Wells Fargo: at least 114 employees in home lending

Wells Fargo, the third-biggest lender by volume in 2021, laid off at least 114 employees in its home lending division this year. As of May 27, Iowa Workforce Development lists 49 layoffs at the Wells Fargo campuses in Des Moines and 34 employee reductions in West Des Moine. Impacted employees, all in the home lending division, will receive pink slips in June and July, according to Iowa’s WARN notification list.

According to Worker Adjustment and Retraining Notification (WARN) notices submitted to the California Employment Development Department (EDD) earlier this month, the company plans to cut 31 jobs in the home lending business, in letters to the EDD reviewed by HousingWire. Layoffs included 17 associate loan servicing representatives and eight loan servicing representatives as well as senior operations processors and senior loan servicing representatives.

“The home lending displacements are the result of cyclical changes in the broader home lending environment,” Lylah Holmes, a spokesperson at Wells Fargo, told HousingWire. Wells Fargo will be providing severance and career counseling, and helping affected employees identify other positions within the bank.

The bank’s revenues in the home lending business totaled $1.5 billion in the first quarter this year, a 19% drop compared to the previous quarter and 33% lower than the same period in 2021.

Wells Fargo executives in early June said the bank was considering pulling back on its mortgage business, where, beyond the challenges related to a decline in originations, it has also struggled with scandals related to minority lending.

loanDepot: Unknown

loanDepot, the fourth-largest lender, per mortgage data firm Polygon Research, conducted an unspecified number of layoffs in late May. Multiple sources told HousingWire that “hundreds” were let go.

Jonathan Fine, loanDepot’s vice president of public relations, declined to say how many positions were cut and suggested that a review of the earnings call transcript from the first quarter would provide needed information.

In April, loanDepot announced plans for potential layoffs in the company’s first quarter earnings call after reporting a net loss of $91.3 million.

Company chief financial officer Patrick Flangagan said loanDepot doesn’t expect to be profitable this year and shared plans to reduce marketing personnel expenses.

Loan origination volume dropped 26% to $21.6 billion from the previous quarter, according to the firm, bringing the company’s market share down to 3.1%. The lender expects loan origination volume to post between $13 billion and $18 billion in the second quarter of this year.

Company executives said loanDepot is not expected to be profitable in 2022.

NewRez LLC: 386 employees

New Residential Investment Corp., the sixth-largest lender per Polygon Research, eliminated 386 positions, accounting for about 3% of the mortgage division’s workforce, in February.

The layoff decision followed New Residential Investment Corp.’s acquisition of multichannel lender Caliber Home Loans last year.

“As we continue to create synergies between companies, we are creating a structure to streamline business channels and create long-term growth,” the NewRez spokesperson wrote in an email to HousingWire in February.

Caliber was a heavy-hitter across multiple origination channels, generating $80 billion in originations and $153 billion in servicing in 2020. Best known for its distributed retail footprint and its fair amount of business in correspondent and wholesale channels, NewRez/Caliber had 3.7% of market share in 2021, according to data from Inside Mortgage Finance.

Owning Group: 189 employees

California-based Owning Corp., a direct-to-consumer lender acquired by Guaranteed Rate in February 2021, cut 189 jobs across three rounds from February to April.

The layoffs included 51 mortgage specialists, the most heavily affected position, and 42 mortgage consultants.

Employees that were let go also included underwriters, closers, and top executives such as lending directors and vice presidents for credit and underwriting.

Owning is the second company acquired by Guaranteed Rate in 2021 to face layoffs in the challenging mortgage market this year.

Early in January, Texas-based Stearns Lending, acquired in January 2021 from the financial giant Blackstone Group for an undisclosed sum, laid off 348 workers following the decision by Guaranteed Rate to discontinue operations of its third-party wholesale channel.

Better.com: more than 4,000 workers

Digital lender Better.com has already conducted three rounds of layoffs since late last year, and it’s unclear where the bottom is. The firm’s CEO infamously laid off 900 employees in a Zoom meeting in December where he then criticized the departing employees to remaining workers, 3,000 workers in March, some of which work in India, and an undisclosed number of people in April.

The firm has been seeking to go public via a special purpose acquisition company (SPAC), known as Aurora Acquisition Corp. But without reliable access to purchase business, conditions look bleak for Better.

An S-4 filing from Aurora, dated April 24 2022, showed that Better.com posted a loss of more than $300 million last year. The “deterioration” in Better’s financial performance was attributed to multiple factors including increasing interest rates and the effects of “negative media coverage” following a series of layoffs that began in December 2021, according to the filing.

Pennymac Financial Services: 474 positions

California-based nonbank mortgage lender and servicer Pennymac submitted WARN notices to cut 474 jobs by July this year.

Following workforce reduction filings of 236 employees in March, the firm submitted WARN notices to lay off 238 positions by June and July, according to letters to the EDD reviewed by HousingWire on May 27. Pink slips will arrive for California employees at six offices in Thousand Oaks, Pasadena, Roseville, Westlake Village, Agoura Hills, and Moorpark.

The latest round of WARN notices will impact 59 loan officers in the Thousand Oaks, Pasadena, and Roseville offices.

The office at Thousand Oaks accounted for the largest layoff notifications — of 97 employees, including 25 loan officers. Most of the other positions to be eliminated were analysts and managers in back office operations.

Top management jobs, such as vice presidents for underwriting and partial credit guarantee (PCG) transaction management, will also be reduced, according to Stacy Diaz, executive vice president of human resources at PennyMac, in letters to the EDD.

Pennymac posted a profitable first quarter but its net income dropped more than 50% driven by lower profits from its production segment.

Interfirst Mortgage Co.: 491 workers

Rosemont, Illinois-based Interfirst Mortgage Co. eliminated more than 490 positions this year in two rounds of layoffs.

Pink slips were delivered to a total of 351 non-commissioned loan officers in January: 77 in North Carolina and 274 in Illinois.

Interfirst felt the consequences of mortgage rates hovering at around 5% in May and announced an additional round of 140 layoffs at the lender’s facility in Rosemont. Starting May 17, or within two weeks of that date, the company cut jobs in the mortgage loan production. Employees that were let go included 26 processors, 20 originators, and 15 mortgage accountant executives in junior and specialist positions.

Administrative positions including human resources, talent acquisition, and executive assistants were also part of the workforce reductions, according to a WARN filed by the company in early March.

Mr. Cooper: about 670 positions

Residential lender and servicer Mr. Cooper slashed 670 jobs this year so far in two rounds of layoffs.

Earlier this month, Mr. Cooper said the elimination 420 positions, 5% of its employee base, will hit the originations side of the business. A total of 120 employees, or about 16% of the staff in California will be affected by the announcement, Mr. Cooper said.

Mr. Cooper laid off about 250 positions in the first quarter, the company said in a response sent following its earnings call in late April. While Mr. Cooper reported a profitable quarter with a net income of $658 million in 2022, the firm didn’t expect that to continue.

“Given lower volumes, rationalizing capacity is an unavoidable theme for everyone in origination and we’ve been very disciplined in managing capacity,” Chris Marshall, vice chairman and president of Mr. Cooper said.

The company forecasts quarterly origination volume earnings to be between $65 million to $85 million for the rest of 2022, compared to $157 million in the first quarter.

Union Home Mortgage: unspecified number of LOs

Union Home Mortgage laid off loan officers in junior and senior positions in April. The firm, like many other companies in the industry, said it’s “temporarily adjusting staffing levels” and declined to provide details on the size of the reduction.

The 49th-largest mortgage lender, according to Inside Mortgage Finance, wasn’t immune to the shrinking mortgage market despite reporting an origination volume of $4.2 billion in the fourth quarter of 2021, up 65.5% from the prior quarter. The lender’s origination volume rose nearly 26% to $13 billion in 2021 from 2020.

