Ashley:

This is Real Estate Rookie Episode 307.

Darren:

If you build $50 to $100 or $150 a month, whatever it ends up being into your pro forma, it’s never going to be an issue as you build out your portfolio. We see this with a lot of people. We ensure versus if you build out 10, 15, 20 properties and then all of a sudden you realize that you’ve had a back-alley agent or whatever it is. Now, you have this additional expense to your business that you really weren’t calculating for from the beginning.

Ashley:

My name is Ashley Kehr and I’m here with my co-host, Tony Robinson.

Tony:

Welcome to the Real Estate Rookie Podcast where every week, twice a week, we bring you the inspiration, motivation, and stories you need to hear to kickstart your investing journey. Today, we are talking about something that is both exceptionally educational but as equally terrifying. We’re talking about insurance for your rental properties.

Today, we have on two guests and both of these guys have just a tremendous amount of experience and knowledge when it comes to the short-term rental space, but they’re actually coming from two different perspectives. We have Christian who actually, in addition to being an insurance broker, also runs the one brokerage with David Green. We also have Darren who runs Proper Insurance, which is an insurance company dedicated to short-term rental.

We’re bringing them on to talk about all things rental insurance, and a couple things just want to call out that jumped out at me. We talked about why you may not need an LLC and how your liability protection through your insurance policies might be able to protect you even better than an LLC can.

We talk about price shopping versus getting the right coverage. We talk about questions that your agent should be asking you. Then Darren gives this really cool breakdown of the three parts of an insurance policy and what those three parts are and why they’re important.

Ashley:

Yeah. You also heard Darren in the intro too after the episode number giving a disclaimer in this to a lot of people try to cheap out on insurance so that their numbers work better. Just like any expense you have for your real estate deal is to make sure that it works in your numbers. It’s not a deal if it doesn’t work. Don’t try to give up some coverage, make your insurance cheaper so that the deal actually does work.

We put that in the intro because we really wanted you guys to listen to that first before you go into this episode and hear all of the nightmare things and the expenses and insurance may cost based on different things. You know it’s impossible to cover everything about insurance, but we hope this is a quick guide for you guys as who get a basic knowledge of your insurance policy, what kind of coverage you should have, and more specifically based on the real estate strategy you are doing.

Tony had brought up this idea on episode 296 and here we are making it happen. Thanks to you rookies for listening to us. We’re able to get things done and bring you guys some more expert guests along with having our favorite rookie investors on here. Head over to YouTube and search Real Estate Rookie and let us know on this video what are some other experts you want to have on the Rookie Podcast. Leave a comment below and let us know, and of course, make sure you are subscribed.

Tony:

Yeah. I’d love to get an appraiser maybe if you guys are interested in that. Someone from a title company, an escrow company, just all the different services that you end up using as you build out your real estate business so that you rookies can understand from a service provider’s perspective what’s important, what are things you should be looking out for, what’s the sign of a good versus bad service provider so you can make sure you’re building out your team the right way.

Before we keep going, I just want to give a quick shout out to someone that’d love to say five-star review on Apple Podcasts. This person goes by the username of Jeremiah Johnson 1. Jeremiah says, “I love all the information. It’s great content. I’m on my second property with three doors total. I’m house hacking/midterm renting for traveling nurses. I’ve been studying for over two years and I’ve read over 20 books, many from BiggerPockets and I’ve read Multifamily Millionaire as well. I love my BP family.”

Jeremiah, we appreciate you and kudos to you on your success. For all of you that are listening, if you haven’t yet left us a rating and review on Apple Podcast, Spotify, wherever it is you’re listening. Please, please take a few minutes out of your day to do that. The reviews really do help the podcast grow and reach more folks. Ultimately, the more folks you can reach, the more folks you’re able to impact and help, which is what we’re all about here at the Rookie Podcast.

Ashley:

Darren and Christian, welcome to the show. Thank you so much for joining us. Darren, let’s get started with you. Tell us a little bit about yourself.

Christian:

Thanks, Ashley. Darren Pettyjohn here. We co-founded Proper Insurance. I’m the co-founder back in 2014. Basically, we saw a need for a specialty insurance product for the short-term rental industry. We would define that as the Airbnb or Vrbo market, basically properties that are rented for 30 days or less.

It was slow going in the beginning like any entrepreneur. Then we started to pick up some steam and we earned an exclusive endorsement from Vrbo about five or six years ago, which really helped kick off the program. I would say to date, as of now, we’re most likely the largest insurer of short-term rental properties in the United States. We insure in all 50 states, and it’s been the big success of my business life was meeting two guys and starting proper insurance.

Ashley:

Congratulations. That’s amazing. What an accomplishment. We’re really excited to have you guys here to really talk about insurance and not even just short-term rental insurance. Christian, what about you? Tell us a little backstory.

Christian:

Absolutely. Yeah. Little bit different, but similar line entrepreneurship. Obviously, those who recognize me from the other podcast, I co-starred, The One Brokerage with David Greene, who’s the host of the BiggerPockets Real Estate Podcast. I also am an insurance broker. I’ve been an Allstate exclusive agent, a farmer’s exclusive agent, a state farm reserve agent, and now I’m an independent broker. I work with a variety of companies now.

Darren, I can speak firsthand proper … There’s a reason why they’re probably the largest insurer of short-term rentals. They got a policy that knows the right things that Airbnbs just have, man, those fine-tuned things that for those of you listening to this who are potentially looking to get into the short-term rental market, there’s so much you don’t know. Get with the right people. Listening to this is a great start. Get the right people in your network because the smallest thing of not getting insured could make a big difference.

Ashley:

That’s the exact reason we wanted to do this podcast. We’re going to talk about some stuff in general about insurance policies and insurance you should have in place. Then towards the end of the episode we’ll kind of niche down as to what are some things you need to know based on your investment strategy.

Let’s kick off with what are some common mistakes rookies make with insurance. First of all, are they even going to the right insurance agent or broker and how do they know that?

Christian:

Yeah. I mean right off the bat, I don’t want to say just don’t go get the cheapest price, because obviously price is important. But it’s price shopping and prioritizing saving 20, 30 bucks on your annual insurance policy versus getting the right coverage. I’d say that’s absolutely number one, whether it’s not insuring yourself for the right liability or the right use that you’re using the property for.

We spoke a little bit about short-term rentals, but there’s midterm rentals. There’s rent by the room and house sharing. There’s whatever you’re doing with the property you got to make. Some people have mixed use where they have a business operating downstairs. All of that is insurance specific that the carrier is going to care about and they’re going to rate you effectively and that’s going to obviously impact your premium, but it’s going to impact your coverage as well. What do you think about that, Darren?

Darren:

No. That was great. I think an overarching issue is insurance is a product that you don’t use. When you go to buy tennis shoes on Amazon, you use them and insurance is an afterthought. Unfortunately, a lot of people just focus on price. They shop the internet, they shop agents, and they almost think of it as something they have to have versus something they need and should understand.

The average property owner in the United States will file an insurance claim every nine years. That’s the equivalent of going and buying a really nice suit and then putting in your closet and nine years later pulling it out. It’s understandable where a lot of confusion comes into the market and really it’s a price driven market. We’ve all seen the Geico commercials, the State Farm, Allstate, Nationwide USA, Liberty Mutual, whatever commercial you see, it seems like they’ll all save you money.

We actually make a joke where if you switch carriers enough, eventually they will pay you because you’re saving so much money along the way. Obviously, proper insurance is different. We focus on coverage and we really look at it from a risk management perspective. Because if you go all the way back to the founding of insurance, which was actually the 1,600 in Lloyd’s of London when people were shipping coffee and tobacco and gold from the New World, United States over to Great Britain, they would lose their gold to pirates or to bad weather.

The concept of insurance of transferring that risk onto an insurance carrier was born in the 1,600. That concept still holds true today. That’s what you’re doing when you buy insurance. You’re taking your risk. You’re paying a premium and you’re transferring that risk over to an insurance carrier. When you buy a home or an investment or a business or whatever it might be, you don’t really think of the claim. You think of how much does this cost because, again, it’s just a product that you don’t use.

