Dave:

Hey everyone. Welcome to On the Market. I’m your host, Dave Meyer, joined by Henry who’s laughing too hard to acknowledge me. Kathy, James, and Jamil. How is everyone today?

Jamil:

Creamy.

Dave:

Why is your face hurt, Henry?

Henry:

From laughing hysterically.

James:

I’m excited. Me, Jamil and Henry are going to go walk houses in Phoenix later today or in Scottsdale.

Dave:

Hey, you all are having a little party without us?

Kathy:

I know my heart hurts a little.

Dave:

We weren’t invited.

Henry:

I mean, I’m rarely invited when I show up in Phoenix, so I just hop on a plane anyway.

James:

You guys will be invited to On the Market house-warming party, if we go for it. We’ll just throw a rager.

Dave:

I would hope so.

Kathy:

Can’t wait.

Dave:

If it’s an On the Market party.

Jamil:

I mean, what else do you throw in 20,000 square feet?

Dave:

James is considering buying a 20,000-square-foot home in… I won’t say where.

James:

It is not 20,000 square feet, but it is 10.

Dave:

It’s a lot.

Jamil:

10, 20, when you’re that big, it doesn’t matter anymore.

Dave:

Well, that’s just the main house, Jamil. That doesn’t account for the-

Jamil:

The guest house.

Dave:

… Secondary house and the pool house.

Jamil:

Yeah.

James:

All right. Well, if I buy this house, we’ll do a big launch party.

Dave:

All right. We’re inviting all the listeners or everyone who’s listening to this can come to James’s house. All right. Today we have a really fun show. It all started… I posted something on Instagram about all this bad advice that I hear people on Instagram giving other real estate investors, aspiring real estate investors, and it just started this whole (beep) storm that I found was really interesting and really interesting conversations going on about different perspectives. And we thought it would be fun for each one of our panelists to bring the worst advice either they’ve ever gotten or that they hear being tossed around these days. So everyone’s going to bring their own. We’ve also asked our community on Instagram for some of the worst advice that they’ve heard, and we’re going to be sharing those with you throughout the episode as well. So we are going to take a quick break to hear a word from our sponsor and then we’ll be back with our bad advice.

Welcome back everyone. We are going to jump right into our bad advice episode. Who’s got the worst advice? James, let’s start with you.

James:

Oh my God, I’m so sick of hearing this.

Dave:

Is this a new one or a current market situation? What’s the context for this bad advice?

James:

This is one that I’m hearing all the time, or I’ve been hearing it for the last nine months, including now, and the advice I keep hearing is it is too risky to be flipping properties right now, sit out the market.

Dave:

Okay. I see Henry laughing. Jamil, all of you guys have been flipping. So before I ask James why you think it’s so bad, let me hear from you, Henry, what’s your thoughts on this?

Henry:

I’m laughing because I’m like I don’t know why I didn’t think of that as my bad advice. People say that all the time to me. You’re actually making money right now? Yeah, we’re making great money flipping houses right now. The market has given us an opportunity to buy at a deeper discount and we’re still seeing elevated prices and getting multiple offers and accepting offers above list. It’s crazy right now. So yeah, I’m doing just fine flipping.

Dave:

Jamil, I mean business sounds like it’s doing all right for you.

Jamil:

Yeah, going well. I mean, I’m not going to lie, I’d lost near half a million dollars on some of my fix and flips towards the end of last year. But that’s the thing. I ended up and got back into the market and just adjusted and pivoted my product and my price point, and as soon as I did those things we’re back in business again. And so I think it’s terrible advice, but I think the people who are giving that are the ones that just won’t ante up or they don’t understand. They’re the kinds of folks that only make money when there’s a bull market. You need to be able to make money in real estate regardless of what’s going on. That’s what makes you a real estate professional.

Henry:

I think, because heard Jamil speak a couple of times, and he talks about being a cautious flipper, and I do think that that’s great advice because the underwriting is key. If you screw up your underwriting, this market isn’t as forgiving as it was and you can lose money. We’re not saying it’s impossible to lose money. You could absolutely lose money, but it is not a bad idea to flip. You just must be cautious.

Kathy:

But you can lose money in a good market too. I mean, it’s all about experience and education and knowing what you’re doing. So Jamil, a lot of people couldn’t handle a half a million dollar loss starting out. So do you think it is a good flip market for someone who doesn’t know what they’re doing or is just starting out?

Jamil:

I never think it’s a good idea to get involved in fix and flipping when you don’t know what you’re doing. I think that’s the reason why you align yourself to somebody who’s doing it really well. I mean, if I’m going to just begin fixing and flipping, I’m going to find a coach. I got to find somebody who can walk me through it, who can teach me underwriting, who can teach me product, who can teach me design and material and the right processes that you need in order not to do this in a bad way. And look, the fact is, is that the market kicked my butt and we had all of our things in place. So even when you are really well insulated, you can still experience some bad deals or hard market cycles. And so being aligned with somebody who can help you mitigate that, I think, look, you’re not going to win 10 out of 10 flips, but if you get eight out of 10, you’re done real well.

James:

If you have five out of 10, you’re doing really well.

Jamil:

And the $500,000 I lost, it’s far out shadowed by the millions I made in the year. So I speak on the $500,000 loss because it happened, but if I blend it all together, we smashed.

James:

And that’s what you should always be buying, right? We’ve been flipping home since 2005. We’ve gone through… 2008 kicked our butt, we kept buying, you kept buying, you kept buying. That money has turned into real money for us over time. And if you sit out on the sidelines, all it does is halt your business. You have to rebuild a whole flipping business again. And that is not an overnight thing. You don’t just go, “Hey, I’m going to go flip houses tomorrow. I’m going to go find a contractor. I’m going to have all my guys and everyone’s going to bring me stuff.” Once you sit on the sidelines, you are on that sideline. And for people like me, that’s a good thing. Get off the field or run with it, but our margins have increased dramatically or back to what it is.

At the end of the day, fix and flip is a high risk investment, but it also has high reward and there’s a purpose to that and people are forgetting what the purpose is. The purpose is growth. We would not have the units we have today if we weren’t flipping properties. We would not have our lending business today if we weren’t flipping properties. It’s taking that risk, evaluating that risk, mitigating it with proper underwriting, like Jamil said, patting your proforma and then putting that plan in play and executing on it. But the gains you can make on flipping are unreal compared to any other business. If you can make 40-50% returns in six months, name another asset class that you’re going to be doing that on a short term, it’s very hard to do. Wholesaling is great too. You don’t even have to come up with money so you can come up with high returns, but that’s how you get growth.

And right now what I’m hearing from investors is they kind of got undisciplined over the last few years, and these are experienced people I’ve been talking to, and they’re all in liquidity crunches right now. They’ve been buying rental properties, they’ve been putting money in syndications, they’ve been doing these things, and all of a sudden the market slowed down. They’re like, “Oh, wait, I’m broke right now.” Well, the best way to get growth then is to get into fix and flip. But yes, make sure your systems are good and you can elevate it up. I also took a huge loss during those last six months, but the goal of flipping is to get the loss back immediately. In the last six months, we have made enough profit to wipe out all of our losses from the previous nine, and so it gets you back in the game, and as long as you do the plan and you adapt and adjust, you should always be buying. It is the biggest mistake I hear. Just adjust your numbers. There’s deals out there. We’re buying on the regular.

Dave:

All right, I like this one. This one’s good. I mean, people ask me about this. I don’t flip houses and I’ve told a lot of people to be cautious about it because I do think it’s been a hard time to get into it, but you all have told me for months now that it’s a great way to make money. I think risk is very relative to your experience in a lot of ways. For me, it probably would be risky, a little bit risky to get into it because I don’t know what I’m doing, but for all of you, it’s obviously not because you’re well-equipped to handle this market and you have good systems built out. All right, Henry, you were wishing you thought of this one. What did you actually bring as your bad advice?

