One thing is for sure; there are still plenty of ways to profit with investment properties, EVEN in today’s wild housing market! So stick around, and hear exactly how you should be doing your deals as 2023 unfolds.

Dave:

Hey, everyone. Welcome to On the Market. I’m your host, Dave Meyer, joined by Kathy, Jamil, James, and Henry today. Good to see you guys. First time we’re all back together since we are in Denver together.

Kathy:

Great to see you. I’m excited for today’s show. Do you hear two live deals?

Jamil:

Feel like I’m going to embody my Kevin O’Leary today.

Dave:

Do you have an impression of Kevin O’Leary for us, Jamil? If you’re listening to this, he just made a very ugly face.

Jamil:

Yeah, and I hissed.

Dave:

We’re going to do this. We’re going to do a new format today where we have a couple listeners joining us. They each are doing a deal right now, and we’re going to learn about what they’re going through really as we speak, as you’re listening to this. This should give you a really good insight into the types of deals that are on the market and how people just like you are adjusting to market conditions and are still making good deals work. What do you all think of our conversations with Matt and Michael today?

Jamil:

Incredible.

Kathy:

Oh, it was so fun.

James:

The fact these guys are out there getting after it is awesome and mean, and one of them fell into a home run. So I’m a little jealous.

Kathy:

And I just loved hearing everybody’s tips and solutions. I felt like I just got an advanced education in the last 45 minutes.

Henry:

Yes, folks, pens and papers, take some notes because you hear some great advice on how to pivot a deal and you give some great advice on how to negotiate and talk to sellers. There’s great stuff being able to listen to this, and I’m just a deal nerd, so hearing people’s deals and talking about them and hearing people’s suggestions for how to work those deals is like music to my ears, man. I love this stuff.

Dave:

All right, great. Well, with that, we’re going to get into it, but first we’re going to take a quick break.

Michael Ye, welcome to On the Market. Thanks for being here.

Michael:

Thanks for having me, Dave. I am so excited to be here.

Dave:

Well, great. Let’s get into it. Can you just start by introducing yourself to the audience and letting us know a little bit about your experience in real estate?

Michael:

Sure. My name is Michael Ye and I am a pastor that’s transitioning out of ministry and into the real estate space. I started in real estate about six or seven months ago. I drank the Kiyosaki Kool-Aid and started down that trek and I just started just drinking in BiggerPockets every single day. I think I’ve must have listened to at least like a hundred hours of BiggerPockets stuff. And I ran across this dude named Henry, Henry Washington and heard his story and he was offering some sort of mastermind class, and I was like, “I got to be a part of that.” And so I did, and that was about six or seven months ago, and now I’m on On the Market. This is amazing.

Dave:

That’s awesome. Well, we’re glad to have you here and would love to hear about the deal that you have to share with us.

Michael:

Sure, sure, sure. So the property is in St. Cloud, Florida, which is right outside of Orlando. We are in central Florida, and it’s not a triplex, but it has three units. It’s a single family unit that has three units. It’s got a main unit that’s a three bedroom, two bath, a studio, and also a mother-in-law suite, all in the back, all on the same property. I purchased it for 240 rehab, just to get it up to speed to be able to rent out. It’s only about 15K or so. ARV is 400. According to Rentometer, I should be getting somewhere in the $3300 a month range combined between the three units.

Kathy:

Score.

Dave:

Yeah. Yeah, I don’t know why you need advice on this. It just seems like you should just go buy this. But before we jump into this one, can you just tell us a little bit about the market?

Michael:

Yeah, Florida in general is just a really, really hot market right now, but central Florida in general, it’s kind of a dark horse, I feel like. The sexy area is Tampa obviously, but central Florida, everybody always thinks of Disney, but central Florida is actually, from what I understand, Florida’s market has consistently kind of experienced very extreme highs and extreme lows, and has fluctuated a lot. But out of the Florida markets, apparently from what the other real estate people tell me, central Florida has been the most stable out of all the markets in Florida. So I live here. Being that I’m a first time investor and such, I do my best. I want to see the property, I want to be able to put my hands on it, that kind of thing. So I started investing here first.

Dave:

That’s great. And before I turn it over to the rest of the panel, last question is, how’d you find this deal?

Michael:

So it was through a wholesaler, a wholesaler that I’ve had a relationship with, and I promised him some money if he brought me the deal first before he blasted it out on email. And lo and behold, one day he just calls me up, he’s like, “Mike, you need to come and get this right now.” And I did.

Kathy:

Money talks.

Michael:

Yes, ma’am.

James:

Well, I know what my first piece of advice is, it’s to sell me the property. The numbers on this look extremely strong. Hey, Michael, have you already closed on this property or …

Michael:

Yes, yes. I closed on it last week actually.

James:

And how did you structure the deal as far as closing? Did you set it up hard money, conforming financing? Did you get a rehab loan or how did you close the deal?

Michael:

So I got hard money because the wholesaler said that we needed to close in two weeks. So yeah, I went ahead and did the hard money and my contractor says that the rehab shouldn’t take more than three weeks or so, so we’re going to be coming out in conventional. I’ve already started the paperwork on doing the conventional loans for this property, so hopefully we’ll be up and running by April.

