David:

This is the BiggerPockets Podcast Show 786.

Brandon:

Oftentimes, we look at moving the wall, we look at some big project like, “I got to do this big thing. I got to get good at real estate. I got to build financial freedom,” and it’s a big wall. It’s a lot of rocks there. It looks heavy. But the fact is, it’s not heavy. It’s 20-pound rocks. Anybody can do it. So, maybe people need to focus a little bit less on the wall and more on the rock. So, what’s the next rock in front of you? What’s the 20-pound rock? It’s not light, 20 pounds is still a little lift, but anybody can do it. A kid could do it. You just move the rock across the field, before you know it, you got a wall over there, you got a new fence.

David:

What’s going on everyone? This is David Greene, your host of the BiggerPockets Real Estate Podcast here today with a special Seeing Greene episode for you. If you haven’t listened to one of these before, these are episodes where we take questions from you, our listener base, our fan base, the people that are trying to build wealth through real estate, and I answer them for you based on my experience or the perspective that I have with real estate. Well, sometimes I bring in help, and today is one of those shows.

I’ve got my best friend, Brandon Turner with me, former host of this same podcast you’re listening to right now, that really helped me get started in the space. And he’s going to help me tackle the questions that our listeners have asked. This is going to be a fascinating show. I’m excited to bring it to you guys today. Now, I don’t want to give away any secrets from today’s show because it was really fun, but I will tell you, I’m about to teleport myself to Hawaii and bring this show to you live from the Sea Shed. So, I’ll see you in a minute.

From flannel to full-time flip-flops, DIYer to visionary, hot chocolate only to coffee connoisseur. He’s traded cold climates and ice cream every night for sun, surfing, and triathlons. Please welcome none other than my brother from another mother and best friend, Tandon Burner.

Brandon:

That was the most ridiculous introduction I’ve ever had. I loved it. Thank you.

David:

It’s not bad.

Brandon:

That’s really good. Did you write that or did Eric write that?

David:

Eric wrote that, absolutely.

Brandon:

Did Eric write that or did AI write that?

David:

That’s a better question, which we probably shouldn’t get into on this episode right now because we’ll talk about it for the whole time. Brandon and I are staunchly opposed on opposite ends of the AI spectrum. He loves it. I hate it. He thinks that it’s going to be cute and fun. I think it’s going to be the Terminator that takes over the world.

Brandon:

No, I think both.

David:

Skynet is Genesis. You heard it here first.

Brandon:

Take over. Take over, man.

David:

So, before we get into the show, can I tell you a funny story? I don’t know if I’ve already told you this, but we’re going to do it on the podcast.

Brandon:

Okay.

David:

Somebody DMed me asking for marriage advice because he was going through a divorce, and he wanted to know, “How can I make sure that my wife doesn’t get all the assets?” And I’m like, “Eh, it’s not really a question I’m going to answer for you, buddy. You need a lawyer, and I don’t feel comfortable telling you how to screw over your ex-wife.” So, instead, I said, “Well, what can you do to save the marriage? Let’s talk about that. That might be a little bit better.” Marriage is sort of under attack in our country, and I’d rather see couples stay together than get divorced.

And he didn’t want to get into that conversation, but I’m like, “Well, I’ve been through a rough breakup, and I thought at the time that I could handle it. It was actually much harder than what I thought. You might want to really think about this because sometimes when you’re frustrated, you’re emotional in your mind you see a situation working out differently than how it actually works.” Have you ever quit a job based on impulse? Probably not you, but people have, and they wake up the next day like, “Why did I do that? I don’t have another job. There’s nothing lined up.”

And his reply was so not like I would expect this guy to answer that. I asked him, “Did you send that from ChatGPT?” And the answer was yes. He gave me a computer-generated answer about me pouring my heart out in an Instagram DM. And I’m like, “This is why I do not like AI.” Because that’s what people are going to do. They’re like, “Okay, how do I say something to my wife on our anniversary that’s going to really make her happy?” And you’re going to go to ChatGPT and say, “Say something really sweet for my wife.” And then you’re going to hand it to her.

Brandon:

I may or may not have done that recently on our, what was it? My wife’s birthday. And I needed a nice birthday message for her on Facebook to be like, “Hey, this is my wife.” So, I went on to ChatGPT, and I put in all my thoughts, and I said, “Can you make this sound better?” And it made it sound better.

David:

At least you put your thoughts in. I’ll give you that. Other people are using it to save time, so they don’t have to think, which is what scares me. And it’s a sickness of the highest order. I don’t like it at all.

Brandon:

Well, why don’t we not talk about it then, man? Because you don’t want to talk about it, so…

David:

No, I want to talk about you. Well, where we’re back in Hawaii, we’re doing our thing, I’ve got my AI disclaimer out of the way. So, there will come a point where you and I will be pitted against each other, like Celebrity Deathmatch on MTV over this AI thing, and we’ll see how that works out. But in today’s episode, Brandon Turner and I have, what’s the word I’m looking for when you come back in contact with someone? Reconnected.

Brandon:

Reconnected.

David:

That’s not the word I was looking for.

Brandon:

I don’t know. We’ll call it that.

David:

Sorry.

Brandon:

It’s a joyful reunion.

David:

Yeah, something like that. It’s a reunion.

Brandon:

ChatGPT and OpenAI, what is another word for, watch this, what is another word for reunion? Another word for reunion is gathering more. Here are some more, meeting, get-together, gathering, rendezvous, assembly, and homecoming. Thank you, ChatGPT. Did you see how fast that was?

David:

Yeah, well, it probably was as fast as we could have just figured it out without having to type. But until ChatGPT is inside of our brains through a Neuralink, we still have to think a little bit.

Brandon:

Give it a year or two.

David:

So, I’m back with Brandon in the Sea Shed and we are talking, in today’s episode, we are going to get into a fire round of questions that people want to know about us.

Brandon:

That sounds good.

David:

We are going to get into, as an ode to the old BP style, a fire round where I’m going to fire questions at you, many of them from some of our listener base, and see what you have to say. So, question number one-

Brandon:

That should be the sound effect, should be like, “Fire out, pew, pew, pew, pew, pew, pew.”

David:

It was something like that, but it was like explosions.

Brandon:

Yeah, But I’m thinking I like that the little pew, pew pews.

David:

I don’t know that that’s still cool, brother. I think that’s like a nine-year-old meme. It was very funny at the time though, especially working in law enforcement. There was pew memes going around all over the place. Question for you.

Brandon:

Okay, here we go.

David:

What happens when you fart in church?

Brandon:

Oh geez. What?

David:

Yeah.

Brandon:

Is that a joke or is that a question?

David:

No, that’s a joke.

Brandon:

Oh, okay. What happens?

David:

They make you sit in the pew. All right, getting into our [inaudible 00:05:57].

Brandon:

Did you make that up or did you hear that?

David:

I heard it sometime a long time ago, but you brought it back.

Brandon:

That’s a good joke.

David:

With your pews. I’m going to list off the types of my boats in my armada. What is your favorite and how would you rank them in order of importance? You’ve got the friendship, the relationship, and the partnership.

Brandon:

Friendship, meaning what do I care more about? Friendship, relationship?

David:

Which is most influential in someone’s life, friendship, relationship, or partnership?

Brandon:

How are they different?

David:

Well, I don’t know. You explain to me. I would think they’re different. Are you…

Brandon:

I’m best friends with my wife. I have a relationship with my wife and my wife’s my partner. You and I are friends, we’re in a relationship, we’re partners, business partners.

David:

Okay, so this would be a romantic relationship.

Brandon:

Okay, so romantic relationship.

David:

Friendship, partnership, and business partnership.

Brandon:

Okay, so business partnership, romantic relationship, and friendship, bromance.

David:

Yes. Most influential in someone’s life. What’s the big rock they want to get right first?

Brandon:

The romantic all day long. You cannot grow beyond, maybe you can, but it’s exceptionally hard to grow beyond the person you picked to spend your life with. If that’s wrong, there’s a great quote. Who said that I’m going to, oh no. Pete Vargas. He’s a speaking coach guy, has a big company. He once told me that his dad would always say, was it Pete? I think it was Pete that said this. I’m going to give him credit anyway, it might have been-

David:

I’m just glad you’re giving credit to someone else for a thing you’re about to say.

