Dave:

Welcome everyone to On the Market. I’m your host, Dave Meyer, joined by Henry, James, and Kathy for a great show. How is everyone?

Henry:

Fantastic.

Kathy:

Wonderful.

James:

I’m doing good.

Dave:

All right. Well, today we’re going to dig into different markets across the country. As we’ve talked about a lot on this show, the housing market is really split and every market is behaving really differently. So we’re going to dive into different markets.

First, we’re going to do a little bit of trivia, and I’m going to see if any of you can guess some of the markets based on some of the characteristics of how they’re performing right now. And then we’re going to get into a Comeback Kid episode where each one of us has brought a market that was experiencing declines over the last six, 12 months, but we are expecting to take off again sometime in the near future.

So that’s our plan for today. So let’s get into our game where I’m going to ask you all to guess the market. Basically what I’m going to do is I’m going to read you three clues and at the end, each of you’re going to have a chance to guess which market this is.

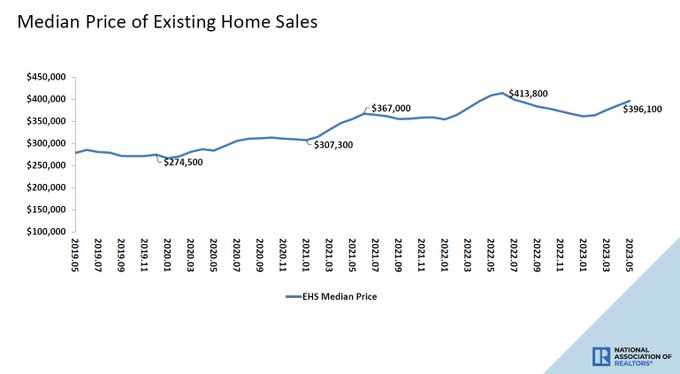

For our first market, it has a median list price of $620,000. So that is well above the national average, which is about $400,000. Home values have increased 4% over pre-pandemic levels, but they have come down off their peak. And the third clue is that this city did not have a professional sports team until 2021. Kathy, you look very deep in thought, so I’m going to pick on you.

Kathy:

Sports team, new sports team. Las Vegas. That’s all I can think. Maybe. And Henry’s shaking his head no.

Dave:

That is a good guess. I’m not going to tell you that… Did they… I think… I don’t know when they got their first sports team, but it was recently. Henry, you know she’s wrong?

Henry:

No, I don’t know she’s wrong. I was nodding my head. I don’t think I was nodding it no, because I also think it’s Las Vegas. The throwing me is the average home price-

Kathy:

I know. Me too.

Henry:

620. That seems high for Las Vegas. But I’m a Raider fan and I know they just moved to Las Vegas recently and they hadn’t had a pro sports team before that. So I’m going to go Las Vegas.

Dave:

All right. James.

James:

I’m with Henry. I’m thrown off by the median home price. But then when did Las Vegas get their hockey team? That was like-

Henry:

Oh, that’s right. They had a hockey team before that.

James:

Man, I was going to agree with them until I just thought about the hockey team.

Henry:

And they also had the Las Vegas Aces. They had the WNBA team.

James:

Is it L.A? Because when did the Rams go there? No, they have tons of teams. What am I talking about?

Dave:

The Clippers, the Dodgers.

James:

I’m just throwing out Austin. I don’t even know.

Dave:

Okay. Well, James, you actually got it right. It was Austin.

James:

I was guessing more of tech cities. I was like, well, it’s Seattle like-

Henry:

But wait-

James:

Because tech’s around 600 to 700 typically.

Henry:

Wait, who’s in Austin? Who plays in Austin?

Dave:

Yeah, what professional sports team is it? I’m googling it.

Henry:

Is it like a soccer team?

Dave:

Okay. Henry, you’re right. Yes, it’s a soccer team. That’s why none of us knew it was the Austin FC, which is the first professional sports team. Shows how much we know about soccer. But that’s right. So I think this is kind of interesting. Austin. Las Vegas was a good guess, but I think the median sale price there is a lot lower.

Kathy:

Yeah, that wasn’t matching.

Dave:

But it is interesting that despite Austin’s pretty big correction that they’re in, still above pre-pandemic levels, but only 4%, which is pretty small compared to all the other… Even other markets that are in a correction right now are still up way more than 4% over pre-pandemic levels. All right, James, that was pretty impressive. Pretty impressive guess right there.

All right, well, let’s go to our second market. This one, right around the median national price. We have the median home price of $389,000. This market has seen huge job growth. 84,000 jobs have been added just since 2021. And most importantly of all, the Cuban sandwich was invented here. James, since you’re the winner?

James:

Miami?

Dave:

That’s a good guess.

James:

Wait, wait. What was the medium home price?

Dave:

389,000.

James:

Oh, that can’t be right. That can’t be right. Charlotte?

Dave:

All right. Henry?

Henry:

Yeah, obviously I’m thinking of a Florida city. Yeah, so like Fort Lauderdale.

Dave:

All right. Kathy?

Kathy:

I’m going to go with Miami just because.

Dave:

All right. The Florida theme was right. Cuban sandwiches. But it is actually Tampa, Florida. Kathy, that’s your market. Kathy, be honest. Have you ever had a Cuban sandwich when you’re in Tampa?

Kathy:

Never. No.

Dave:

That’s a shame. I’ve never been to Tampa. But let’s go and get some Cuban sandwiches,

Henry:

Aren’t you the DataDeli? How have you never had a Cuban sandwich in the home of the Cuban sandwich?

Dave:

I don’t know. This needs to be rectified immediately.

Kathy:

I don’t even remember seeing signs for one when I’m there.

Dave:

All right, so no one was there. James still has the lead. Market number three, though, median list price almost exactly the same. 389,000. One of the fastest growing cities in the entire country with a 2.8% population growth since 2022, which is huge, just for reference; it’s usually below 1% even for fast growing cities. And this city is named after an English explorer. I have no idea. Kailyn, this is a good one because no one’s going to know. All right, Henry, you’re up first.

Henry:

Come on. I don’t know. Columbus, Ohio?

Dave:

Oh, that’s pretty good. He wasn’t English, though.

Henry:

Yeah, exactly.

Dave:

All right. Kathy?

Kathy:

Mr. Dallas? I don’t know. [inaudible 00:05:56] Dallas?

Dave:

Mr. Dallas. Yes. The famous Mr. Dallas.

Henry:

The famous English explorer, Mr. Dallas.

Dave:

Yes. I remember him fondly from high school world history class. James, what do you got?

James:

I don’t know. Kensington?

Dave:

Is that even a place? Isn’t that like the ketchup, Mr. Kensington? That’s like that fancy ketchup?

James:

It sounds English.

Dave:

It does sound English. No, it is Raleigh, North Carolina, one of the fastest growing places. Wow. And it is according to Kailyn, it is named after Sir Walter Raleigh, an explorer and nobleman who funded the first expeditions to the coast of modern day North Carolina. Can’t believe you guys didn’t know that.

Kathy:

It all makes so much sense now.

Dave:

Well James, I think you won this because you were the only one who got that right.

All right, well that was fun. But we are going to get into markets that we actually know something about in the next segment. But first we’re going to take a quick break.

All right. Welcome back everyone. We are now going to jump into our comeback kid markets. Again, as we talked about at the top of the show, these are markets that have seen a correction over the last couple of months, but as the housing market, on a national basis, is starting to find its footing a little bit, I think it’s too early to call a bottom on a national level. There are definitely certain markets that are starting to see a rebound, at least for now. And we’re here to try and predict and talk about some of the markets that we think have the strongest potential to rebound throughout the rest of this year.

Henry, let’s start with you. What market do you think has the best chance of rebounding?

Henry:

Yeah, I went with Austin, Texas, which is sad that I didn’t know the answer that Austin had a professional sports team, but none of that came up in my research.