James:

Then are you going to short-term rental or mid-term rent it, or are you going to go with the long-term rental or are you going to go do a mixture between the two?

Michael:

We’re going with the long-term rental. In this business, relationships are everything. And it just so turns out that my contractor knew a guy who really needed to move into a space and the space was just perfect for him. And so he decided that he’s going to rent out all three units. And so I’m running my credit checks on him right now and stuff, but it seems like it’s a go.

James:

And then how much based on the lenders you’re talking to or which lenders are you trying, what’s the end goal? So when we’re buying, I know when I’m buying single family rentals, a lot of times I’m buying for high cash flow like this deal or with some kind of equity position with a development upside on it. But for me, I’m always wondering how much cash do I have to lock in the deal or do I go with a different type of lender to try to leverage back? Are you going to plan, are you planning it on leaving your initial with your hard money guy? I’m guessing you’re putting 20% down roughly?

Michael:

Yeah, something like that, yeah.

James:

Are you planning on leaving that in the deal or are you able to burn this property and get your capital back out?

Michael:

For right now, I’m planning on keeping it in there just for the time being, and then I’m hoping to maybe refinance out of it when the interest rates do inevitably drop at some point and to get some of my money back out that way. But honestly, the property itself, the area is just starting to show signs of the first phase of gentrification, unfortunately. And so gentrification, I have mixed feelings about it, but from a property owner standpoint, it’s great for me. So yeah, it’s really an equity buy more than anything.

Jamil:

Michael, nice to meet you. Congratulations on getting this deal as well, seven months out of the gate and you’ve taken action. Phenomenal. There’s a couple of questions that I have about the exit. And so you’ve mentioned that the property is zoned single family, but there’s three units on the property that can be rented out. Now, my experience is that conventional lenders are going to make sure that the zoning matches what the use case is for your property before they’re going to loan on it. And so immediately the red flag that I get is when the lender comes and they notice that you’ve got a threeplex on a single family, they’re not going to want a loan on the property. How have you mitigated that situation and what is your plan if you can’t get conventional financing?

Michael:

I’ll be perfectly honest with you, Jamil, I don’t know quite yet.

Dave:

Sell it to James. You already know. You have another exit strategy.

Michael:

There you go. Yeah, I’ll be honest with you, I haven’t thought that far ahead. I just closed on it last week and I’m just trying to get all of that taken care of. But from what I understand, my lender, my conventional lender, it seems like it’s not going to be a problem. I’ll be honest with you. I didn’t think about that, what you just proposed.

Kathy:

So that’s exactly what I was going to ask is are those units permitted? Do you know?

Michael:

Yes, yes, they are.

Kathy:

All those areas are permitted, but not as a triplex.

Michael:

Not as a triplex, yeah.

Kathy:

Okay. Because I know obviously Florida law is very different than California law, but a lot of people don’t realize they’ll create these extra units and rent them out, but they’re not covered. They’re not covered by insurance, and you can get in big trouble for that if you get caught.

Michael:

Yeah, yeah, I made sure that they were covered, so we’re good.

Henry:

I think the benefit is what you did well here is a lot of people look at a deal like this and they say, “Oh, I’m willing to pay triplex numbers because I’m going to rent it like a triplex.” But you analyze the deal like a single family, which is at its true form what it actually is, and you bought it based on those numbers. And so renting it as a triplex is icing on the cake, which is I think the proper way you look at something like this, and yeah, Jamil’s right, you could run into a conventional lender not wanting to finance it because it’s three units, but you could also run into a conventional lender that will finance it.

The first property I house hacked, I still own it. It’s on an FHA loan and it’s a house with a mother-in-law house behind it. And they did say something when we were buying it and we sent them some pictures and told him it’s a single family, but it’s got a mother-in-law suite behind it and then they financed it. So it know it’s going to depend on that lender, but he’s absolutely right. Something to definitely, definitely think about, and it just means if that lender doesn’t want to do it doesn’t mean that another one won’t.

Michael:

Absolutely.

Jamil:

Michael, another question. You mentioned the $15,000 rehab, but you said a timeline of three weeks. And so instinctively for me, I have a lot of experience with contractors and I have always learned that you double everything that they tell you something is going to cost, and you also double the timeline, not because they’re dishonest, but because they’re dishonest. And so when you take that into consideration, how long have you known this contractor and what’s the experience that you have with him? I think $15,000 sounds very low, in considering today’s inflated material costs. You can get nothing done these days for 5 or 10 or $15,000. And so I’m curious, what does the scope of work look like for $15,000? Because three weeks is actually in the world of renovations quite a long time, so I’m interested to understand what that scope of work is.

Michael:

Sure, sure. So the contractor, interestingly enough, the contractor is a pastor.

Jamil:

Oh, good. Okay. So that checks the dishonest box off, right?

Michael:

Definitely. So I arrived in Orlando maybe about four months ago or so from New Jersey, and one of the first things I did as a pastor was I wanted to meet all the other pastors in the area, and I met this guy and turns out that he was a contractor. I was like, “Hey, I’m just getting into real estate myself. You want to work together?”

