if I had to pick that one idea that’s the closest to a secret in real estate, it’s this, I’ve met two types of real estate investors in my life. 95% of the people, of the real estate investors I meet have never ever done a deal. They want to do a deal, they’re trying to do a deal, they’re thinking about doing a deal, but they haven’t yet done a deal. That’s 95% of the investors I meet. The other 5% of investors I meet are people who have done three deals or five deals or 10 deals or 50 or a hundred deals.

There’s one type of investor I hardly ever meet, if ever, and that’s an investor who has done one deal. And there’s a reason for that. There’s a reason for that because if you can do one deal, if you do one deal, you’re going to do a second, and you’re going to do a third, and you’re going to do a fifth, and you’re going to do a 10th. It’s so hard to get that first deal. But anybody that does recognizes the second one becomes so much easier because all the pieces fall into place and the third one becomes so much easier after that, and the fifth one and the 10th one, they all get easier.

So if you’re one of those people that’s on zero deals right now, just remember if you can get to one deal, you will do 3, 5, 10, 50, a hundred deals. You just cannot stop until you get to that first deal. Don’t give up until you get to that first deal. And once you do, you’re going to realize, “Wow, this really isn’t that hard, and now I understand, and all the pieces have fallen in place, and everything’s going to get easier.” So for anybody out there that needs a little bit of motivation, don’t think about how hard it’s going to be to do 10 deals because it won’t be. It’s hard to do one deal. And as long as you don’t give up before you do that first deal, the rest of this business is easy.

Dave:

I love that. I’m feeling inspired now, J. That is good. I totally agree. That’s a good point. I don’t know anyone who’s been in the game, who did a deal five years ago and was like, “Eh, I had enough. I’m good.”

J:

Exactly.

Dave:

Well, J and Henry, thank you so much. Again, if you want to check out the book that J and I wrote together, it is available right now for pre-order. If you use the code, either JSCOTT or DAVE, you’ll get 10% off and a chance to win coaching calls with either J or myself. And hope you check it out. I think you’ll really like it. J, where can people connect with you if they want to do that?

J:

Yeah, absolutely. So anybody who wants to connect with me, go to www.connectwithjscott.com. And that’ll link you out to everything you need to know and also let you get in touch with me directly if you want to.

Dave:

And Henry, I know that everyone who has an Instagram account already follows you. Your Instagram is so, so popular, but if there’s three people out there who don’t know yet, where should people connect with you?

J:

Yeah, best place, Instagram. I’m @thehenrywashington on Instagram.

Dave:

All right. Thank you both for being here, and thank you everyone for listening. We’ll see you next time for On The Market. On The Market is created by me, Dave Meyer and Kailyn Bennett, produced by Kailyn Bennett, editing by Joel Ascarza and Onyx Media, Copywriting by Nate Weintraub, and a very special thanks to the entire BiggerPockets team. The content on the show On The Market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

11 Twitter accounts to help you stay up-to-date on the housing market

Twitter has become somewhat ubiquitous in today’s social media landscape, with more than 200 million users worldwide.

The timeline moves about as quickly as the news does, which is why it can be such a valuable resource for those trying to keep up with current events. Mortgage professionals are no exception – whether you find yourself tweeting for work or in your free time, you may also want to follow accounts for people and organizations that are relevant to the industry in order to stay up-to-date on the latest news about the housing market.

We’ve curated a list of 11 Twitter accounts you should follow to gain the latest insights and analysis of the housing market and economy.

Retweet-worthy individuals to follow for housing market updates

Logan Mohtashami: (@LoganMohtashami) Logan Mohtashami is a housing data analyst, financial writer and blogger who covers the U.S. economy and specializes in the housing market. He is also our lead analyst and “chart guy” at HousingWire. Now retired, Mohtashami has years of direct lending experience and his astute analysis of economic data allows him to present a unique, informed and unbiased perspective on the financial markets. His Twitter includes links to his analyses and podcast appearances.