Tony:

Darren, you’re telling me that insurance policies found their origin because of pirates?

Darren:

Pirates and bad weather. Yeah.

Tony:

That is why.

Darren:

If you look it up, the concept of insurance was actually a coffee shop in London. It was the Lloyd’s coffee shop, and there were a bunch of pretty well-to-do folks sitting around and they basically decided to put their money in a pool and ensure these ships that were coming from America over to Great Britain. But there was a catch. The catch was if the ship made it and there was no pirate or bad weather and your golden tobacco made it, you didn’t get your premium back. The insurance carrier got to keep the premium. That concept still holds true today.

Tony:

Wow. Crazy. I learned something new in almost every episode. That’s wild. Christian, I want to go back to you for this next question then, Darren, we’ll hear from you afterwards. But you said one of the challenges or I guess mistakes that rookies make when it comes to insurance is putting price or prioritizing price over getting the right coverage, define right coverage.

If I’m a first-time real estate investor, how do I even know what right coverage means for me? Can you walk us through what things we should be looking for?

Christian:

Great question. Yeah. It just goes to show that it’s not people’s fault while they do this, why they do this. Think of the last insurance commercial you saw, what was it about?

Tony:

Fifteen minutes saved you 15% or more.

Christian:

100%. It wasn’t about insurance. It was just about saving money. That’s what every insurance company commercials are about. To answer your question, going to your insurance broker, your insurance agent proper, whoever it is, and giving the true story about what the use case of the property is or what your intentions with the property are is how you start that conversation.

Now, that doesn’t mean your insurance provider is good, because Darren and I had some off-air talks about how other companies are not doing it right now. But for instance, there’s a question on most insurance applications to say, “Is one more than one tenant going to be occupying the property per year.” If you’re midterm rental, short-term rental rent by the room, the answer to that is yes.

I can’t tell you how many times I’ve seen even on policies that I’ve gotten myself, I’ll go to my insurance broker, they won’t ask me that question. I just say, “This is going to be a rental.” They say, “Okay. We’re getting you a landlord’s policy.” I know what I’m doing. I say, “Well, hold on.” I stopped them. But if that was not me doing that, that person gets a one tenant a year landlord’s policy.

If the carrier ends up finding out that there were people every three days in that thing because it’s in the Smoky Mountains, Tennessee, and it burns down because the tenant did something stupid with the electrical, potentially denied coverage right there, just because that question wasn’t asked. The carrier was not aware that it was insured correctly. They weren’t insuring it as 50 tenants a year. They were insuring it as one.

All you can do is start the conversation and if you get an idea that you’re not being asked the right questions, it’s very possible you’re not partnered with the right person. That’s the same with anything. I mean you guys all the time, I’m sure, interview realtors and lenders, you can tell when you’re talking to a good one a lot of times. They’re taking an advisory council position with you. They’re walking you through the stages. They’re letting you know what to look out for.

That’s the sign that, “Hey, I might be in the right room with the right people now.” But you won’t even get to that point if you’re not asking the questions. That’s the mistake most people make. They just go to say, “I want an insurance policy, or I want a loan, or I want to buy a house,” and there’s nothing more that’s shared. It doesn’t actually allow the advisor to advise.

Ashley:

Christian, what I’m hearing you say is that you also have to not only ask questions, but you have to give them all the information, too, as to you have to be open and honest about what is going on in the property to actually get the correct coverage for yourself. One question I do have real quick as far as asking your agent or your broker these questions, is there one key question that you can ask in a way to phrase it?

For example, with real estate agents, we’ve had someone recommend to us, instead of asking an agent, do you work with real estate investors, ask them how many deals have they closed with real estate investors or wording questions differently like that as to being able to get a specific answer. Is there anything, any questions like that, that you can think of to word differently to get a more accurate response rather than, “Oh, yeah. I do everything. Yes, of course, I can take care of your short-term rental policy.”

Christian:

Yeah. No. I love that. I mean, I’d say first and foremost, I mean, maybe this scales as you continue your journey. This is the question I ask now, but I’d go and ask, “Hey, if I give you everything that I own could you analyze my net worth and insure me properly?” Because not everybody needs mountains and mountains of insurance.

But like myself, if I went … I mean you guys, if we went and got a policy from State Farm, Geico, whoever, and they didn’t quote one of us, an umbrella policy on top of our landlords, they’re doing you a massive disservice because we have a lot to lose. If somebody builds up a portfolio of five, six, seven houses and you’re not insured and umbrellas are cheap … I mean, it’s like you’re paying …

Ashley:

Can you just explain what an umbrella policy is real quick for anyone …

Christian:

Yeah. That’s fair.

Ashley:

… that doesn’t know, please? Yeah. Thank you.

Christian:

On homeowners, on car, you guys think of anything that can be insured, typically, there’s a portion of it that is liability coverage. All liability means is that if you cause harm or some pain and suffering to somebody, they can be compensated for that, whether it’s through a lawsuit, anything like that. That’s just hitting somebody with a car and costing personal injury. This is somebody being injured on your property due to some amount of negligence by yourself.

Maybe you didn’t repair the stairs on your Airbnb and your gas tripped down because there was a safety hazard and you neglected it. All these things could be picked up under general liability coverage. The same thing goes with business. There’s liability coverage when you own a business. However, your home policy is not really meant to be a liability policy.

What I mean by that is that the home’s primary purpose is to ensure the home. If it burns down, if there’s a storm, if there’s a pipe burst and your house floods, all things like that are why it’s really there. The liability coverage is just like a little extra perk. Like, “Oh, by the way, if somebody trips and falls in your house, you can be covered.”

What an umbrella policy does is that you have your car insurance, your business insurance, your home insurance, but none of them is purpose is really liability. An umbrella takes a global stance on everything going on in your life and adds blanket coverage. That’s what we call it. That’s why it’s called an umbrella. It’s meant to cover everything you have, but strictly for liability.

This is if somebody were to sue me over and above what any of my individual policies cover, typically a home is $100 to $300,000. What if you get sued for a million? Your home will cover you for 100 grand. Does that mean I’m on the hook for the next $900,000? Yes. That’s one of us happening, that means they’re taking a house or a lawyer’s coming after your business or they’re coming after this podcast or they’re coming after me and David with the one brokerage. That’s what would happen if you didn’t have the proper insurance. Proper insurance, huh?

Darren:

Yeah, buddy.

Ashley:

No pun intended there.

Christian:

Yeah. Right. That’s a great name. You get people accidentally saying that all the time. But no, I mean, all jokes aside, instead of me being liable for that 900,000 in the event I get sued for a million and my home covers me for 100, you can get an umbrella policy up to a million dollars, and now your insurance policies are completely covering everything and there’s no situation that would lead to you having to sell your business, sell your home, and go backwards on all these hard things that you work to accomplish.

Tony:

Christian, a lot of good information. I want to pull a couple more threads in the umbrella policy. But before I do, you mentioned early on about the right coverage, about making sure that the broker is asking you the right questions. Darren, I want to point this question to you first and then Christian, we’ll hear from you.

But Darren, when you’re writing a policy up for someone, what are the questions that you’re asking that person to make sure you’re getting the right information? The reason why I want to know is because I want our rookies who are listening to understand. If I’m not hearing these questions from my broker, then maybe I should be concerned. What are some usual questions you ask someone when they come to you for a policy?

Darren:

Yeah. Our application process is fairly intense. As far as short-term rentals are concerned, it’s your online listing. That’s the beauty of the short-term rental business is these properties are advertised online. You have a snapshot into the business. If you were running a coffee shop or a grocery store or any other business, your website and your business itself would be underwritten. Those would be the questions that you’re asking.