But I went with Austin mainly because I’m going to start with the end first. So the main reason I chose Austin is because the key factor in real estate is always location, right? Location, location, location. And people have been moving to, and living in, Austin because of the location, because of the amenities that it provides, because of the music life and the nightlife and the indoor/outdoor kind of living and all for essentially what can be considered a reasonable cost of living if you compare it to coastal cities or in the far east coast. And so you kind of get a little bit of lifestyle and some affordability. And so even though the pandemic caused this market to skyrocket and then now fall back to reality a little bit, the lifestyle there is still the same and people still want to enjoy those amenities.

So I think as the market moves closer to where it was pre-pandemic, it’s going to just encourage more people to go there. When I say people, I don’t just mean people. I also mean businesses. People work at businesses. Businesses want to be able to enjoy these amenities when they’re not at work. And so they move. There’s several companies who have either relocated or opened up offices in the Austin, Texas area. You’ve got Oracle moved their headquarters from California to Austin and they did that in 2020. BAE Systems moved their office. They’re a defense contractor, essentially. They moved their offices to Austin in 2021. HP. Everybody knows who HP is. They moved headquarters from California to Spring, Texas, which is just outside of Austin. So these are big employers that employed lots of people across a couple different industries. And it’s cheaper for them, I’m sure, than what it costs them to office and have headquarters in California and other cities. And so that’s bringing people because people work there. And as those companies continue to grow, more people work there.

Some stats that I did find interesting: population growth has gone up year over year since 2020. So it went up about 3% in from 2020 to ’21, 2.79% from ’21 to ’22, and then 2.39% from ’22 to ’23.

Dave:

That’s got to be like one of the fastest growing markets in the country.

Henry:

It is. It is the fourth fastest growing city in the US. And it ranks number one in growth rate among cities with over a million people. So it rapidly growing.

And the median home price, if you look at home values in 2021, average price was 451. In ’22 it was 567. So it jumped 26%. And now in ’23 it’s 530,000. So it’s down 15% from last year, but it’s still up from the 451 from pre[pandemic levels levels, going back to what we talked about in the last segment with Austin.

And so I think it’s a comeback city because the location is still phenomenal. The cost of living, when compared to other cities, is still fantastic. Companies are moving here, which is bringing jobs. People can still work remote in a lot of companies, so they’re wanting to move places where they would enjoy the lifestyle. And I just think that’s going to cause this place to continue to boom as the market softens.

Kathy:

Yeah. And with all those tech companies moving from California, that’s one big reason that people are moving there. But it’s really the tagline of Austin is why Californians are moving there. Keep Austin weird, right? Yeah. So we’re going to do that as Californians as we move out there. We’ll just keep it weird.

Henry:

California said, hold my beer. We got you.

James:

Henry, I love this pick because I’m a firm believer that the tech cities are going to all make comebacks right now. I think the pandemic got… Everything changed so much during that time where people could work remote. They were moving around. These tech companies have been very clear they want people back in the office and things are getting back to normal. And these are where all the jobs are right now. There’s massive growth in all these cities. There’s lots of job openings across the board. Income is rising.

The only thing I would say about Austin as a whole is it’s a very large geographical area. I don’t know if the outskirts are going to do… Randomly, the guy that won me at the BP Con was from Austin, Texas. He’s a flipper out there. He texted me last night and he said his inventory’s stacking up everywhere on the outskirts. And so that would be the only thing that would maybe hold that city back a little bit is just the sheer size of it. And there’s so many different income pockets in that size that it could skew the math a little bit. But I think the core city where the jobs are will be growing pretty strong.

Dave:

The only other thing I’d add… I agree; I think Austin has one of the best long-term potentials of any city in the country, if not the single best. And if prices are coming down, it could be a good opportunity to buy.

The thing I would caution against is Austin is one of the most overbuilt cities in terms of multifamily specifically. And that could create some competition and some stagnation of rent growth even in single families in the short term just because there’s a lot of supply coming online in Seattle. And that is also – spoiler – true of the city that I am going to present. This naturally happens.

Henry, this is a great pick, but you’re not the only person who sees Austin as a great long-term buy. So builders see that and they start buying and building like crazy. And when we enter a correction like this, it’s looking like it’s poorly timed. So that might play out in Austin, at least over the next couple of months.

All right. Well, great pick. Kathy, what about you? Where are you expecting a big comeback?

Kathy:

Well, it’s so funny. Just one comment on Austin. This is an example of why sometimes cashflow shouldn’t always be the thing to focus on. Because I remember, I’ve been doing this a long time, but 15 years ago I would always say, ah, I’m not going to buy an Austin because it just doesn’t cashflow. And back then the average price there was, I don’t know, 200,000 or something. I’m like, it just doesn’t cash flow. Henry, what’d you say the medium price is now?

Henry:

The medium price of 2023 is 530,000.

Kathy:

Yeah. So it’s one of those examples of sometimes when you see all those factors in play, maybe it’s okay to break even. Maybe it’s okay to just hold that property knowing that there’s going to be so much growth.

And that is how I feel about the market I’m going to present. We have a development nearby, as you guys know, but Salt Lake City is the market that I’m focused on. It’s getting hit a little bit hard right now. There is increased inventory for sure, but those fundamentals are there, like I saw in Austin many years ago. What’s happening in Salt Lake is really massive population growth. And the factors that I follow, I know you guys do do too, is number one is population growth. I want to know that people are moving there and want to be there and aren’t leaving. And usually population growth comes from job growth. People move where the jobs are. And when you can still get affordable properties in those markets, to me, one of those places where you just sit and wait it out. And even if the cash flow is not great, when you have just massive population and job growth, you’re probably going to be okay in the end.

So what’s happening in Salt Lake is the population has increased 161% over the past 10 years. And the fertility rate is 3.4. Nationwide, it’s 1.8 to 2. So lots of baby boom in Salt Lake. Of course, that probably has a lot to do with the Mormon population there where families do marry… They’re formed very young and of course have a lot of kids. So we’re just seeing outstanding population growth there.

Jobless rate is 2.2%; lowest in the country, 43,000 new jobs. Zillow forecast growth of 1.4% next year. So these are just some of the basic reasons why I’m bullish on Salt Lake. And of course we do see a lot of tech companies moving there as well to the Silicon Slopes as they call it.

Dave:

Well, I was going to agree with you, Kathy, but if Zillow is forecasting growth, that probably means it’s going to decline.

Kathy:

I think it’s wrong in the sense that it’s going to be higher than that, honestly. Because it already is. It’s already showing that it’s coming back. It’s a comeback city. One of the things… This is a cool slide on the youngest cities. And you know what? Seattle is number one, Denver second, but Salt Lake’s on that list too of the median age being five years younger than the national average.

Dave:

Oh wow. Well, if I was giving up points for this presentation, I would give you some points for bringing in fertility rate. I think that’s a new data point on this show. I don’t think we’ve ever had that, but it totally makes sense. It’s a good one. James, Henry, what do you guys think?

Henry:

I think she gets points with the fertility rate and loses points on the Zestimate.

Kathy:

Fair. I’ll take it. When they change their forecast, I don’t know, five times or something. I want to do that. I want to forecast and then just change it every month.

Henry:

I mean, that’s what forecasting is, right?

Kathy:

That’s true.

Dave:

Yeah, it is. That is exactly what it is. It’s better than just pretending that something that you already know is wrong is still-

Kathy:

It’s still right. Yeah.

Dave:

Yeah. So I think updating the forecast is still a good idea.

Kathy:

It’s fair. The world changes so quickly.

James:

Yeah, I love Salt Lake City. I’ve been there a few times and the quality of living’s really good there. You can just tell as you go around, everything’s clean. There’s good infrastructure there. I don’t know a whole lot about the job growth and economy there. But I kind of foresee that being more of a stable market than seeing it kind of hockey stick back up. I think there’ll be more steady growth. I think these other secondary cities are going to be more going into the steady, stable growth and they’re going to fall behind these tech cities with the comeback. But I do think they’re good quality living. There’s a lot of people living there. Shoot, I tried to go skiing at Kathy’s… We stayed at Kathy’s development and we tried to go skiing. There were so many people, I had to turn around and leave. I was like, this is unreal.