Brandon:

A wise man once said, it might actually might have been Daniel Grothe, who wrote a great book called The Power of Place, but either way, the quote was they were together that’s why the three of us were together when I heard this. They said, “When everything’s right at 123 Main Street,” their house, “everything’s right.” When everything’s right at home, everything else is right. When everything’s wrong at home, everything else is wrong. Therefore, romantic partner, number one, most important thing, get that right pick the right person.

David:

That takes up so much real estate in your head, right?

Brandon:

It takes up so much real estate. When things are wrong in your relationship, you’re not working out, you’re not thinking about real estate, you’re not doing a lot of things.

David:

You’re in survival mode.

Brandon:

You’re in survival mode. That’s it.

David:

Good point.

Brandon:

Yeah. So, that’s where I go.

David:

That’s really good. Jay Papasan at your BetterLife Conference seconded that when he was talking about, “I am a husband first, then a father, then a businessperson.” If I get those first two right, all the other dominoes tend to fall in line. So, that’s very good. After romantic relationship, friendships, or business partnerships, most influential.

Brandon:

I can’t separate them, I don’t have friends that aren’t business partners.

David:

You are that way actually, your friends become your business partners and your business life are your friends. That’s a great point.

Brandon:

I’m not sure I have any friends that I don’t do some kind of business with. No, I’m sure I do. There’s some people from church, for example.

David:

It’s thought, man, I’ve never thought about that.

Brandon:

Do you have a lot of friends that aren’t business related? I have a hard time, I mean, let’s be real. I have a hard time connecting with people that aren’t in my world of business. Doesn’t mean they do what I do, but they’re at the same mind-

David:

Because your business is so tied to your mission, that’s why. For you to have a friend outside of your business means they’re also outside of your mission in life, that’s so important to you.

Brandon:

Yeah. When you get around people and you’ve been around people that are like, “Man, my bosses won’t give me that raise and I’ve been working 40 hours a week,” and they’re like, “They’re not giving me a raise. It’s so stupid.” How do I even resonate with that? I can’t. We’re operating at very different frequencies, and I don’t want to be in that frequency. So, I almost don’t want to be around. Now there are people I’m friends with, I guess that I’m not in any kind of business thing. However, they are in some kind of business thing usually. So, they’re operating at a similar frequency. We’re all running on the same frequency.

David:

Yeah, that’s a great point. All right. Our first question is going to come from the new co-hosts, Rob Abasolo in the H.

Brandon:

What does the H mean?

David:

This is what the new people in Houston refer to, it used to be called H Town. They thought they were cool to call it that, H Town became cheesy. So, now they call it the H.

Brandon:

Rob lives in Houston?

David:

Yeah.

Brandon:

How did I not know that? I thought he was in California.

David:

He used to be in LA for a time, but he’s in Houston. He’s one of those guys that bounces around wherever he’s investing. He wants to go live there. But he’s in Houston now.

Brandon:

He’s investing in Houston?

David:

I believe he is.

Brandon:

I’m buying.

David:

You are too.

Brandon:

I got two huge apartments right now that I’m buying.

David:

Yeah. So, Rob, if you ever need a place to live, [inaudible 00:09:58] on that rent. Yeah. Rob’s question. How has raising funds in the recent months changed for you? What are some tips that you may have for vetting operators?

Brandon:

It is the hardest time in the history of me being in real estate in 20 years almost of raising money, raising capital. And I would include that being in ’07. Not that I was doing a lot in ’07, ’08, but man, it is tough. It is tough right now.

David:

What makes it tough?

Brandon:

A couple of things. Number one, the news makes things tough, right? Consumer confidence is what drives a lot of this. The news has made it very scary, “Recession coming, recession coming, the real estate’s going to crash,” even though there’s almost no data that supports the real estate’s going to crash. But the news likes, likes to say that there’s very little that…

David:

Why’s it going to crash? Because it happened before.

Brandon:

Yeah, exactly. People cannot think outside of what happened before. That’s all they can think is, did this before. Humans need patterns, right? Because our brains-

David:

To feel safe.

Brandon:

To feel safe, they need patterns. So, the way that we-

David:

Especially when 80% of the real estate in our brain is not safe.

Brandon:

Yes.

David:

We look for the comfort and the pattern. And we miss what is actually happening.

Brandon:

Yeah. There’s a whole, I mean, books have been written on this topic of humans having to categorize things and find patterns and find meaning in things.

David:

Oh, for sure. Have you ever dated somebody who their father left their family when they were younger? I guess not because you’ve only dated one person your entire life. But this will come up with somebody who… Another one of my best friends, Kyle, he lost a job out of nowhere. He just got married. He started a job with another coach. That coach committed a moral indiscretion and was fired from the job, which meant Kyle was fired with him even though he did nothing wrong. And it set this pattern in his life of you can’t ever feel safe. At any minute, the hammer’s going to drop on you.

Or someone who was left by a romantic partner. They were left by a parent. They have this belief that people always leave. And what’s crazy is they now find a way to make that a self-fulfilling prophecy. They push people away to say, “Well, I wanted to hurt you before you hurt me,” or “I wanted to leave you before you left me.” And then they end up using that as confirmation bias to support a, see everyone leaves. See, you’ll never… That person won’t commit to a job. That’s not the case in Kyle’s case, but that’s because we’ve talked about it a ton. He easily could have been in, “I’m going to quit this job before I lose it.”

And I think the same thing happens with the real estate stuff. People are like, “It happened before it’s going to happen again.” And so, they don’t go invest in real estate. Meanwhile, when I look at the market, I don’t know if you think the same, but we very well could be going into a recession. I think we’re probably in a recession, but inflation masks that a lot of the time. But all the money’s flooding into real estate. It is the safest place to put your money right now.

Brandon:

Yeah. Let’s also remember, because again, people have bad memories and maybe they don’t know the data, but I think it’s like seven out of the last eight recessions real estate went up. It was only the ’07, ’08, ’09-

David:

Because that recession was based upon-

Brandon:

That was the real estate recess.

David:

Yes.

Brandon:

So, when people think recession, they think real estate recession.

David:

Yes. Because that’s the most recent-

Brandon:

Because that’s in their memory and that’s all we can remember.

David:

Such a good point.

Brandon:

So, most recessions, almost all of them in American history have been good for real estate investors. That said, I love the point you made. I’m going to bring it even broader, sometimes if you focus so much on that like you said, the self-fulfilling prophecy comes through. We could see a real estate recession and we’re going to make it happen to ourselves because we’re all freaked out now. I don’t believe that’s going to happen because I think there’s so many people waiting right now because of the BiggerPockets effect. I mean, we changed America in terms of real estate. There are millions of people looking for deals. The second there’s a deal, people are going to fill that gap. And so, we’ve got a long time before I think we are going to see a collapse.

David:

So, there’s two points I’d make there. It is very true that it could happen because we do it to ourselves. And that makes me think about, well, if it does happen, it won’t last forever, right? Makes me think about, there are times where just by pure, sheer force, you can hold a beach ball underneath the ocean, but at a certain point, your arms get tired. What happens when you let go? Shooting right back up and the further down you pushed it, the faster and the higher it comes right back up.

Brandon:

We need an analogy button, just boom.

David:

Boom.

Brandon:

Bing.

David:

Yeah. So, when you do see something like all the investors get scared, and so they all sell their real estate, and that floods the market with supply like what we saw in 2010. Yes, that can happen, but at some point, people, investors realize, “Oh my God, this thing cash flows so easy, let’s go buy it.” It turns around just as fast as it went bad, it goes shooting right back up. The other thing, my opinion, I can’t prove this, but I think real estate has always been, from a financial perspective, not from an easy perspective it’s probably a more difficult asset class to invest in compared to stocks or other things you can just go buy. But it’s always been the best.

And it reminds me of jiu-jitsu. Jiu-jitsu was always around. Karate was always around. Sumo wrestling was always around, wrestling was always around. Taekwondo was always around, but you didn’t know which one was the best because whoever you talked to was a sensei in that thing and they always thought theirs was the best. And then the Ultimate Fighting Championship came around and we actually pitted all of the different martial arts against each other. And it became very clear that this little guy doing jiu-jitsu was beating all of the big guys doing other things. And we had objective evidence to see it was better. And then the popularity of jiu-jitsu exploded.

