Did COVID-19 Affect Rent Prices? Here’s What We Know

Much has been made of the insane price appreciation in the housing market. Many cities are seeing housing prices go through the roof, with double-digit year-over-year gains. But what about rent? Are rents keeping pace with property appreciation in the nation’s biggest metros?

Let’s examine how rents have grown since the beginning of 2020, which cities have seen the largest rent growth, and which cities have slid backward since the pandemic began.

Methodology

For this dataset, I am examining Zillow’s Observed Rent Index (ZORI). I took that data and calculated five high-level metrics to see how rent has performed across 106 metro areas.

- Median rent growth for each city from January 2020 through April 2021. This gives us the most holistic look at what has changed since COVID-19 was introduced to all of us early last year. So I made this metric up, and I’ll call it the “Since COVID-19 Started” (SCS) growth rate.

- Year-over-year (YoY) growth

- Year to date (YTD) growth

- Month-over-month (MoM) growth shows up what happened between March and April 2021.

More Pro-only insights from Dave

Analysis

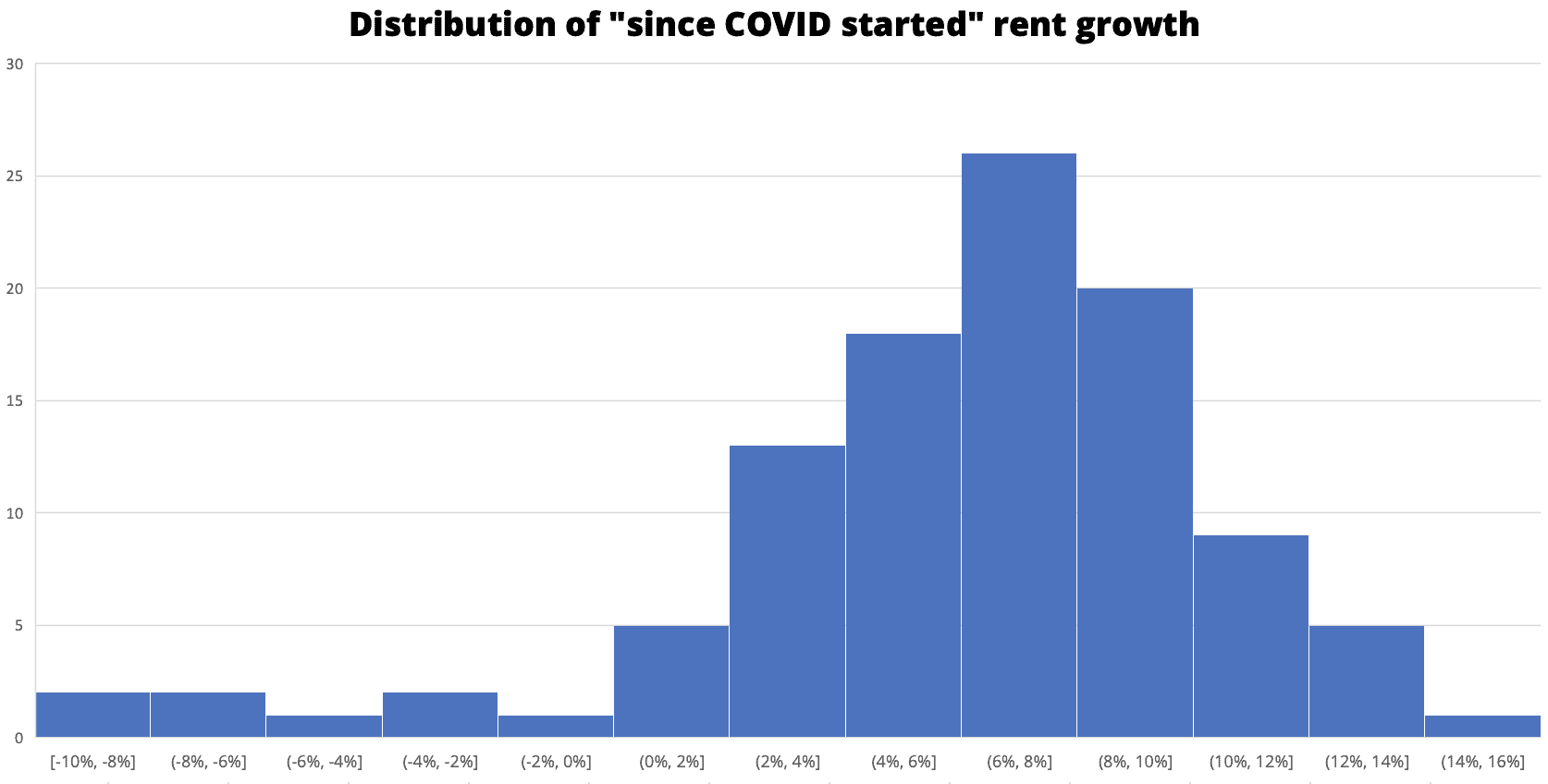

Let’s state the obvious: Rent went up in the vast majority of cities since COVID-19 started. The average growth rate is 5.8%, with a median of 6.8%. That’s a lot of growth!

To show just how many cities have seen rent increases since January of 2020, I made a histogram to show the distribution of growth rates. As you can see below, the most common bucket was 6-8% growth, followed by 8-10% growth.

The same chart for YoY rent growth looks pretty similar. I won’t publish it here but will tell you that the mean YoY growth rate was 5.2%, with a median of 5.7%. To put this in perspective, between April 2018 and April 2019 (the last non-COVID-19-affected year), the average rent growth rate was 4% YoY. Thus, rents grew faster on average during the pandemic than before the pandemic.