Fairway: cuts in wholesale and retail channels

Employees in the wholesale and retail channels, including analysts and senior positions in underwriting, training and information technology, were let go in May.

While Fairway didn’t provide any comment, a dozen employees affected by the layoff told HousingWire the company laid off professionals who were with the company for more than two years as well as those who started less than four months ago.

The firm was in a better position than its rivals six months ago but Fairway felt the pinch of mortgage rates in the 5% range and surging housing prices.

Fairway’s loans accounted for about 62% of the company’s total origination in 2021, the highest share among the top 12 lenders in the U.S., according to Inside Mortgage Finance.

The lender offered a two-week severance payment for some employees but no career transition support, former employees said.

Stearns Lending: 348 employees

Stearns Lending laid off nearly 348 employees in March following Guaranteed Rate’s decision to discontinue operations of its third-party wholesale channel.

In January 2021, Guaranteed Rate acquired Stearns Holding from Blackstone Group for an undisclosed sum. The acquisition will enable Guaranteed Rate “to bolster retail loan origination and further its joint venture platform while developing new multichannel capabilities, the company said at the time of the acquisition.

Guaranteed Rate’s CEO Victor Ciaradelli, in a letter to brokers about shutting down Stearns wholesale channel, said the company will focus on leveraging its “industry-leading purchase platform augmented by the best loan officers in the business.”

Redfin mortgage: 121 employees

Redfin issued pink slips to 121 employees in January following the real estate giant’s announcement of an acquisition of mortgage lender Bay Equity Home Loans for $135 million.

The impacted employees, less than 2% of the total staff, were mainly in sales support, capital markets, and operations.

“Reorganizing our mortgage operations unfortunately means some colleagues and friends will be leaving Redfin,” Adam Wiener, Redfin’s president of real estate operations, said in a statement in January. “Many of these people are the pioneers who helped build Redfin Mortgage from scratch and we owe them a debt of gratitude.”

The workforce reduction was expected to bring $6 million to $7 million in costs and transaction advisory fees of approximately $3.5 million, according to Redfin. The firm also forecasted to incur a non-cash impairment charge of $2 million to $3 million on mortgage-specific, internally developed software.

Interactive Mortgage: 51 employees

Mortgage lender WinnPointe Corporation, doing business as Interactive Mortgage, laid off 51 employees in 2022 following a workforce reduction of 128 people last year.

The permanent layoffs, according to the WARN notices sent to the California Employment Development Department, was in part due to the more than $1 million dollars in losses from rises in increase rates and the “economic collapse triggered by the Covid-19 pandemic.”

Of the 51 employees who were laid off in April, three are underwriters, 15 are LOs, 11 are processors, 19 are admins, and three are funders. The 128 employees who were let go last year, included six underwriters, 20 loan officers, 26 processors, 51 admins, and 25 funders.

USAA Bank: more than 90 employees

Texas-based USAA Bank reduced its mortgage sales team by more than 90 employees, the San Antonio Express News reported in April.

The publication said the layoffs came amid USAA Bank’s projections of a 34% drop to about 25,000 real estate loans despite having adequate staff in place to facilitate 38,000 loans, citing internal emails.

The company confirmed the cuts but categorized the workforce reduction as business as usual for a company of its size.

USAA Bank was founded in 1922 by a group of 25 U.S. Army officers to insure each other’s vehicles because of the perception that military officers were a high-risk group. Headquartered in San Antonio, Texas, the bank has five financial centers across the country including New York and Colorado.

Tomo Mortgage: almost a third of its workforce

Tomo issued pink slips to 44 employees, almost a third of its employees in late May.

Greg Schwartz, CEO at Tomo, said in a LinkedIn post said the firm was “impacted by the rapid rise in interest rates that has reduced purchase mortgage margins.”

With venture capital pulling back, Schwartz said the firm “must map out a stable budget that will rely on less capital for longer.”

Tomo will dial back market expansion plans and focus on building tech that will deliver a faster and less costly home buying process, Schwartz added.

The firm, which now has 110 employees, raised $40 million in a Series A funding round in March and touted a valuation of $640 million.

Founded in 2020 by former Zillow executives Carey Armstrong and Shwartz, Tomo claims to close 98% of its loans on time.

No layoffs here*

Lenders that haven’t laid off employees yet this year include United Wholesale Mortgage (UWM) and Rocket Mortgage.

UWM, the nation’s second-largest lender by volume, hasn’t instituted layoffs like many of its competitors, though executives are mindful of expenses.

Total expenses dropped to $316.9 million in the first quarter of 2022 from $364.4 million during the same period in 2021. In Q1 2022, salaries, commissions and benefits reached $160.6 million, which CEO Mat Ishbia considered a “solid” number.

“It’s very important that we continue to manage our expenses. We have complete control of this, and we feel great about where we’re at,” Ishbia said to analysts during UWM’s earnings call.

Rocket Companies, the parent of Rocket Mortgage and Amrock Title, has not eliminated any positions but has offered a voluntary buyout to 8% of its staff in April.

In its most recent earnings call in May, executives said Rocket took “significant cost reduction measures” that includes implementing a voluntary career transition program to certain team members, reducing production costs, and shifting its market spending for the second quarter.

The firm in April said the buyout would save $40 million per quarter, after a one-time charge between $50 million and $60 million.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com

Are home prices about to fall?

We are at the point of the economic cycle where I really just get two questions: Are we going into recession and are home prices about to fall? I am going to do my best to try to make sense of what is happening with the housing market right now, since the years 2020-2024 have been a talking point of mine for years and my biggest concern since the fall of 2020 has been prices overheating — not having a deflationary collapse.

For over a decade, a lot of people didn’t believe in housing inflation but in the deflationary housing story, which hasn’t ended well for them since 2012. Talking about this from a historical standpoint will help us understand better what is happening today.

I have separated my work into two different time frames: 2008-2019 and 2020-2024.

In the years 2008-2019 we saw the weakest housing recovery ever. I predicted that purchase application data wouldn’t reach 300 until years 2020-2024 and housing starts wouldn’t start a year at 1.5 million until then as well. In contrast, I knew 2020-2024 would have the best housing demographic patch ever as the country’s biggest demographic group hits the median age for first-time homebuyers.

Let’s look back at how some people have interpreted housing market data.

A short history of the housing crash narrative

2012: What they said: Shadow inventory will cause prices to fall. The reality: Inventory broke down in 2012, and the monthly supply data got below 6.0 months. The “shadow inventory” was not an issue as it took years to get rid of the distressed supply from the housing bubble years.

2013: What they said: Because mortgage rates were rising and the Fed was tapering, housing would crash. The reality: The 10-year yield shot up from 1.60% to 3% (sound familiar?), making housing cool down noticeably. Nominal home price growth cooled down, but we had no negative year-over-year price declines as inventory didn’t even get over five months back then.

2014: What they said: Housing would crash because purchase application data was down 20% year over year; adjusting to the population, it was the lowest ever. (Total inventory grew this year, and sales were negative. This was the last time total inventory did grow in America.) The reality: Even though sales fell and inventory grew, nominal home prices didn’t decline since the monthly supply of homes never came close to breaking over six months.

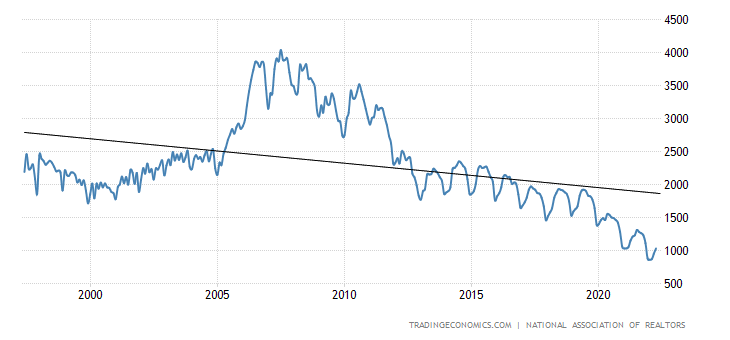

NAR total inventory data:

2015: What they said: This was the start of the Silver Tsunami. The first baby boomer turned 62 in 2008, and thus 2015 was the start of what they said would be a mass downsizing that would collapse prices because nobody could buy a home from the Boomers, and they needed to discount their net wealth by 70% to have a smaller home to live in. The reality: The Silver Tsunami didn’t happen; this was supposed to be a decade-long process up to 2025, and still hasn’t happened.