Kathy:

It was packed.

James:

It was packed. So there definitely is a lot of bodies there.

Henry:

I think the outdoor lifestyle is going to draw lots of tourism, which brings money in that supports that community that and the people don’t stay. So I think that’s going to help. My concern is long term job growth. So if they’re having such a baby boom and there’s going to be so many people, if they don’t continue to have increasing job growth, then where are all these people going to work and how are they going to continue to produce for their families?

Dave:

All right. Well, I like it. James, what about you? Are you on the Austin/Salt Lake bandwagon or you got something else?

James:

I like Austin. I like the tech cities on the comeback. I feel like they got overcorrected a little bit during those rate hikes. But I’m a repping my backyard, Seattle, Washington. I think that is going to be the biggest comeback kid market and mostly because I’m living in it right now and it just feels different. We put a house up for sale on Friday, had four offers in three hours on it, and we were at the top end of the pricing. And what I’m seeing is if you have a good product in a good neighborhood, that stuff is selling and it’s selling for above list. Things trading below list now in this market is not happening. And who knows, we might be seeing a seasonal change.

The main reason like Seattle is the population is growing. We have so many jobs. People can get good paying jobs. There’s no income tax in this state. And so people can… They get to save more. They get to walk with more in our state, and that’s a big benefit. But Seattle’s population increased 2.4% from 2021 to 2022, and they’re anticipating the same growth. That is the fastest growing city in 2022.

So there’s growth and the companies are also growing rapidly as well. Like we’re watching Amazon, Facebook, Microsoft, expand out their campuses. Microsoft’s building out a campus that’s being built over a 10 year period; that’s how big it is. And they’re ready to fill these places up with bodies, which means good paying jobs are going to be in our market.

Home values, what we’ve seen is we’ve seen this hockey stick back up. This is really interesting. So we saw the median home price drop down in December to 754,000. That was a huge drop from the previous 12 months. But recently we are now sitting, since December, we’re at 840,000. We’re seeing this swing back up and I’m seeing it in real time data.

We were comping a property in Bellevue yesterday and Bellevue, Washington’s a nice suburb city right outside Seattle. Properties that we’re selling for 850, 90 days ago are now selling for 1.15 to 1.2 in the exact same condition. And we’re seeing this rapid growth. There’s very, very little inventory. Our inventory went up to about two and a half, almost three months. We’re back down to under a month worth of inventory. And so things are getting consumed and there’s a lot of buyers in the market. So any market that has that much pent up buyer demand with no inventory, regardless of rates, there’s transactions going down.

And the transactions are trending up, not trending the other way. And I think that comes down to a lot of these tech cities. They’re smart buyers. They like to overthink things. And when these rates spiked up, they all went on the sidelines for a minute. They saw it kind of come down and then they saw it stabilize out and now they’re having massive FOMO and they’re jumping in. And as they’re jumping in, values are going up.

Rents are also still climbing. There’s massive rent growth the last two years; I think it was 23% rent growth over the last 24 months. And we’re still seeing it grow. It’s growing at a more stable pace, but we have not seen the decline like Austin saw. It grew at 2.7% in the last 60 days on rent growth. We saw a little bit of a dip for that last quarter in ’22, but not much and now it’s growing it as the cost of housing is going up, with the interest rates and the monthly expenses, so is rent. So rent is getting pulled up as well.

So all the key indicators are showing that it’s rebounding really well and things are increasing. And not only are the values increasing, the wages are increasing. Wages are up 5% year over year. So there’s a lot of jobs in the market. 119,000 open jobs, people are getting paid more and there’s no inventory. And so the people with jobs want to settle in. And that’s what we’re seeing is the market is rebounding pretty consistently.

Kathy:

That is so shocking. Really, that people can buy those high priced homes with today’s interest rates and that they’re not the shortage of them. Are they paying cash? I mean, who are these people?

James:

They’re financing the deals. That’s the thing. There’s a lot of financing. And we’re also down in SoCal and the competition, I know, that is growing too right now. Like Newport Beach is accelerating still. That’s cash buyers. I’m seeing it. People are stroking big checks for houses. This is, they’re financed tech buyers that are putting about 25% down. They’re your standard buyer. And I was a little shocked too because if you really think about what the average tech workers making, around a hundred grand a year, and the housing cost is pretty expensive. People are paying five, six, $7,000 for these houses in these neighborhoods. It does surprise me, but they are transacting. I think there is also still a lot of cash that is sitting in people’s banks right now and they’re just utilizing it. There was so much cash printed, people made so much money the last 24 months. Now they’re just putting it to work.

Kathy:

I mean, I was just under the impression that they were feeling depleted after the stock market went down and they lost their money in crypto and so forth. But if some of these people are from California and they’re buying a million dollar house, they may be leaving a 2 million house or a 3 million house. And so perhaps it is more affordable for them from that perspective. But if they’re not, if they’re just locals, it’s still, like you said, if they’re making a hundred thousand maybe per person and it’s a couple, it still seems like a stretch. But it’s amazing.

Dave:

I think the other really interesting thing about Seattle, and honestly a lot of these markets, is that the tech, we’ve seen a lot of high profile tech layoffs, and I think that perhaps led to some fear, particularly over the winter. People were sort of waiting to see what happened. But from some of the data… I mean, we see the labor market data, which is pretty darn strong given where we are in the tightening cycle. But I was reading something the other day about how ChatGPT has all of these major companies like Microsoft, Google, all of them in this arms race again now, and they’re staffing up again. They’re all trying to hire quickly to try and get the best AI engineers and be able to beat each other to the market. So it’ll be really interesting to see if the very well publicized layoffs in tech slow down and we start to see these tech markets start to take off again.

Henry:

You talk about the stock market. The stock market’s been kind of rebounding over the past couple of weeks. I know my portfolio’s looking better than it has in a long time. And so I think people are starting to see some of that positivity. I think if the interest rate hikes slow down, stop, or reverse, I think you’re going to see a boom in these markets, especially one like Seattle with such great fundamentals. Because you’ve got the jobs, you’ve got the job growth. It’s a place where people want to live. It’s desirability. I don’t like rain a lot, so I don’t want to live there, but lots of people enjoy that part of the country.

I think if you’re waiting on the sidelines or you’re looking for a place to invest, thinking about a place that has these strong market dynamics and fundamentals, I think it’s such a sweet spot right now because the rates haven’t completely changed direction yet. And I think once they do, it’s going to create this big bump or demand. And so there’s this sweet spot where you can get in right now, especially if you can buy at somewhat of a discount. And then even if that property, like Kathy said, breaks even, when you’re buying in a market with these great fundamentals, you know it’s a waiting game. And if you can hold that property long term… You may not even have to hold it that long depending on what happens with rates. But if you can hold that property long term, I think you’re playing the market conditions safely.

Kathy:

I do want to share one last thing that Marcus and Millichap Research Services came out with the employment pre-pandemic percent change. So which cities have more jobs now than pre-pandemic? And interestingly enough, Austin came number one with 14% more jobs now than before the pandemic. Dallas was second with 9.9 and Salt Lake was third with 9% more jobs than pre-pandemic. And Seattle’s not on the list, but maybe that’s because Seattle already had so many jobs that… I don’t know, but I think that’s interesting.

James:

You just made my hand sweaty, Kathy.

Kathy:

But I mean there were already so many jobs up there that and just obviously not enough real estate for all the jobs that are there.

Dave:

All right. Well, for our last market… I guess this is a theme; I picked one that’s sort of in line with what the three of you have already picked. It is the home, if you know these places, home of Qdoba, Chipotle, all sorts of other fast food restaurants. And that is of course, Denver, Colorado where I am just like James and I’m just a homer, picking the market I know best.

