Why It Matters, and What It Means for Real Estate Investors

On Wednesday, March 16, 2022, the Federal Reserve announced it would be raising interest rates for the first time since 2018. While the 25 basis point hike (one basis point=0.01%) was largely expected, the underlying shift in Fed policy will impact the housing market, and real estate investors should understand and pay attention to it.

In this article, I will provide a brief overview of what the Fed is doing, why they are doing it, and how it could impact real estate investors.

At the conclusion of the March meeting of the Federal Reserve, it was announced that the Fed’s target for the federal funds rate would increase by 25 basis points. The target federal funds rate is the interest rate at which banks borrow reserve balances from one another. It doesn’t actually impact consumers directly.

However, when the target rate rises, it sets off a domino effect that ultimately hits consumers. An increase to the federal funds rate makes it more expensive for banks to borrow; this, in turn, makes it more expensive for banks to lend to consumers—the cost of which is passed along to consumers.

This week, it got a bit more expensive for banks to borrow and lend. It’s a big shift from the stimulative policies the Fed has embraced since early 2020.

The federal funds rate is one of the primary tools the Federal Reserve has to manage the economy. In difficult economic times, it is lowered to stimulate economic growth. We saw this after the Great Recession, and then again at the beginning of the COVID-19 pandemic.

By lowering interest rates, the Fed incentivizes business and consumers to finance their spending by borrowing money. For businesses, this could mean new hiring or expanding into new markets. For consumers, this could mean buying a new car or house while rates are low and debt is cheap. The impact of cheap debt is an increase in the amount of money circulating in the economy, also known as monetary supply. An increase in monetary supply generally stimulates spending and economic growth.

There is a downside to so much money flowing through the economy: inflation. Inflation is commonly described as “too much money chasing too few goods.” So to fight inflation—and reduce the monetary supply—the Fed raises rates. As interest rates climb, businesses and individuals are less inclined to borrow money to make big purchases, which means more money sits on the sidelines, helping curb inflation.

Raising interest rates is a bit of a dance. Rates must increase to fight inflation, but rising rates also put the economy at risk of reduced GDP growth—or even a recession. Again, the potential for reduced borrowing and spending that comes with increased interest rates can hurt economic growth.

This is why people like me watch the Fed’s moves so closely; we want to know how they will balance their dual responsibilities of fighting inflation and promoting economic growth. It’s a tightrope walk.

What happened this week was expected. As they have been signaling for weeks, the Fed raised rates by 25 basis points. There’s nothing particularly interesting about that announcement, in my opinion.

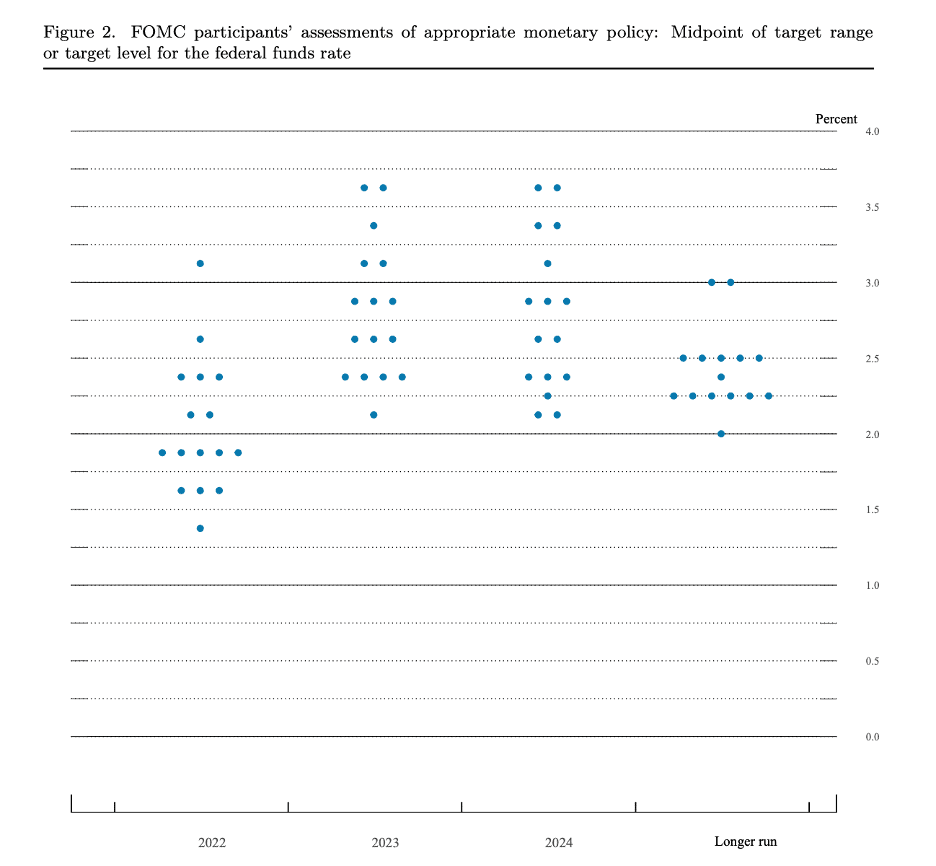

The data that interests me the most, however—and the data that will impact real estate investors the most—is contained in the dot plot.

