Inventory Shortage Could Continue As Interest Rates Rise and Homeowners Feel “Locked-In”

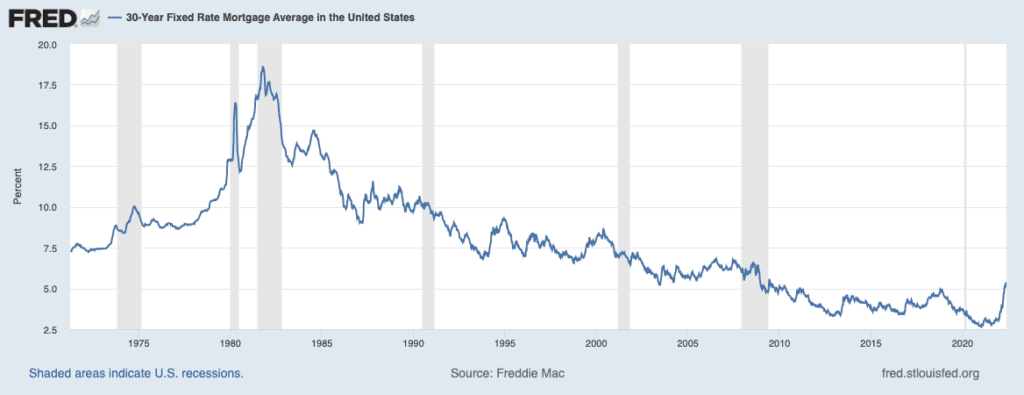

As the Federal Reserve aggressively raises interest rates and bond yields climb, we are leaving behind the era of ultra-low mortgage rates that prevailed from 2020 through the end of 2021.

Over the past several years, we’ve become accustomed to mortgage rates below 4%, with the average rate on a 30-year fixed-rate mortgage (for an owner occupant) dipping as low as 2.65% in January of 2021. Those are extremely low in a historical context. As of this writing, the average rate on the same loan is about 5.3%.

For at least the next several months and perhaps for years to come, we will experience a higher interest rate environment. However, the lingering impact of these years of ultra-low interest rates could be felt for the next several years or even decades to come due to what has recently been coined the “Lock-In Effect.”

In the short-term, rising interest rates will do what it always does to demand—curtail it. Over the last several months, we’ve seen this happening as mortgage purchase applications are down about 15% through May 13 from the same period in 2021. Rising rates reduce affordability, pricing would-be homebuyers out of the market. As long as interest rates continue to increase, they will continue to put downward pressure on demand—nothing new here.

However, what is potentially new is how rising interest rates could negatively impact inventory.

Recent data from Redfin shows that 51% of homeowners with a mortgage have an interest rate below 4%. With so many homeowners locked into super low rates, there could be a disincentive for homeowners to sell.

Think, if you have a home with a mortgage rate under 4%, why would you choose to sell that home and enter a super competitive housing market with high prices, only to pay more interest on your next loan? It’s not a very attractive proposition.

To put it in perspective, consider a $425k house. If you had a 3.5% mortgage rate, your monthly payment would be around $1,910. If you rebought a home at a similar price with an interest rate of 5.3%, your monthly payment would be about $2,360. That comes out to roughly $450 more per month or $5,400 per year.

Or consider someone looking to downsize. Perhaps an aging couple wants to sell the home they raised a family in, get some cash to invest with, and reduce their monthly expenses.

If this couple downsized from a home worth $425,000 to a home worth $350,000—they would be saving approximately $0 per month. That’s right, they could buy a cheaper, smaller home, and still be paying the same amount. Sure, they’d get some equity on the trade, but their monthly costs would be the same, which is super important for people in retirement. Again, not a super attractive proposition.

It’s for this reason the term “Lock-In Effect” has been coined. Many economists and analysts believe the number of new listings could remain low for a few years while homeowners feel “locked in” to their unusually low mortgage rates.

It is worth mentioning that the number of homeowners who may be “locked in” varies considerably. According to the same Redfin report, Utah, Colorado, and Washington, D.C. have the highest proportion of homeowners with low rates. Oklahoma and Mississippi have the fewest.

While we don’t know if this Lock-In Effect will happen, the logic checks out. If it does materialize, it could have profound impacts on the housing market for years, if not decades to come.