But I really believe that Denver, like these other cities, is poised for really big comeback for some of the same reasons we’ve been talking about, is really strong fundamentals. The population growth has been very strong for 15 years. Prices have dropped a little bit, so they’ve become a little bit more affordable, but it is heating up really quickly. Days on market in Denver have dropped down to just 11 days right now. Yeah, so we’re seeing a lot of activity.

And actually, I texted my real estate agent to just ask him, is the data we’re seeing real? And he said that just this week he had two clients that both offered 70,000 over asking with an appraisal gap and did not win either of them. So that’s a 15% over asking and they’re not winning. So I don’t know if this means that the bidding wars and crazy appreciation is coming back, but just shows what happens in a market with strong fundamentals when there’s no supply. People still want to live there. And so I think Denver, especially after the Nuggets winning the NBA championship the other day-

Henry:

Oh, slid that one in there.

Dave:

Absolutely. Because we have actual, real professional sports teams in Denver. Unlike Austin.

James:

The Nuggets just crushed that playoffs.

Dave:

Yeah, they’re amazing. I unfortunately couldn’t watch because game five was on at 2:30 in the morning. It started at 2:30 in the morning.

Henry:

So you’re not that diehard of a fan?

Dave:

No, no. I’m more of a Knicks fan and they’re just terrible.

Kathy:

They’re going to have to change their name from Nuggets to Boulders or something. They’re playing big time.

Dave:

I think people like the Nuggets name for a few reasons.

Henry:

Okay, I get it. I get it.

Dave:

All right. Well, what do you guys make of this? I mean, I think we all sort of picked similar things. We did not plan this out, but it seems like we’re all sort of aligned that these big cities, they’ve seen a correction and they are starting to come back. Is that the general sentiment? Do you think other markets are starting to come back? Were there any others you’re considering?

Kathy:

I mean, these three cities, we said Austin, Salt Lake and Seattle are big tech cities, and anyone who thought that tech was dead because there were layoffs is just not realizing the next 10 years is going to be so tech heavy. The changes that are coming. I mean, we’re just at the beginning of technology ruling our lives, of controlling the world. It’s coming and it’s going to be massive. And I think you’re just not going to go wrong in a tech city.

James:

I agree with Kathy. I think that’s just where the jobs and the potential are. That’s why they have such booms in general. But ones that boom also settle down. And I think the other big cities that did boom, like Phoenix, Vegas, are going to not have the same rebound because just the jobs aren’t there. But the tech makes a big driver.

The biggest surprising thing I’ve heard though today was actually when Dave was talking about… I didn’t know Denver’s the home of fast food because everybody is so fit in Denver. I’m shocked. It’s just the home of beer and fast food and people are still fit there.

Dave:

Well, I should say fast casual. We’re not [inaudible 00:31:05] McDonald’s. But honestly, it’s crazy how many of them there are. It’s like Qdoba, Chipotle, Quizno’s, Smashburger, they’re all started there.

Henry:

Why would you be surprised that Denver is the home of the places where you want to get munchies?

Dave:

Okay, Henry. All right, this started-

Kathy:

Well played.

Dave:

… well before the law in question.

Henry:

No, we need burritos, guys. We need a lot of burritos.

In all seriousness, I think a lot of this goes back to some of the things we’ve talked about for a long time on this show. I remember when rates were spiking. We did a show where we had a conversation where we essentially were saying, at some point these high rates just become normal. And when life normalizes, people don’t just move because of financial decisions, they move because they want to. They move because of life changes. They move because of job changes. And life will continue to happen. And the more comfortable people are with the market dynamics, the more they’re going to jump in. I think what’s been holding people back is the level of uncomfortability or uncertainty that’s out there. But if people start to feel more comfortable even with the volatility, or more comfortable even with the higher rates, you’re going to see more buyers enter the market. And I think that’s just going to help a lot of markets start to rebound a little bit. Obviously the ones with the better market dynamics will rebound harder.

Dave:

Well said. Well, what a good way to get out of here. Thank you all for doing all this homework and bringing these shows. This was a lot of fun for Henry, James and Kathy. I’m Dave Meyer. Thank you all so much for listening. See you next time for On The Market.

On The Market is created by me, Dave Meyer and Kailyn Bennett, produced by Kailyn Bennett, editing by Joel Esparza and Onyx Media, research by Puja Gendal, copywriting by Nate Weintraub. And a very special thanks to the entire BiggerPockets team. The content on the show On the Market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

New home sales defy recession calls

New home sales are up 20% year over year, and existing home sales are down 20% year over year; this is something we don’t see very often. One group has the advantage here while the other doesn’t: The new home sales market is minuscule versus the existing one, and the builders sell their homes like a commodity.

Last year a theme of mine was that new home sales are historically low, and the builders know how to move products when needed. This means they will cut prices, buy down rates, and do whatever it takes because they’re in business to make money. They have no emotional ties to houses and don’t need to sell a home to buy another one. They’re effective sellers and don’t want to create a backlog of completed units for sale because that would ruin their business model.

Case in point: Today we have 69,000 new homes completed and ready to sell, as shown below. The builders have managed their backlog nicely to ensure this data line doesn’t explode higher on them like we saw in 2008. An average number would be around 80,000 homes for sale, so we are returning to normal.

But a bigger story here is that the builders’ biggest competition isn’t other builders — it’s the number of existing homes on the market. Existing homes are cheaper and have a geographical advantage because they’re all over the map. In 2007, we had more than 4 million total active listings, which was too much supply for the builders to compete effectively. Today, the total number of active listings according to NAR is 1.080 million, and that number is down year over year.

NAR total active listings data going back to 1982:

This explains why the builders and new homes are doing better than the existing home sales market, which deals with higher mortgage rates and low active listings. Some people prefer something other than the current active existing inventory. This means new homes — with all the bells and whistles — can peel some buyers from the existing home sales market, especially if they pay down mortgage rates.

Now on to the report.

From Census:

New Home Sales: Sales of new single‐family houses in May 2023 were at a seasonally adjusted annual rate of 763,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.2 percent (±12.8 percent)* above the revised April rate of 680,000 and is 20.0 percent (±15.5 percent) above the May 2022 estimate of 636,000.

As we can see in the chart below, new home sales aren’t booming like what we saw at the peak of 2005 but are getting back to trend sales growth from the bottom we saw when rates got 5% in 2018. New home sales can be wild monthly, so if we see some negative revisions to this report, just remember: it’s the trend that matters, and it’s gotten much better here.

Also, in the chart below, we can all agree it isn’t housing 2005 or housing 2008 with new home sales.

For Sale Inventory and Months’ Supply: The seasonally‐adjusted estimate of new houses for sale at the end of May was 428,000. This represents a supply of 6.7 months at the current sales rate.

As home sales improve, the builders are winding down their monthly supply, which is good for the economy. I have a straightforward model for when the homebuilders will start issuing new permits with some kick. My rule of thumb for anticipating builder behavior is based on the three-month supply average. This has nothing to do with the existing home sales market — this monthly supply data only applies to the new home sales market and the current level of 6.7 months.

Housing permits will follow since this data line improves as new home sales keep growing. The model below has been my bread and butter for years:

The current data has seen significant improvement, as the chart below shows. Also, the only bubble crash this year has been in cancellation rates, not existing home sales prices.

Also, it’s vital to break down the monthly supply data into different supply categories.

This is a solid report today as the builders are moving products and making deals to get buyers in. I love it.

Housing has always been used as an indicator of the economy. As the builder confidence data rose, many pessimists ignored it because they assumed it was a dead-cat bounce. Now that we are almost to July 4, 2023, it’s a wake-up call. I ask my bearish friends who use housing as a leading indicator going into recession and out what they believe the data is telling them now. So far, I haven’t heard back.

Home Builder Confidence Index

The builder’s confidence index is gold because the builders are thinking about making money, whereas some indexes might have a political or ideological twist. I track the builders’ confidence and the 10-year yield because these two are essential for housing. This report is a plus for the economy because construction worker employment risk will decrease if sales continue to higher and mortgage rates can fall.