BiggerPockets sort of functions like the UFC. We started to see everyone’s learning this tool now, everyone’s learning jiu-jitsu, it’s going all over the place. And then as they start comparing their investing vehicle versus the other people’s, real estate’s blowing everyone away. Now everyone wants to train in jiu-jitsu. It used to be a secret If you knew that you could beat up the big guy. Well, now the big guy knows it too. And Blackstone in this case is the big guy who’s going to go in there and buy it all up.

So, what I’ve been telling people is, I am more worried that you will not take action, that there’s not enough urgency about how valuable buying real estate is, and you will miss out on an opportunity to buy it, period, while they’re waiting for this huge crash that’s going to come so that they can get it even better. I don’t want to get too far off our questions, but do you think that I am being a little too greedy in my perspective that real estate is more likely to become too expensive for people to buy than it is to crash and become more affordable and people should wait to jump in?

Brandon:

[inaudible 00:15:32]No, I agree. I think given a long enough horizon, real estate’s always going to be more expensive. And so, now I also think rents are going to go up. I mean, you made the brilliant point this weekend we were talking that 30 years ago a house was 20 grand in some areas, and now it’s 200 grand. So, that means today if it’s 200 grand, it might be 2 million in 30 years.

David:

Logically it would be.

Brandon:

Or even more because of all the money-

David:

Because we’ve printed more money.

Brandon:

So, at the same time, rents that were $200 a month are now $2,000 a month, and they’re going to be $20,000 a month potentially. And so, it flows together. It’s like grandpa’s like, “When I was a kid you could buy a house for $12 and a pack of smokes.” It’s like, “Yep.” And everyone thought that was crazy that houses would be $1,000.

David:

[inaudible 00:16:13], “When I was a kid you could buy a house for $200,000.”

Brandon:

Exactly, exactly. And so, the more we can lock in debt today, the more we can lock in good debt, even at seven or 8%, I don’t care, as long as you can lock in good debt.

David:

It’s good stuff though. Yeah. It’s really going to be thinking that way. You notice in our position as people who are teaching real estate and have to pay attention to it, there’s certain facts that people like to grab ahold of, and there’s other ones that are uncomfortable and they dismiss it. So, you’ll often hear it said cash flow is guaranteed, but appreciation is just icing on the cake, it’s probably not going to happen. But you look back over 30 years, was appreciation just, it happened to happen or was it pretty predictable?

Brandon:

Exactly.

David:

And then when you try to live off your cash flow as someone like us that’s done it before, it’s actually wildly unpredictable. You never know when the thing’s going to break, the tenant’s going to leave, the problem’s going to occur. And then everyone accepts that appreciation could happen for the price, but we never think about the fact that it happens for rents too. Appreciation applies to rent. Rents go up over time while the mortgage stays the same. That’s what makes real estate make sense.

Your loan balance stays the same. Your value of your home goes up. Your mortgage stays the same, your rent goes up, over time this always happens yet there’s this consistent message of, “Well, don’t bank on that. Don’t bet on that.” And we’re not telling people to go out there and get yourself in the whole two grand a month buying a property that you can’t afford. No one would say that, but just let’s quit pretending appreciation in rents and prices and stuff is an accident that just happened like it’s not predictable that that’s going to continue.

Brandon:

Yeah. Agreed man. Agreed. But to continue the topic really quickly about raising capital, yes, it’s hard right now, but this is where my mind goes with that. Let’s just say half as many people are willing to invest in, let’s say Open Door Capital right now, we’re doing a big raise right now. Let’s say half as many people are interested. And out of those people, let’s say they’re only investing half as much. So, now it’s literally four times harder to raise capital than it was before, which is probably about where we’re at. Okay. So, we have two options, you can shut down and you can say, “I’m not going to raise as much capital. I’m going to lower my goals.” My buddy in high school, Corey would always say, “If you can’t reach your goals, lower your standards.” You can do that, not good advice.

David:

That’s funny.

Brandon:

Yeah. He was talking about that in terms of hitting on girls.

David:

I had a friend that had the same thing with hitting on girls, and he used to say, what did he always say? He said something like, “Lower your standards, raise your average.” The same thing.

Brandon:

Yeah. So, you can choose to do that if you want to, but instead, I just asked the question, “How do I get in front of four times as many people?” And so, we started advertising on Facebook and Google and YouTube, and I went, and I started going on more podcasts and instead, I took a problem, identified the problem, and then I asked, “How do I overcome that problem? Let’s really look at it and dissect it that way.” And so, if somebody’s trying to raise capital right now, whether it’s you’re trying to find one hard moneylender to fund your flip and there’s half as many hard moneylenders and they’re turning you down twice as much, it’s four times harder to get hard money.

Okay. Apply for four times as many hard money loans. If you are trying to raise money from family or friends or you’re trying to get a bank to finance your deal or an FHA loan to house hack, I don’t care. And it’s harder, don’t wish you were easier wish you were better, right? That’s a famous quote as well.

David:

Weights get lighter when you lift them.

Brandon:

Yeah. No, no. Well, wait, what?

David:

They feel lighter, but the weights aren’t actually becoming lighter, you’re becoming stronger.

Brandon:

Yes. That’s it. So, raising capital right now that’s important. On the LP side, let me just speak to those people who have money right now and are thinking about investing it. But you’re nervous because it’s a scary time, quote-unquote, right now. First of all, it’s always a scary time. There has never been a time, even when it was easier to raise capital, everyone’s like, “Oh, we have it. A recession’s coming anytime.” They’ve been saying that for eight years. You remember a podcast, we interviewed a guy years ago, not to call him out, I won’t even say his name, but years ago who, I mean, this is 2011 maybe.

And he was talking about musical chairs and he’s like, “Look, we’re going to go into another recession probably I don’t need it.” It’s like, the real estate’s a game of musical chairs and everyone’s dancing and having a good time right now. But you know what? Chairs are being pulled away and the music’s just going, but there’s fewer and fewer chairs. So, you know what? I don’t have to be the last one to get a chair. I’m going to sit down right now and I’m going to just watch people dance. And then the melody’s going to come on. The music’s going to stop. Everyone’s going to scramble for a chair and a bunch of people are going to lose. But I’m going to just sit down and watch. That was 2011. What did this guy miss out on? We didn’t see a double dip. He missed out on 10 years. Maybe he got back into it. I don’t even know the story.

David:

No, but theoretically if he followed his own advice, he missed out on the biggest run we’ve ever seen in housing prices because of all the money that was printed.

Brandon:

Correct. So, again, we make the best decisions with the data that we have, I understand that. But there is never going to be a time that you are going to feel good about investing in real estate. There’s never going to be a time that there’s not a question of fear coming around the corner.

David:

Oh, 100%.

Brandon:

Right. It’s always something scary coming around the corner. Always. I’ve been in this since 2007. There’s always been somebody shouting from the rooftop, usually Robert Kiyosaki, that the world’s going to fall. Right. That it’s going to collapse.

David:

And it’s comforting to hear that because it affirms our fear.

Brandon:

Yes. Yeah. But the reality is we don’t know. So, the best you can do is you can find a good horse and bet on the best jockey and the best horse you can find. And maybe spread the risk a little bit among multiple deals or multiple people.

David:

Yeah. But if you’re going to invest in something, I like investing in real estate the most because if my stock portfolio dips, if my crypto dips, if my NFTs dip, if whatever I put my money in goes down, I’m not getting rent paid, they can weather that storm so that I can bounce back. Real estate ends up being the best offensively and defensively when you look at it.

Brandon:

It does. Yeah. And what I like about real estate is it’s not going to go to zero. I mean, almost for sure not going to go zero. And so, business could, stocks could, you invest in your brother-in-law’s startup, it’s going to go to zero almost for sure. All this can go to zero. But real estate is as long as you can hold it long enough. So, this is the final tip I have for everybody in this economy right now, whether you’re raising capital, whether you’re thinking about investing in somebody else’s deal, whatever, the debt matters now more than ever before, that’s where you’re going to lose is with bad debt.

And then really, it’s that it’s any market. The way you lose is bad debt. And what I mean by bad debt, I mean is loans that are maybe riskier, that are adjustable rate at a level you can’t handle that are short term. There’s going to be a massive problem in the coming years. This is a whole different conversation. But with all the bridge debt, which is short-term debt that went on commercial real estate over the past five, six years, it’s all coming due, those people can’t refinance. They’re in trouble. The debt is what’s going to sink people. Dave Ramsey has been preaching this for years now. His answer is no debt. Mine is to be very cognizant of the debt that you’re doing or that the investor that you’re investing with is doing.

