How to Analyze a Short-Term Rental Before Buying

Short-term rentals (STRs) have become increasingly popular investments over the past several years, and for good reason.

Recent data has shown that short-term rentals have weathered the pandemic better than their hotel counterparts and are poised for even greater growth in 2021. As my colleague Jason Allen wrote recently, rural/mountain regions and beach/lake communities are doing particularly well.

A lot of market factors signal that it’s a good time to be an STR investor, so now might be a good time to consider the strategy. But if you’re thinking about investing in an STR, you need to learn how to analyze a deal properly, as it’s a bit different than analyzing traditional rentals.

The concepts and metrics are the same in the end, but gathering the right data to input into your analysis is a bit trickier, and there extra factors to consider.

When I started searching for a short-term rental a few years ago, I knew that the foundations of deal analysis were essentially the same: income, rehab costs, utilities, property management, etc. I quickly realized the problem was finding good data. I was unsure how to alter the assumptions I regularly make when analyzing a traditional rental to account for the nuances of an STR.

But being the data enthusiast that I am, I obsessively hunted down the best information for running STR deals and walked away with a great deal. Here’s what I learned.

Take an investing deep dive

Want more in-depth analyses like this from Dave? Successful investing requires accurate, easy-to-understand information about your properties and the markets you invest in. BiggerPockets Pro gives you the information you need to find your next great deal and maximize your current investments.

Revenue

Unlike traditional rentals, STRs have variable income. Meaning you don’t have a lease with a fixed amount of rent coming in. Instead of being able to estimate rent, I learned that I needed two inputs to estimate my income: occupancy rates and average daily rate (ADR).

Occupancy rate = the percentage of nights per month you have a guest in your property.

ADR = the average price the guest pays for a night in your property.

In its simplest form, all you need to do is multiply occupancy rate by the number of days in the month by ADR to get your estimated monthly income.

Occupancy Rate x Calendar days in month x Average daily rate = Estimated monthly income

If you are analyzing a deal in a metro area where bookings are consistent year-round, that’s all you need to do. You have your estimated revenue!

But if you’re like me and are considering an STR in a vacation area (mine is in a mountain town) you’ll want to get a bit more sophisticated in your analysis and account for seasonality.

What is seasonality?

Seasonality is a statistical term that measures patterns in data over time; it doesn’t actually have anything to do with the seasons. Many STRs experience what is known as annual seasonality—revenue follows a similar pattern each year.

For me, that pattern is a huge spike in revenue during the ski season (December-March), followed by a slowdown in the spring mud season (April-May). Then I have my best months over the summer, from June-August, followed by another down season from September-November.

Because this pattern of peaks and valleys occurs every year, it’s important that I factor in seasonality to make sure my analysis is as accurate as possible and ensure I am not at risk of cash flow shortfalls during my slower periods.