Henry:

Yeah, if you want to get started in real estate investing, go and get your license.

Dave:

Like to be an agent?

Henry:

Yeah, your real estate agent license. Yeah. I think this is… Here’s how I think this typically plays out, is people think that getting their license is moving them in a positive direction. It feels like they’re doing work toward their goal and it’s safe because they’re not taking a risk. They’re paying something, they’re studying, and then at the end they get a license and they feel like they’ve done something positive towards their investing journey when you really haven’t done anything yet. And so it’s another way for people to belabor getting started, and then it adds another realtor to the pool of tons and tons of realtors. In most markets, there’s more realtors than there are homes for sale on the market-

Dave:

Yeah, by like four to one.

Henry:

Yeah, I think we’ve just… It’s oversaturated. There’s enough mediocre real estate agents out there. I think if you’re going to get your license because you want to be an excellent agent because you want to go and kill it, yes, get your license, go be an excellent agent. But if you’re just getting your license to be a real estate investor, I don’t think that that’s the first move you make. I’m not saying don’t get your license as an investor. I’m just saying that’s not the way you should get started because you don’t know how you’re going to leverage that tool yet. I think if you’re going to get started, your focus should be on the lowest common denominator in real estate, and that is finding good deals.

Because if you can find good deals, you will be able to monetize those deals however you want to, you can assign those contracts, you can fix and flip those deals, you can keep them as rental properties, you can whole tail them and you don’t have to renovate them if you don’t want to or you can just get sell that lead to another investor. There’s so many ways to monetize a good deal, and if you focus your efforts on learning what good deals look like in your market, learning how to underwrite, and then learning how to find those good deals and control those good deals, then you’ll be able to make money how you want to. And then after you’ve done a deal or two, you’ll know more about your particular investing strategy and how you might or might not want to get your license.

For me right now, I’m glad I didn’t get my license because I don’t want it. It would make my life harder, but I do know that I wish my wife or somebody on my team would have their license because then I could monetize more of my leads by having them get referral fees for taking my agent leads and referring them to other agents.

Dave:

Right. I totally agree with you. I think it’s terrible advice. Not that becoming an agent is bad idea, but it’s the wrong focus. It’s like when you’re first starting, you need to learn and you need to build up your capital to invest. So if you think being an agent is going to get you that faster than other options, then maybe you should become a real estate agent. But that’s just one of many different ways that you could accomplish those things. James, you’re an agent, right? Is James the only agent among us? That’s kind of funny.

Kathy:

I’m an agent.

Dave:

You are?

Kathy:

Yeah.

Dave:

When was the last time you showed a house to someone, Kathy?

Kathy:

Oh, I never have.

James:

She’s on the Henry Washington referral feed, yeah.

Dave:

Yeah, the referrals, right. Which is a good idea. I mean-

Kathy:

Yeah, I mean, I’ve helped friends buy houses locally and stuff, but we don’t do business in California, but we are licensed and a lot of people don’t realize you do need to be licensed to do a referral arrangement.

James:

I a hundred percent agree this is bad advice. I did not get licensed. Getting licensed for me was a means to an end in something that we had to do at the time. I started off as a wholesaler getting deals done, flipping homes, and then in 2008 when the market crashed, no one would buy anything, and so the only thing that we… The solution we came up with was to become a broker to help new investors so we could really educate them and then offer them services and discounts to get the transaction done. So it was kind of a means to end and then it turned into this huge thing. I will say it’s my least favorite business that I’m in. The service business is tough. I do think it comes with benefits because you get access to information, but the goal of investing is to live a passive lifestyle.

And that means if you want to be passive, you want financial freedom, you should build that broker on your team. You don’t need to become one. I would say you’d want to spend more time… The hours that people are going to put in to become a real estate broker, for education, if they did an internship and an investment company, they will get 10x out of that because I can tell you everything I learned in my real estate book that I studied to pass the test, I use zero of it on the regular. I use life experience numbers and that’s how we invest and so it’s not going to get you that… I think sometimes people think it’s that magical cloak that they’re going to be invincible if they’re a broker, because they have all the info, but it’s about what you do with the info. And so I would say if you want to get into investing, then work with investors. Go spend your hours with syndicators, flippers, whoever it is that you want to get and get the hands-on experience, you’ll learn 10x.

Dave:

All right. I’m going to read a couple of our… I want to get your just quick reactions to some of the advice we’ve heard from people in our community. Oh, this one gets me. Wait until there are foreclosures post-COVID foreclosure moratorium to start investing. You guys heard this one?

Kathy:

Yeah.

Dave:

Still waiting on that one.

Kathy:

We’re still waiting, yeah. Not finding much at the auctions.

Dave:

Yeah.

James:

You know what’s funny, is people associate foreclosures with the best possible deals, and that’s just not true.

Henry:

They’re not.

James:

Not most of the deals we bought that have been the best deals, haven’t had nothing to do with the foreclosure or distress at all. It was just doing a deal with somebody that wanted to get rid of something that needed a lot of work.

Dave:

I think there was just a point in time in 2009, in 2010, when it was good, but that was an anomaly. It’s not regularly a good thing.

James:

I made more money in the last couple years and there was no foreclosures. You don’t need… It’s just a product that comes to the market. If anything, honestly, it distracts people more than it’s beneficial.

Jamil:

What I think is that you can really look at that advice and what they’re really saying is, wait. Then you can insert whatever thing you want to put in after that, but that will constantly change as the world goes. But wait is what they’re really saying. And that’s essentially the kind of people that just aren’t going to take action. So wait, wait, wait, wait, wait, wait, wait, wait until when.

Dave:

Jamil, I feel like you’re reading the rest of the things that I’m about to read because literally half of them start with the word wait. The other two are wait for interest rates to come down. I’m sure everyone has heard that one a lot.

Kathy:

Good luck.

Dave:

And then the third is wait for the crash, which is, I think, people have been saying since 2014.

Kathy:

I think 2012 maybe.

Dave:

Yeah, at least. I just find it interesting advice because those things could happen. There could be a time where property prices crash and interest rates come down, but I just feel like as an investor, you want to invest in things that you have some control over and that you have some influence over. And all of these things are like, wait until some magical force creates these perfect conditions, which is never going to happen. And so I just think that whole category of advice is bad.

Kathy:

Yeah. I mean, I remember when we had John Burns on maybe a year ago, and he said that prices were going to go down 20% or something and like, ah, oh my goodness. And he was right. There were certain areas where that’s happened and there’s other areas where that hasn’t happened at all. In fact, prices have gone up. So you’ve got to know your industry, you’ve got to know your market, and then all the headlines just don’t matter. Honestly, it just doesn’t matter when you know, when you’re really dug in on the area that you’re in. I mean, we had a pretty kind of high profile guest on here and she knew a lot about one thing, but not about another thing, which is our market. We’re like, what can I say? As investors, we defy the headlines. That’s the best way to say it. And that’s what makes us investors. That’s what makes us good because when everybody’s running that way and we’re running this way, that’s when we get the deals.

Dave:

All right, Jamil, what’s the worst advice you’ve heard recently?

Jamil:

Well, just piggybacking off what Kathy just said, when everybody’s zigging or going one way, you go the other way. So just recently I had somebody quote that to me and say, “Hey, as a smart investor, you should always zig when people are zagging. That’s why it’s an incredible time for you to get involved in office space.”

Dave:

Enough said.

Kathy:

I did actually meet somebody at one of those seminars I was at recently who’s buying office, and I did the same thing. Like, “What?” But you know what? I just got my nails done yesterday. I’ll probably get my hair done. There are certain small suburban office spaces that will be-

Jamil:

Retail.

Dave:

Retail, yeah.