“Oh yeah, sure.” So that’s kind of how we met and we talk every day. We have a level of trust with one another and all of that stuff, and we analyze deals together and we have that kind of a close relationship. In terms of the scope of work, what we were talking about, like I said, just to get it up to speed is we’re talking some paint. We’re talking changing out a couple of the baseboard stuff and some kitchen counters. That’s pretty much it.

Jamil:

Really minimal stuff.

Michael:

Really minimal stuff to just get it up to speed.

Henry:

What a deal.

Michael:

Yeah, it’s pretty excellent, I got to say, man. But there are other things that we would like to do. I guess one of my questions to you guys was I want to be able to rent it at the top of the market, but I would say that right now as it stands, the environment is probably like a C plus neighborhood. And so how much is too much renovation? You know what I mean?

Jamil:

Does the neighborhood have the potential to go to a B or a B plus? Because if you have comps that are a B plus, then you can anchor on that number and then you can elevate to that and change the entire scope.

Michael:

Yeah, it does have the potential, but I would say if I were to just guess, I would say we’re probably about five to 10 years out.

James:

I think that’s a great question question, because we buy a lot of property as well that we can condo off later down the road. In the short term, we want to keep as rental property. And for me, when I’m looking at a five to 10 year appreciation play, which there’s nothing wrong with that, I typically like to put in cheaper material that will last longer, or not cheaper material but more bulletproof, but like LVP, solid types of floors, more indestructible items, and I’ll spend the money there, but I won’t go for the full cosmetic because what’s happened, what we’ve been doing in Seattle is we kind of land bank those because as the density changes throughout the whole United States, like in Washington state they just passed a new law that there is no more single family zoning allowed. Everything is allowed to be condoed off, built and sold separately.

So my recommend, when I’m looking at those deals, I actually try to put in, make sure it can be a great cash flow because this thing cash flow is at 24% cash on cash return with leaving 20% in the deal. That’s a great return. You can ride that cash flow and I would suggest doing the bare minimums that will last. But then once you get to that next path of progress event, which is in five to 10 years, then go for the full rebuild because you might be able to actually condo all three units off, sell those separately, and then 1031 those a larger amount into a bigger property.

But when you do those condos, sometimes you have to do some substantial renovations to improve it, add new water lines, do types of sewers. So in my opinion, it’s always best to get it bulletproof rental style, wait for that path of progress, then vacate, and then go for the optimal pricing. Because if you do it now, the market could look different in 10 years and then you have to redo the whole thing all over again. And so if you think it’s that five to 10 year play, then just make it to where it can sustain itself and you’re not going to get bled out by fees and maintenance costs and then go for the big rip in five to 10 years.

Dave:

Michael, you said that you wanted to rent at top dollar, which is obviously everyone’s goal, but you are also renting all three units to one tenant. Do you think that’s helping your rent situation or did you lower your overall rent for the convenience factor?

Michael:

I lowered the rent just for the convenience factor. And also the guy who’s coming in is a strong renter, and I figured, rather than having to deal with managing three separate units we just had the one guy, and it turns out the guy is also a contractor, so he said that he’d be willing to do some menial stuff for me and stuff, so that was attractive as well. So I did lower the rent a little bit for him.

Dave:

Does he need three kitchens or what’s the plan for three units?

Kathy:

Yeah, that’s what I was going to ask.

Michael:

Actually, his college age children are just graduating out and they need a place to live for at least a few years. And so the idea is that everyone’s going to kind of live on the property together. So I figure we will be good for at least a few years.

Dave:

Well, definitely go with the cheaper stuff then if there’s college kids going to be living there.

Jamil:

Is the rent rate with the one tenant the 3,300 a month or is it below that?

Michael:

So we’re at 32.

Jamil:

Okay, so just a hundred dollars discount. Not bad at all.

Kathy:

How did you screen for him? How do you know he’s a good tenant?

Michael:

I put him through the RentRedi process, RentRedi, the software. Also, he came armed with an Experian report that was done a month ago or so, and I had him submit his bank statements plus his tax return from last year. And so I did all of that. And I’m still kind of looking through government stuff to see if there’s any bankruptcies or anything like that, but everything seems to be a go.

Henry:

I want on top of that call references. So if he has a past landlord, I’d get on the phone with them. I love asking past landlords, because they’ll give you a report. And then the last question I typically ask them, as I say, either if it’s a landlord, I asked them, would you rent to them again if you had the opportunity? And if it’s a employer, you should also call his employers if he’s not self-employed.

Jamil:

I would want to add to that, go to landlords back because the last landlord may lie just to get them out.

Dave:

Exactly.

Kathy:

Yeah.