This article aims to show how much progress we have made in this sector and why it’s happening. The report today is a positive story for the U.S. Hopefully, this trend continues because the best way to deal with inflation is always with supply, not demand destruction. Demand destruction is a short-term fix, but supply needs to grow over time to beat inflation.

Source link

Eviction filings are up more than 50% in some cities compared to pre-pandemic levels

Eviction filings have risen more than 50% in some cities when compared to pre-pandemic levels, as expiring relief measures and economic volatility play havoc with the finances of renters in certain parts of the country.

This is according to data from the Eviction Lab at Princeton University, as reported by the Associated Press.

“Protections have ended, the federal moratorium is obviously over, and emergency rental assistance money has dried up in most places,” Daniel Grubbs-Donovan, research specialist at the Eviction Lab told the AP. “Across the country, low-income renters are in an even worse situation than before the pandemic due to things like massive increases in rent during the pandemic, inflation and other pandemic-era related financial difficulties.”

Eviction Lab tracks data in roughly 36 cities and 10 states, finding that eviction filings are more than 50% higher in certain areas. Landlords file about 3.6 million eviction cases each year, according to the organization.

Among the cities with the highest rates, Houston came in the highest. Evictions there were 56% higher in April and 50% higher in May, according to the data. In Minneapolis/St. Paul, rates were 106% higher in March, 55% higher in April and 63% higher in May. Nashville was 35% and Phoenix was 33% higher in May, while Rhode Island was 32% higher in May.

“The latest data mirrors trends that started last year, with the Eviction Lab finding nearly 970,000 evictions filed in locations it tracks — a 78.6% increase compared to 2021, when much of the country was following an eviction moratorium,” the Ap report said. “By December, eviction filings were nearly back to pre-pandemic levels.”

Rent prices have also steadily increased, being roughly 5% higher in 2023 over last year, and over 30% higher in 2023 when compared to 2019 according to data from Zillow as shared in the report.

As federal relief programs from the pandemic are increasingly expiring or becoming phased out, calls for additional resources from Congress have failed to gain any significant momentum, particularly as concerns over spending dominate the legislative agenda of the U.S. House of Representatives.

The expiration of eviction moratoria is also leading to higher rates of eviction. But similarly to a lack of will seen in the U.S. Congress, a number of state legislatures have not seen any meaningful legislation emerge to combat the trend, despite organized efforts in states like New York and Texas.

However, several pandemic housing relief measures have been made permanent.

Nationwide, 200 measures have passed since January 2021, including legal representation for tenants, sealing eviction records and mediation to resolve cases before they reach court, according to the National Low Income Housing Coalition.

Source link

MAXEX lands equity investment, partnership to expand liquidity

Digital mortgage exchange and loan aggregator MAXEX announced on Monday it closed an equity investment round and partnerships to expand liquidity amid the recent market volatility. Terms of the transaction were not disclosed.

The investment round was led jointly by the financial institution South Street Securities Holdings and the investment firm Atlas Merchant Capital, headed by former Barclays CEO Bob Diamond. (Atlas also has a minority investment in South Street.)

The three companies will collaborate to accelerate industry adoption of MAXEX’s platform and expand access to MAXEX and South Street products and services. The companies claim they collectively serve more than 500 market participants.

Several of MAXEX’s existing investors, including J.P. Morgan and Moore Asset Backed Fund, also participated in the round.

Houlihan Lokey served as the financial advisor to MAXEX.

“MAXEX’s mission is to serve as a market utility and liquidity provider for the U.S. mortgage markets,” Tom Pearce, CEO, chairman and co-founder of MAXEX, said in a statement. “This partnership enables us to further accelerate our growth, expand our product suite and broaden our network.”

South Street will provide capital support to MAXEX’s existing clearinghouse facility as part of the deal.

It will “further enhance MAXEX’s counterparty strength by leveraging South Street’s investment-grade rating and approximately $30 billion balance sheet,” the company said in a statement.

According to Jim Tabacchi, president and CEO of South Street, “Recent market volatility emphasized the need for fundamental change in the mortgage secondary market as lenders and investors struggled to adapt to rapidly rising rates, liquidity shortages, and the need to operate with more nimble, flexible infrastructure.”

The deal with MAXEX expands access to a broad range of non-agency and agency-eligible mortgage loan programs.

“This partnership enhances our offering and TBA pipeline hedging platform by giving clients access to MAXEX’s loan trading exchange,” Tabacchi said.

In May 2022, MAXEX launched a DSCR [debt-service coverage ratio] loan-purchasing program for originators looking to tap into the growing mortgage demand from individual and small-business real estate investors, such as rental property owners, who “tend to prioritize property cash flow over interest rate.”

The company also announced that it expanded its bulk- and forward-trading loan programs.

In September 2022, the digital mortgage platform unveiled a series of new programs designed to serve originators and loan buyers in the growing non-QM lending market.

Source link

Fannie Mae lowers 2023 single-family originations forecast to $1.59 trillion

Current housing market dynamics continue to be fueled by the lack of existing homes available for sale, a trend that did not improve during the spring homebuying season, when more homes are typically put on the market. This has led Fannie Mae to revise its 2023 single-family originations forecast to $1.59 trillion, down from $1.65 trillion.

This lack of inventory has also resulted in the return of home price growth in recent months and has boosted new home construction, Fannie Mae‘s Economic and Strategic Research (ESR) Group said Monday.

While the flow of new listings remained suppressed for much of 2022 due to a mortgage rate lock-in effect, the slower pace of sales led to a build-up of active inventories for sale and a modest decline in national house prices in late 2022, the ESR group explained.

Single-family housing starts surged 18.5% in May to a seasonally adjusted annualized rate of 997,000 units.

Single-family housing permits, which tend to be more indicative of the underlying trend, also rose, but by a smaller 4.8% and to a seasonally adjusted annualized rate of 897,000 units, well below the pace of starts.

Still, the permits data points to a clear upward trend in recent months, and this coincides with improvement in homebuilder sentiment. Homebuilder confidence moved into a positive territory for the first time in nearly a year amid recent data from the U.S. Census Bureau showed that about 1.69 million single-family and multifamily housing units are under construction across the country in May, nearing the highest levels recorded in the last 50 years.

Without a broader economic slowdown, current home prices and lack of existing inventory will lead to more home construction, Fannie Mae’s ESR group projected.

Doug Duncan, senior vice president and chief economist, pointed out that housing prices continue to show stronger growth than what was previously expected given the “suddenness and significant magnitude” of mortgage rate increases.

Homebuilders continue to add to the supply of historically low inventory levels, but years of meager homebuilding over the past business cycle means the imbalance will likely continue for some time, according to Duncan.

The ESR group projects single-family mortgage originations for 2023 to be $1.59 trillion, down from its previous forecast of $1.65 trillion. In 2024, about $1.90 trillion origination volume for total single-family houses is projected, also down from the previous forecast of $2.03 trillion.

Fannie Mae reiterated that the economic downturn remains a question of “when” rather than “if.”

The ESR group expects a modest recession in the fourth quarter of 2023, a shift from last month’s forecast from the beginning of the second half of the year.

“We do expect housing will be supportive of the overall economy as it exits the modest recession,” Duncan said.

The good news is that ongoing resilience in employment, strong housing demand, and current financial conditions do not point to an immediate downturn.

Fannie Mae upgraded its 2023 GDP forecast to 0.1% from -0.3% on a Q4/Q4 basis while it downgraded its 2024 GDP forecast to 0.8% from 1.2%.

Source link

4 Comeback Housing Markets That Could Rebound in 2023

Looking for housing markets with population growth, new jobs, rising home prices, and unlimited profit potential? If so, you’re in luck! In this episode, we’ll reveal four of our favorite “comeback” housing markets primed to explode over the next few years. Thanks to the recent housing correction pushing home prices lower, some top investing areas are sitting on suppressed prices that might not last long. So, what are our top markets?