So, yeah, pay attention to the length of time. The more time you have, the less risky it is. You get a 30-year loan, it’s really hard to screw that up. You get a 30-year loan with some cash flow, it’s really hard to screw that up.

David:

Avoid a cocaine addiction and you’re probably going to be okay.

Brandon:

Yeah, you’re going to be fine. Yeah. So, given enough time, you’re going to be fine. In fact, we just recently changed our whole model at Open Door Capital where almost every deal we do now is what we call a generational wealth fund. Because we were looking at the market, we’re like, “I don’t like the risk.” Let’s just pull back and say, “Every deal we buy now,” generally speaking, we will do some one-offs that aren’t this way, “we’re going to hold forever.” Forever, there’s no end date, there’s no end date. And we just tell our investors, “Hey, invest with us. You get all the cash flow, all the cash flow until you get 100% of your money back through refinances.”

At that point, we split everything, not 50/50. We give them more than we usually give 70/30. So, they get 70%. So, in other words, you get all the cash flow until we refinance it someday until you get your money back, and then you stay in the deal for the rest of your life, forever. We don’t sell, we don’t plan, infinite return at that point. And we get the longest debt we can get. We can try to get 30-year debt all day long. It just takes all the risk down. And is the return less than if we were to go flip apartments every six months? Sure.

If we wanted to flip apartments, get really risky, low debt, or really risky high leverage debt that we have one year to get a property and turn around and flip it, you’re going to get a better return, guaranteed. And so, there are people doing that. If that’s your game, go do it. What I want is I want consistency. I want low-risk. So, I want really good, solid, stable debt for the long haul. And that’s my advice for anybody in real estate right now is look for the long play, the long game.

David:

All right. Next question here, Brendan, you’re an expert and relentless marketer, podcast video content all around you and you help build a foundation of what BiggerPockets is today. You also grew your own brand and several social accounts along the way. What is the status of the competition that you had with Investor Girl Britt to get to 300,000 followers? Is there a winner? Have debts been paid and are there new bets to be made?

Brandon:

Great question. So, by the way, Investor Girl Britt and I raced to 100,000 originally, she won. Then we raced to 200,000. She won. And then we set the bet, but we didn’t set it at 300 actually. So, the bet is 500,000. We wanted more time to build up here and I don’t want to lose again. So, this time she is at 259,000 followers. And I am at more than that 330, or something like that, 330.

David:

But you didn’t win because you didn’t set the milestone at 300, you said it at 500.

Brandon:

Correct.

David:

Which you thought would be an advantage and actually [inaudible 00:25:31] against you.

Brandon:

So, what’s the $300,000 milestone in your life, David? That you should be setting instead? You were afraid and so you…

David:

I don’t track shallow metrics like followers, so I don’t know. I would track them if I was good at it. I’m at like 150, half of you.

Brandon:

There you go. Well, let’s talk about this for a minute. I think this is a very interesting point you just brought up shallow metric.

David:

Doors, number of doors.

Brandon:

Well, no, that’s not where I was going, but maybe that is. People might think social media is a vanity metric, followers is a vanity metric.

David:

Oh, I see. It’s not in our business.

Brandon:

It is very tied to how much capital I can raise, is the number of people who know, like, and trust me, how does somebody know, like, and trust me? They have to see you over and over and over. That’s why people [inaudible 00:26:13].

David:

And they have to see patterns of consistency in your message and in your life.

Brandon:

Yeah. Over and over and over. So, show me a way to do that at scale other than social media and I’ll go do that, but it doesn’t exist. Social media, TV, that’s it. But we own-

David:

The currency of the future is attention, it’s even more important than dollars because dollars can be inflated. It’s very difficult to inflate attention.

Brandon:

Yeah. I don’t know if I had to guess I spend half a million dollars a year on my team, the team members that run everything from video to social to all that stuff. We probably spend a good chunk of money on that. Why? Because I’m trying to buy $10 billion of real estate. By the time this episode airs in a week, I’ll be just on the edge of a billion dollars of real estate. I got 10 times more to go. So, what does that mean? I need 10 times more people to know, like, and trust me. I need to consistently find good deals.

And this is the other thing with social media, actually, the number one reason to have social media is not to raise capital, it’s to raise people. The best people I have, all my top people, I’m a who, not how guy. All my top people came from social media, they followed me, they found me. I mean, they listened to the podcast, which I would include in social media, but they found me on the podcast, or they read my book maybe. But then they followed me on social media. They saw a pattern over time and now they are working for me.

Now people might be saying like, “Yeah, that’s easy when you have 330.” I didn’t, five years ago, I didn’t 10 years ago. I started with zero. Just like you would, just like everyone does. We all start with zero. And I’ve been working on it for a long time. And so, it goes back to the idea that Jordan Harbinger told us on the podcast when we interviewed him back a few years ago. I don’t remember what episode that was, but he used that line, “Dig your well before you’re thirsty.” Look, I don’t care if you’re raising capital right now, but someday you may want to raise capital, someday you may want to bring an employee, someday you may want to whatever. Maybe now is the time to start focusing a little bit more on your social media.

David:

Well, I’m glad you’re focusing on it because my best people come from you. So, please continue. Now remind me, what was the bet that you had with Brittany? What does the loser have to do?

Brandon:

Oh, man. Nickelback tattoo on the lower back.

David:

Now, was it a coincidence that you look like the Nickelback guy? So, Brittany’s going to have to get a tattoo that looks like you.

Brandon:

This is how you remind me.

David:

You sound like him too.

Brandon:

I do sound like him.

David:

We’ve talked about this before. Might as well do it on the podcast. Is Nickelback as bad as the reputation?

Brandon:

No, dude. Okay. So, I was working out with Jerry back like a year ago.

David:

Yeah, he’s our jiu-jitsu instructor.

Brandon:

And we’re working out and he’s like, “What music do you want to listen to today?” I was like, “Let’s put on Nickelback. That’ll be funny, right?” So, we play it and we’re working out. And I’m like, “This song’s awesome.” I was like, “I forgot about this song.” And then the next song comes on and we’re like, “This song’s great.” The next song came out for an hour and a half, didn’t repeat just song after song. Everyone was a freaking hit, and everyone was amazing. It’s like the Taylor Swift of Rock. And I’m like, “Do we hate them because they’re bad or do we hate them because they’re good?”

David:

That’s deep. So, what’s the Nickelback in your life?

Brandon:

What’s the Nickelback in your life? Who are you looking down on because they’re more successful because, at the end of the day, you are jealous? Whether you want to admit it or not, you’re jealous of their success. So, you’re looking down on them. Is anybody out there listening to this going, “I don’t really like Brandon.”? Probably. Maybe you don’t like my beard. Maybe you don’t like my voice. That’s very possible. But I know that for me when I look at people and I don’t like them, it’s almost always rooted in an a-

David:

It exposes something about you.

Brandon:

It exposes something, a hole in me that makes me feel like the bad guy. And a wise man once said, “No one wants to be the villain in their own story.”

David:

Or what opinions have you formed because everybody else was saying it and you were lazy [inaudible 00:29:32] listen to it yourself?

Brandon:

There you go. Yep. Dude, that’s a question right there. Like, “Oh, this doesn’t work, BRRRR doesn’t work, house-hacking doesn’t work, subject-to doesn’t work.” Or subject-to works, BRRRR works. Or how-

David:

There’s going to going to be another recession [inaudible 00:29:42].

Brandon:

There’s going to be another recession. Yeah. We love to take these shortcuts. It’s easier just to rip on Nickelback because yeah, Nickelback is an incredible band.

David:

I was a little scared to say that out loud because I thought there might be the answer for why everybody hates them, but I couldn’t understand why they’re so hated. Paramore was another one. People were just ripping on Paramore and how bad their music was. And I’m not a huge that type of music fan, but they don’t sound bad to me when I hear it. There is one small thing that has been known to plague you from early on in life about personal hygiene. Can you share what that is and if you have found a solution for it yet?

Brandon:

Oh my gosh. Bringing back from a long time ago, I had a youth pastor when I was in sixth grade, Jodi de Young, shout out to Jodi. She said, “Hey guys, you realize that nobody ever cleans the middle of their back?” And I was like… Because you can’t reach, there’s like a one-inch spot in the middle of your back you can’t reach.