James:

One thing, Michael, you mentioned was this guy’s willing to do some work on your property. I have done that numerous times. I’ve done it the right way and the wrong way. One is the verbal like, “Hey, I’ll help you work on this property later.” And that’s great, and that’s a great gesture. But the problem is a lot of times that doesn’t actually happen. And so this is an opportunity I always look for. How can I bundle up things to reduce my expenses, whether it’s construction, whether it’s rental maintenance. If I’m renting to a property manager or something that works in there, maybe I give them a lower rate because they’re looking over a building. But this is a great opportunity to slow down and go, “Hey, I’m willing to give you a discount of a hundred dollars a month. Market is 3300, you’re getting it for 3200, but I would like you to cover these maintenance items for the duration of the rent.

And because that could save you hundreds of dollars a month, which will substantially affect your cash flow. And you don’t have to make it huge, but just say, “Hey, if when any of these 10 items happened, you’re willing to come out there and do the labor for free and I’ll pay for the materials.” And I would say it’s better to lock that in up front because the overall return on that, if he’s there for three years, you’re going to put an extra 4, 5% back in your pocket with cash flow because you’re not going to get bled on the maintenance expenses. So just put it in writing and then because I have had it where I’m like, “Hey, you said you were going to do these things.” And they’re like, “Yeah, here’s your bill.” I’m like, “Well, now I’m overpaying.” And so that’s a great opportunity, especially as a first time landlord, to really lock in a person in your property that can make your life easier for the next two to three years.

Kathy:

Oh my gosh, I can’t agree more. Make sure it’s all in writing, legal. People have different ideas of what is cool. So I’ve done that where I ended up with purple walls. So anything they do, in my opinion, needs to be approved. You need to know what they’re doing.

James:

Purple walls aren’t a good way to maximize your rent.

Kathy:

It cost me several thousand dollars to repaint it because it’s hard to paint over purple.

Michael:

Oh, God.

Dave:

Well, Michael, thank you for bringing this deal. Is there anything, any last questions you have for the panel before you get out of here?

Michael:

It’s funny because I had a whole bunch of questions and now that we’re at the end, I don’t feel like I have any left.

Dave:

Well, that means we did our job, I guess.

Michael:

Yes, you did. Yes, you did. So happy to have been here. Thank you so much.

Dave:

Of course. And congratulations. Sounds like a great deal.

Jamil:

Absolutely.

Henry:

Congrats buddy.

Michael:

Thank you. Thank you.

Dave:

Matt McMains, welcome to On the Market. Thanks for being here.

Matt:

Hey, thanks for having me, Dave.

Dave:

Well, let’s start by telling us a little bit about your experience in real estate.

Matt:

My experience is somewhat minimal. I do have a primary house that I bought right at the beginning of COVID, which helped instill me into the real estate world. And then refied out of that and bought a rental property in Pensacola, Florida, and initially started off as an AirBNB and then come fall we had transitioned into a long-term rental.

Dave:

Okay, great. And that’s not where you live. In Florida?

Matt:

Correct. I grew up in Orange County, California, Southern California, and I went to college in Pensacola. So that’s where the familiarity comes with that area.

Dave:

All right, great. So tell us a little bit about the deal you’re looking at now.

Matt:

All right. So it was an on market deal I found in Pensacola just by scrubbing everything that’s been on market more than 90 days. And this one actually was only at 40 days when I found it, but I had noticed they had dropped the price three times. So to me I was like, “Oh, probably trying to get rid of it, so let’s just throw an offer in.” And as Henry says in his Mastermind, “Just put offers in and let them choose if they want it or not.” So that’s what I did. And this one actually stuck. It was listed at 161. I got it locked in at 140 currently.

Dave:

Awesome. Well, I want to hear more about that. Before we do, for those of us who don’t know anything about Pensacola, can you just tell us a little bit about the area?

Matt:

So Pensacola, there’s a few colleges there and there’s the Naval Air Station. So there’s a lot of movement and traffic into the panhandle of Florida, but it’s kind of near the Alabama side. The market analysis I did you just looking back over the years, it did good through the last recession. There wasn’t too much fluctuation there. So I took that as hey, they could probably be pretty stable moving forward through anything else that comes their way. And also the sale to list ratio was pretty good. So that’s where I just chose. I have the familiarity of just the area. They’re building the downtown so there’s a lot of good things coming, I believe.

Dave:

Great. And your plan is to flip it, right?

Matt:

Correct. My plan is to putting 20% down on properties isn’t really cutting it for me because I’m two properties in and I’m already pretty much dry. So I’m trying to do just zero or low money out of my pocket and try to flip this first one to ultimately start BRRRR-ing and putting renters in and refinancing out of it, but using other people’s money.

James:

Matt, so on your rehab budget you have on this property, A, I like the price point in this property, 140, that’s great for a first when you’re flipping remote, especially lower price point, it sounds like more of a cosmetic turn. And I think when you’re buying out of state, cosmetic turns are great because there’s less variables in there. My concern with this deal is it’s a little tight. I think the numbers look good for a lot of different ways, but on a flip, it can be a little tight, especially if you’re flipping remote, because if you can’t control the cost as much, if it creeps over a little bit be you could go into red fairly quickly on this deal.