This graph shows what the people who actually make decisions about interest rates believe about where the federal funds rate will be going forward. Each dot represents the opinion of one Federal Open Market Committee (FOMC) participant.

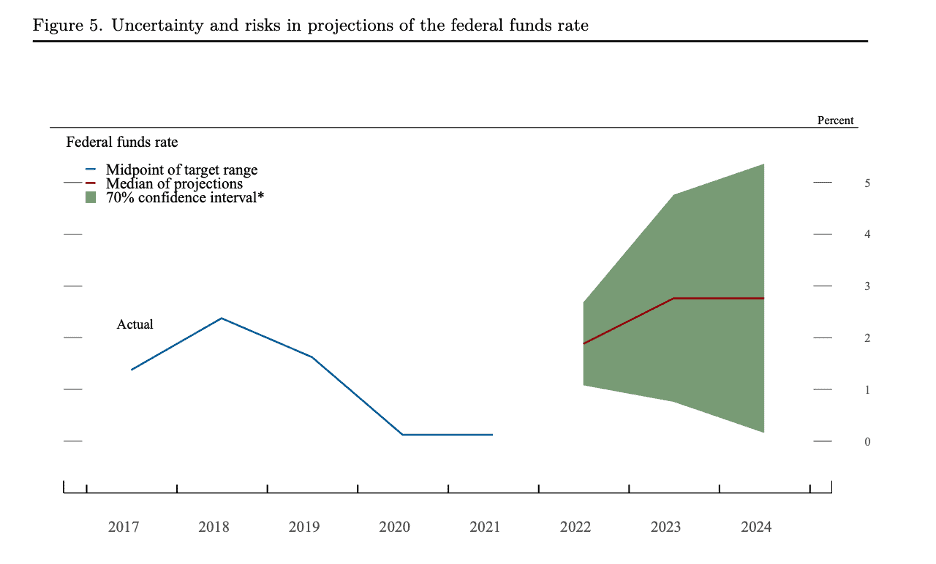

Another way to look at this data is presented here:

From this, you can see that the median projection of FOMC participants is now about 1.875% for 2022—a very dramatic increase from where we are today. This shows a clear position by the Fed. They intend to raise interest rates aggressively through 2022 and expect rates to keep climbing to 2.8% in 2023 before flattening out in 2024. Over the long run, the FOMC would like to see rates at around 2.4%.

For context, the highest the upper limit of the target rate has hit since the Great Recession was 2.5%, which is where it sat for most of 2019. The Fed is planning to go higher than we’ve seen in years, and then bring it back down a bit, presumably once inflation is in the 2%–3% year-over-year range that the Fed targets.

For real estate investors, interest rates are hugely important. As I’ve discussed already, they impact the entire economy. Importantly, rates also impact real estate investors and the housing market more directly—through mortgage rates.

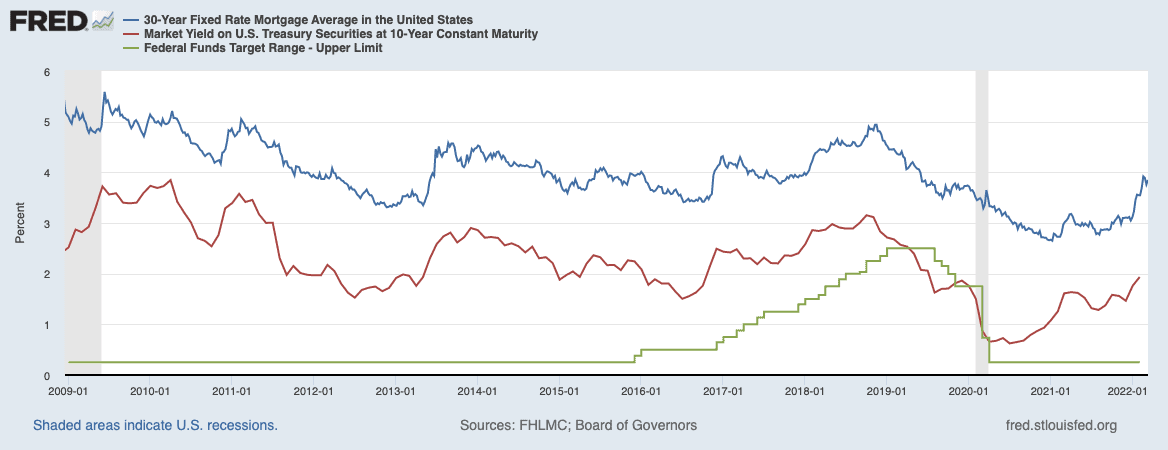

The reality is this: Although the Fed announcements make for a lot of news, the Fed’s target rate doesn’t impact mortgages that much. Check out this chart:

The green line is the federal funds rate (the chart hasn’t been updated to reflect the announced rate hike), the blue line is the average rate on a 30-year fixed-rate mortgage (owner-occupied), and the red line is the yield on the 10-year U.S. Treasury bond.

