How Biden’s Neighborhood Homes proposal impacts real estate investors

Auction.com buyer and real estate investor Sue McCormick is ahead of the curve when it comes to President Joe Biden’s plan to revitalize underserved neighborhoods while also providing affordable housing for low- and moderate-income homebuyers.

“My passion is really going back into the neighborhoods I grew up in and helping to enhance those areas through my rehabs,” said McCormick, who lives in Atlanta but is buying investment properties in her hometown of Dayton, Ohio. “And I also want to make a profit, of course.”

Since buying her first investment home in early 2020, McCormick said she has purchased or is in the process of purchasing 11 more in the Dayton area — all for under $50,000 and all in need of extensive rehab.

“The first house I rehabbed last year, it was a house that had fire damage in the kitchen, and it was just kind of an eyesore on a nice quiet street,” said McCormick, who said she purchased the home for $25,000 and then put $65,000 into renovations before selling to an owner-occupant buyer for $134,000.

“It was in a predominantly African-American area close to my childhood home,” McCormick continued. “To see older people and even some younger homeowners walkthrough and literally thank me … That really made this project extra special.”

Local Investment at a Larger Scale

McCormick’s real estate investing strategy and its outcomes in underserved Dayton neighborhoods represent a microcosm of what a new tax credit proposal from the Biden administration is designed to encourage across the country in similar neighborhoods. Dubbed the Neighborhood Homes Tax Credit, the proposal is part of the larger American Jobs Plan legislation — also known as Biden’s infrastructure plan.

The tax credit’s goals include attracting “private investment in the development of affordable homes,” and bolstering “homeownership rates for low- and moderate-income homebuyers in underserved communities,” according to a White House fact sheet.

The tax credit is structured to incentivize the type of homeownership-producing development that McCormick is doing, but on a larger scale, according to Julia Gordon, president of the National Community Stabilization Trust (NCST).

“NCST strongly supports this legislation, which is different from other real estate development incentives because it is reserved for homeownership only. Our organization has worked on it for about five years now, and we manage the large coalition that has been supporting its passage,” Gordon said. “The goal is to support rehabbing or constructing homes at scale, so we could potentially see comprehensive community revitalization projects that affect 50, 100, or even more units.”

Identifying Underserved Neighborhoods

Properties in underserved Census tracts will qualify for the tax credit, which will go to help cover losses that developers might experience when investing in these areas. The White House estimates about one in four Census tracts are underserved, defined as those with poverty rates that are at least 130% of the area poverty rate, have a median family income below 80% of the area median family income and have median home values that are lower than area median home values.

The Neighborhood Homes Coalition, the coalition led by NCST in support of the proposal, has created a map showing which Census tracts qualify.

Nearly one-third of the more than 70,000 Census tracts nationwide (32%) are classified as low-income, meaning the tract’s median income is at or below 80% of the area median income, according to the 2019 Low-Income Areas File from the Federal Housing Finance Administration (FHFA).

In Montgomery County, Ohio, where the city of Dayton is located, 39% of Census tracts are classified as low income. The county’s 59 low-income Census tracts are the 80th highest number among more than 3,000 counties nationwide.