David:

It’s like on the windshield, the little triangle that the windshield wipers…

Brandon:

Yes. Yes, that’s exactly, there’s this little triangle-angled spot on the back of you as well that has never seen soap a day in its life.

David:

Even with your arms. You’re Mr. Fantastic [inaudible 00:30:47].

Brandon:

Yes. I got some arms, but I can not reach that one little spot right there. I mean, yeah, you could let the soap drip down. You can take a towel and maybe do this, but none of us do, instead we’re all just gross. And don’t let anybody lick your back. It’s disgusting.

David:

At least not that spot.

Brandon:

Not that spot. Lick at the rest of it.

David:

I wonder if massage therapists know that and they avoid it, they just take a detour around it every single time they get there?

Brandon:

Yeah. The question I have for you though is what is that little spot in your life? Where in your real estate have you just been avoiding?

David:

Again, if you guys have ever wanted to know what it’s like to be best friends with Brandon Turner, it’s that question on repeat every single time that you try to talk.

Brandon:

Listen man, in your business, there is something that you just… You’ve been doing everything. You have these patterns in your life. You do the same thing every time you get in and you just do your thing. But there’s one thing you’ve been avoiding and that’s the part that’s starting to stink, man. It’s the part that you need to focus on because right now is the time to focus on that spot on your back.

David:

The bacterial dilemma.

Brandon:

The Bacterial Dilemma by David Greene. It’s the new book.

David:

All right.

Brandon:

Well, we’ve got nowhere in this show.

David:

I hope you guys are enjoying the nowhere run that we’re on. I mean, Seinfeld was a show about nothing, and it did really well. Right?

Brandon:

This is a show about nothing too. But I guarantee you by the end of the show, you will be financially free or your money back.

David:

That’s exactly right. All that money that you paid us, you’ll get it at [inaudible 00:31:57].

Brandon:

All that money you paid us today to listen to this show.

David:

Next question, where did our obsession with jiu-jitsu, which we’ve already mentioned once unfortunately, begin, and who was responsible for the hundreds of mentions that our audience now has to endure?

Brandon:

So, episode number 365. I like that. Jocko was on episode 365, and I’ve listened to Joe Rogan, I’ve listened to other people talking about jiu-jitsu, Tim Kennedy, and others. And it was always one of those, “Yeah, that’s a cool, neat thing, that’d be fun.” And they say there’s a lot of reasons to jiu-jitsu and Jocko did it and I like Jocko. And he gets on the podcast, and I said to him, “Yeah, man, I would love to someday-”

David:

Big mistake.

Brandon:

… “Do jiu-jitsu.” And as any good friend does, not that I can call Jocko a friend though.

David:

He was a friend to you.

Brandon:

He was a friend to me.

David:

He who is my neighbor in the story of the Good Samaritan is, who do you choose to be a neighbor to?

Brandon:

Yeah. Do you know why? Because he said to me, “Someday? What day?” I’m like…

David:

Yeah, Brandon Turnered you is what he did. And I got to watch it in real-time.

Brandon:

I’m like, “I’m going to go Monday.” He’s like, “Okay, here’s what I want you to do. I want you to go on Monday. I want you to text me on Tuesday and let me know that you went.” So, I show up on Monday, I’ve told this story before I’m going to tell it real briefly now, I show up on Monday. I Googled. I’m like, “Okay, I know there’s one in my town. I Googled jiu-jitsu in Kihei and there’s a place. I go, “Okay, great.” So, I drive over there during the day to go check it out and it’s out of business. And I’m like, “Oh no.” So, I go back home, I Google again, where’s another one? It’s 40 minutes from my house. I’m like, “Shoot.” So, I go there and I’m late that night because it was Monday. So, I go there and I’m late.

David:

Nothing better than being the white guy in Hawaii that walks in late on their first day of a jiu-jitsu class.

Brandon:

And this was in Wailuku, this is the local area, meaning this is not where tall, inky, Brandon shows up to jiu-jitsu five minutes late.

David:

You’re walking in the wolf’s den.

Brandon:

Oh. And everyone’s in a gi and I’m not, and I walk in there and I’m five minutes late and there’s a woman at the front desk sitting there and there’s 30 men looking strong and talking and doing some warmup stuff. And they’re on the mat. And I’m like, “Hi.” And she’s like, “Can I help you?” And I’m like, “Yeah, I’d like to do jiu-jitsu.” And she goes, “Today?” Like “Yeah.” She goes, “Here?” And I was like, “Yeah.” And she goes, “What’d you Google it or something?” And I’m like, “Yeah.”

She looks at me and she’s like, “You want to do this?” And I’m like, “Yes.” “Well, I don’t… I mean, just go sit over there.” And she points to this bench. And on this bench is three six-year-old kids, maybe five or six-year-old kids. And they’re all just sitting there playing video games on their iPads. She’s like, “Just go sit over there.” So, I literally walk over there, all six foot five of me, and I sit down on this little kid’s bench. There’s one kid to my left, two kids to my right.

David:

Never heard the detail of this story.

Brandon:

And I sit there for an hour and a half, and I just watch these guys roll.

David:

The bench of shame.

Brandon:

The bench of shame. And I was so mortified every second. But you know what? That’s what accountability does. I was so scared to walk in. I was so scared to go there. New place didn’t know what was going on, out of place, didn’t know what jiu-jitsu was, didn’t have my gi, didn’t know what a gi was. And I’m sitting on the bench feeling like a moron. But I knew I was going to have to report back to Jocko. That’s why I’m such a fanatical about accountability because when I tell something to myself, I will lie to myself all day long. When I tell something to somebody, I respect that I’m going to do something I am going to do that thing.

And this is why in the BetterLife tribe, we have pods, right? GoBundance has the same thing, pods. Hold each other accountable in a pod, whether you’re in my group, whether you’re in David’s group because you got accountability, I got accountability. Build accountability in your life if you want to see tremendous growth. So, the story goes on, I leave quickly as soon as it ends, I ran out and I was like, “That was terrible.” But now I have at least done a little bit. It’s like the newbie going into real estate. And you go in and you’re like, “Hey, I’m going to look like a moron.” And you make an offer on a property that’s completely stupid, or maybe you go to an open house, and you don’t even know what you’re doing.

And you walk out and you’re like, “That was dumb. I’m never going to do it again.” And most people never go back. But I got home and I’m like, “All right, can’t be worse than that.” So, I Google it again, I find another place. I was like, “I’m going to go to that one anymore. That was too awkward.” So, I go to the other place, I Google it, and two days later I go to that one. I walk in. This time I walked in a little early. There’s four guys standing around, I’m like, “Hey, what’s up everyone?” And they looked at me and they’re like, “Can we help you?” And I’m like, “Yeah, I was hoping to do some jiu-jitsu.” And they’re like literally said, “What’d you Google it or something?” And I’m like, “Yes. I Googled it.”

I’m like, “What do I do?” And I’m not kidding. The instructor points to the bench and he says, “Yeah, just go sit over there.” And I go sit down again. And I watched the entire thing and I just sat there and watched. But at some point, at the very end, he’s like, “Yeah, come over here and stretch with us.” And at the very end, I went and str did the ending stretch with them. And I showed up the next day. And that time I got to do the beginning stretch. And then I got to watch them roll. And the next time I did a little more. And next time I did a little more. And before long I was in jiu-jitsu.

So, long story short, there’s such a great metaphor for life here in terms of real estate. People want to get into real estate, and they get scared, and they don’t show up, or they get scared, and they do show up and they do something stupid, or they make a mistake and then they quit. But as Tony Horton from P90X fame would say at the end of every single episode of P90X, every single video, he’d say, “Hey, just keep pushing and play. No matter what you feel, no matter what you’re doing, you show up tomorrow and just press play.” And that’s my advice for people today trying [inaudible 00:37:28].

David:

Even Brandon Turner did not eat the whole thing in one bite. You had to split into several small bites and kept showing up and went through some embarrassment, went through some shame, went through some humiliation, which is funny because they didn’t directly humiliate you. But being told to sit on a bench with a bunch of six-year-olds while you watch everybody else get to be cool. And then the real embarrassment starts when you actually go out there and start having to do it, right?