2016: What they said: Because manufacturing was in a recession, and stocks pulled back 15%, people were pushing a general recession premise. The reality: Home prices grew because inventory fell once again. (Here’s me on a treadmill challenging those calling for a recession.)

2017: What they said: Because home prices were back to the housing bubble peak, prices had to crash. The reality: Inventory fell again and home prices rose.

2018: What they said: With mortgage rates rising to 5% and the new home sales sector getting hit hard, housing would crash. The reality: The existing home sales marketplace was in much better shape. Sales fell, but the total inventory still didn’t grow. The monthly supply data increased as it took longer to buy homes: there was no inventory growth and purchase application data were only negative for three weeks out of this year.

2019: What they said: Housing would crash because Inventory was up year over year on the monthly supply data for a few months, and the sales trend was still falling. The reality: As rates fell, housing rebounded in the second half of 2019. I enjoyed the 2019 housing market because real home prices went negative briefly, and people had choices. Not many people liked this market, but it was as good as it gets because the days on the market climbed to over 30 days and we had no drama.

2020: COVID-19 hit us and thus the housing crash premise went into overdrive. Even though I tried my best in 2019 to warn my housing bubble friends not to go there with a bubble crash, they did. I was willing to forgive them early on since it was our first global pandemic in recent history and the economy paused, leading to a drastic downturn in economic activity. What they said: COVID would lead to a housing crash. The reality: I wrote on April 7, 2020, we would have an economic recovery in 2020 if you follow these data lines and dates. Regarding housing, I said please wait until July 15 to see June’s data before you go all housing crash on us. They didn’t wait and missed the greatest recovery ever. I retired that economic recovery model on Dec. 9 2020, and now we were dealing with the Forbearance Crash Bros.

2021: What they said: After failing with another housing crash call, what do all crash call boys and girls do? They move the goal post to next year and the theme was forbearance —all the people coming off of forbearance would crash the housing market. The reality: Data was stable and most people making over $60,000 a year got their jobs back by October of 2020.

Now that we have that 10 years of history on the books, it’s time to talk about the future because the housing market has had a material change based on my own economic work. One thing is for sure, demographics are economics, and mother demographics flexed her muscle during COVID-19. Ages 28-34 are the biggest age group ever and when you add them with move-up, move-down, cash, and investor buyers together, you have solid replacement demand.

This also means we might have problems with inventory as well. As you can see here with the NAR total inventory data, total inventory has been falling since 2014, but with a bump in demand, we had the potential to break under 1.52 million. Historically, 2 million to 2.5 million of inventory is normal. Post-2014, a slow but potential dangerous downtrend formed right when our demographic patch was about to kick in.

NAR total inventory data going back to 1982

My rule of thumb for years 2020-2024: As long as home prices grew just at 23% or less during these five years, the sales goal of having over 6.2 million total home sales should be achievable.

Unfortunately, so far 2020 and 2021 got a terrible grade on home-price growth. It was too hot. The home-price growth was an apparent deviation from what we experienced in the previous expansion. Rising home prices was the real housing crisis this time around. A raw shortage of homes created forced bidding during a better demographic patch, and we are still today seeing home-price growth gains that are way too hot.

Now data from the S&P Case Shiller Index lag, but you can see the damage done in such a short time with prices.

Even with some of the recent weakness in demand, we haven’t seen a significant dynamic shift yet to bring prices down because total inventory data is still too low. Here are some weekly data from Realtor.com and Redfin.

I do believe higher mortgage rates work, but it needs time to work itself in our housing market.

What do we need to see before home prices fall?

Traditionally, people believe you need six months of monthly supply because that happened during the housing bubble crash. That was a forced selling period, and the credit stress data from 2005 through 2008 isn’t here.

American homeowners are in an excellent financial position, and they’re not going to sell their homes at 30%, 50%, or 70% off the market bid prices to get out at all costs. We are in June now, and the market inventory data inventory is nowhere close to 2018 levels nor 2014 or 2010 levels. Looking back at total inventory data going back to 1982, when I was seven years old, the only panic selling we saw was forced credit stress selling. The homeowners now don’t have exotic loan debt structures they need to recast, and their cash flow is good.

RIP my price model

I lost my price growth model, and I want it back! Imagine if home prices grew at 4.6% or less per year from 2020 to 2024; we would have so much leeway for prices to rise without impacting demand enough to get us under 6.2 million total home sales. However, that is not the case! And once the 10-year yield broke over 1.94%, we can see that demand is being hit more than it would have if price growth were much tamer.

The marginal homebuyer is always impacted; that would not have changed if price growth was less, but the massive price gains since 2020 have made things a lot worse.

This means home prices need to decrease for my model to work again before 2024. Does this mean I will get want I want? What am I looking for now?

First, we need to get monthly supply data above four months with duration. The last existing home sales report came in at 2.2 months. So we aren’t there yet, but once we get above that, you have a more traditional housing market regarding supply.

NAR: Monthly Supply Data

Why focus on four months instead of six months as many people do? Traditionally inventory levels are between 2 million and 2.5 million. We started the year at 870,000 and we are dealing with the biggest housing demographic patch in their peak home-buying age. People need shelter!

If we had started the year at 2.4 million total inventory and home prices and rates rose, we would have seen a noticeable cooling down, similar to what we saw in 2013-2014, which would have pushed the monthly supply over six months. However, we are far from the total inventory data of 2014, let alone the 3 million to 4 million inventory levels after the housing crash. In theory, if we had 2.4 million inventory, we wouldn’t have seen the massive price gains from 2020 to 2022.

My next stage of watching inventory is getting back into a range of 1.52 – 1.93 million and monthly supply above four months with duration. Once we get to those levels, we will revisit the housing inventory situation. Then I can remove my savagely unhealthy housing market label because I believe that is an acceptable level. To have any meaningful price declines — to have my model get back in line — I need to see these things occur, and I believe higher rates can help bring some sanity back to the housing market.

Hopefully, this gives you a better idea of inventory channels with total inventory and monthly supply data. This also explains why pricing is still strong even with declining sales.

Looking to the future, higher mortgage rates will create weaker demand. So far, I have been wrong on my premise that we would see 18%-22% declines in this data line on a four-week moving average, but we are starting to head in that direction.

As we can see from Wednesday’s purchase application data, purchase application was down 7% week to week, down 21% year over year. The four-week moving average is down 16.5% year over year. We are getting closer to the range I thought we should be at on the 4-week MA 18%-22% declines. The comps will get harder starting in October. Also, you can see that purchase application data is back at 2009 levels, but sales and inventory are not. Remember that is trend survey data, not an exact science with sales, but a trend.

Even if mortgage rates drop, that won’t be the savior we had in the previous expansion. Think of it as a stabilizer. Only when the economy goes into a job loss recession do you have more distressed inventory. As I stated at the top, this is the other question I get all the time: Are we going into a recession? I have a recession red flag model and right now only four of the six red flags are raised, but I am keeping a close eye on it.

So are home prices about to fall? What I’ve presented here are the key data lines that need to happen first: monthly supply data getting over four months with some duration and total inventory levels getting back into a range of 1.52 -1.93 million. Until that happens, don’t look for anything big in terms of price declines as total inventory and a monthly supply of homes are just still too low.

The post Are home prices about to fall? appeared first on HousingWire.