In addition to if you’re stacking the leverage and you’re looking for 100% financing, that debt cost is going to be higher than a normal flipper at that point. A lot of times when we’re flipping, we’re leaving 20, 25% in the deal, which is going to usually get back to us in the six to nine month period at that point. Because when I was looking at the flip numbers, have you established your hard money rate yet on this deal? What’s your debt cost on this? Because that’s going to make a big impact on the margin.

Matt:

So as far as the hard money, the way I’m planning to structure this deal is it’s hard money for the purchase and the rehab. And then I have a private money lined up that I met at a real estate meetup here in Orange County that is willing to do the down payment and any overhead costs on that. But the hard money I should have locked up today, their quoting me it will be around 12% with 10% down. So currently waiting back to hear from there and then that’ll dictate where I’m at on a deal.

Jamil:

Matt, what do you, what’s your full-time W2?

Matt:

I’m a federal officer.

Jamil:

Oh, awesome man. So you’re pretty well versed in being able to understand if somebody is telling you the truth. How do you feel about your contractor? Do you feel good about the numbers that they’re giving you do, do you think that the scope of work is in line with what’s being presented?

Matt:

I’m pretty confident. I’m reviewing two right now. One, when I locked this property up my estimate was 60,000. I had two contractors come out, both I have a fairly relationship with them just through my last deal out there. One came in at 52 and the other one’s at 65. So I’m kind of juggling those. I feel like either one or I’m going to be just fine truthfully, but I haven’t made a decision on it.

Jamil:

Are you past your inspection period on the property?

Matt:

Yes, as of Saturday, so just a day ago. Yeah.

James:

So Matt, your debt caught, I want to come back because I’m trying to figure out the flip. Because flip’s always based on A, I think your approach to the best thing you can do to build capital is to wholesale and flip as you’re trying to build up to keep buying your rental properties. It’s a great engine, it’s a high tax engine, but it really does work. And for me, when we’re looking at flips, it’s all about cash on cash return. And my concern on this deal is I think this deal on paper could work really well for a couple different exit strategies including wholesaling.

But on a flip deal, if your construction’s already creeping over a little bit over on cost and your debt is going to be at 12%, what’s the sale cost out in Florida? Is it typically … In Washington we pay roughly about 10% when we’re selling something out the door. Excise tax, closing costs, real estate fees, what’s the cost out there? Because if we were in Washington, the margin would be almost under 10% or it would be under 10,000 as a profit, which is going to not have a lot of cushion in this deal. And then my other question is for that specific market, when you’re selling at that 250 range, is that something that buyers are expecting their closing cost to be paid for? Because that’s something that can also substantially affect this deal on the margin.

Matt:

Great questions, James. So I’ll be honest, I’m not sure what I was estimating around like 6,000 to 10 in closing costs, but I do need to probably do some due diligence there and make sure I know exactly what that is going into this.

James:

Yeah, because when you’re flipping, we got to pack all these costs in, your debt cost, your construction cost, your sale cost, and then look at what that net number is. So I would definitely dig into what the sale cost is. Cause I know each county varies. I know in Washington we have a sliding excise tax, depending on your price point, you can pay 1.2% and sale cost, or if you’re expensive, you pay up to 3% as an excise tax. And so it can make a big, big variance on the deal.

Kathy:

And you have property tax and insurance and all of these things really add up the longer you hold it. I’m curious if you do end up having to hold it because you can’t sell it for what you want, you don’t want to lose money. Have you qualified, are you able to refi into a longer term rate?

Matt:

Yes. I did already speak to a lender as a potential out the cash flow if I do need to rent it will be minimal, but it will cash flow. So I do have that as a backup exit strategy.

Jamil:

Will you be able to take out your private money lender with that refinance?

Matt:

Yes, it’ll be close, but I’ll be able to cover it.

Jamil:

Awesome.

James:

Matt, what kind of loan did you get set up? Because when I was looking at the rental numbers on that, typically you’re going to be able to get a loan for 70, 75% of value, which is going to give you a balance loan of about 160, 165 on this, and you’re all ins at 200 plus debt costs. And so is that something that you’ve looked at that you feel pretty comfortable leaving 30, 40 grand on that deal?

Matt:

It’s definitely not my … Yeah, I wouldn’t say I’m super comfortable with it, but kind of have some things to work through on that exit front.

Jamil:

Just as a one last ditch negotiation technique, Matt, and I know you’re past your inspection period, and it’s not necessarily the best form to try to negotiate anything deeper once you’re past your due diligence periods, but it happens. And so I’m curious if, because I think you do need about another 10 or $20,000 in cushion in this deal. And I feel that if you look at the motivation of your sellers, how much do you have risk right now for EMD?

Matt:

1300.

Jamil:

Okay, so it’s a substantial amount, but I don’t think enough for your sellers to say, “Hey, let’s take the money and run.” So Mike, I’m curious if you’ve comfortable with trying to go back, even though you’re a day past inspection period, to go back and say, “Hey, after looking at my numbers, I think I do need to ask for an additional credit.” I think if you got another $20,000 off the purchase price of this deal, you would be in fantastic shape. And I would recommend, even if they refuse, Matt, even if they refuse, taking the shot is always worth it because you still have the right to say, “Okay, they refused. I’m still going to move forward. I don’t want to risk my $1,300. I’m going to close and we’re going to move forward with the deal.” But you still have the right to try and to move forward. So I’m curious, is that something that you’d be comfortable doing? And if so, I can help you with what that best technique could be.