Brandon:

Yes. Then you really get embarrassed. But then you’re on the mat, then you’re there. I’ll give you one more, actually two more quick, very quick stories. I know people are tired of jiu-jitsu analogies. I’m walking through Costco, and I’ve told this on the show before, but I’m walking through Costco, and I meet this guy who recognizes me from BiggerPockets. What up? Shout out to you if you’re listening right now. And he says, “Hey man, I heard you’re doing jiu-jitsu. I’m a black belt.”

And I’m like, “Oh, cool man. Yeah, I’ve been doing it for about six months now. I’m just a white belt.” And he stops me. He goes, “Hey man, you’re not just a white belt. You’re not just a white belt.” He said, “You know what? The white belt is the hardest belt to get.” Now for those who don’t know, the white belt is the one they give you for showing up. That’s the beginner belt. And he said, “99% of people will never earn their white belt,” earn their white belt.

David:

Good point.

Brandon:

They give you the white belt, but you have got to show up.

David:

Oh, yeah. How many of the people listening to this are looking at you, the black belt investor, I’m going to own a billion dollars of real estate. And they’re comparing themselves to you. And they’re like, it’s how we feel when we look at a black belt, “I will never ever, ever, ever be them.”

Brandon:

Be there.

David:

And you know what the next thought is? “So, why show up? Why even try? Because I can’t be them.” Versus looking backward and saying, “Look at all the people who don’t know anything about real estate, who have no money saved up, who are actually in massive debt, who don’t know any path out of where they are, other than just working that same job and hoping something external just magically finds them and changes their life that have no plan to find financial freedom.” But they’re listening to this podcast and that’s starting to be developed.

There’s some people that are listening like you on the bench with the six-year-olds that are watching what it looks like to do jiu-jitsu. And the neurons are being rearranged in their brain as they’re starting to figure out what this thing looks like. That is progress. You don’t have to be buying 700 doors a year for it to be considered progress.

Brandon:

There’s a man in Ireland back in the day who wanted to move a rock fence. Have you ever been to Ireland? They have these rock fences. They’re like, not mortared or anything, just piles of rocks, and then make the whole fence. And he had to move the fence from this side of the field to another side of the field. And so, he goes over there, and he grabs a rock, but probably 20 pounds let’s say. And he takes the rock, and he walks across the field, and he sets the rock down. Then he walks back, grabs another rock, moves across the field, sets it down.

And each of these rocks, let’s say weigh 20 pounds. And over the course of the day, he moves, we’ll call it 10 rocks. Did that man move 200 pounds? Yes. Did he move 200 pounds at one time? No, he never had to move more than 20 pounds. And so, oftentimes we look at moving the wall, we look at this big project, like, “I got to do this big thing. I got to get good at real estate. I got to build financial freedom.” Let’s take it back to the ff. I got to build this financial freedom. And it’s a big wall. It’s a lot of rocks there.

It looks heavy, but the fact is it’s not heavy. It’s 20-pound rocks. Anybody can do it. So, maybe people need to focus a little bit less on the wall and more on the rock. What’s the next rock in front of you? What’s a 20-pound rock? It’s not, it’s not light. 20 pounds is still a little lift, but anybody can do it. A kid could do it. You just move the rock across the field, before you know it, you got a wall over there, you got a new fence.

David:

That’s a great example.

Brandon:

Thanks, man.

David:

You’re not too bad at those.

Brandon:

Thanks, man.

David:

Next question. We know that time with your family has always been a driving motivator. What’s something else that real estate has afforded you?

Brandon:

Oh, real estate has afforded me a luxury, ridiculously nice property where I live. I talk a lot about these 10 categories of life. It’s your spirituality, your finance, your career, your relationship. But one of them, out of a 10, and we do like this little project, the Wheel of Life, but one of them I call environment. The environment is the physical world around you. It’s the car you drive, the house you live in, the office you go to work to every day. It’s the physical world, the things you touch, see, hear, feel all that, every single day.

And now happiness is not derived purely from your environment. You can be happy and living in the middle of nowhere in a terrible house and driving a terrible car and be perfectly happy. However, the more of your life categories that are on a scale of one to 10, closer to 10, the general better happiness I feel, the more fulfilled I feel. So, real estate has allowed me to maximize my environment in a way that allows me more, again, doesn’t just alone bring me happiness, but my environment brings me a lot of peace and enjoyment. I’m able to host people here all the time, and I’m able to take my kids in the pool. I’m able to do a lot of things that I could not do when I lived in the rain of Grays Harbor because of real estate investing.

And I’m not talking about the money of real estate. I’m talking about, I’m house-hacking this house. I’m living in Hawaii for cheaper than people live in Ohio. And that’s the fact of the matter. I’m living in a $4 million house in Hawaii cheaper than people live in Ohio because of real estate investing. So, hashtag house-hacking.

David:

That’s a great point. I loved it because you asked the question, how do I do it? Not can I do it.

Brandon:

Technically you asked the question, how can you do it? And then I answered to you.

David:

But you already knew it.

Brandon:

Yeah. But you helped me understand that again, the power of accountability and friends that challenge you. So, thank you. You pushed me to buy this house.

David:

My pleasure, man. Thanks for putting me in the position where I was able to talk to you. You wouldn’t be on the podcast right now, even having those real estate conversations if it wasn’t for you. And again, I’m also enjoying this $4 million house in Maui that I don’t own myself. So, please keep doing what you’re doing because it definitely benefits me.

Brandon:

I feel like we’re shutting down, but we still have the Famous Four, aren’t we? Is that still a thing?

David:

Yeah, we’re heading to that.

Brandon:

Oh, okay. Good.

Speaker 1:

Famous Four.

David:

All right. Famous Four. I get to ask you these questions. Question number one, what is your current favorite real estate book that is not your own?

Brandon:

All right. This is a book, and I know you ask the business book one next, but it’s a business book, but there’s a chapter on real estate. The book is called, shoot, Keith Cunningham, The Road Less Stupid and I’ve been told by multiple people to read it. Chapter 10 in The Road Less Stupid is probably the single greatest chapter of any book I’ve ever read in terms of real estate, because-

David:

You read a lot of books too.

Brandon:

I read a lot of books. Here’s what happened. He went bankrupt back in the ’80s, the whole real estate thing, just like Dave Ramsey had the trouble, that whole world of real estate changed in the late ’80s and a lot of people went bankrupt. So, him and all his buddies who were all millionaires, that all went bankrupt, sat down, and said, “Let’s make a list of every single lesson we learned.” And they just wrote a list. He just took that list and the whole chapter is simply a hundred lessons of somebody who had come just out of a collapse. And so, reading this, I was taking a pen and [inaudible 00:43:57]every single line. I underlined I was like, “Oh, I need to know this. This is great.”

David:

It’s concentrated wisdom.

Brandon:

Concentrated wisdom from multiple people in real estate. It was fantastic. And it’s all commonsense stuff, but it’s stuff that you need to hear. Just stuff about being greedy, going too fast.

David:

But that’s what fundamentals are.

Brandon:

Yeah, it’s fundamentals.

David:

And you have to be reminded of fundamentals all the time.

Brandon:

Yeah. Yeah. It was a really good chapter. I read at a really good time.

David:

Something I like about you is that you put the fun in fundamentals.

Brandon:

I put the fun.

David:

Because you’re entertaining.

Brandon:

I would say I put the fun in fund.

David:

Yes, you do.

Brandon:

Open Door Capital, we put the fun in fund.

David:

All right. Question number two, what is your favorite business book?

Brandon:

Business book. Man. Favorite’s a hard one. I’m going to go with, I think I will go with The One Thing I really like The One Thing I’ve been hanging out with you and Jay Papasan here in Hawaii because he was a keynote for the BetterLife Real Estate Investment Summit. But I really like The One Thing. When I read that book, I don’t know if I’ve talked about this, I probably have. But when I read that book, first of all, it was the only book I’ve ever read where I finished page whatever, 250, whatever the last page is. And then I went and turned back to page one, and I read it again. I read it twice in a row.

And then I had this epiphany. I said, the idea of The One Thing is what’s the one thing you can do that if you just did that, everything else becomes easier, not needed, basically. And I said, “If I could just get this concept and the concept in this book into my thick skull if I could just really internalize this, my life would be completely different.” Everything else would be easier. In fact, the book, The One Thing is the one thing. And so, I said, instead of reading 20 books this year, or 30 books this year, I’m going to read one book 20 times. And I went and read The One Thing, I think 20 times.