Jamil:

Retail’s different.

James:

Yeah.

Kathy:

Yeah.

Jamil:

Retail’s different than office.

James:

But there’s also opportunities for rezoning.

Jamil:

Yes.

James:

That’s what we’re looking at. What buildings are going to get hammered, and then it’s going, okay, we want to target where the up zone’s going to be because that kind of gets overlooked a lot. And you can sit and take a negative return for two, three years, but if it gets rezoned into apartment dirt… Our landlord bought our building that was office for 8 million bucks, 10 years later it got rezoned into apartments… I think he just sold it for… Actually, you know what? I probably shouldn’t just be rattling off numbers.

Dave:

That’s the whole point of the show, James.

Henry:

That’s what we do.

James:

Yeah, well, I know it’s in contract for nearly 40.

Henry:

Whoo.

Jamil:

Wow.

James:

And that’s a hit. And when he bought that was in 2009 when no one wanted office space and no one wanted anything, but he just bought it because it was cheap. There’s certain guidelines. If you’re buying below replacement costs, you’re buying below dirt value, then buy that deal. But yes, it’s office. I would be buying it for a different purpose not to lease it to offices. I know that.

Jamil:

I agree, James. And I think that if you can solve the problem on how to, A, expeditiously do those rezones or figure out how you can convert into mixed use, there’s a huge opportunity there for you. But that’s the expertise you need to bring to the table. You don’t just start buying office space because people are leaving it. So you’re 1000% correct. I think that’s the segue or that’s the piece that you really need to be deliberate and say, “Look, I have a plan for this. It might take 10 years, might take longer, but my plan is that I’m going to rezone or I’m going to create a new use case to this and then I’m going to add value.” Because then we’re just talking about adding value, right? You change zoning, you’re adding value.

James:

Right.

Jamil:

That’s it. That’s the play.

Kathy:

And I want to know what you guys consider the difference between retail office, because Rich just… We’re the typical age where we’re going to be spending a lot on fixing ourselves up to live another 50 years. And Rich just had both of his eyes done. You guys, it’s crazy. He could see like a four-year-old right now, but he went to a doctor’s office. So how do you define retail? I’ve always considered that more selling stuff. Yes, he does have bionic eyes.

Dave:

My mom just got that surgery, probably the same one. She said it was like crazy. You can get bifocals implanted into eyes.

Kathy:

Crazy. Yeah, they cut his eyeball open and stuck in…

Dave:

Wild.

Kathy:

Yeah.

Dave:

But I think the difference between retail is like it’s like foot traffic, right? It’s like a storefront where people go in, so they can sell goods or services, but it’s open to the public. Whereas I think office is more like private businesses. I don’t know. Jamil, you might know.

Jamil:

Yeah. And I think medical is also segregated into its own global class too. So you got medical office, you’ve got commercial retail, and then you’ve got office space. And I think that medical, absolutely, people are still going to need to see doctors, specialists, get imaging done. And you typically see medical parks just attract dentists, doctors, or dentists, endodontists, whatever it is. Plastic surgeons are all going to be hanging out together. But it’s like where do I go in for my data entry job? Where am I going into do my whatever office clerical job that I had, whatever that would be. There’s more than just clerical jobs at offices, but you know what I mean.

So I think that’s where the biggest opportunity, if there was one is, if you can solve the problem that James talked about. But to just buy it… This guy was pitching me an opportunity where it was like, “Hey, buy into this office building because the sellers have discounted it a couple million dollars.” And I’m looking at it and I’m thinking, “Yeah, there’s not a deal here at $2 million less. There’s not even a deal here at half of what you’re asking right now.” So I’m still confused.

Dave:

Yeah, it’s like people during the extreme bull market of the last 15 years were got into this buy the dip mentality. Anything that went down, you just buy it when it goes down because it’s going to go back up again. But there are certain businesses in the stock market and there’s certain classes of real estate and individual properties that aren’t going to go back up again. You look at, I don’t know, pick a pandemic stock, like Peloton. That thing went crazy. You think anyone’s buying the dip on Peloton right now? It’s like there are reasons that people are selling those things. And I think to Jamil’s point and James’s point, there are still opportunities in office, but it’s not just a blanket statement that because prices have gone down a lot that they’re going to go back up and it’s going to be a screaming deal.

James:

Oh, I lost like $700,000 on that mindset in 2008. We bought an office building and it was 65% below appraisal. We’re like, “That’s a buy,” until you find out no one wants to rent it. And we had to move our whole office to the hood of all hoods and we had to door knock to get tenants for two years just to fill that thing and then we got out of there.

Dave:

Wow.

James:

And we sold that building 10 years later for less than we paid for it.

Dave:

All right. So don’t do that.

James:

Don’t do that. Bad plan.

Dave:

All right, Kathy, what’s your bad advice?

Kathy:

All right. You guys don’t judge me. All you guys are the cool kids and I’m just, I don’t know, on the playground by myself but-

Henry:

I’ve seen your house.

James:

You’re the prom queen.

Dave:

Yeah. Exactly.

Kathy:

I’ll take that.

James:

Prom queen for sure.

Kathy:

Okay, well, the bad advice I hear, and I’m sure you guys give this advice, is never pay retail for investment property. And I disagree, and I’ll tell you why I disagree with that and always have. When I started investing, I came from California and had the California mindset, which is that you can’t get anything for less than a million dollars. So then the first place I went to invest out of state was Texas, and I saw these brand new houses that were $140,000 retail, brand new. And it just looked like candy, it was so cheap. And so beyond that, because Californians can get messed up a lot because everything looks cheap to them. If it’s also in a rapidly growing area, like I said, where something big is happening, but the locals don’t know because they’ve lived there all their lives and they’re not checking with the chamber of commerce or checking where businesses are moving or where people are moving and looking at the migration data I do.

So they don’t know what’s happening. So I’m so happy to pay retail because I know the intrinsic value of that property. I knew that if all these Californians were moving because of the tech jobs moving to that area, that it wouldn’t be $140,000 for long. And those houses were in A-class neighborhoods, great schools, brand new. What a wonderful investment for somebody who’s out of state, who just needs to forget about it. It needs to be mailbox money. There’s so many people who would never invest in real estate if they had to find a deal that was under market and they had to fix it up and all the things that a traditionally very savvy investor would do. There’s professional athletes, there’s tech workers that work 80 hours a week and then they go home and try to get a moment for their family. They don’t have time. They need to buy something that they really need to put no time into.

So for me, and then also, when you’re that kind of investor, you’re buying for the longterm. So if you got a $10,000… If I were to get a $10,000 discount, which I wouldn’t have been able to negotiate because the area was already growing, but let’s say I was able to on the $140,000 house that I bought in Rockwall, Texas, and was super proud of myself because I got a discount. Would I care today 15 years later when those properties have tripled and really had very little maintenance issues because they were brand new in A-class neighborhoods? So again, depending on who you are and where you’re buying, I think you sometimes have to pay retail and that’s okay. That’s the message I want to tell people.

When we first started investing in Cleveland and Indianapolis and Kansas City and Ohio, these were areas that had never done anything before in terms of values going up. And if you’re in an area where values don’t traditionally go up, you have to buy at a discount. That’s the only way you’re going to win the game. You have to. But if you know that something’s changing, for example in Indianapolis, we knew that they were investing a bunch of money, billions, because the Super Bowl was coming. So we bought old little houses that were in the path of that, where we knew there was development coming. And in some of those neighborhoods, the $80,000 properties went up to 400,000 in just a matter of years.

So again, I have no problem paying retail if I can just sit back, buy something that will just over time continue to grow all the while my tenant is paying off my mortgage for me and I’m getting tax deductions for that and I’m paying down my loan. So that in the long run… I’ve taught many students that if you take all your cashflow, if you don’t need it today and you just use that to pay off your loan, in 15 years you can have all those properties paid off, I don’t think you’ll care if you got a discount.