It all comes down to inventory. If fewer homeowners put their homes up for sale, it could prevent inventory from recovering to more normal, pre-covid levels when the housing market was more balanced.

As I wrote recently, inventory needs to increase for prices to moderate or go down (or whatever you think will happen).

There are a lot of different metrics related to inventory, so let me explain.

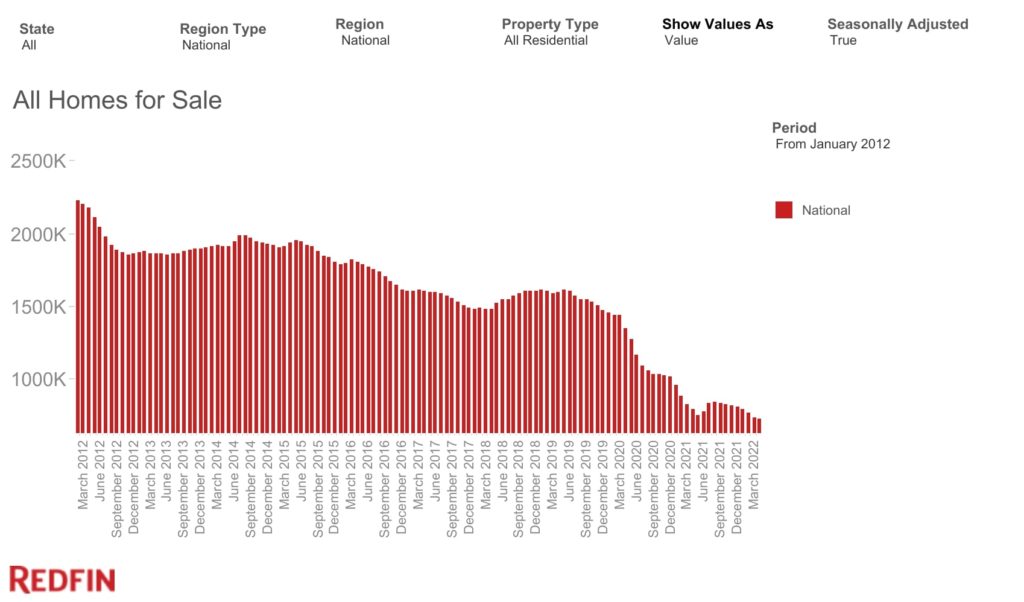

Inventory is defined as the total number of homes on the market at the end of a given month. It is a very useful metric because it combines both supply and demand. It factors in how many people put their house on the market (known as New Listings) as well as how many and how quickly those homes are being sold (demand).

This is where inventory is as of March 2022.

There’s a pretty dramatic story depicted in this chart. Pre-pandemic, we expected about 1.8M units of inventory over the busy summer months. Now, we’re at 600k.

As other housing market analysts and I believe, this number needs to increase for the housing market to return to a healthier and more normal level (or to crash). Prices were still appreciating when inventory was at 1.8M, so you can bet they’ll go up with dramatically lower supply.