First, we head down south to talk about an explosive city that tanked in property pricing but now looks like a strong buy. Then, we’ll head to the Silicon Slopes to break down why this new tech hub (and ski city) boasts some surprising metrics that could mean more money for rental property investors. From there, we’ll enter into the dense forest and fog of an iconic city that isn’t even close to past its prime. Finally, we’ll finish with a nugget of wisdom from Dave on why this “fast food city” might be worth more than its munchies.

So, if you’ve been preparing for your next out-of-state investment or are just looking for a market that’ll bring you long-term growth, tune in to hear where our experts are planning their property purchases!

Dave:

Welcome everyone to On the Market. I’m your host, Dave Meyer, joined by Henry, James, and Kathy for a great show. How is everyone?

Henry:

Fantastic.

Kathy:

Wonderful.

James:

I’m doing good.

Dave:

All right. Well, today we’re going to dig into different markets across the country. As we’ve talked about a lot on this show, the housing market is really split and every market is behaving really differently. So we’re going to dive into different markets.

First, we’re going to do a little bit of trivia, and I’m going to see if any of you can guess some of the markets based on some of the characteristics of how they’re performing right now. And then we’re going to get into a Comeback Kid episode where each one of us has brought a market that was experiencing declines over the last six, 12 months, but we are expecting to take off again sometime in the near future.

So that’s our plan for today. So let’s get into our game where I’m going to ask you all to guess the market. Basically what I’m going to do is I’m going to read you three clues and at the end, each of you’re going to have a chance to guess which market this is.

For our first market, it has a median list price of $620,000. So that is well above the national average, which is about $400,000. Home values have increased 4% over pre-pandemic levels, but they have come down off their peak. And the third clue is that this city did not have a professional sports team until 2021. Kathy, you look very deep in thought, so I’m going to pick on you.

Kathy:

Sports team, new sports team. Las Vegas. That’s all I can think. Maybe. And Henry’s shaking his head no.

Dave:

That is a good guess. I’m not going to tell you that… Did they… I think… I don’t know when they got their first sports team, but it was recently. Henry, you know she’s wrong?

Henry:

No, I don’t know she’s wrong. I was nodding my head. I don’t think I was nodding it no, because I also think it’s Las Vegas. The throwing me is the average home price-

Kathy:

I know. Me too.

Henry:

620. That seems high for Las Vegas. But I’m a Raider fan and I know they just moved to Las Vegas recently and they hadn’t had a pro sports team before that. So I’m going to go Las Vegas.

Dave:

All right. James.

James:

I’m with Henry. I’m thrown off by the median home price. But then when did Las Vegas get their hockey team? That was like-

Henry:

Oh, that’s right. They had a hockey team before that.

James:

Man, I was going to agree with them until I just thought about the hockey team.

Henry:

And they also had the Las Vegas Aces. They had the WNBA team.

James:

Is it L.A? Because when did the Rams go there? No, they have tons of teams. What am I talking about?

Dave:

The Clippers, the Dodgers.

James:

I’m just throwing out Austin. I don’t even know.

Dave:

Okay. Well, James, you actually got it right. It was Austin.

James:

I was guessing more of tech cities. I was like, well, it’s Seattle like-

Henry:

But wait-

James:

Because tech’s around 600 to 700 typically.

Henry:

Wait, who’s in Austin? Who plays in Austin?

Dave:

Yeah, what professional sports team is it? I’m googling it.

Henry:

Is it like a soccer team?

Dave:

Okay. Henry, you’re right. Yes, it’s a soccer team. That’s why none of us knew it was the Austin FC, which is the first professional sports team. Shows how much we know about soccer. But that’s right. So I think this is kind of interesting. Austin. Las Vegas was a good guess, but I think the median sale price there is a lot lower.

Kathy:

Yeah, that wasn’t matching.

Dave:

But it is interesting that despite Austin’s pretty big correction that they’re in, still above pre-pandemic levels, but only 4%, which is pretty small compared to all the other… Even other markets that are in a correction right now are still up way more than 4% over pre-pandemic levels. All right, James, that was pretty impressive. Pretty impressive guess right there.

All right, well, let’s go to our second market. This one, right around the median national price. We have the median home price of $389,000. This market has seen huge job growth. 84,000 jobs have been added just since 2021. And most importantly of all, the Cuban sandwich was invented here. James, since you’re the winner?

James:

Miami?

Dave:

That’s a good guess.

James:

Wait, wait. What was the medium home price?

Dave:

389,000.

James:

Oh, that can’t be right. That can’t be right. Charlotte?

Dave:

All right. Henry?

Henry:

Yeah, obviously I’m thinking of a Florida city. Yeah, so like Fort Lauderdale.

Dave:

All right. Kathy?

Kathy:

I’m going to go with Miami just because.

Dave:

All right. The Florida theme was right. Cuban sandwiches. But it is actually Tampa, Florida. Kathy, that’s your market. Kathy, be honest. Have you ever had a Cuban sandwich when you’re in Tampa?

Kathy:

Never. No.

Dave:

That’s a shame. I’ve never been to Tampa. But let’s go and get some Cuban sandwiches,

Henry:

Aren’t you the DataDeli? How have you never had a Cuban sandwich in the home of the Cuban sandwich?

Dave:

I don’t know. This needs to be rectified immediately.

Kathy:

I don’t even remember seeing signs for one when I’m there.

Dave:

All right, so no one was there. James still has the lead. Market number three, though, median list price almost exactly the same. 389,000. One of the fastest growing cities in the entire country with a 2.8% population growth since 2022, which is huge, just for reference; it’s usually below 1% even for fast growing cities. And this city is named after an English explorer. I have no idea. Kailyn, this is a good one because no one’s going to know. All right, Henry, you’re up first.

Henry:

Come on. I don’t know. Columbus, Ohio?

Dave:

Oh, that’s pretty good. He wasn’t English, though.

Henry:

Yeah, exactly.

Dave:

All right. Kathy?

Kathy:

Mr. Dallas? I don’t know. [inaudible 00:05:56] Dallas?

Dave:

Mr. Dallas. Yes. The famous Mr. Dallas.

Henry:

The famous English explorer, Mr. Dallas.

Dave:

Yes. I remember him fondly from high school world history class. James, what do you got?

James:

I don’t know. Kensington?

Dave:

Is that even a place? Isn’t that like the ketchup, Mr. Kensington? That’s like that fancy ketchup?

James:

It sounds English.

Dave:

It does sound English. No, it is Raleigh, North Carolina, one of the fastest growing places. Wow. And it is according to Kailyn, it is named after Sir Walter Raleigh, an explorer and nobleman who funded the first expeditions to the coast of modern day North Carolina. Can’t believe you guys didn’t know that.

Kathy:

It all makes so much sense now.

Dave:

Well James, I think you won this because you were the only one who got that right.

All right, well that was fun. But we are going to get into markets that we actually know something about in the next segment. But first we’re going to take a quick break.

All right. Welcome back everyone. We are now going to jump into our comeback kid markets. Again, as we talked about at the top of the show, these are markets that have seen a correction over the last couple of months, but as the housing market, on a national basis, is starting to find its footing a little bit, I think it’s too early to call a bottom on a national level. There are definitely certain markets that are starting to see a rebound, at least for now. And we’re here to try and predict and talk about some of the markets that we think have the strongest potential to rebound throughout the rest of this year.

Henry, let’s start with you. What market do you think has the best chance of rebounding?

Henry:

Yeah, I went with Austin, Texas, which is sad that I didn’t know the answer that Austin had a professional sports team, but none of that came up in my research.

But I went with Austin mainly because I’m going to start with the end first. So the main reason I chose Austin is because the key factor in real estate is always location, right? Location, location, location. And people have been moving to, and living in, Austin because of the location, because of the amenities that it provides, because of the music life and the nightlife and the indoor/outdoor kind of living and all for essentially what can be considered a reasonable cost of living if you compare it to coastal cities or in the far east coast. And so you kind of get a little bit of lifestyle and some affordability. And so even though the pandemic caused this market to skyrocket and then now fall back to reality a little bit, the lifestyle there is still the same and people still want to enjoy those amenities.