My advice is, at least for the short-term rental segment, if that’s what you’re doing, you need to be very upfront with your insurance agent and actually send them the online listing. Unfortunately, and thanks to podcasts like this and getting the awareness out is we actually do hear a lot of people say, “Oh, well, I don’t want to do that because then my insurance carrier will cancel me.” It’s just misinformation.

Again, it goes back where the property owner just isn’t quite getting the idea that, “Look, you’re buying insurance to protect you.” The online listing is the key. That shows that it’s a business. It also shows the amenities if you have a swimming pool or bicycles or canoes or kayaks, whether you have a ring video doorbell in the front of your property, because we’ve actually started to run into quite a few invasion of privacy lawsuits.

One that came up recently, actually, it’s kind of funny, but the gentleman was smoking in front of the property and then the host called them and said, “Look, this is a no smoking property.” The gentleman said, “Well, how do you know I’m smoking?” Then realized that he had been being watched by the ring video doorbell in the front and filed an invasion of privacy lawsuit.

We do run into those from time to time, but again, maybe I’m getting a little off track here. But the online listing is the key for the short-term rental aspect.

Tony:

Got it. Then Christian, just if you can just rattle off what do you feel are some important questions on your side as a broker that if I’m accustomed, I should expect to be asked to make sure I’m getting the right coverage?

Christian:

Yeah. I mean, not to broken record, but I always ask for a net worth analysis. What else do you own to make sure I’m protecting you correctly? Obviously, bundling comes into play when you’re a broker because I want to make sure that we have the proper coverage on car, auto, home. Typically, it’s a string. I ask, “What’s your net worth? What is that comprised of? What can we ensure in that net worth analysis?”

Then breaking it down more specifically to individual products. For real estate use case? Absolutely. How many tenants? What I would actually really like to focus on is difference between replacement and actual cost. I’ve seen so many policies with actual cost value a lot, and I’ll explain what that is.

Basically, when you … Insurance companies have found so many different ways to be tricky on how they insure stuff, what the actual dollar amount is that they reimburse you for, and there’s pretty much, too, that the industry has decided on. There’s replacement costs and actual. What that means is that let’s say your house burns down, your roof has a value. Some roof policies are on actual cost, which means what’s the actual value of that roof when it burned down after depreciation, after wear and tear after everything else.

Maybe that roof that as of right now would’ve costed $25,000, $30,000 to put back up, they’re going to give you like eight grand for it, because replacing the actual cost. They’re not insuring you for the replacement value. The replacement value is how much does it take right now to put it back? That’s not including depreciation because you’re not insuring the actual thing.

You can do the same thing with your dwelling if you have a guest house. This is so common. Oh, my gosh. If you have a guest house or an ADU on the property, I’m in California, this is getting so common. I don’t know where everybody’s from here. But if you have an ADU and you have just a standard homeowners or landlord’s policy, there’s just a tiny bit of coverage for other structures, but it’s not really built to be a dwelling coverage.

There’s a lot of exclusions that other structures coverage has. Same thing, I would make sure that I’m asking that, “Hey, what’s your plan for this ADU?” I always when I’m insuring property, I pull up the Google Maps view of it. I try to do the satellite, the top-down as well as the front facing from the yard. What’s going on on the property? Do you have a horse stable? Oh, do we need some farm insurance? Do we need some animal insurance? I mean, you guys can see the string that I go down. But it could expand based on those answers.

Tony:

You’re right. It’s just like you want someone that’s going to ask a lot of questions. I think it’s the gist that we’re getting at here.

Christian:

That’s what I’m getting at. Yeah.

Tony:

If you reach out to someone and they say, “Hey, give me the address. Here’s a quote.” Then maybe that’s not the right policy that you’re looking for. I appreciate that because what I want our rookie center stand is like, “Hey, what’s the level of curiosity that we should see from these insurance folks?” We’re having those conversations.

The next question I have, and it ties into what we’ve already been talking about, is the umbrella policy versus the LLC. A big, not misconception, but maybe like an obstacle that new investors feel they have to get over before they can get started investing is, “Hey, I need an LLC. I need an LLC for tax purposes, which you don’t technically. I need an LLC for liability protection,” which maybe you do, maybe you don’t. Where do you stand on the debate?

Darren, I think I’ll go with you first and Christian will jump back to you. But if I’m a new investor and I’m just getting started, do I necessarily need an LLC for liability protection or can I get pretty good liability protection through something like an umbrella policy or something that I can get from my insurance company?

Darren:

Yeah. Filing the LLC, the concept on that is that they can’t penetrate through the business to your personal assets. The issue with that is, unless the house is in the LLC, unless the loan was actually under the LLC, it’s pretty easy to penetrate through those than to go after somebody’s personal assets. I wouldn’t hang my hat on it. I mean, from a liability perspective, you have to think what’s your biggest liability in life without a question, hands down as driving your car.

If you’re texting and you’re driving or you’re just driving in general, there’s a high likelihood at some point you might hit somebody with your car. At that point, they’re going to come back to you for their bodily injury. Maybe their family sues you, worst case scenario, whatever it is. You have liability limits on your auto policy.

Once those limits are exhausted, then your umbrella policy would kick in above and beyond that. The same thing goes for short-term rental properties. If you think, “Well, okay, driving a car, it’s essentially a weapon.” What’s your second biggest exposure in life? What we tell people is, “It’s your short-term rental business because you have people from all over the world coming to stay at a property that they’ve never been to. You’re competing against Hilton and Marriott and you’re subject to the same hospitality laws.”

What that means is you have a legal duty to provide a safe premises to those people. A lot of people do not understand that. It’s a business, but you have to realize if you have personal liability and a personal umbrella on a investment property, that personal umbrella is not going to kick in above and beyond because it excludes business activity. There’s the personal world. There’s the business world.

The only way to do it accurately is have an underlying business policy on your short-term rental. Then if those limits are exhausted, a commercial umbrella above and beyond those limits. There’s a commercial umbrella. There’s a personal umbrella. The personal umbrella will go over your car, your home, your auto, all the things, your boat, your ATVs, your motorcycle, all of the personal items you have in life.

If you own a business, you have business insurance and a separate commercial umbrella above and beyond that business. My advice would be it’s not a bad idea to put your property under an LLC, but what typically happens is people finance the house under themselves personally because the business has no assets. The business would never qualify for the loan anyway.

Then they do the financing personally, and then they go out and they create an LLC for 25 bucks and they try and quick deed the property over to the LLC or whatever it might be. I’m telling you right now, we have paid million dollar lawsuits for drownings and swimming pools, carbon monoxide poisoning, invasion of privacy, decks collapsing on and on and on. When someone gets seriously injured at your property, they’re coming after you and their ability to penetrate that LLC is very high. Do not solely rely on the LLC.

Ashley:

Your solution to that is to get your usual coverage on the property, but also have the commercial umbrella policy over?

Darren:

It depends. I mean, for our program specific, our minimum liability is $1 million. We joke and say, “Look, a million dollars isn’t what it used to be.” But in the event of a death suit, if somebody was to die at your property, it’s always policy limits. It’s always a million bucks. It’s just the way it goes. Usually what will happen is the plaintiff will accept that. They’ll accept the settlement of a million dollars and the family will move on with life, and it is what it is.

But we do have a two million option that’s built in where people can do a two million per occurrence limit. Some people feel more comfortable with that. Then if you were a very high net worth individual and you wanted to go above a $2 million occurrence limit, you could buy a $5 or $10 million commercial umbrella, which again, we always have to tell people, buy as much insurance as you can afford, because we do get some folks who just go, “Look, I want as much as I can get, basically.” But most people are comfortable with a million dollar occurrence limit.

Ashley:

It’s not very expensive, is it? I mean, I think my umbrella policy is maybe … I mean, it’s less than $200 a year.

Darren:

Yeah. A core concept, too, that really we didn’t touch on earlier is the less expensive your insurance costs, the less coverage you have. Again, when you’re dealing with an insurance agent, I would phrase the question as, “If they’re saving you money, what coverage are you giving up?” Because we insure tens of thousands of properties. We’ve written over 100,000, 150,000 policies, and our risk is spread out.