Dave:

Yeah, I mean, it totally depends on your strategy, right? I mean, have any of you not paid retail before? Jamil maybe.

Jamil:

I’ve paid retail before. That’s the not norm for me. I will typically buy under retail, but I’ve paid retail. The house I’m in right now, I paid retail for.

James:

Isn’t every on market deal just retail though? You’re paying market value, right? Whether there’s potential in the property you… And I love what Kathy said because almost every property I buy is that market value for the as-is condition.

Jamil:

Yes.

James:

When we’re buying a building that’s got a three cap on it, but we’re going to turn it into a six and a half cap, we’re still buying it retail or above retail at the first purchase. And so it’s a perception of… And that’s what we spend a lot of time training that. The as-is value is the as-is value of the property. And that’s full retail. And so when we’re talking to even sellers, we’re like, “Hey, look, we’re paying you full market value,” because we are. Here’s three comps, same condition. And so it’s more about the potential on the investment that Kathy’s talking about. Paying loans property down, getting cash flow or increasing the value and racking a return.

Dave:

Yeah, that’s a great point that anything on market is paying full retail.

Kathy:

Yeah.

Henry:

I think all the terms get mixed up in people’s heads too, because we talk a lot about, or new investors thinking, I want to build wealth, so I want to buy rentals, but they want to buy rentals because they want cash flow because they want cash flow because they want to quit their jobs. And wealth isn’t really built through cash flow. Wealth is built through appreciation and then being able to leverage that appreciation and grow your portfolio. So they’re just saying things they don’t fully understand yet.

If you’re investing because you have money, you don’t have time, well then appreciation is your best way to get to wealth. So you can pay retail in an emerging market and build wealth. If you’re investing in real estate because you’re trying to build up enough cash flow to quit your job, well, you’re not building wealth on the front side. You’re going to build wealth down the line by holding those properties when they appreciate. But you’re investing for cash flow, so you can’t pay retail. It’s just people just… They say the words because popular and they hear them a lot, but I don’t think people quite understand what they mean yet.

Kathy:

That’s a good point.

Dave:

So what’s better advice for this?

Kathy:

Yeah, that’s a great question. It’s again, get into… For me, if it’s a buy and hold, you’ve got to look at the longterm of what you’re trying to do. If you’re flipping, you’re looking at the short term, you’ve got to know what that property’s going to sell for in six months. If you’re looking for a longterm buy and hold to build wealth for your future and have your retirement, then you’ve really got to look at longterm. What’s this area going to be like in 10 years or 15 years?

And do not base your decision on year one proforma, because that proforma has all the costs upfront and the lowest rent that you’re probably going to see on that property over that 10 to 15 year time period. So knowing that, hey, I’m in a growing area, probably rents are going to go up, there’s not a lot of other builders may be coming into this area, but there’s a lot of businesses coming in. And just knowing that over time, again, looking at more of a 10-year or a 15-year proforma is going to really help that. That’s where I just hate to see people not get in the game because they can’t find that deal with a 30% discount.

Dave:

Good advice. All right. Well my bad advice that started this whole thing is… Have you guys heard this one? Date the rate and marry the house?

Henry:

Yes.

Dave:

Have you heard that?

Kathy:

Yeah.

Jamil:

I have. Yes.

James:

Way too many times I’ve heard this.

Jamil:

It’s so ridiculous.

James:

On every mortgage broker’s social media channel.

Dave:

Yeah, exactly. So basically the idea behind this is that you should buy a house that you love, even if it’s borderline out of your price range because the interest rate will change. And I just think it’s the worst possible advice because you’re just banking on something that’s completely out of your control to make a good financial situation. And when I said this on Instagram, all these people were like, “Well, you shouldn’t wait to buy.” And I was like, “I’m not saying wait to buy. Only buy stuff that makes sense with rates the way they are.” Don’t count on rates falling to a certain rate for your investments to make decision. If you find things that pencil right now, go for it. But I would not buy something that only works if rates dropped to 5% in the next year because it might happen, but it also might not. And that’s a lot of risk for probably limited upside.

Kathy:

Yeah, that’s great advice.

James:

Yeah and I get the premise of the advice, like, hey, don’t get too caught up on the rate because that’s everyone’s main excuse not to buy. But I mean, what you said, it’s like don’t date the rate, just plan a budget and then put yourself… That’s just normal life. Everyone has to budget. Just create your housing budget, buy the house that works for it.

Dave:

Exactly. Yeah. It’s like, I’m not saying that don’t buy it at whatever today’s rates are. Just buy something you can afford at today’s rates or that makes money.

Kathy:

Yeah, there’s no guarantee. No guarantee rates are going down. We think they could and they might. They might go in the other direction. One thing we learned in 2020, is we really have a hard time predicting the future, and 5% is kind of a actually low rate 6%. So where we are is where we might stay and the property does need to make sense today. I learned my lesson on negative cashflow properties in 2005, and I’m not a fan. I don’t recommend it, don’t do it.

I actually had a very high level person reach out to me who hadn’t really done a lot of single family investing and said, “Hey, I found this house in the Phoenix area, and I think I got a pretty good deal on it. Would you buy it if it was $600 a month, negative cash flow?” And I was like, “Definitely not. I’ve done that and it didn’t work out for me.” And this person was like, “I have plenty of money, it’s not a problem.” And I said, “Well, the only time I would ever do that is if I got a huge discount.” Like the house next door is a million and I bought it for $500,000 or something like that. But otherwise, no. Got to make sense.

Dave:

All right. Well, thank you all for bringing this. This was fun. I like this episode. If people like hearing this bad advice and better advice kind of thing, please let us know in the comments or in the reviews on Apple or Spotify. Since we did this relatively quick, we have time for a listener question. This question comes from David Eslinger and the question is, is buying two brand new houses to rent out next door to each other a good idea. So I think there’s kind of two questions here. One is brand new houses, I think that’s new construction. And then the second question here, is there anything wrong with buying two houses next to each other. Who wants to take this one? Kathy?

Kathy:

I mean, we just don’t have enough information. Is it negative $600 a month cash flow? Is it in a good neighborhood?

Dave:

Yeah, we don’t know. Let’s presume that they cash flow decently. What’s your opinion on just new construction and buying new construction?

Kathy:

I love new construction if it’s a buy and hold and the numbers work and it’s in a growing area. If you’re just a kind of set it and forget it type person, and obviously you need to pay attention to your properties, but if you’re buy and hold, a new property is going to generally have less maintenance. It comes with a one-year warranty. You can get an inspection right before that one year warranty is up and make sure everything is perfect and it’s paid for by the builder. So there’s a whole lot of reasons. Insurance is lower. So I do like new homes as rental properties for longterm hold in growth areas because if there’s new construction around it, that generally means the area’s growing. If there’s new… Again, we need more information. Are there jobs coming in? What’s happening in the area?

If the question is, should I diversify more? Is it bad to buy two next to each other? I don’t think so. You’re going to be competing against each other if they’re both vacant. I would be very cautious about buying in an all rental subdivision. I’ve seen people do that where a builder builds 50 homes and sells them all to investors and now there’s 50 investors competing against each other for rents. That’s extremely dangerous. I’d be cautious about that.

Dave:

Yeah. I’m always worried that could create sort of this race to the bottom kind of situation.

Kathy:

I’ve seen it.

Dave:

If there’s vacancies, everyone’s offering the same products. The only way to compete is on price. And so people just start dropping rents.