Matt:

Yeah, definitely comfortable. I don’t mind, I’ll certainly ask.

Henry:

He’s in law enforcement, of course he can ask.

Matt:

Yeah, confrontation is not my weakness. But yeah, definitely, and I would appreciate the help too. Absolutely.

Kathy:

Jamil, I’m curious, are there any creative options he might have bringing the seller in somehow on splitting any profit there might be if they do lower it to encourage them to do that?

Jamil:

Given his purchase price here, I would’ve opted for innovation where the seller would’ve retained title of the property and Matt would’ve brought the private money lender into the deal, had the renovation done and had no origination costs or no loan costs to get into the property. Then all he’s got is that renovation that’s there. And he agrees to a sale price at 140 with his sellers, but he’s going to save like $7,000 in just closing and origination fees. And so creatively for me, that would’ve been the most strategic move because then he just brings his private money lender to the table. He doesn’t have to put 20% down because he doesn’t have to take title, private money lender comes in with the $52,000 in renovation expenses, they’re in it now for 192, he sells for 250. There’s a profit.

James:

The only concern I would have is just knowing that sale cost and then who. On these first time home buyer markets really dig into the comparables. Most times, I know in Washington we can see whether closing costs was paid or not. That’s three and a half percent a lot of times right off the deal, and that’s 50% of the profit on something like this, but I think that’s a great way to structure that because the problem is the debt cost is going to destroy this deal. And then if it goes long, it can go red fairly quickly.

Henry:

Jamil, what are your thoughts being a master wholesaler? So what are your thoughts if in that negotiation you are asking the seller to come down, but you’re also asking the wholesaler to come off his fee a little bit to make up for, so there’s a middle ground there?

Jamil:

So this got bought from a wholesaler as well, or was he the one who went, I think he went directly to the agent, right?

Matt:

Sister and agent on market.

Jamil:

Yes. Okay. So I think that there could be a play to ask the agent to come down on because did they do dual representation, Matt? Listing agent represented you?

Matt:

I went through my own agent.

Jamil:

Okay. So I like doing dual representation because you now put the listing agent in a situation where they now have double the commission to play with. And when they really want to get something done, they’re willing to get play with 3% often because they want the deal to close. And so normally when I’m buying on market, I’ll always go directly to a listing agent, ask for dual representation, or I’ll just say, “Hey, look, I can come in unrepresented, let’s give the 3% back either to myself or to your sellers, depending on the price point that I’m coming in at and just to make the deal sweeter or make it make more financial sense for myself and the homeowner.” I think in this specific instance, you’ve got a buyer agent, which is good because their fiduciary duty is to you.

