Fratantoni: Why FHFA and GSEs should revisit their pricing framework

Potential homebuyers in today’s market are facing a number of challenges, including increasing mortgage rates and a sizeable supply and demand imbalance that is pushing home-price appreciation to very high levels throughout the country. MBA’s Purchase Application Payment Index (PAPI) has increased by 32% thus far this year, indicating that payments have risen much faster than personal income.

Primary mortgage market rates are a function of several factors. First, mortgage rates are influenced by benchmark rates, including longer-term Treasuries. These rates are impacted by the strength of the economy, the level of inflation, and the expected direction of monetary policy, among other factors.

Secondary market rates, yields on mortgage-backed securities, are determined by factors that influence the supply and demand of these securities. These include expected prepayment rates, expectations of net supply to the market, and drivers of net demand from different investors including banks, Fannie Mae and Freddie Mac (the GSEs), asset managers, global investors, and in recent times, the Federal Reserve.

The spread between primary and secondary rates is impacted by yet another set of drivers, including the level of available capacity in the industry — which can vary significantly over the cycle; servicing values, which are impacted by market demand for MSRs, including any changes to servicing costs; and credit pricing, which includes guarantee fees, loan-level price adjustment (LLPAs), and mortgage insurance premiums (MIPs).

The primary mortgage market is intensely competitive, as I highlighted in a column earlier this year. Lenders are essentially price-takers in this market. If they raise their offered rates much above the market, they will lose the business. If they lower them much below market rates, they won’t be able to cover their costs in the long run.

In this column, I will walk through how FHFA, Fannie Mae and Freddie Mac determine their pricing, and why recent pricing changes to high-balance loans and second homes deserve a review for reconsideration, particularly if the Federal Housing Finance Agency (FHFA) wants the GSEs to use these products to generate sufficient funds to further subsidize loans to “core mission” borrowers.

The secondary market entities face a different challenge.

Fannie Mae, Freddie Mac, FHA, the U.S. Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) have substantial market and pricing power. When Fannie and Freddie — through their regulator, FHFA, — decide where to set prices, or when FHA sets the MIP, they are not facing a situation of perfect competition, and hence have the ability to set prices at levels that might be different than where competitive markets would go.

However, there are certainly limits to the pricing power of these agencies. While private markets, either portfolio or private-label security (PLS) executions, may not readily be able to compete for agency business, if rates are pushed too high, these alternative executions may offer a better deal for lenders and their customers, particularly for low-risk loans. On the other hand, for some parts of the business that may be higher risk, if agency pricing is too high, these borrowers may not have another place to turn.

I began my career in the mortgage industry at Fannie Mae, helping to develop some of the analytical models that provided inputs into Fannie’s guarantee pricing model. While I have not been at a GSE for some time, by following FHFA’s guarantee fee report and other public information, my understanding is that the conceptual basis for credit pricing has not changed.

On a fundamental basis, the credit price for a loan, the base guarantee fee and the LLPAs, should cover both the expected losses from the loan and GSE administrative costs. The GSEs earn float income for the period of time they hold principal and interest payments, which provide a small offset to these costs. However, the largest component of credit pricing is a function of the capital that each GSE needs to hold against a stress level of credit losses associated with the loan (e.g., the level of losses for that type of loan experienced during the Great Financial Crisis (GFC) as a result of large declines in home prices and a deep recession).

To put numbers on it, while a certain loan might have an expected loss (in normal economic conditions) of 40 basis points (1% probability of default, 40% loss given default), in a stressful environment, that same type of loan might have a loss of 200 basis points (4% probability of default, 50% loss given default). Like an insurance company, a GSE needs to be sure it has sufficient resources to weather an appropriately severe stress event. Setting aside an appropriate amount of capital, and charging enough to earn a market rate of return on that capital, should do that.

You might recall the recent debates over FHFA’s revisions to the GSE capital requirements.