Kathy:

And if you’ve got 50 different owners and one is distressed and they really need to drop the price and they need to drop the rent, it affects the whole neighborhood. So a build-to-rent scenario where it’s managed like an apartment could work, but a bunch of individual investors is terrifying. I had someone bring us a “deal”, a 400 homes they were building in Florida that they were going to sell individually to investors, all investor. I’m like, “Oh gosh.” I walked through a situation like that in Texas in 2008 or 2007, where, you guys, I was heartbreaking. There were streets and streets and streets all with for sale signs, all with for rent signs, nothing moving. And I knew each investor was just suffering in that development because some group sold it to all their friends or whatever. And I know who it is, I won’t say, but that’s when I learned very early on that that’s dangerous.

James:

And the theory of having rentals in a small proximity, that’s a great idea. You’ll reduce your maintenance cost, you won’t stretch it out. Great idea. Buying new construction. If you’re a new investor that wants no headaches, that’s a great idea too. I personally like to buy stuff with a discount so I can get the cash flow and I’d rather buy two fixers next to each other than two new construction. But that’s my skillset, what I’m trying to do. So if you really want to be passive, it’s good to get warrantied. You’re not going to have that deferred maintenance just crush you for the next 10 years because it’s new. In theory, it’s a good idea, but Kathy made some really good points about who’s building it, what’s there, and there’s a lot more to explore outside that question.

Dave:

Yeah. When I was doing self-management, I bought houses that were intentionally close to where I was living. Because I was working full-time, I was in school and I just didn’t have a lot of time and I bought places where I could literally walk to and just talk to a tenant or do a showing or do some small maintenance. I actually think it enables you… If you’re doing self-management and you’re trying to scale up a couple properties, it actually is really beneficial because you can do a whole call to a tenant in less time than it would take to drive across town. So it’s actually a really good idea.

James:

Yeah, reduce your property management costs too.

Henry:

At face value, that’s the sweet spot, right? Two assets that have deferred maintenance and cash flow. Yeah, obviously there has to be more to the puzzle.

Dave:

All right, well, you all are full of good advice, so thank you all for bringing it to us. Let’s just do a round to remind people if they want to learn about all your excellent advice. Jamil, where can people find out more about you?

Jamil:

You can find me on YouTube at youtube.com/jamildamji and my Instagram @jdamji.

Henry:

Hey, did you just write a book?

Jamil:

You can also read my book. I didn’t say anything about it, Dave, because I still don’t have a copy of my own book.

Dave:

You don’t have… When does it come out? Is it out?

Jamil:

It’s out. My students have my book. They’re sending me… They’re gaslighting me, sending me pictures. Just as you are right now.

Dave:

Yeah.

Jamil:

Are you holding my book? And I’m like bookless.

Kathy:

Hey, Jamil, you can go to BiggerPockets and order it.

Jamil:

I have.

Dave:

Have you ordered it yet, Kathy?

Jamil:

On the spot.

Dave:

Wow.

Kathy:

I’m going to right now.

Dave:

Wow.

Kathy:

I’m going to right now. Yes. Sorry.

Jamil:

Geez. I’m hurt.

Dave:

James, just looks scared. He hasn’t ordered it either. You guys got to get on that.

Jamil:

James, seeing how rich you are and the fact that you haven’t ordered it yet, I think you need to order a thousand copies.

Kathy:

Yeah.

Dave:

That would be the nice thing to do if you guys [inaudible 00:39:15].

Henry:

James’s camera froze.

James:

Yeah, that’s it. That’s exactly what I was doing. I was like, hopefully they think it’s frozen.

Dave:

All right, well James, where can people find more about you?

James:

Best way to find me is at jamesdainard.com or on Instagram @jdainflips.

Dave:

Henry?

Henry:

Best way to contact me is Instagram @thehenrywashington on Instagram or you can check out my website henrywashington.com.

Dave:

All right. And Kathy?

Kathy:

My Instagram is my name, Kathy Fettke, or realwealth.com. And for my single family rental fund, it’s growdevelopments.com.

Dave:

All right, and if you want to find me, I am @thedatadeli. Thank you all so much for listening. We will see you all next time for On the Market. On The Market is created by me, Dave Meyer and Kailyn Bennett, produced by Kailyn Bennett, editing by Joel Esparza and Onyx Media, research by Pooja Jindal, copywriting by Nate Weintraub and a very special thanks to the entire BiggerPockets team. The content on the show on the market are opinions only. All listeners should independently verify data points, opinions, and investment strategies.

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

It all comes down to trust in data

Here’s one for you: How many fintech companies does it take to reduce the cost to originate a loan? There’s no great punchline to throw in here — only the sobering fact that it cost a record high of $13,171 to originate a loan in the first quarter of 2023, according to Fannie Mae’s recent lender sentiment survey.

Still, the FHFA set out to answer this question by gathering more than 60 companies together in Washington, D.C. for the inaugural Velocity TechSprint in July. This hackathon of sorts had a single goal: determine the best solution to effectively use data to reduce loan cost and make lending more attainable and fair for consumers.

I was one of 80 participants assembled together in 10 different teams. Each team contained a cross section of lenders, fintechs, consultants and others united by a common goal. We had three days to engineer a viable solution to some of the biggest challenges in lending — oh, and boil down those three days of solutioning into a five-minute pitch in front of industry judges. No pressure there.

This was very much an exercise for optimists, innovators and maybe even dreamers. Loan costs have risen every quarter since the first of 2020. So what could really be done in three days that hasn’t been tried in three years? We have watched the record rise and fall of investment in technology solutions over the past few years amidst record loan volumes, many of which promised to automate a better borrower experience and deliver shorter loan closing times. But the stubborn fact remains that transformative change has yet to materialize.

Still, that evidence made the idea of locking arms with industry leaders and working with competitors even more compelling. People arrived ready to ideate, compete and cooperate.

A few things became apparent within our team on the first day of working together, and we were ready to attack every aspect of the loan lifecycle to make it better. From consumer financial readiness to loan servicing years after close, everything was on the table. Our knowledge of how the whole thing fits together was exciting. To make a big impact, we have to have a big solution, right?

It wasn’t until the second day that the truth finally became clear: We only had time to flesh out and describe one good idea, not the more than five we had packaged into one big solution. As the team debated and consumed an intense amount of coffee, it became clear that every solution idea we wanted to build upon was lacking one key component that had yet to be solved for the industry. There was a lack of data trust.

Lenders and other stakeholders spend countless hours checking, verifying, rechecking and reverifying the same data over and over again. That data usually comes in the form of a document, which gets sent around to various stakeholders, sometimes with accompanying structured data, sometimes not. Data gets re-extracted over and over again. There’s an industry-wide inability to easily understand whether the data or document has changed since the last time it was checked, and to understand if that data is from the original, direct source.

The mortgage industry loves using the phrase “checking the checker,” because this is common practice even when GSE automated underwriting systems are fully in use. Our team set out to solve this data trust issue and give lenders a way to check an authoritative source to verify if data has changed since last delivery, instead of having to reverify all the data from scratch again.

It turns out we were not the only team that arrived at this conclusion — at least half of the pitches featured some aspect of data trust. Whether the focus was on providing better ways for consumers to control and securely share their own financial data, or on enabling lenders to more efficiently consume new alternative sources of credit data, data trust was a central theme.

There were some strong cases made for the use of blockchain and NFTs to provide a tokenized way of securely sharing and trusting consumer data, but in the end it wasn’t the lack of technology that was identified as the biggest speed bump, it was the lack of standardization and central authority.

Which leads us to one of the most surprising themes of the week: fintechs asking for government involvement. There seemed to be a common realization that a healthy cooperation between the public and private sector was needed to create a major change to the status quo.

Yes, I realize that the event was hosted by the FHFA, so maybe this isn’t surprising. The cold hard truth is this: The need for centralized data trust in an ecosystem as complex and regulated as the mortgage industry is beyond what any one innovator can bring about quickly. Some sprint teams proposed cooperatives with public and private organizations, while others asked for outright government agency and mandates.