At the end of the day, our goal is to collect more premium than we pay out in claims. But that margin is pretty small. We don’t need a 40% margin. But at the end of the day, if your insurance is less expensive, then you’re giving up coverage. A great example would be you switch car insurance and the agent says, “Oh, hey, I saved you $40.” Well, then you need to ask, “Well, what coverage am I giving up? Why is this so inexpensive?”

They say, “Well, let me do a coverage comparison. Oh, actually what you gave up was windshield coverage.” You no longer have windshield coverage, but I saved you $40 a year. Again, a concept you just have to understand is if you’re getting the least expensive or cheapest insurance, then you’re getting the least amount of coverage possible. Ask your agent, “What am I giving up by buying such inexpensive insurance?”

Ashley:

Darren, when we get a policy quote sent to us by an insurance agent, how much of that information is actually useful to us without seeing the whole policy? Is that something we should be requesting is how do we find out what is actually covered in the policy? Should we be comparing it ourselves or should we be relying on the agents? Kind of walk us through once we get the quote, what we should be looking at and even how to read the quote, what information do we see on there?

Darren:

Right. What you’re referring to most times is what’s called a dec page, a declarations page where our insurance contract, for example, is I believe 95 to 100 pages depending on the state. But yet the proposal that we deliver is only a few pages long. It’s a summary to your point. But you can get most of the crucial information from that summary as Christian pointed out earlier, whether it’s replacement cost valuation or actual cash value on your building, your contents, and then obviously you have business income or lost rental income from a rental perspective.

But you just need to ask your agent to walk it through. I mean, that’s their duty. They have a fiduciary duty as a professional to walk you through and explain what that proposal means. You just need to ask questions. We get it a lot. Ours is actually much more detailed than most of our competitors.

We have people call in all the time and say, “Hey, look, I want you to walk me through this. What is business income versus loss of rent? Do you have actual cash value on your roof? Do you have a water damage limitation?” All of these details. Just have them walk you through it and then you’ll be more comfortable. But fundamentally, you just have to understand there’s two parts. In the rental business, three parts to any insurance policy.

There’s property coverage, that’s an exposure. You own that asset and you need to protect that asset. What do you need to protect it from? Fire, wind, hail damage, water damage, vandalism theft, so on and so forth. But it’s the asset that you can touch and feel. I own this asset. I need to protect this asset. The second piece of the policy is what’s called liability. Then that’s any bodily injury or property damage that you could be held liable for.

A lot of people forget that. But in the liability component of an insurance policy, there’s the liability for property damage. Let’s say you own a short-term rental. It’s 4th of July and the renters burn your neighbor’s house down. Well, that’s property damage that you are now liable for. Then the third component would be the income generating component of a rental property.

It obviously generates an income. You need to protect that income in the event of a loss, and you need to dig into the details from the income side of things. But again, core concept here, that’s it. There’s nothing else to talk about. There’s property coverage, there’s liability coverage, and then there’s income coverage.

Ashley:

Is anyone else terrified yet to have a short-term rental with all these horrific scenarios you’re throwing at us, Darren?

Tony:

Yeah. It’s like I need to go back and reread through all of my insurance policies right now.

Darren:

It’s only once every 10 years though, guys. That’s the good news. Insurance once every 10 years, it’s just when does it happen? But I will tell you, if you’re in this business long enough, again, we’ve written hundreds of thousands of short-term rental properties. We have seen everything. Eventually, if you’re in the business long enough, something will happen at your property. It’s like any property though. You just have to have good insurance and move on with life, and it’s a great industry to be in. It’s a very profitable industry.

Tony:

Yeah. Let me ask a question because it ties into the three parts you talked about. You talked about property coverage, liability, and then income coverage. Christian, maybe I’ll point this one to you. When you think about those three layers on an insurance policy, what are some things that maybe people assume are included in most policies but that actually aren’t? If you’ve seen someone maybe get surprised by, “Oh, my gosh. I thought this was covered. Because why isn’t it when in reality it probably isn’t in most policies?”

Christian:

Absolutely. It’s the same thing with your car insurance. Your tires aren’t covered, anything that has to do with wear and tear. Your fixtures, your faucets like, “Oh, my shower head’s leaking.” It’s not an insurance claim. You guys would be surprised. I get questions about it all the time. Floods, named storms, hurricanes, fires in California, big natural disasters are typically structured as separate policies where your standard homeowner’s insurance.

Those of you in California, I’m sure most people are aware, earthquakes not covered. Big major storms in Florida, named hurricanes typically aren’t covered on your standard homeowner’s insurance policy. You need to go get hurricane coverage. Typically, these big large events are not … Those are exclusions. Thinking of other exclusions, acts of war, I mean that’s not really super common in America.

Tony:

But that is interesting to call out there that something like I’m in California and I actually didn’t even realize it. Earthquake coverage isn’t included in my policy. The house that I’m sitting in right now, you’re saying if there is an earthquake and my house toppled over, I would be homeless.

Christian:

You’re either paying for it out-of-pocket or hoping that FEMA comes in and saves the day. I mean, that’s basically your options at that point.

Ashley:

Tony, that’s actually happened where there was an earthquake while we were recording before.

Tony:

Yea. Literally, there was an earthquake. I mean luckily it was a small one. But yeah, there was definitely an earthquake while we were recording. Yeah. Natural disasters, things of that nature, fire. I guess something else, and I’m curious your take on this. I was reading an article about … actually two separate articles. One about California where I think it was State Farm is no longer insuring properties in California.

I read a separate article about a lot of insurance providers pulling out of parts of Florida due to hurricanes and things of that nature. What is an investor supposed to do? Say take Florida for example, if all of the insurance providers pull out of a specific area, what am I supposed to do as an investor to cover my property?

Christian:

Yeah. This is a really good question. Something that current event-wise is so important. I think I might have said fires or exclusion California. I was talking to earthquakes, so I may have misspoke there. The fires are a coverage of your policy if your house burn down. But no, going back to your question though, this is a really big thing, and it’s shaking up the industry right now. Specifically, California and Florida, there’s a couple more happenings of this across the country. But California and Florida, the two talking points for sure.

Florida, there’s a state offered insurance called Citizens. It’s something through the actual state of Florida. Historically it’s been the insurance of last resort. What that means when State Farm denies you, when Allstate denies you, when Proper denies you, when Geico denies you, whoever it is, you can’t get a policy somewhere else. You go to the state and there’s a state fund that’s not really ran to be a for-profit entity just to be the insurance of last resort.

The problem is now it’s gotten to the point where almost like your first choice has to be citizens, and even they’re getting a little picky with some things now. I know a lot of people who are literally, there’s not a company who will pick up this house for me. Maybe the roof’s old. In Florida, your roofs are everything. I mean, there’s these things called four-point inspections in Florida and wind mitigation reports.

Florida’s a different breed animal, for sure. But I mean the equivalent to that in California, and to add a little understanding behind why this happened with Allstate and State Farm basically exiting the state altogether is you can apply every year for rate increases. When you’re operating at a loss in a certain state, you go to the Department of Insurance in that state and you start lobbying for a rate increase, “Hey, we need to charge more to remain profitable.”

The California Department of Insurance is notorious for being one of the most picky and the most nightmares to work with in terms of rate increases or policy adjustments or whatever the case is. These companies aren’t able to get a whole lot through. I remember this being such a big deal when I was an Allstate agent, we would have these market meetings with our field sales leader that all the time they were just like, “We’re fighting with the state. We’re fighting with the state. We’re fighting with the state.”

It was leading to them just denying policies in the time being. Now, we’ve reached the absolute pinnacle of that as they’re just saying, “Okay, then we’re out. Screw the state,” which is wild. The reasoning behind it is that if you’re in California and you’re assuring a car, what’s the likelihood somebody hits a Tesla? Pretty high. That’s a number of the drivers in California.

