A transparent foreclosure marketplace reveals hidden equity

Over the past five years, more than $1.2 billion in potential home equity has been uncovered for distressed homeowners facing foreclosure.

That $1.2 billion is the amount of surplus funds generated by foreclosure sales on the Auction.com platform between 2016 and 2020. Surplus funds are proceeds from a foreclosure sale to a third-party buyer that are above and beyond the total debt owed to the foreclosing lender.

After first paying off any junior lien holders, surplus funds go to the distressed homeowner.

“A foreclosure sale usually represents the last chance for a distressed homeowner to benefit from any equity in a property being foreclosed,” said Ali Haralson, Auction.com president. “If a property reverts back to the foreclosing lender at the foreclosure sale and becomes real estate owned (REO), the distressed homeowner is not due any surplus proceeds from a subsequent sale of the REO property.”

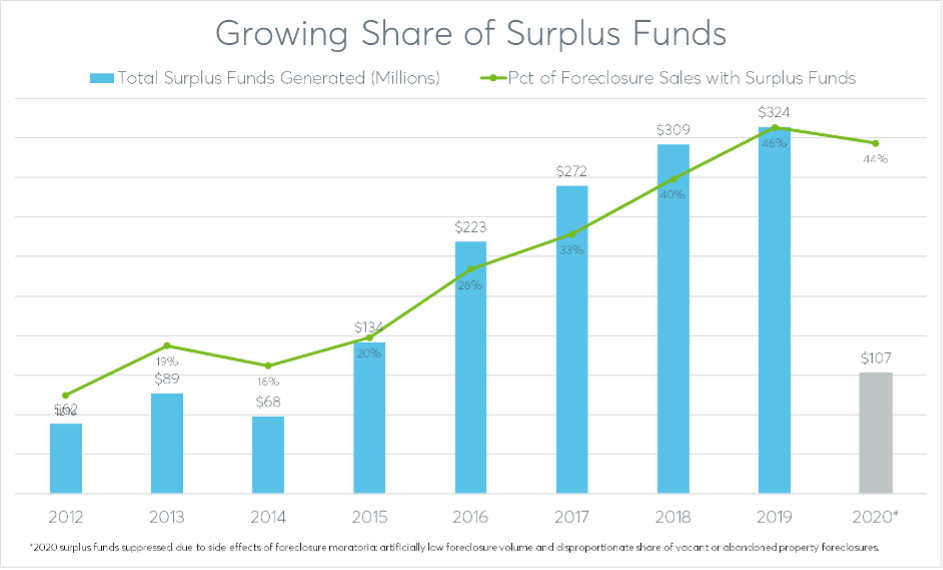

The share of Auction.com foreclosure sales with surplus funds has steadily risen in recent years, hitting a new record high of 46% in 2019 before slipping slightly to 44% in 2020 — still more than twice the share of foreclosure sales with surplus funds between 2012 and 2015.

The slight pullback in 2020 is due largely to side effects of the pandemic-induced foreclosure moratorium on government-backed mortgages in place for most of the year. The moratorium meant a disproportionately high share of foreclosures on vacant or abandoned properties — less likely to have any equity — because those properties are exempt from the moratorium.

The rising tide of a booming housing market, which has lifted all home price boats, is partially to thank for the steady rise in the share of foreclosure sales with surplus funds over the last five years. But given the intrinsically hidden nature of a foreclosure sale — before Auction.com, foreclosure sales were held at the county courthouse steps with little fanfare and minimal proactive marketing — a transparent, open marketplace for foreclosure sales has been key to ensuring all distressed homeowner equity is uncovered.

“We use Auction.com on the foreclosure side to increase the market size of the bidding process for foreclosure sales, which is very beneficial to ensure both the consumer as well as our investors receive an optimal bid for the property — before having to go into REO and maintenance the property and sell it on the market,” said Toby Wells, CEO of Specialized Loan Servicing (SLS), a mortgage servicer that services a $120 billion mortgage portfolio for 80 clients.