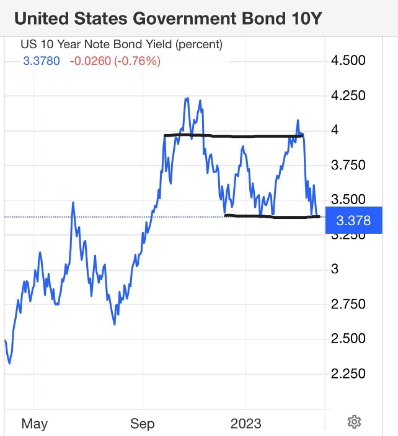

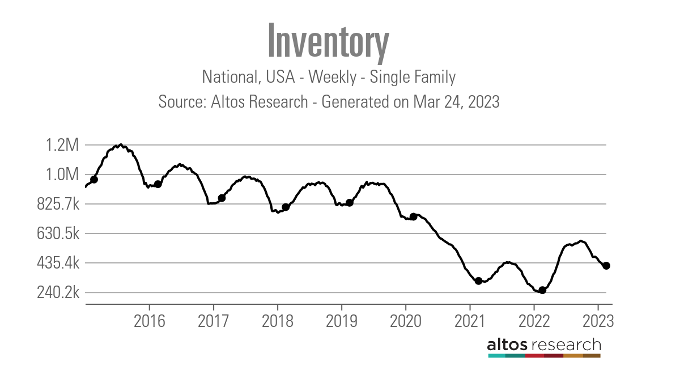

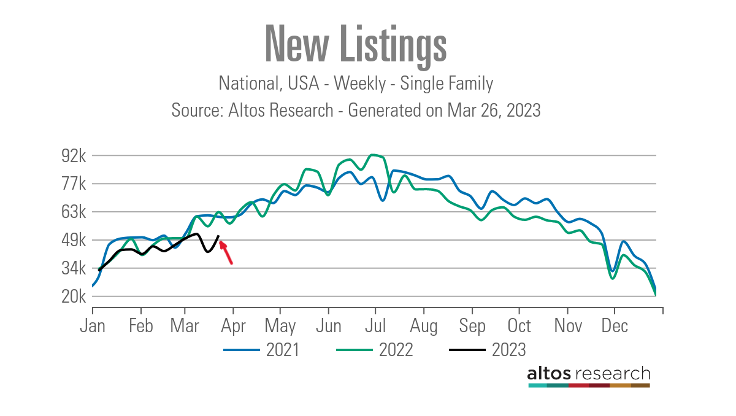

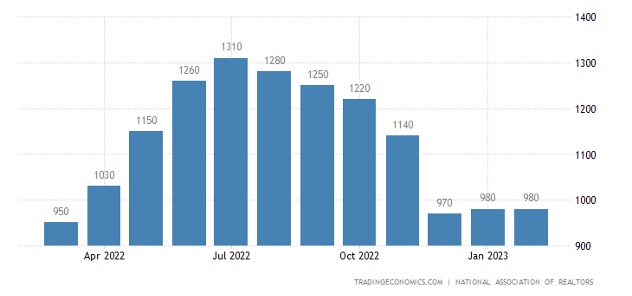

And so I think you’d really need to have a heart-to-heart with your buyer’s agent and say, “I am looking at these numbers and I’m starting to get a little concerned looking at my loan cost, looking at the market.” And even though the market is strong in Pensacola, I’m really bullish on Florida. We just had the economic data right now is not the best. The Fed is signaling more rate hikes. And so with that said, there could still be some depreciation in your asset that you haven’t accounted for. And if you take another 5 or 10% dip in your ARV on that property, it’s done. This is a reality, and I think even over the weekend and over through last week, we’ve seen so much turmoil, banks shutting down, bank runs happening. There’s just so many things that you can use as economic indicators that make you nervous for moving forward. And I think that if you brought these situations to the table, also hiring a licensed inspector, did you do that for your inspection period? Did you get an inspection report done?

Matt:

No, I had two licensed contractors come out and dig through the property.

Jamil:

Okay, perfect. Good enough. So I would also use those. And I think that it’s smarter for you to use the higher of the two numbers just because the higher one is probably more likely to be the right number than the lower number. When you look at the world of contracting, I’ve never had a deal come in less than what they said. It’s always more, and my sister’s my contractor, I trust her more than anyone in the world and it’s still always wrong. And so with that said, I think that you’ve got a really strong case to present to your buyer’s agent who will then have to make the case to the listing agent. So there’s going to be a little friction there because you’re going to play telephone game. And you can even give your agent the right to forward your email.

I would make a case, I would say, “Look, given this bid that I got, given the economic data that we’re looking at and seeing all the things that happened over the week last week, I am feeling less confident about this deal at this price. And I really think this sellers want to move this house. I really want to perform on this deal, but I’m feeling very nervous to perform at 140.”

Kathy:

I love what you’re saying, Jamil, because this house has been on the market and they want to get rid of it.

Jamil:

And they had three price reductions. And that’s a signal that these people are motivated.

Kathy:

They’re a great sign to go back and say you’re getting cold feet and just this past weekend is enough for them to understand, that there are bank failures and give it a go. What do you have to lose?

James:

And that’s one, I think important thing right now is the market has changed and the velocity of the market has changed. We were all writing everything with no inspections, quick inspections the last two years. You don’t need to do that anymore. And what’s really important is you’re prepping your deal, your inspection timeline can be extended. And if you have not locked your debt, your bids are not firm and you don’t have the full grasp of the cost, that’s okay. You want to ask for that extension on the feasibility at that point, get more time. The more time you have, the better you can prep your deal. The more time you have, the more prep you have, the less risk in a deal. And so never waive until you are all the way locked in on that to where you feel good about your financing, it’s set up.

Because also, if that secondary lender bails on you last minute, if that’s not locked in and has a full commitment on that, that’s where your earnest money can be at risk. And so use that feasibility to get your term set up correctly. And I do think, Matt, one question I have is what will this rent for? Because I think maybe flipping just the wrong kind of dispo on this and maybe bringing it to someone like Jamil that has buy and whole renters, I mean that’s a good price point in an area with some growth in it that people can afford. I’m looking at them if you have a loan for 160,000, which a lot of people will leave 40 grand at a rental property that’s a payment of 1250 a month. You might just be able to wholesale that off, which gets you to your goal of building capital and not taking on this risk, which is a little thin.

Matt:

Yeah, I like it. The median rent and the cost for that specific area are at 1475 monthly. So the rents are definitely strong over there.

Jamil:

I’m happy to connect you with some strong disposition people there as well. I think in tandem, Matt, if you, when’s your closing date?

Matt:

April 3rd.

Jamil:

Okay, so you’ve got a little time. So what I would do in this period is make a case for a strong renegotiation. In the meantime, try a wholesale exit strategy. Even if you make $5,000 on this, Matt, it’s $5,000. You risk 13 to make 5 grand. That’s a great return. You transact it, in and out, move on to the next. But I also think that you have an opportunity to add more upside if you are successful in that renegotiation. Say you say wholesale this for 145 and you get another $10 or $20,000 off the purchase price. Now all of a sudden you’re making what you were going to make in the flip on flipping the paper. And that to me, coming from a person whose business model is wholesale, I’ll tell you that makes me more excited than putting a hammer to a house any day.