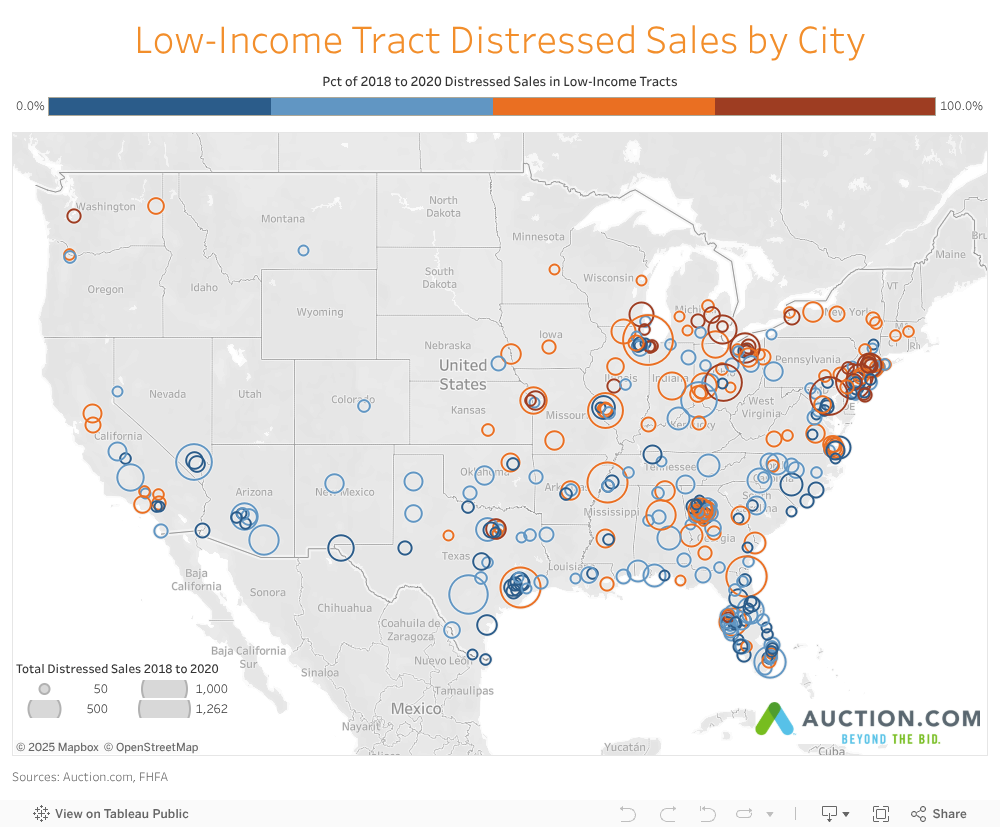

Markets with Most Qualifying Inventory

Between 2018 and 2020, a total of 218 distressed properties — either foreclosure sales or bank-owned (REO) sales — in low-income Census tracts were sold via the Auction.com platform in the city of Dayton. That was the 20th highest of any city nationwide and represented 64% of all distressed property sales in Dayton during that period. By comparison, only 34% of all distressed property sales nationwide between 2018 and 2020 were in low-income Census tracts, according to the Auction.com data.

The top five cities with the most distressed property sales in low-income Census tracts between 2018 and 2020 were Chicago (902), Baltimore (606), Memphis (541), Columbus, Ohio (533), and Philadelphia (531). The average price of a distressed property located in a low-income Census tract in those five cities ranged from $40,592 in Memphis to $86,338 in Philadelphia. The average price for a distressed property located in a low-income Census tract in Dayton was $38,668 — right in the middle of McCormick’s purchase price range.

var divElement = document.getElementById(‘viz1626897583563’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; if ( divElement.offsetWidth > 800 ) { vizElement.style.width=”1000px”;vizElement.style.height=”827px”;} else if ( divElement.offsetWidth > 500 ) { vizElement.style.width=”1000px”;vizElement.style.height=”827px”;} else { vizElement.style.width=”100%”;vizElement.style.height=”727px”;} var scriptElement = document.createElement(‘script’); scriptElement.src=”https://public.tableau.com/javascripts/api/viz_v1.js”; vizElement.parentNode.insertBefore(scriptElement, vizElement);

Achieving Better Neighborhood Outcomes

Purchasing properties in underserved neighborhoods alone won’t allow developers to qualify for the tax credit. They’ll also need to sell the rehabbed properties to eligible homebuyers — presumably owner-occupants, although the proposal doesn’t explicitly specify that — for an affordable price point. The proposal defines that affordable price point as one that does not exceed four times the area median family income. Additionally, properties must be sold to buyers with incomes not exceeding 140% of the area median family income.

Local investors like McCormick are also well-aligned when it comes to achieving those desired outcomes of homeownership and affordable inventory. And investors like McCormick are achieving these socially responsible outcomes even while raising home values through extensive rehab and while building wealth for themselves.

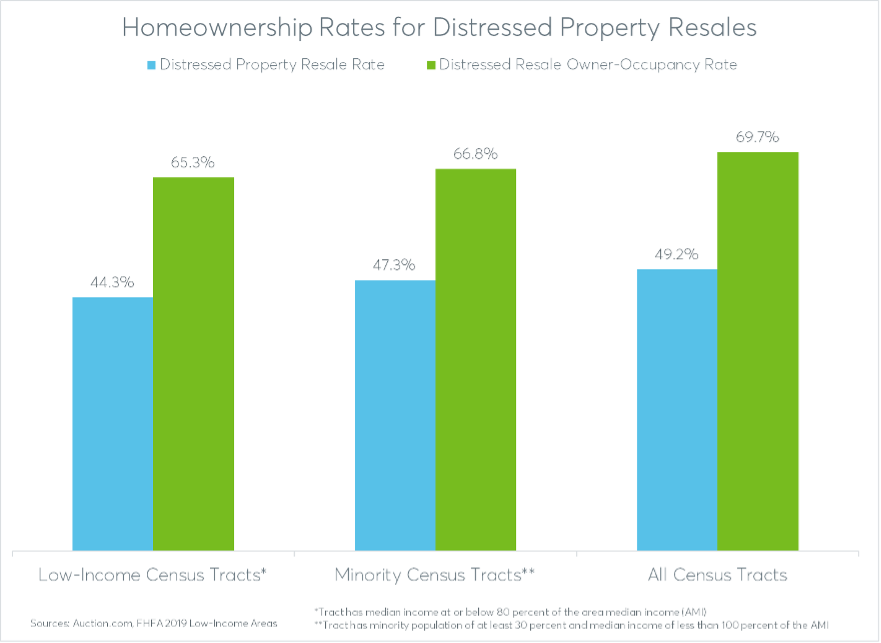

Among more than 110,000 distressed property sales on the Auction.com platform between 2018 and 2020 with Census tract information available, 49.2% were subsequently resold, according to an analysis of subsequent sales using public record and multiple listing service (MLS) data. The public record data also shows that 69.7% of those resales were owner-occupied — well above the national homeownership rate of 65.% in the first quarter of 2021, according to the Census Bureau.