I put it on Audible and just for the rest of the year, the whole year, that’s pretty much all I read was The One Thing. I’d go for walks, it was when I was running a lot. So, I just go for a run and I just listened to an hour of The One Thing every day and I just kept listening over and over and over. I told that to Jay and he probably thought I was a stalker. And then I look at where I’m at today, and I’m like, “It’s so many of the lessons in that book.” In fact, just sitting with Jay at a table this weekend, I was like talking, we were just BSing and telling stories.

And there were three different times where I was like, “Wait, I think that story was in The One Thing.” And he’d laugh and went, “Yeah.” So, so much of what I do and say, and teach just came from that book. So, The One Thing, Jay Papasan, and Gary Keller.

David:

There’s a verse in the Bible that talks about that same principle about read the Word, meditate on the Word, drill it into your forehead, make it so it’s so ingrained in who you are that you don’t have to think to try to remember. It is a part of you. That sounds like exactly what you did with The One Thing. And when it comes to wisdom, that is a really good idea. It acts as a compass that guides you when you feel lost. When you get confused, you’re less likely to stray away from the path, so to speak, when you’ve got that software downloaded into you.

Brandon:

There’s a great quote from Bruce Lee that says, “I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.”

David:

That quote is in BRRRR.

Brandon:

Is it?

David:

Yep.

Brandon:

What does that mean to you?

David:

It’s repetition. It creates mastery. That’s the way that I use it, it’s why I talked about Bruce Lee so many times. You don’t get good at anything doing it once or twice a year or once every three or four years, which is how most people buy real estate. You have to do it a lot if you want to be good at it, just like anything else. And so, there’s always a new, shiny thing. It’s nice to say, “I know 10,000 different kicks, look what I can do.” But to do one kick 10,000 times is how you become a master of it, which makes you a more feared opponent.

Brandon:

Moving on.

David:

Question number three. What is one habit or trait you have picked up lately?

Brandon:

That’s like my question and I don’t even know, tennis. I’m going to go tennis. And I’ve actually stopped the last few months as I got into the gym instead. But for the last year, I did a lot, I got a tennis membership, and I started playing tennis. Why? Because I wanted something I could do with my wife. And she had friends that were playing tennis. So, I said, “Okay, let’s do tennis.” So, we started playing together and it was fun. We were having a good time. I’m going to likely switch over to Pickleball and try that. I’ve not played yet.

David:

Such a follower.

Brandon:

I know people just say… Here’s my problem with Pickleball. It’s always been, I never saw somebody have a sweat playing Pickleball. No one has a sweat playing Pickleball. It’s always like… Right? But then I met an actual professional Pickleball player and he’s like-

David:

Pickleballer?

Brandon:

Pickleballer. I met a professional Pickleballer and he’s super in shape and he is like, “Dude, no, Pickleball is intense. It’s like racquetball, but you can play it outside anywhere you want.” I mean all over the place. And that’s what convinced me because I’m a racquetball player through and through. I love racquetball with all my heart, soul, and mind. I love it.

David:

Yeah. You’ve always loved it.

Brandon:

Always loved it. There’s just one place on the island to do it. In fact, I’m going to build a co-working spot in Maui, we’re actually working on it right now. We’re going to buy land; we’re going to build a big co-working spot. I’m going to put a Pickleball, I mean I’m going to put a racquetball court in it because there’s nothing else. So, I’m going to house-hack my racquetball court. And if you’re a member of the co-working spot, you can therefore use the racquetball court.

And this will interest you, you know how racquetball courts are made up of all those four by eight panels all over it, the bottom whole level I’m going to have on hinges that swing up and inside will be mats, and you can roll them out and you have a jiu-jitsu gym as well. So, I can rent it out to jiu-jitsu academies or have one hosted there. And then we can just roll it back up and back to the racquetball courts. You can reserve the court for either racquetball or jiu-jitsu, martial arts.

David:

Brandon Turner idea right there.

Brandon:

Yeah. I’m going to literally house-hacking an office because I need an office. I need a better studio than this. And I’m like, “I don’t want to pay for it.” So, I’m doing a $16 million development project right now and we’re going to raise capital for it. We’re going to do the whole thing and it’s going to be so I can have an office, but the returns are actually stupid because there’s a big need for that here.

David:

Awesome man. Very cool to hear that.

Brandon:

Anyway, that is what I’m working on.

David:

All right, question number four. What is one of your favorite things about me?

Brandon:

About you? That is not a question.

David:

What the producer put in there.

Brandon:

Okay. Your analogies are pretty great. You show up when I ask you to. And when I ask for a favor, you have never said no, ever. You encourage me a lot, and other people, you’re very good at encouraging. That is maybe a gift you have, which is you see the best in people and then you call it out on them. But you also see room for improvement and call that out on them. And that’s what a true friend does, so…

David:

Thanks, man.

Brandon:

Not bad at all.

David:

Appreciate that. Not my hair, huh?

Brandon:

Going to say the beard’s looking pretty nice, but hey,

David:

Dude, it’s harder to grow longer than I thought. I just thought it would sprout right out. It got to this point and then stopped.

Brandon:

You got to eat more carrots or something.

David:

Okay, we’ve got to talk about that. I was wondering if it was like a beard oil thing. Question number five, tell us where people can find out more about you.

Brandon:

I am an Instagram nerd. So, BeardyBrandon, beard with a Y, Beardy. But notice how I said BeardyBrandon beard with a Y. People are like, “Okay, that’s B-Y-R-D. I’m like, “beard Y.” Think Spanish like beard E Brandon. It’s like beard and Brandon, BeardyBrandon on Instagram, TikTok, all that stuff. The podcast is A Better Life with Brandon Turner. We hit number 40 of all podcasts in the world when we launched.

David:

That’s nice.

Brandon:

That was awesome. It’s not there now, but was, we have a traveling podcast. So, I travel around the country, and I record people and that’s been a wild adventure to do that. We’ll fly into a city and record seven podcasts at one time over a three-day period with no sleep. And we go out with the guests afterward and it’s been an adventure. But man, it’s been fun. So, that’s it. A Better Life with Brandon Turner, go to listen to the podcast and you were on it. So, go listen to that episode everyone.

I heard multiple people say that when you and I were chatting on, we did a live podcast recording, then we followed it up with a little interview after. But when we did the live one, almost everybody I talked to said that was the best part of the entire conference that I held and that it was the best thing that you and I have done together. People thought it was one of the best things for you and I. Now I think this interview was pretty darn awesome but go listen.

David:

All right. You got a lot going on, man. You’ve not been resting on your laurels, that’s for sure. Very cool to see this and cool to see that the vision is still firing even faster than it was when we were doing our stuff together. That’s right. Thanks for joining us, everybody. Please go check out Brandon all over the place and send him a message. Let him know what you thought about this show. Let you get out of here because you’ve been sitting down for a long time. This is David Greene for Beardy, pew, pew Brandon, signing off.

All right. That was the first half of my conversation with Brandon Turner. We’re about to get into another conversation that isn’t Seeing Greene style, but it’s still going to be fascinating. We’re going to talk about the five episodes on BiggerPockets that had the biggest impact on both of us. You don’t want to miss it. So, check out that episode next.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

