RE team rev increased, net operating percentages decreased in 2023: Streamlined

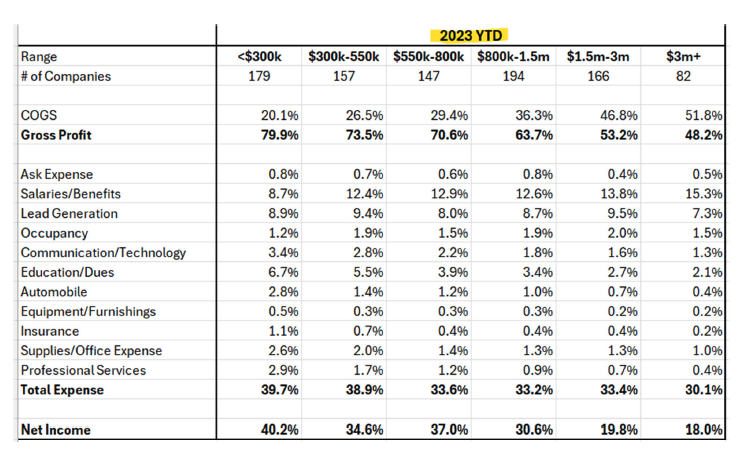

Upon examining the financial performance across various gross revenue categories, 2023 reveals a distinctive pattern in net operating percentages as they relate to increasing revenue levels, according to the Streamlined Quarterly Team Benchmarking Report, which looked at the financial performance of more than 200 teams across the nation.

This report covers the Q4 2023 and the year at a glance. Steamlined, based in Arizona, has a roster of hundreds of U.S. real estate teams and individual agents as clients for their accounting and bookkeeping services. The firm confirms actual financial and operational details of these businesses and assemble the data in useful benchmark studies to help their clients assess how effectively they are operating.

A clearer understanding of the performance of teams helps everyone understand the impact of the growth of the organization and performance of teams.

For 2023, initially, the net operating percentages are considerably high, starting at 40% for the lowest revenue category. This indicates a positive net income percentage, especially for businesses at the beginning stages of revenue generation.

However, as revenue increases, there’s a general downward trend in net operating percentages, confirming that higher revenue levels might be associated with increased operating costs or other factors that diminish the proportion of revenue retained as operating income.

As a reminder, in our years of experience and analysis, a larger net income percentage is not equal to more money in the bank. When given the opportunity, most business owners would take 10% of a large revenue number over 40% of a low revenue number. Despite this trend, the net operating percentages remain positive, underlining efficient operational management is key to continued success.

The latest financial insights for the residential real estate teams and agents present a picture of resilience and strategic adaptability, even in the face of shifting economic landscapes.

The seasonality effect, particularly in Quarter 2 and Quarter 3, plays a pivotal role in enhancing the annual averages of net operating percentages. This seasonal uplift lead to improved financial performance and contributed to a more robust annual net income percentage. Such seasonality can be attributed to factors such as market demand, operational efficiencies, and strategic marketing efforts tailored to capitalize on seasonal trends.

Furthermore, the analysis highlights the consistency of lead generation costs, which remain about 9% of revenue across all categories. This consistency is notable, as it suggests a stable and effective marketing strategy that scales proportionally with revenue.

The ability to maintain lead generation costs at a steady percentage of revenue is indicative of strategic planning and execution in client acquisition efforts, contributing to the overall financial health and sustainability of this industry.

While there’s a noticeable decrease in net operating percentages with increased revenue, the overall financial health of businesses remains strong, encouraged by positive net income percentages, beneficial seasonal trends, and effective lead generation strategies. These elements combined suggest a well-managed operation capable of navigating the complexities of scaling and market fluctuations, positioning the business for sustained growth and profitability.

Streamlined, RTC Consulting and HWMedia are teaming up to share this data with our readers to help create transparency in the results of over 200 teams. We will publish these results on a quarterly basis roughly 45 days after the end of each calendar quarter.

David Pittiglio is the CEO of Streamlined Business Solutions.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com