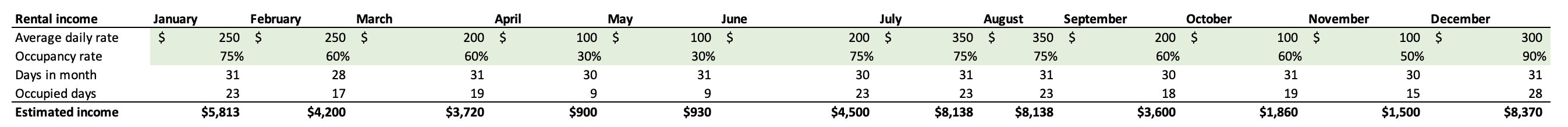

Estimating monthly revenue

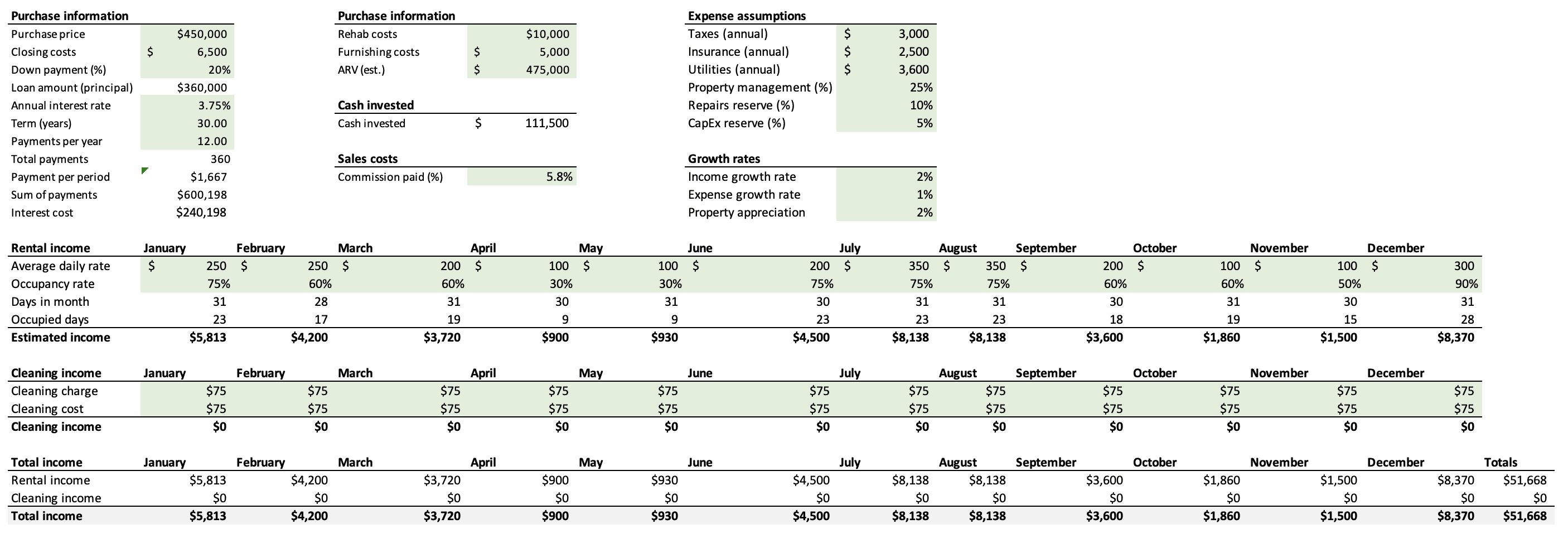

In order to do this, you need to create a table to estimate monthly revenue. It should look something like this.

I’ve used my occupancy rate and number of days in a month to calculate my occupied days and then multiplied that by ADR to get my estimated revenue.

Note: This screenshot is taken from the Excel calculator I made. Just put your numbers into the green cells.

Having made this table I have a good idea of what my cash flow will be for the entire year and for the individual months. Seeing the data laid out this way helped me realize that I would need to keep extra reserves on hand during the mud seasons. For a normal rental, I try to withdraw and reinvest excess profit as much as possible. With my STR, I am a bit more conservative.

How to find out occupancy rates

If you’re wondering where to get data on occupancy rates, there are two good places.

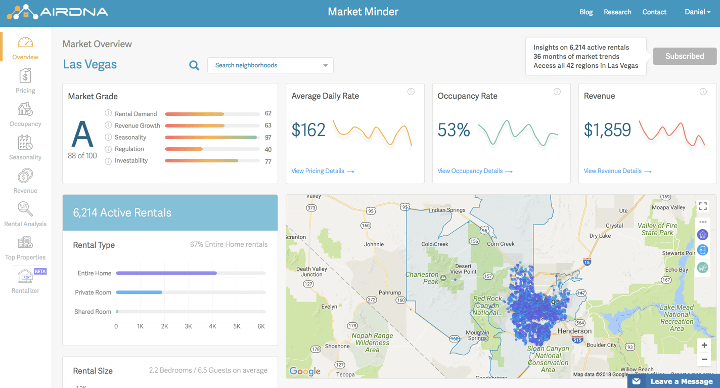

Option 1 is AirDNA. AirDNA is a company that provides all the relevant data you need to run a good analysis of an STR deal. You can see an example of one of their dashboards below.

Not only do they show high-level stats about the market, but they also show occupancy rates and ADR by month, enabling you to conduct a thorough analysis as we outlined above. Prices depend on which market you want to look at, but generally run about $30-$50 per month per market. Not bad for helping you make a good decision on an investment.

If you don’t want to pay for the data, it’s time to start counting. Go on Airbnb, VRBO, or wherever and calculate these numbers yourself.