I was reminded of the recent plea from generative AI companies asking for government regulation. Interestingly enough, reducing the risk of bias in generative AI models comes down to data trust as well, so it appears we are onto something here.

I came away from the event encouraged once again in the mortgage industry’s willingness to work together to solve big problems, but the real test is what happens next.

Source link

Why “Lazy” Investors Won’t Make It in 2023’s Housing Market

The housing market has dealt a tough hand to real estate investors as of late. Prices are staying the same, but mortgage rates are rising, rents have peaked, and so-called “easy” investments have been increasingly difficult to manage. The “lazy” investors who bought simple short-term rentals are now sitting with empty units, and BRRRRers that never adjusted their strategy are stuck with standard houses producing bleak returns. What’s the right move to make when investing is harder than ever before?

We wanted to know what’s REALLY happening in the housing market. So we brought on short-term rental expert Avery Carl, father of the BRRRR method David Greene, and luxury flipper James Dainard, to get their opinions on what’s working, what isn’t, and what investors should do now. Surprisingly, all these experts agree that ONE type of investing is the best way to go, and it’s such an obvious choice that you may miss it.

But, before this real estate investing strategy smackdown begins, we’ll get to know the current states of short-term rentals, flipping, and BRRRRing, plus which strategies are making money and which are falling flat. This is a new housing market; if you want to make it, you can’t play by the same rules.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Watch the Episode Here

https://www.youtube.com/watch?v=bgj2azYXcUw123???????????????????

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

Links from the Show

Book Mentioned in the Show

Connect with Dave and Avery:

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

Source link

Housing inventory stalls: Less than 3K homes added

The housing inventory data from last week makes me wonder if we are starting the seasonal decline in active listings in August. Mortgage rates also had a crazy week and purchase apps fell once again.

Weekly housing inventory

Traditionally, we would see a seasonal decline of active listings for single-family homes going into the fall, but seeing less than 3,000 homes added to the active listings data last week makes me wonder if we are going to see that decline early this year.

Saying that the housing inventory growth in 2023 has been disappointing is an understatement. It took the longest time in history to find the seasonal bottom, which happened on April 14. We usually see this in January or maybe February. Then the growth rate was so slow that we had weeks of negative year-over-year inventory data. Last week was another slow week of active listings.

As we can see in the chart below, active listings have been negative year over year for some time now. Demand isn’t booming for the existing home sales market, but it’s not crashing like it did in 2022. Last week, I talked about the stable, not booming, housing demand on CNBC. That stabilization in demand has slowed inventory growth down this year.

New listing data has been trending at the lowest levels recorded in history for the last 12 months. However, on a positive note, we haven’t seen another new leg lower, meaning that if this trend continues, we should see some flat to higher year-over-year numbers this year. As we can see in the chart below, new listing data is very seasonal and running into its seasonal decline period now. However, the decline is orderly, unlike last year.

Here’s how new listings this week compare to the same week in past years:

Mortgage rates and bond yields

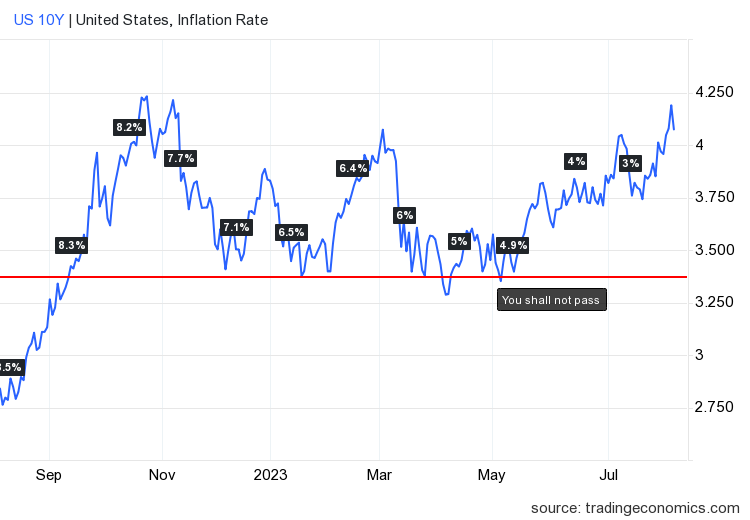

Last week was wild for the 10-year yield and mortgage rates as we came close to testing my peak 10-year yield call of 4.25%, hitting 4.20% on jobs Friday, only to fall back toward 4.04%. Mortgage rates started the day at 7.20% and ended the day at 7.03%. We need the 10-year yield to stay below 4% to see mortgage rates drop below 7%, into the 6%-6.875% range.

My 2023 forecast range for the 10-year yield was 3.21%-4.25%, meaning mortgage rates between 5.75%-7.25%. Rates got worse after the banking crisis but are behaving better lately; hopefully, this trend will improve with time. As we can see in the chart below, the forecast range has stuck for 100% of the year.

Purchase application data

Purchase application data was down again by 3% last week, making the count year-to-date at 14 positive and 15 negative prints. If we start from Nov. 9, 2022, it’s been 21 positive prints versus 15 negative prints. Mortgage rates near or above 7% are making it difficult to get any traction on the demand side of housing. The best data we had here recently was from Nov. 9 until the first week of February, giving us three months of positive data. However, after that, it’s been a flat year with apps.

The week ahead: Inflation week is here!

It’s Inflation week, so get ready for two key reports: the Consumer Price Index on Thursday and the Producer Price Index on Friday. It is key for the housing market and the economy that core inflation continues to see lower growth. The Federal Reserve is very focused on core inflation, not headline inflation, so that’s what I will be focusing on with the two inflation reports. And of course, every Thursday we also have the jobless claims report to be mindful of.

Source link

Florida affordable housing law that dilutes local power has upset the apple cart

A new affordable housing law passed by Florida’s legislature and signed in March by Gov. Ron DeSantis is reportedly creating anxiety among local elected officials who are concerned that the new law cedes too much control over zoning and other matters to the state government.

The “Live Local Act,” passed unanimously in the State Senate and by a vote of 103-6 in the House, represents a sizable investment in housing by incentivizing developers to construct affordable housing units while restricting zoning and planning restrictions in local jurisdictions approving multifamily construction projects in order to limit bureaucratic barriers to increase supply.

But some of those local officials are now expressing concern that the provisions of the new law are restricting their ability to more actively participate in development decisions within their communities, according to reporting by WUSF Public Media.

“I think the hesitancy comes with the fact that it’s a preemption. I think whenever we’re talking about home rule or preemption, there’s always going to be local pushback,” Florida Housing Coalition Legal Director Kody Glazer told the outlet.

The new law comes with restrictions as to how much local elected officials can influence zoning and development decisions as well as density and height restrictions. Some of these concerns have been echoed in other states that have passed restrictions on zoning in other states including Massachusetts and Washington.

The Tampa metro area has experienced among the highest home price increases in the country since 2019, in large part because the counties have in place restrictive zoning policies that increase the value of land.

Following antidevelopment protests from residents ostensibly concerned about local infrastructure, in late 2019 Hillsborough County placed a moratorium on the rezoning of land for housing in some areas. Two years later, Pasco County, north of Tampa, also put a moratorium on rezoning to multifamily use in some areas.

The new Florida law applies to any residential housing projects that sit “on commercial, industrial or mixed-use land that allocates at least 40% of units to be affordable for residents earning up to 120% of the area median income,” according to WUSF. The law went into effect on July 1, and officials in cities including St. Petersburg and Tampa were reportedly briefed on their remaining rights overseeing such projects under the new law.

The process has gone more smoothly in St. Petersburg than Tampa, where officials in the former have “already heard interest from ‘ready to build’ developers in recent weeks” based on local reporting by the Tampa Bay Business Journal. In Tampa itself, however, a city council meeting on July 13 featured sometimes tense discussions between city leaders centered on compliance anxiety with the new law.

