How Much Debt is America In? Charting the Debt Crisis

In case you’ve had your head comfortably situated beneath the sand for a very long time now, you are well aware that the United States is awash in debt. Government debt, municipal debt, corporate debt, personal debt, mortgage debt, student loan debt, car debt, and credit card debt. Etcetera.

However, for this post, we’ll focus exclusively on the massive federal government debt. A debt that, especially with the massive deficit the United States ran in 2020 (a cool $3.7 trillion), is becoming quite a problem.

Are you ready to invest?

One of the most frequently asked questions in the BiggerPockets forums is “How can I start investing in real estate with no money and bad credit?” The answer? You shouldn’t. You need to fix your situation and invest from a position of financial strength.

Charting America’s debt

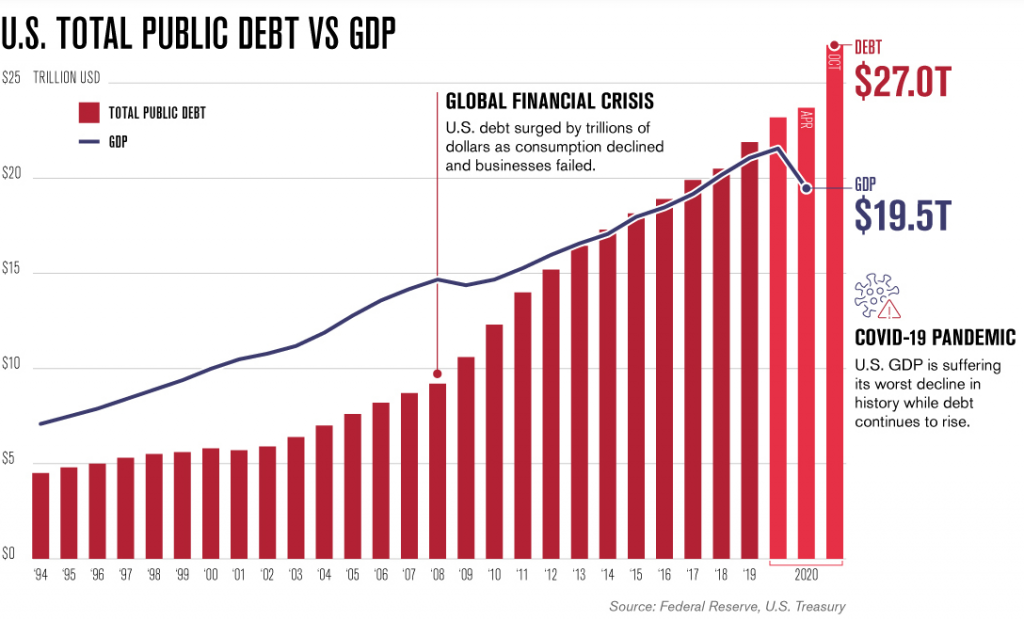

Visual Capitalist has released another analysis filled with their usual nifty visuals that puts the sheer quantity of the government’s rapidly increasing debt into perspective.

The rapidly climbing chart actually looks better than it is because, as you can see, 2020 is broken out into quarters and doesn’t even go all the way until the end of the year. Indeed, the chart appears to be exponential, which is not a good thing when it comes to debt. After all, what can’t go on forever, doesn’t.

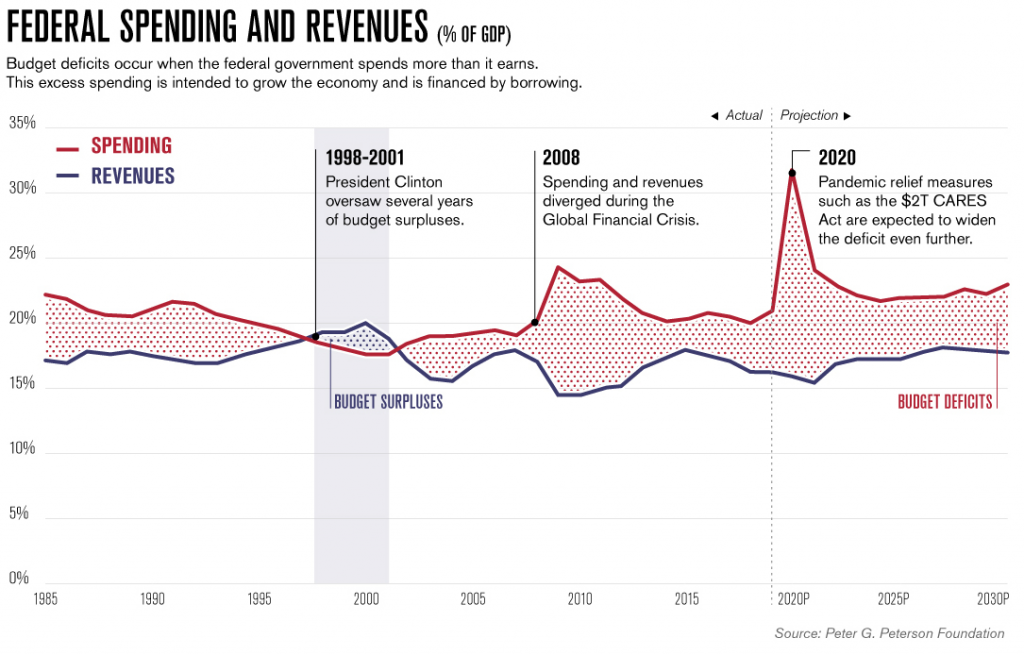

At least regarding the deficit, however, things are projected to improve and get back to a more “normal” deficit. Unfortunately, it is still not projected to get anywhere near a balanced budget anytime soon. Indeed, over the past 35 years, we only had a positive surplus for a very short while in the late ’90s.