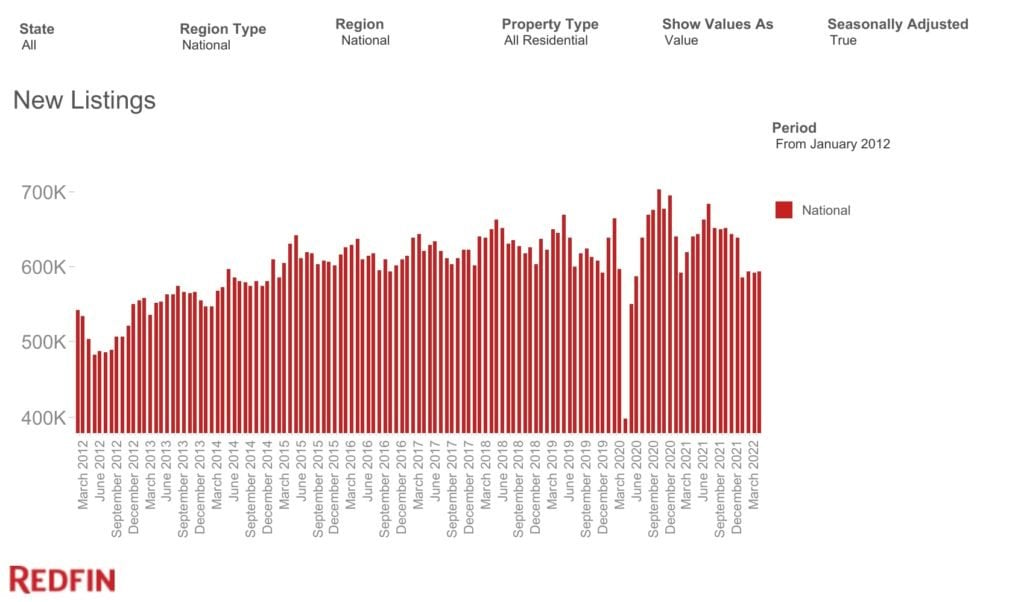

As demand moderates, inventory could start to pick up, but we’ll likely need to see more new listings. As of now, that’s not happening, as New Listings are down on a seasonally-adjusted basis.

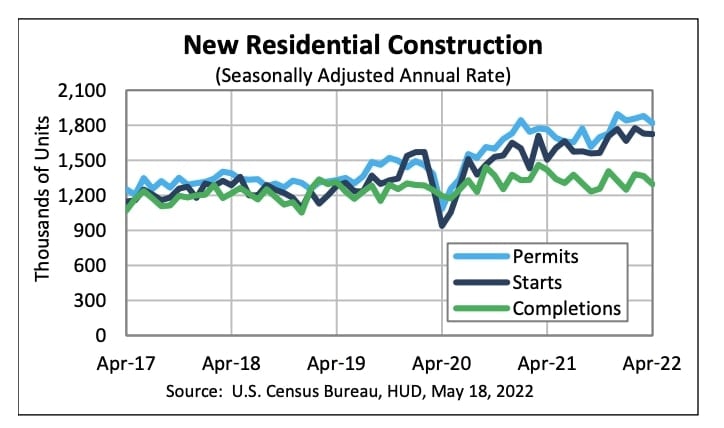

But, New Listings could increase from three places: homeowners selling, new construction, or foreclosures.

New construction could add to new inventory, but supply chain issues have suppressed completions, and new permits started to drop as of April 2022.

Many people believe a wave of foreclosures is coming and will add inventory, but that’s not going to happen. You can watch my other interviews and videos about that, but to put it shortly, mortgage delinquencies have dropped for seven straight quarters. Homeowners are not defaulting. Could a recession change this? Sure, but the inventory from a potential increase in foreclosures would be gradual and take years to play out.

The last and the most important source of New Listings are homeowners. Normally, as COVID-19 becomes a receding part of our lives, I would think that New Listings from existing homeowners would increase. But this is where the Lock-In Effect could come into play. If over 50% of homeowners with a mortgage have ultra-low mortgage rates, we may not see many homeowners list their homes for sale.

If fewer homeowners put their homes up for sale, that will put upward pressure on housing prices. Of course, some, or maybe all of that upward pressure, could be offset by the downward force of rising interest rates, but the impact of years of ultra-low rates will be a super important factor in the housing market, likely for many years.

I can even see a scenario where this Lock-In Effect impacts the market for decades. Again, interest rates during the pandemic were the lowest they’ve ever been, and it’s not clear if rates will ever get as low as they just were. Ever. And even if it does happen, it could be a long time before it does.

Personally, I think rates will rise for another year or so, but then we’ll see a gradual easing of interest rates. After all, the Fed has pursued easy money policies for about 15 years under four different administrations. While the Fed is temporarily raising rates, I don’t currently think we’re going back to an era of double-digit mortgage rates. At the same time, I also don’t know if we’ll see a 2.7% fixed-rate mortgage again in our lifetimes. It’s only happened once and took a very unique set of circumstances to get there.

Of course, no one knows what happens next. But if you’re like me and want to get a sense of where the housing market is heading, keep an eye on the Lock-In Effect. It will be very interesting to see if the predictions of lower inventory come true. To keep track, just look at new listing and inventory numbers each month.

If you want more data-driven information about the housing market, investing, and the economy, check out On The Market, BiggerPockets’ newest podcast, where I’m the host. Every Monday, you can find new episodes on Apple, Spotify, or YouTube.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com