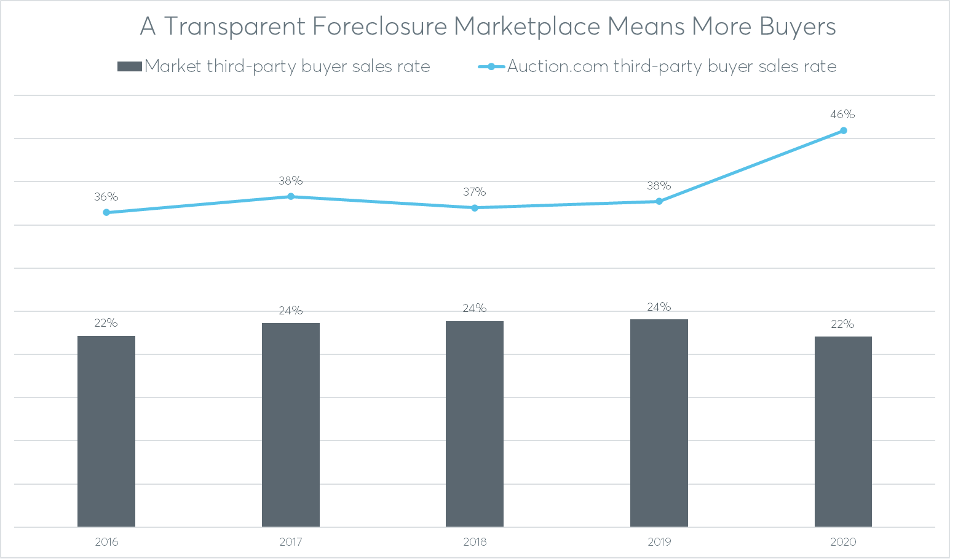

The increased market size Wells refers to is best demonstrated in the third-party buyer sales rate for foreclosures brought to auction on the Auction.com platform compared to the overall market. In 2020, the third-party sales rate on Auction.com was 46% — more than twice the third-party sales rate of 22% in the overall market, according to data from ATTOM Data Solutions.

$36,000 Surplus per Sale

The full impact of a transparent foreclosure marketplace like Auction.com — which has more than 6 million registered users and a robust marketing effort— can be more clearly seen when separating foreclosure sales into the two basic credit bid strategies employed by foreclosing lenders: total debt credit bids and specified credit bids.

Before diving into those two strategies, it’s important to define credit bid in the foreclosure auction context: the credit bid represents the floor for any successful third-party bids; any winning bid must be at least $1 above the credit bid (i.e. a foreclosure sale with a $100,000 credit bid requires a winning bid of at least $100,001).

The maximum allowable credit bid at foreclosure auction is the amount of total debt owed on the defaulted mortgage. When a foreclosing lender sets this as its credit bid, it typically indicates that the lender’s estimated market value of the property exceeds the total debt owed. In other words, the property is perceived to have at least some equity, which will be realized in the form of surplus funds at the foreclosure sale if that perception turns out to be a reality.

What’s surprising is just how much surplus is being generated.

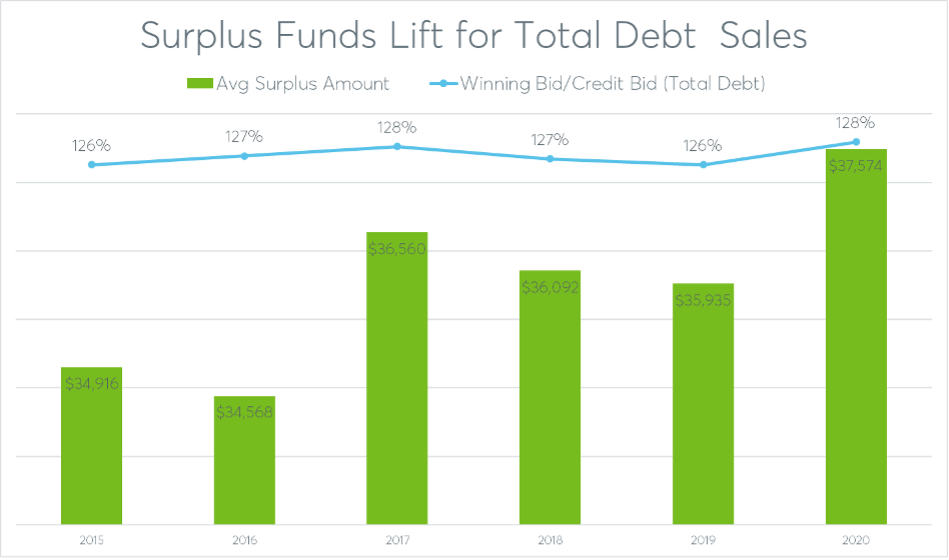

Winning bids on total debt foreclosure sales were 127% of the total debt on average over the last five years. In a non-transparent foreclosure marketplace with little or no competition from other bidders, one would expect the winning bid to come in just barely above 100%. Bidders with no competition will not be motivated to bid more than the minimum amount they need to win — $100,001 in the case of a $100,000 credit bid.