Dr. Jessica Lautz: (@JessicaLautz) Dr. Jessica Lautz is the vice president of Demographics and Behavioral Insights for the National Association of Realtors’ Research group. Dr. Lautz’ research focuses on analyzing trends for both NAR members and housing consumers. She regularly speaks at events and her work is often cited in media outlets. She was also named a 2021 HousingWire Woman of Influence. Dr. Lautz regularly tweets about her speaking engagements and articles she’s consulted on, as well as provides commentary on NAR reporting.

Len Kiefer: (@lenkiefer) Len Kiefer is the deputy chief economist at Freddie Mac. Kiefer has expertise in forecasting/predictive modeling, mortgage markets and housing. His work focuses on helping Freddie Mac develop its economic outlook, including forecasts of trends in the economy and housing markets. He also conducts research and analysis around economic trends, providing commentary and analysis. On his account, Kiefer shares charts and insights about the housing economy.

Bill McBride: (@calculatedrisk) Bill McBride is the author of the Calculated Risk economics blog and writes a real estate newsletter. He has a background in management, finance and economics, and holds an MBA from the University of California, Irvine. Calculated Risk has been cited by a variety of publications in lists of must-follow economic and financial blogs. In addition to linking to his blog for commentary on housing numbers, McBride also tweets about other economic reports.

Odeta Kushi: (@odetakushi) Odeta Kushi is the deputy chief economist for First American Financial Corporation and is responsible for analysis, commentary and forecasting trends in the real estate and mortgage markets. Her research has been published by outlets such as the Wall Street Journal and Business Insider and she is regularly featured on CNBC and Bloomberg. Kushi also co-hosts the REconomy Podcast, which discusses economic issues that impact real estate, housing and affordability. On Twitter, Kushi breaks down housing data in informative threads that include useful charts for data visualization.

John Burns: (@johnburnsjbrec) John Burns founded John Burns Real Estate Consulting, a leading U.S. real estate research firm, in 2001. The John Burns Real Estate Consulting research and consulting team collects and analyzes as much housing industry information as possible in order to help its clients make informed investment decisions. Burns specializes in real estate market research, housing analysis, strategic planning, financial analysis and valuation. His account includes data from a variety of sources, including JBREC.

Educational organizations and institutions that keep you in the know

Realtor.com Economics: (@RDC_Economics) Realtor.com offers a comprehensive list of for-sale properties and the information and tools needed to make informed decisions about real estate. Realtor.com Economic Research combines proprietary metrics with the latest economic data and other industry statistics to produce a timely view of the market. On Twitter, the Realtor.com economics team provides expert insights on housing, the economy and real estate, including a Weekly Housing Trends View.

NAR Research: (@NAR_Research) The National Association of Realtors is the country’s largest trade association, with more than 1.5 million members, involved in all aspects of the residential and commercial real estate industries. NAR aims to position Realtors as consumers’ best source of information on the real estate transaction. The association produces housing statistics on the national, regional and metro-market level where data is available, including reports such as its Housing Affordability Index. NAR’s research Twitter account shares insights from the association’s experts about the economy and housing market.

Mortgage Bankers Association: (@MBAMortgage) The Mortgage Bankers Association (MBA) is the national association representing the real estate finance industry, as well as its leading advocate. The association represents all segments of the real estate finance industry, uniting the interests of a variety of stakeholders. The MBA supports its members’ success in part with its news and research, which include critical industry economic data. The association shares these reports and insights on its Twitter account.

Fannie Mae and Freddie Mac: (@FannieMae, @FreddieMac) Fannie Mae and Freddie Mac are the two government-sponsored enterprises of the housing industry. Fannie Mae was chartered to provide a reliable source of affordable mortgage financing across the country, and Freddie Mac was chartered to support the housing finance system and to help ensure a reliable and affordable supply of mortgage funds across the country. Both GSEs provide market intelligence and expertise to help clarify changes and trends in the housing and economic environment, including forecasts, analyses and expert perspectives. By following the two on Twitter, you can be sure to keep up with the latest insights and outlooks.

Quick tip: If you find that your housing-specific follows are getting lost among the rest of your timeline, you can use the Lists feature on Twitter to create a curated list of accounts that you can check separately from your main timeline.