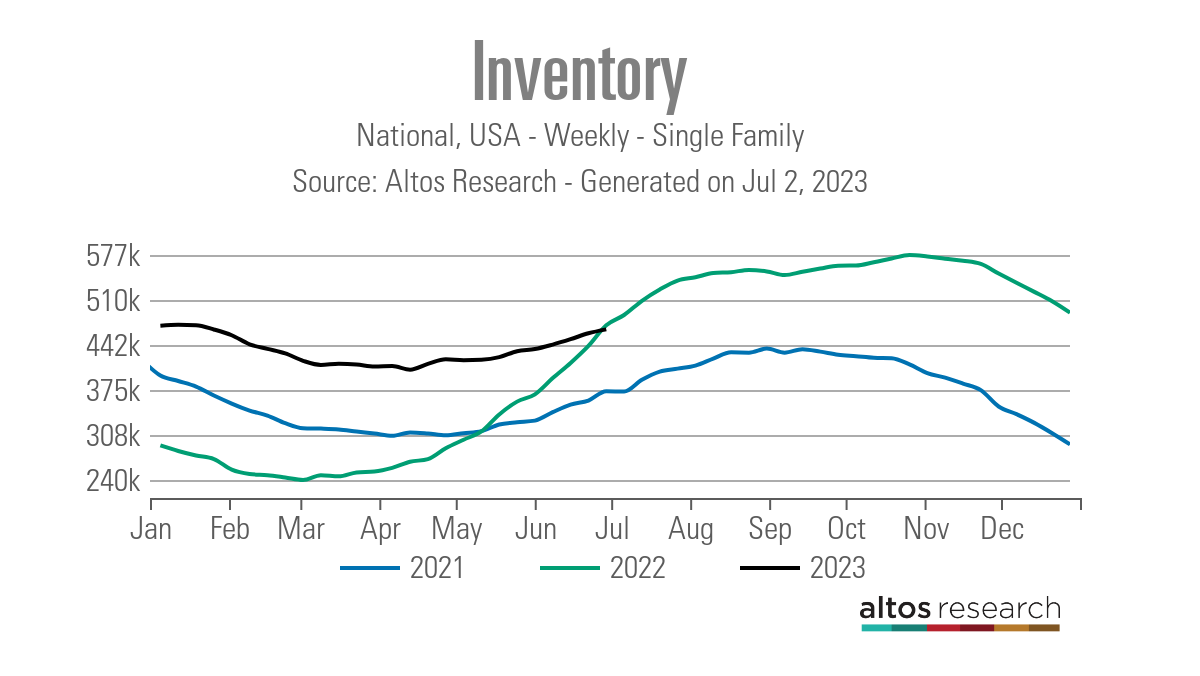

The hunt for housing inventory is in full safari mode

The nation’s housing industry has entered a new normal in which the dynamics of the market appear perplexing — marked by high interest rates and high home prices, along with shrinking mortgage originations.

The perplexing part: Why are home prices not declining in this environment? It boils down to two factors, according to housing-industry experts: a lack of housing inventory, or supply; and high demand for that limited housing stock — which also is fueling a jump in new-home sales.

Fannie Mae recently projected originations for 2023 at $1.59 trillion, a revision downward from its January estimate of $1.65 trillion — with sales of new homes rising in dominance. That compares to a record $4.4 trillion in mortgage originations in 2021.

New-home sales are up 20% year over year as of May 2023 while sales of existing homes are down by the same level, resulting in new-home sales accounting for some 30% of total housing inventory. That’s more than double the typical range of 10% to 15%, according to the National Association of Home Builders.

Meanwhile, mortgage interest rates have hovered in the 6% to 7% range over the past six months, up more than 3 percentage points since early 2022, yet home prices have increased for several months in a row, Freddie Mac’s chief economist, Sam Khater, points out in a recent commentary.

Doug Duncan, chief economist at Fannie Mae, attributes the dearth of existing-home sales to the so-called “lock-in effect,” in which homeowners with low legacy rates in the 3% range “are disincentivized to list their home due to not wanting to give up a mortgage rate much lower than current market rates.”

“I don’t see homebuying costs decreasing significantly in the next few quarters,” said Arvind Mohan, CEO of Kiavi, a fix and flip lender. “As interest rates stabilize near their current levels, they will normalize from the record-low rates we saw during the pandemic.

“This, in part, is causing the tight inventory we’re seeing in the housing market today, as two out of every three houses have mortgages with interest rates below 4% and aren’t motivated to sell their house unless a significant circumstance warrants it.”

Very little inventory

Mike Simonsen, founder and president of real estate data firm Altos Research, said many homebuyers are adjusting to higher rates, however, and finding ways to pursue home-purchase transactions.

“And so, demand has been significantly more robust than we expected and, as a result, there’s very few homes for sale across the country,” Simonsen said. “…This is what I call a supply-constrained market.

“In other words, if there were more inventory, we would have more sales happening.”

Where might added inventory come from, if the bulk of existing homeowners continue to remain on the sidelines? One source of added inventory is the fix and flip industry, which is expected to acquire and renovate some 350,000 homes in 2023, according to Kurt Carlton, president of New Western, a private real estate investment marketplace.

“Not a lot of people are aware of this, but we have more than 15 million vacant homes in the United States,” Carlton said. “Now some of them are vacant because they’re second homes and things like that, but many of them are vacant because they’re dilapidated and uninhabitable.”

Clearly, not all these homes can be returned to the market in a cost-effective way, or face other obstacles, such as their location in higher-crime or deteriorating neighborhoods, according to Keith Lind, CEO of Acra Lending.

“Just because there’s vacant homes in the U.S. that doesn’t mean if you make them nice that people are going to automatically want to live there,” Lind said.

Carlton adds, however, that for fix and flip investors who understand their local markets, that vacant housing stock, in the right locations, still represents an opportunity.

“So, finding those opportunities, rehabbing and returning them to the market solves part of the [inventory] problem,” Carlton said.

Kiavi’s Mohan said that in the current environment, there is less homebuyer demand for purchasing homes that need renovation work than there is for acquiring a property that has already been “renovated/flipped.”

“[Real estate agents] believe this is due to the housing-affordability crisis paired with higher interest rates, so there’s no extra room in [homebuyers’] budgets to fix up a house after it’s purchased,” Mohan said. “This is yet another illustration of the important role real estate investors have in helping to combat the housing-affordability crisis.”

The Leading Indicator of Remodeling Activity, or LIRA, a measure developed by Joint Center for Housing Studies at Harvard University, seems to support Mohan’s assessment, showing that year over year “expenditures for home improvements and maintenance will post a modest decline of 2.8% through the first quarter of 2024.”

Another source of potential housing inventory is foreclosed properties — although absent a full-on recession, it’s still likely to remain a muted source of potential housing stock. As of the second quarter of this year, real estate data firm ATTOM reports that 311,500 residential properties nationwide were somewhere in the foreclosure process.

That’s up 20% year over year and up 45% from the third quarter of 2021, “when the foreclosure moratorium imposed during the coronavirus pandemic was lifted,” according to ATTOM CEO Rob Barber.

“The number of empty, abandoned properties in foreclosure — so-called zombie properties — was also up, 16% annually, to about 8,800,” he added. “Those numbers remain way below where they were when the housing market crashed after the Great Recession of the late-2000s, but still up.

“… The recent increase in foreclosures should help boost the supply of homes for sale. “

The other variable that could help to put more homes on the market is a bit counter-intuitive — and longer-term. Altos Research’s Simonsen said if we have multiple years of higher rates, that could spark many more homeowners to seek to sell their homes.

“Lower rates goose demand but not necessarily supply,” he explained. “If we have multiple years of higher rates, what we’re doing is resetting the cost basis for homebuyers.

“So, maybe you get to 12 million to 15 million homeowners that have 5%, 6%, 7% mortgages, then it’s more expensive for those folks to hold.”

Affordable housing

Still, given the housing inventory shortage, relying on new-home construction, fix-and-flippers, foreclosures or longer-term high rates alone is not likely to address the problem in full. A recent report by online home marketplace Zillow estimates that the nation needs 4.3 million more housing units to meet existing demand.

“Not only does the number of ‘missing households’ without a place of their own to live [some 8 million families] exceed the number of available housing units, this gap has increased over time,” Zillow reports. “The magnitude of the housing deficit and how quickly builders can fill this gap will go a long way toward determining the path for U.S. housing affordability.”

Given the huge chasm, Lawrence Yun, chief economist at the National Association of Realtors (NAR), said some government intervention may be required to help address the existing supply/demand imbalance in the housing market.

“NAR is advocating for temporarily lower capital gains taxes for mom-and-pop real estate investors [i.e., fix-and-flippers] who are willing to sell to a first-time buyer,” he said. “This incentive can boost inventory and help meet housing demand while keeping home prices manageable and stable from the increased supply.”

ATTOM’s Barber adds that state and local governments also have financial-incentive programs designed to bolster more housing production, such as tax breaks, other subsidies for builders and local zoning-law waivers.

“At the same time, some of the key headwinds contributing to the [housing] shortage include local zoning laws that restrict how much housing can be built in any given community, stemming heavily from local neighborhood resistance to more development,” Barber said. “That gets into some very dicey issues connected to perceptions of crime, traffic, effects on existing property values and the even-thornier issues of race and class.