Source link

United Wholesale Mortgage launches platform for brokers

Pontiac, Michigan-based lender United Wholesale Mortgage (UWM) Wednesday launched a new platform for independent mortgage brokers to access purchase leads, past clients and real estate agents — a move to entice and retain loan officers in a shrinking mortgage market.

UWM, the largest wholesale lender in the country, has been challenged by rising mortgage rates, decreasing refinancing volumes and fierce competition in the wholesale channel during the past couple of years, mainly from Rocket Mortgage.

Dubbed “Boost,” the new platform is a one-stop-shop allowing past clients to call on their previous brokers’ behalf, being transferred directly to them. The marketplace also provides purchase leads at a discount tailored to the brokers’ needs.

“Staying in front of past clients and building new connections are two of the most critical and challenging parts of any business,” said Mat Ishbia, president and CEO at UWM, according to a news release. “Boost will save brokers time while helping them establish and maintain relationships for short-term and long-term wins.”

The platform also will identify potential real estate agent partners in the mortgage broker’s area and schedule one-on-one personal meetings. Rocket Pro TPO, the wholesale arm of the lending giant, started connecting its broker partners with real estate agents through Rocket Homes, the company’s real estate listing platform, in October 2021.

UWM’s new platform launch follows a decline in the lender’s total production in the first quarter of 2022. UWM posted an increase in profits over the prior quarter, increasing its purchase volumes to record levels, but the total origination fell during the same period, mainly due to refinancings.

According to its earnings report, UWM originated $38.8 billion in mortgage loans in the first quarter of 2022, a 29.7% decrease compared to the previous quarter and a 20.8% decline year-over-year. Purchase loans grew from 24.9% of the total origination volume in Q1 2021 to 49% in Q1 2022 to $19.1 billion.

So far, the company has been proactive in rolling out new products. In March, UWM unveiled two new offerings in the non-qualified mortgages (non-QM) space: a bank statement loan product for self-employed borrowers and a product to qualify borrowers for investment properties based on the monthly rental income, rather than their current income.

UWM also is pressuring competitors via prices. In May, the lender said it will price-match loans up to 40 basis points with that of 20 different competitors, through June 30, to any conventional, government or jumbo loan on a primary, secondary or investment property.

The lender’s move comes at a time of increasing competition. In January, Rocket Pro TPO announced a program to pair each of its brokers with a team of in-house experts, made up of underwriters, closing specialists and purchase title coordinators, to help brokers navigate the loan closing process.

In April, Rocket launched a program to guarantee financing to close loans in 15 days, seeking to attract brokers. The promotion, valid until the end of the month, awarded borrowers a $2,500 lender credit if the loan does not close on its promised due date.

UWM’s most aggressive step, however, was in March 2021, when the company told brokers they could not continue to work with Rocket Pro TPO or Fairway Independent Mortgage and still work with UWM.

To reinforce the rule, the company this year sued three broker shops for sending loans to its rivals, among them America’s MoneyLine, Kevron Investments Inc. and Mid Valley Funding & Inv. Inc.

The post United Wholesale Mortgage launches platform for brokers appeared first on HousingWire.

Source link

“It’s math:” How mortgage solutions companies are fighting for survival

Businesses and entire industries tanked during the pandemic, but it created an ideal environment for mortgage tech companies, some of which rode the wave to banner years and historic growth. With interest rates hitting all-time lows, lenders doubled their origination volume to more than $4 trillion in both 2020 and 2021, hired more staff and ramped up investment in technology to close loans faster.

As the market has shifted, however, with mortgage rates rising in 2022 faster than forecast and lenders quickly cutting costs, some tech providers now are left vulnerable. That has led to a reckoning in the mortgage industry, which is in the midst of a rightsizing that has already resulted in layoffs at numerous firms. Layoffs at mortgage tech companies appear inevitable, along with other cost-saving measures, including diminished investments in technology.

With a deadly combination of the tight housing inventory, reduction in refis and surging mortgage rates, consolidation seems to be the natural path.

“Rising tide raises all ships, but subsequently lowering tides drop off ships,” said John Hudson, executive vice president at Mortgage Financial Services.

“With less volume out there, it’s only a matter of numbers and math. Less loans equals less revenue across the board. You’re going to see some that’ll survive and some will simply not make it. You’ll be seeing a lot of mergers and acquisition activity in the mortgage tech space this year,” Hudson added.

The downturn in a highly cyclical mortgage industry is nothing new for solutions providers with experience navigating the ups and downs in the market. And the well-prepared could ultimately benefit from current conditions if they seize the opportunity to absorb vulnerable newbies lacking sufficient capital to weather the storm. As such, a strategic merger or acquisition is emerging as one opportunity to outmaneuver the shrinking mortgage market.

Strategic M&As

Intercontinental Exchange (ICE), the corporate parent of the New York Stock Exchange, earlier this month announced its intent to acquire Black Knight in a deal valued at $13.1 billion. The merger of the two biggest suppliers of mortgage loan software signals the potential creation of a dominant player in the mortgage tech industry.

Of the $387.2 million in revenue Black Knight made in the first quarter of this year, 57% came from the servicing software and about 66% of ICE’s first quarter revenue of $1.9 billion came from its origination technology, according to their earnings reports.

“From a client perspective, a fully integrated soup-to-nuts digital offering for mortgage origination and servicing should significantly reduce the cost of originating and servicing a mortgage,” according to an analyst who spoke on the condition of anonymity.

Executives from each company have suggested the businesses are complementary — ICE focuses on tech solutions for originators and Black Knight’s business model is dependent on servicers and the secondary market.

The deal isn’t expected to close until 2023 as executives must persuade regulators the acquisition doesn’t hinder competition.

Several mortgage analysts said smaller mortgage tech providers will be challenged by the giant ICE-Black Knight conglomerate during a market downturn in which revenues are plummeting, a number of smaller competitors, such as loan origination system (LOS) provider LendingPad, see an opportunity to push an alternative product to lenders.

“There’s been a fair amount of discontent among lenders with loan origination systems,” said Dan Smith, vice president of sales and strategy at LendingPad. Focused on customer support and offering the latest tech stack that is easily configurable for lenders, LendingPad doubled in sales volume in a little over a year, said Smith, who declined to share specific numbers.

In July, LendingPad plans on rolling out ComplyIO, an automated compliance engine that scans data to see if a loan that is near closing complies with all the state and federal rules and regulations. The company said it will be offered both as part of an LOS and a standalone product.

A handful of vendors made strategic acquisitions and acquisitions for capitalization in the fall of 2021.

Seattle-based proptech firm Porch Group acquired point-of-sales software company Floify for $90 million in October and North Carolina-based publicly traded fintech firm nCino bought mortgage tech vendor SimpleNexus in a $1.2 billion deal the next month.

At the time, Porch said Floify’s brand would remain intact and investments were planned to help make the homebuying and moving process easier. The firm’s software — which it says streamlines the loan origination process by allowing document sharing and communication between loan officers and real estate agents — helped to close more than 77,000 mortgage applications per month, according to Porch.

nCino noted SimpleNexus operates a “per-seat subscription-based revenue model, enabling the company to generate financial results that are more predictable, recurring and not based on mortgage transaction volumes.”

“I think they were looking toward the future,” said Tammy Richards, CEO of LendArch, a mortgage tech consulting firm.

Period of ‘spend nothing’

It’s hard to assess how private mortgage tech companies are performing in a shrinking mortgage market, but layoffs suggest difficult days.

Tomo, a fintech startup that aims to be a “PayPal for the mortgage industry,” laid off 44 employees, almost a third of its employees in late May.

Founded in October 2020 by former Zillow executives who envisioned a way to accelerate the mortgage approval process, the Tomo notched a valuation of $640 million after raising $40 million in Series A funding in March.

Tomo wasn’t immune to the rapid rise in interest rates despite its focus on the purchase mortgage sector.