What’s the likelihood if a house burns down? It’s worth 1.5 million, pretty high. The issue now becomes these insurance, like Darren was sharing, why it runs every 10 years. Well, driving cars probably once every three or four years, somebody’s getting in an accident that requires a claim. The cost of living in California has become so extraordinarily high that how can you remain profitable if every 10 years you’re replacing a million-dollar house and every three years you’re replacing a $200,000 car.

It’s just very difficult. It’s a difficult environment to operate in if you’re trying to be a for-profit business. This is something, man. I don’t know what the answer’s going to be. Maybe it just ends up being state subsidized insurance. I don’t know. But there needs to be a really smart guy to come along and rework how the Department of Insurances in these states work and rework how we quote properly, which is why I’d invite Darren to be on with us.

I mean they’re one of the few that are … I love Darren, I didn’t even know what you said. We require a million-dollar liability. Why doesn’t everybody do that? What is bodily harm worth nowadays? Why don’t you just require a certain set of liability to be covered? Then the person’s going to come and say, “Oh, but I want to save the 50 bucks a year.” No. If you get sued, let’s have the coverage.

There’s a lot of insurance brokers, admittingly. I’m one of them in California, and so many of them. I mean, I know a lot of my co-brokers, whatever I can call them in California, a lot of them were writing policies just to live, to put food on the table, to make money. You don’t get paid if the policy doesn’t bind. They start cutting coverages and then they’re starting improperly quoting and just to get the client and just to get the referral business and just to get the car when you can bind the home.

It just leads to this domino effect of, “Oh, he got me a policy. If I got somebody policy and I referred Darren, Tony and Ashley, and I gave him a really good recommendation, now that person gets three referrals, but now he’s motivated to give you all bad policies because he already gave me one.” It becomes just almost like this pandemic of everybody’s chronically underinsured.

The absolute pinnacle of this was when Paradise burned down in California. I don’t know if anybody’s familiar with that story. Do you guys know what happened in Paradise?

Tony:

The whole town burned down, right?

Christian:

Yeah. This is a great. Just bringing this all together and then really tying it to a real life happening. This happened, guys, for all the listeners. Paradise was a retirement community in Northern California, very nice multimillion-dollar houses. All these people, all this wealth moved into this town, beautiful structures, beautiful houses, everything was perfect. A fire ravaged the entire town of Paradise. I’ve never thought of something like this.

But the fire got so hot that it burned the asphalt on the roads. You guys realize how hot it needs to be for the road to burn? That’s how bad the fire was. You couldn’t even drive through the road. People’s tires were popping as they were driving. They were trying to get out of the town and their tires were popping. It was like hell. It was literally hell on earth.

All of that to say that people come back after the fire’s gone and they try to start rebuilding their lives. I’d say probably 95% of the town was improperly insured. You can still go drive through Paradise and there’s probably 60%, 70% of the houses that are not rebuilt. That town is gone. We’ll never be back to where it was, because they were in California and they didn’t have annual insurance reviews and their broker or insurance agent weren’t advising them correctly, and they weren’t insuring the properties for what they’re actually worth.

When these three and a half, $4-million houses burned down, they were insured for $800,000 in dwelling, and you couldn’t rebuild that house for $800,000. You just couldn’t. That was a travesty. I mean, these people who saved their entire lives to build up to own their retirement home, either had to rebuild it in cash, which is like, I hope you got enough. Or they just had to take a little percentage of what their house was worth and go somewhere else, which is an absolute devastating tragedy to these people who saved up their whole lives.

That’s a real-life situation of in mass what could happen when improper, quoting, improper guidance happens on a mass scale in a small area.

Ashley:

Christian, I want to take this towards a landlord aspect. For your example, it was probably mostly homeowners of people that were owning this retirement community. But what about a landlord that has a tenant in place? Why should we request a tenant to have a landlord or a tenant policy in place? What are the benefits to, yeah, renter’s policy?

What are some of the benefits to me as the landlord of requiring my tenants in case there is something that happens and maybe you can give us a scenario as if it’s a tenant’s fault they actually start the fire, or if it’s something that’s not their fault?

Christian:

Yeah. It always helps at having a little extra liability coverage. Breaking down the actual differences between landlords and tenant’s obligation is something that I would have the conversation with an insurance provider because that could vary provider to provider. However, if the tenant owns a dog, it’d be probably good to have a dog right on your renter’s application.

Also, the tenant’s personal property, your policy does not cover it. If you’re renting something unfurnished and they’re coming in and furnishing and the house burns down, it’d be nice for the tenant to get reimbursed for all their furniture, their $15,000, $20,000 in furniture they moved in. Their clothes, their personal property, if somebody steals something of theirs, their tenant policy could potentially cover against theft of their personal property. Your landlord’s policy isn’t going to cover that. For the tenant, it may cover something that’s stolen of yours.

Not only is it good advice, tenant policies are like $7 a month. I think the most expensive tenant policy I’ve ever seen is like 25 bucks a month. They’re really cheap. I mean, I’ll share a little bit about my own. I rent my primary residence, which everybody thinks is super funny. I don’t think it’s that funny. But on my house where I rent, I have rentals, obviously. But on my house that I rent, my car actually just got broken into up in Berkeley. I was hanging out in my old summit grounds. I went to uc, Berkeley for college, and my car had a break-in and they stole a laptop.

My renter’s policy that I pay $7 a month for, reimbursed me for a stolen laptop when I was not home. Pretty cool. Let’s really go down the chain here. If that laptop and impaired my ability to work, maybe that would’ve impaired my ability to pay rent, maybe that would’ve impaired my landlord’s happiness with me. Now by having that renter’s policy, I’ve saved all this chain of events happening where now my landlord and me have a better relationship because I could continue working and I wasn’t financially impaired from losing my work laptop. If you’re a landlord, that’s even more motivation. Keep the person’s stuff protected.

Tony:

Just a quick sidenote, the same thing happened to my cousin. She was actually overseas in Europe and someone stole her cellphone while she was in Europe and her homeowner’s insurance paid to replace her cellphone, which was crazy. I was like, “I never would’ve thought had I lost my cell phone overseas that my insurance company would’ve paid for it.” All right. Moving on here, I want to talk a little bit about working with the broker versus going with an agent and maybe what are the pros and cons to each approach?

Darren, Christian, whichever you kind of feels like more inspired here, I’m just curious. If I’m a new investor, which approach maybe makes more sense for me going with a particular company or trying to find an insurance broker?

Christian:

I can start off. I mean, what I can say is that there’s not 100% you’re going to work with a good person … percentages on either of those options. There’s bad brokers, there’s bad agents, there’s bad direct carriers, there’s good and bad of everything. If there’s a company that provides what you’re looking for and they specialize in that and you feel like you’re getting good advice, you’re probably in good hands, whether that’s a broker or a direct carrier.

The benefit with direct carriers is you go direct and they may know their products a little bit better. Darren knows more about proper insurance than I could ever know. That’s his baby. That’s everything he’s got. He knows every fine working of every claim they’ve had and every right, all the fine details. He would probably be able to advise on a proper policy better than I can.

As a broker, I have access to 100 carriers. I know a little bit about Farmers, a little bit about Allstate. I know who’s good at what. I know a little bit about whoever. It’s the shotgun approach. I go out and I get as much information as, you bring it back, you interpret it, and then I can disperse that information in a way that makes sense to the client.

I’m like a filter when you’re a broker. Instead of the borrower having to go to 15 different carriers, they come to me and I can tell them which is the best for them, but you lose a little bit of that expertise on each individual provider.

Tony:

Yeah. Your perspective is the actual company thoughts on broker versus going straight?

Darren:

Yeah. It’s a good question. In life you need an insurance agent. You need a insurance broker. We’re not necessarily a broker. We’re the managing general agent. It’s a term most people don’t know MGA, which means we underwrite issue and do everything. A broker and an agent could almost be the same thing. But you need one for your home, for your car, for your businesses that you own and different things.