Market participants know that setting required capital for the GSEs too high would artificially inflate credit pricing and could reduce credit availability in the market. Setting it too low puts the GSEs at risk of another failure in the event of a severe recession or housing market crash. Beyond the top-line capital numbers, the precise calibration of required capital for different types of loans can have momentous impacts on how these products and loan-level attributes fare in the marketplace.

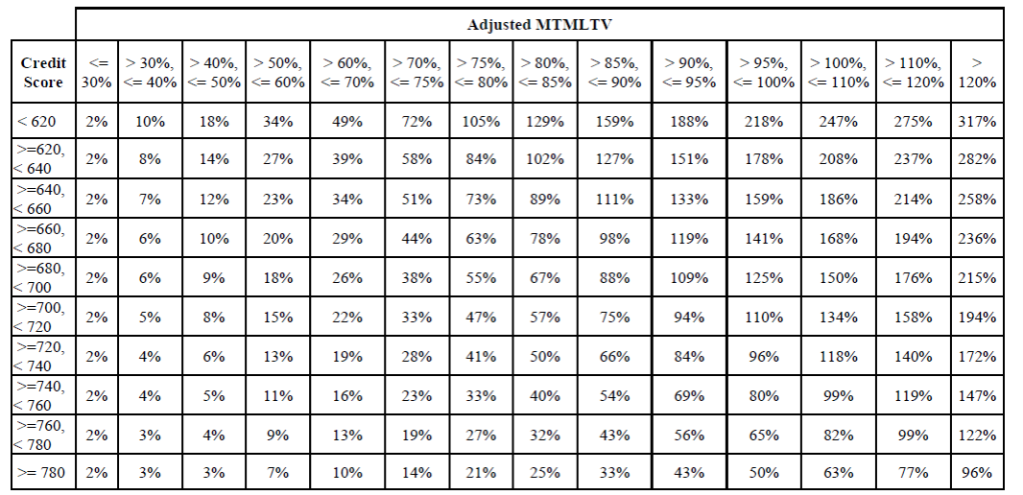

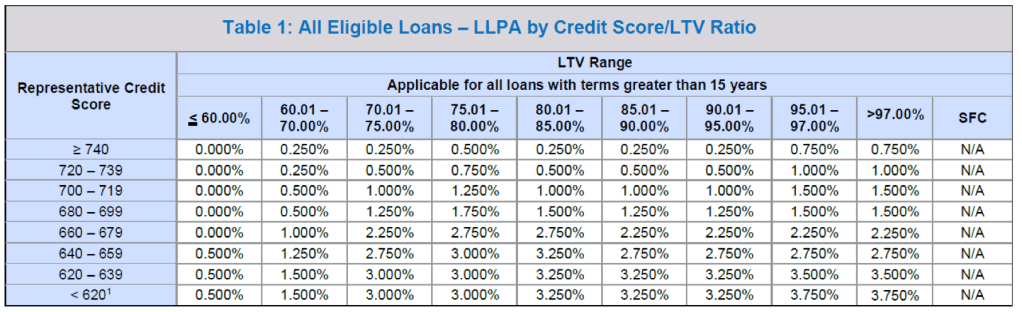

Exhibit 1 shows the grid of capital requirements for loans with different loan-to-value (LTV) ratios and credit scores from the FHFA capital rule. Exhibit 2 shows the “multipliers” used in the rule: for a loan with any given LTV ratio and credit score, loans with these attributes are projected to have a multiple of these loss rates in stressful conditions.

(As a quick example of how to read this: the base risk weight for a 720-740 credit score, 80-85% LTV ratio loan is 50%. That implies 4% capital given the 8% capital requirement. Now go to Exhibit 2 for the multipliers: A one-unit purchase loan (1.0 multiplier) for an owner-occupied home (1.0 multiplier) would require 4% capital, i.e., no adjustment. A cash-out refi (1.4 multiplier) on a condo (1.1 multiplier) would require (1.4×1.1=1.54 x 4%) = 6.16% capital).