“We are dialing back our market expansion plans and will focus on building tech enabled mortgage experiences that deliver faster, less costly and less stressful experiences for homebuyers and the real estate agents that serve them in our existing footprint,” said Greg Schwartz, chief executive officer at Tomo, said in a LinkedIn post announcing the layoffs.

Publicly traded Blend Labs, which debuted on the New York Stock Exchange in July 2021, also announced its intention to issue pink slips to 200 workers, about 10% of its workforce, by the second quarter in 2022.

Blend has attracted a bevy of investors who were impressed by its market position. The company powers mortgage applications on the websites of major lenders such as Wells Fargo and U.S. Bank.

But the firm, which hasn’t turned a profit since going public, reported increased operational losses of $69.7 million in the first quarter of 2022. Blend brought in more than $71 million in the first three months of 2022, but more than half of its revenue came from title insurance and settlement services provider Title 365 in the challenging origination environment.

Co-founder Nima Ghamsari believes Blend will weather the storm. Blend is focused on long-term growth, investment in technology and diversifying its revenue model. But some analysts, speaking on the condition of anonymity, said the layoff announcement was a clear sign Blend and other tech firms are struggling in the downmarket.

“My own view is that those folks have a better shot at long term survival simply because they can tap capital elsewhere to help survive,” said Brian Hale, CEO at Mortgage Advisory Partners. “Companies that come into this down trough, who were not as well capitalized, could either be consolidated or could be eliminated.”

New tech companies, often products of the refi-boom that attracted loans with low rates, may find it harder to raise money.

“They had a massive ability to attract loans with low prices, low rates, which equals low revenue,” Hale said. “They had no second act when the dance stopped.”

Jerry Halbrook, chief executive officer at Volly and former president of the origination technologies division for Black Knight Financial Services, agrees: “I think the bigger worry is really with the new entrants which haven’t really gone through a lot of cycles.” Halbrook said. “I suspect the ever-rising valuation of fintech companies is over for a while.”

It would be a mistake to pull back from platform investments, experts said, but some smaller tech firms have already given up on them.

“Inside every one of those small companies right now, it’s going to be a period of ‘spend nothing’ until we know how deep the water is,” said Hale, of Mortgage Advisory Partners.

It’s all about that niche

It’s the well-capitalized players like Blend and Roostify that have a better chance of surviving, some mortgage tech analysts said.

Roostify, the digital platform for mortgage lenders that competes with Blend, raised $32 million in venture funding in January 2021, bringing its total funding to $65 million.

The cash injection helps the company provide tech to about 200 lending institutions on its platform, including two of its investors, J.P. Morgan Chase and Santander Bank (the latter of which recently exited the mortgage business). According to Roostify, the company handles $50 billion in loan volume every month.

Although it’s not yet profitable, the artificial intelligence and machine learning capabilities embedded into Roostify’s point-of-sale system platform make it competitive, Roostify CEO Rajesh Bhat told HousingWire.

For example, its product Roostify Beyond gives instant feedback to applicants who upload incorrect or illegible documents, without having to talk to the lending team directly, ultimately helping lenders process mortgage applications with greater speed, Bhat said.

“We believe this is fairly differentiated (from other companies’ products) and really focused on the collaboration between the loan officer, the processor and the consumer. So it’s like middle-office, later stage workflow. It is predicated on having robust integrations with the loan origination systems.”

Small solutions providers offering unique services and products in a shrinking mortgage market are also well-positioned to survive.

Dru Brents, chief executive officer of PreApps 1003, says its mobile responsive, all-in-one platform BrokerPlus provides a niche for broker companies.

“As far as I know, we are the only single login mobile responsive, all-in-one platform that includes the customer relationship management system, E-signatures, point-of-sale system, loan origination system and the pricing engine,” Brents said.

Companies sign on to use BrokerPlus because it can replace multiple systems in a streamlined, cost-saving platform, he said.

“They are eliminating multiple tech stacks and they’re using our platform, so it saves them money. It’s really meeting the needs of every piece of technology that a broker would need,” he said.

Since the company launched in 2015, PreApp1003 has “thousands of paid subscribers” and continues to see “significant growth,” although Brents would not cite specific numbers.

“We’ve never received investments. We’ve always been self-funded. We build and we test.”

Reaping investments

Despite myriad products rolled out during the two-year refi boom, the level of adoption remains low throughout the industry.

“I’m not so sure that’s a bad thing. The market really needs to absorb what’s already been built in terms of new technology,” said Volly’s Halbrook.

Many mortgage analysts and consultants noted new tech is needed to build modern, efficient and automated processes.

“Our whole industry right now is yearning for a new model, [a] more automated approach, including our customers who are going to be those Gen Zers, who were born with phones in their hands, and are going to really deserve and want an automated approach,” said Richards, from LendArch.

Loan officers say the products that will last leverage technology that provides value to customers without a lot of effort.

That technology includes a marketing platform that automates valuation model technology, and an application platform to which applicants can upload mortgage documents to speed up the loan process.

“But those companies that haven’t invested in tech are going to have a hard time through this market,” Richards said. “Because if you have implemented your tech properly, you should be receiving efficiencies and expanded capacity, that reduces your cost.”

The post “It’s math:” How mortgage solutions companies are fighting for survival appeared first on HousingWire.

Source link

Are these factors creating chaos in your mortgage lending ops?

Few other industries must deal with the level of complexity of home finance. From mortgage origination to servicing, companies are constantly grappling with high volume and stringent regulatory oversight while managing a large cohort of vendor partners. Add to those challenges increased competition in a rising interest rate environment that is choking off refinance business, driving overall mortgage volume down significantly.

When the squeeze is on, lenders must offer higher levels of customer satisfaction, lower costs or both to remain competitive. That requires elevated efficiency to counter the growing complexities, which likely include a more aggressive Consumer Financial Protection Bureau (CFPB). Technology will be the most popular solution, but choosing to implement multi-million-dollar platforms to streamline operations introduces even more complexity before savings are realized.

Two data degrees of separation

All too often though, it’s not the lender’s operation that is the problem. For both mortgage originators and servicers, the aforementioned large cohort of vendors must rely on third-party partners that introduce friction and uncertainty into their process. And automation is only as good as the information flowing through, much of it coming from two data degrees of separation.

For example, a loan processor may use a modern LOS to order a flood certification, title report, AUS decision or data verifications, but once the order has been placed, what if the data doesn’t arrive? On the servicing side, a default servicer will work with a number of third-party vendors to gather collateral valuation, title information, property inspections and field services reports. The servicing platform can place the orders easily enough, but then what?

Lenders and servicers have focused a lot of attention on making their internal process as efficient as possible. Current LOS and servicing software can place orders and receive reports quite well, but they do a very poor job of managing the process in between those events. It’s where their internal process intersects with that of their third-party partners — and the lack of visibility there — that they encounter the failure points that waste time, increase costs and destroy borrower satisfaction.

The result is that they will be less competitive than their peers and run higher non-compliance risk in the current regulatory environment.

The companies that run the highest risk

No company is immune from this challenge, but the pain — and the benefits of solving this problem — are disproportionately higher for a certain class of lender/servicer.

Smaller mortgage originators often deal with this problem by throwing more people at it. If a manager inside the lender’s shop can ride herd on the vendors in process at any given time, the risk of lost or incorrect orders goes down. But as the lender grows, this becomes unmanageable.

Once the lender is operating in several states with multiple branches and a large cadre of vendors, the institution must either open and staff a number of separate centralized processing centers or find a better technology solution. Even then, they are often still operating in a binary environment: either the report they ordered was received on time or it was not.

Servicers of any size could benefit from a better solution, as even the smallest sub-servicers are holding tens of thousands of loans in their portfolio. We don’t have enough people in the industry today to throw at the problems that will result if defaults continue to trend upward in the wake of the end of forbearance.