Everyone should find an insurance agent they trust with proper insurance. We do it both ways. We do work with insurance agents. We refer to them as retail agents or brokers, and they do sell our product to the market. It’s not our primary focus. But with good agents, and I know I’m talking with Christian about working together, which is exciting, but we also sell direct. It’s just the modern way. Progressive sells direct, but they also sell through retail agents as well.

But bottom line is you need a good insurance agent just for life. As your kids grow up and need car insurance and as you get personal umbrellas and possibly life insurance and other things like you’ve got to have an agent you trust, something you need to do in life.

Ashley:

Darren, I have one last question for you before we wrap up. What is the difference between getting your property coverage for a short-term rental versus what AirCoverage offers you on Airbnb? Can you go through some of the differences in why you need short-term rental coverage and AirCoverage?

Darren:

Yeah. Good question. In order to get a loan from a bank, you need fire insurance. If you’re in Florida, you need fire and wind insurance. Because at the end of the day, we all like to think of the fact that we own the property, but we don’t, especially in the beginning. The bank loans us money and they own the property and they need to protect that asset. We talked about that earlier.

The biggest exposure they have is if that property burns down, they need to know that that property is going to be rebuilt. Everyone who owns a short-term rental property or long-term or midterm for that matter, you typically need insurance unless you own it outright. If you have no outstanding balance, no loan on the property, you could technically self-insure that property and say, “I don’t want home insurance.” But no matter what, that’s something that you need to have.

Now, I know the story of AirCover very well, and if we go years back, Airbnb was obviously trying to get hosts on their platform to grow the business. One of the friction points was insurance. They came out with the host guarantee, which is a property coverage, and then the host liability, which is host protection, which was the liability. They’ve obviously rebranded that now as AirCover and it’s all combined. But it worked extremely well.

List your property on Airbnb, but don’t worry about all the insurance components because we’ve got you covered. We work with Airbnb quite a bit. I mean, again, I won’t say that they’ve never paid out. We’ve been involved in multimillion dollar lawsuits with them where we’ve been the insurer and they’ve stepped up and there’s been other ones where maybe they haven’t done such a good job. But at the end of the day, your name is not on AirCover. It’s their insurance policy. They decide to provide to you guys, but as hosts.

But this is the core concept is … This is a huge fundamental mistake in the industry, is I don’t want to tell my homeowner’s insurance carrier that I’m short-term renting my property and I’m going to solely rely on AirCover. Let’s think this through. You invest. You buy a short-term rental property. You buy some type of landlord or homeowner’s policy, it’s fairly inexpensive, and you have that on your property.

You have supplemental coverage through Airbnb, assuming that all your bookings are through Airbnb and you have no direct bookings. You’re solely relying on AirCover for any type of that protection. Then a big tree falls on your house and damages your house causes $100,000 in damage. What was the cause of loss? Wind. Wind caused the tree to fall on your house.

You call your insurance company and you file S100,000 claim for roof damage. If that carrier finds out that you’re running a short-term rental property, they can rightfully deny that claim. They can say, “You’re a short-term rental. You wrote this policy as a long-term rental landlord or as a primary residence, there’s simply no coverage.”

People sometimes don’t believe that. They say, “Really? They can just void my coverage altogether?” Yes. On our website, we have case after case after case. The one that I always tell people, because it’s so cut and dry is just go to Google and search Emily Richer versus Traveler’s Insurance. It’s public domain. It’s on the internet. Sacks scenario that I just told you.

She had listed her Airbnb property for two weeks. She got three bookings, $100,000 tree claim, denied. She came back and sued Travelers in California and said, “This is bogus. They have a right to defend me. They need to pay.” That’s one example of so many lawsuits that are out there. Thinking of AirCover as a backup plan, fantastic. If 60%, 70%, 80% of your bookings are run through Airbnb and it gives you a warm and fuzzy and you feel pretty good about having that extra layer of protection there, if something goes wrong, great.

But at the end of the day, you need to have insurance specifically designed for what you’re doing at your rental property. Otherwise, you’ll have no coverage. Ninety-five percent of property damage claims are fire, wind, and water damage. None of those have anything to do with a short-term rental property, fire, wind, water damage. That’s what you’re paying for. You’ve got to have your own standalone policy and look at AirCover as a nice backup.

Tony:

All right. That’s both enlightening and scary. I just looked up Emily Richter’s case here and see what you’re talking about here. Last question for you before we wrap things up here. If you guys can just each give me maybe like, “Hey, here’s the one thing for this niche that you need to make sure is included in your insurance policy,” what your thoughts are.

Christian for you, I’d say we already talked a little bit about long-term rentals. We didn’t talk about flipping as much. But if I’m flipping just quickly, what’s one thing I need to make sure I have in that insurance policy to protect myself?

Christian:

I’d say for flipping, I’d say the company doing the flip should have general liability. That way if one of the workers gets hurt on a construction site is obviously a danger, need to have some commercial general liability. Because if it’s just you and your buddy flipping and a part of the roof collapses on, your buddy, buddy may not be your buddy anymore. He is going to try to go get his medical bills paid for.

You guys can see anything that you ask me, I immediately jumped to liability, because you can rebuild a property, you can fix a leak, you can fix a blown off roof, but you can’t fix somebody getting injured a lot of times. There’s a loss of income there. There’s a loss of value of life, whatever the case is. That’s where these big lawsuits really tend to happen. It’s always about liability. Those are the massive ones. I would say just talk with your insurance provider and make sure you have the liability during the bill.

Tony:

Got you. Okay. Liability for the actual construction site. Then Darren, if there’s one thing that someone who today maybe already has insurance for what they think is a good insurance for their short-term rental, what’s one thing they should add to really make sure that they’re covered as well?

Darren:

Well, I’m going to hit two things just because I want to focus on property and then focus on liability. From a property perspective, if we think it through, I have this beautiful property and I’m entrusting that property to short-term rental guests on a regular basis, what is my biggest concern? What is my biggest exposure? Your biggest exposure is damage to that property caused by a guest.

You may end up having 500 wonderful bookings and then eventually you get the Airbnb nightmare, which again is very rare. This doesn’t happen all the time and they destroy and really trash your property. You really want to have no limit on damage caused by a guest. No matter what, if you get that terrible guest and they trash your property, you have no limit on damage caused by a guest, which you’re only going to find at one place. That was a little self-promoting there.

The second would be a minimum of a million dollars in liability coverage. Christian touched on this a lot is $100,000, $300,000, $500,000 is a good start, but really you need a base layer of a minimum of a million dollars in liability coverage on your short-term rental property with your name on it.

Christian:

If I could add one more for free, too, if anybody is driving with the state minimums on your auto insurance policy, you are committing a crime. Get off of state minimums. State minimums just means in California it’s 15, 30. You can drive around California with $15,000 in coverage, $15,000 doesn’t buy a tire anymore it feels like. Have a review with your in … There’s no point in insuring your home for millions of dollars if you’re driving around your car with your biggest risk factor at $15,000 in coverage.

I get it. You’re trying to save money. But in the event you hit somebody, especially if you’re driving around in a high cost of living area, the chances of you hitting a Tesla or a Lambo or a Range Rover is fairly high. Get insured so you don’t have to take 15 steps back if God forbid something does happen. Knock on wood. But yeah, that that’ll be one I throw in for free, not real estate related, but please get off of state minimums.

Ashley:

Well, Christian and Darren, thank you guys so much for joining us. Really enlightening episode. Put a little fear I think into all of us, but good that we can go and take a look at all of our policies and make any corrections and also going forward, making sure that we are properly covered. Darren, can you let everyone know where they can reach out to you and find out some more information about you?

Darren:

Yeah. Proper is www, if I remember correctly, that’s the worldwide web proper.insure, www.proper.insure. There’s no.com, proper.insure. You can get a quote in three to five minutes online. We really do think of ourselves as the education company from a short-term rental insurance perspective. Get connected with one of our agents and we love coverage comparisons on your current insurance or whether you’re shopping insurance or renewing insurance. That’s how we built the brand.

