Local Markets: Louisville, Reno and San Diego

Local markets is a HousingWire magazine feature spotlighting housing trends across the country.

Louisville, Kentucky

Affordable housing prices combined with a vibrant history and a thriving culinary scene have certainly made Derby City a popular destination for homebuyers. However, even Louisville’s active housing market has slowed down recently. “I haven’t been seeing as many multiple offer situations lately,” Christine Ridenour Lindsey, a local agent with RE/MAX Properties East, said. “Last year you might have 20 offers on a house and half of them would be cash.” According to Ridenour Lindsey, as the market has cooled, she has noticed fewer all-cash offers being made. This trend has made it easier for buyers with financing and other contingencies to purchase a home. Also helping buyers is an increase in housing inventory, Ridenour Lindsey said. “It is hard to tell if more homes are being listed or if things are just sitting a bit longer, but there is definitely more inventory,” she said. “Interest rates going up has slowed the market down a little bit, which we needed — it was unsustainable the way it was going.”

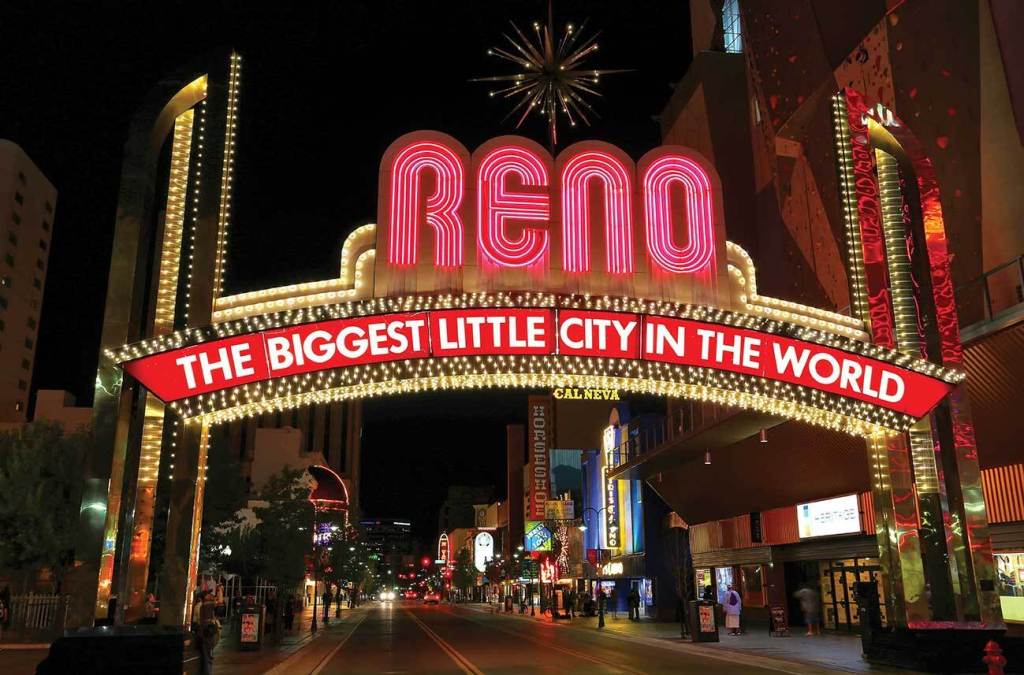

Reno, Nevada

Known as “The Biggest Little City in the World,” Reno, Nevada, has been a hub for everything from railway expansion to gambling to divorce settlements. The city was named after Civil War Union Major General Jesse L. Reno, who was killed in action during the Battle of South Mountain at nearby Fox’s Gap. It has become a major technology center as it is home to offices for Amazon, Tesla, Panasonic, Microsoft, Apple and Google. Accompanying the influx of tech companies has been an influx of tech workers, causing home prices in the metro area to rise rapidly. “We have seen tremendous growth,” Mike Wood, a local RE/MAX agent, said. “Since May of 2020 we have seen growth accelerating faster than the national average and this happened as well from 2003 to 2007, but then our decline was also accelerated. It is like a roller coaster: the steeper the climb, the faster the drop.” According to Wood, this latest market shift is no exception to the rule. “I would say our price decrease should probably rank within the 10 highest in the nation, percentage-wise,” he said. “And our buyers that do get under contract are a little bit more skittish and quicker to cancel, so I have seen a high number of back-on-markets.” Looking ahead, Wood said making sure homes are well staged and presented and priced fairly will be key to getting to the closing table.