Do you have more recommendations for must-follows? Let us know in the comments below, and be sure to follow HousingWire for even more news and analysis on the housing market!

The post 11 Twitter accounts to help you stay up-to-date on the housing market appeared first on HousingWire.

Source link

4 Critical Things You Must Do To Protect Your Investments During The Housing Correction

Two articles ago, I pontificated about the coming disaster for many real estate investors. I quoted Warren Buffett and Howard Marks. I played my “third decade in real estate” card. I tried to convince you that we are in a dangerous lag time that happens at the top of a bubble, like the front car in a roller coaster hangs in suspension on top of the first hill.

I pleaded with investors not to optimistically overpay for assets declining in value due to interest rate hikes and the potential cooling of rent growth.

Then I switched gears in the following article. I argued for reasons I might have been wrong. Or at least factors that could mitigate the severity of the likely downturn on real estate investors.

I argued that continuing rent inflation, quick economic response to interest rate hikes, the Fed not over-correcting, or ongoing supply and demand imbalances could rescue many real estate speculators.

But note that all of these are economic and market factors. These are out of the investor’s control and, therefore, not something we can count on in our investment strategies. If you count on the market and the economy to go your way, you are a speculator.

It’s okay to speculate if that’s your thing. But don’t kid yourself that you’re really an investor. And if you’re a syndicator taking other people’s money, please be honest with them.

Anyway, there are at least four strategies to invest wisely (rather than speculate) in any market or economic cycle. In keeping with the themes of this series, I’m focusing here on the current context at the time of writing: the rise in interest rates, the current lag in corresponding cap rate expansion (price drops), and the likelihood we are near the burst of a bubble.

1. Keep Low to Moderate Debt Levels

It probably goes without saying that those with no or moderate debt will be less affected by interest rate increases or economic downturns. Investors who depend on low-interest rates to make their numbers work may find themselves in trouble during a higher interest rate environment.

In the event of a drop in value, it’s possible that over-leveraged investors will experience a loss of equity or even negative equity, meaning the reduction in value will cancel out their gains and even their original cash outlay. As a syndicator, this could result in a capital call from already unhappy investors.

This can also hurt during refinancing. Economic troughs also kindle tight credit markets. Banks raise their lending standards, lower their loan-to-cost ratios, and generally become harder to borrow from. This can also lead to negative equity and the potential to lose an excellent cash-flowing asset.

Over-leveraging can turn a low-risk investment into risky speculation. Investors beware.

2. Use Fixed-Rate, Long-Term Debt

This goes hand-in-hand with the first strategy. We may be heading into a downturn. But that direction will eventually turn north again. Though timing will vary, it’s likely that investors with long-term, fixed-rate debt will ride the cycle through the trough and up the other side. And rent inflation will likely continue to raise revenues during this entire cycle, creating excellent cash flow and value for these investors.

It’s okay to utilize short-term, adjustable-rate debt. There’s certainly a place for it. But if you’re concerned about our position in the current economic cycle, carefully consider the structure of your debt.

3. Buy Off-Market When Possible, And Don’t Overpay

We discussed the importance of not overpaying in the prior article. With the massive number of investors competing for a finite number of deals over the last decade, it may be tempting to jump on any deal you can get as this market loosens.

With the market at a historical top, overpaying right now creates the highest risk at the worst possible time. Margins of safety are at perhaps an all-time low, and this is the time to be prudent. One way to do that is to buy off-market.

Real estate investors with a robust off-market acquisition strategy will find deals with lower buyer competition and likely at better prices.

There are a variety of ways to find off-market deals. Much depends on your asset class and team capabilities. My firm invests in recession-resistant commercial real estate with top operators. My favorite operator has a team of eight working full-time to contact off-market self-storage and mobile home park owners. This strategy has produced stunning results over many years.

One tactic to boost this effort is to carry significant cash reserves. Those who can buy for cash and refinance later may access deals and prices unavailable to many other investors.

Buying favorably priced off-market deals often coincides with my favorite wise investment strategy, which you can predictably count on in any market or economic cycle.