“The state is going to just gonna keep taking and taking and taking – and I’m not willing to give an inch more than I’m required to,” said Tampa city council member Lynn Hurtak, according to WUSF. She later introduced a motion to implement only what was legally required by the city to comply with the new law until the next scheduled council meeting. That motion passed.

During the meeting, another city official – Nicole Travis, Tampa’s economic development director – explained that while she understood the council’s frustrations, “the new housing rules make the approval process of eligible affordable housing projects a solely administrative function that can circumvent city council,” according to WUSF.

Source link

The labor market showed signs of modest cooling in July

Data from the July jobs report released Friday fell roughly in line with expectations. Job gains came in lower than both the 278,000 monthly average for the first half of 2023 and the 399,000 average of 2022. Total nonfarm payroll employment increased by 187,000 jobs, compared to 209,000 in June, according to data released by the Bureau of Labor Statistics.

The unemployment rate changed little at 3.5%, compared to 3.6% in May, with the total number of unemployed persons falling to 5.8 million. The unemployment rate has remained between 3.4% and 3.7% since March 2022.

In June, job openings eased back to 9.6 million, bringing the openings rate to 5.8%. Meanwhile job quits slipped to 3.8 million or 2.4%.

“The incoming economic data continue to convey conflicting signals about the strength of the economy. Indicators of manufacturing and service sector health remain lackluster, measures of inflation have moved lower, while GDP growth in the second quarter was stronger than expected and consumer spending remains resilient,” said Mortgage Bankers Association VP and Deputy Chief Economist Joel Kan.

While job growth is weakening, and wage growth is holding steady, both metrics are still above the pace that would be consistent with the Federal Reserve’s inflation target, noted Kan.

“However, we expect that the FOMC will hold the federal funds target at its current level given the declining trend in inflation,” he added.

The lion’s share of the job growth in June came from gains in health care (+63,000), social assistance (+24,000), financial activities (+19,000), and wholesale trade (+18,000), according to the report.

Employment in the construction industry continued to trend up in July, adding 19,000 jobs, especially in the residential construction space. The ongoing shortage of housing inventory helped spur an increase in home building and home improvement activity, Kan said.

On average, the industry added 16,000 jobs per month in the second quarter of the year, after employment was essentially flat in the first quarter. Over the month, a job gain in real estate and rental and leasing (+12,000) partially compensated for a loss in commercial banking (-3,000).

Furthermore, residential building construction employment was flat year-over-year in July, while non-residential was up by 5.9%, according to First American Economist Ksenia Potapov. Compared with pre-pandemic levels, residential building employment is up 10%, while non-residential building is up 3%.

“Like June, the fastest monthly growth came from residential specialty trade contractors. This sub-sector comprises establishments whose primary activity is performing specific activities, such as pouring concrete, site preparation, plumbing, painting and electrical work,” said Potapov.

Employment in the professional and business services sector and in the leisure and hospitality sector changed little in July.

What’s next ?

At the July Fed meeting, the FOMC hiked the benchmark rate by a quarter percentage point, as widely expected. During the press conference that followed the meeting, Fed Chair Jerome Powell said that another rate hike in September is “certainly possible,” but so is a pause.

According to Realtor.com‘s chief economist Danielle Hale, today’s report is unlikely to sway the Fed.

“Today’s jobs report is unlikely to change those odds significantly as it is one of several pieces of additional data that the Fed will have to consider before the next decision. The Fed will see not only an additional jobs report, but also two more readings each on consumer prices and producer prices along with several other indicators before its September 19-20 meeting and decision,” said Hale.

On the housing market, she said that conditions are still favorable for households, supporting housing demand. However, climbing mortgage rates remain a substantial obstacle for homebuyers. Hale expects more “coping strategies” on the buyer’s end, such as moving further away to find affordability. Another outcome will be that affordable markets, such as those in the Midwest, will continue to see an outsized level of housing activity for both homeowners and renters, she said.

As existing homeowners remain rate-locked into their homes with no financial incentive to move, homeowners are likely to increasingly turn to renovating their homes to suit their evolving needs, added Potapov.

Source link

10 essential skills real estate agents should possess

Achieving success as a real estate agent requires more than simply understanding the mechanics of the job. Yes, you should certainly be able to post an impressive listing and understand the ins and outs of closing, but helping buyers and sellers means cultivating a diverse set of skills to navigate a complex and ever-changing real estate market. Here are 10 essential skills every real estate agent should possess.

1. Solid understanding of the market

It doesn’t matter if you specialize in investment properties, second homes, condos, or single-family homes for first-time buyers. The first skill you need is the desire and drive to stay current with market conditions. This includes understanding:

This knowledge helps you find the best properties for your buyers and ensures that you price a seller’s property appropriately.

2. Skillful communication

Communication is one of the most critical skills a real estate professional can cultivate. These skills help you to be both a better listener and a better speaker. And why is this so important?

Real estate professionals who listen carefully better understand their clients’ wants and needs. They won’t waste time on mismatched properties or investments beyond a client’s reach. And when it’s time to wade through complicated contract language or explain the benefits or drawbacks of a property, agents who communicate better have a leg up on their competition.

3. Talent for negotiation

Negotiation isn’t easy. There’s a delicate balance between being assertive and pushy compared to compromising and capitulating. Real estate agents who work hard to refine their skills are better at reading a buyer or seller so they can negotiate the best deal possible, even under challenging circumstances.

4. Dedication to service

Real estate is, in the end, customer service. So how does your customer service measure up?

If you answered “no” to any of the above questions, chances are good your customer relations need some work. This does not mean you should allow clients to walk all over you. But ultimately, if you want to close the deal, the customer (with a bit of hand-holding) is always right. It can be challenging to deal with needy clients, but they can also be the most loyal when you demonstrate your commitment to their happiness.

5. Ability to network

As with many jobs these days, you’re only as good as your team. Real estate agents may seem like lone wolves, but they are just the leader of a tight-knit pack of professionals. These include:

Real estate professionals who can call on a trusted network to make the deal move through the channels smoothly are more successful and sought after than those who struggle to make or keep contacts.

6. Marketing skills

Real estate agents are a little of everything: teacher, counselor, and financial adviser. Another hat to place on your head? Marketer.

Nothing draws more potential buyers than a beautifully crafted listing with eye-catching photos and tantalizing text. That doesn’t happen all on its own. And once you get that perfect listing assembled, it’s time to blast it on social media to get even more eyes on it.

Skillful marketing is also about understanding who’s buying and selling. A change in the target demographic means adjusting your marketing strategy appropriately. Some old-school realtors need help to adapt to marketing methods beyond paper advertising or direct mail. Don’t let that be you.

7. Comfort with new technology

Marketing is another area that has seen massive change in the last decade. These days, buyers and sellers complete complex real estate transactions from their couch, never visiting a property or setting foot in a closing agent’s office. So how comfortable are you with new real estate technology?

Can you:

Realtors who are not comfortable with the latest technology in real estate will not be as successful in the years to come.

8. Time management

There’s an old saying: There’s no such thing as being on time — only late or early. It’s common for people to juggle full-time work, family, and volunteer activities, but how do you get it all done?

Time management. It doesn’t matter what your system is for being on time and meeting deadlines, so long as you have one. No client wants to feel like they are last on your list, even if you have a sick toddler or an overdue project for a night class. Use online planning tools or a paper notebook: whatever it takes to ensure your clients get the attention and service they need right on time.

9. Emotional intelligence

Buying and selling a home can be a complex and emotional process. Maybe a family is selling the home of a loved one who has moved to assisted living and needs to liquidate this asset. Perhaps a first-time buyer is realizing the dream of their first step to generational wealth building.