Our average call is about 45 minutes, believe it or not, because once you get into that property liability, business income, that the questions just start to come and that’s how we’ve built our brand and our trust in the industry.

Ashley:

And Christian?

Christian:

Yeah. For me, I’m feel like all over BiggerPockets, but the one broker on social medias, if you want to get into contact with me, [email protected] is an easy find and I’ll put some links down here and whatnot. But appreciate you guys having us. It’s been fun. Good. Kind of bringing the scary reality to the forefront and making sure people are advised and guided the right ways.

Ashley:

Yeah. Thank you guys so much for joining us. We really appreciate it. I’m Ashley at Wealth from Rentals and he’s Tony at Tony J. Robinson and we’ll be back with another episode. See you guys next time.

(singing)

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

The Agency ventures into core services

Mauricio Umansky‘s residential brokerage The Agency is venturing into core services.

Through partnerships with Bubble Insurance Solutions and New American Funding, real estate agents at The Agency will have access to mortgage lending services and insurance services for their clients.

With Bubble Insurance Services, The Agency is launching its own affiliate insurance service, Agencia Insurance Solutions, which will serve new and past The Agency clients in California and Arizona. Through Agencia Insurance Solutions, agents will be able to offer clients access to flexible online home, auto and life insurance options.

The affiliation will provide The Agency’s agents with access to Bubble Insurance’s insurance coverage for their clients. The firm said the association aims to help homebuyers make more informed decisions by providing them with data-based insights into the risks associated with their home and neighborhood. These insights will be provided by Bubble Insurance’s patent-pending AI-based guidance system, HomePal, which uses data to match the most common environmental hazards for a property with the right policies and the right coverages for homeowners.

“Bubble’s AI-based shopping engine is specially crafted to integrate into home purchase and ownership flows to enable quick and smart insurance purchase,” Avi Gupta, the founder and CEO of Bubble Insurance, said in a statement. “Our one-stop insurance shop model is designed to give homeowners peace of mind and protect their investment, no matter what life throws their way.”

Through The Agency’s partnership with New American Funding, the mortgage lender will serve as The Agency’s preferred mortgage lender partner.

“We’re thrilled to officially announce our partnership with New American Funding,” Burke Smith, the executive vice president of affiliated businesses at The Agency, said in a statement. “Expanding our core real estate services with like-minded partners empowers our agents to provide their clients with best-in-class service and guidance throughout the entire transaction process.”

NAF offers numerous home financing options including conventional, jumbo, non-QM, as well as others. The Agency said that the partnership provides their agents with greater control over the transaction and enables them to offer better customer service to clients.

In 2023, The Agency ranked as the No. 18 brokerage in the country in the RealTrends 500 after reporting a total sales volume of $10.997 billion in 2022.

New American Funding ranked as the 31st largest mortgage lender in America for the first half of 2023, according to Inside Mortgage Finance data. The California-headquartered lender originated $4.69 billion in mortgage loans in the first half of the year.

Source link

PCE price index, one of the key inflation measures, kept cooling in June

The personal consumption expenditures price index excluding food and energy increased just 0.2% in June from the previous month, the Commerce Department said Friday. On a year-to-year basis, the core PCE rose 4.1%, the slowest annual rate since September 2021. It marked a decrease from the 4.6% annual pace in May.

Headline PCE inflation including food and energy costs also increased 0.2% on the month and rose 3% on an annual basis. It was the lowest yearly rate since March 2021, down from 3.8% in May.

This latest reading strengthens the general idea that prices have slowly begun to ease. Other readings such as the consumer price index earlier this month are also showing a slower rise in inflation. Meanwhile, consumer expectations are also coming back in line with longer-term trends. Personal income rose 0.3% while spending rose 0.5%. Income came in slightly below expectations, while spending was in line.

The PCE indices are part of the Personal Income and Outlays report, which provides a more comprehensive look at shifts in prices, including how consumers respond to them and how much consumers are spending, bringing in and saving.

The report comes two days after the Fed announced a quarter percentage point interest rate increase, its 11th hike since March 2022.

Recent inflation and employment data show slowing price growth and more moderate hiring. However, persistently-robust consumer spending kept inflation running above the 2% target, cutting against the Fed’s strategy.

During his press conference on Wednesday, Federal Reserve Chairman Jerome Powell further emphasized the importance of a “data-informed” approach to future rate hikes. The goal, he said, remains to restore price stability, which will “require a period of below-trend growth and some softening of labor market conditions.”

Source link

Today’s real estate agents see the light at the end of the tunnel

Outsiders to the real estate industry may assume that the tight market has real estate agents hanging up their hats. In reality, today’s agents are seizing the market and feeling confident.

Real estate agents are still confident in the industry and the market. Even as the housing market comes down from its COVID-19 pandemic highs, there are houses to be sold and deals to be made. And, AceableAgent — an online real estate agent licensing firm — recently compiled a survey to answer the question, “Is now a good time to be a real estate agent?”

The answer is undeniable. Yes!

Agent satisfaction by the numbers

“An impressive 88% of agents surveyed reported being satisfied (or very satisfied) with their careers in real estate,” said the report.

This satisfaction comes from many sources, flexibility, control, income potential and ease of entry are all cited by agents as the factors that make them enjoy their jobs so much. These factors even outweigh the current lack of listings and longer wait times on commission checks.

“[Some] 58% of respondents feel positive about the current real estate market,” said the report. A large part of these feelings could be due to the fact that, per the report, the tight market comes with positive changes too.

For veteran agents, tight markets often mean the removal of “fair-weathered” agents, those who got in the game during a high and won’t wait out the lows. There are also more opportunities to go to bat for your buyers and be seen as a valuable resource. Or, for those agents who really hit it big during the 2020 and 2021 boom years, now may be the perfect time to slow down business and strategize for the future.

“In the go-go-go market of the last few years, many agents were simply rushing from one client to the next with little time for strategizing to maximize workflow efficiencies. Now that things are slowing down, you can take a beat to reevaluate business strategies like marketing, branding, and operations,” said the report.

The housing market by the numbers

According to the latest, national data from Altos Research, the housing market may be approaching a soft landing. So, for those 83% of agents that said the market would improve in the next 6 months, the light at the end of the tunnel may be closer than they think.

As of mid-July 2022, the average cost of a single-family home in the U.S. was $450,000. According to Altos Research, that data is basically unchanged from 2022. And, inventory is on the rise — slowly. There were 470,000 single-family homes for sale in the U.S. during the same time period. That trend increased by 1% from the week prior.

“Since January, homebuyers have defied all expectations. Sellers have not materialized and buyers have been buying everything that becomes available,” said Altos Founder, Mike Simonsen.

There aren’t many listings to go around, but agents have made it clear that they don’t believe these market conditions are here to stay. There is a light at the end of the tunnel.

So what are agents doing in the meantime to improve their businesses? According to AceableAgent, real estate pros are focusing on networking, digital marketing and client service skills to stay ahead of the competition in today’s market.

Source link

Mortgage rates inch closer to 7%

Mortgage rates rose slightly this week ahead of the Federal Reserve Open Markets Committee‘s rate hike. The 25-basis point increase to the federal funds rate was widely anticipated and priced in by capital markets.

Freddie Mac’s Primary Mortgage Market Survey, which focuses on conventional and conforming loans with a 20% down payment, shows the 30-year fixed rate averaged 6.81% as of July 27, up from last week’s 6.78%. By contrast, the 30-year fixed-rate mortgage was at 5.30% a year ago at this time. The 15-year fixed-rate mortgage also rose this week to 6.11%, up five basis points from the prior week.