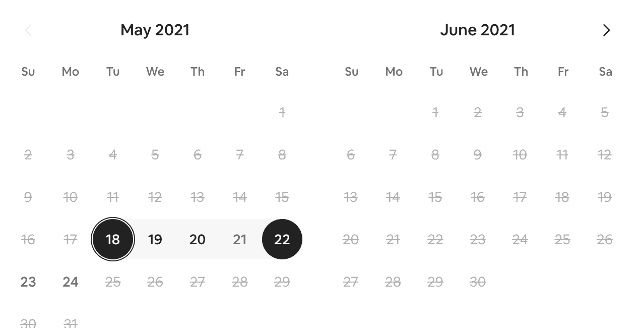

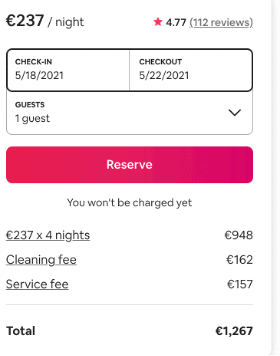

As you see in the picture below from Airbnb, you can figure out occupancy rates by clicking on any property’s calendar. From this example, I can see that this property is occupied for 25/31 (81%) days in May and 30/30 days in June (100%)—that’s great occupancy.

It also tells me the rate per night.

If you’re going to go this route, make sure you are thorough. Look at several properties that are good comps for your deal and look at their calendars year-round to account for seasonality.

But honestly, buy the data from Airbnb and save yourself this headache.

So that’s it. To estimate rental income, figure out ADP, occupancy rate, and seasonality. Once you have those numbers, you can plug them right into the calculator and start analyzing your deal.

More on short-term rentals from BiggerPockets

Cleaning fees

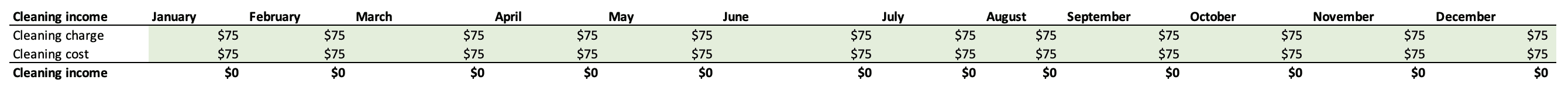

Another source of revenue is cleaning fees. Some hosts choose to engage in cleaning fee arbitrage by charging the guests slightly more than it costs the host to have the place cleaned.

Personally, I don’t do this. I just charge what I want to make and make my prices transparent. But if you want to do it you can enter those numbers into the calculator below.

In order to get this data, it’s as simple as just calling around to some cleaning services to get a quote. If you’re going to clean your property yourself, then you just put in what you think your time is worth and is a reasonable price for guests to pay.

And with that, we have figured out the revenue half of the analysis equation. On to expenses.

Estimating expenses

When examining expenses for an STR, the inputs are basically the same big categories: financing, taxes, insurance, property management, rehab costs, and utilities. You do also need to add one other important category as well: furnishing. Let’s go through these one by one.

Furnishing costs

Let’s just start with the biggest challenge for me: furnishing. Furnishing my STR was extremely stressful and time-consuming (but worth it!). My STR is big–five bedrooms—and I completely underestimated the cost and time it would take to furnish. I kid you not, at one point I picked up 187 boxes from IKEA. Breaking down those boxes and hauling them to the recycling drop-off took me eight hours.

Oh yeah, and this casual delivery from Wayfair.

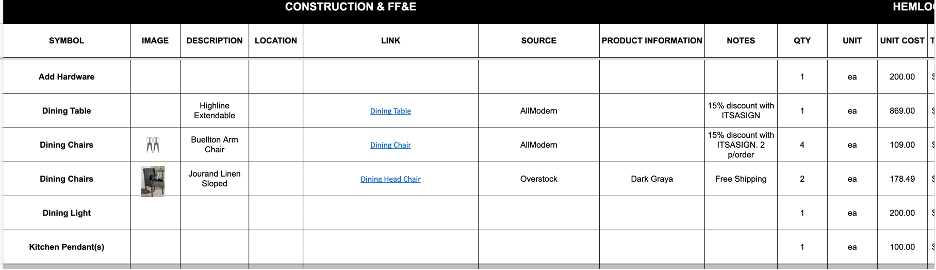

I’m showing you this because I miscalculated my budget by about 35% even though I thought I was being diligent. Luckily I had built in some contingencies, but I would highly recommend spending a good amount of time creating a furnishing budget for any STR you plan to purchase, then adding 25% to it. There is so much you forget. Here is a good list to get you started. Put this list in a spreadsheet and start shopping.