If you eyeball the relationship between the green line (federal funds rate) and the blue line (mortgage rates), you can see that there hasn’t been a particularly strong correlation between the two variables, at least since the Great Recession.

Instead, look at the relationship between the red line (yields on 10-year treasuries) and the blue line. There is a robust correlation. If you want to know where mortgage rates are going, you need to examine the yield on 10-year U.S. Treasuries—not the Fed’s target rate.

Yes, bond yields are impacted by the federal funds rate, but they’re also influenced by geopolitical events, the stock market, and many other variables. I am not a bond yield expert, but bond yields have risen rapidly this year, and given recent events, I wouldn’t be surprised to see yields hit 2.5% or higher this year.

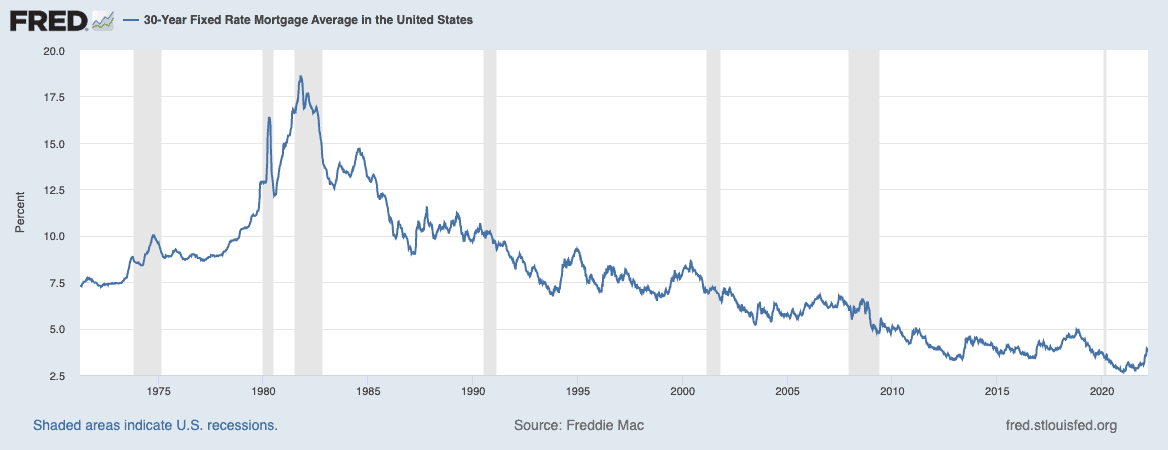

If that happens, I think mortgage rates for a 30-year fixed owner-occupied property could be around 4.50%–4.75% by the end of the year. That would be a significant increase from where we’ve been over the last few years, although still very low in a historical context.

Before the Great Recession, rates were never below 5%, for as far back as I have data. Keep that in mind as you navigate the current investing environment.

Mortgage rates will rise, and this will put downward pressure on the housing market. Rising mortgage rates decrease affordability, which then lowers demand. In a more typical housing market, this would have a pretty immediate impact on housing prices. But the current housing market is different, and “downward pressure” on housing prices does not necessarily mean “negative price growth.”

Remember, there are other forces driving the housing market right now, many of which put upward pressure on prices. Demand is still high, driven by millennials reaching peak homebuying age, increased investor activity, and higher demand for second homes. Additionally, supply remains severely constrained, and as long as that is the case, there will be upward pressure on housing prices.

What happens next is hard to predict. On the one hand, we have rising rates putting downward pressure on the housing market. On the other hand, we have supply and demand exerting upward pressure. Without a crystal ball, it remains to be seen how this all plays out.

If I had to guess, I believe prices will continue to grow at an above-average rate through the summer, and then come back down to normal (2%–5% YoY appreciation) or even flat growth in the fall. Past that, I won’t even venture a guess.

Although I like to make projections to help other investors understand the economic climate, in uncertain times like these, my personal approach to investing is not to try to time the market. Instead, I try to look past the uncertainty. In my mind, the housing market’s potential for long-term growth remains unaffected by today’s economic climate. Short-term investments, to me, are risky right now. (Full disclosure, I don’t flip houses even during more certain economic times.) But long-term rental property investing remains a great option to hedge against inflation and set yourself up for a solid financial future five years or more down the road. I’m still actively investing because inflation will eat away at my savings if I do nothing. And I know that even if prices dip temporarily in the coming year, investing now will still help set me up to hit my long-term financial goals.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com