Why institutions are having trouble solving this problem

You can’t solve a problem until you know exactly what the problem is. In our experience, these are the challenges that both lenders and servicers are facing today. They are hiding in the vendor management function.

Over the past few years, more financial institutions have staffed up their vendor management departments in response to the CFPB’s vendor risk management guidelines. It is reasonable to see these companies, after going to this expense, trying to manage this problem with their internal staff by managing the Service Level Agreements (SLAs) they have in place with their vendors. Unfortunately, there are three significant challenges that stand in their way:

Challenge 1: The time crunch

Both lenders and servicers are under constant time pressure to complete their work. Originators will lose out to quicker competitors, especially in a purchase money market. Servicers, especially those who service government-insured loan products, are under statutory time constraints that give them very little wiggle room.

Finding a problem may be possible for the vendor management staff, but getting it corrected quickly will be difficult. The more often it happens, the less likely the institution will have a favorable outcome as problems tend to multiply.

Challenge 2: Shrinking margins

Margins were tight prior to the COVID-19 crisis and long before the Fed decided to start raising interest rates. In a highly competitive market, margins are the first to be sacrificed, making the problem even worse. This will make it more difficult to afford vendor management staff and make manpower a solution with diminishing returns.

Cost savings aren’t possible when the solution involves throwing more people at a problem. Only increased automation can bring costs down and increase profit margins.

Challenge 3: The industry brain drain

Ask anyone in the HR department of a loan origination or servicing shop and they’ll tell you that a storm is coming. The industry’s workforce is made up primarily of professionals who are now in the later stages of their careers. We’re seeing mortgage executives and workers retiring at record rates.

On the other side, recruiting is a challenge after years of negative publicity that has painted our industry in a poor light. Automation continues to be the solution of choice for growing companies who cannot attract enough manpower to build out their teams.

But unless the automation is specifically designed to solve these problems, it stands little chance of being effective. Going into the lender’s next discussion with a prospective vendor with these challenges in mind will help them better evaluate any solutions that are offered.

Shamit Vohra is Vice-President of Strategic Accounts for Visionet Systems Inc., a New Jersey-based technology and mortgage-services organization.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Shamit Vohra at at Shamit.vohra@visionet.com

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com

The post Are these factors creating chaos in your mortgage lending ops? appeared first on HousingWire.

Source link

How Much of Your Income Do You Need to Save?

Can you reach financial independence and retire within the next 10 years?

Yes, but it would take a huge savings rate.

I’ve never subscribed to the idea of retiring at 65 years old with an office cake and a gift watch. You can retire at any age—if you’re willing to live on a fraction of your income and invest the rest.

The higher your savings rate, the faster you reach financial freedom.

Savings Rate, Living Expenses, and Replacement Income

Your savings rate is the percentage of your income that goes toward investments, paying off debts early, or cash savings such as your emergency fund. If you bring home $5,000 per month after taxes and save and invest $2,000 of it, you have a 40% savings rate.

This means you live on $3,000 per month. Those lower living expenses not only let you save more each month, but they also mean you don’t need as much passive income to reach financial independence. In this example, you would only need $3,000 per month in passive income—or $36,000 per year.

Compare that to someone with a 10% savings rate who spends $4,500 per month. They need to replace $54,000 per year in income—a feat that will take them far longer if they’re only saving $500 per month.

The “Safe Withdrawal Rates” Model of Retirement

We all need to answer the question, “How much do I need to save for retirement?”

The classic 4% Rule offers one way of answering this question. It posits that if you withdraw 4% of your nest egg in the first year of retirement and adjust upward by inflation each year after, your nest egg should last at least 30 years. So, if you have $1 million saved for retirement, you can withdraw $40,000.

Following the rule’s logic, you can multiply your annual living expenses by 25 to reach your target nest egg (25 x 4 = 100%). So, in the example above, annual living expenses of $36,000 would require a nest egg of $900,000. Annual living expenses of $54,000 would need a seven-figure nest egg of $1,350,000.

Even at these modest annual retirement incomes, older Americans lag far behind the savings they’ll need. The average baby boomer’s retirement savings is only $136,779, which would yield only $5,471 per year in income according to the 4% Rule.

Note that this rule was calculated based on a portfolio of stocks and bonds, not real estate. More on that later.

How Long It Takes to Retire Based on Savings Rate

So, we calculated how quickly you could retire based on the 4% Rule. It required an assumption for return on investment, so I used a generous 10% return for these calculations. Why so generous? Because the average return on the S&P 500 since its inception is around 10.5%.

The average stock investor doesn’t earn nearly that much because they try to get fancy by picking stocks or timing the market. But I digress.

To illustrate these numbers tangibly, I ran them for someone with a $100,000 take-home income ($8,333.33/month). But the same number of years would apply to each savings rate, regardless of the amounts.

Even with extreme savings of 80% of your income, you still couldn’t retire in under five years.

But for real estate investors, that doesn’t represent the whole story.

How Real Estate Tweaks the Math

We’ve all read case studies of people who retired young with real estate. How could they do it if even an 80% savings rate wouldn’t let you retire in under five years?

Because real estate changes the math of early retirement.

You don’t have to worry about safe withdrawal rates because you aren’t withdrawing money from your nest egg. You keep earning ongoing income from your rental properties without selling any assets.

If you only need $3,000 per month to reach financial independence, and you can earn $500 per month in cash flow from each rental property you buy, you only need six properties to retire. And while that might still sound daunting, remember that you can finance the bulk of each property with other people’s money.

Using the BRRRR strategy, you can invest without leaving a single dime of your own money invested in each property post-refinance.

Real estate buffers you against inflation as well. You can raise rents to adjust for inflation—it’s one reason I replace bonds in my portfolio with real estate.

All of this means real estate investors can earn higher cash-on-cash returns than 10% and withdraw—or more accurately collect—more than 4% of their nest egg each year.

Working Before and After Financial Independence

The overwhelming majority of people I’ve interviewed who have reached financial independence didn’t actually “retire” to never work again. Instead, they went on to work on fun or fulfilling projects that didn’t necessarily pay quite as well as their old day job.

But they still earned money. In retrospect, they could have quit their day job much earlier, living on a combination of their passive income from investments and their new active income.

Continuing the example above, you wouldn’t need to wait until you reached $36,000 per year in passive income from investments before quitting your day job. You could quit when you got halfway there, as long as you found other fun ways to bring in the additional $18,000.

For example, many real estate investors get their real estate license to help their investing work. While a real estate agent’s income is variable based on the number of sales made, you could potentially earn enough commissions to bridge the gap after quitting your day job.

Or become a freelance writer, flip houses, pour wine at a winery, or do consulting work. Personally, I’m not yet financially independent. However, I still live something akin to a good lifestyle—living overseas most of the year on a combination of my online business income and a few fun side gigs.

Final Thoughts

The chart above is a starting point for plotting your own course and timeline to financial independence, not the final word on the subject.

Invest in a mix of stocks and real estate to bend the math of cash-on-cash returns and the 4% Rule. Start planning your ideal side gig after you quit your day job but before you’re completely financially independent. Don’t succumb to the mainstream tendency to spend almost every penny you earn in a vain attempt to keep up with the Joneses.

If you want real wealth, save more money, invest it, and get off the hedonic treadmill.

Build a stable financial foundation

Are you tied to a nine-to-five workweek? Would you like to “retire” from wage-paying work within ten years? Are you in your 20s or 30s and would like to be financially free?the sort of free that ensures you spend the best part of your day and week, and the best years of your life, doing what you want?

What’s your plan for reaching financial freedom and retiring? How does real estate fit in? Let us know in the comments below!