Mortgage servicers don’t directly receive any benefit to their bottom line if the winning bid is 127% of the credit bid instead of 101% of the credit bid — in either case they receive a full pay off for the total debt owed. But that 26 percentage-point lift does benefit distressed homeowners, translating into $1.1 billion in surplus funds over the last five years — an average of more than $36,000 per sale.

Finding Nonexistent Equity

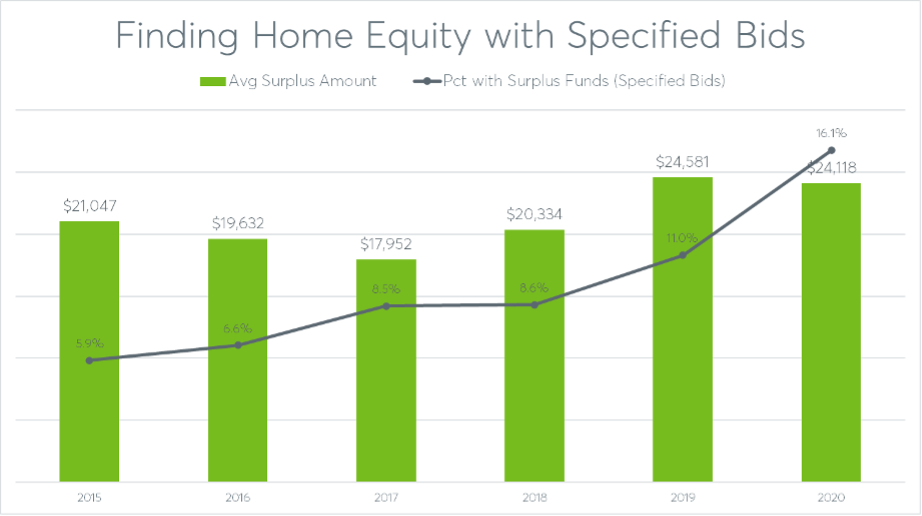

That leaves about $129 million in surplus funds generated from foreclosure sales with specified credit bids over the last five years. While this pales in comparison to the total surplus funds generated by total debt foreclosure sales, the fact that specified bid foreclosure sales generate any surplus funds at all provides even stronger evidence that a transparent foreclosure marketplace can uncover hidden home equity for distressed homeowners.

Mortgage servicers typically employ the specified credit bid approach when the estimated market value of the property is less than the total debt owed. With no perceived equity in the property, the lender lowers the credit bid below the total debt owed, believing there is little chance of recouping that total debt.

But it turns out a transparent, competitive foreclosure marketplace can uncover home equity in the form of surplus funds for the borrower, even when it didn’t look like that was possible. In 2020, 16% of specified credit bid foreclosure sales on the Auction.com platform generated surplus funds — up from 11% in 2019 to a new record high. For sales with surplus funds, the average surplus funds amount was $24,118 in 2020.

In the case of specified bid foreclosure sales, a transparent foreclosure marketplace protects the financial interest of mortgage servicers, helping them to benefit in the form of full payoffs even when they misjudge the market value of a home.

Similarly, a transparent foreclosure marketplace protects home equity for distressed homeowners — in both the case of specified credit bids and in the case of total debt credit bids. The marketplace reveals and delivers that often-hidden equity in the form of surplus funds — even if the homeowner doesn’t know there is any equity, and even if the homeowner hasn’t been able to realize any known equity by selling on the retail market prior to foreclosure.

Moving the Marketplace Upstream

This of course begs the question: if more than 40% of foreclosure sales generate surplus funds, indicating equity, why aren’t more of the distressed homeowners with equity selling pre-foreclosure? Selling pre-foreclosure would not only help them walk away with money to show for that equity, but also help them to avoid the negative credit consequences of a foreclosure.