Exhibit 1: Base risk weights from FHFA’s Enterprise Capital Final Rule, Table 2 to Paragraph (c)(1)

Source: Enterprise Capital Final Rule for Website.pdf (fhfa.gov), Page 263

Exhibit 2: Multipliers from FHFA’s Enterprise Capital Final Rule, Table 6 to Paragraph (d)(2), see: Enterprise Capital Final Rule for Website.pdf (fhfa.gov), page 265.

Economists, data scientists, statisticians, market participants, and others could argue all day about these numbers and the underlying data and models that created them. For example, many view the multiplier on TPO loans may be too high. However, following a notice and comment process and several rounds of reviews, these fundamental credit risk estimates for a wide variety of mortgage loans are generally defensible.

But we have not reached the end of the story.

While these estimates of relative risk that enter the capital requirements are a critical component of the guarantee fees and LLPAs that the GSEs charge, the GSEs and FHFA take another step when it comes to setting pricing, subjectively adjusting relative prices to require a premium on certain types of loans, while cross-subsidizing others.

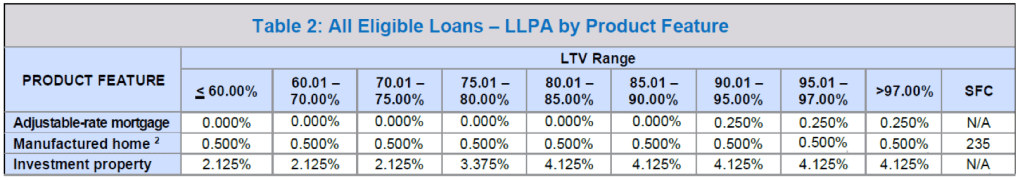

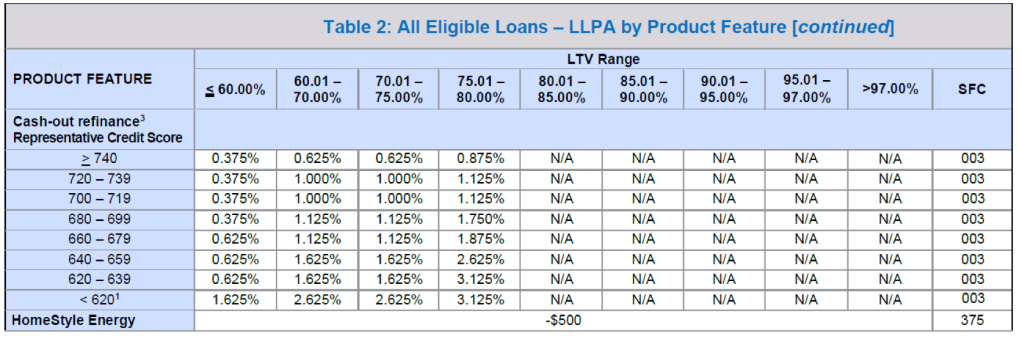

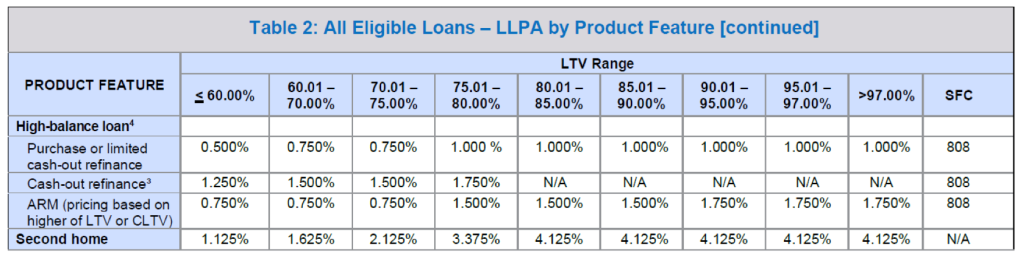

Exhibit 3 shows a portion of the current LLPA grids for Fannie Mae. Of course, these LLPAs are in addition to base guarantee fees (which include a 10-basis-point add-on which goes to the government, not towards covering credit costs), which are running at about 55 basis points, of which 45 basis points go to the GSEs. Using a 5:1 multiplier, total credit pricing for an 80% LTV ratio, 740 credit score, otherwise vanilla loan would be 45 + (50/5) = 55 basis points.