Source link

These mortgage lenders have cut jobs in 2022

It’s a tough time for mortgage lenders. A rapid rise in mortgage rates and a big drop in origination volume has led to thousands of industry job losses over the last six months. And it’s likely to continue – executives are calling this one of the most challenging periods in memory. By some estimates, origination volume will fall in 2022 to about $2 trillion, about half the volume from the record-breaking years of 2021 and 2020.

Few originators have been left unscathed by the industry-wide reduction in capacity.

Wells Fargo, one of the nation’s largest banks, had at least 114 layoffs in its home lending business following a drop in revenue in that division in the first quarter of 2022. Sources told HousingWire the number was substantially higher, though the lender declined to provide figures.

Nonbank lenders such as Pennymac, Mr. Cooper, loanDepot, Guaranteed Rate, Fairway Independent Mortgage, Interfirst Mortgage Co., Movement Mortgage and Better.com all conducted at least one round of workforce reductions this year as mortgage rates surged past the 5% mark.

Below is a roundup of some of the notable lenders that have issued pink slips this year. We have undoubtedly missed some job cuts; you can share news of layoffs anonymously by emailing Connie Kim at connie@hwmedia.com. This list will be updated throughout the year.

Wells Fargo: at least 114 employees in home lending

Wells Fargo, the third-biggest lender by volume in 2021, laid off at least 114 employees in its home lending division this year. As of May 27, Iowa Workforce Development lists 49 layoffs at the Wells Fargo campuses in Des Moines and 34 employee reductions in West Des Moine. Impacted employees, all in the home lending division, will receive pink slips in June and July, according to Iowa’s WARN notification list.

According to Worker Adjustment and Retraining Notification (WARN) notices submitted to the California Employment Development Department (EDD) earlier this month, the company plans to cut 31 jobs in the home lending business, in letters to the EDD reviewed by HousingWire. Layoffs included 17 associate loan servicing representatives and eight loan servicing representatives as well as senior operations processors and senior loan servicing representatives.

“The home lending displacements are the result of cyclical changes in the broader home lending environment,” Lylah Holmes, a spokesperson at Wells Fargo, told HousingWire. Wells Fargo will be providing severance and career counseling, and helping affected employees identify other positions within the bank.

The bank’s revenues in the home lending business totaled $1.5 billion in the first quarter this year, a 19% drop compared to the previous quarter and 33% lower than the same period in 2021.

Wells Fargo executives in early June said the bank was considering pulling back on its mortgage business, where, beyond the challenges related to a decline in originations, it has also struggled with scandals related to minority lending.

loanDepot: Unknown

loanDepot, the fourth-largest lender, per mortgage data firm Polygon Research, conducted an unspecified number of layoffs in late May. Multiple sources told HousingWire that “hundreds” were let go.

Jonathan Fine, loanDepot’s vice president of public relations, declined to say how many positions were cut and suggested that a review of the earnings call transcript from the first quarter would provide needed information.

In April, loanDepot announced plans for potential layoffs in the company’s first quarter earnings call after reporting a net loss of $91.3 million.

Company chief financial officer Patrick Flangagan said loanDepot doesn’t expect to be profitable this year and shared plans to reduce marketing personnel expenses.

Loan origination volume dropped 26% to $21.6 billion from the previous quarter, according to the firm, bringing the company’s market share down to 3.1%. The lender expects loan origination volume to post between $13 billion and $18 billion in the second quarter of this year.

Company executives said loanDepot is not expected to be profitable in 2022.

NewRez LLC: 386 employees

New Residential Investment Corp., the sixth-largest lender per Polygon Research, eliminated 386 positions, accounting for about 3% of the mortgage division’s workforce, in February.

The layoff decision followed New Residential Investment Corp.’s acquisition of multichannel lender Caliber Home Loans last year.

“As we continue to create synergies between companies, we are creating a structure to streamline business channels and create long-term growth,” the NewRez spokesperson wrote in an email to HousingWire in February.

Caliber was a heavy-hitter across multiple origination channels, generating $80 billion in originations and $153 billion in servicing in 2020. Best known for its distributed retail footprint and its fair amount of business in correspondent and wholesale channels, NewRez/Caliber had 3.7% of market share in 2021, according to data from Inside Mortgage Finance.

Owning Group: 189 employees

California-based Owning Corp., a direct-to-consumer lender acquired by Guaranteed Rate in February 2021, cut 189 jobs across three rounds from February to April.

The layoffs included 51 mortgage specialists, the most heavily affected position, and 42 mortgage consultants.

Employees that were let go also included underwriters, closers, and top executives such as lending directors and vice presidents for credit and underwriting.

Owning is the second company acquired by Guaranteed Rate in 2021 to face layoffs in the challenging mortgage market this year.

Early in January, Texas-based Stearns Lending, acquired in January 2021 from the financial giant Blackstone Group for an undisclosed sum, laid off 348 workers following the decision by Guaranteed Rate to discontinue operations of its third-party wholesale channel.

Better.com: more than 4,000 workers

Digital lender Better.com has already conducted three rounds of layoffs since late last year, and it’s unclear where the bottom is. The firm’s CEO infamously laid off 900 employees in a Zoom meeting in December where he then criticized the departing employees to remaining workers, 3,000 workers in March, some of which work in India, and an undisclosed number of people in April.

The firm has been seeking to go public via a special purpose acquisition company (SPAC), known as Aurora Acquisition Corp. But without reliable access to purchase business, conditions look bleak for Better.

An S-4 filing from Aurora, dated April 24 2022, showed that Better.com posted a loss of more than $300 million last year. The “deterioration” in Better’s financial performance was attributed to multiple factors including increasing interest rates and the effects of “negative media coverage” following a series of layoffs that began in December 2021, according to the filing.

Pennymac Financial Services: 474 positions

California-based nonbank mortgage lender and servicer Pennymac submitted WARN notices to cut 474 jobs by July this year.

Following workforce reduction filings of 236 employees in March, the firm submitted WARN notices to lay off 238 positions by June and July, according to letters to the EDD reviewed by HousingWire on May 27. Pink slips will arrive for California employees at six offices in Thousand Oaks, Pasadena, Roseville, Westlake Village, Agoura Hills, and Moorpark.

The latest round of WARN notices will impact 59 loan officers in the Thousand Oaks, Pasadena, and Roseville offices.

The office at Thousand Oaks accounted for the largest layoff notifications — of 97 employees, including 25 loan officers. Most of the other positions to be eliminated were analysts and managers in back office operations.

Top management jobs, such as vice presidents for underwriting and partial credit guarantee (PCG) transaction management, will also be reduced, according to Stacy Diaz, executive vice president of human resources at PennyMac, in letters to the EDD.

Pennymac posted a profitable first quarter but its net income dropped more than 50% driven by lower profits from its production segment.

Interfirst Mortgage Co.: 491 workers

Rosemont, Illinois-based Interfirst Mortgage Co. eliminated more than 490 positions this year in two rounds of layoffs.

Pink slips were delivered to a total of 351 non-commissioned loan officers in January: 77 in North Carolina and 274 in Illinois.

Interfirst felt the consequences of mortgage rates hovering at around 5% in May and announced an additional round of 140 layoffs at the lender’s facility in Rosemont. Starting May 17, or within two weeks of that date, the company cut jobs in the mortgage loan production. Employees that were let go included 26 processors, 20 originators, and 15 mortgage accountant executives in junior and specialist positions.

Administrative positions including human resources, talent acquisition, and executive assistants were also part of the workforce reductions, according to a WARN filed by the company in early March.

Mr. Cooper: about 670 positions

Residential lender and servicer Mr. Cooper slashed 670 jobs this year so far in two rounds of layoffs.

Earlier this month, Mr. Cooper said the elimination 420 positions, 5% of its employee base, will hit the originations side of the business. A total of 120 employees, or about 16% of the staff in California will be affected by the announcement, Mr. Cooper said.

Mr. Cooper laid off about 250 positions in the first quarter, the company said in a response sent following its earnings call in late April. While Mr. Cooper reported a profitable quarter with a net income of $658 million in 2022, the firm didn’t expect that to continue.