So I think as the market moves closer to where it was pre-pandemic, it’s going to just encourage more people to go there. When I say people, I don’t just mean people. I also mean businesses. People work at businesses. Businesses want to be able to enjoy these amenities when they’re not at work. And so they move. There’s several companies who have either relocated or opened up offices in the Austin, Texas area. You’ve got Oracle moved their headquarters from California to Austin and they did that in 2020. BAE Systems moved their office. They’re a defense contractor, essentially. They moved their offices to Austin in 2021. HP. Everybody knows who HP is. They moved headquarters from California to Spring, Texas, which is just outside of Austin. So these are big employers that employed lots of people across a couple different industries. And it’s cheaper for them, I’m sure, than what it costs them to office and have headquarters in California and other cities. And so that’s bringing people because people work there. And as those companies continue to grow, more people work there.

Some stats that I did find interesting: population growth has gone up year over year since 2020. So it went up about 3% in from 2020 to ’21, 2.79% from ’21 to ’22, and then 2.39% from ’22 to ’23.

Dave:

That’s got to be like one of the fastest growing markets in the country.

Henry:

It is. It is the fourth fastest growing city in the US. And it ranks number one in growth rate among cities with over a million people. So it rapidly growing.

And the median home price, if you look at home values in 2021, average price was 451. In ’22 it was 567. So it jumped 26%. And now in ’23 it’s 530,000. So it’s down 15% from last year, but it’s still up from the 451 from pre[pandemic levels levels, going back to what we talked about in the last segment with Austin.

And so I think it’s a comeback city because the location is still phenomenal. The cost of living, when compared to other cities, is still fantastic. Companies are moving here, which is bringing jobs. People can still work remote in a lot of companies, so they’re wanting to move places where they would enjoy the lifestyle. And I just think that’s going to cause this place to continue to boom as the market softens.

Kathy:

Yeah. And with all those tech companies moving from California, that’s one big reason that people are moving there. But it’s really the tagline of Austin is why Californians are moving there. Keep Austin weird, right? Yeah. So we’re going to do that as Californians as we move out there. We’ll just keep it weird.

Henry:

California said, hold my beer. We got you.

James:

Henry, I love this pick because I’m a firm believer that the tech cities are going to all make comebacks right now. I think the pandemic got… Everything changed so much during that time where people could work remote. They were moving around. These tech companies have been very clear they want people back in the office and things are getting back to normal. And these are where all the jobs are right now. There’s massive growth in all these cities. There’s lots of job openings across the board. Income is rising.

The only thing I would say about Austin as a whole is it’s a very large geographical area. I don’t know if the outskirts are going to do… Randomly, the guy that won me at the BP Con was from Austin, Texas. He’s a flipper out there. He texted me last night and he said his inventory’s stacking up everywhere on the outskirts. And so that would be the only thing that would maybe hold that city back a little bit is just the sheer size of it. And there’s so many different income pockets in that size that it could skew the math a little bit. But I think the core city where the jobs are will be growing pretty strong.

Dave:

The only other thing I’d add… I agree; I think Austin has one of the best long-term potentials of any city in the country, if not the single best. And if prices are coming down, it could be a good opportunity to buy.

The thing I would caution against is Austin is one of the most overbuilt cities in terms of multifamily specifically. And that could create some competition and some stagnation of rent growth even in single families in the short term just because there’s a lot of supply coming online in Seattle. And that is also – spoiler – true of the city that I am going to present. This naturally happens.

Henry, this is a great pick, but you’re not the only person who sees Austin as a great long-term buy. So builders see that and they start buying and building like crazy. And when we enter a correction like this, it’s looking like it’s poorly timed. So that might play out in Austin, at least over the next couple of months.

All right. Well, great pick. Kathy, what about you? Where are you expecting a big comeback?

Kathy:

Well, it’s so funny. Just one comment on Austin. This is an example of why sometimes cashflow shouldn’t always be the thing to focus on. Because I remember, I’ve been doing this a long time, but 15 years ago I would always say, ah, I’m not going to buy an Austin because it just doesn’t cashflow. And back then the average price there was, I don’t know, 200,000 or something. I’m like, it just doesn’t cash flow. Henry, what’d you say the medium price is now?

Henry:

The medium price of 2023 is 530,000.

Kathy:

Yeah. So it’s one of those examples of sometimes when you see all those factors in play, maybe it’s okay to break even. Maybe it’s okay to just hold that property knowing that there’s going to be so much growth.

And that is how I feel about the market I’m going to present. We have a development nearby, as you guys know, but Salt Lake City is the market that I’m focused on. It’s getting hit a little bit hard right now. There is increased inventory for sure, but those fundamentals are there, like I saw in Austin many years ago. What’s happening in Salt Lake is really massive population growth. And the factors that I follow, I know you guys do do too, is number one is population growth. I want to know that people are moving there and want to be there and aren’t leaving. And usually population growth comes from job growth. People move where the jobs are. And when you can still get affordable properties in those markets, to me, one of those places where you just sit and wait it out. And even if the cash flow is not great, when you have just massive population and job growth, you’re probably going to be okay in the end.

So what’s happening in Salt Lake is the population has increased 161% over the past 10 years. And the fertility rate is 3.4. Nationwide, it’s 1.8 to 2. So lots of baby boom in Salt Lake. Of course, that probably has a lot to do with the Mormon population there where families do marry… They’re formed very young and of course have a lot of kids. So we’re just seeing outstanding population growth there.

Jobless rate is 2.2%; lowest in the country, 43,000 new jobs. Zillow forecast growth of 1.4% next year. So these are just some of the basic reasons why I’m bullish on Salt Lake. And of course we do see a lot of tech companies moving there as well to the Silicon Slopes as they call it.

Dave:

Well, I was going to agree with you, Kathy, but if Zillow is forecasting growth, that probably means it’s going to decline.

Kathy:

I think it’s wrong in the sense that it’s going to be higher than that, honestly. Because it already is. It’s already showing that it’s coming back. It’s a comeback city. One of the things… This is a cool slide on the youngest cities. And you know what? Seattle is number one, Denver second, but Salt Lake’s on that list too of the median age being five years younger than the national average.

Dave:

Oh wow. Well, if I was giving up points for this presentation, I would give you some points for bringing in fertility rate. I think that’s a new data point on this show. I don’t think we’ve ever had that, but it totally makes sense. It’s a good one. James, Henry, what do you guys think?

Henry:

I think she gets points with the fertility rate and loses points on the Zestimate.

Kathy:

Fair. I’ll take it. When they change their forecast, I don’t know, five times or something. I want to do that. I want to forecast and then just change it every month.

Henry:

I mean, that’s what forecasting is, right?

Kathy:

That’s true.

Dave:

Yeah, it is. That is exactly what it is. It’s better than just pretending that something that you already know is wrong is still-

Kathy:

It’s still right. Yeah.

Dave:

Yeah. So I think updating the forecast is still a good idea.

Kathy:

It’s fair. The world changes so quickly.

James:

Yeah, I love Salt Lake City. I’ve been there a few times and the quality of living’s really good there. You can just tell as you go around, everything’s clean. There’s good infrastructure there. I don’t know a whole lot about the job growth and economy there. But I kind of foresee that being more of a stable market than seeing it kind of hockey stick back up. I think there’ll be more steady growth. I think these other secondary cities are going to be more going into the steady, stable growth and they’re going to fall behind these tech cities with the comeback. But I do think they’re good quality living. There’s a lot of people living there. Shoot, I tried to go skiing at Kathy’s… We stayed at Kathy’s development and we tried to go skiing. There were so many people, I had to turn around and leave. I was like, this is unreal.

Kathy:

It was packed.

James:

It was packed. So there definitely is a lot of bodies there.