While the full answer to this question is more complex, deserving its own dedicated article, one piece of the answer ties into the discussion of a transparent and competitive marketplace. While such a marketplace exists for traditional retail properties in the form of the Multiple Listing Service (MLS), that retail marketplace does not always deliver for distressed properties.

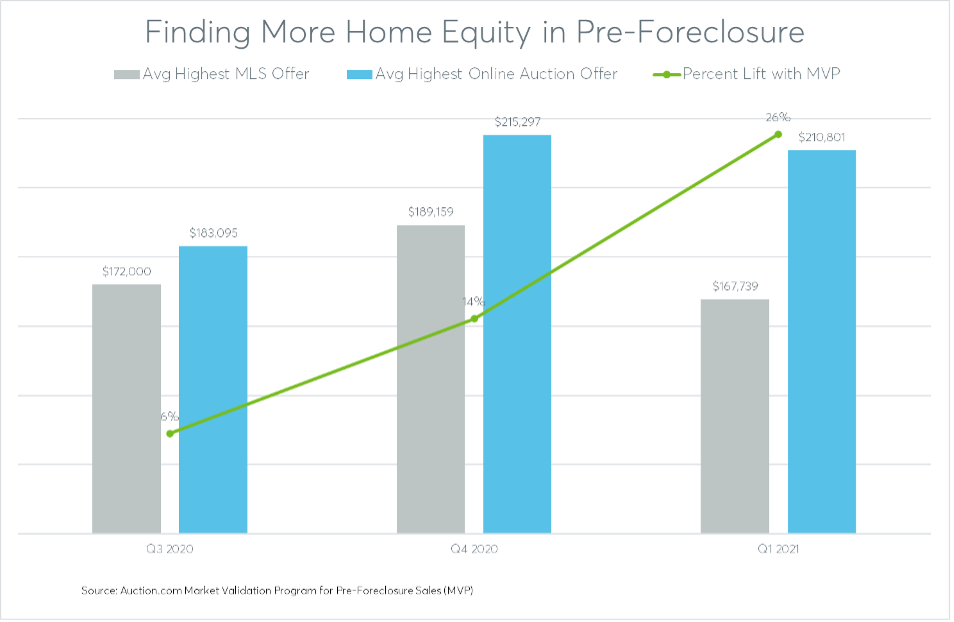

The limitations of the traditional retail marketplace to always deliver the highest and best offer for distressed property sales have become plainly evident in recent data from the Auction.com Market Validation Program (MVP) for pre-foreclosure sales. In this program, short sales and other pre-foreclosure sales are offered for bidding in the online auction environment — in parallel to being listed on the MLS.

Over the past eight months, 55% of the pre-foreclosure properties brought to auction through MVP — while simultaneously being listed for sale on the MLS — have received a higher offer through MVP. Those winning MVP offers have averaged 19% higher — or more than $33,000 higher — than the highest offer received on the MLS.

These results demonstrate that many distressed property buyers are not looking to the MLS first — or even at all in some cases — when searching for acquisition opportunities.

“The last one that I purchased was a short sale,” said Karen Tyler, owner/broker of Virginia Beach-based Prodigy Realty, describing her most recent investment property purchase on Auction.com. “I didn’t even know it was a short sale — listed on my own MLS — because that particular property was not something I would look for — an investment property — through the MLS. But if it’s an Auction.com property, I actually pay a little more attention to it.”

Tyler’s experience combined with the early data from MVP indicate that there is an opportunity for a transparent and competitive marketplace to uncover hidden equity for distressed homeowners earlier in the process — before foreclosure. This will result in more distressed homeowners avoiding foreclosure and its negative credit consequences even while often walking away with cash proceeds from the sale.

“Short sales really provide for a graceful exit from the property if the homeowner can no longer afford the mortgage,” Wells said. “So short sales are a really critical resolution, and certainly preferable to any type of foreclosure, REO, etc. If we can work with a homeowner to exit the property early, it’s beneficial for both the homeowner and the investor.”

The post A transparent foreclosure marketplace reveals hidden equity appeared first on HousingWire.

:215-447-7209

:215-447-7209 : deals(at)frankbuysphilly.com

: deals(at)frankbuysphilly.com