Five cities have actually posted double-digit growth rates over the last year: Boise, Idaho; Riverside, California; Tucson, Arizona; Spokane, Washington; and Phoenix, Arizona. All in the West.

After the top five, it gets more geographically dispersed. Memphis, Tennessee, is the first southern city on the list, sitting in sixth place with 9.9% YoY growth. Providence, Rhode Island, reps the Northeast in the eighth spot with 9.7% YoY growth.

Here’s a list of the top 10 performers.

| Region | Rank size | Year to date | Year-over-year | Since January 2020 | Month-over-month |

| Boise City, ID | 85 | 4.9% | 13.9% | 15.6% | 1.2% |

| Riverside, CA | 13 | 4.0% | 11.6% | 13.3% | 1.0% |

| Tucson, AZ | 53 | 3.7% | 10.7% | 12.4% | 0.9% |

| Spokane, WA | 99 | 3.5% | 10.5% | 12.2% | 0.9% |

| Memphis, TN | 41 | 3.2% | 9.9% | 12.0% | 0.8% |

| Phoenix, AZ | 14 | 3.6% | 10.4% | 12.0% | 0.9% |

| Stockton, CA | 77 | 3.3% | 9.9% | 11.5% | 0.8% |

| Providence, RI | 38 | 3.3% | 9.7% | 11.1% | 0.8% |

| Fresno, CA | 56 | 3.3% | 9.3% | 10.9% | 0.8% |

| Port St. Lucie, FL | 119 | 3.0% | 8.9% | 10.8% | 0.7% |

| Bakersfield, CA | 63 | 2.9% | 8.9% | 10.8% | 0.7% |

The cities near the top in one category are near the top in pretty much every category. In fact, Boise was the top city for YTD, SCS, and MoM. As of this writing, these markets are showing no signs of slowing down.

I wanted to test a hypothesis, so I used Zillow’s Size Ranking to test the idea that the SCS growth rate might be related to the size of the city. There does appear to be a small correlation at .36. This indicates that the smaller the city, the higher the rent growth rate tends to be—but it’s only a modest relationship as measured by correlation.

But just looking at the data visually tells me something a little different. Remember our histogram above? There were only eight cities that had rent growth of 0 or less: New York (1), Los Angeles (2), Chicago (3), Washington D.C. (7), Boston (10), San Francisco (11), Seattle (15), and San Jose (34). Seven of the eight cities that saw declining rents SCS were in the top 15 biggest cities.

It seems that while the “smaller cities are seeing better rent growth” hypothesis is not true when looking at the whole dataset, for a subset of the data (the largest of all cities), a fairly obvious relationship exists. Perhaps I should reword the hypothesis to be, “the largest cities are faring the worst.”

| Region | Rank size | Year-to-date | Year-over-year | Since January 202 | Month-over-month |

| New York, NY | 1 | 3.6% | 9.5% | 10.6% | 4.1% |

| Los Angeles-Long Beach-Anaheim, CA | 2 | 4.2% | 10.4% | 13.1% | 5.7% |

| Chicago, IL | 3 | 4.0% | 9.5% | 10.2% | 4.2% |

| Dallas-Fort Worth, TX | 4 | 5.6% | 11.9% | 13.0% | 8.1% |

| Philadelphia, PA | 5 | 5.0% | 13.3% | 14.7% | 4.2% |

| Houston, TX | 6 | 4.0% | 9.1% | 10.2% | 5.3% |

| Washington, DC | 7 | 4.9% | 11.5% | 12.7% | 3.7% |

| Miami-Fort Lauderdale, FL | 8 | 3.7% | 9.1% | 10.7% | 6.5% |

| Atlanta, GA | 9 | 5.7% | 13.0% | 14.7% | 7.7% |

| Boston, MA | 10 | 4.5% | 11.6% | 13.3% | 5.5% |

| San Francisco, CA | 11 | 3.9% | 7.4% | 8.8% | 6.8% |

| Detroit, MI | 12 | 3.8% | 11.0% | 13.4% | 7.4% |

| Riverside, CA | 13 | 7.1% | 16.2% | 17.8% | 6.7% |

| Phoenix, AZ | 14 | 7.8% | 20.4% | 23.7% | 8.2% |

| Seattle, WA | 15 | 5.5% | 14.6% | 17.9% | 9.3% |

Clearly, something is going on in the country’s largest cities. There are a few strong performers in this group (Atlanta, Detroit, Riverside, and Phoenix), but pretty much all of the negative numbers come from this group (only San Jose is negative and not featured above).

While we’re on the subject of the poorer-performing cities, it’s worth noting that things aren’t changing for the better. Rather, these cities are continuing to see declining rents. Of the cities with negative SCS rates, all of them also had negative MoM rates (Los Angeles was flat, fine).

What does this mean?

These findings lend credence to the theory that many Americans are moving out of the country’s biggest cities and into smaller cities or the suburbs.

Despite the pandemic, most American metro areas have seen significant rent growth since the beginning of 2020. At this point, the cities that have seen the most explosive growth are not showing any signs of slowing down and could make worthwhile considerations for investors.

I think rent growth will likely continue upward, on average, for the foreseeable future. With inflation likely (at least in the short-term), economic expansion, and potentially even wage growth, many indicators signal continued rent growth.

But what about those large cities still seeing declines? I think things will level out rather quickly but might not start growing again for a few months.

Why? My hunch is that these cities saw a lot of workers exit the city during the pandemic to work remotely or live somewhere with more space. As work returns to normal and cities reopen, my guess is that demand for rentals in the country’s biggest cities will return gradually.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com