Kathy:

I’m also wondering if you did decide to just have it be a buy and hold if there would be less to repair if you don’t have to really make it flip ready and more rental ready, could that construction price come down?

Matt:

That’s a good thought, definitely something that I would like to look into after talking to you guys.

Kathy:

It does sound like a great rental. Yeah, it’s a great market. Lots of dynamics. My biggest concern about that property as a buy and hold is that Pensacola got hit so hard by hurricanes that I imagine the insurance is just astronomical, but still, the numbers could still really work for a buy and hold investor at that price.

Matt:

Very good point on that.

Henry:

I wholeheartedly agree with Jamil. My same suggestion was going to be a, maybe see if Jamil has some buyers in that market because that is a great buy and hold price point. The other thing is, as you’re going through this renegotiation, I would pull up all the LLCs who own houses in the neighborhoods around there. Because typically those are investors who are using it as rentals. And then I would prioritize that list based on the LLC that owns the most. And then I would find who owns the LLC and I would call them and say, would you want this deal for XYZ price? Because clearly they like the neighborhood, they’ve got other rentals in the neighborhood and they may be willing to pay that price. And you could find your buyer that way as well. So I would do that today.

Matt:

Great suggestion, Henry. Thank you.

Jamil:

And if you’re not familiar with that process, Henry can probably walk you through it offline as well. I have some utility that I can help you with in skip tracing and you’re a federal law enforcement officer, you know how to find anything.

Dave:

All right, Matt. Well, thank you. Hopefully this advice has been helpful to you. We appreciate you bringing us the deal and sharing all this with us.

Jamil:

Thank you for your service too, Matt. I

Matt:

I appreciate it. Thank you guys. I feel like I got educated, so thanks for it.

Kathy:

Awesome.

Dave:

All right, well, thank you all for participating in the infomercial for Henry’s coaching business.

Kathy:

I love to see the difference he’s making. Just wonderful meetings.

Dave:

No, seriously, man, that was awesome. Both of them, both Matt and Michael were super interesting, knew what they were talking about, were open to feedback. It was great talking to them. So Henry, how’d you feel about your students joining the show?

Henry:

Man, I thought it was amazing, man. Helping people invest in real estate is obviously a passion of mine. That’s why I’m here on this show in general. But I get more excited when my students get deals and when I get deals, man, and obviously Michael hit a home run for his very first real estate deal with his three unit single family deal. And that’s obviously what everybody would love to do. And then I think some people are going to look at Matt’s deal and go, “Oh man, that’s a tough spot to be in.” But I’d urge everybody to look at this in a different light. What Matt’s done is he’s taken massive action. He’s learning trial by fire. And so many people are scared to do that. They’re scared to get out there, analyze deals and make offers.

Because they think the world is going to end if they get themselves into a bad deal and bad deals are no fun. Don’t let me put that out there. But at the end of the day, if Matt walks away from this deal, because he doesn’t like the risk he would take on, he loses $1,300, but he doesn’t really lose $1,300. He paid $1,300 for an incredible education, for more education than he could have ever got in somebody’s class. More education that he’s getting in the Mastermind. He got trial by fire, he had to go find a deal, analyze the deal, talk to an agent, put in the offer, do the inspections, go back and renegotiate to try to get the deal to where it makes sense now, and then look at multiple exit strategies to try to get out where it makes sense.

And then if it doesn’t, then he has to get out. Then he has to get out and lose 1300 bucks. Well, man, so many people wouldn’t do that. And because they wouldn’t do that, they’re not going to find themselves in a position to build wealth. But Matt is going to find himself in a position where he could make money on this deal, or if he doesn’t, he’s going to hit a home run on the next one because of the education that he bought himself with that $1,300, I think it’s incredible that he’s taken that action

James:

Contacts equal contracts.

Henry:

That’s right, absolutely.

Jamil:

I think he learned a lot of really important lessons as well. And like you just said, Henry, all of this is phenomenal, but how do I get Michael’s deal?

Henry:

Do you want me to give you the link to join my program?

Dave:

I was going to ask for it if we can get a discount.

James:

Yeah, Jamil, you’re the wholesaler. Will you get me Michael’s deal.

Jamil:

Right. I mean, I was trying to talk him out of it, but he already closed it, so I was like, oh.

Kathy:

He better not get used to those numbers because that could be a hard one to find again. But who knows?

Henry:

That’s a screaming deal, screaming deal.

Dave:

Good for him. Well, thank you all for being here. This was a lot of fun. We’d love to hear your feedback on this. This is the first time we’ve done one of these live shows with a bunch of people. You can find any of us on Instagram or you can post on the BiggerPockets forums where there is an On the Market forum specifically that we will check and check in with. So hope you all appreciate it. Thank you all for listening, and we’ll see you for the next episode of On The Market.

On The Market is created by me, Dave Meyer and Kailyn Bennett, produced by Kailyn Bennett, editing by Joel Esparza and Onyx Media, researched by Puja Gendal, and a big thanks to the entire BiggerPockets team. The content on the show On the Market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com