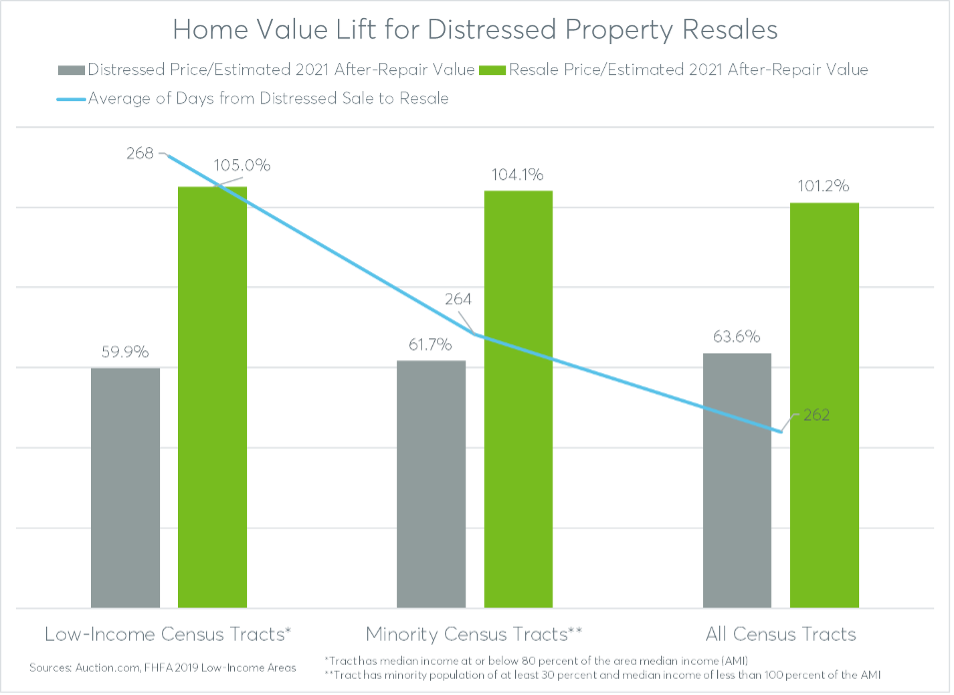

The average distressed property price was 63.6% of the property’s 2021 estimated market value (assuming good condition), but the subsequent resale price was 101.2% of the 2021 estimated market value. This 38-percentage-point lift in value implies extensive renovations between distressed purchase and resale — which was an average of 262 days.

Low-Income-Tract Outcomes

The resale rate and owner-occupancy rate were about five percentage points lower, but still impressive, for the subset of more than 37,000 distressed property sales in low-income Census tracts: 44.3% subsequently resold, and 65.3% of those resales went to owner-occupant buyers. Among minority Census tracts — defined by the FHFA as those with a minority population of at least 3% and a median income of less than 100% of the area median income — 47.3% of distressed sales were subsequently resold, and 66.8% of those resales were to owner-occupant buyers.

In some cases, the outcomes were even more impressive in low-income and minority tracts. In low-income tracts, the resale price was 105.0% of the 2021 estimated market value, a 45 percentage point increase in value from the 55.6% of 2021 market value represented by the distressed sale price. In minority tracts, the resale price was 104.1% of the 2021 estimated market value, a 42 percentage point lift.

Even with the steep increase in home values, low-income tracts still solidly outperformed when it came to affordable housing. The average resale price of previously distressed properties in low-income tracts was $193,444, 20% lower than the average resale price of $240,589 for previously distressed properties not located in low-income tracts.

The resale rate of distressed properties in low-income tracts in Dayton was a below-average 28.5%, but the owner-occupancy rate for those resales was an above-average 68.3%. Thanks to extensive rehab, smaller, community-focused investors like McCormick are raising the price-to-value ratio by an astounding 63 percentage points. Even with that significant improvement in value, the average resale price for previously distressed properties in Dayton’s low-income tracts is well below the national average at $86,405.

“It was really fulfilling to do that,” McCormick said of her first distressed property rehab and resale, noting the sale of that property helped build wealth for other homeowners in the neighborhood. “After we listed, a couple others sold and got a premium for their homes.”

The post How Biden’s Neighborhood Homes proposal impacts real estate investors appeared first on HousingWire.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com