Henry:

I think the outdoor lifestyle is going to draw lots of tourism, which brings money in that supports that community that and the people don’t stay. So I think that’s going to help. My concern is long term job growth. So if they’re having such a baby boom and there’s going to be so many people, if they don’t continue to have increasing job growth, then where are all these people going to work and how are they going to continue to produce for their families?

Dave:

All right. Well, I like it. James, what about you? Are you on the Austin/Salt Lake bandwagon or you got something else?

James:

I like Austin. I like the tech cities on the comeback. I feel like they got overcorrected a little bit during those rate hikes. But I’m a repping my backyard, Seattle, Washington. I think that is going to be the biggest comeback kid market and mostly because I’m living in it right now and it just feels different. We put a house up for sale on Friday, had four offers in three hours on it, and we were at the top end of the pricing. And what I’m seeing is if you have a good product in a good neighborhood, that stuff is selling and it’s selling for above list. Things trading below list now in this market is not happening. And who knows, we might be seeing a seasonal change.

The main reason like Seattle is the population is growing. We have so many jobs. People can get good paying jobs. There’s no income tax in this state. And so people can… They get to save more. They get to walk with more in our state, and that’s a big benefit. But Seattle’s population increased 2.4% from 2021 to 2022, and they’re anticipating the same growth. That is the fastest growing city in 2022.

So there’s growth and the companies are also growing rapidly as well. Like we’re watching Amazon, Facebook, Microsoft, expand out their campuses. Microsoft’s building out a campus that’s being built over a 10 year period; that’s how big it is. And they’re ready to fill these places up with bodies, which means good paying jobs are going to be in our market.

Home values, what we’ve seen is we’ve seen this hockey stick back up. This is really interesting. So we saw the median home price drop down in December to 754,000. That was a huge drop from the previous 12 months. But recently we are now sitting, since December, we’re at 840,000. We’re seeing this swing back up and I’m seeing it in real time data.

We were comping a property in Bellevue yesterday and Bellevue, Washington’s a nice suburb city right outside Seattle. Properties that we’re selling for 850, 90 days ago are now selling for 1.15 to 1.2 in the exact same condition. And we’re seeing this rapid growth. There’s very, very little inventory. Our inventory went up to about two and a half, almost three months. We’re back down to under a month worth of inventory. And so things are getting consumed and there’s a lot of buyers in the market. So any market that has that much pent up buyer demand with no inventory, regardless of rates, there’s transactions going down.

And the transactions are trending up, not trending the other way. And I think that comes down to a lot of these tech cities. They’re smart buyers. They like to overthink things. And when these rates spiked up, they all went on the sidelines for a minute. They saw it kind of come down and then they saw it stabilize out and now they’re having massive FOMO and they’re jumping in. And as they’re jumping in, values are going up.

Rents are also still climbing. There’s massive rent growth the last two years; I think it was 23% rent growth over the last 24 months. And we’re still seeing it grow. It’s growing at a more stable pace, but we have not seen the decline like Austin saw. It grew at 2.7% in the last 60 days on rent growth. We saw a little bit of a dip for that last quarter in ’22, but not much and now it’s growing it as the cost of housing is going up, with the interest rates and the monthly expenses, so is rent. So rent is getting pulled up as well.

So all the key indicators are showing that it’s rebounding really well and things are increasing. And not only are the values increasing, the wages are increasing. Wages are up 5% year over year. So there’s a lot of jobs in the market. 119,000 open jobs, people are getting paid more and there’s no inventory. And so the people with jobs want to settle in. And that’s what we’re seeing is the market is rebounding pretty consistently.

Kathy:

That is so shocking. Really, that people can buy those high priced homes with today’s interest rates and that they’re not the shortage of them. Are they paying cash? I mean, who are these people?

James:

They’re financing the deals. That’s the thing. There’s a lot of financing. And we’re also down in SoCal and the competition, I know, that is growing too right now. Like Newport Beach is accelerating still. That’s cash buyers. I’m seeing it. People are stroking big checks for houses. This is, they’re financed tech buyers that are putting about 25% down. They’re your standard buyer. And I was a little shocked too because if you really think about what the average tech workers making, around a hundred grand a year, and the housing cost is pretty expensive. People are paying five, six, $7,000 for these houses in these neighborhoods. It does surprise me, but they are transacting. I think there is also still a lot of cash that is sitting in people’s banks right now and they’re just utilizing it. There was so much cash printed, people made so much money the last 24 months. Now they’re just putting it to work.

Kathy:

I mean, I was just under the impression that they were feeling depleted after the stock market went down and they lost their money in crypto and so forth. But if some of these people are from California and they’re buying a million dollar house, they may be leaving a 2 million house or a 3 million house. And so perhaps it is more affordable for them from that perspective. But if they’re not, if they’re just locals, it’s still, like you said, if they’re making a hundred thousand maybe per person and it’s a couple, it still seems like a stretch. But it’s amazing.

Dave:

I think the other really interesting thing about Seattle, and honestly a lot of these markets, is that the tech, we’ve seen a lot of high profile tech layoffs, and I think that perhaps led to some fear, particularly over the winter. People were sort of waiting to see what happened. But from some of the data… I mean, we see the labor market data, which is pretty darn strong given where we are in the tightening cycle. But I was reading something the other day about how ChatGPT has all of these major companies like Microsoft, Google, all of them in this arms race again now, and they’re staffing up again. They’re all trying to hire quickly to try and get the best AI engineers and be able to beat each other to the market. So it’ll be really interesting to see if the very well publicized layoffs in tech slow down and we start to see these tech markets start to take off again.

Henry:

You talk about the stock market. The stock market’s been kind of rebounding over the past couple of weeks. I know my portfolio’s looking better than it has in a long time. And so I think people are starting to see some of that positivity. I think if the interest rate hikes slow down, stop, or reverse, I think you’re going to see a boom in these markets, especially one like Seattle with such great fundamentals. Because you’ve got the jobs, you’ve got the job growth. It’s a place where people want to live. It’s desirability. I don’t like rain a lot, so I don’t want to live there, but lots of people enjoy that part of the country.

I think if you’re waiting on the sidelines or you’re looking for a place to invest, thinking about a place that has these strong market dynamics and fundamentals, I think it’s such a sweet spot right now because the rates haven’t completely changed direction yet. And I think once they do, it’s going to create this big bump or demand. And so there’s this sweet spot where you can get in right now, especially if you can buy at somewhat of a discount. And then even if that property, like Kathy said, breaks even, when you’re buying in a market with these great fundamentals, you know it’s a waiting game. And if you can hold that property long term… You may not even have to hold it that long depending on what happens with rates. But if you can hold that property long term, I think you’re playing the market conditions safely.

Kathy:

I do want to share one last thing that Marcus and Millichap Research Services came out with the employment pre-pandemic percent change. So which cities have more jobs now than pre-pandemic? And interestingly enough, Austin came number one with 14% more jobs now than before the pandemic. Dallas was second with 9.9 and Salt Lake was third with 9% more jobs than pre-pandemic. And Seattle’s not on the list, but maybe that’s because Seattle already had so many jobs that… I don’t know, but I think that’s interesting.

James:

You just made my hand sweaty, Kathy.

Kathy:

But I mean there were already so many jobs up there that and just obviously not enough real estate for all the jobs that are there.

Dave:

All right. Well, for our last market… I guess this is a theme; I picked one that’s sort of in line with what the three of you have already picked. It is the home, if you know these places, home of Qdoba, Chipotle, all sorts of other fast food restaurants. And that is of course, Denver, Colorado where I am just like James and I’m just a homer, picking the market I know best.

But I really believe that Denver, like these other cities, is poised for really big comeback for some of the same reasons we’ve been talking about, is really strong fundamentals. The population growth has been very strong for 15 years. Prices have dropped a little bit, so they’ve become a little bit more affordable, but it is heating up really quickly. Days on market in Denver have dropped down to just 11 days right now. Yeah, so we’re seeing a lot of activity.