Destin, Florida

In November 2021, the median home sales price in Destin soared to $650,000, a year-over-year increase of 28.1%, according to Redfin. Since then, prices have cooled considerably, dropping to a median of $605,000 in August 2022, just 1.0% higher than a year ago. But with beautiful beaches and great amenities, it appears that Destin’s popularity is here to stay. Family circumstances forced Destin, Florida-based Corcoran Group agent and leader of The Ketchersid Team Jodi Ketchersid to take a step back from her real estate career in May. When she returned to the industry in late summer, the housing market looked different. A lot different. “It was like, ‘Holy cow! What happened to the market?’” Ketchersid said. “It felt like it happened overnight, but it wasn’t like the light shut off. I think this area was being really undervalued for so long — prices were low — and then everything went crazy and house prices became almost hyperinflated as people were willing to pay well over list price.”

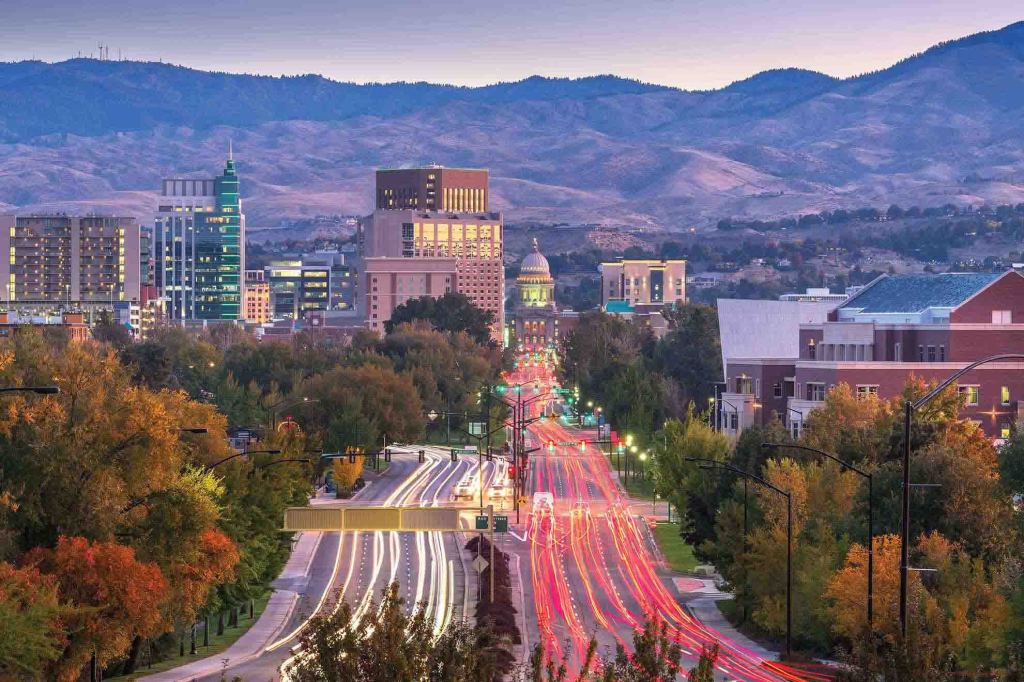

Boise, Idaho

Boise, Idaho, made quite a few headlines over the past few years as homebuyers flocked to the state’s capital city. In June 2022, the Boise housing market was the most overpriced in the U.S., according to an analysis of 100 markets conducted by researchers at Florida Atlantic University and Florida International University. The study found that property prices in the Boise metro area were 69% higher than they should have been given Boise’s long-term pricing pattern. But the rapidly appreciating home prices and rising mortgage rates have taken a toll on buyers’ purchase power, causing listings to sit on the market longer. “Houses aren’t flying off the shelf like they were last year with multiple offers,” Christina Ward, a local Keller Williams agent, said. Ward said this slowdown has led to an increase in housing inventory. In September, she said the metro area had about double the number of houses for sale as it did a year prior. “We have about 2.6 months of inventory and that is still a seller’s market.” Ward also noted that she is seeing fewer out-of-town buyers. “The buyers we are seeing need to move because they have to — they got a divorce or have an addition to the family, or a new job or are empty nesters wanting to downsize.”

San Diego, California

Like so many other markets across the country, rising mortgage rates have taken a toll on the San Diego housing market. According to the San Diego Association of Realtors, the median price of a single-family home in the county dropped 5% in August to $910,000. While still pricy compared to the national median sales price of $389,500, according to the National Association of Realtors, it is a significant decrease. “I have a lot of buyers that are popping back up out of the woodwork,” Alanna Strei, a local eXp Realty agent, said. “They don’t like the interest rates, but it is not stopping them, they just aren’t happy about it.” Despite the slowdown, Strei said home price growth year over year was still at about 15% in September. “The fact that we are considering that as slow is kind of insane,” she said. “It is still a great time to sell.”

This article was originally published in the December/January issue of HousingWire Magazine, click here to read the full magazine.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com