4. Invest In Intrinsic Value

Warren Buffett said, “Price is what you pay. Value is what you get.”

Top real estate investment strategists seek opportunities with significant untapped intrinsic value, just like those in the stock market or any investment do. This is value inherent in an acquired asset that a skillful operator can harvest.

These properties are often acquired from mom-and-pop operators in highly fragmented asset classes. Though the possibilities are extensive, we have found the best opportunities in asset classes like mobile home parks, self-storage, and RV parks. Our firm also selectively invests in certain multifamily, light industrial, and retail center opportunities with significant intrinsic value at acquisition.

Warren Buffett says that acquiring assets with a high margin of safety is the key to investing success. Tapping assets with high intrinsic value can create a sizable margin of safety, especially in times when buyers risk overpaying for underwhelming properties with questionable upside.

The debt service coverage and loan-to-value ratios are two meaningful and related margin of safety metrics. The debt service coverage ratio is the ratio of periodic debt payments to net operating income. Banks like to see a minimum DSCR of about 1.20, meaning a 20% margin of safety between debt service and net income. However, this is a small margin, and it can evaporate quickly if floating interest rates rise or if net income takes a hit.

Harvesting intrinsic value from assets should create increasing net income and a higher DSCR. This rising margin of safety results in much lower risk in tenuous economic environments. And this harvest produces meaningful gains in value, which can offset cap rate expansion resulting from interest rate hikes—a significant win for investors.

Many of the assets we invest in achieve DSCR levels well above 2.0, translating to a 100% margin of safety. Some even surpass 3.0, a 200% safety margin.

Higher margins of safety usually correspond with decreasing loan-to-value (LTV) ratios. This margin of safety matters most at the time of refinancing. The difference between the asset value and the loan balance is the investor’s equity. Lower LTVs result in higher equity and lower risk during economic contraction.

One of our operators starts with a modest LTC (loan-to-cost ratio, which is the LTV at acquisition) of about 65%. But harvesting value can result in a drop to their current average LTV of 35%. A very safe place for investors.

Avoiding risk is great. Mr. Buffett calls not losing money his first rule for successful investing. But the ultimate goal is to create true wealth. True wealth is assets that produce cash flow. I can’t think of a better way to avoid risk and create wealth than acquiring assets with latent value that a skilled operator can tap.

The Way Forward

I’ve penned multiple posts about the importance of buying assets with hidden intrinsic value. Our firm is obsessed with providing our investors with this strategy’s corresponding safety and profitability. Since this is my favorite of the four wise investment strategies, I will devote six future articles to case studies on harvesting intrinsic value in:

Here’s a preview of some of the case studies we’ll cover:

Note that I won’t just be reviewing the case studies. I’ll apply the concepts of avoiding risk and creating value and wealth by implementing these value investment principles in your real estate investing strategy. I can’t wait to share these stories and principles with you!

Run Your Numbers Like a Pro!

Deal analysis is one of the first and most critical steps of real estate investing. Maximize your confidence in each deal with this first-ever ultimate guide to deal analysis. Real Estate by the Numbers makes real estate math easy, and makes real estate success inevitable.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Source link

Title insurers reckon with attorney opinion letters

Unlike the title industry’s cybersecurity and wire fraud challenges, which are strictly 21st century issues, the recent interest and use of attorney opinion letters (AOLs) harkens back to an earlier era of homebuying.

Prior to the advent and widespread use of title insurance, before taking title to a property, the buyer required that the title be free of any rights, interests, liens or encumbrances of others for which the buyer would be responsible for. A title search would be conducted and then a conveyancer would issue an opinion on the title, an incredibly similar process to the AOL option which Fannie Mae announced it would start accepting this past April.

Since the government sponsored entity’s announcement, the American Land Title Association has taken a strong stance against AOLs and other title insurance alternatives. Now, thanks to United Wholesale Mortgage (UWM) CEO Mat Ishbia’s recent announcement that his company is hiring attorneys to review title and closing documents, AOLs and the risks associated with them, have been a hot topic at this year’s ALTA One conference.

