DataDigest: New data shows how brokerages, agents, landlords & homebuilders were reshaped by the pandemic

A once-in-a-century pandemic, global inflation, supply chain shocks – 2020 truly was a pivotal year. Now, newly released data from the U.S. Census Bureau shows how the business landscapes changed for homebuilders, lessors, agents and other real estate professionals in the first full year after the pandemic began.

The effects on each industry segment were disparate, the most recently available data for 2021 shows.

Business Dynamic Statistics data reveal that 2021 was a year of major growth for homebuilders but steep contraction for landlords (called “lessors” in the BDS). It was also a year in which many agents and brokers started new firms.

Homebuilders

Homebuilder business dynamics were bright in 2021, accelerating a trend that began before the pandemic.

The industry segment totaled 823,091 jobs in 2021, the highest total since 2007. That total was a 4.9% increase from 2020 and the ninth consecutive annual increase.

The number of firms jumped by almost 10,000 to 162,286, the most homebuilder firms since 2006. The increase in the number of firms in 2021, 6.16%, has only been topped twice since the statistics were first recorded in 1978 – 6.33% in 2004 and 12.06% in 1984.

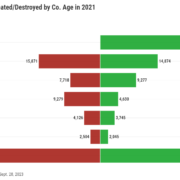

In fact, new homebuilder firms have been springing up at such a rapid pace that almost half of all homebuilder firms – 47.7% – were five-years-old or younger as of 2021. That figure was below 40% as recently as 2016. A third of all homebuilder employees worked at these young companies in 2021.

Homebuilder establishments (physical locations) expanded at an even faster rate than firms and jobs, jumping 13.1% in 2021.

Lessors

The picture was far less rosy for real estate lessors (typically landlords and real estate investment trusts) in 2021. The number of firms in the industry group shrank by about 1,000 to 85,625, the fewest since 2011. Nearly 8,600 firms exited, the most exits in a single year since 1997. This is likely because rates of nonpayment from both commercial and residential tenants skyrocketed during the pandemic.

Unlike in the construction industry, the BDS data does not distinguish between residential and non-residential, so it is unclear how residential lessors fared relative to retail, office, etc. But generally speaking, commercial landlords — office in particular — have been hit hardest by the pandemic’s effect on the workforce. U.S. office values are currently down by about a third since March 2022, when the Federal Reserve began raising interest rates, and over $1.2 trillion of commercial property is considered “seriously troubled,” according to Green Street.

The lessor industry group netted an annual loss of more than 31,500 jobs, a 5.2% loss, in 2021. That is the second largest decline in recorded history after a 10.1% drop in 1991.

Unlike homebuilders, which are seeing a flourishing of young companies, the percentage of firms in each age range has remained virtually unchanged for lessors over the last decade. Companies aged 1-5 years-old, 11-25 years-old and 26-years-old or older each comprise about 25% of all firms while startups and companies 6-10 years-old make up the difference.

Agents and Brokers

The trajectory of agent and broker offices mirrors that of homebuilders. Jobs, establishments and firms were consistently on the rise pre-pandemic, then surged once the pandemic was underway.

Each year since 2018 has set an all-time record high for the number of firms in the agent/broker industry group. There were 102,235 firms in 2021, surging 11.5% from 2020. That is the second largest increase all time, after a 12.2% gain in 2005.

Similarly, each of the years between 2017 and 2021 set an all-time record high for the number of establishments within the industry group. The total was almost 117,000 in 2021.

The number of employees, too, hit an all-time record in 2021: 383,521. However, the 8.1% year-over-year change does not rank in the top five all time, and the years preceding 2021 did not break employment records. The fact that firms and locations grew at a faster rate than employees suggests the industry was splintering rather than consolidating.

In fact, the majority – 53.2% – of agent/broker firms in 2021 were five-years-old or younger. A decade prior, that figure was only 38.1%.

Employees of these startups came predominantly from companies that are 11-years-old or older, the data shows. In 2021, companies between 11 and 15-years-old lost about twice as many jobs as they created.

Other Real Estate Professions

In addition to the previous industry groups, the BDS data breaks out “activities related to real estate,” which includes property managers, appraisers and “other.” Like the others, there is no distinction between residential and non-residential.

Employment for this group has been on a tear. It set all-time highs in 2014-2021, reaching 751,606 in 2021. Firms, similarly, broke records from 2015-2021 and reached more than 75,000 in 2021.

However, the pace of growth slowed significantly in 2021. Jobs were basically flat, growing only 0.12%. Firm growth, at about 4%, was middle of the pack historically.

Similarly to lessors, the percentage of firms for this industry group within each age range has remained virtually unchanged in recent years, with no noticeable change in the pandemic era.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com