The debt, on the other hand, has grown enormously both in real terms and as a percentage of GDP. And Visual Capitalist notes:

“U.S. debt was relatively moderate between 1994 to 2007, averaging 60% of GDP over the timeframe. This took a drastic turn during the Global Financial Crisis, with debt climbing to 95% of GDP by 2012.

“Since then, America’s debt has only increased in relative size. In April 2020, with the COVID-19 pandemic in full force, it reached a record 122% of GDP. This may sound troubling at first, but there are a few caveats.”

The government debt has effectively doubled over the past 15 years.

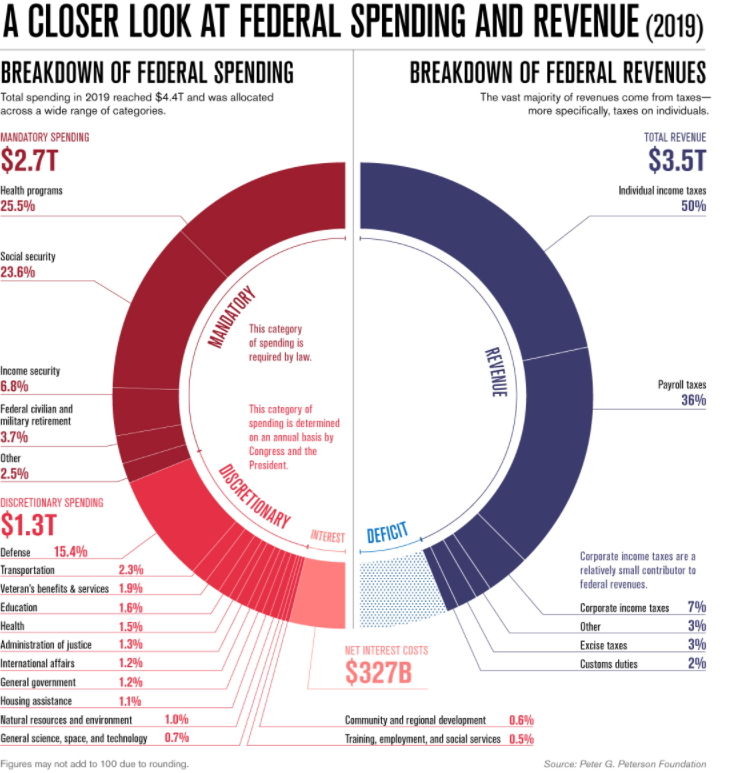

And of course, as every borrower knows all too well, this amount of debt comes with very large interest payments that continue year in and year out as the debt grows larger. “For FY2019, this was approximately $327 billion,” per Visual Capitalist.

Components of the federal debt

The piece by Visual Capitalist also notes where all of this spending goes. A full 62.2% of spending, or $2.735 trillion, goes to mandatory spending, including things like health programs ($1.1 billion), social security ($1 billion), and income security ($301 billion).

30.4%, or $1.338 billion, goes to discretionary spending, which includes things like transportation ($100 billion) and education ($72 billion). But by far the most goes to the military, at $677 billion (which accounts for 37% of the entire world’s military spending). And again, there’s that pesky $327 billion that goes toward debt service.

I should note that this doesn’t include state and municipal government spending, which is where most of the spending for things like education comes from.

Revenue is a bit simpler (and smaller) and comes from the following sources.

| Category | Amount (USD billions) | Percent of total revenues |

| Individual income taxes | $1,732B | 50% |

| Payroll taxes | $1,247B | 36% |

| Corporate income taxes | $242B | 7% |

| Other | $104B | 3% |

| Excise taxes | $104B | 3% |

| Customs duties | $69B | 2% |

| Total revenues | $3,464B | 100% |

Understanding federal spending

Visual Capitalist also helps us visualize this mass of spending and where it goes/comes from in another helpful chart.

Visual Capitalist concludes:

“Looking beyond COVID-19, however, does reveal some warning signs. One frequent criticism of the ever-growing national debt is its associated interest costs, which could cannibalize investment in other areas. In fact, the effects of this dilemma are already becoming apparent. Over the past decade, the U.S. has spent more on interest than it has on programs such as veterans benefits and education.”

In my own judgment, we don’t face a short-term crisis, but if interest rates rise, things could get very ugly and the government will likely have to raise taxes at the same time interest rates are climbing. In other words, a recession, and possibly a very bad one. By no means does this mean you should stop investing, but it should encourage a bit of caution.

More on personal finance at BiggerPockets

A great credit score, some cash in the bank, and strong stable income can be invaluable assets for those looking to begin or add to their real estate portfolio. For a more in-depth discussion and debate about best practices in personal finance, you may want to check out the Personal Finance Forum.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com