“Since Fannie’s announcement earlier this year, ALTA has been out front opposing the irresponsible use of title insurance alternatives that provide less coverage and introduce more risk for the lenders and the consumers,” Diane Tomb, the CEO of ALTA, told conference attendees gathered in the historic Hotel del Coronado’s Ocean Ballroom Thursday morning. “This is a top priority for ALTA.”

Daniel Wold, ALTA’s president, added: “We will continue speaking out against alternatives to title, which pose an even greater risk to the housing finance system.”

Fannie Mae’s April announcement that it would be accepting AOLs in lieu of a title insurance policy “in limited circumstances,” was similar to the announcement by Freddie Mac two years ago, with similar requirements for the letter and the attorney writing it.

Over the summer, Tomb said the impact of this policy change was expanded when the Federal Housing Finance Agency approved the GSEs’ release of their Equitable Housing Finance Plans.

“The intent was to promote affordable and sustainable housing opportunities for more households nationwide,” Tomb said. “One of the goals they outlined in those plans is a push to reduce closing costs, especially for low-income borrowers. Based on those plans, both GSEs are pushing pilot programs promoting the use of attorney opinion letters, reportedly as an alternative to reduce closing costs.”

While some proponents of AOLs, such as Voxtur Analytics, claim that the savings generated by using an AOL product instead of a traditional title insurance policy could save consumers up to an “entire mortgage payment,” ALTA says it has not noted any considerable savings in using AOLs versus a traditional title policy. Instead, ALTA warns that due to the risks posed by AOL coverage, using an AOL may cost a consumer more in the long run.

“These products that are going into the market — it is confusing because they are giving people who need it the most, less coverage,” Tomb said. “We haven’t seen any real data based on the conversation that it is going to save money. In some ways it could cost them more. They might actually lose their home.”

Unlike AOLs, title insurance policies provide lenders with a defense, including attorney’s fees and costs, in any dispute or claim that may arise.

“It is so easy to spend $10,000 in court on anything and then your other option is to pay another $298 on an owners title policy,” Charles Cain, the senior vice president for the national agency division of FNF Family of Companies, said. “When they talk about reducing closing costs for underserved communities, these people need title insurance more than anybody else because while $10,000 in legal fees may be doable for someone who owns a $4 million house, it is a struggle for someone who owns a $140,000 house.”

Aside from the financial burden AOLs could pose for homeowners, ALTA also takes issue with the numerous coverage gaps, especially when it comes to issues of forgery and fraud.

“Forgery and fraud are the biggest things not covered by any of those alternative products,” Steve Gottheim, ALTA’s general counsel, said. “It is also the third-biggest source of claims in our industry right now. So, it is hundreds of millions of dollars the industry pays out on those types of issues that lenders are not prepared to take on.”

According to ALTA, AOLs only cover things discoverable in a public records search, meaning that they would not cover things like federal tax liens, mis-indexed items or HOA liens. In addition, if a title issue arises on a property covered by an attorney opinion letter, the buyer would need to prove negligence on the part of the attorney to pursue the claim with them. If the buyer is unable to prove negligence on the part of the attorney, the claimant would likely need to pay the legal costs involved to litigate the title matter.

Cain said this can get even trickier in some states, where the statute of limitations on an attorney’s malpractice insurance is one year from the date of when the opinion letter was issued, not the date of when the issue arose.

“An AOL is not going to cover the period of a 30-year loan,” Cain said. “As an attorney, I don’t know how that is going to work.”

But AOL proponents have a different take.

“We created the attorney opinion letter as an alternative product not with the intention of completely displacing title insurance, but creating an alternative that could be used in certain situations, particularly those where the cost of title insurance is not necessarily proportionate to the risk that is being covered,” Stacy Mestayer, the chief legal officer of Voxtur, told HousingWire earlier this year.

Voxtur’s CEO Jim Albertelli added in an email: “The use of Attorney Opinion Letters as an alternative to title insurance is an established practice that provides security and coverage to the lender and borrower comparable to that of title insurance. As this alternative continues to grow in popularity, we anticipate that misinformation will continue to be released, particularly by those that see an alternative product as a competitive threat. The reality is that innovation like this leads to more efficient processes and lower costs that benefit homeowners, and that is exactly what we should all be striving to achieve.”