It’s not just a simple business transaction for these sellers and buyers. It’s personal, and you need to have the emotional intelligence necessary to honor their experience while still serving the needs of the transaction. It’s a delicate balance, but it’s essential to ease people through sometimes-challenging transitions.

10. Integrity

Integrity is doing the right thing even if no one is looking, and it can be a difficult skill in a profession with its fair share of dubious loopholes and quasi-legal transactions that nevertheless feel a little “off.”

Don’t be that real estate professional who goes for the deal at any cost. Too many people get so blinded by the possibility of lucrative commissions that they neglect to act ethically. This compromises the respect of the profession overall and can undoubtedly damage your reputation locally.

Act in a way that feels ethical and honorable to maintain personal integrity and achieve a successful career you can be proud of.

Luke Babich is co-founder and CEO of Clever Real Estate.

Source link

The Worst Real Estate Investing Advice of 2023

Real estate investing advice is everywhere, especially from people who don’t invest. You’ve seen the financial influencers screaming, “Don’t buy!” or “Wait for the crash!” often while doing a little dance or pointing to some cherry-picked statistics. While this amateur advice rarely gets considered by investing experts, those who are just getting started are susceptible to following this dumpster fire of investing guidance and will end up losing money as a result. But don’t worry; we’ve brought the antidote to this horrible advice.

We got the entire On the Market panel together to give their favorite pieces of lousy investing advice and what to do instead so you can ACTUALLY build wealth. From waiting for the crash to only buying foreclosures to purchasing a property way over your budget, this real estate investing advice is some of the worst, if not most hilarious, we’ve seen in a long time. And with the economy on the edge of a recession, now is NOT the time to take money tips from twenty-two-year-olds on the internet.

For every piece of bad advice we get, we’ll give you our personal, time-tested advice on what we’d do in today’s housing market. Some of this expert advice may shock you since it goes against what everyday investors have been told. But, if you follow it, you could be building wealth like our multi-millionaire guests!

Dave:

Hey everyone. Welcome to On the Market. I’m your host, Dave Meyer, joined by Henry who’s laughing too hard to acknowledge me. Kathy, James, and Jamil. How is everyone today?

Jamil:

Creamy.

Dave:

Why is your face hurt, Henry?

Henry:

From laughing hysterically.

James:

I’m excited. Me, Jamil and Henry are going to go walk houses in Phoenix later today or in Scottsdale.

Dave:

Hey, you all are having a little party without us?

Kathy:

I know my heart hurts a little.

Dave:

We weren’t invited.

Henry:

I mean, I’m rarely invited when I show up in Phoenix, so I just hop on a plane anyway.

James:

You guys will be invited to On the Market house-warming party, if we go for it. We’ll just throw a rager.

Dave:

I would hope so.

Kathy:

Can’t wait.

Dave:

If it’s an On the Market party.

Jamil:

I mean, what else do you throw in 20,000 square feet?

Dave:

James is considering buying a 20,000-square-foot home in… I won’t say where.

James:

It is not 20,000 square feet, but it is 10.

Dave:

It’s a lot.

Jamil:

10, 20, when you’re that big, it doesn’t matter anymore.

Dave:

Well, that’s just the main house, Jamil. That doesn’t account for the-

Jamil:

The guest house.

Dave:

… Secondary house and the pool house.

Jamil:

Yeah.

James:

All right. Well, if I buy this house, we’ll do a big launch party.

Dave:

All right. We’re inviting all the listeners or everyone who’s listening to this can come to James’s house. All right. Today we have a really fun show. It all started… I posted something on Instagram about all this bad advice that I hear people on Instagram giving other real estate investors, aspiring real estate investors, and it just started this whole (beep) storm that I found was really interesting and really interesting conversations going on about different perspectives. And we thought it would be fun for each one of our panelists to bring the worst advice either they’ve ever gotten or that they hear being tossed around these days. So everyone’s going to bring their own. We’ve also asked our community on Instagram for some of the worst advice that they’ve heard, and we’re going to be sharing those with you throughout the episode as well. So we are going to take a quick break to hear a word from our sponsor and then we’ll be back with our bad advice.

Welcome back everyone. We are going to jump right into our bad advice episode. Who’s got the worst advice? James, let’s start with you.

James:

Oh my God, I’m so sick of hearing this.

Dave:

Is this a new one or a current market situation? What’s the context for this bad advice?

James:

This is one that I’m hearing all the time, or I’ve been hearing it for the last nine months, including now, and the advice I keep hearing is it is too risky to be flipping properties right now, sit out the market.

Dave:

Okay. I see Henry laughing. Jamil, all of you guys have been flipping. So before I ask James why you think it’s so bad, let me hear from you, Henry, what’s your thoughts on this?

Henry:

I’m laughing because I’m like I don’t know why I didn’t think of that as my bad advice. People say that all the time to me. You’re actually making money right now? Yeah, we’re making great money flipping houses right now. The market has given us an opportunity to buy at a deeper discount and we’re still seeing elevated prices and getting multiple offers and accepting offers above list. It’s crazy right now. So yeah, I’m doing just fine flipping.

Dave:

Jamil, I mean business sounds like it’s doing all right for you.

Jamil:

Yeah, going well. I mean, I’m not going to lie, I’d lost near half a million dollars on some of my fix and flips towards the end of last year. But that’s the thing. I ended up and got back into the market and just adjusted and pivoted my product and my price point, and as soon as I did those things we’re back in business again. And so I think it’s terrible advice, but I think the people who are giving that are the ones that just won’t ante up or they don’t understand. They’re the kinds of folks that only make money when there’s a bull market. You need to be able to make money in real estate regardless of what’s going on. That’s what makes you a real estate professional.

Henry:

I think, because heard Jamil speak a couple of times, and he talks about being a cautious flipper, and I do think that that’s great advice because the underwriting is key. If you screw up your underwriting, this market isn’t as forgiving as it was and you can lose money. We’re not saying it’s impossible to lose money. You could absolutely lose money, but it is not a bad idea to flip. You just must be cautious.

Kathy:

But you can lose money in a good market too. I mean, it’s all about experience and education and knowing what you’re doing. So Jamil, a lot of people couldn’t handle a half a million dollar loss starting out. So do you think it is a good flip market for someone who doesn’t know what they’re doing or is just starting out?

Jamil:

I never think it’s a good idea to get involved in fix and flipping when you don’t know what you’re doing. I think that’s the reason why you align yourself to somebody who’s doing it really well. I mean, if I’m going to just begin fixing and flipping, I’m going to find a coach. I got to find somebody who can walk me through it, who can teach me underwriting, who can teach me product, who can teach me design and material and the right processes that you need in order not to do this in a bad way. And look, the fact is, is that the market kicked my butt and we had all of our things in place. So even when you are really well insulated, you can still experience some bad deals or hard market cycles. And so being aligned with somebody who can help you mitigate that, I think, look, you’re not going to win 10 out of 10 flips, but if you get eight out of 10, you’re done real well.

James:

If you have five out of 10, you’re doing really well.

Jamil:

And the $500,000 I lost, it’s far out shadowed by the millions I made in the year. So I speak on the $500,000 loss because it happened, but if I blend it all together, we smashed.

James:

And that’s what you should always be buying, right? We’ve been flipping home since 2005. We’ve gone through… 2008 kicked our butt, we kept buying, you kept buying, you kept buying. That money has turned into real money for us over time. And if you sit out on the sidelines, all it does is halt your business. You have to rebuild a whole flipping business again. And that is not an overnight thing. You don’t just go, “Hey, I’m going to go flip houses tomorrow. I’m going to go find a contractor. I’m going to have all my guys and everyone’s going to bring me stuff.” Once you sit on the sidelines, you are on that sideline. And for people like me, that’s a good thing. Get off the field or run with it, but our margins have increased dramatically or back to what it is.