Mine looked like this.

IKEA, Wayfair, whatever you want to use–just be diligent to add up all your costs. You can be thrifty, but don’t be cheap. People want to feel like they’re in a nice place when they’re traveling. Buy durable, nice products for a good value. It’s an upfront investment, but it will pay off with good reviews, higher occupancy, and a higher ADR.

When you’re still in the deal analysis phase, you still should do this. If you know you’re looking for a two-bedroom, you can add up the costs of furnishing a generic two-bedroom. Add up kitchen expenses, linens, towels, and everything else. Then add 25% to ensure you account for whatever unique items will be required when you find the actual property you’re going to purchase.

Do not overlook the furnishing. It’s hugely important and an entirely new expense that needs to be added to the traditional rental analysis. Make sure you have the cash on hand to properly furnish an STR. Going cheap here will hurt your revenue and diminish your returns.

Financing

Financing for an STR is really not that different from other types of deals. Of course, you cannot get an FHA loan or any other type of owner-occupied loan, but for all intents and purposes, you can calculate financing the same for STRs as you would for a traditional rental property.

Taxes

For the most part, taxes won’t change whether you’re using your property as a traditional rental, owner-occupied, or STR. You do, however, want to check what taxes your municipality may levy on STRs. Many towns, for example, have STRs pay an occupancy tax similar to what hotels pay. Others, like the town my STR is in, have you pay a flat annual fee for a license. Make sure to build these costs into your analysis.

Insurance

As always, the only way to get a good idea of insurance costs is to call a broker. Do that! STR insurance can be a bit higher than other forms of property insurance. When deciding if you want to use a property management company (more on that next), check whether they offer any type of insurance. My PM company offers damage insurance for furniture and the contents of the house, which definitely comes in handy.

Property management

This is a big deal with STRs, and coming from self-managing my other rentals, it was a big change for me. But I have to say, I love it. I hired a full-service property management (PM) company that does all the interactions with the guests, coordinates cleanings, handles maintenance, sets prices, restocks things that break, applies for and maintains my licenses, prepares my tax documents at the end of the year, and more. It’s great.

But of course, they charge me a lot for that. I pay about 20% of revenue for this service (as opposed to 8-12% for traditional property management), and PM fees can actually go up to 40%. Prices are coming down due to increased competition in the market, but I recommend Googling and calling around to get some quotes.

Reviews are everything in the STR game, and if you are going to hire a PM company, guests are essentially going to be reviewing the PM company’s performance. Remember that you get what you pay for and pick a good company.

Rehab costs

There’s no difference between rehabbing an STR and another rental. Since BiggerPockets has tons of great content on how to estimate rehab costs, I am not going to get into that here. My only piece of advice: Go durable.

The wear and tear on an STR are higher than in a rental. Buy stuff that will last, even if it’s more of an upfront investment. It will save you money in the long run, trust me. If something can break, an STR guest will find a way to break it.

Repairs and maintenance

Double what you think you’re going to need for repairs and maintenance just to be safe. While the majority of guests are good people and mean well, people use STRs hard. They are on vacation! They want to party, or cook an overly ambitious meal, or disassemble a retaining wall to build a fire out in wildfire country in the middle of a drought. Who knows what they do in there!

Get used to it–it’s just the cost of doing business. Ten percent of revenue should suffice in most cases. I reserve 15% because my house is definitely a party house.

Utilities

Utilities, unfortunately, cannot get passed along to tenants, as is common with traditional rental properties. You’ll need to Google or ask your property management company for insight into how much utilities will cost.

Estimate high. People are on vacation! Sometimes they want to watch TV while sitting in a hot tub while running the air conditioning with the doors open. You can’t stop them!

Putting it all together

Now that we’ve gone over how to estimate your revenue and expenses, it’s time to analyze the deal. And lucky for you, you can use the calculator I made to do this in under five minutes.

Simply adjust the green cells on the inputs tab.

And then click on the “Results” tab to get your analysis! It’s as easy as that. From there you can evaluate the results the same as you would for a normal rental, cash-on-cash return, and compound annual growth rate being my personal favorites for looking at the long-term returns on an STR.

Taking on this new strategy was a really interesting process for me, but I am so glad I did it! My property has been doing really well, generating great returns, and staying really hands-off because I hired a full-service PM company.

I also think it came out looking great.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com