ALTA voiced its concerns about AOLs in a letter to FHFA director Sandra Thompson earlier this year and Tomb says she hopes the trade organization can be part of these discussions moving forward, as she said the group was not consulted prior to the GSE’s announcement.

While ALTA supports the FHFA’s mission to lower the cost of homeownership, it aims to do so in a way that protects both consumers and lenders.

“Over the last 10 years, rates have gone down 6% across the industry and that is important for homeowners and it’s because of the investment the industry has put into things around automation and using machine learning and AI to search title and come to a faster decision about the title,” Gottheim said. “These technologies come with a cost at the front end, but over time, they bring that efficiency and bring the price down.”

ALTA is also working with lenders, Realtors, the Department of Housing and Urban Development and down payment assistance programs to provide homebuyers with information on the differences between AOLs and title insurance, and finding ways to reduce costs.

“We are protecting the American Dream,” Tomb said.

The post Title insurers reckon with attorney opinion letters appeared first on HousingWire.

Source link

Specter of the S&L crisis haunts today’s mortgage market

The financial chaos that sparked the savings and loan crisis of the 1980s, leading to a government bailout, now haunts the independent mortgage banking market this Halloween season — and beyond.

Independent mortgage banks (IMBs) account for nearly 74% of agency mortgage originations, which is the bulk of the market, according to a recent report by the Urban Institute’s Housing Finance Policy Center (HFPC). In 1980, some 4,000 savings and loan institutions (S&Ls or thrifts) accounted for about half of the nation’s $960 billion in outstanding home mortgages at that time.

The federal agency set up in the late 1980s to oversee and dispose of the assets of failed thrifts, the Resolution Trust Corp. (RTC), closed 747 S&Ls with assets of more than $407 billion.

One market expert sees a similar fate ahead for IMBs, absent an RTC, predicting that over the next two years more than one-fifth of the nonbank lenders now operating nationwide will merge or otherwise disappear.

The pressure cooker prompting that dire prediction is being heated by persistent inflation and rising interest rates. Mortgage origination volume this year is projected to decline drastically, by $2 trillion to $2.1 trillion compared with 2021, according to estimates by Fannie Mae, Freddie Mac and the Mortgage Bankers Association (MBA). Most of that decline will be on the refinance side, with the MBA estimating that the refi share of originations will drop from 62% last year to 33% this year and 27% in 2023.

Rate locks on rate-term refinancings in August were down 93% from a year ago and cash-out refis were down 78%, according to Black Knight.

“Many [IMBs] expanded operations during an unsustainable refi boom and now face painful adjustments,” said Richard Koss, chief of research at New York-based mortgage-data analytics firm Recursion.

John Toohig, head of whole-loan trading at Raymond James in Memphis, explained that the mortgage market has essentially been cut in half from last year’s volume. “So, there’s fewer loans to go around, fewer loans being sold at premiums, so mortgage companies are likely in for consolidation,” he said.

Storm Brewing

Tom Capasse is managing partner and co-founder of New York-based Waterfall Asset Management, a global alternative investment manager with some $11 billion in assets under management. The firm specializes in asset-backed credit, whole loans and private equity.

Capasse sees the headwinds facing the independent mortgage banking industry over the next couple years as being near hurricane-force in their impact. He points out that in 2021, 85% of the U.S. mortgage market was ripe for refinancing, but today closer to 10%.

“There’s roughly 4,400 independent mortgage banks in the United States, and we estimate that probably half two-thirds today are breaking even at best,” he added. “[Origination] volumes have fallen 50% to 60%, but margins have fallen 75%.

“You’re going to have a lot of fallout,” Capasse added. “We think that this period of restructuring that’s occurring in industry is probably an 18-month to two-year process, and at least one-fifth of the industry will probably merge or go away.”