As mentioned above, due to their market power, the GSEs are price-makers rather than price-takers, at least to some extent. While there are alternative executions available for some categories of loans that the GSEs guarantee, these alternatives may involve more friction, more risk, and/or different regulatory or other requirements. With respect to risk, at least historically, non-agency executions have been more susceptible to financial market disruptions, while the agency channel has been able to remain open given the government support.

However, while these alternatives may typically be more expensive, market conditions combined with GSE pricing may change that comparison. As noted above, if GSE prices are too high, lower-risk loans may go to depository balance sheets or PLS. If pricing on higher-risk loans is too low, the GSEs may take market share away from FHA or other government agencies or they could be adversely selected, winding up with a larger share of higher-risk loans than they had intended.

What does Exhibit 3 show when compared with Exhibits 1 and 2? With respect to credit scores and LTV ratios, both required capital and credit pricing increase significantly with higher risk in both tables. Looking at the drop in pricing above 80% LTV ratios, loans which require private mortgage insurance or other credit enhancement, there is some recognition of the support provided by MIs, at least at higher credit scores. The cross subsidization appears in the relatively flat pricing gradient at higher LTV ratios for stronger credit scores in Exhibit 3, while Exhibit 1 shows a steeper relationship along these lines with respect to stress losses and required capital.

Let’s now examine the most recent set of pricing changes that were implemented as of April 2022. Shown in the last section of Exhibit 3/Table 2, these (large) LLPAs are for high-balance conforming loans and for second homes. However, loan size does not show up as a risk factor meriting a multiplier in Exhibit 2. Typically, default risk is somewhat higher for smaller loan sizes, all else equal, and there is somewhat more risk of higher loss given default for very expensive properties. However, it does not seem likely that the fundamentals would warrant a 50-175 basis point LLPA for high balance conforming loans. If it did, Exhibit 2 would likely show a multiplier.

Similarly, while the LLPAs are 112-412 basis points for second home loans, Exhibit 2 shows second homes receiving the same 1.0 multiplier as owner-occupied properties. For higher LTV ratios, the LLPAs for second homes are now the same as those for investment properties.

These price increases were intended, at least in part, to generate revenue which could be used to cross-subsidize loans that are closer to the core mission of the GSEs, particularly helping underserved markets and first-time homebuyers. These are worthy goals, but the question is whether such price changes, which seem to be very far removed from risk fundamentals, may not be effective at raising revenue if they push lenders to seek alternative executions.

Exhibit 3: Selections from Fannie Mae LLPA Grids as of 4/6/2022

Source: display (fanniemae.com)

So what’s next?

Mortgage lenders are battling through a steep decline in origination volume as the market transitions to predominantly purchase business. More than ever, every basis point will count as lenders and borrowers work to address worsening affordability conditions. As a result, credit pricing may get more attention in 2022 than it has in some time.

The industry is anticipating a reduction soon in the FHA MIP, given the agency’s strong capital position and further declines in delinquency rates. This would certainly help many potential first-time homebuyers. However, given the challenges in affordability and headwinds facing the housing market, this also is a good time for the GSEs and FHFA to make adjustments to their pricing framework, ensuring that their pricing effectively supports market liquidity and helps to fund their missions.

Michael Fratantoni is MBA’s Chief Economist and Senior Vice President of Research and Industry Technology.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Mike Fratantoni at mfratantoni@mba.org.

To contact the editor responsible for this story:

Sarah Wheeler at swheeler@housingwire.com

The post Fratantoni: Why FHFA and GSEs should revisit their pricing framework appeared first on HousingWire.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com