“Given lower volumes, rationalizing capacity is an unavoidable theme for everyone in origination and we’ve been very disciplined in managing capacity,” Chris Marshall, vice chairman and president of Mr. Cooper said.

The company forecasts quarterly origination volume earnings to be between $65 million to $85 million for the rest of 2022, compared to $157 million in the first quarter.

Union Home Mortgage: unspecified number of LOs

Union Home Mortgage laid off loan officers in junior and senior positions in April. The firm, like many other companies in the industry, said it’s “temporarily adjusting staffing levels” and declined to provide details on the size of the reduction.

The 49th-largest mortgage lender, according to Inside Mortgage Finance, wasn’t immune to the shrinking mortgage market despite reporting an origination volume of $4.2 billion in the fourth quarter of 2021, up 65.5% from the prior quarter. The lender’s origination volume rose nearly 26% to $13 billion in 2021 from 2020.

Fairway: cuts in wholesale and retail channels

Employees in the wholesale and retail channels, including analysts and senior positions in underwriting, training and information technology, were let go in May.

While Fairway didn’t provide any comment, a dozen employees affected by the layoff told HousingWire the company laid off professionals who were with the company for more than two years as well as those who started less than four months ago.

The firm was in a better position than its rivals six months ago but Fairway felt the pinch of mortgage rates in the 5% range and surging housing prices.

Fairway’s loans accounted for about 62% of the company’s total origination in 2021, the highest share among the top 12 lenders in the U.S., according to Inside Mortgage Finance.

The lender offered a two-week severance payment for some employees but no career transition support, former employees said.

Stearns Lending: 348 employees

Stearns Lending laid off nearly 348 employees in March following Guaranteed Rate’s decision to discontinue operations of its third-party wholesale channel.

In January 2021, Guaranteed Rate acquired Stearns Holding from Blackstone Group for an undisclosed sum. The acquisition will enable Guaranteed Rate “to bolster retail loan origination and further its joint venture platform while developing new multichannel capabilities, the company said at the time of the acquisition.

Guaranteed Rate’s CEO Victor Ciaradelli, in a letter to brokers about shutting down Stearns wholesale channel, said the company will focus on leveraging its “industry-leading purchase platform augmented by the best loan officers in the business.”

Redfin mortgage: 121 employees

Redfin issued pink slips to 121 employees in January following the real estate giant’s announcement of an acquisition of mortgage lender Bay Equity Home Loans for $135 million.

The impacted employees, less than 2% of the total staff, were mainly in sales support, capital markets, and operations.

“Reorganizing our mortgage operations unfortunately means some colleagues and friends will be leaving Redfin,” Adam Wiener, Redfin’s president of real estate operations, said in a statement in January. “Many of these people are the pioneers who helped build Redfin Mortgage from scratch and we owe them a debt of gratitude.”

The workforce reduction was expected to bring $6 million to $7 million in costs and transaction advisory fees of approximately $3.5 million, according to Redfin. The firm also forecasted to incur a non-cash impairment charge of $2 million to $3 million on mortgage-specific, internally developed software.

Interactive Mortgage: 51 employees

Mortgage lender WinnPointe Corporation, doing business as Interactive Mortgage, laid off 51 employees in 2022 following a workforce reduction of 128 people last year.

The permanent layoffs, according to the WARN notices sent to the California Employment Development Department, was in part due to the more than $1 million dollars in losses from rises in increase rates and the “economic collapse triggered by the Covid-19 pandemic.”

Of the 51 employees who were laid off in April, three are underwriters, 15 are LOs, 11 are processors, 19 are admins, and three are funders. The 128 employees who were let go last year, included six underwriters, 20 loan officers, 26 processors, 51 admins, and 25 funders.

USAA Bank: more than 90 employees

Texas-based USAA Bank reduced its mortgage sales team by more than 90 employees, the San Antonio Express News reported in April.

The publication said the layoffs came amid USAA Bank’s projections of a 34% drop to about 25,000 real estate loans despite having adequate staff in place to facilitate 38,000 loans, citing internal emails.

The company confirmed the cuts but categorized the workforce reduction as business as usual for a company of its size.

USAA Bank was founded in 1922 by a group of 25 U.S. Army officers to insure each other’s vehicles because of the perception that military officers were a high-risk group. Headquartered in San Antonio, Texas, the bank has five financial centers across the country including New York and Colorado.

Tomo Mortgage: almost a third of its workforce

Tomo issued pink slips to 44 employees, almost a third of its employees in late May.

Greg Schwartz, CEO at Tomo, said in a LinkedIn post said the firm was “impacted by the rapid rise in interest rates that has reduced purchase mortgage margins.”

With venture capital pulling back, Schwartz said the firm “must map out a stable budget that will rely on less capital for longer.”

Tomo will dial back market expansion plans and focus on building tech that will deliver a faster and less costly home buying process, Schwartz added.

The firm, which now has 110 employees, raised $40 million in a Series A funding round in March and touted a valuation of $640 million.

Founded in 2020 by former Zillow executives Carey Armstrong and Shwartz, Tomo claims to close 98% of its loans on time.

No layoffs here*

Lenders that haven’t laid off employees yet this year include United Wholesale Mortgage (UWM) and Rocket Mortgage.

UWM, the nation’s second-largest lender by volume, hasn’t instituted layoffs like many of its competitors, though executives are mindful of expenses.

Total expenses dropped to $316.9 million in the first quarter of 2022 from $364.4 million during the same period in 2021. In Q1 2022, salaries, commissions and benefits reached $160.6 million, which CEO Mat Ishbia considered a “solid” number.

“It’s very important that we continue to manage our expenses. We have complete control of this, and we feel great about where we’re at,” Ishbia said to analysts during UWM’s earnings call.

Rocket Companies, the parent of Rocket Mortgage and Amrock Title, has not eliminated any positions but has offered a voluntary buyout to 8% of its staff in April.

In its most recent earnings call in May, executives said Rocket took “significant cost reduction measures” that includes implementing a voluntary career transition program to certain team members, reducing production costs, and shifting its market spending for the second quarter.

The firm in April said the buyout would save $40 million per quarter, after a one-time charge between $50 million and $60 million.

The post These mortgage lenders have cut jobs in 2022 appeared first on HousingWire.

Source link

How to Find and Hire the Right Property Manager

Rental properties have tremendous potential to generate revenue. However, the success of your investment rests heavily on the quality of your property management. Finding a quality property manager (PM) isn’t as cut and dry as one might think. Many factors must be considered when assessing a property’s needs.

This article will explain what a property manager is, why they are important, and how to find the right one to maximize your rental property’s earning potential.

What is a Property Manager?

A property manager is defined as any person or firm that carries out the various tasks involved in operating a residential or commercial rental property in exchange for a fee. In short, you pay them to take care of the grunt work so that you can invest your time elsewhere.

The tasks involved in managing property will vary depending on the type of property, size, location, and personal preferences. That being said, here are a few of the general responsibilities of a property manager:

Not all property managers are the same. In many cases, a property manager or management firm will specialize in a specific area of expertise. Not all experienced property managers are suited for the same role. For example, a PM may have years of experience managing single-family residential properties but may fall short when managing a multi-family unit such as a residential apartment complex.

PM responsibilities also depend on what role you’d like them to assume. You can appoint specific duties, such as responding to tenant emergencies, scheduling routine maintenance, and rent collection, while outsourcing other tasks like leasing, marketing, and legal matters. Or, you can choose to hire a management firm that can handle 100% of your property’s needs.

Why Hire a Property Manager?

If you have the time and resources to manage a property on your own, you can save yourself a little money. However, managing a property can be a full-time responsibility. Many investors don’t have the time or desire to manage a rental property’s nuances. Here are a few common reasons to hire a property manager.

Time