There are many economic variables that can yet affect the future course of events in the industry, for better or worse, including Capasse’s dire projections for the IMB market. Still, signs of the stress facing the market have surfaced already this year — with the Chapter 11 bankruptcy filing by First Guaranty Mortgage Corp; the failure of Sprout Mortgage; a dozen channel exits; and the many mergers and acquisitions completed or in motion.

Garth Graham, senior partner and manager of mergers and acquisitions activities for the STRATMOR Group, a Colorado-based mortgage advisory firm, said for all of 2021, there was a total of 29 merger and acquisition deals that involved at least one IMB. So far in 2022, he added, “there are over 25 already, and the pace is picking up.”

“There likely will be 40 to 50 deals done this year,” Graham said. “The primary deals are large IMB’s buying smaller IMBs.”

Graham explained that if a smaller IMB’s loan volume is cut in half, it’s hard for that lender to cut its corporate expenses in half to remain profitable. “Meanwhile,” he added, “a large buyer might be able to load that same [mortgage] production [via an acquisition] and not take on any [additional] corporate expenses.”

“Lenders that turn all their attention to refinances when that business skyrockets enjoy huge profits,” Graham said. “But the tide always eventually turns, and when it does, many of those lenders struggle to stay afloat.

“We’re seeing a lot of that this year, and it will certainly continue in 2023. … Over 50% of IMB’s lost money in Q2, and that number will go up in Q3.”

Graham said there are now many buyers who are active in the IMB space, and “the lender who does not want to risk their company or put capital into their company during this downturn should (and is) considering an exit.”

“We get calls every day on that basis,” he added.

Past is Present

Rising interest rates, inflation and risky loans made to chase higher returns all contributed to the rolling S&L industry crisis in the 1980s. Texas was ground zero for the S&L industry implosion, with more than 40% of thrift failures in 1988 — the peak year for the crisis — occurring in the Lone Star State.

“Emblematic of the excesses that took place, in 1987 the FSLIC [the now-defunct Federal Savings and Loan Insurance Corp.] decided it was cheaper to actually burn some unfinished condos that a bankrupt Texas S&L had financed rather than try to sell them,” states the Federal Reserve synopsis of the S&L crisis.

“The thrift crisis came to its end when the RTC was eventually closed on December 31, 1995,” the synopsis states. ”The ultimate cost to taxpayers was estimated to be as high as $124 billion.”

Like the 1980s, the country now finds itself in a period of high inflation — 8.3% annualized as of August per the Consumer Price Index — as well as fast-rising interest rates.

The Federal Reserve has raised its benchmark rate by 3 percentage points since March of this year — helping to catapult the interest rate on a 30-year fixed-rate mortgage from just under 3% in October of last year to about 6.7% as of early October 2022, according to Freddie Mac’s market survey. The Fed is expected to announced more rate bumps in the months ahead.

Unlike the havoc and taxpayer burden created by the S&L crisis some 40 years ago, however, what’s expected to unfold in the nonbank sector restructuring ahead, Capasse said, will be a much more orderly, market-driven process — absent a taxpayer bailout or asset-liquidation agency like the RTC of the S&L era, he added.

That’s primarily because the bulk of the nonbank assets that will be up for grabs in the industry re-alignment — mortgage loans and servicing contracts — are quality assets that are performing well.

“This looks a lot like that [the S&L crisis], though there won’t be any RTC, but it smells a lot like what happened back in those days, when savings and loans got restructured or went out of business,” Capasse said. “So, it’s the same thing with these 4,400 independent mortgage banks.

“At least 1,000 of them are going to go through some level of restructuring over the next two years.”

For the buyers — other better-positioned industry players, including competing IMBs, private-equity firms, real estate investment trusts, banks and more — that means solid assets will be available at bargain-basement prices.

“[The restructuring] will involve sales of these very clean, good senior-credit quality assets, like mortgage servicing rights and non-QM home loans and these scratch-and-dent loans — the illiquid assets on the balance sheets of these highly leveraged IMBs that are going to provide investment opportunities,” Capasse said.

In short, the IMB industry will contract and reconfigure via failures, asset sales, mergers and acquisitions, according to Capasse’s forecast. The mortgage-finance space will be opened up to many new players, and some existing players will expand their reach in the market.