“Mortgage rates inched up slightly after a significant decline last week,” said Sam Khater, Freddie Mac’s chief economist. “Higher interest rates continue to dampen activity in interest rate-sensitive sectors, such as housing. However, overall U.S. consumer confidence is unwavering, surging to a two-year high in the Conference Board’s Consumer Confidence Index for July 2023. Rising consumer confidence often leads to greater spending, which could drive more consumers into the housing market.”

Recent inflation and employment data shows slowing price growth and more moderate hiring. However, persistently-robust consumer spending kept inflation running above the 2% target, cutting against the Fed’s strategy. As a result, the FOMC raised the target policy rate a quarter point in Wednesday’s meeting.

Federal Reserve Chairman Jerome Powell said that the full impact of the rate hikes and credit tightening has not yet been realized and further emphasized the importance of a “data-informed” approach to future rate hikes. The goal remains to restore price stability, to do so will “require a period of below-trend growth and some softening of labor market conditions,” he said during the press conference with reporters Wednesday.

Other mortgage rate indexes showed mixed results on Thursday morning:

HousingWire’s Mortgage Rates Center showed Optimal Blue’s 30-year fixed rate for conventional loans at 6.85% on Wednesday, compared to 6.74% the previous week. However, the 30-year fixed rate for conventional loans was at 6.95% at Mortgage News Daily on Wednesday, up 5 basis points from the previous week.

The sideways trajectory of the 10-year Treasury which climbed lately, mirrored financial markets’ uncertainty. For consumers, the Fed’s rate hike means that borrowing costs will be even higher, with effects likely to be felt in the next month and a half, according to George Ratiu, chief economist at Keeping Current Matters.

The rates for credit cards, auto and personal loans, as well as adjustable-rate mortgages will increase. In addition, the spread between the 10-year Treasury and the 30-year fixed rate mortgage is poised to widen as uneasy investors might keep the risk premium elevated.

“Higher borrowing costs will also spill over into real estate markets, keeping mortgage rates at the higher echelons of the 6% – 7% range we have experienced over the past 11 months. For buyers of a median-priced home, the monthly mortgage payment—assuming a 20% down payment—amounts to about $2,300, not including property taxes and insurance,“ said Ratiu.

The cost of financing a median-priced U.S. home, assuming a 20% downpayment, rose 12.4% from June 2022, according to Realtor.com economic researcher Hannah Jones. In addition, supply remains very tight: total existing home sales slipped 3.3% in June from the prior month to a seasonally adjusted annual rate of 4.16 million. Year-over-year, sales dropped 18.9% from 5.13 million in June 2022. Bidding wars are raging in some markets of the country, preventing home prices from falling significantly nationally, noted Jones.

Some buyers have turned to new construction to secure a home, and builders are ramping up their workforces to complete projects. Economists are hopeful that it might ease the housing supply shortage that has widened over the past decade.

“Both increased housing supply and eventual lower inflation would usher in a healthier housing market with more evenly matched supply and demand, taking some of the upward pressure off prices,” said Jones in a statement.

Source link

Despite Fed talk, only 72K new homes are for sale

At the Federal Reserve meeting Wednesday, Chairman Jay Powell said more housing supply is coming online. But the new home sales report begs to differ. We only have 72,000 new homes completed for sale in a country of 335 million people, and active inventory is near all-time lows. Where is Powell’s housing supply coming from?

The new home sales market isn’t the best avenue for completed units available for sale and it hasn’t been that way for a long time. Even during the biggest housing bubble crash, we never got to 200,000 new housing units for sale because this isn’t how the new home sales or builders operate their business.

As you can see in the chart below, the ability of this marketplace to provide millions of active listings is impossible.

During the housing bubble crash years, active listings grew to more than 4 million in 2007 because most of the inventory in the U.S. comes from the existing home sales market.

NAR active listings data (see chart below):

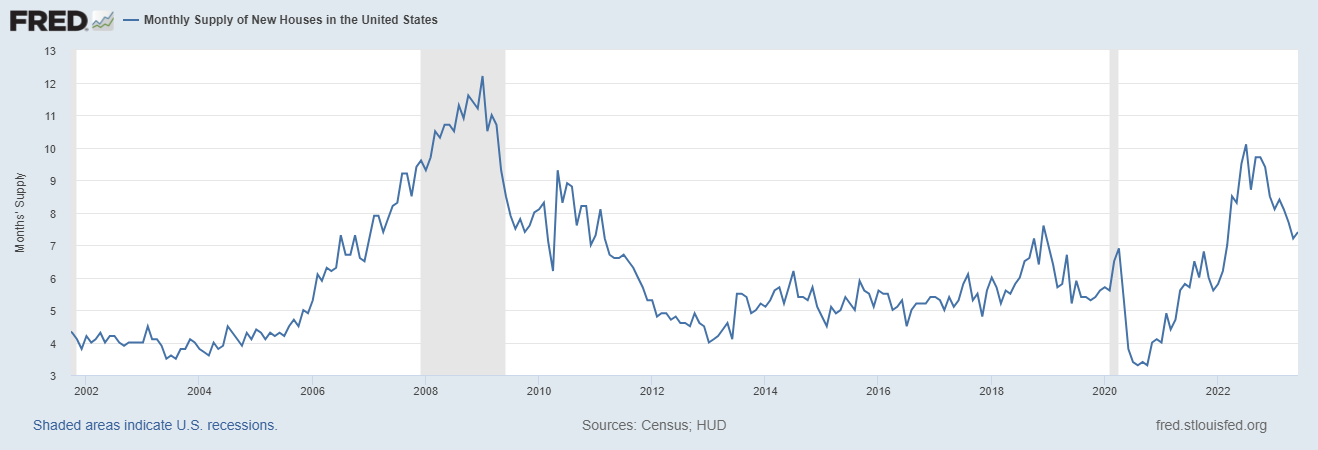

On a positive note, the monthly supply of new homes has been falling from the peak of 10.1 months to 7.4 months, which means the builders are working through their backlog. But 7.4 months of supply, as the chart below shows, is still too much for the builders to get excited about adding to housing permits in a meaningful way.

Now let’s look at the rest of the new home sales report.

From Census: New Home Sales Sales of new single‐family houses in June 2023 were at a seasonally adjusted annual rate of 697,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.5 percent (±12.7 percent)* below the revised May rate of 715,000, but is 23.8 percent (±22.5 percent) above the June 2022 estimate of 563,000.

New home sales missed estimates and had three months of negative revisions. As always, these reports are wild month to month, so when you see a big print, either negative or positive, it will most likely get revised, so the trend is more important. We saw sales bottom in 2022, and they’ve risen higher ever since.

We have to remember that the new home sales market has some advantages that the existing one doesn’t, which is why we see 23.8% year-over-year sales growth for new homes. The new home sales market is much smaller than the existing one and doesn’t rely on a seller listing their home for demand to grow.

The builders sell their homes like they sell a commodity and they’re efficient sellers — they can cut prices and buy down rates for a smaller marketplace. In addition, the low number of active listings for existing homes makes the builders’ homes a more attractive option. Why not buy a new home instead of an older home that might need a lot of work?

From Census: For Sale Inventory and Months’ Supply: The seasonally-adjusted estimate of new houses for sale at the end of June was 432,000. This represents a supply of 7.4 months at the current sales rate.

It’s always critical to explain how the monthly supply data and numbers work for new homes because I believe a lot of confusion about supply comes from not understanding this data line.

Breaking down the monthly supply data (7.4 months) into different categories is vital:

The builders manage their supply like good business people because they want to sell these homes at the highest profit possible and have the margin to spare if they need to make some deals. So, they’re not going to put their heads down.

My model for the builders is simple. To see real growth in permits we need monthly supply to get below 6.5 months with rising sales. We are working our way back to that level but have yet to arrive. We have to remember the builders had a backlog of homes to work off, so we had a pipeline of homes that need to be completed.

Here’s my model to understanding the builders:

Overall, this was not the best new home sales report: sales missed estimates and we had negative revisions in the prior three months. But, the trend of new home sales improving using a low bar from last year is still intact.